The SaaS-based Core Banking Software Market is Predict to reach USD 43.72 Billion by 2032, at a CAGR of 18.9%

Special Offering :

Industry Insights | Market Trends | Highest number of Tables | 24/7 Analyst Support

SaaS-based Core Banking Software Market Growth, Trends and Report Highlights

According to a new report, published by KBV research, The Global SaaS-based Core Banking Software Market size is expected to reach USD 43.72 billion by 2032, rising at a market growth of 18.9% CAGR during the forecast period.

The global SaaS-based core banking software market is competitive because both long-established core banking vendors are moving to cloud-native models and new cloud-first companies are going after both digital-only and traditional banks. Brand reputation is still important, but now competitive advantage depends on how flexible, integrated, resilient, and mature governance features are. Providers that can show they follow the rules, quickly deploy products, and deliver composable, API-driven architectures are in the best position to gain market share.

The Public Cloud segment is experiencing a CAGR of 18.4 % during the forecast period. Hybrid cloud solutions enable banks to maintain sensitive data on private infrastructure while leveraging the public cloud for less critical applications. This model provides a balance between control, security, and scalability, which is particularly important for institutions operating in highly regulated environments.

The Retail Banking segment led the maximum revenue in the Global SaaS-based Core Banking Software Market by End-User in 2024, thereby, achieving a market value of USD 20.86 Billion by 2032. The corporate banking segment focuses on providing financial services to businesses, including business loans, lines of credit, and cash management. Cloud-based core banking solutions are gaining popularity in corporate banking due to their ability to handle complex financial transactions, integrate with enterprise resource planning (ERP) systems, and provide real-time data analytics.

The Large Banks segment is growing at a CAGR of 18 % during the forecast period. Midsize banks require solutions that are scalable and cost-effective but also need the flexibility to offer competitive products to both individual and business customers. SaaS solutions help midsize banks compete with larger institutions by providing them access to the same cutting-edge technology and innovations, such as real-time processing and enhanced customer service capabilities, without the need for significant upfront investments.

Full Report: https://www.kbvresearch.com/saas-based-core-banking-software-market/

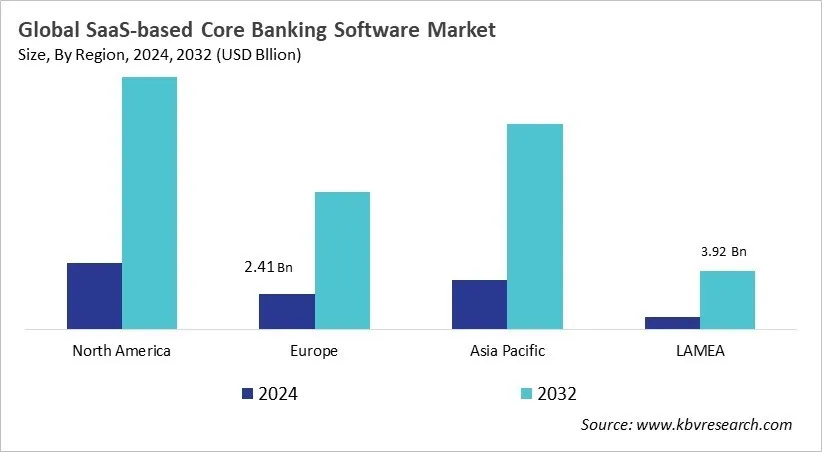

The North America region dominated the Global SaaS-based Core Banking Software Market by Region in 2024, thereby, achieving a market value of USD 16.87 Billion by 2032. The Asia Pacific region is anticipated to grow a CAGR of 19.7% during (2025 - 2032). Additionally, The Europe region would witness a CAGR of 18.4% during (2025 - 2032).

List of Key Companies Profiled

- nCino, Inc

- Temenos AG

- Mambu B.V

- Oracle Corporation

- Fiserv, Inc.

- Jack Henry & Associates, Inc.

- Finastra Group Holdings Limited (Vista Equity Partners)

- Tata Consultancy Services Ltd.

- SAP SE

- Fidelity National Information Services, Inc.

SaaS-based Core Banking Software Market Report Segmentation

By Deployment

- Public Cloud

- Hybrid Cloud

- Private Cloud

By End-User

- Retail Banking

- Corporate Banking

- Treasury

- Wealth Management

By Banking Type

- Large Banks

- Midsize Banks

- Small Banks

- Community Banks

- Credit Unions

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Related Reports: