North America Telecom API Market Size, Share & Industry Analysis Report By End User (Partner Developers, Enterprise Developers, Internal Telecom Developers, and Long Tail Developers), By Type (Messaging API, Web RTC API, Payment API, IVR API, Location API, and Other Type), By Country and Growth Forecast, 2025 - 2032

Published Date : 17-Jun-2025 |

Pages: 156 |

Report Format: PDF + Excel |

COVID-19 Impact on the North America Telecom API Market

The North America Telecom API Market would witness market growth of 21.7% CAGR during the forecast period (2025-2032).

The US market dominated the North America Telecom API Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $284,923.4 million by 2032. The Canada market is experiencing a CAGR of 24.3% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 23% during (2025 - 2032).

The Telecom API market has emerged as a pivotal force in the telecommunications industry, transforming how communication services are integrated, delivered, and monetized in an increasingly digital world. Telecom APIs serve as the critical bridge between telecommunications infrastructure and third-party applications, enabling seamless connectivity, data exchange, and service innovation across diverse ecosystems. These interfaces allow developers, businesses, and service providers to leverage telecom capabilities—such as voice, messaging, location services, and billing—without needing to build complex infrastructure from scratch.

By abstracting the underlying complexity of telecom networks, APIs empower organizations to create tailored solutions, enhance customer experiences, and unlock new revenue streams. As the demand for real-time, scalable, and flexible communication solutions grows, the Telecom API market is witnessing rapid expansion, driven by the convergence of telecommunications with digital platforms, cloud computing, and emerging technologies.

North America holds a prominent position in the global Automotive Energy Recovery Systems (AERS) market, driven by the region's advanced automotive industry, stringent environmental regulations, and ongoing investments in green mobility technologies. Countries like the United States and Canada are at the forefront of adopting energy-efficient vehicle components that reduce fuel consumption and CO₂ emissions. The North American AERS market includes a broad spectrum of systems such as regenerative braking, exhaust heat recovery, and thermoelectric generation—each playing a vital role in enhancing vehicle energy efficiency. With a high concentration of both established automobile manufacturers and emerging electric vehicle (EV) startups, the region demonstrates strong momentum toward next-generation vehicle technologies, where energy recovery systems are integral.

A major trend shaping the North American AERS market is the increasing shift toward electric and hybrid vehicles. Regenerative braking systems are now standard in most EVs and hybrid electric vehicles (HEVs), with automakers like Tesla, Ford, and GM actively refining these technologies to improve efficiency and extend driving range. The competitive landscape in North America is dominated by a mix of traditional OEMs, such as Ford, General Motors, and Stellantis, alongside new entrants like Rivian and Lucid Motors. These companies are increasingly collaborating with Tier 1 suppliers including Bosch, Continental, BorgWarner, and Denso, who are major innovators in AERS components.

The region has witnessed a surge in patent filings and technical partnerships as companies race to develop more compact, efficient, and cost-effective energy recovery systems. Competitive differentiation is emerging around system integration, software intelligence, and modularity, enabling flexible application across vehicle platforms. Lastly, high fuel prices and public consciousness around sustainability have made energy-efficient driving more desirable, directly supporting the expansion of the AERS market across both passenger and commercial vehicle segments.

Free Valuable Insights: The Telecom API Market is Predict to reach USD 1233.96 Billion by 2032, at a CAGR of 22.3%

Based on End User, the market is segmented into Partner Developers, Enterprise Developers, Internal Telecom Developers, and Long Tail Developers. Based on Type, the market is segmented into Messaging API, Web RTC API, Payment API, IVR API, Location API, and Other Type. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Adobe, Inc.

- Avaya, Inc. (Avaya Holdings Corp.)

- Deutsche Telekom AG

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- AT&T, Inc.

- Verizon Communications, Inc.

- Ericsson AB

- Twilio, Inc.

North America Telecom API Market Report Segmentation

By End User

- Partner Developers

- Enterprise Developers

- Internal Telecom Developers

- Long Tail Developers

By Type

- Messaging API

- Web RTC API

- Payment API

- IVR API

- Location API

- Other Type

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Telecom API Market, by End User

1.4.2 North America Telecom API Market, by Type

1.4.3 North America Telecom API Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter Five Forces Analysis

Chapter 4. Value Chain Analysis of Telecom API Market

4.1 Research and Development (R&D)

4.2 API and Component Development

4.3 API Integration and Testing

4.4 API Management and Monetization

4.5 Developer Ecosystem and Platform Enablement

4.6 Security, Compliance, and Governance

4.7 Deployment, Monitoring, and Lifecycle Support

4.8 Feedback and Customer Support

Chapter 5. Key Customer Criteria of Telecom API Market

5.1 API Reliability and Uptime

5.2 Security and Compliance

5.3 Ease of Integration and Developer Experience

5.4 Global Reach and Carrier Coverage

5.5 Latency and Performance

5.6 Pricing Transparency and Cost Efficiency

5.7 Feature Breadth

5.8 Customer Support and SLAs

5.9 Analytics and Reporting Capabilities

5.10. Scalability and Redundancy

Chapter 6. North America Telecom API Market by End User

6.1 North America Partner Developers Market by Country

6.2 North America Enterprise Developers Market by Country

6.3 North America Internal Telecom Developers Market by Country

6.4 North America Long Tail Developers Market by Country

Chapter 7. North America Telecom API Market by Type

7.1 North America Messaging API Market by Country

7.2 North America Web RTC API Market by Country

7.3 North America Payment API Market by Country

7.4 North America IVR API Market by Country

7.5 North America Location API Market by Country

7.6 North America Other Type Market by Country

Chapter 8. North America Telecom API Market by Country

8.1 US Telecom API Market

8.1.1 US Telecom API Market by End User

8.1.2 US Telecom API Market by Type

8.2 Canada Telecom API Market

8.2.1 Canada Telecom API Market by End User

8.2.2 Canada Telecom API Market by Type

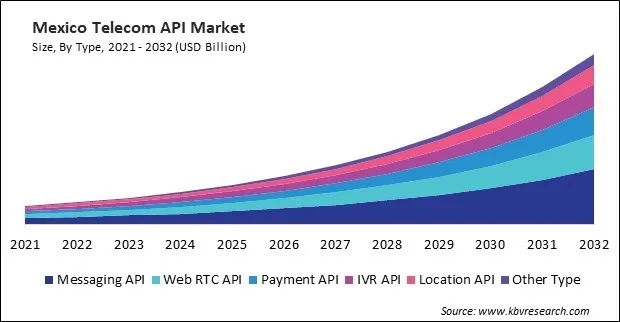

8.3 Mexico Telecom API Market

8.3.1 Mexico Telecom API Market by End User

8.3.2 Mexico Telecom API Market by Type

8.4 Rest of North America Telecom API Market

8.4.1 Rest of North America Telecom API Market by End User

8.4.2 Rest of North America Telecom API Market by Type

Chapter 9. Company Profiles

9.1 Adobe, Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expense

9.1.5 SWOT Analysis

9.2 Avaya, Inc. (Avaya Holdings Corp.)

9.2.1 Company Overview

9.2.2 SWOT Analysis

9.3 Deutsche Telekom AG

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 SWOT Analysis

9.4 IBM Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Regional & Segmental Analysis

9.4.4 Research & Development Expenses

9.4.5 SWOT Analysis

9.5 Microsoft Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 SWOT Analysis

9.6 Amazon Web Services, Inc. (Amazon.com, Inc.)

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 SWOT Analysis

9.7 AT&T, Inc.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expense

9.7.5 SWOT Analysis

9.8 Verizon Communications, Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental Analysis

9.8.4 SWOT Analysis

9.9 Ericsson AB

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Research & Development Expense

9.9.5 SWOT Analysis

9.10. Twilio, Inc.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Segment & Regional Analysis

9.10.4 Research & Development Expense

9.10.5 SWOT Analysis

TABLE 2 North America Telecom API Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria of Telecom API Market

TABLE 4 North America Telecom API Market by End User, 2021 - 2024, USD Million

TABLE 5 North America Telecom API Market by End User, 2025 - 2032, USD Million

TABLE 6 North America Partner Developers Market by Country, 2021 - 2024, USD Million

TABLE 7 North America Partner Developers Market by Country, 2025 - 2032, USD Million

TABLE 8 North America Enterprise Developers Market by Country, 2021 - 2024, USD Million

TABLE 9 North America Enterprise Developers Market by Country, 2025 - 2032, USD Million

TABLE 10 North America Internal Telecom Developers Market by Country, 2021 - 2024, USD Million

TABLE 11 North America Internal Telecom Developers Market by Country, 2025 - 2032, USD Million

TABLE 12 North America Long Tail Developers Market by Country, 2021 - 2024, USD Million

TABLE 13 North America Long Tail Developers Market by Country, 2025 - 2032, USD Million

TABLE 14 Use Case-1: Partner Developers Enablement Program (2025)

TABLE 15 Use Case-2 Enterprise Developers Build Private 5G Applications via Telecom APIs (2025)

TABLE 16 Use-Case-3: Internal Developers Driving Network Automation via APIs (2025)

TABLE 17 Use Case-4: Long Tail Developer Access to Telecom APIs for Niche Apps (2025)

TABLE 18 North America Telecom API Market by Type, 2021 - 2024, USD Million

TABLE 19 North America Telecom API Market by Type, 2025 - 2032, USD Million

TABLE 20 North America Messaging API Market by Country, 2021 - 2024, USD Million

TABLE 21 North America Messaging API Market by Country, 2025 - 2032, USD Million

TABLE 22 North America Web RTC API Market by Country, 2021 - 2024, USD Million

TABLE 23 North America Web RTC API Market by Country, 2025 - 2032, USD Million

TABLE 24 North America Payment API Market by Country, 2021 - 2024, USD Million

TABLE 25 North America Payment API Market by Country, 2025 - 2032, USD Million

TABLE 26 North America IVR API Market by Country, 2021 - 2024, USD Million

TABLE 27 North America IVR API Market by Country, 2025 - 2032, USD Million

TABLE 28 North America Location API Market by Country, 2021 - 2024, USD Million

TABLE 29 North America Location API Market by Country, 2025 - 2032, USD Million

TABLE 30 North America Other Type Market by Country, 2021 - 2024, USD Million

TABLE 31 North America Other Type Market by Country, 2025 - 2032, USD Million

TABLE 32 Use Case-1: Messaging API for Omnichannel Customer Engagement (2025)

