North America Stemware Market Size, Share & Industry Analysis Report By Product (Wine Glasses, Cocktail Glasses, Champagne Glasses, Martini Glasses, and Other Product), By Application (Residential, and Commercial), By Distribution Channel (Offline, and Online), By Country and Growth Forecast, 2025 - 2032

Published Date : 09-Dec-2025 |

Pages: 128 |

Report Format: PDF + Excel |

COVID-19 Impact on the North America Stemware Market

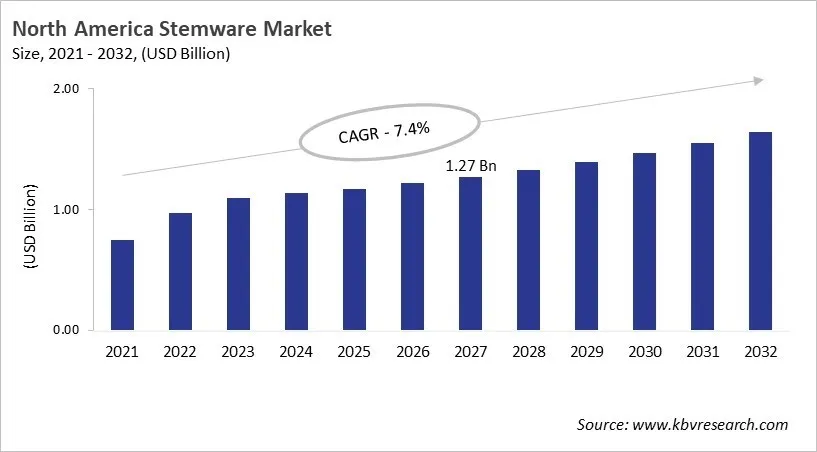

The North America Stemware Market would witness market growth of 4.9% CAGR during the forecast period (2025-2032).

The US market dominated the North America Stemware Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $1,088.7 million by 2032. The Canada market is experiencing a CAGR of 6.7% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 6% during (2025 - 2032). The US and Canada led the North America Stemware Market by Country with a market share of 70.1% and 15.1% in 2024.

The North American stemware market has changed a lot because of changing tastes, more drinking, and new ways of making glass. Historically, European craftsmanship had an impact on local production in the U.S. and Canada. Companies like Libbey expanded their operations to an industrial scale, making high-quality glassware more accessible to everyone. The market has grown because more people are drinking wine and spirits, the hospitality industry is growing, and wine culture is spreading in places like Napa Valley, Oregon, and British Columbia. OEM innovations, like RIEDEL's designs that focus on performance and Libbey's durable, cost-effective materials, along with strong trade networks, have made products more diverse and competition stronger.

Digital commerce, premiumization, and sustainability are some of the most important trends that are changing the market right now. More and more, customers want stemware that is design-focused and specific to a certain type of drink. To meet this demand, manufacturers are using eco-friendly materials, energy-efficient processes, and recyclable packaging. E-commerce and omni-channel distribution have made glassware more available, which has helped both the retail and hospitality industries meet the growing demand for both functional and decorative glassware. Performance-driven design, optimizing manufacturing, building a brand, and sustainability initiatives are some of the main strategies used by industry leaders. The competition is still strong, with domestic OEMs, high-end European brands, and small producers all competing on factors like material, durability, sensory performance, and environmental responsibility.

Product Outlook

Based on Product, the market is segmented into Wine Glasses, Cocktail Glasses, Champagne Glasses, Martini Glasses, and Other Product. Among various US Stemware Market by Product; The Wine Glasses market achieved a market size of USD $534.6 Million in 2024 and is expected to grow at a CAGR of 3.7 % during the forecast period. The Martini Glasses market is predicted to experience a CAGR of 5.2% throughout the forecast period from (2025 - 2032).

