North America UPS Battery Market Size, Share & Trends Analysis Report By Battery (Li-ion, Lead Acid, Nickel Cadmium, and Other Battery), By Application (Data Centers, Industrial, Commercial, and Residential), By Country and Growth Forecast, 2024 - 2031

Published Date : 16-Apr-2025 |

Pages: 98 |

Report Format: PDF + Excel |

COVID-19 Impact on the North America UPS Battery Market

The North America UPS Battery Market would witness market growth of 12.9% CAGR during the forecast period (2024-2031).

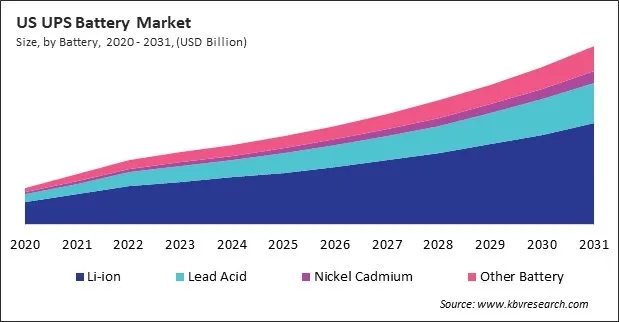

The US market dominated the North America UPS Battery Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $5,597 Million by 2031. The Canada market is experiencing a CAGR of 15.3% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 14.4% during (2024 - 2031).

The UPS battery market is a cornerstone of modern infrastructure, ensuring continuity in an increasingly digital and power-dependent world. As businesses, households, and critical systems rely on seamless electricity to function, the demand for reliable backup power solutions has surged, propelling the market into a phase of rapid growth and transformation. UPS batteries serve as the heartbeat of these systems, storing energy and delivering it instantaneously during outages, fluctuations, or disruptions. This market, driven by technological advancements, environmental considerations, and the global push for resilience, is evolving to meet the diverse needs of industries ranging from IT and healthcare to manufacturing and renewable energy integration.

UPS batteries find their utility across various applications, reflecting their versatility and critical role in modern society. One of the most prominent applications is in data centers, where uninterrupted power is essential to prevent data loss, hardware damage, and service disruptions. As cloud computing, big data analytics, and edge computing gain traction, data centers—ranging from hyperscale facilities to small enterprise setups—rely heavily on UPS systems to ensure 24/7 uptime. Lithium-ion batteries, with their high energy density and longer lifespan, are increasingly favored in these settings, though lead-acid batteries remain a cost-effective staple.

According to the U.S. Energy Information Administration (EIA), electricity customers in the U.S. experienced an average of 5.6 hours of power interruptions per year in 2022, with each customer-facing 1.4 outages annually. These statistics highlight ongoing challenges in grid reliability, emphasizing the need for UPS battery solutions to mitigate the impact of power disruptions.

Industries such as healthcare, manufacturing, IT, and finance rely heavily on continuous power supply to prevent operational losses, equipment damage, and data loss. The increasing frequency of power outages in the U.S. drives higher adoption of UPS battery systems across residential, commercial, and industrial sectors. Additionally, the rising integration of renewable energy into the power grid creates a demand for battery backup solutions to stabilize power flow and provide emergency energy storage. Thus, the market in North America is expanding due to rising construction investments in Canada, Mexico’s shift toward clean energy, and the United States’ ongoing power reliability issues.

Free Valuable Insights: The UPS Battery Market is Predict to reach USD 26.71 Billion by 2031, at a CAGR of 13.6%

Based on Battery, the market is segmented into Li-ion, Lead Acid, Nickel Cadmium, and Other Battery. Based on Application, the market is segmented into Data Centers, Industrial, Commercial, and Residential. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- ABB Group

- Schneider Electric SE

- Eaton Corporation plc

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Delta Electronics, Inc.

- Vertiv Group Corp.

