North America Robotics System Integration Market Size, Share & Trends Analysis Report By Type (Industrial Robots, Autonomous Robots, Service Robots, and Collaborative Robots), By Application, By End-use, By Country and Growth Forecast, 2025 - 2032

Published Date : 28-Apr-2025 |

Pages: 145 |

Report Format: PDF + Excel |

COVID-19 Impact on the North America Robotics System Integration Market

The North America Robotics System Integration Market would witness market growth of 9.2% CAGR during the forecast period (2025-2032).

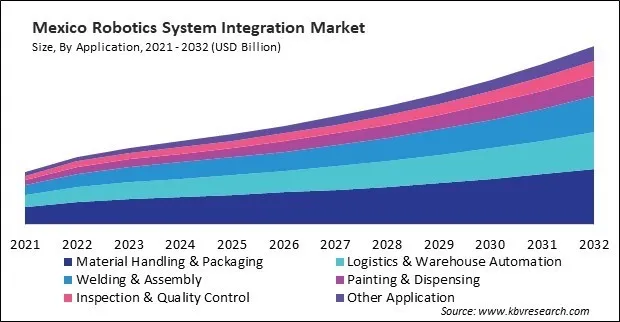

The US market dominated the North America Robotics System Integration Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $28,908.7 million by 2032. The Canada market is experiencing a CAGR of 11.3% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 10.2% during (2025 - 2032).

The robotics system integration market is experiencing rapid growth, driven by technological advancements, increasing automation across industries, and the need for enhanced productivity and efficiency. Robotics integration combines robotic systems, hardware, software, and infrastructure to create cohesive automation solutions tailored to specific industrial tasks. This comprehensive integration enables industries to streamline operations, reduce costs, and improve product quality.

Robotics system integration finds applications across a wide range of industries. Robots are increasingly used for material handling because they can work on multiple processes simultaneously and improve efficiency. The need to move bulk payloads efficiently in the automotive industry has resulted in a high demand for robotics system integration. The chemical industry also represents a major consumer due to handling hazardous materials and the desire to reduce liability and refurbishment costs.

Canada’s ambitious plan to add 1.6 GW of utility-scale solar power annually, alongside British Columbia’s $5 billion in proposed hydrogen projects, underlines the country’s deep commitment to renewable energy and green hydrogen development. With 98% of British Columbia’s electricity being clean or renewable, robotics system integration plays a crucial role in constructing and maintaining solar facilities and hydrogen production plants. Integrated robotics systems enable the safe, efficient handling of hydrogen, precision assembly of photovoltaic panels, and automation of large-scale energy storage solutions. In addition, Mexico’s semiconductor and component manufacturing sector showed a quarterly growth of 5.06% in Q2 2024, reaching a GDP contribution of MX$6.58 trillion. This growth underlines the country's increasing sophistication and scale of high-tech manufacturing. Robotics system integration is essential in this space, where precision, cleanliness, and speed are critical to success. Integrating robotics into semiconductor fabrication facilities supports wafer handling, component placement, and real-time quality control. In conclusion, Canada’s renewable energy initiatives, Mexico’s expanding semiconductor manufacturing, and the U.S.’s dominant aerospace industry all present powerful drivers for the growth of the market in North America.

Free Valuable Insights: The Robotics System Integration Market is Predict to reach USD 150.84 Billion by 2032, at a CAGR of 9.4%

Based on Type, the market is segmented into Industrial Robots, Autonomous Robots, Service Robots, and Collaborative Robots. Based on Application, the market is segmented into Material Handling & Packaging, Logistics & Warehouse Automation, Welding & Assembly, Painting & Dispensing, Inspection & Quality Control, and Other Application. Based on End-use, the market is segmented into Automotive, Electronics & Semiconductor, Aerospace & Defense, Food & Beverage, Pharmaceuticals & Healthcare, E-commerce & Retail, Energy & Utilities, Agriculture, and Other End-use. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Hitachi High-Technologies Corporation (Hitachi Ltd.)

- IPG Photonics Corporation

- JH Robotics, Inc.

- ABB Ltd.

- FANUC Corporation

- Teradyne, Inc.

- Kuka AG (Midea Group Co., Ltd.)

- Siemens AG

- Rockwell Automation, Inc.

