North America Novel Spectrometry Market Size, Share & Trends Analysis Report By Application, By Type, By End Use, By Country and Growth Forecast, 2025 - 2032

Published Date : 22-Apr-2025 |

Pages: 130 |

Report Format: PDF + Excel |

COVID-19 Impact on the North America Novel Spectrometry Market

The North America Novel Spectrometry Market would witness market growth of 19.1% CAGR during the forecast period (2025-2032).

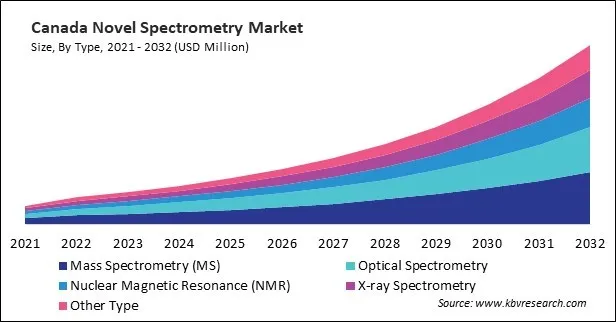

The US market dominated the North America Novel Spectrometry Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $3,895 million by 2032. The Canada market is experiencing a CAGR of 21.4% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 20.6% during (2025 - 2032).

Quantum Cascade Lasers (QCLs) are increasingly being adopted in mid-infrared spectrometry systems, marking a significant leap in optical performance. Unlike traditional infrared sources, QCLs offer tunable, coherent light across a broad range of wavelengths, resulting in enhanced spectral resolution and signal-to-noise ratios. This innovation is particularly valuable in real-time gas phase analysis, such as detecting trace-level atmospheric pollutants, greenhouse gases, or volatile organic compounds. Integrating QCLs in portable spectrometry devices improves sensitivity while reducing energy consumption and footprint, aligning well with mobile and field-deployable applications.

Moreover, to address increasingly complex analytical requirements, there is a growing trend of developing hybrid systems that combine spectrometry with other analytical techniques, such as chromatography, microscopy, or electrophoresis. These multimodal platforms allow scientists to obtain complementary data sets from a single sample, improving analytical depth and efficiency.

The market is gaining significant traction across North America, driven by sector-specific demands and economic transformations in Canada, the United States, and Mexico. In these nations, the convergence of healthcare expansion, agricultural advancements, and mineral exploration has created fertile ground for the adoption of spectrometry technologies. Spectrometry’s precise, real-time analytical capabilities are indispensable in improving quality control, enhancing diagnostics, and enabling sustainable industrial practices. Each country, with its distinct economic drivers, contributes uniquely to the expanding application and integration of spectrometry solutions across various domains.

Free Valuable Insights: The Novel Spectrometry Market is Predict to reach USD 14.17 Billion by 2032, at a CAGR of 19.7%

Based on Application, the market is segmented into Analytical Testing & Diagnostics, Environmental Monitoring, Food Safety & Inspection, Quality Control & Assurance, Material Identification, and Other Application. Based on Type, the market is segmented into Mass Spectrometry (MS), Optical Spectrometry, Nuclear Magnetic Resonance (NMR), X-ray Spectrometry, and Other Type. Based on End Use, the market is segmented into Healthcare & Pharmaceuticals, Agriculture, Government & Academic Institutions, Chemical & Material Industries, Food & Beverage Industry, Energy & Utilities, and Other End Use. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Rigaku Holdings Corporation

- Thermo Fisher Scientific, Inc.

- Bruker Corporation

- Hitachi High-Technologies Corporation (Hitachi Ltd.)

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Danaher Corporation

- Waters Corporation

- MKS Instruments, Inc.

- Advion, Inc.

North America Novel Spectrometry Market Report Segmentation

By Application

- Analytical Testing & Diagnostics

- Environmental Monitoring

- Food Safety & Inspection

- Quality Control & Assurance

- Material Identification

- Other Application

By Type

- Mass Spectrometry (MS)

- Optical Spectrometry

- Nuclear Magnetic Resonance (NMR)

- X-ray Spectrometry

- Other Type

By End Use

- Healthcare & Pharmaceuticals

- Agriculture

- Government & Academic Institutions

- Chemical & Material Industries

- Food & Beverage Industry

- Energy & Utilities

- Other End Use

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Novel Spectrometry Market, by Application

