North America Optical Brighteners Market Size, Share & Trends Analysis Report By Application (Detergents & Soaps, Paper, Fabrics, Synthetics & Plastics, and Other Application), By End-use, By Country and Growth Forecast, 2025 - 2032

Published Date : 05-May-2025 |

Pages: 87 |

Report Format: PDF + Excel |

COVID-19 Impact on the North America Optical Brighteners Market

The North America Optical Brighteners Market would witness market growth of 4.6% CAGR during the forecast period (2025-2032).

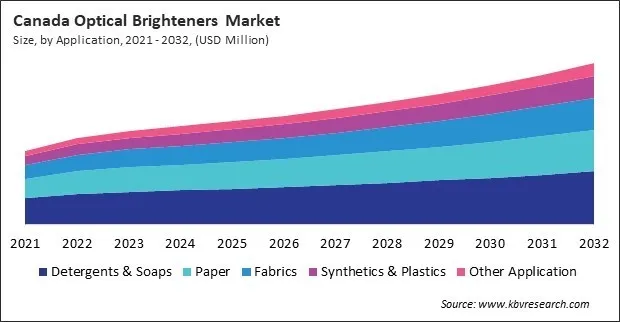

The US market dominated the North America Optical Brighteners Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $423.6 million by 2032. The Canada market is experiencing a CAGR of 6.6% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 5.7% during (2025 - 2032).

These brighteners, also known as optical brightening agents (OBAs), are chemicals that absorb ultraviolet (UV) light and re-emit it as visible blue light, effectively enhancing the brightness and whiteness of materials. These agents predominantly impart a fluorescent effect to textiles, papers, detergents, and plastics, making them appear brighter and whiter under daylight or artificial lighting conditions. This market has grown substantially due to their wide applications across various industries, including textiles, paper, detergents, coatings, and plastics.

This growth can be attributed to the increasing demand for brighter and cleaner products and the constant advancements in the development and application of OBAs. The textile industry is one of the largest consumers of these brighteners. OBAs are used to finish fabrics, yarns, and garments to improve their brightness and whiteness. As cotton, polyester, and nylon tend to turn yellow or lose brilliance over time, these brighteners help restore their original appearance.

Canada’s cosmetics sector, which generated approximately USD 1.24 billion in 2021 and is projected to reach USD 1.8 billion in sales by 2024, directly supports the expansion of the market. These brighteners are widely used in cosmetic product formulations to enhance skincare and beauty products' luminous and vibrant appearance. Additionally, they are important in cosmetics packaging, improving shelf appeal and consumer perception. Mexico’s manufacturing sector, with a gross domestic product of $6.26 trillion MXN in the first quarter of 2024, is seeing major investments in advanced manufacturing technologies to boost productivity. This modernization effort supports the increased use of high-quality materials, including applying optical brighteners in plastic products, packaging, and industrial goods. Advanced manufacturing processes often prioritize material quality, aesthetics, and sustainability—all areas in which these brighteners enhance end-product brightness and visual quality. In conclusion, the growing cosmetics sector in Canada, advanced manufacturing in Mexico, and strong textile exports from the U.S. are driving the growth of the market in North America.

Free Valuable Insights: The Optical Brighteners Market is Predict to reach USD 2.44 Billion by 2032, at a CAGR of 5.3%

Based on Application, the market is segmented into Detergents & Soaps, Paper, Fabrics, Synthetics & Plastics, and Other Application. Based on End-use, the market is segmented into Consumer Products, Textiles & Apparel, Packaging, Security & Safety, and Other End-use. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- BASF SE

- Huntsman International LLC

- Archroma Management GmbH

- Milliken & Company

- 3V Sigma S.p.A.

- Clariant AG

- Eastman Chemical Company

- Teh Fong Min International CO.LTD.

- Shandong Raytop Chemical Co., Ltd.

- Mayzo Inc.

