North America Organic Yogurt Market Size, Share & Industry Analysis Report By Product Type (Flavored and Plain), By Form (Spoonable & Cup Yogurt and Drinkable Yogurt), By Ingredient (Dairy-based and Plant-based), By Distribution Channel, By Country and Growth Forecast, 2025 - 2032

Published Date : 01-Sep-2025 |

Pages: 151 |

Report Format: PDF + Excel |

COVID-19 Impact on the North America Organic Yogurt Market

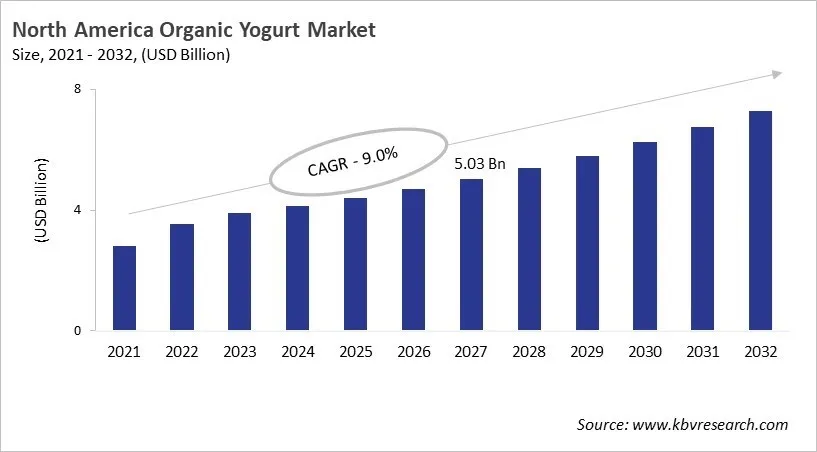

The North America Organic Yogurt Market would witness market growth of 7.5% CAGR during the forecast period (2025-2032).

The US market dominated the North America Organic Yogurt Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $5,460.9 million by 2032. The Canada market is experiencing a CAGR of 9.6% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 9.3% during (2025 - 2032). The US and Canada led the North America Organic Yogurt Market by Country with a market share of 78.8% and 12% in 2024.

Growing environmental and health consciousness has propelled the North American organic yogurt market from a niche to a mainstream category. Government support for organic certification has also fueled this growth. Thanks to the entry of large food companies and the expansion of their product lines, organic yogurt is now widely accessible through supermarkets, internet platforms, and convenience stores. Previously, it was only available at specialty stores. Clean-label products, sustainable sourcing methods, and consumer demand for probiotics are major growth drivers. These factors position organic yogurt as a healthy and morally righteous option.

While plant-based and drinkable options are quickly gaining traction among younger, urban, and health-conscious demographics, market segmentation shows strong performance across flavoured varieties, Spoonable & cup formats, and dairy-based products. Off-trade channels, especially supermarkets and hypermarkets, continue to dominate distribution, but e-commerce and specialty shops are becoming more and more significant. Large multinational corporations and local producers are balanced by competitive dynamics, which are reinforced by retailer-driven promotions and private-label competition. The market's long-term growth trajectory is further reinforced by consumer trust in organic farming and ethical sourcing, as well as innovation in flavors, packaging, and sustainability.

Ingredient Outlook

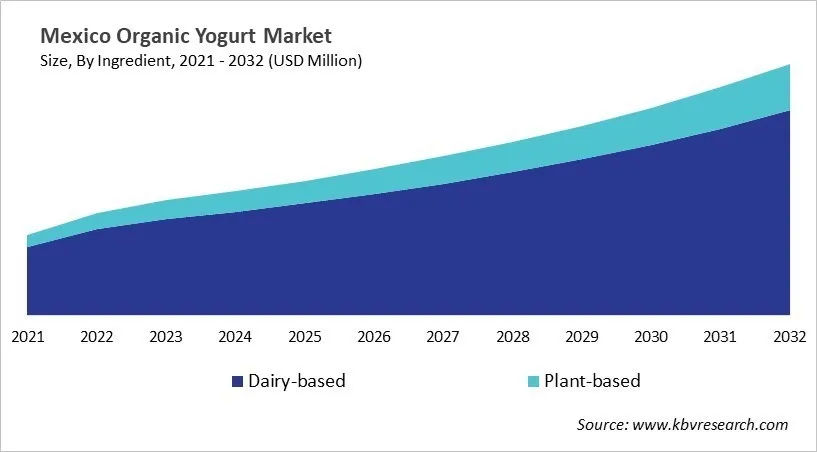

Based on Ingredient, the market is segmented into Dairy-based and Plant-based. With a compound annual growth rate (CAGR) of 9% over the projection period, the Dairy-based Market, dominate the Mexico Organic Yogurt Market by Ingredient in 2024 and would be a prominent market until 2032. The Plant-based market is expected to witness a CAGR of 10.9% during (2025 - 2032).

