The Crop Insurance Market is Predict to reach USD 59.32 Billion by 2032, at a CAGR of 5.8 %

Special Offering :

Industry Insights | Market Trends | Highest number of Tables | 24/7 Analyst Support

Crop Insurance Market Growth, Trends and Report Highlights

According to a new report, published by KBV research, The Global Crop Insurance Market size is expected to reach $59.32 billion by 2032, rising at a market growth of 5.8% CAGR during the forecast period.

There is a rising emphasis on climate-smart insurance products that address the increasing frequency and severity of climate-related risks. These products are designed to promote resilience by encouraging sustainable farming practices, such as crop diversification or soil conservation, which help mitigate the impact of climate change. The trend toward digitalization is also transforming the market, with mobile apps and online platforms making it easier for farmers to purchase policies, submit claims, and receive payouts.

The Multi-peril Crop Insurance (MPCI) segment is experiencing a CAGR of 5.4 % during the forecast period. This is primarily due to the broad coverage that MPCI offers, protecting farmers against a range of risks such as drought, floods, pests, disease, and other natural calamities. The comprehensive nature of this policy makes it highly preferred by farmers seeking financial stability and risk mitigation across the entire growing season.

The Revenue Protection segment led the maximum revenue in the Global Crop Insurance Market by Coverage in 2024, thereby, achieving a market value of $30.5 billion by 2032. This type of coverage provides dual protection by compensating for losses stemming from both reduced yield and declining commodity prices. It is especially valued by farmers who are exposed to market volatility and are seeking to stabilize their overall income. With increasing unpredictability in global agricultural markets and weather patterns, revenue protection has emerged as a strategic financial tool, particularly among commercial farming operations.

The Government Agencies segment is growing at a CAGR of 5.4 % during the forecast period. This dominance is largely attributed to strong governmental support for agricultural stability through subsidized insurance schemes and public-private partnerships. In many countries, national governments play a central role in offering crop insurance to ensure food security and protect farmers from economic distress.

Full Report: https://www.kbvresearch.com/crop-insurance-market/

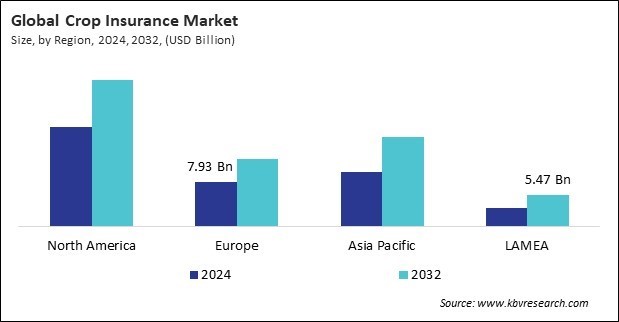

The North America region dominated the Global Crop Insurance Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $26.1 billion by 2032. The Europe region is anticipated to grow at a CAGR of 5.5% during (2025 - 2032). Additionally, The Asia Pacific region would witness a CAGR of 6.6% during (2025 - 2032).

List of Key Companies Profiled

- USI Insurance Services, LLC

- QBE Insurance Group Limited

- Chubb Limited

- Zurich Insurance Group Ltd.

- Great American Insurance Company (American Financial Group, Inc.)

- American International Group, Inc. (AIG)

- Nationwide Mutual Insurance Company

- ICICI Lombard General Insurance Company Limited (ICICI Bank Limited)

- AXA SA

- Bajaj Allianz General Insurance Company

Crop Insurance Market Report Segmentation

By Type

- Multi-peril Crop Insurance (MPCI)

- Crop-hail Insurance

- Revenue Insurance

By Coverage

- Revenue Protection

- Yield Protection

- Price Protection

By Distribution Channel

- Government Agencies

- Insurance Companies

- Other Distribution Channel

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Related Reports: