North America NDT and Inspection Market Size, Share & Trends Analysis Report By Offering (Services and Technique), By Vertical (Manufacturing, Public Infrastructure, Automotive, Power Generation, Aerospace, Oil & Gas and Others), By Country and Growth Forecast, 2023 - 2030

Published Date : 26-Mar-2024 | Pages: 143 | Formats: PDF |

COVID-19 Impact on the North America NDT and Inspection Market

The North America NDT and Inspection Market would witness market growth of 9.6% CAGR during the forecast period (2023-2030).

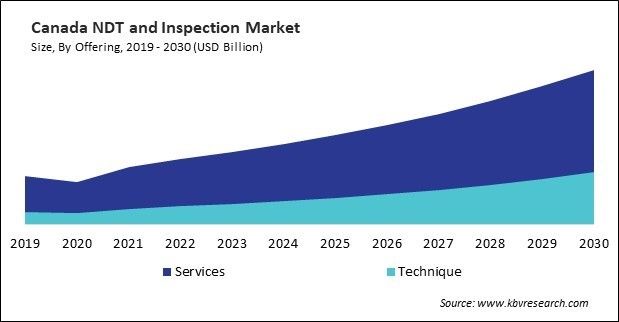

The US market dominated the North America NDT and Inspection Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $5,290.3 million by 2030. The Canada market is experiencing a CAGR of 12.1% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 11.1% during (2023 - 2030).

Safety remains of the utmost importance within the oil and gas sector, considering the inherent dangers that may arise during the extraction and exploration procedures. The services are of the utmost importance in identifying structural issues, corrosion, and defects in pressure vessels, pipelines, and other equipment to avert catastrophic failures that might result in environmental catastrophes or accidents. Oil and gas exploration frequently occurs in arduous and difficult environments, including offshore drilling platforms and remote locations on land.

Moreover, pipelines are a lifeline of the oil and gas industry, transporting hydrocarbons over vast distances. NDT techniques like ultrasonic, magnetic particle, and radiographic testing are employed to assess pipeline integrity, identify defects, and ensure pipelines can withstand transportation stresses without leaks or failures. Pressure vessels are critical components in oil and gas processing facilities. Ensuring their integrity is vital to prevent catastrophic failures.

The growth of manufacturing in Canada is likely to contribute to the expansion of the market in the country. Like many developed nations, Canada maintains strict regulatory standards across industries. Compliance with these standards necessitates using NDT and inspection techniques to identify and rectify defects or irregularities, ensuring that products and processes meet the required safety and quality criteria. According to Statistics Canada, in 2020, manufacturing revenues reached $24.6 billion. In 2020, net revenues reached $2.47 billion compared to $2.05 billion in 2019. Thus, the growing manufacturing activities in North America will lead to enhanced growth in the regional market.

Free Valuable Insights: The NDT and Inspection Market is Predict to reach USD 21.3 Billion by 2030, at a CAGR of 10.4%

Based on Offering, the market is segmented into Services (Inspection Services, Equipment Rental Services, Calibration Services, and Training Services) and Technique (Ultrasonic Testing (UT), Magnetic Particle Testing (MPT), Radiographic Testing (RT), Acoustic Emission Testing (AET), Visual Testing (VT), Liquid Penetrant Testing (LPT) and Eddy-Current Testing (ECT)s). Based on Vertical, the market is segmented into Manufacturing, Public Infrastructure, Automotive, Power Generation, Aerospace, Oil & Gas and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- General Electric Company

- Mistras Group, Inc.

- Olympus Corporation

- Eddyfi Technologies

- Intertek Group PLC

- Bureau Veritas S.A.

- TÜV Rheinland AG

- DEKRA SE

- Carestream Health, Inc. (Onex Corporation)

- Creaform, Inc. (AMETEK, Inc.)