- Omron Corporation

North America Robotics System Integration Market Report Segmentation

By Type

- Industrial Robots

- Autonomous Robots

- Service Robots

- Collaborative Robots

By Application

- Material Handling & Packaging

- Logistics & Warehouse Automation

- Welding & Assembly

- Painting & Dispensing

- Inspection & Quality Control

- Other Application

By End-Use

- Automotive

- Electronics & Semiconductor

- Aerospace & Defense

- Food & Beverage

- Pharmaceuticals & Healthcare

- E-commerce & Retail

- Energy & Utilities

- Agriculture

- Other End-use

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Robotics System Integration Market, by Type

1.4.2 North America Robotics System Integration Market, by Application

1.4.3 North America Robotics System Integration Market, by End-Use

1.4.4 North America Robotics System Integration Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2024

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2021-2025)

4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2024, Feb – 2025, Apr) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. North America Robotics System Integration Market by Type

5.1 North America Industrial Robots Market by Country

5.2 North America Autonomous Robots Market by Country

5.3 North America Service Robots Market by Country

5.4 North America Collaborative Robots Market by Country

Chapter 6. North America Robotics System Integration Market by Application

6.1 North America Material Handling & Packaging Market by Country

6.2 North America Logistics & Warehouse Automation Market by Country

6.3 North America Welding & Assembly Market by Country

6.4 North America Painting & Dispensing Market by Country

6.5 North America Inspection & Quality Control Market by Country

6.6 North America Other Application Market by Country

Chapter 7. North America Robotics System Integration Market by End-use

7.1 North America Automotive Market by Country

7.2 North America Electronics & Semiconductor Market by Country

7.3 North America Aerospace & Defense Market by Country

7.4 North America Food & Beverage Market by Country

7.5 North America Pharmaceuticals & Healthcare Market by Country

7.6 North America E-commerce & Retail Market by Country

7.7 North America Energy & Utilities Market by Country

7.8 North America Agriculture Market by Country

7.9 North America Other End-use Market by Country

Chapter 8. North America Robotics System Integration Market by Country

8.1 US Robotics System Integration Market

8.1.1 US Robotics System Integration Market by Type

8.1.2 US Robotics System Integration Market by Application

8.1.3 US Robotics System Integration Market by End-use

8.2 Canada Robotics System Integration Market

8.2.1 Canada Robotics System Integration Market by Type

8.2.2 Canada Robotics System Integration Market by Application

8.2.3 Canada Robotics System Integration Market by End-use

8.3 Mexico Robotics System Integration Market

8.3.1 Mexico Robotics System Integration Market by Type

8.3.2 Mexico Robotics System Integration Market by Application

8.3.3 Mexico Robotics System Integration Market by End-use

8.4 Rest of North America Robotics System Integration Market

8.4.1 Rest of North America Robotics System Integration Market by Type

8.4.2 Rest of North America Robotics System Integration Market by Application

8.4.3 Rest of North America Robotics System Integration Market by End-use

Chapter 9. Company Profiles

9.1 Hitachi High-Tech Corporation (Hitachi, Ltd.)

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 Recent strategies and developments:

9.1.5.1 Acquisition and Mergers:

9.1.6 SWOT Analysis

9.2 IPG Photonics Corporation

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Research & Development Expenses

9.2.5 Recent strategies and developments:

9.2.5.1 Product Launches and Product Expansions:

9.2.5.2 Acquisition and Mergers:

9.3 JH Robotics, Inc.

9.3.1 Company Overview

9.4 ABB Ltd.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expense

9.4.5 Recent strategies and developments:

9.4.5.1 Partnerships, Collaborations, and Agreements:

9.4.5.2 Product Launches and Product Expansions:

9.4.5.3 Acquisition and Mergers:

9.4.6 SWOT Analysis

9.5 FANUC Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Regional Analysis

9.5.4 SWOT Analysis

9.6 Teradyne, Inc.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Recent strategies and developments:

9.6.4.1 Partnerships, Collaborations, and Agreements:

9.6.5 SWOT Analysis

9.7 Kuka AG (Midea Group Co., Ltd.)

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expenses

9.7.5 Recent strategies and developments:

9.7.5.1 Partnerships, Collaborations, and Agreements:

9.7.6 SWOT Analysis

9.8 Siemens AG

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Research & Development Expense

9.8.5 Recent strategies and developments:

9.8.5.1 Partnerships, Collaborations, and Agreements:

9.8.6 SWOT Analysis

9.9 Rockwell Automation, Inc.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Research & Development Expenses

9.9.5 Recent strategies and developments:

9.9.5.1 Partnerships, Collaborations, and Agreements:

9.9.5.2 Acquisition and Mergers:

9.9.6 SWOT Analysis

9.10. Omron Corporation

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Segmental and Regional Analysis

9.10.4 Research & Development Expenses

9.10.5 Recent strategies and developments:

9.10.5.1 Partnerships, Collaborations, and Agreements:

9.10.6 SWOT Analysis

TABLE 2 North America Robotics System Integration Market, 2025 - 2032, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Robotics System Integration Market

TABLE 4 Product Launches And Product Expansions– Robotics System Integration Market

TABLE 5 Acquisition and Mergers– Robotics System Integration Market

TABLE 6 North America Robotics System Integration Market by Type, 2021 - 2024, USD Million

TABLE 7 North America Robotics System Integration Market by Type, 2025 - 2032, USD Million