North America Optical Brighteners Market Report Segmentation

By Application

- Detergents & Soaps

- Paper

- Fabrics

- Synthetics & Plastics

- Other Application

By End-Use

- Consumer Products

- Textiles & Apparel

- Packaging

- Security & Safety

- Other End-use

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Optical Brighteners Market, by Application

1.4.2 North America Optical Brighteners Market, by End-Use

1.4.3 North America Optical Brighteners Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter Five Forces Analysis

Chapter 4. North America Optical Brighteners Market by Application

4.1 North America Detergents & Soaps Market by Country

4.2 North America Paper Market by Country

4.3 North America Fabrics Market by Country

4.4 North America Synthetics & Plastics Market by Country

4.5 North America Other Application Market by Country

Chapter 5. North America Optical Brighteners Market by End-use

5.1 North America Consumer Products Market by Country

5.2 North America Textiles & Apparel Market by Country

5.3 North America Packaging Market by Country

5.4 North America Security & Safety Market by Country

5.5 North America Other End-use Market by Country

Chapter 6. North America Optical Brighteners Market by Country

6.1 US Optical Brighteners Market

6.1.1 US Optical Brighteners Market by Application

6.1.2 US Optical Brighteners Market by End-use

6.2 Canada Optical Brighteners Market

6.2.1 Canada Optical Brighteners Market by Application

6.2.2 Canada Optical Brighteners Market by End-use

6.3 Mexico Optical Brighteners Market

6.3.1 Mexico Optical Brighteners Market by Application

6.3.2 Mexico Optical Brighteners Market by End-use

6.4 Rest of North America Optical Brighteners Market

6.4.1 Rest of North America Optical Brighteners Market by Application

6.4.2 Rest of North America Optical Brighteners Market by End-use

Chapter 7. Company Profiles

7.1 BASF SE

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental and Regional Analysis

7.1.4 Research & Development Expenses

7.1.5 SWOT Analysis

7.2 Huntsman International LLC

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Segment and Regional Analysis

7.2.4 Research & Development Expense

7.2.5 SWOT Analysis

7.3 Archroma Management GmbH

7.3.1 Company Overview

7.3.2 Recent strategies and developments:

7.3.2.1 Product Launches and Product Expansions:

7.4 Milliken & Company

7.4.1 Company Overview

7.5 3V Sigma S.p.A.

7.5.1 Company Overview

7.6 Clariant AG

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Segmental and Regional Analysis

7.6.4 Research & Development Expenses

7.6.1 SWOT Analysis

7.7 Eastman Chemical Company

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Segmental and Regional Analysis

7.7.4 Research & Development Expense

7.7.5 SWOT Analysis

7.8 Teh Fong Min International Co., Ltd.

7.8.1 Company Overview

7.9 Shandong Raytop Chemical Co., Ltd.

7.9.1 Company Overview

7.10. Mayzo Inc.

7.10.1 Company Overview

TABLE 2 North America Optical Brighteners Market, 2025 - 2032, USD Million

TABLE 3 North America Optical Brighteners Market by Application, 2021 - 2024, USD Million

TABLE 4 North America Optical Brighteners Market by Application, 2025 - 2032, USD Million

TABLE 5 North America Detergents & Soaps Market by Country, 2021 - 2024, USD Million

TABLE 6 North America Detergents & Soaps Market by Country, 2025 - 2032, USD Million

TABLE 7 North America Paper Market by Country, 2021 - 2024, USD Million

TABLE 8 North America Paper Market by Country, 2025 - 2032, USD Million

TABLE 9 North America Fabrics Market by Country, 2021 - 2024, USD Million

TABLE 10 North America Fabrics Market by Country, 2025 - 2032, USD Million

TABLE 11 North America Synthetics & Plastics Market by Country, 2021 - 2024, USD Million

TABLE 12 North America Synthetics & Plastics Market by Country, 2025 - 2032, USD Million

TABLE 13 North America Other Application Market by Country, 2021 - 2024, USD Million

TABLE 14 North America Other Application Market by Country, 2025 - 2032, USD Million

TABLE 15 North America Optical Brighteners Market by End-use, 2021 - 2024, USD Million

TABLE 16 North America Optical Brighteners Market by End-use, 2025 - 2032, USD Million

TABLE 17 North America Consumer Products Market by Country, 2021 - 2024, USD Million

TABLE 18 North America Consumer Products Market by Country, 2025 - 2032, USD Million

TABLE 19 North America Textiles & Apparel Market by Country, 2021 - 2024, USD Million

TABLE 20 North America Textiles & Apparel Market by Country, 2025 - 2032, USD Million

TABLE 21 North America Packaging Market by Country, 2021 - 2024, USD Million

TABLE 22 North America Packaging Market by Country, 2025 - 2032, USD Million

TABLE 23 North America Security & Safety Market by Country, 2021 - 2024, USD Million