TABLE 33 Use Case-2: WebRTC API for Real-Time Voice & Video Communications (2025)

TABLE 34 Use Case-3: Payment API for Seamless Mobile Billing (2025)

TABLE 35 Use Case-4: IVR API for Automated Customer Self-Service (2025)

TABLE 36 Use Case-5: Location API for Real-Time Location-Based Services (2025)

TABLE 37 Use Case-6: Network Analytics API for Proactive Network Management (2025)

TABLE 38 North America Telecom API Market by Country, 2021 - 2024, USD Million

TABLE 39 North America Telecom API Market by Country, 2025 - 2032, USD Million

TABLE 40 US Telecom API Market, 2021 - 2024, USD Million

TABLE 41 US Telecom API Market, 2025 - 2032, USD Million

TABLE 42 US Telecom API Market by End User, 2021 - 2024, USD Million

TABLE 43 US Telecom API Market by End User, 2025 - 2032, USD Million

TABLE 44 US Telecom API Market by Type, 2021 - 2024, USD Million

TABLE 45 US Telecom API Market by Type, 2025 - 2032, USD Million

TABLE 46 Canada Telecom API Market, 2021 - 2024, USD Million

TABLE 47 Canada Telecom API Market, 2025 - 2032, USD Million

TABLE 48 Canada Telecom API Market by End User, 2021 - 2024, USD Million

TABLE 49 Canada Telecom API Market by End User, 2025 - 2032, USD Million

TABLE 50 Canada Telecom API Market by Type, 2021 - 2024, USD Million

TABLE 51 Canada Telecom API Market by Type, 2025 - 2032, USD Million

TABLE 52 Mexico Telecom API Market, 2021 - 2024, USD Million

TABLE 53 Mexico Telecom API Market, 2025 - 2032, USD Million

TABLE 54 Mexico Telecom API Market by End User, 2021 - 2024, USD Million

TABLE 55 Mexico Telecom API Market by End User, 2025 - 2032, USD Million

TABLE 56 Mexico Telecom API Market by Type, 2021 - 2024, USD Million

TABLE 57 Mexico Telecom API Market by Type, 2025 - 2032, USD Million

TABLE 58 Rest of North America Telecom API Market, 2021 - 2024, USD Million

TABLE 59 Rest of North America Telecom API Market, 2025 - 2032, USD Million

TABLE 60 Rest of North America Telecom API Market by End User, 2021 - 2024, USD Million

TABLE 61 Rest of North America Telecom API Market by End User, 2025 - 2032, USD Million

TABLE 62 Rest of North America Telecom API Market by Type, 2021 - 2024, USD Million

TABLE 63 Rest of North America Telecom API Market by Type, 2025 - 2032, USD Million

TABLE 64 Key Information – Adobe, Inc.

TABLE 65 Key Information – Avaya, Inc.

TABLE 66 Key Information – Deutsche Telekom AG

TABLE 67 Key Information – IBM Corporation

TABLE 68 Key Information – Microsoft Corporation

TABLE 69 Key Information – Amazon Web Services, Inc.

TABLE 70 Key Information – AT&T, Inc.

TABLE 71 key information – Verizon Communications, Inc.

TABLE 72 key information – Ericsson AB

TABLE 73 Key Information – Twilio, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Telecom API Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Telecom API Market

FIG 4 Porter’s Five Forces Analysis – Telecom API Market

FIG 5 Value Chain Analysis of Telecom API Market

FIG 6 Key Customer Criteria of Telecom API Market

FIG 7 North America Telecom API Market share by End User, 2024

FIG 8 North America Telecom API Market share by End User, 2032

FIG 9 North America Telecom API Market by End User, 2021 - 2032, USD Million

FIG 10 North America Telecom API Market share by Type, 2024

FIG 11 North America Telecom API Market share by Type, 2032

FIG 12 North America Telecom API Market by Type, 2021 - 2032, USD Million

FIG 13 North America Telecom API Market share by Country, 2024

FIG 14 North America Telecom API Market share by Country, 2032

FIG 15 North America Telecom API Market by Country, 2021 - 2032, USD Million

FIG 16 SWOT Analysis: Adobe, Inc.

FIG 17 Swot Analysis: Avaya, Inc.

FIG 18 Swot Analysis: Deutsche Telekom AG

FIG 19 SWOT Analysis: IBM Corporation

FIG 20 SWOT Analysis: Microsoft Corporation

FIG 21 SWOT Analysis: Amazon Web Services, Inc.

FIG 22 SWOT Analysis: AT&T Inc.

FIG 23 SWOT Analysis: Verizon Communications, Inc.

FIG 24 SWOT Analysis: Ericsson AB

FIG 25 Swot Analysis: Twilio, Inc.