North America Filler Masterbatch Market Size, Share & Trends Analysis Report By Carrier Polymer, By Application (Injection & Blow Molding, Films & Sheets, Tapes, and Others), By End-Use, By Country and Growth Forecast, 2023 - 2030

Published Date : 28-Mar-2024 | Pages: 103 | Formats: PDF |

COVID-19 Impact on the North America Filler Masterbatch Market

The North America Filler Masterbatch Market would witness market growth of 6.5% CAGR during the forecast period (2023-2030). In the year 2019, the North America market's volume surged to 431.46 hundred Tonnes, showcasing a growth of 3.9% (2019-2022).

Filler masterbatches play a crucial role in providing color consistency, UV resistance, and chemical stability to plastic components used in consumer goods manufacturing. Additionally, in the automotive industry, filler masterbatches are utilized in interior and exterior components, including dashboards, panels, and trim, to enhance strength, reduce weight, and improve surface finish. Therefore, the Mexico market will use 1936.9 hundred tonnes of filler masterbatch in consumer goods by 2030.

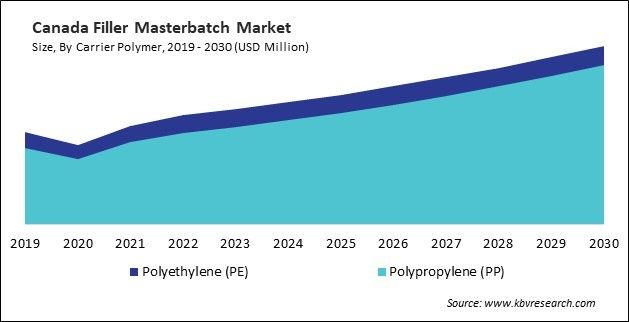

The US market dominated the North America Filler Masterbatch Market by Country in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $90,163.8 Thousands by 2030. The Canada market is experiencing a CAGR of 6.8% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 7.5% during (2023 - 2030).

One of the primary uses of filler masterbatch is in the plastics industry, where it acts as a reinforcement agent for polymer matrices. Incorporating fillers such as calcium carbonate, talc, or glass fibers enhances the mechanical properties of plastics. This reinforcement improves tensile strength, modulus, and impact resistance, making it an ideal solution to produce high-strength plastic products. Applications include packaging materials, automotive components, and industrial containers.

Filler masterbatch is pivotal in the coloration and aesthetic enhancement of polymer products. Manufacturers can achieve consistent and vibrant colors by incorporating pigments into the masterbatch, ensuring uniform dispersion throughout the product. This is particularly crucial in industries with significant product aesthetics, such as consumer goods, cosmetics packaging, and household items. Automotive applications benefit significantly from filler masterbatch, especially in producing lightweight yet sturdy components.

E-commerce companies increasingly adopt sustainable practices, including using recyclable packaging materials in North America. E-commerce businesses often seek customized packaging solutions to enhance branding and provide a unique customer experience in North America. Anti-counterfeiting methods are more important in North America due to the increase of counterfeit products, particularly in e-commerce. Hence, the factors mentioned above will drive the regional market growth.

Free Valuable Insights: The Filler Masterbatch Market is Predict to reach USD 588.9 Million by 2030, at a CAGR of 7.1%

Based on Carrier Polymer, the market is segmented into Polyethylene (PE), and Polypropylene (PP). Based on Application, the market is segmented into Injection & Blow Molding, Films & Sheets, Tapes, and Others. Based on End-Use, the market is segmented into Packaging, Building & Construction, Consumer Goods, Agriculture, Automotive & Transportation, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Alok Masterbatches Pvt. Ltd.

- PMJ Joint Stock Company

- Phu Lam Import-Export Co., Ltd

- ADC Plastic Joint Stock Company (ADC Plastic., JSC)

- Vinares Vietnam JSC

- Vietnam Colour Trading and Manufacturing Co., LTD.

- Pha Le Plastics Manufacturing & Technology Joint Stock Company

- An Tien Industries JSC (An Phat Holdings JSC)

- Us Masterbatch Joint Stock Company

- Plastiblends India Limited (Kolsite Group)

North America Filler Masterbatch Market Report Segmentation

By Carrier Polymer (Volume, Hundred Tonnes, USD Million, 2019-2030)

- Polyethylene (PE)

- Polypropylene (PP)

By Application (Volume, Hundred Tonnes, USD Million, 2019-2030)

- Injection & Blow Molding

- Films & Sheets

- Tapes

- Others

By End-Use (Volume, Hundred Tonnes, USD Million, 2019-2030)

- Packaging

- Building & Construction

- Consumer Goods

- Agriculture

- Automotive & Transportation

- Others

By Country (Volume, Hundred Tonnes, USD Million, 2019-2030)

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Filler Masterbatch Market, by Carrier Polymer

1.4.2 North America Filler Masterbatch Market, by Application

1.4.3 North America Filler Masterbatch Market, by End-Use

1.4.4 North America Filler Masterbatch Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. North America Filler Masterbatch Market by Carrier Polymer

4.1 North America Polyethylene (PE) Market by Region

4.2 North America Polypropylene (PP) Market by Region

Chapter 5. North America Filler Masterbatch Market by Application

5.1 North America Injection & Blow Molding Market by Country

5.2 North America Films & Sheets Market by Country

5.3 North America Tapes Market by Country

5.4 North America Others Market by Country

Chapter 6. North America Filler Masterbatch Market by End-Use

6.1 North America Packaging Market by Country

6.2 North America Building & Construction Market by Country

6.3 North America Consumer Goods Market by Country

6.4 North America Agriculture Market by Country

6.5 North America Automotive & Transportation Market by Country

6.6 North America Others Market by Country

Chapter 7. North America Filler Masterbatch Market by Country

7.1 US Filler Masterbatch Market

7.1.1 US Filler Masterbatch Market by Carrier Polymer

7.1.2 US Filler Masterbatch Market by Application

7.1.3 US Filler Masterbatch Market by End-Use

7.2 Canada Filler Masterbatch Market

7.2.1 Canada Filler Masterbatch Market by Carrier Polymer

7.2.2 Canada Filler Masterbatch Market by Application

7.2.3 Canada Filler Masterbatch Market by End-Use

7.3 Mexico Filler Masterbatch Market

7.3.1 Mexico Filler Masterbatch Market by Carrier Polymer

7.3.2 Mexico Filler Masterbatch Market by Application

7.3.3 Mexico Filler Masterbatch Market by End-Use

7.4 Rest of North America Filler Masterbatch Market

7.4.1 Rest of North America Filler Masterbatch Market by Carrier Polymer

7.4.2 Rest of North America Filler Masterbatch Market by Application

7.4.3 Rest of North America Filler Masterbatch Market by End-Use

Chapter 8. Company Profiles

8.1 Alok Masterbatches Pvt. Ltd.

8.1.1 Company Overview

8.1.2 Recent strategies and developments:

8.1.2.1 Partnerships, Collaborations, and Agreements:

8.1.2.2 Product Launches and Product Expansions:

8.2 PMJ Joint Stock Company

8.2.1 Company Overview

8.3 Phu Lam Import-Export Co., Ltd

8.3.1 Company Overview

8.4 ADC Plastic Joint Stock Company (ADC Plastic., JSC)

8.4.1 Company Overview

8.5 Vinares Vietnam JSC

8.5.1 Company Overview

8.6 Vietnam Colour Trading and Manufacturing Co., LTD.

8.6.1 Company Overview

8.7 Pha Le Plastics Manufacturing & Technology Joint Stock Company

8.7.1 Company Overview

8.8 An Tien Industries JSC (An Phat Holdings JSC)

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.9 Us Masterbatch Joint Stock Company

8.9.1 Company Overview

8.10. Plastiblends India Limited (Kolsite Group)

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Research & Development Expenses

TABLE 2 North America Filler Masterbatch Market, 2023 - 2030, USD Thousands

TABLE 3 North America Filler Masterbatch Market, 2019 - 2022, Hundred Tonnes

TABLE 4 North America Filler Masterbatch Market, 2023 - 2030, Hundred Tonnes

TABLE 5 North America Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, USD Thousands