1.4.2 North America Novel Spectrometry Market, by Type

1.4.3 North America Novel Spectrometry Market, by End Use

1.4.4 North America Novel Spectrometry Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis – Global

4.1 Market Share Analysis, 2024

4.2 Porter Five Forces Analysis

Chapter 5. North America Novel Spectrometry Market by Application

5.1 North America Analytical Testing & Diagnostics Market by Country

5.2 North America Environmental Monitoring Market by Country

5.3 North America Food Safety & Inspection Market by Country

5.4 North America Quality Control & Assurance Market by Country

5.5 North America Material Identification Market by Country

5.6 North America Other Application Market by Country

Chapter 6. North America Novel Spectrometry Market by Type

6.1 North America Mass Spectrometry (MS) Market by Country

6.2 North America Optical Spectrometry Market by Country

6.3 North America Nuclear Magnetic Resonance (NMR) Market by Country

6.4 North America X-ray Spectrometry Market by Country

6.5 North America Other Type Market by Country

Chapter 7. North America Novel Spectrometry Market by End Use

7.1 North America Healthcare & Pharmaceuticals Market by Country

7.2 North America Agriculture Market by Country

7.3 North America Government & Academic Institutions Market by Country

7.4 North America Chemical & Material Industries Market by Country

7.5 North America Food & Beverage Industry Market by Country

7.6 North America Energy & Utilities Market by Country

7.7 North America Other End Use Market by Country

Chapter 8. North America Novel Spectrometry Market by Country

8.1 US Novel Spectrometry Market

8.1.1 US Novel Spectrometry Market by Application

8.1.2 US Novel Spectrometry Market by Type

8.1.3 US Novel Spectrometry Market by End Use

8.2 Canada Novel Spectrometry Market

8.2.1 Canada Novel Spectrometry Market by Application

8.2.2 Canada Novel Spectrometry Market by Type

8.2.3 Canada Novel Spectrometry Market by End Use

8.3 Mexico Novel Spectrometry Market

8.3.1 Mexico Novel Spectrometry Market by Application

8.3.2 Mexico Novel Spectrometry Market by Type

8.3.3 Mexico Novel Spectrometry Market by End Use

8.4 Rest of North America Novel Spectrometry Market

8.4.1 Rest of North America Novel Spectrometry Market by Application

8.4.2 Rest of North America Novel Spectrometry Market by Type

8.4.3 Rest of North America Novel Spectrometry Market by End Use

Chapter 9. Company Profiles

9.1 Rigaku Holdings Corporation

9.1.1 Company Overview

9.2 Thermo Fisher Scientific, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Research & Development Expenses

9.2.5 SWOT Analysis

9.3 Bruker Corporation

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expense

9.3.5 SWOT Analysis

9.4 Hitachi High-Tech Corporation (Hitachi, Ltd.)

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expenses

9.4.5 SWOT Analysis

9.5 Agilent Technologies, Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expense

9.5.5 SWOT Analysis

9.6 Shimadzu Corporation

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expenses

9.6.5 SWOT Analysis

9.7 Danaher Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expense

9.7.5 SWOT Analysis

9.8 Waters Corporation

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Research & Development Expense

9.8.5 SWOT Analysis

9.9 MKS Instruments, Inc.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Research & Development Expenses

9.9.5 SWOT Analysis

9.10. Advion, Inc. (Advion Interchim Scientific)

9.10.1 Company Overview

TABLE 2 North America Novel Spectrometry Market, 2025 - 2032, USD Million

TABLE 3 North America Novel Spectrometry Market by Application, 2021 - 2024, USD Million

TABLE 4 North America Novel Spectrometry Market by Application, 2025 - 2032, USD Million

TABLE 5 North America Analytical Testing & Diagnostics Market by Country, 2021 - 2024, USD Million

TABLE 6 North America Analytical Testing & Diagnostics Market by Country, 2025 - 2032, USD Million

TABLE 7 North America Environmental Monitoring Market by Country, 2021 - 2024, USD Million

TABLE 8 North America Environmental Monitoring Market by Country, 2025 - 2032, USD Million

TABLE 9 North America Food Safety & Inspection Market by Country, 2021 - 2024, USD Million

TABLE 10 North America Food Safety & Inspection Market by Country, 2025 - 2032, USD Million

TABLE 11 North America Quality Control & Assurance Market by Country, 2021 - 2024, USD Million

