North America Fingerprint Biometrics Market Size, Share & Trends Analysis Report By Type (Non-AFIS Technology, and AFIS Technology), By Offering (Hardware, Software, and Services), By End User, By Country and Growth Forecast, 2023 - 2030

Published Date : 18-Mar-2024 | Pages: 116 | Formats: PDF |

COVID-19 Impact on the North America Fingerprint Biometrics Market

The North America Fingerprint Biometrics Market would witness market growth of 12.5% CAGR during the forecast period (2023-2030).

The healthcare sector employs fingerprint biometrics for secure patient identification. This application enhances the accuracy of medical records, ensures patient privacy, and reduces the risk of identity-related errors in healthcare settings. Educational institutions utilize fingerprint biometrics for campus security and access control. By implementing biometric systems, schools and universities can restrict access to authorized personnel, ensuring a secure learning environment.

In addition, the fingerprint biometrics market is dynamic, influenced by ongoing technological advancements, changing security landscapes, and evolving user preferences. Fingerprint biometrics is increasingly integrated with smart devices and the Internet of Things (IoT). This trend extends beyond smartphones to include smart door locks, wearables, and connected home devices, creating a seamless and interconnected ecosystem of biometric-enabled devices.

Mexico’s BFSI sector has been experiencing growth, driven by increasing financial inclusion, technological advancements, and government initiatives to promote digital financial services. The adoption of digital banking solutions, mobile banking, and online financial services has increased. Therefore, the rising BFSI and telecom sectors in North America will assist in the expansion of the regional fingerprint biometrics market.

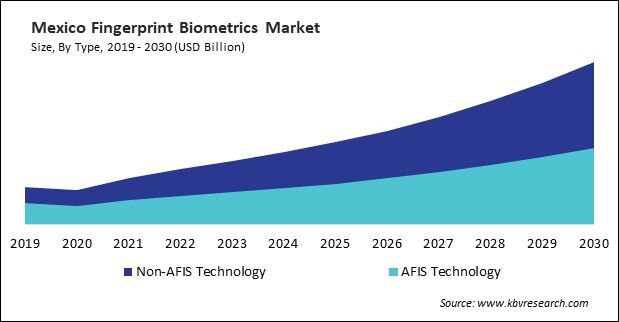

The US market dominated the North America Fingerprint Biometrics Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $13,810.6 million by 2030. The Canada market is experiencing a CAGR of 15.1% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 14.1% during (2023 - 2030).

Free Valuable Insights: The Fingerprint Biometrics Market is Predict to reach USD 55.7 Billion by 2030, at a CAGR of 13.3%

Based on Type, the market is segmented into Non-AFIS Technology, and AFIS Technology. Based on Offering, the market is segmented into Hardware, Software, and Services. Based on End User, the market is segmented into Government & Defense, BFSI, IT & Telecom, Healthcare, Automotive, Travel & Tourism, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- HID Global Corporation (Assa Abloy AB)

- NEC Corporation

- Thales Group S.A.

- Dermalog Identification Systems Gmbh

- M2SYS Technology, Inc.

- IDEMIA SAS (Advent International, Inc.)

- BIO-key International, Inc.

- Fingerprint Cards AB

- Fingercheck LLC

- Anviz Global Inc.

North America Fingerprint Biometrics Market Report Segmentation

By Type

- Non-AFIS Technology

- AFIS Technology

By Offering

- Hardware

- Software

- Services

By End User

- Government & Defense

- BFSI

- IT & Telecom

- Healthcare

- Automotive

- Travel & Tourism

- Others

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Fingerprint Biometrics Market, by Type

1.4.2 North America Fingerprint Biometrics Market, by Offering

1.4.3 North America Fingerprint Biometrics Market, by End User

1.4.4 North America Fingerprint Biometrics Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 Market Share Analysis, 2022