Application Outlook

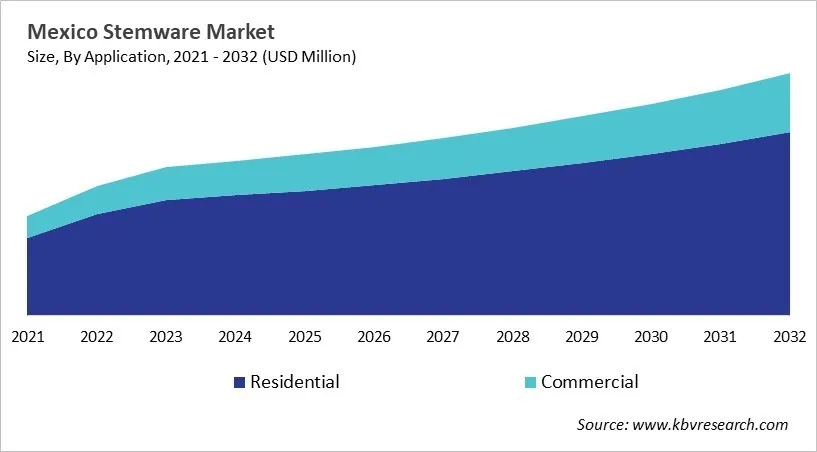

Based on Application, the market is segmented into Residential, and Commercial. With a compound annual growth rate (CAGR) of 5.6% over the projection period, the Residential Market, dominate the Mexico Stemware Market by Application in 2024 and would be a prominent market until 2032.The Commercial market is expected to witness a CAGR of 7.1% during (2025 - 2032).

Free Valuable Insights: The Stemware Market is Predicted to reach USD 6.34 Billion by 2032, at a CAGR of 5.3%

Country Outlook

The US stemware market is big and well-established, thanks to a strong wine culture, a strong hospitality industry, and people spending money on home entertaining and kitchenware all the time. The rise in wine consumption has led to a shift from mass-produced glassware to high-end crystal. At the same time, restaurants, hotels, and bars keep the market growing by buying more glassware. Some of the most important trends are the rise of high-clarity, thin-rimmed glasses, the growth of craft cocktail culture, and the growing interest in sustainability among consumers. There is a lot of competition, with big domestic companies like Libbey and Arc competing with imported European luxury brands. E-commerce platforms make it easier for people to buy both mass-market and artisanal goods. Design, durability, brand heritage, and performance all play a role in product differentiation, which reflects the different tastes of customers in both retail and commercial settings.

List of Key Companies Profiled

- Libbey Glass LLC

- Tiroler Glashütte GmbH (Riedel)

- Fiskars Group (Waterford)

- Baccarat SA (Fortune Legend Limited)

- Zwiesel Kristallglas AG (Fortessa Tableware Solutions, LLC)

- Bormioli Luigi S.p.A.

- Bayerische Glaswerke GmbH (Nachtmann)

- Stölzle Lausitz GmbH

- ARC Management & Services SAS (Cristal d'Arques Paris)