TABLE 12 North America Quality Control & Assurance Market by Country, 2025 - 2032, USD Million

TABLE 13 North America Material Identification Market by Country, 2021 - 2024, USD Million

TABLE 14 North America Material Identification Market by Country, 2025 - 2032, USD Million

TABLE 15 North America Other Application Market by Country, 2021 - 2024, USD Million

TABLE 16 North America Other Application Market by Country, 2025 - 2032, USD Million

TABLE 17 North America Novel Spectrometry Market by Type, 2021 - 2024, USD Million

TABLE 18 North America Novel Spectrometry Market by Type, 2025 - 2032, USD Million

TABLE 19 North America Mass Spectrometry (MS) Market by Country, 2021 - 2024, USD Million

TABLE 20 North America Mass Spectrometry (MS) Market by Country, 2025 - 2032, USD Million

TABLE 21 North America Optical Spectrometry Market by Country, 2021 - 2024, USD Million

TABLE 22 North America Optical Spectrometry Market by Country, 2025 - 2032, USD Million

TABLE 23 North America Nuclear Magnetic Resonance (NMR) Market by Country, 2021 - 2024, USD Million

TABLE 24 North America Nuclear Magnetic Resonance (NMR) Market by Country, 2025 - 2032, USD Million

TABLE 25 North America X-ray Spectrometry Market by Country, 2021 - 2024, USD Million

TABLE 26 North America X-ray Spectrometry Market by Country, 2025 - 2032, USD Million

TABLE 27 North America Other Type Market by Country, 2021 - 2024, USD Million

TABLE 28 North America Other Type Market by Country, 2025 - 2032, USD Million

TABLE 29 North America Novel Spectrometry Market by End Use, 2021 - 2024, USD Million

TABLE 30 North America Novel Spectrometry Market by End Use, 2025 - 2032, USD Million

TABLE 31 North America Healthcare & Pharmaceuticals Market by Country, 2021 - 2024, USD Million

TABLE 32 North America Healthcare & Pharmaceuticals Market by Country, 2025 - 2032, USD Million

TABLE 33 North America Agriculture Market by Country, 2021 - 2024, USD Million

TABLE 34 North America Agriculture Market by Country, 2025 - 2032, USD Million

TABLE 35 North America Government & Academic Institutions Market by Country, 2021 - 2024, USD Million

TABLE 36 North America Government & Academic Institutions Market by Country, 2025 - 2032, USD Million

TABLE 37 North America Chemical & Material Industries Market by Country, 2021 - 2024, USD Million

TABLE 38 North America Chemical & Material Industries Market by Country, 2025 - 2032, USD Million

TABLE 39 North America Food & Beverage Industry Market by Country, 2021 - 2024, USD Million

TABLE 40 North America Food & Beverage Industry Market by Country, 2025 - 2032, USD Million

TABLE 41 North America Energy & Utilities Market by Country, 2021 - 2024, USD Million

TABLE 42 North America Energy & Utilities Market by Country, 2025 - 2032, USD Million

TABLE 43 North America Other End Use Market by Country, 2021 - 2024, USD Million

TABLE 44 North America Other End Use Market by Country, 2025 - 2032, USD Million

TABLE 45 North America Novel Spectrometry Market by Country, 2021 - 2024, USD Million

TABLE 46 North America Novel Spectrometry Market by Country, 2025 - 2032, USD Million

TABLE 47 US Novel Spectrometry Market, 2021 - 2024, USD Million

TABLE 48 US Novel Spectrometry Market, 2025 - 2032, USD Million

TABLE 49 US Novel Spectrometry Market by Application, 2021 - 2024, USD Million

TABLE 50 US Novel Spectrometry Market by Application, 2025 - 2032, USD Million

TABLE 51 US Novel Spectrometry Market by Type, 2021 - 2024, USD Million

TABLE 52 US Novel Spectrometry Market by Type, 2025 - 2032, USD Million

TABLE 53 US Novel Spectrometry Market by End Use, 2021 - 2024, USD Million

TABLE 54 US Novel Spectrometry Market by End Use, 2025 - 2032, USD Million

TABLE 55 Canada Novel Spectrometry Market, 2021 - 2024, USD Million

TABLE 56 Canada Novel Spectrometry Market, 2025 - 2032, USD Million

TABLE 57 Canada Novel Spectrometry Market by Application, 2021 - 2024, USD Million