TABLE 6 North America Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, USD Thousands

TABLE 7 North America Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, Hundred Tonnes

TABLE 8 North America Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, Hundred Tonnes

TABLE 9 North America Polyethylene (PE) Market by Region, 2019 - 2022, USD Thousands

TABLE 10 North America Polyethylene (PE) Market by Region, 2023 - 2030, USD Thousands

TABLE 11 North America Polyethylene (PE) Market by Region, 2019 - 2022, Hundred Tonnes

TABLE 12 North America Polyethylene (PE) Market by Region, 2023 - 2030, Hundred Tonnes

TABLE 13 North America Polypropylene (PP) Market by Region, 2019 - 2022, USD Thousands

TABLE 14 North America Polypropylene (PP) Market by Region, 2023 - 2030, USD Thousands

TABLE 15 North America Polypropylene (PP) Market by Region, 2019 - 2022, Hundred Tonnes

TABLE 16 North America Polypropylene (PP) Market by Region, 2023 - 2030, Hundred Tonnes

TABLE 17 North America Filler Masterbatch Market by Application, 2019 - 2022, USD Thousands

TABLE 18 North America Filler Masterbatch Market by Application, 2023 - 2030, USD Thousands

TABLE 19 North America Filler Masterbatch Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 20 North America Filler Masterbatch Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 21 North America Injection & Blow Molding Market by Country, 2019 - 2022, USD Thousands

TABLE 22 North America Injection & Blow Molding Market by Country, 2023 - 2030, USD Thousands

TABLE 23 North America Injection & Blow Molding Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 24 North America Injection & Blow Molding Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 25 North America Films & Sheets Market by Country, 2019 - 2022, USD Thousands

TABLE 26 North America Films & Sheets Market by Country, 2023 - 2030, USD Thousands

TABLE 27 North America Films & Sheets Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 28 North America Films & Sheets Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 29 North America Tapes Market by Country, 2019 - 2022, USD Thousands

TABLE 30 North America Tapes Market by Country, 2023 - 2030, USD Thousands

TABLE 31 North America Tapes Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 32 North America Tapes Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 33 North America Others Market by Country, 2019 - 2022, USD Thousands

TABLE 34 North America Others Market by Country, 2023 - 2030, USD Thousands

TABLE 35 North America Others Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 36 North America Others Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 37 North America Filler Masterbatch Market by End-Use, 2019 - 2022, USD Thousands

TABLE 38 North America Filler Masterbatch Market by End-Use, 2023 - 2030, USD Thousands

TABLE 39 North America Filler Masterbatch Market by End-Use, 2019 - 2022, Hundred Tonnes

TABLE 40 North America Filler Masterbatch Market by End-Use, 2023 - 2030, Hundred Tonnes

TABLE 41 North America Packaging Market by Country, 2019 - 2022, USD Thousands

TABLE 42 North America Packaging Market by Country, 2023 - 2030, USD Thousands

TABLE 43 North America Packaging Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 44 North America Packaging Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 45 North America Building & Construction Market by Country, 2019 - 2022, USD Thousands

TABLE 46 North America Building & Construction Market by Country, 2023 - 2030, USD Thousands

TABLE 47 North America Building & Construction Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 48 North America Building & Construction Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 49 North America Consumer Goods Market by Country, 2019 - 2022, USD Thousands

TABLE 50 North America Consumer Goods Market by Country, 2023 - 2030, USD Thousands

TABLE 51 North America Consumer Goods Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 52 North America Consumer Goods Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 53 North America Agriculture Market by Country, 2019 - 2022, USD Thousands

TABLE 54 North America Agriculture Market by Country, 2023 - 2030, USD Thousands

TABLE 55 North America Agriculture Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 56 North America Agriculture Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 57 North America Automotive & Transportation Market by Country, 2019 - 2022, USD Thousands

TABLE 58 North America Automotive & Transportation Market by Country, 2023 - 2030, USD Thousands

TABLE 59 North America Automotive & Transportation Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 60 North America Automotive & Transportation Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 61 North America Others Market by Country, 2019 - 2022, USD Thousands