Distribution Channel Outlook

Based on Distribution Channel, the market is segmented into Off-trade (Supermarkets & Hypermarkets, Online Retail Stores, Convenience Stores, Specialty Stores, and Other Off-trade type) and On-trade. The Off-trade market segment dominated the US Organic Yogurt Market by Distribution Channel is expected to grow at a CAGR of 6.5 % during the forecast period thereby continuing its dominance until 2032. Also, The On-trade market is anticipated to grow as a CAGR of 8.2 % during the forecast period during (2025 - 2032).

Free Valuable Insights: The Organic Yogurt Market is Predict to reach USD 20.28 Billion by 2032, at a CAGR of 8.2%

Country Outlook

Consumer focus on health, wellness, and clean-label nutrition is driving the organic yogurt market in the U.S. This market is powered by both dairy’s improved image and rising demand for protein and functional benefits. Although receiving less advertising support than other dairy segments, organic yogurt is a strategic priority for retailers, bolstered by e-commerce and subscription models that enhance accessibility. Major industry players, such as Lactalis and Chobani, are intensifying competition through major investments, leading to further market consolidation. At the same time, innovation in flavours, product formats, and plant-based options demonstrates shifting consumer preferences, with taste, health, and ethics emerging as key differentiators. Overall, the sector is being shaped by the balance between niche innovation and the dominance of leading brands.

List of Key Companies Profiled

- Danone S.A.

- General Mills Inc.

- Lactalis Group

- Chobani LLC

- Arla Foods Amba

- Nestle S.A.

- Fage International S.A.

- Nancy’s Yogurt

- Yeo Valley Organic Limited

- Kite Hill

North America Organic Yogurt Market Report Segmentation

By Product Type

- Flavored

- Plain

By Form

- Spoonable & Cup Yogurt

- Drinkable Yogurt

By Ingredient

- Dairy-based

- Plant-based

By Distribution Channel

- Off-trade

- Supermarkets & Hypermarkets

- Online Retail Stores

- Convenience Stores

- Specialty Stores

- Other Off-trade type

- On-trade

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Organic Yogurt Market, by Product Type

1.4.2 North America Organic Yogurt Market, by Form

1.4.3 North America Organic Yogurt Market, by Ingredient

1.4.4 North America Organic Yogurt Market, by Distribution Channel

1.4.5 North America Organic Yogurt Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Market Trends – North America Organic yogurt market