- Panasonic Holdings Corporation

- GS Yuasa Corporation

- Exide Industries Limited

- EnerSys

North America UPS Battery Market Report Segmentation

By Battery

- Li-ion

- Lead Acid

- Nickel Cadmium

- Other Battery

By Application

- Data Centers

- Industrial

- Commercial

- Residential

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America UPS Battery Market, by Battery

1.4.2 North America UPS Battery Market, by Application

1.4.3 North America UPS Battery Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis – Global

4.1 Market Share Analysis, 2023

4.2 Porter Five Forces Analysis

Chapter 5. North America UPS Battery Market by Battery

5.1 North America Li-ion Market by Country

5.2 North America Lead Acid Market by Country

5.3 North America Nickel Cadmium Market by Country

5.4 North America Other Battery Market by Country

Chapter 6. North America UPS Battery Market by Application

6.1 North America Data Centers Market by Country

6.2 North America Industrial Market by Country

6.3 North America Commercial Market by Country

6.4 North America Residential Market by Country

Chapter 7. North America UPS Battery Market by Country

7.1 US UPS Battery Market

7.1.1 US UPS Battery Market by Battery

7.1.2 US UPS Battery Market by Application

7.2 Canada UPS Battery Market

7.2.1 Canada UPS Battery Market by Battery

7.2.2 Canada UPS Battery Market by Application

7.3 Mexico UPS Battery Market

7.3.1 Mexico UPS Battery Market by Battery

7.3.2 Mexico UPS Battery Market by Application

7.4 Rest of North America UPS Battery Market

7.4.1 Rest of North America UPS Battery Market by Battery

7.4.2 Rest of North America UPS Battery Market by Application

Chapter 8. Company Profiles

8.1 ABB Ltd.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expense

8.1.5 SWOT Analysis

8.2 Schneider Electric SE

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.2.5 SWOT Analysis

8.3 Eaton Corporation PLC

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 SWOT Analysis

8.4 Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Research & Development Expenses

8.4.5 SWOT Analysis

8.5 Delta Electronics, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expenses

8.6 Vertiv Group Corp.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Regional Analysis

8.7 Panasonic Holdings Corporation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expenses

8.7.5 SWOT Analysis

8.8 Enersys

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental Analysis

8.8.4 SWOT Analysis

8.9 GS Yuasa Corporation

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental Analysis

8.9.4 Research & Development Expenses

8.10. Exide Industries Limited

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Regional Analysis

TABLE 2 North America UPS Battery Market, 2024 - 2031, USD Million

TABLE 3 North America UPS Battery Market by Battery, 2020 - 2023, USD Million

TABLE 4 North America UPS Battery Market by Battery, 2024 - 2031, USD Million

TABLE 5 North America Li-ion Market by Country, 2020 - 2023, USD Million

TABLE 6 North America Li-ion Market by Country, 2024 - 2031, USD Million

TABLE 7 North America Lead Acid Market by Country, 2020 - 2023, USD Million

TABLE 8 North America Lead Acid Market by Country, 2024 - 2031, USD Million

TABLE 9 North America Nickel Cadmium Market by Country, 2020 - 2023, USD Million

TABLE 10 North America Nickel Cadmium Market by Country, 2024 - 2031, USD Million

TABLE 11 North America Other Battery Market by Country, 2020 - 2023, USD Million

TABLE 12 North America Other Battery Market by Country, 2024 - 2031, USD Million

TABLE 13 North America UPS Battery Market by Application, 2020 - 2023, USD Million

TABLE 14 North America UPS Battery Market by Application, 2024 - 2031, USD Million