TABLE 24 North America Security & Safety Market by Country, 2025 - 2032, USD Million

TABLE 25 North America Other End-use Market by Country, 2021 - 2024, USD Million

TABLE 26 North America Other End-use Market by Country, 2025 - 2032, USD Million

TABLE 27 North America Optical Brighteners Market by Country, 2021 - 2024, USD Million

TABLE 28 North America Optical Brighteners Market by Country, 2025 - 2032, USD Million

TABLE 29 US Optical Brighteners Market, 2021 - 2024, USD Million

TABLE 30 US Optical Brighteners Market, 2025 - 2032, USD Million

TABLE 31 US Optical Brighteners Market by Application, 2021 - 2024, USD Million

TABLE 32 US Optical Brighteners Market by Application, 2025 - 2032, USD Million

TABLE 33 US Optical Brighteners Market by End-use, 2021 - 2024, USD Million

TABLE 34 US Optical Brighteners Market by End-use, 2025 - 2032, USD Million

TABLE 35 Canada Optical Brighteners Market, 2021 - 2024, USD Million

TABLE 36 Canada Optical Brighteners Market, 2025 - 2032, USD Million

TABLE 37 Canada Optical Brighteners Market by Application, 2021 - 2024, USD Million

TABLE 38 Canada Optical Brighteners Market by Application, 2025 - 2032, USD Million

TABLE 39 Canada Optical Brighteners Market by End-use, 2021 - 2024, USD Million

TABLE 40 Canada Optical Brighteners Market by End-use, 2025 - 2032, USD Million

TABLE 41 Mexico Optical Brighteners Market, 2021 - 2024, USD Million

TABLE 42 Mexico Optical Brighteners Market, 2025 - 2032, USD Million

TABLE 43 Mexico Optical Brighteners Market by Application, 2021 - 2024, USD Million

TABLE 44 Mexico Optical Brighteners Market by Application, 2025 - 2032, USD Million

TABLE 45 Mexico Optical Brighteners Market by End-use, 2021 - 2024, USD Million

TABLE 46 Mexico Optical Brighteners Market by End-use, 2025 - 2032, USD Million

TABLE 47 Rest of North America Optical Brighteners Market, 2021 - 2024, USD Million

TABLE 48 Rest of North America Optical Brighteners Market, 2025 - 2032, USD Million

TABLE 49 Rest of North America Optical Brighteners Market by Application, 2021 - 2024, USD Million

TABLE 50 Rest of North America Optical Brighteners Market by Application, 2025 - 2032, USD Million

TABLE 51 Rest of North America Optical Brighteners Market by End-use, 2021 - 2024, USD Million

TABLE 52 Rest of North America Optical Brighteners Market by End-use, 2025 - 2032, USD Million

TABLE 53 Key Information – BASF SE

TABLE 54 key Information – Huntsman International LLC

TABLE 55 key Information – Archroma Management GmbH

TABLE 56 key Information – Milliken & Company

TABLE 57 key Information – 3V Sigma S.p.A.

TABLE 58 Key Information – Clariant AG

TABLE 59 Key Information – Eastman Chemical Company

TABLE 60 key Information – Teh Fong Min International Co., Ltd.

TABLE 61 Key Information – Shandong Raytop Chemical Co., Ltd.

TABLE 62 Key Information – Mayzo Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Optical Brighteners Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Optical Brighteners Market

FIG 4 Porter’s Five Forces Analysis – Optical Brighteners Market

FIG 5 North America Optical Brighteners Market share by Application, 2024

FIG 6 North America Optical Brighteners Market share by Application, 2032

FIG 7 North America Optical Brighteners Market by Application, 2021 - 2032, USD Million

FIG 8 North America Optical Brighteners Market share by End-use, 2024

FIG 9 North America Optical Brighteners Market share by End-use, 2032

FIG 10 North America Optical Brighteners Market by End-use, 2021 - 2032, USD Million

FIG 11 North America Optical Brighteners Market share by Country, 2024

FIG 12 North America Optical Brighteners Market share by Country, 2032

FIG 13 North America Optical Brighteners Market by Country, 2021 - 2032, USD Million

FIG 14 SWOT Analysis: BASF SE

FIG 15 SWOT Analysis: Huntsman International LLC

FIG 16 SWOT Analysis: Clariant AG

FIG 17 SWOT Analysis: Eastman Chemical Company