- GLASVIN

North America Stemware Market Report Segmentation

By Product

- Wine Glasses

- Cocktail Glasses

- Champagne Glasses

- Martini Glasses

- Other Product

By Application

- Residential

- Commercial

By Distribution Channel

- Offline

- Home Improvement Stores

- Hypermarkets/Supermarkets

- Specialty Stores

- Other Offline Type

- Online

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Stemware Market, by Product

1.4.2 North America Stemware Market, by Application

1.4.3 North America Stemware Market, by Distribution Channel

1.4.4 North America Stemware Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter Five Forces Analysis

Chapter 4. Market Trends – North America Stemware Market

Chapter 5. State of Competition – North America Stemware Market

Chapter 6. Value Chain Analysis of Stemware Market

Chapter 7. Product Life Cycle – Stemware Market

Chapter 8. Market Consolidation – Stemware Market

Chapter 9. Key Customer Criteria – Stemware Market

Chapter 10. North America Stemware Market by Product

10.1 North America Wine Glasses Market by Country

10.2 North America Cocktail Glasses Market by Country

10.3 North America Champagne Glasses Market by Country

10.4 North America Martini Glasses Market by Country

10.5 North America Other Product Market by Country

Chapter 11. North America Stemware Market by Application

11.1 North America Residential Market by Country

11.2 North America Commercial Market by Country

Chapter 12. North America Stemware Market by Distribution Channel

12.1 North America Offline Market by Country

12.2 North America Stemware Market by Offline Type

12.2.1 North America Home Improvement Stores Market by Country

12.2.2 North America Hypermarkets/Supermarkets Market by Country

12.2.3 North America Specialty Stores Market by Country

12.2.4 North America Other Offline Type Market by Country

12.3 North America Online Market by Country

Chapter 13. North America Stemware Market by Country

13.1 US Stemware Market

13.1.1 US Stemware Market by Product

13.1.2 US Stemware Market by Application

13.1.3 US Stemware Market by Distribution Channel

13.1.3.1 US Stemware Market by Offline Type

13.2 Canada Stemware Market

13.2.1 Canada Stemware Market by Product

13.2.2 Canada Stemware Market by Application

13.2.3 Canada Stemware Market by Distribution Channel

13.2.3.1 Canada Stemware Market by Offline Type

13.3 Mexico Stemware Market

13.3.1 Mexico Stemware Market by Product

13.3.2 Mexico Stemware Market by Application

13.3.3 Mexico Stemware Market by Distribution Channel

13.3.3.1 Mexico Stemware Market by Offline Type

13.4 Rest of North America Stemware Market

13.4.1 Rest of North America Stemware Market by Product

13.4.2 Rest of North America Stemware Market by Application

13.4.3 Rest of North America Stemware Market by Distribution Channel

13.4.3.1 Rest of North America Stemware Market by Offline Type

Chapter 14. Company Profiles

14.1 Libbey Glass LLC

14.1.1 Company Overview

14.2 Tiroler Glashütte GmbH (Riedel)

14.2.1 Company Overview

14.3 Fiskars Group (Waterford)

14.3.1 Company Overview

14.3.2 Financial Analysis

14.3.3 Segmental and Regional Analysis

14.3.4 Research & Development Expenses

14.4 Baccarat SA (Fortune Legend Limited)

14.4.1 Company Overview

14.5 Zwiesel Kristallglas AG (Fortessa Tableware Solutions, LLC)

14.5.1 Company Overview

14.6 Bormioli Luigi S.p.A.

14.6.1 Company Overview

14.7 Bayerische Glaswerke GmbH (Nachtmann)

14.7.1 Company Overview

14.8 Stölzle Lausitz GmbH

14.8.1 Company Overview

14.9 ARC Management & Services SAS (Cristal d'Arques Paris)

14.9.1 Company Overview

14.10. GLASVIN

14.10.1 Company Overview

TABLE 2 North America Stemware Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria – Stemware Market

TABLE 4 North America Stemware Market by Product, 2021 - 2024, USD Million

TABLE 5 North America Stemware Market by Product, 2025 - 2032, USD Million

TABLE 6 North America Wine Glasses Market by Country, 2021 - 2024, USD Million

TABLE 7 North America Wine Glasses Market by Country, 2025 - 2032, USD Million

TABLE 8 North America Cocktail Glasses Market by Country, 2021 - 2024, USD Million

TABLE 9 North America Cocktail Glasses Market by Country, 2025 - 2032, USD Million

TABLE 10 North America Champagne Glasses Market by Country, 2021 - 2024, USD Million

TABLE 11 North America Champagne Glasses Market by Country, 2025 - 2032, USD Million

TABLE 12 North America Martini Glasses Market by Country, 2021 - 2024, USD Million

TABLE 13 North America Martini Glasses Market by Country, 2025 - 2032, USD Million

TABLE 14 North America Other Product Market by Country, 2021 - 2024, USD Million

TABLE 15 North America Other Product Market by Country, 2025 - 2032, USD Million

TABLE 16 North America Stemware Market by Application, 2021 - 2024, USD Million

TABLE 17 North America Stemware Market by Application, 2025 - 2032, USD Million

TABLE 18 North America Residential Market by Country, 2021 - 2024, USD Million

TABLE 19 North America Residential Market by Country, 2025 - 2032, USD Million

TABLE 20 North America Commercial Market by Country, 2021 - 2024, USD Million

TABLE 21 North America Commercial Market by Country, 2025 - 2032, USD Million

TABLE 22 North America Stemware Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 23 C

TABLE 24 North America Offline Market by Country, 2021 - 2024, USD Million

TABLE 25 North America Offline Market by Country, 2025 - 2032, USD Million

TABLE 26 North America Stemware Market by Offline Type, 2021 - 2024, USD Million

TABLE 27 North America Stemware Market by Offline Type, 2025 - 2032, USD Million

TABLE 28 North America Home Improvement Stores Market by Country, 2021 - 2024, USD Million

TABLE 29 North America Home Improvement Stores Market by Country, 2025 - 2032, USD Million

TABLE 30 North America Hypermarkets/Supermarkets Market by Country, 2021 - 2024, USD Million

TABLE 31 North America Hypermarkets/Supermarkets Market by Country, 2025 - 2032, USD Million

TABLE 32 North America Specialty Stores Market by Country, 2021 - 2024, USD Million

TABLE 33 North America Specialty Stores Market by Country, 2025 - 2032, USD Million

TABLE 34 North America Other Offline Type Market by Country, 2021 - 2024, USD Million

TABLE 35 North America Other Offline Type Market by Country, 2025 - 2032, USD Million

TABLE 36 North America Online Market by Country, 2021 - 2024, USD Million

TABLE 37 North America Online Market by Country, 2025 - 2032, USD Million

TABLE 38 North America Stemware Market by Country, 2021 - 2024, USD Million

TABLE 39 North America Stemware Market by Country, 2025 - 2032, USD Million

TABLE 40 US Stemware Market, 2021 - 2024, USD Million

TABLE 41 US Stemware Market, 2025 - 2032, USD Million

TABLE 42 US Stemware Market by Product, 2021 - 2024, USD Million

TABLE 43 US Stemware Market by Product, 2025 - 2032, USD Million

TABLE 44 US Stemware Market by Application, 2021 - 2024, USD Million

TABLE 45 US Stemware Market by Application, 2025 - 2032, USD Million

TABLE 46 US Stemware Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 47 US Stemware Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 48 US Stemware Market by Offline Type, 2021 - 2024, USD Million