TABLE 62 North America Others Market by Country, 2023 - 2030, USD Thousands

TABLE 63 North America Others Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 64 North America Others Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 65 North America Filler Masterbatch Market by Country, 2019 - 2022, USD Thousands

TABLE 66 North America Filler Masterbatch Market by Country, 2023 - 2030, USD Thousands

TABLE 67 North America Filler Masterbatch Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 68 North America Filler Masterbatch Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 69 US Filler Masterbatch Market, 2019 - 2022, USD Thousands

TABLE 70 US Filler Masterbatch Market, 2023 - 2030, USD Thousands

TABLE 71 US Filler Masterbatch Market, 2019 - 2022, Hundred Tonnes

TABLE 72 US Filler Masterbatch Market, 2023 - 2030, Hundred Tonnes

TABLE 73 US Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, USD Thousands

TABLE 74 US Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, USD Thousands

TABLE 75 US Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, Hundred Tonnes

TABLE 76 US Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, Hundred Tonnes

TABLE 77 US Filler Masterbatch Market by Application, 2019 - 2022, USD Thousands

TABLE 78 US Filler Masterbatch Market by Application, 2023 - 2030, USD Thousands

TABLE 79 US Filler Masterbatch Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 80 US Filler Masterbatch Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 81 US Filler Masterbatch Market by End-Use, 2019 - 2022, USD Thousands

TABLE 82 US Filler Masterbatch Market by End-Use, 2023 - 2030, USD Thousands

TABLE 83 US Filler Masterbatch Market by End-Use, 2019 - 2022, Hundred Tonnes

TABLE 84 US Filler Masterbatch Market by End-Use, 2023 - 2030, Hundred Tonnes

TABLE 85 Canada Filler Masterbatch Market, 2019 - 2022, USD Thousands

TABLE 86 Canada Filler Masterbatch Market, 2023 - 2030, USD Thousands

TABLE 87 Canada Filler Masterbatch Market, 2019 - 2022, Hundred Tonnes

TABLE 88 Canada Filler Masterbatch Market, 2023 - 2030, Hundred Tonnes

TABLE 89 Canada Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, USD Thousands

TABLE 90 Canada Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, USD Thousands

TABLE 91 Canada Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, Hundred Tonnes

TABLE 92 Canada Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, Hundred Tonnes

TABLE 93 Canada Filler Masterbatch Market by Application, 2019 - 2022, USD Thousands

TABLE 94 Canada Filler Masterbatch Market by Application, 2023 - 2030, USD Thousands

TABLE 95 Canada Filler Masterbatch Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 96 Canada Filler Masterbatch Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 97 Canada Filler Masterbatch Market by End-Use, 2019 - 2022, USD Thousands

TABLE 98 Canada Filler Masterbatch Market by End-Use, 2023 - 2030, USD Thousands

TABLE 99 Canada Filler Masterbatch Market by End-Use, 2019 - 2022, Hundred Tonnes

TABLE 100 Canada Filler Masterbatch Market by End-Use, 2023 - 2030, Hundred Tonnes

TABLE 101 Mexico Filler Masterbatch Market, 2019 - 2022, USD Thousands

TABLE 102 Mexico Filler Masterbatch Market, 2023 - 2030, USD Thousands

TABLE 103 Mexico Filler Masterbatch Market, 2019 - 2022, Hundred Tonnes

TABLE 104 Mexico Filler Masterbatch Market, 2023 - 2030, Hundred Tonnes

TABLE 105 Mexico Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, USD Thousands

TABLE 106 Mexico Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, USD Thousands

TABLE 107 Mexico Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, Hundred Tonnes

TABLE 108 Mexico Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, Hundred Tonnes

TABLE 109 Mexico Filler Masterbatch Market by Application, 2019 - 2022, USD Thousands

TABLE 110 Mexico Filler Masterbatch Market by Application, 2023 - 2030, USD Thousands

TABLE 111 Mexico Filler Masterbatch Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 112 Mexico Filler Masterbatch Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 113 Mexico Filler Masterbatch Market by End-Use, 2019 - 2022, USD Thousands

