North America Energy-efficient Industrial Cooling Systems Market Size, Share & Industry Analysis Report By Deployment (New Installations and Retrofit Installations), By Cooling Capacity (100-500 kW, 500-1,000 kW, >1,000 kW, and <100 kW), By Industry, By Country and Growth Forecast, 2025 - 2032

Published Date : 26-Jun-2025 |

Pages: 165 |

Report Format: PDF + Excel |

COVID-19 Impact on the North America Energy-efficient Industrial Cooling Systems Market

The North America Energy-efficient Industrial Cooling Systems Market would witness market growth of 9.5% CAGR during the forecast period (2025-2032).

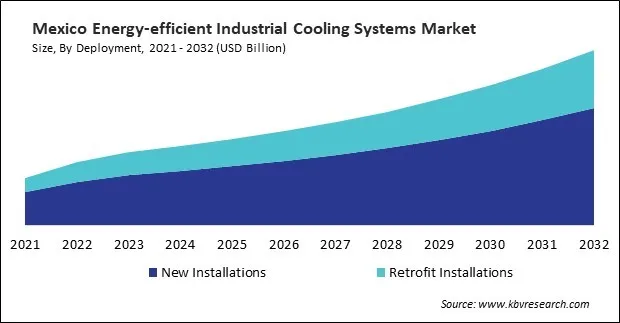

The US market dominated the North America Energy-efficient Industrial Cooling Systems Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $2,435.2 million by 2032. The Canada market is experiencing a CAGR of 11.5% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 10.7% during (2025 - 2032).

A prominent trend reshaping the global energy-efficient industrial cooling systems market is the integration of digital and smart control systems. OEMs are embedding Internet of Things (IoT) sensors, artificial intelligence (AI), and machine learning into cooling equipment to deliver real-time monitoring, predictive maintenance, and operational analytics. Johnson Controls’ OpenBlue platform, launched in 2020, has been instrumental in enabling facilities to optimize energy consumption based on dynamic demand. Similarly, Schneider Electric’s EcoStruxure platform enhances operational efficiency by integrating AI-powered edge computing to control power loads and manage cooling needs dynamically. These technologies are being rapidly adopted in industries such as automotive manufacturing, data centers, and pharmaceuticals, where thermal stability is mission-critical.

Another transformative trend is the adoption of sustainable and low-emission cooling technologies. Rising energy prices and carbon taxation in various regions have made energy-intensive cooling systems economically unviable in the long run. Companies are responding by developing systems that employ natural refrigerants or those with low Global Warming Potential (GWP). For instance, Gradient’s 2022 release of a high-efficiency window-mounted heat pump using less potent refrigerants reflects a market-wide shift toward decarbonized, scalable cooling solutions. Trane's CenTraVac chillers, installed in energy-intensive environments like the Channel Tunnel, use low-GWP refrigerants while delivering over 30% energy savings. These examples underscore the movement toward climate-conscious cooling technologies.

The North American market for energy-efficient industrial cooling systems is shaped by a convergence of stringent energy regulations, technological innovation, and decarbonization initiatives. Across the U.S., Canada, and Mexico, industrial sectors are under increasing pressure to enhance energy productivity while reducing emissions in compliance with regulatory frameworks such as the U.S. Energy Policy Act, ASHRAE standards, and Canada’s Net-Zero Emissions Accountability Act.

Free Valuable Insights: The Energy-efficient Industrial Cooling Systems Market is Predict to reach USD 12.99 Billion by 2032, at a CAGR of 10.0%

Based on Deployment, the market is segmented into New Installations and Retrofit Installations. Based on Cooling Capacity, the market is segmented into 100-500 kW, 500-1,000 kW, >1,000 kW, and <100 kW. Based on Industry, the market is segmented into Data Centers, Food & Beverage, Electronics Manufacturing, Pharmaceuticals, Automotive, Food Retail, and Other Industry. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Johnson Controls International PLC

- ABB Ltd.

- Schneider Electric SE

- Trane Technologies PLC (Thermo King)

- Vertiv Group Corp.

- Daikin Industries Ltd.

- Emerson Electric Co.

- LG Electronics, Inc. (LG Corporation)

- Honeywell International, Inc.