4.2 Recent Strategies Deployed in Fingerprint Biometrics Market

4.3 Porter’s Five Forces Analysis

Chapter 5. North America Fingerprint Biometrics Market by Type

5.1 North America Non-AFIS Technology Market by Region

5.2 North America AFIS Technology Market by Region

Chapter 6. North America Fingerprint Biometrics Market by Offering

6.1 North America Hardware Market by Country

6.2 North America Software Market by Country

6.3 North America Services Market by Country

Chapter 7. North America Fingerprint Biometrics Market by End User

7.1 North America Government & Defense Market by Country

7.2 North America BFSI Market by Country

7.3 North America IT & Telecom Market by Country

7.4 North America Healthcare Market by Country

7.5 North America Automotive Market by Country

7.6 North America Travel & Tourism Market by Country

7.7 North America Others Market by Country

Chapter 8. North America Fingerprint Biometrics Market by Country

8.1 US Fingerprint Biometrics Market

8.1.1 US Fingerprint Biometrics Market by Type

8.1.2 US Fingerprint Biometrics Market by Offering

8.1.3 US Fingerprint Biometrics Market by End User

8.2 Canada Fingerprint Biometrics Market

8.2.1 Canada Fingerprint Biometrics Market by Type

8.2.2 Canada Fingerprint Biometrics Market by Offering

8.2.3 Canada Fingerprint Biometrics Market by End User

8.3 Mexico Fingerprint Biometrics Market

8.3.1 Mexico Fingerprint Biometrics Market by Type

8.3.2 Mexico Fingerprint Biometrics Market by Offering

8.3.3 Mexico Fingerprint Biometrics Market by End User

8.4 Rest of North America Fingerprint Biometrics Market

8.4.1 Rest of North America Fingerprint Biometrics Market by Type

8.4.2 Rest of North America Fingerprint Biometrics Market by Offering

8.4.3 Rest of North America Fingerprint Biometrics Market by End User

Chapter 9. Company Profiles

9.1 HID Global Corporation (Assa Abloy AB)

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expense

9.1.5 Recent strategies and developments:

9.1.5.1 Product Launches and Product Expansions:

9.1.5.2 Acquisition and Mergers:

9.1.6 SWOT Analysis

9.2 NEC Corporation

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Research & Development Expenses

9.2.5 Recent strategies and developments:

9.2.5.1 Partnerships, Collaborations, and Agreements:

9.2.6 SWOT Analysis

9.3 Thales Group S.A.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 SWOT Analysis

9.4 Dermalog Identification Systems Gmbh

9.4.1 Company Overview

9.4.2 Recent strategies and developments:

9.4.2.1 Acquisition and Mergers:

9.4.3 SWOT Analysis

9.5 M2SYS Technology, Inc.

9.5.1 Company Overview

9.5.2 SWOT Analysis

9.6 IDEMIA SAS (Advent International, Inc.)

9.6.1 Company Overview

9.6.2 Recent strategies and developments:

9.6.2.1 Partnerships, Collaborations, and Agreements:

9.6.3 SWOT Analysis

9.7 BIO-key International, Inc.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Research & Development Expenses

9.7.4 Recent strategies and developments:

9.7.4.1 Partnerships, Collaborations, and Agreements:

9.7.4.2 Acquisition and Mergers:

9.7.5 SWOT Analysis

9.8 Fingerprint Cards AB

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Recent strategies and developments:

9.8.4.1 Partnerships, Collaborations, and Agreements:

9.8.5 SWOT Analysis

9.9 Fingercheck LLC

9.9.1 Company Overview

9.9.2 SWOT Analysis

9.10. Anviz Global Inc.

9.10.1 Company Overview

9.10.2 SWOT Analysis

TABLE 2 North America Fingerprint Biometrics Market, 2023 - 2030, USD Million

TABLE 3 North America Fingerprint Biometrics Market by Type, 2019 - 2022, USD Million

TABLE 4 North America Fingerprint Biometrics Market by Type, 2023 - 2030, USD Million

TABLE 5 North America Non-AFIS Technology Market by Region, 2019 - 2022, USD Million

TABLE 6 North America Non-AFIS Technology Market by Region, 2023 - 2030, USD Million

TABLE 7 North America AFIS Technology Market by Region, 2019 - 2022, USD Million

TABLE 8 North America AFIS Technology Market by Region, 2023 - 2030, USD Million

TABLE 9 North America Fingerprint Biometrics Market by Offering, 2019 - 2022, USD Million