TABLE 8 North America Industrial Robots Market by Country, 2021 - 2024, USD Million

TABLE 9 North America Industrial Robots Market by Country, 2025 - 2032, USD Million

TABLE 10 North America Autonomous Robots Market by Country, 2021 - 2024, USD Million

TABLE 11 North America Autonomous Robots Market by Country, 2025 - 2032, USD Million

TABLE 12 North America Service Robots Market by Country, 2021 - 2024, USD Million

TABLE 13 North America Service Robots Market by Country, 2025 - 2032, USD Million

TABLE 14 North America Collaborative Robots Market by Country, 2021 - 2024, USD Million

TABLE 15 North America Collaborative Robots Market by Country, 2025 - 2032, USD Million

TABLE 16 North America Robotics System Integration Market by Application, 2021 - 2024, USD Million

TABLE 17 North America Robotics System Integration Market by Application, 2025 - 2032, USD Million

TABLE 18 North America Material Handling & Packaging Market by Country, 2021 - 2024, USD Million

TABLE 19 North America Material Handling & Packaging Market by Country, 2025 - 2032, USD Million

TABLE 20 North America Logistics & Warehouse Automation Market by Country, 2021 - 2024, USD Million

TABLE 21 North America Logistics & Warehouse Automation Market by Country, 2025 - 2032, USD Million

TABLE 22 North America Welding & Assembly Market by Country, 2021 - 2024, USD Million

TABLE 23 North America Welding & Assembly Market by Country, 2025 - 2032, USD Million

TABLE 24 North America Painting & Dispensing Market by Country, 2021 - 2024, USD Million

TABLE 25 North America Painting & Dispensing Market by Country, 2025 - 2032, USD Million

TABLE 26 North America Inspection & Quality Control Market by Country, 2021 - 2024, USD Million

TABLE 27 North America Inspection & Quality Control Market by Country, 2025 - 2032, USD Million

TABLE 28 North America Other Application Market by Country, 2021 - 2024, USD Million

TABLE 29 North America Other Application Market by Country, 2025 - 2032, USD Million

TABLE 30 North America Robotics System Integration Market by End-use, 2021 - 2024, USD Million

TABLE 31 North America Robotics System Integration Market by End-use, 2025 - 2032, USD Million

TABLE 32 North America Automotive Market by Country, 2021 - 2024, USD Million

TABLE 33 North America Automotive Market by Country, 2025 - 2032, USD Million

TABLE 34 North America Electronics & Semiconductor Market by Country, 2021 - 2024, USD Million

TABLE 35 North America Electronics & Semiconductor Market by Country, 2025 - 2032, USD Million

TABLE 36 North America Aerospace & Defense Market by Country, 2021 - 2024, USD Million

TABLE 37 North America Aerospace & Defense Market by Country, 2025 - 2032, USD Million

TABLE 38 North America Food & Beverage Market by Country, 2021 - 2024, USD Million

TABLE 39 North America Food & Beverage Market by Country, 2025 - 2032, USD Million

TABLE 40 North America Pharmaceuticals & Healthcare Market by Country, 2021 - 2024, USD Million

TABLE 41 North America Pharmaceuticals & Healthcare Market by Country, 2025 - 2032, USD Million

TABLE 42 North America E-commerce & Retail Market by Country, 2021 - 2024, USD Million

TABLE 43 North America E-commerce & Retail Market by Country, 2025 - 2032, USD Million

TABLE 44 North America Energy & Utilities Market by Country, 2021 - 2024, USD Million

TABLE 45 North America Energy & Utilities Market by Country, 2025 - 2032, USD Million

TABLE 46 North America Agriculture Market by Country, 2021 - 2024, USD Million

TABLE 47 North America Agriculture Market by Country, 2025 - 2032, USD Million

TABLE 48 North America Other End-use Market by Country, 2021 - 2024, USD Million

TABLE 49 North America Other End-use Market by Country, 2025 - 2032, USD Million

TABLE 50 North America Robotics System Integration Market by Country, 2021 - 2024, USD Million

TABLE 51 North America Robotics System Integration Market by Country, 2025 - 2032, USD Million

TABLE 52 US Robotics System Integration Market, 2021 - 2024, USD Million

TABLE 53 US Robotics System Integration Market, 2025 - 2032, USD Million

TABLE 54 US Robotics System Integration Market by Type, 2021 - 2024, USD Million

TABLE 55 US Robotics System Integration Market by Type, 2025 - 2032, USD Million

TABLE 56 US Robotics System Integration Market by Application, 2021 - 2024, USD Million

TABLE 57 US Robotics System Integration Market by Application, 2025 - 2032, USD Million

TABLE 58 US Robotics System Integration Market by End-use, 2021 - 2024, USD Million

TABLE 59 US Robotics System Integration Market by End-use, 2025 - 2032, USD Million