TABLE 114 Mexico Filler Masterbatch Market by End-Use, 2023 - 2030, USD Thousands

TABLE 115 Mexico Filler Masterbatch Market by End-Use, 2019 - 2022, Hundred Tonnes

TABLE 116 Mexico Filler Masterbatch Market by End-Use, 2023 - 2030, Hundred Tonnes

TABLE 117 Rest of North America Filler Masterbatch Market, 2019 - 2022, USD Thousands

TABLE 118 Rest of North America Filler Masterbatch Market, 2023 - 2030, USD Thousands

TABLE 119 Rest of North America Filler Masterbatch Market, 2019 - 2022, Hundred Tonnes

TABLE 120 Rest of North America Filler Masterbatch Market, 2023 - 2030, Hundred Tonnes

TABLE 121 Rest of North America Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, USD Thousands

TABLE 122 Rest of North America Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, USD Thousands

TABLE 123 Rest of North America Filler Masterbatch Market by Carrier Polymer, 2019 - 2022, Hundred Tonnes

TABLE 124 Rest of North America Filler Masterbatch Market by Carrier Polymer, 2023 - 2030, Hundred Tonnes

TABLE 125 Rest of North America Filler Masterbatch Market by Application, 2019 - 2022, USD Thousands

TABLE 126 Rest of North America Filler Masterbatch Market by Application, 2023 - 2030, USD Thousands

TABLE 127 Rest of North America Filler Masterbatch Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 128 Rest of North America Filler Masterbatch Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 129 Rest of North America Filler Masterbatch Market by End-Use, 2019 - 2022, USD Thousands

TABLE 130 Rest of North America Filler Masterbatch Market by End-Use, 2023 - 2030, USD Thousands

TABLE 131 Rest of North America Filler Masterbatch Market by End-Use, 2019 - 2022, Hundred Tonnes

TABLE 132 Rest of North America Filler Masterbatch Market by End-Use, 2023 - 2030, Hundred Tonnes

TABLE 133 Key Information – Alok Masterbatches Pvt. Ltd.

TABLE 134 Key Information – PMJ Joint Stock Company

TABLE 135 Key Information – Phu Lam Import-Export Co., Ltd

TABLE 136 Key Information – ADC Plastic Joint Stock Company (ADC Plastic., JSC)

TABLE 137 Key Information – Vinares Vietnam JSC

TABLE 138 Key Information – Vietnam Colour Trading and Manufacturing Co., LTD.

TABLE 139 Key Information – Pha Le Plastics Manufacturing & Technology Joint Stock Company

TABLE 140 Key Information – An Tien Industries JSC

TABLE 141 Key Information – Us Masterbatch Joint Stock Company

TABLE 142 Key Information – Plastiblends India Limited (Kolsite Group)

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Filler Masterbatch Market, 2019 - 2030, USD Thousands

FIG 3 Key Factors Impacting Filler Masterbatch Market

FIG 4 Porter’s Five Forces Analysis – Filler masterbatch market

FIG 5 North America Filler Masterbatch Market share by Carrier Polymer, 2022

FIG 6 North America Filler Masterbatch Market share by Carrier Polymer, 2030

FIG 7 North America Filler Masterbatch Market by Carrier Polymer, 2019 - 2030, USD Thousands

FIG 8 North America Filler Masterbatch Market share by Application, 2022

FIG 9 North America Filler Masterbatch Market share by Application, 2030

FIG 10 North America Filler Masterbatch Market by Application, 2019 - 2030, USD Thousands

FIG 11 North America Filler Masterbatch Market share by End-Use, 2022

FIG 12 North America Filler Masterbatch Market share by End-Use, 2030

FIG 13 North America Filler Masterbatch Market by End-Use, 2019 - 2030, USD Thousands

FIG 14 North America Filler Masterbatch Market share by Country, 2022

FIG 15 North America Filler Masterbatch Market share by Country, 2030

FIG 16 North America Filler Masterbatch Market by Country, 2019 - 2030, USD Thousands

FIG 17 Recent strategies and developments: Alok Masterbatches Pvt. Ltd.