Chapter 5. State of Competition – North America Organic yogurt market

Chapter 6. Competition Analysis – Global

6.1 Market Share Analysis, 2024

6.2 Porter Five Forces Analysis

Chapter 7. Value Chain Analysis of Organic Yogurt Market

Chapter 8. Product Life Cycle – Organic yogurt market

Chapter 9. Market Consolidation – Organic Yogurt Market

Chapter 10. Key Customer Criteria - Organic Yogurt Market

Chapter 11. North America Organic Yogurt Market by Product Type

11.1 North America Flavored Market by Region

11.2 North America Plain Market by Region

Chapter 12. North America Organic Yogurt Market by Form

12.1 North America Spoonable & Cup Yogurt Market by Region

12.2 North America Drinkable Yogurt Market by Region

Chapter 13. North America Organic Yogurt Market by Ingredient

13.1 North America Dairy-based Market by Country

13.2 North America Plant-based Market by Country

Chapter 14. North America Organic Yogurt Market by Distribution Channel

14.1 North America Off-trade Market by Country

14.2 North America Organic Yogurt Market by Off-trade type

14.2.1 North America Supermarkets & Hypermarkets Market by Country

14.2.2 North America Online Retail Stores Market by Country

14.2.3 North America Convenience Stores Market by Country

14.2.4 North America Specialty Stores Market by Country

14.2.5 North America Other Off-trade type Market by Country

14.3 North America On-trade Market by Country

Chapter 15. North America Organic Yogurt Market by Country

15.1 US Organic Yogurt Market

15.1.1 US Organic Yogurt Market by Product Type

15.1.2 US Organic Yogurt Market by Form

15.1.3 US Organic Yogurt Market by Ingredient

15.1.4 US Organic Yogurt Market by Distribution Channel

15.1.4.1 US Organic Yogurt Market by Off-trade type

15.2 Canada Organic Yogurt Market

15.2.1 Canada Organic Yogurt Market by Product Type

15.2.2 Canada Organic Yogurt Market by Form

15.2.3 Canada Organic Yogurt Market by Ingredient

15.2.4 Canada Organic Yogurt Market by Distribution Channel

15.2.4.1 Canada Organic Yogurt Market by Off-trade type

15.3 Mexico Organic Yogurt Market

15.3.1 Mexico Organic Yogurt Market by Product Type

15.3.2 Mexico Organic Yogurt Market by Form

15.3.3 Mexico Organic Yogurt Market by Ingredient

15.3.4 Mexico Organic Yogurt Market by Distribution Channel

15.3.4.1 Mexico Organic Yogurt Market by Off-trade type

15.4 Rest of North America Organic Yogurt Market

15.4.1 Rest of North America Organic Yogurt Market by Product Type

15.4.2 Rest of North America Organic Yogurt Market by Form

15.4.3 Rest of North America Organic Yogurt Market by Ingredient

15.4.4 Rest of North America Organic Yogurt Market by Distribution Channel

15.4.4.1 Rest of North America Organic Yogurt Market by Off-trade type

Chapter 16. Company Profiles

16.1 Danone S.A.

16.1.1 Company Overview

16.1.2 Financial Analysis

16.1.3 Regional Analysis

16.1.4 Research & Development Expenses

16.1.5 SWOT Analysis

16.2 General Mills, Inc.

16.2.1 Company Overview

16.2.2 Financial Analysis

16.2.3 Segmental and Regional Analysis

16.2.4 Research & Development Expense

16.2.5 SWOT Analysis

16.3 Lactalis Group

16.3.1 Company Overview

16.3.2 Recent strategies and developments:

16.3.2.1 Product Launches and Product Expansions:

16.4 Chobani LLC

16.4.1 Company Overview

16.4.2 Recent strategies and developments:

16.4.2.1 Product Launches and Product Expansions:

16.4.3 SWOT Analysis

16.5 Arla Foods amba

16.5.1 Company Overview

16.5.2 Financial Analysis

16.5.3 Regional Analysis

16.5.4 SWOT Analysis

16.6 Nestle S.A.

16.6.1 Company Overview

16.6.2 Financial Analysis

16.6.3 Segmental and Regional Analysis

16.6.4 Research & Development Expenses

16.6.5 SWOT Analysis

16.7 Fage International S.A.

16.7.1 Company Overview

16.7.2 Financial Analysis

16.7.3 Regional Analysis

16.8 Nancy’s Yogurt

16.8.1 Company Overview

16.9 Yeo Valley Organic Limited

16.9.1 Company Overview

16.10. Kite Hill

16.10.1 Company Overview

16.10.2 SWOT Analysis

TABLE 2 North America Organic Yogurt Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria - Organic Yogurt Market

TABLE 4 North America Organic Yogurt Market by Product Type, 2021 - 2024, USD Million

TABLE 5 North America Organic Yogurt Market by Product Type, 2025 - 2032, USD Million

TABLE 6 North America Flavored Market by Region, 2021 - 2024, USD Million

TABLE 7 North America Flavored Market by Region, 2025 - 2032, USD Million

TABLE 8 North America Plain Market by Region, 2021 - 2024, USD Million

TABLE 9 North America Plain Market by Region, 2025 - 2032, USD Million

TABLE 10 North America Organic Yogurt Market by Form, 2021 - 2024, USD Million

TABLE 11 North America Organic Yogurt Market by Form, 2025 - 2032, USD Million

TABLE 12 North America Spoonable & Cup Yogurt Market by Region, 2021 - 2024, USD Million

TABLE 13 North America Spoonable & Cup Yogurt Market by Region, 2025 - 2032, USD Million

TABLE 14 North America Drinkable Yogurt Market by Region, 2021 - 2024, USD Million

TABLE 15 North America Drinkable Yogurt Market by Region, 2025 - 2032, USD Million

TABLE 16 North America Organic Yogurt Market by Ingredient, 2021 - 2024, USD Million