- Fujitsu Limited

North America Energy-efficient Industrial Cooling Systems Market Report Segmentation

By Deployment

- New Installations

- Retrofit Installations

By Cooling Capacity

- 100-500 kW

- 500-1,000 kW

- >1,000 kW

- <100 kW

By Industry

- Data Centers

- Food & Beverage

- Electronics Manufacturing

- Pharmaceuticals

- Automotive

- Food Retail

- Other Industry

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Energy-efficient Industrial Cooling Systems Market, by Deployment

1.4.2 North America Energy-efficient Industrial Cooling Systems Market, by Cooling Capacity

1.4.3 North America Energy-efficient Industrial Cooling Systems Market, by Industry

1.4.4 North America Energy-efficient Industrial Cooling Systems Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Key Customer Criteria – Global Energy-efficient Industrial Cooling Systems Market

4.1 Energy Efficiency and Operational Cost Savings

4.2 Compliance with Environmental Regulations

4.3 System Reliability and Uptime

4.4 Ease of Integration and Scalability

4.5 Water Efficiency and Sustainable Resource Use

4.6 Lifecycle Cost and ROI

4.7 Digital and Automation Readiness

Chapter 5. Competition Analysis – Global

5.1 Market Share Analysis, 2024

5.2 Strategies Deployed in Energy-efficient Industrial Cooling Systems Market

5.3 Porter Five Forces Analysis

Chapter 6. Value Chain Analysis of Energy-efficient Industrial Cooling Systems Market

Chapter 7. North America Energy-efficient Industrial Cooling Systems Market by Deployment

7.1 North America New Installations Market by Country

7.2 North America Retrofit Installations Market by Country

Chapter 8. North America Energy-efficient Industrial Cooling Systems Market by Cooling Capacity

8.1 North America 100-500 kW Market by Country

8.2 North America 500-1,000 kW Market by Country

8.3 North America >1,000 kW Market by Country

8.4 North America <100 kW Market by Country

Chapter 9. North America Energy-efficient Industrial Cooling Systems Market by Industry

9.1 North America Data Centers Market by Country

9.2 North America Food & Beverage Market by Country

9.3 North America Electronics Manufacturing Market by Country

9.4 North America Pharmaceuticals Market by Country

9.5 North America Automotive Market by Country

9.6 North America Food Retail Market by Country

9.7 North America Other Industry Market by Country

Chapter 10. North America Energy-efficient Industrial Cooling Systems Market by Country