TABLE 15 North America Data Centers Market by Country, 2020 - 2023, USD Million

TABLE 16 North America Data Centers Market by Country, 2024 - 2031, USD Million

TABLE 17 North America Industrial Market by Country, 2020 - 2023, USD Million

TABLE 18 North America Industrial Market by Country, 2024 - 2031, USD Million

TABLE 19 North America Commercial Market by Country, 2020 - 2023, USD Million

TABLE 20 North America Commercial Market by Country, 2024 - 2031, USD Million

TABLE 21 North America Residential Market by Country, 2020 - 2023, USD Million

TABLE 22 North America Residential Market by Country, 2024 - 2031, USD Million

TABLE 23 North America UPS Battery Market by Country, 2020 - 2023, USD Million

TABLE 24 North America UPS Battery Market by Country, 2024 - 2031, USD Million

TABLE 25 US UPS Battery Market, 2020 - 2023, USD Million

TABLE 26 US UPS Battery Market, 2024 - 2031, USD Million

TABLE 27 US UPS Battery Market by Battery, 2020 - 2023, USD Million

TABLE 28 US UPS Battery Market by Battery, 2024 - 2031, USD Million

TABLE 29 US UPS Battery Market by Application, 2020 - 2023, USD Million

TABLE 30 US UPS Battery Market by Application, 2024 - 2031, USD Million

TABLE 31 Canada UPS Battery Market, 2020 - 2023, USD Million

TABLE 32 Canada UPS Battery Market, 2024 - 2031, USD Million

TABLE 33 Canada UPS Battery Market by Battery, 2020 - 2023, USD Million

TABLE 34 Canada UPS Battery Market by Battery, 2024 - 2031, USD Million

TABLE 35 Canada UPS Battery Market by Application, 2020 - 2023, USD Million

TABLE 36 Canada UPS Battery Market by Application, 2024 - 2031, USD Million

TABLE 37 Mexico UPS Battery Market, 2020 - 2023, USD Million

TABLE 38 Mexico UPS Battery Market, 2024 - 2031, USD Million

TABLE 39 Mexico UPS Battery Market by Battery, 2020 - 2023, USD Million

TABLE 40 Mexico UPS Battery Market by Battery, 2024 - 2031, USD Million

TABLE 41 Mexico UPS Battery Market by Application, 2020 - 2023, USD Million

TABLE 42 Mexico UPS Battery Market by Application, 2024 - 2031, USD Million

TABLE 43 Rest of North America UPS Battery Market, 2020 - 2023, USD Million

TABLE 44 Rest of North America UPS Battery Market, 2024 - 2031, USD Million

TABLE 45 Rest of North America UPS Battery Market by Battery, 2020 - 2023, USD Million

TABLE 46 Rest of North America UPS Battery Market by Battery, 2024 - 2031, USD Million

TABLE 47 Rest of North America UPS Battery Market by Application, 2020 - 2023, USD Million

TABLE 48 Rest of North America UPS Battery Market by Application, 2024 - 2031, USD Million

TABLE 49 Key Information – ABB Ltd.

TABLE 50 Key Information – Schneider Electric SE

TABLE 51 Key Information – Eaton Corporation PLC

TABLE 52 Key Information – Huawei Technologies Co., Ltd.

TABLE 53 Key Information – Delta Electronics, Inc.

TABLE 54 Key Information – Vertiv Group Corp.

TABLE 55 Key Information – Panasonic Holdings Corporation

TABLE 56 Key Information – enersys

TABLE 57 Key Information – GS Yuasa Corporation

TABLE 58 Key Information – Exide Industries Limited

List of Figures

FIG 1 Methodology for the research

FIG 2 North America UPS Battery Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting UPS Battery Market

FIG 4 Market Share Analysis, 2023

FIG 5 Porter’s Five Forces Analysis – UPS Battery Market

FIG 6 North America UPS Battery Market share by Battery, 2023

FIG 7 North America UPS Battery Market share by Battery, 2031

FIG 8 North America UPS Battery Market by Battery, 2020 - 2031, USD Million

FIG 9 North America UPS Battery Market share by Application, 2023

FIG 10 North America UPS Battery Market share by Application, 2031

FIG 11 North America UPS Battery Market by Application, 2020 - 2031, USD Million

FIG 12 North America UPS Battery Market share by Country, 2023

FIG 13 North America UPS Battery Market share by Country, 2031

FIG 14 North America UPS Battery Market by Country, 2020 - 2031, USD Million

FIG 15 SWOT Analysis: ABB ltd.

FIG 16 SWOT Analysis: Schneider Electric SE

FIG 17 SWOT Analysis: Eaton Corporation PLC

FIG 18 SWOT Analysis: Huawei Technologies Co., Ltd.

FIG 19 SWOT Analysis: Panasonic Holdings Corporation

FIG 20 SWOT Analysis: Enersys