TABLE 17 North America Organic Yogurt Market by Ingredient, 2025 - 2032, USD Million

TABLE 18 North America Dairy-based Market by Country, 2021 - 2024, USD Million

TABLE 19 North America Dairy-based Market by Country, 2025 - 2032, USD Million

TABLE 20 North America Plant-based Market by Country, 2021 - 2024, USD Million

TABLE 21 North America Plant-based Market by Country, 2025 - 2032, USD Million

TABLE 22 North America Organic Yogurt Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 23 North America Organic Yogurt Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 24 North America Off-trade Market by Country, 2021 - 2024, USD Million

TABLE 25 North America Off-trade Market by Country, 2025 - 2032, USD Million

TABLE 26 North America Organic Yogurt Market by Off-trade type, 2021 - 2024, USD Million

TABLE 27 North America Organic Yogurt Market by Off-trade type, 2025 - 2032, USD Million

TABLE 28 North America Supermarkets & Hypermarkets Market by Country, 2021 - 2024, USD Million

TABLE 29 North America Supermarkets & Hypermarkets Market by Country, 2025 - 2032, USD Million

TABLE 30 North America Online Retail Stores Market by Country, 2021 - 2024, USD Million

TABLE 31 North America Online Retail Stores Market by Country, 2025 - 2032, USD Million

TABLE 32 North America Convenience Stores Market by Country, 2021 - 2024, USD Million

TABLE 33 North America Convenience Stores Market by Country, 2025 - 2032, USD Million

TABLE 34 North America Specialty Stores Market by Country, 2021 - 2024, USD Million

TABLE 35 North America Specialty Stores Market by Country, 2025 - 2032, USD Million

TABLE 36 North America Other Off-trade type Market by Country, 2021 - 2024, USD Million

TABLE 37 North America Other Off-trade type Market by Country, 2025 - 2032, USD Million

TABLE 38 North America On-trade Market by Country, 2021 - 2024, USD Million

TABLE 39 North America On-trade Market by Country, 2025 - 2032, USD Million

TABLE 40 North America Organic Yogurt Market by Country, 2021 - 2024, USD Million

TABLE 41 North America Organic Yogurt Market by Country, 2025 - 2032, USD Million

TABLE 42 US Organic Yogurt Market, 2021 - 2024, USD Million

TABLE 43 US Organic Yogurt Market, 2025 - 2032, USD Million

TABLE 44 US Organic Yogurt Market by Product Type, 2021 - 2024, USD Million

TABLE 45 US Organic Yogurt Market by Product Type, 2025 - 2032, USD Million

TABLE 46 US Organic Yogurt Market by Form, 2021 - 2024, USD Million

TABLE 47 US Organic Yogurt Market by Form, 2025 - 2032, USD Million

TABLE 48 US Organic Yogurt Market by Ingredient, 2021 - 2024, USD Million

TABLE 49 US Organic Yogurt Market by Ingredient, 2025 - 2032, USD Million

TABLE 50 US Organic Yogurt Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 51 US Organic Yogurt Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 52 US Organic Yogurt Market by Off-trade type, 2021 - 2024, USD Million

TABLE 53 US Organic Yogurt Market by Off-trade type, 2025 - 2032, USD Million

TABLE 54 Canada Organic Yogurt Market, 2021 - 2024, USD Million

TABLE 55 Canada Organic Yogurt Market, 2025 - 2032, USD Million

TABLE 56 Canada Organic Yogurt Market by Product Type, 2021 - 2024, USD Million

TABLE 57 Canada Organic Yogurt Market by Product Type, 2025 - 2032, USD Million

TABLE 58 Canada Organic Yogurt Market by Form, 2021 - 2024, USD Million

TABLE 59 Canada Organic Yogurt Market by Form, 2025 - 2032, USD Million

TABLE 60 Canada Organic Yogurt Market by Ingredient, 2021 - 2024, USD Million

TABLE 61 Canada Organic Yogurt Market by Ingredient, 2025 - 2032, USD Million

TABLE 62 Canada Organic Yogurt Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 63 Canada Organic Yogurt Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 64 Canada Organic Yogurt Market by Off-trade type, 2021 - 2024, USD Million

TABLE 65 Canada Organic Yogurt Market by Off-trade type, 2025 - 2032, USD Million