TABLE 10 North America Fingerprint Biometrics Market by Offering, 2023 - 2030, USD Million

TABLE 11 North America Hardware Market by Country, 2019 - 2022, USD Million

TABLE 12 North America Hardware Market by Country, 2023 - 2030, USD Million

TABLE 13 North America Software Market by Country, 2019 - 2022, USD Million

TABLE 14 North America Software Market by Country, 2023 - 2030, USD Million

TABLE 15 North America Services Market by Country, 2019 - 2022, USD Million

TABLE 16 North America Services Market by Country, 2023 - 2030, USD Million

TABLE 17 North America Fingerprint Biometrics Market by End User, 2019 - 2022, USD Million

TABLE 18 North America Fingerprint Biometrics Market by End User, 2023 - 2030, USD Million

TABLE 19 North America Government & Defense Market by Country, 2019 - 2022, USD Million

TABLE 20 North America Government & Defense Market by Country, 2023 - 2030, USD Million

TABLE 21 North America BFSI Market by Country, 2019 - 2022, USD Million

TABLE 22 North America BFSI Market by Country, 2023 - 2030, USD Million

TABLE 23 North America IT & Telecom Market by Country, 2019 - 2022, USD Million

TABLE 24 North America IT & Telecom Market by Country, 2023 - 2030, USD Million

TABLE 25 North America Healthcare Market by Country, 2019 - 2022, USD Million

TABLE 26 North America Healthcare Market by Country, 2023 - 2030, USD Million

TABLE 27 North America Automotive Market by Country, 2019 - 2022, USD Million

TABLE 28 North America Automotive Market by Country, 2023 - 2030, USD Million

TABLE 29 North America Travel & Tourism Market by Country, 2019 - 2022, USD Million

TABLE 30 North America Travel & Tourism Market by Country, 2023 - 2030, USD Million

TABLE 31 North America Others Market by Country, 2019 - 2022, USD Million

TABLE 32 North America Others Market by Country, 2023 - 2030, USD Million

TABLE 33 North America Fingerprint Biometrics Market by Country, 2019 - 2022, USD Million

TABLE 34 North America Fingerprint Biometrics Market by Country, 2023 - 2030, USD Million

TABLE 35 US Fingerprint Biometrics Market, 2019 - 2022, USD Million

TABLE 36 US Fingerprint Biometrics Market, 2023 - 2030, USD Million

TABLE 37 US Fingerprint Biometrics Market by Type, 2019 - 2022, USD Million

TABLE 38 US Fingerprint Biometrics Market by Type, 2023 - 2030, USD Million

TABLE 39 US Fingerprint Biometrics Market by Offering, 2019 - 2022, USD Million

TABLE 40 US Fingerprint Biometrics Market by Offering, 2023 - 2030, USD Million

TABLE 41 US Fingerprint Biometrics Market by End User, 2019 - 2022, USD Million

TABLE 42 US Fingerprint Biometrics Market by End User, 2023 - 2030, USD Million

TABLE 43 Canada Fingerprint Biometrics Market, 2019 - 2022, USD Million

TABLE 44 Canada Fingerprint Biometrics Market, 2023 - 2030, USD Million

TABLE 45 Canada Fingerprint Biometrics Market by Type, 2019 - 2022, USD Million

TABLE 46 Canada Fingerprint Biometrics Market by Type, 2023 - 2030, USD Million

TABLE 47 Canada Fingerprint Biometrics Market by Offering, 2019 - 2022, USD Million

TABLE 48 Canada Fingerprint Biometrics Market by Offering, 2023 - 2030, USD Million

TABLE 49 Canada Fingerprint Biometrics Market by End User, 2019 - 2022, USD Million

TABLE 50 Canada Fingerprint Biometrics Market by End User, 2023 - 2030, USD Million