TABLE 49 US Stemware Market by Offline Type, 2025 - 2032, USD Million

TABLE 50 Canada Stemware Market, 2021 - 2024, USD Million

TABLE 51 Canada Stemware Market, 2025 - 2032, USD Million

TABLE 52 Canada Stemware Market by Product, 2021 - 2024, USD Million

TABLE 53 Canada Stemware Market by Product, 2025 - 2032, USD Million

TABLE 54 Canada Stemware Market by Application, 2021 - 2024, USD Million

TABLE 55 Canada Stemware Market by Application, 2025 - 2032, USD Million

TABLE 56 Canada Stemware Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 57 Canada Stemware Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 58 Canada Stemware Market by Offline Type, 2021 - 2024, USD Million

TABLE 59 Canada Stemware Market by Offline Type, 2025 - 2032, USD Million

TABLE 60 Mexico Stemware Market, 2021 - 2024, USD Million

TABLE 61 Mexico Stemware Market, 2025 - 2032, USD Million

TABLE 62 Mexico Stemware Market by Product, 2021 - 2024, USD Million

TABLE 63 Mexico Stemware Market by Product, 2025 - 2032, USD Million

TABLE 64 Mexico Stemware Market by Application, 2021 - 2024, USD Million

TABLE 65 Mexico Stemware Market by Application, 2025 - 2032, USD Million

TABLE 66 Mexico Stemware Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 67 Mexico Stemware Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 68 Mexico Stemware Market by Offline Type, 2021 - 2024, USD Million

TABLE 69 Mexico Stemware Market by Offline Type, 2025 - 2032, USD Million

TABLE 70 Rest of North America Stemware Market, 2021 - 2024, USD Million

TABLE 71 Rest of North America Stemware Market, 2025 - 2032, USD Million

TABLE 72 Rest of North America Stemware Market by Product, 2021 - 2024, USD Million

TABLE 73 Rest of North America Stemware Market by Product, 2025 - 2032, USD Million

TABLE 74 Rest of North America Stemware Market by Application, 2021 - 2024, USD Million

TABLE 75 Rest of North America Stemware Market by Application, 2025 - 2032, USD Million

TABLE 76 Rest of North America Stemware Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 77 Rest of North America Stemware Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 78 Rest of North America Stemware Market by Offline Type, 2021 - 2024, USD Million

TABLE 79 Rest of North America Stemware Market by Offline Type, 2025 - 2032, USD Million

TABLE 80 Key Information – Libbey Glass LLC

TABLE 81 Key Information – Tiroler Glashütte GmbH

TABLE 82 Key Information – Fiskars Group

TABLE 83 Key Information – Baccarat SA

TABLE 84 Key Information – Zwiesel Kristallglas AG

TABLE 85 Key Information – Bormioli Luigi S.p.A.

TABLE 86 Key Information – Bayerische Glaswerke GmbH

TABLE 87 Key Information – Stölzle Lausitz GmbH

TABLE 88 Key Information – ARC Management & Services SAS

TABLE 89 Key Information – GLASVIN

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Stemware Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting north America Stemware Market

FIG 4 Porter’s Five Forces Analysis – Stemware Market

FIG 5 Value Chain Analysis of Stemware Market

FIG 6 Product Life Cycle – Stemware Market

FIG 7 Market Consolidation – Stemware Market

FIG 8 Key Customer Criteria – Stemware Market

FIG 9 North America Stemware Market share by Product, 2024

FIG 10 North America Stemware Market share by Product, 2032

FIG 11 North America Stemware Market by Product, 2021 - 2032, USD Million

FIG 12 North America Stemware Market SHARE by Application, 2024

FIG 13 North America Stemware Market SHARE by Application, 2032

FIG 14 North America Stemware Market by Application, 2021 - 2032, USD Million

FIG 15 North America Stemware Market SHARE by Distribution Channel, 2024

FIG 16 North America Stemware Market SHARE by Distribution Channel, 2032

FIG 17 North America Stemware Market by Distribution Channel, 2021 - 2032, USD Million

FIG 18 North America Stemware Market SHARE by Country, 2024

FIG 19 North America Stemware Market SHARE by Country, 2032

FIG 20 North America Stemware Market by Country, 2021 - 2032, USD Million