TABLE 58 Canada Novel Spectrometry Market by Application, 2025 - 2032, USD Million

TABLE 59 Canada Novel Spectrometry Market by Type, 2021 - 2024, USD Million

TABLE 60 Canada Novel Spectrometry Market by Type, 2025 - 2032, USD Million

TABLE 61 Canada Novel Spectrometry Market by End Use, 2021 - 2024, USD Million

TABLE 62 Canada Novel Spectrometry Market by End Use, 2025 - 2032, USD Million

TABLE 63 Mexico Novel Spectrometry Market, 2021 - 2024, USD Million

TABLE 64 Mexico Novel Spectrometry Market, 2025 - 2032, USD Million

TABLE 65 Mexico Novel Spectrometry Market by Application, 2021 - 2024, USD Million

TABLE 66 Mexico Novel Spectrometry Market by Application, 2025 - 2032, USD Million

TABLE 67 Mexico Novel Spectrometry Market by Type, 2021 - 2024, USD Million

TABLE 68 Mexico Novel Spectrometry Market by Type, 2025 - 2032, USD Million

TABLE 69 Mexico Novel Spectrometry Market by End Use, 2021 - 2024, USD Million

TABLE 70 Mexico Novel Spectrometry Market by End Use, 2025 - 2032, USD Million

TABLE 71 Rest of North America Novel Spectrometry Market, 2021 - 2024, USD Million

TABLE 72 Rest of North America Novel Spectrometry Market, 2025 - 2032, USD Million

TABLE 73 Rest of North America Novel Spectrometry Market by Application, 2021 - 2024, USD Million

TABLE 74 Rest of North America Novel Spectrometry Market by Application, 2025 - 2032, USD Million

TABLE 75 Rest of North America Novel Spectrometry Market by Type, 2021 - 2024, USD Million

TABLE 76 Rest of North America Novel Spectrometry Market by Type, 2025 - 2032, USD Million

TABLE 77 Rest of North America Novel Spectrometry Market by End Use, 2021 - 2024, USD Million

TABLE 78 Rest of North America Novel Spectrometry Market by End Use, 2025 - 2032, USD Million

TABLE 79 Key Information – Rigaku holdings Corporation

TABLE 80 Key Information – Thermo Fisher Scientific, Inc.

TABLE 81 Key Information – Bruker Corporation

TABLE 82 Key Information – Hitachi High-Tech Corporation

TABLE 83 key Information – Agilent Technologies, Inc.

TABLE 84 Key Information – Shimadzu Corporation

TABLE 85 Key Information – Danaher Corporation

TABLE 86 Key Information – Waters Corporation

TABLE 87 Key Information – MKS Instruments, Inc.

TABLE 88 Key Information – Advion, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Novel Spectrometry Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Novel Spectrometry Market

FIG 4 Market Share Analysis, 2024

FIG 5 Porter’s Five Forces Analysis – Novel Spectrometry Market

FIG 6 North America Novel Spectrometry Market share by Application, 2024

FIG 7 North America Novel Spectrometry Market share by Application, 2032

FIG 8 North America Novel Spectrometry Market by Application, 2021 - 2032, USD Million

FIG 9 North America Novel Spectrometry Market share by Type, 2024

FIG 10 North America Novel Spectrometry Market share by Type, 2032

FIG 11 North America Novel Spectrometry Market by Type, 2021 - 2032, USD Million

FIG 12 North America Novel Spectrometry Market share by End Use, 2024

FIG 13 North America Novel Spectrometry Market share by End Use, 2032

FIG 14 North America Novel Spectrometry Market by End Use, 2021 - 2032, USD Million

FIG 15 North America Novel Spectrometry Market share by Country, 2024

FIG 16 North America Novel Spectrometry Market share by Country, 2032

FIG 17 North America Novel Spectrometry Market by Country, 2021 - 2032, USD Million

FIG 18 SWOT Analysis: Thermo Fisher Scientific, Inc.

FIG 19 Swot Analysis: Bruker Corporation

FIG 20 SWOT Analysis: Hitachi High-Technologies Corporation

FIG 21 Swot Analysis: Agilent Technologies, Inc.

FIG 22 Swot Analysis: Shimadzu Corporation

FIG 23 SWOT Analysis: Danaher Corporation

FIG 24 SWOT Analysis: Waters Corporation

FIG 25 Swot Analysis: MKS Instruments, Inc.