TABLE 60 Canada Robotics System Integration Market, 2021 - 2024, USD Million

TABLE 61 Canada Robotics System Integration Market, 2025 - 2032, USD Million

TABLE 62 Canada Robotics System Integration Market by Type, 2021 - 2024, USD Million

TABLE 63 Canada Robotics System Integration Market by Type, 2025 - 2032, USD Million

TABLE 64 Canada Robotics System Integration Market by Application, 2021 - 2024, USD Million

TABLE 65 Canada Robotics System Integration Market by Application, 2025 - 2032, USD Million

TABLE 66 Canada Robotics System Integration Market by End-use, 2021 - 2024, USD Million

TABLE 67 Canada Robotics System Integration Market by End-use, 2025 - 2032, USD Million

TABLE 68 Mexico Robotics System Integration Market, 2021 - 2024, USD Million

TABLE 69 Mexico Robotics System Integration Market, 2025 - 2032, USD Million

TABLE 70 Mexico Robotics System Integration Market by Type, 2021 - 2024, USD Million

TABLE 71 Mexico Robotics System Integration Market by Type, 2025 - 2032, USD Million

TABLE 72 Mexico Robotics System Integration Market by Application, 2021 - 2024, USD Million

TABLE 73 Mexico Robotics System Integration Market by Application, 2025 - 2032, USD Million

TABLE 74 Mexico Robotics System Integration Market by End-use, 2021 - 2024, USD Million

TABLE 75 Mexico Robotics System Integration Market by End-use, 2025 - 2032, USD Million

TABLE 76 Rest of North America Robotics System Integration Market, 2021 - 2024, USD Million

TABLE 77 Rest of North America Robotics System Integration Market, 2025 - 2032, USD Million

TABLE 78 Rest of North America Robotics System Integration Market by Type, 2021 - 2024, USD Million

TABLE 79 Rest of North America Robotics System Integration Market by Type, 2025 - 2032, USD Million

TABLE 80 Rest of North America Robotics System Integration Market by Application, 2021 - 2024, USD Million

TABLE 81 Rest of North America Robotics System Integration Market by Application, 2025 - 2032, USD Million

TABLE 82 Rest of North America Robotics System Integration Market by End-use, 2021 - 2024, USD Million

TABLE 83 Rest of North America Robotics System Integration Market by End-use, 2025 - 2032, USD Million

TABLE 84 Key Information – Hitachi High-Tech Corporation

TABLE 85 Key Information – IPG Photonics Corporation

TABLE 86 Key Information – JH Robotics, Inc.

TABLE 87 Key Information – ABB Ltd.

TABLE 88 key information – FANUC Corporation

TABLE 89 Key Information – Teradyne, Inc.

TABLE 90 Key Information – Kuka AG

TABLE 91 Key Information – Siemens AG

TABLE 92 Key Information – Rockwell Automation, Inc.

TABLE 93 Key Information – Omron Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Robotics System Integration Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Robotics System Integration Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2024

FIG 6 Key Leading Strategies: Percentage Distribution (2021-2025)

FIG 7 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2024, Feb – 2025, Apr) Leading Players

FIG 8 Porter’s Five Forces Analysis – Robotics System Integration Market

FIG 9 North America Robotics System Integration Market share by Type, 2024

FIG 10 North America Robotics System Integration Market share by Type, 2032

FIG 11 North America Robotics System Integration Market by Type, 2021 - 2032, USD Million

FIG 12 North America Robotics System Integration Market share by Application, 2024

FIG 13 North America Robotics System Integration Market share by Application, 2032

FIG 14 North America Robotics System Integration Market by Application, 2021 - 2032, USD Million

FIG 15 North America Robotics System Integration Market share by End-use, 2024

FIG 16 North America Robotics System Integration Market share by End-use, 2032

FIG 17 North America Robotics System Integration Market by End-use, 2021 - 2032, USD Million

FIG 18 North America Robotics System Integration Market share by Country, 2024

FIG 19 North America Robotics System Integration Market share by Country, 2032

FIG 20 North America Robotics System Integration Market by Country, 2021 - 2032, USD Million

FIG 21 SWOT Analysis: Hitachi High-Technologies Corporation

FIG 22 Recent strategies and developments: IPG Photonics Corporation

FIG 23 Recent strategies and developments: ABB ltd.

FIG 24 SWOT Analysis: ABB ltd.

FIG 25 SWOT Analysis: FANUC Corporation

FIG 26 SWOT Analysis: Teradyne, Inc.

FIG 27 Swot Analysis: Kuka AG

FIG 28 SWOT Analysis: Siemens AG

FIG 29 Recent strategies and developments: Rockwell Automation, Inc.

FIG 30 SWOT Analysis: Rockwell Automation, Inc.

FIG 31 SWOT Analysis: Omron Corporation