North America NDT and Inspection Market Report Segmentation

By Offering

- Services

- Inspection Services

- Equipment Rental Services

- Calibration Services

- Training Services

- Technique

- Ultrasonic Testing (UT)

- Magnetic Particle Testing (MPT)

- Radiographic Testing (RT)

- Acoustic Emission Testing (AET)

- Visual Testing (VT)

- Liquid Penetrant Testing (LPT)

- Eddy-Current Testing (ECT)s

By Vertical

- Manufacturing

- Public Infrastructure

- Automotive

- Power Generation

- Aerospace

- Oil & Gas

- Others

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America NDT and Inspection Market, by Offering

1.4.2 North America NDT and Inspection Market, by Vertical

1.4.3 North America NDT and Inspection Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.2.4 Geographical Expansion

4.3 Market Share Analysis, 2022

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

4.4.2 Key Strategic Move: (Mergers & Acquisitions : 2019, Feb – 2023, Oct) Leading Players

4.4.3 Key Strategic Move: (Product Launches and Product Expansions : 2021, Nov – 2023, Nov) Leading Players

4.5 Porter’s Five Forces Analysis

Chapter 5. North America NDT and Inspection Market by Offering

5.1 North America Services Market by Region

5.2 North America NDT and Inspection Market by Services Type

5.2.1 North America Inspection Services Market by Country

5.2.2 North America Equipment Rental Services Market by Country

5.2.3 North America Calibration Services Market by Country

5.2.4 North America Training Services Market by Country

5.3 North America Technique Market by Region

5.4 North America NDT and Inspection Market by Technique Type

5.4.1 North America Ultrasonic Testing (UT) Market by Country

5.4.2 North America Magnetic Particle Testing (MPT) Market by Country

5.4.3 North America Radiographic Testing (RT) Market by Country

5.4.4 North America Acoustic Emission Testing (AET) Market by Country

5.4.5 North America Visual Testing (VT) Market by Country

5.4.6 North America Liquid Penetrant Testing (LPT) Market by Country

5.4.7 North America Eddy-Current Testing (ECT)s Market by Country

Chapter 6. North America NDT and Inspection Market by Vertical

6.1 North America Manufacturing Market by Country

6.2 North America Public Infrastructure Market by Country

6.3 North America Automotive Market by Country

6.4 North America Power Generation Market by Country

6.5 North America Aerospace Market by Country

6.6 North America Oil & Gas Market by Country

6.7 North America Others Market by Country

Chapter 7. North America NDT and Inspection Market by Country

7.1 US NDT and Inspection Market

7.1.1 US NDT and Inspection Market by Offering

7.1.1.1 US NDT and Inspection Market by Services Type

7.1.1.2 US NDT and Inspection Market by Technique Type

7.1.2 US NDT and Inspection Market by Vertical

7.2 Canada NDT and Inspection Market

7.2.1 Canada NDT and Inspection Market by Offering

7.2.1.1 Canada NDT and Inspection Market by Services Type

7.2.1.2 Canada NDT and Inspection Market by Technique Type

7.2.2 Canada NDT and Inspection Market by Vertical

7.3 Mexico NDT and Inspection Market

7.3.1 Mexico NDT and Inspection Market by Offering

7.3.1.1 Mexico NDT and Inspection Market by Services Type

7.3.1.2 Mexico NDT and Inspection Market by Technique Type

7.3.2 Mexico NDT and Inspection Market by Vertical

7.4 Rest of North America NDT and Inspection Market

7.4.1 Rest of North America NDT and Inspection Market by Offering

7.4.1.1 Rest of North America NDT and Inspection Market by Services Type

7.4.1.2 Rest of North America NDT and Inspection Market by Technique Type

7.4.2 Rest of North America NDT and Inspection Market by Vertical

Chapter 8. Company Profiles

8.1 General Electric Company

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expense

8.1.5 Recent strategies and developments:

8.1.5.1 Partnerships, Collaborations, and Agreements:

8.1.6 SWOT Analysis

8.2 Mistras Group, Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expenses

8.2.5 Recent strategies and developments:

8.2.5.1 Acquisition and Mergers:

8.2.6 SWOT Analysis

8.3 Olympus Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 SWOT Analysis

8.4 Eddyfi Technologies

8.4.1 Company Overview

8.4.2 Recent strategies and developments:

8.4.2.1 Product Launches and Product Expansions:

8.4.2.2 Acquisition and Mergers:

8.4.3 SWOT Analysis

8.5 Intertek Group PLC

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Recent strategies and developments:

8.5.4.1 Acquisition and Mergers:

8.5.5 SWOT Analysis

8.6 Bureau Veritas S.A.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expenses

8.6.5 Recent strategies and developments:

8.6.5.1 Acquisition and Mergers:

8.6.6 SWOT Analysis

8.7 TÜV Rheinland AG

8.7.1 Company Overview

8.7.2 Recent strategies and developments:

8.7.2.1 Acquisition and Mergers:

8.7.3 SWOT Analysis

8.8 DEKRA SE

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.8.4 Recent strategies and developments:

8.8.4.1 Partnerships, Collaborations, and Agreements:

8.8.4.2 Geographical Expansions:

8.8.5 SWOT Analysis

8.9 Carestream Health, Inc. (Onex Corporation)

8.9.1 Company Overview

8.9.2 SWOT Analysis

8.10. Creaform, Inc. (Ametek, Inc.)

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Segmental and Regional Analysis

8.10.4 Research & Development Expenses

8.10.5 Recent strategies and developments:

8.10.5.1 Product Launches and Product Expansions:

8.10.6 SWOT Analysis

TABLE 2 North America NDT and Inspection Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– NDT and Inspection Market

TABLE 4 Product Launches And Product Expansions– NDT and Inspection Market

TABLE 5 Acquisition and Mergers– NDT and Inspection Market

TABLE 6 Geographical Expansion – NDT and Inspection Market

TABLE 7 North America NDT and Inspection Market by Offering, 2019 - 2022, USD Million

TABLE 8 North America NDT and Inspection Market by Offering, 2023 - 2030, USD Million

TABLE 9 North America Services Market by Region, 2019 - 2022, USD Million

TABLE 10 North America Services Market by Region, 2023 - 2030, USD Million

TABLE 11 North America NDT and Inspection Market by Services Type, 2019 - 2022, USD Million

TABLE 12 North America NDT and Inspection Market by Services Type, 2023 - 2030, USD Million

TABLE 13 North America Inspection Services Market by Country, 2019 - 2022, USD Million

TABLE 14 North America Inspection Services Market by Country, 2023 - 2030, USD Million

TABLE 15 North America Equipment Rental Services Market by Country, 2019 - 2022, USD Million

TABLE 16 North America Equipment Rental Services Market by Country, 2023 - 2030, USD Million

TABLE 17 North America Calibration Services Market by Country, 2019 - 2022, USD Million

TABLE 18 North America Calibration Services Market by Country, 2023 - 2030, USD Million

TABLE 19 North America Training Services Market by Country, 2019 - 2022, USD Million

TABLE 20 North America Training Services Market by Country, 2023 - 2030, USD Million

TABLE 21 North America Technique Market by Region, 2019 - 2022, USD Million

TABLE 22 North America Technique Market by Region, 2023 - 2030, USD Million

TABLE 23 North America NDT and Inspection Market by Technique Type, 2019 - 2022, USD Million

TABLE 24 North America NDT and Inspection Market by Technique Type, 2023 - 2030, USD Million

TABLE 25 North America Ultrasonic Testing (UT) Market by Country, 2019 - 2022, USD Million

TABLE 26 North America Ultrasonic Testing (UT) Market by Country, 2023 - 2030, USD Million

TABLE 27 North America Magnetic Particle Testing (MPT) Market by Country, 2019 - 2022, USD Million

TABLE 28 North America Magnetic Particle Testing (MPT) Market by Country, 2023 - 2030, USD Million

TABLE 29 North America Radiographic Testing (RT) Market by Country, 2019 - 2022, USD Million

TABLE 30 North America Radiographic Testing (RT) Market by Country, 2023 - 2030, USD Million

TABLE 31 North America Acoustic Emission Testing (AET) Market by Country, 2019 - 2022, USD Million

TABLE 32 North America Acoustic Emission Testing (AET) Market by Country, 2023 - 2030, USD Million

TABLE 33 North America Visual Testing (VT) Market by Country, 2019 - 2022, USD Million

TABLE 34 North America Visual Testing (VT) Market by Country, 2023 - 2030, USD Million

TABLE 35 North America Liquid Penetrant Testing (LPT) Market by Country, 2019 - 2022, USD Million