TABLE 51 Mexico Fingerprint Biometrics Market, 2019 - 2022, USD Million

TABLE 52 Mexico Fingerprint Biometrics Market, 2023 - 2030, USD Million

TABLE 53 Mexico Fingerprint Biometrics Market by Type, 2019 - 2022, USD Million

TABLE 54 Mexico Fingerprint Biometrics Market by Type, 2023 - 2030, USD Million

TABLE 55 Mexico Fingerprint Biometrics Market by Offering, 2019 - 2022, USD Million

TABLE 56 Mexico Fingerprint Biometrics Market by Offering, 2023 - 2030, USD Million

TABLE 57 Mexico Fingerprint Biometrics Market by End User, 2019 - 2022, USD Million

TABLE 58 Mexico Fingerprint Biometrics Market by End User, 2023 - 2030, USD Million

TABLE 59 Rest of North America Fingerprint Biometrics Market, 2019 - 2022, USD Million

TABLE 60 Rest of North America Fingerprint Biometrics Market, 2023 - 2030, USD Million

TABLE 61 Rest of North America Fingerprint Biometrics Market by Type, 2019 - 2022, USD Million

TABLE 62 Rest of North America Fingerprint Biometrics Market by Type, 2023 - 2030, USD Million

TABLE 63 Rest of North America Fingerprint Biometrics Market by Offering, 2019 - 2022, USD Million

TABLE 64 Rest of North America Fingerprint Biometrics Market by Offering, 2023 - 2030, USD Million

TABLE 65 Rest of North America Fingerprint Biometrics Market by End User, 2019 - 2022, USD Million

TABLE 66 Rest of North America Fingerprint Biometrics Market by End User, 2023 - 2030, USD Million

TABLE 67 Key Information – HID Global Corporation

TABLE 68 KEY INFORMATION – NEC Corporation

TABLE 69 Key Information – Thales Group S.A.

TABLE 70 Key Information – Dermalog Identification Systems Gmbh

TABLE 71 Key Information – M2SYS Technology, Inc.

TABLE 72 Key Information – IDEMIA SAS

TABLE 73 Key information – BIO-key International, Inc.

TABLE 74 Key Information – Fingerprint Cards AB

TABLE 75 Key Information – Fingercheck LLC

TABLE 76 Key Information – Anviz Global Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Fingerprint Biometrics Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Fingerprint Biometrics Market

FIG 4 Market Share Analysis, 2022

FIG 5 Porter’s Five Forces Analysis – Fingerprint biometrics market

FIG 6 North America Fingerprint Biometrics Market share by Type, 2022

FIG 7 North America Fingerprint Biometrics Market share by Type, 2030

FIG 8 North America Fingerprint Biometrics Market by Type, 2019 - 2030, USD Million

FIG 9 North America Fingerprint Biometrics Market share by Offering, 2022

FIG 10 North America Fingerprint Biometrics Market share by Offering, 2030

FIG 11 North America Fingerprint Biometrics Market by Offering, 2019 - 2030, USD Million

FIG 12 North America Fingerprint Biometrics Market share by End User, 2022

FIG 13 North America Fingerprint Biometrics Market share by End User, 2030

FIG 14 North America Fingerprint Biometrics Market by End User, 2019 - 2030, USD Million

FIG 15 North America Fingerprint Biometrics Market share by Country, 2022

FIG 16 North America Fingerprint Biometrics Market share by Country, 2030

FIG 17 North America Fingerprint Biometrics Market by Country, 2019 - 2030, USD Million

FIG 18 Recent strategies and developments: HID Global Corporation

FIG 19 SWOT Analysis: HID Global Corporation

FIG 20 SWOT Analysis: NEC Corporation

FIG 21 SWOT Analysis: Thales Group S.A.

FIG 22 SWOT Analysis: Dermalog Identification Systems Gmbh

FIG 23 SWOT Analysis: M2SYS Technology

FIG 24 Swot Analysis: IDEMIA SAS

FIG 25 Recent strategies and developments: BIO-key International, Inc.

FIG 26 Swot Analysis: BIO-key International, Inc.

FIG 27 Swot Analysis: Fingerprint Cards AB

FIG 28 Swot Analysis: Fingercheck, LLC

FIG 29 Swot Analysis: Anviz Global Inc.