TABLE 66 Mexico Organic Yogurt Market, 2021 - 2024, USD Million

TABLE 67 Mexico Organic Yogurt Market, 2025 - 2032, USD Million

TABLE 68 Mexico Organic Yogurt Market by Product Type, 2021 - 2024, USD Million

TABLE 69 Mexico Organic Yogurt Market by Product Type, 2025 - 2032, USD Million

TABLE 70 Mexico Organic Yogurt Market by Form, 2021 - 2024, USD Million

TABLE 71 Mexico Organic Yogurt Market by Form, 2025 - 2032, USD Million

TABLE 72 Mexico Organic Yogurt Market by Ingredient, 2021 - 2024, USD Million

TABLE 73 Mexico Organic Yogurt Market by Ingredient, 2025 - 2032, USD Million

TABLE 74 Mexico Organic Yogurt Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 75 Mexico Organic Yogurt Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 76 Mexico Organic Yogurt Market by Off-trade type, 2021 - 2024, USD Million

TABLE 77 Mexico Organic Yogurt Market by Off-trade type, 2025 - 2032, USD Million

TABLE 78 Rest of North America Organic Yogurt Market, 2021 - 2024, USD Million

TABLE 79 Rest of North America Organic Yogurt Market, 2025 - 2032, USD Million

TABLE 80 Rest of North America Organic Yogurt Market by Product Type, 2021 - 2024, USD Million

TABLE 81 Rest of North America Organic Yogurt Market by Product Type, 2025 - 2032, USD Million

TABLE 82 Rest of North America Organic Yogurt Market by Form, 2021 - 2024, USD Million

TABLE 83 Rest of North America Organic Yogurt Market by Form, 2025 - 2032, USD Million

TABLE 84 Rest of North America Organic Yogurt Market by Ingredient, 2021 - 2024, USD Million

TABLE 85 Rest of North America Organic Yogurt Market by Ingredient, 2025 - 2032, USD Million

TABLE 86 Rest of North America Organic Yogurt Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 87 Rest of North America Organic Yogurt Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 88 Rest of North America Organic Yogurt Market by Off-trade type, 2021 - 2024, USD Million

TABLE 89 Rest of North America Organic Yogurt Market by Off-trade type, 2025 - 2032, USD Million

TABLE 90 Key information – Danone S.A.

TABLE 91 Key Information – General Mills, Inc.

TABLE 92 Key Information –Lactalis Group

TABLE 93 key information – Chobani LLC

TABLE 94 Key information – Arla Foods amba

TABLE 95 Key Information – Nestle S.A.

TABLE 96 key information – Fage International S.A.

TABLE 97 Key Information – Nancy’s Yogurt

TABLE 98 Key Information – Yeo Valley Organic Limited

TABLE 99 Key Information – Kite Hill

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Organic Yogurt Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting North America Organic Yogurt Market

FIG 4 Market Share Analysis, 2024

FIG 5 Porter’s Five Forces Analysis – Organic Yogurt Market

FIG 6 Key Customer Criteria for Organic Yogurt Market

FIG 7 North America Organic Yogurt Market share by Product Type, 2024

FIG 8 North America Organic Yogurt Market share by Product Type, 2032

FIG 9 North America Organic Yogurt Market by Product Type, 2021 - 2032, USD Million

FIG 10 North America Organic Yogurt Market share by Form, 2024

FIG 11 North America Organic Yogurt Market share by Form, 2032

FIG 12 North America Organic Yogurt Market by Form, 2021 - 2032, USD Million

FIG 13 North America Organic Yogurt Market share by Ingredient, 2024

FIG 14 North America Organic Yogurt Market share by Ingredient, 2032

FIG 15 North America Organic Yogurt Market by Ingredient, 2021 - 2032, USD Million

FIG 16 North America Organic Yogurt Market share by Distribution Channel, 2024

FIG 17 North America Organic Yogurt Market share by Distribution Channel, 2032

FIG 18 North America Organic Yogurt Market by Distribution Channel, 2021 - 2032, USD Million

FIG 19 North America Organic Yogurt Market share by Country, 2024

FIG 20 North America Organic Yogurt Market share by Country, 2032

FIG 21 North America Organic Yogurt Market by Country, 2021 - 2032, USD Million

FIG 22 SWOT Analysis: Danone, S.A.

FIG 23 Swot Analysis: General Mills, Inc.

FIG 24 SWOT Analysis: Chobani LLC

FIG 25 SWOT Analysis: Arla Foods amba

FIG 26 SWOT Analysis: Nestle S.A.

FIG 27 SWOT Analysis: Kite Hill