TABLE 36 North America Liquid Penetrant Testing (LPT) Market by Country, 2023 - 2030, USD Million

TABLE 37 North America Eddy-Current Testing (ECT)s Market by Country, 2019 - 2022, USD Million

TABLE 38 North America Eddy-Current Testing (ECT)s Market by Country, 2023 - 2030, USD Million

TABLE 39 North America NDT and Inspection Market by Vertical, 2019 - 2022, USD Million

TABLE 40 North America NDT and Inspection Market by Vertical, 2023 - 2030, USD Million

TABLE 41 North America Manufacturing Market by Country, 2019 - 2022, USD Million

TABLE 42 North America Manufacturing Market by Country, 2023 - 2030, USD Million

TABLE 43 North America Public Infrastructure Market by Country, 2019 - 2022, USD Million

TABLE 44 North America Public Infrastructure Market by Country, 2023 - 2030, USD Million

TABLE 45 North America Automotive Market by Country, 2019 - 2022, USD Million

TABLE 46 North America Automotive Market by Country, 2023 - 2030, USD Million

TABLE 47 North America Power Generation Market by Country, 2019 - 2022, USD Million

TABLE 48 North America Power Generation Market by Country, 2023 - 2030, USD Million

TABLE 49 North America Aerospace Market by Country, 2019 - 2022, USD Million

TABLE 50 North America Aerospace Market by Country, 2023 - 2030, USD Million

TABLE 51 North America Oil & Gas Market by Country, 2019 - 2022, USD Million

TABLE 52 North America Oil & Gas Market by Country, 2023 - 2030, USD Million

TABLE 53 North America Others Market by Country, 2019 - 2022, USD Million

TABLE 54 North America Others Market by Country, 2023 - 2030, USD Million

TABLE 55 North America NDT and Inspection Market by Country, 2019 - 2022, USD Million

TABLE 56 North America NDT and Inspection Market by Country, 2023 - 2030, USD Million

TABLE 57 US NDT and Inspection Market, 2019 - 2022, USD Million

TABLE 58 US NDT and Inspection Market, 2023 - 2030, USD Million

TABLE 59 US NDT and Inspection Market by Offering, 2019 - 2022, USD Million

TABLE 60 US NDT and Inspection Market by Offering, 2023 - 2030, USD Million

TABLE 61 US NDT and Inspection Market by Services Type, 2019 - 2022, USD Million

TABLE 62 US NDT and Inspection Market by Services Type, 2023 - 2030, USD Million

TABLE 63 US NDT and Inspection Market by Technique Type, 2019 - 2022, USD Million

TABLE 64 US NDT and Inspection Market by Technique Type, 2023 - 2030, USD Million

TABLE 65 US NDT and Inspection Market by Vertical, 2019 - 2022, USD Million

TABLE 66 US NDT and Inspection Market by Vertical, 2023 - 2030, USD Million

TABLE 67 Canada NDT and Inspection Market, 2019 - 2022, USD Million

TABLE 68 Canada NDT and Inspection Market, 2023 - 2030, USD Million

TABLE 69 Canada NDT and Inspection Market by Offering, 2019 - 2022, USD Million

TABLE 70 Canada NDT and Inspection Market by Offering, 2023 - 2030, USD Million

TABLE 71 Canada NDT and Inspection Market by Services Type, 2019 - 2022, USD Million

TABLE 72 Canada NDT and Inspection Market by Services Type, 2023 - 2030, USD Million

TABLE 73 Canada NDT and Inspection Market by Technique Type, 2019 - 2022, USD Million

TABLE 74 Canada NDT and Inspection Market by Technique Type, 2023 - 2030, USD Million

TABLE 75 Canada NDT and Inspection Market by Vertical, 2019 - 2022, USD Million

TABLE 76 Canada NDT and Inspection Market by Vertical, 2023 - 2030, USD Million

TABLE 77 Mexico NDT and Inspection Market, 2019 - 2022, USD Million

TABLE 78 Mexico NDT and Inspection Market, 2023 - 2030, USD Million

TABLE 79 Mexico NDT and Inspection Market by Offering, 2019 - 2022, USD Million

TABLE 80 Mexico NDT and Inspection Market by Offering, 2023 - 2030, USD Million

TABLE 81 Mexico NDT and Inspection Market by Services Type, 2019 - 2022, USD Million

TABLE 82 Mexico NDT and Inspection Market by Services Type, 2023 - 2030, USD Million

TABLE 83 Mexico NDT and Inspection Market by Technique Type, 2019 - 2022, USD Million

TABLE 84 Mexico NDT and Inspection Market by Technique Type, 2023 - 2030, USD Million

TABLE 85 Mexico NDT and Inspection Market by Vertical, 2019 - 2022, USD Million

TABLE 86 Mexico NDT and Inspection Market by Vertical, 2023 - 2030, USD Million

TABLE 87 Rest of North America NDT and Inspection Market, 2019 - 2022, USD Million

TABLE 88 Rest of North America NDT and Inspection Market, 2023 - 2030, USD Million

TABLE 89 Rest of North America NDT and Inspection Market by Offering, 2019 - 2022, USD Million

TABLE 90 Rest of North America NDT and Inspection Market by Offering, 2023 - 2030, USD Million

TABLE 91 Rest of North America NDT and Inspection Market by Services Type, 2019 - 2022, USD Million

TABLE 92 Rest of North America NDT and Inspection Market by Services Type, 2023 - 2030, USD Million

TABLE 93 Rest of North America NDT and Inspection Market by Technique Type, 2019 - 2022, USD Million

TABLE 94 Rest of North America NDT and Inspection Market by Technique Type, 2023 - 2030, USD Million

TABLE 95 Rest of North America NDT and Inspection Market by Vertical, 2019 - 2022, USD Million

TABLE 96 Rest of North America NDT and Inspection Market by Vertical, 2023 - 2030, USD Million

TABLE 97 Key Information – General Electric Company

TABLE 98 Key Information – Mistras Group, Inc.

TABLE 99 Key Information – Olympus Corporation

TABLE 100 Key Information – Eddyfi Technologies

TABLE 101 Key Information – Intertek Group PLC

TABLE 102 Key Information – Bureau Veritas S.A.

TABLE 103 Key Information – TÜV Rheinland AG

TABLE 104 Key Information – DEKRA SE

TABLE 105 Key Information – Carestream Health, Inc.

TABLE 106 Key Information – Creaform, inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America NDT and Inspection Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting NDT and Inspection Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2022

FIG 6 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 7 Key Strategic Move: (Mergers & Acquisitions : 2019, Feb – 2023, Oct) Leading Players

FIG 8 Key Strategic Move: (Product Launches and Product Expansions : 2021, Nov – 2023, Nov) Leading Players

FIG 9 Porter’s Five Forces Analysis - NDT and Inspection Market

FIG 10 North America NDT and Inspection Market share by Offering, 2019

FIG 11 North America NDT and Inspection Market share by Offering, 2019

FIG 12 North America NDT and Inspection Market by Offering, 2019 - 2030, USD Million

FIG 13 North America NDT and Inspection Market share by Vertical, 2019

FIG 14 North America NDT and Inspection Market share by Vertical, 2019

FIG 15 North America NDT and Inspection Market by Vertical, 2019 - 2030, USD Million

FIG 16 North America NDT and Inspection Market share by Country, 2019

FIG 17 North America NDT and Inspection Market share by Country, 2019

FIG 18 North America NDT and Inspection Market by Country, 2019 - 2030, USD Million

FIG 19 SWOT Analysis: General electric (GE) Co.

FIG 20 SWOT Analysis: Mistras Group, Inc.

FIG 21 SWOT Analysis: Olympus Corporation

FIG 22 Recent strategies and developments: Eddyfi Technologies

FIG 23 SWOT Analysis: Eddyfi Technologies

FIG 24 Swot Analysis: Intertek Group PLC

FIG 25 Swot Analysis: Bureau Veritas S.A.

FIG 26 Swot Analysis: TÜV Rheinland AG

FIG 27 Recent strategies and developments: DEKRA SE

FIG 28 Swot Analysis: DEKRA SE

FIG 29 SWOT Analysis: Carestream Health, Inc.

FIG 30 SWOT Analysis: Creaform, Inc.