10.1 US Energy-efficient Industrial Cooling Systems Market

10.1.1 US Energy-efficient Industrial Cooling Systems Market by Deployment

10.1.2 US Energy-efficient Industrial Cooling Systems Market by Cooling Capacity

10.1.3 US Energy-efficient Industrial Cooling Systems Market by Industry

10.2 Canada Energy-efficient Industrial Cooling Systems Market

10.2.1 Canada Energy-efficient Industrial Cooling Systems Market by Deployment

10.2.2 Canada Energy-efficient Industrial Cooling Systems Market by Cooling Capacity

10.2.3 Canada Energy-efficient Industrial Cooling Systems Market by Industry

10.3 Mexico Energy-efficient Industrial Cooling Systems Market

10.3.1 Mexico Energy-efficient Industrial Cooling Systems Market by Deployment

10.3.2 Mexico Energy-efficient Industrial Cooling Systems Market by Cooling Capacity

10.3.3 Mexico Energy-efficient Industrial Cooling Systems Market by Industry

10.4 Rest of North America Energy-efficient Industrial Cooling Systems Market

10.4.1 Rest of North America Energy-efficient Industrial Cooling Systems Market by Deployment

10.4.2 Rest of North America Energy-efficient Industrial Cooling Systems Market by Cooling Capacity

10.4.3 Rest of North America Energy-efficient Industrial Cooling Systems Market by Industry

Chapter 11. Company Profiles

11.1 Johnson Controls International PLC

11.1.1 Company Overview

11.1.2 Financial Analysis

11.1.3 Segmental & Regional Analysis

11.1.4 Research & Development Expenses

11.1.5 Recent strategies and developments:

11.1.5.1 Partnerships, Collaborations, and Agreements:

11.1.5.2 Product Launches and Product Expansions:

11.1.5.3 Acquisition and Mergers:

11.1.6 SWOT Analysis

11.2 ABB Ltd.

11.2.1 Company Overview

11.2.2 Financial Analysis

11.2.3 Segmental and Regional Analysis

11.2.4 Research & Development Expenses

11.2.5 Recent strategies and developments:

11.2.5.1 Product Launches and Product Expansions:

11.2.6 SWOT Analysis

11.3 Schneider Electric SE

11.3.1 Company Overview

11.3.2 Financial Analysis

11.3.3 Segmental and Regional Analysis

11.3.4 Research & Development Expense

11.3.5 Recent strategies and developments:

11.3.5.1 Product Launches and Product Expansions:

11.3.5.2 Geographical Expansions:

11.3.6 SWOT Analysis

11.4 Trane Technologies PLC (Thermo King)

11.4.1 Company Overview

11.4.2 Financial Analysis

11.4.3 Segmental Analysis

11.4.4 Research & Development Expenses

11.4.5 SWOT Analysis

11.5 Vertiv Group Corp.

11.5.1 Company Overview

11.5.2 Financial Analysis

11.5.3 Regional Analysis

11.5.4 Recent strategies and developments:

11.5.4.1 Product Launches and Product Expansions:

11.6 Daikin Industries Ltd.

11.6.1 Company Overview

11.6.2 Financial Analysis

11.6.3 Segmental and Regional Analysis

11.6.4 Research & Development Expenses

11.6.5 SWOT Analysis

11.7 Emerson Electric Co.

11.7.1 Company Overview

11.7.2 Financial Analysis

11.7.3 Segmental and Regional Analysis

11.7.4 Research & Development Expense

11.7.5 SWOT Analysis

11.8 LG Electronics, Inc. (LG Corporation)

11.8.1 Company Overview

11.8.2 Financial Analysis

11.8.3 Regional & Segmental Analysis

11.8.4 Research & Development Expenses

11.8.5 SWOT Analysis

11.9 Honeywell International, Inc.

11.9.1 Company Overview

11.9.2 Financial Analysis

11.9.3 Segmental and Regional Analysis

11.9.4 Research & Development Expenses

11.9.5 SWOT Analysis

11.10. Fujitsu Limited

11.10.1 Company Overview

11.10.2 Financial Analysis

11.10.3 Segmental and Regional Analysis

11.10.4 Research & Development Expenses

11.10.5 SWOT Analysis

TABLE 2 North America Energy-efficient Industrial Cooling Systems Market, 2025 - 2032, USD Million

TABLE 3 Global Ratings - Energy-efficient Industrial Cooling Systems Market

TABLE 4 North America Energy-efficient Industrial Cooling Systems Market by Deployment, 2021 - 2024, USD Million

TABLE 5 North America Energy-efficient Industrial Cooling Systems Market by Deployment, 2025 - 2032, USD Million

TABLE 6 North America New Installations Market by Country, 2021 - 2024, USD Million

TABLE 7 North America New Installations Market by Country, 2025 - 2032, USD Million

TABLE 8 North America Retrofit Installations Market by Country, 2021 - 2024, USD Million

TABLE 9 North America Retrofit Installations Market by Country, 2025 - 2032, USD Million

TABLE 10 North America Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2021 - 2024, USD Million

TABLE 11 North America Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2025 - 2032, USD Million

TABLE 12 North America 100-500 kW Market by Country, 2021 - 2024, USD Million

TABLE 13 North America 100-500 kW Market by Country, 2025 - 2032, USD Million

TABLE 14 North America 500-1,000 kW Market by Country, 2021 - 2024, USD Million

TABLE 15 North America 500-1,000 kW Market by Country, 2025 - 2032, USD Million

TABLE 16 North America >1,000 kW Market by Country, 2021 - 2024, USD Million

TABLE 17 North America >1,000 kW Market by Country, 2025 - 2032, USD Million

TABLE 18 North America <100 kW Market by Country, 2021 - 2024, USD Million

TABLE 19 North America <100 kW Market by Country, 2025 - 2032, USD Million

TABLE 20 North America Energy-efficient Industrial Cooling Systems Market by Industry, 2021 - 2024, USD Million

TABLE 21 North America Energy-efficient Industrial Cooling Systems Market by Industry, 2025 - 2032, USD Million

TABLE 22 North America Data Centers Market by Country, 2021 - 2024, USD Million

TABLE 23 North America Data Centers Market by Country, 2025 - 2032, USD Million

TABLE 24 North America Food & Beverage Market by Country, 2021 - 2024, USD Million

TABLE 25 North America Food & Beverage Market by Country, 2025 - 2032, USD Million

TABLE 26 North America Electronics Manufacturing Market by Country, 2021 - 2024, USD Million

TABLE 27 North America Electronics Manufacturing Market by Country, 2025 - 2032, USD Million

TABLE 28 North America Pharmaceuticals Market by Country, 2021 - 2024, USD Million

TABLE 29 North America Pharmaceuticals Market by Country, 2025 - 2032, USD Million

TABLE 30 North America Automotive Market by Country, 2021 - 2024, USD Million

TABLE 31 North America Automotive Market by Country, 2025 - 2032, USD Million

TABLE 32 North America Food Retail Market by Country, 2021 - 2024, USD Million

TABLE 33 North America Food Retail Market by Country, 2025 - 2032, USD Million

TABLE 34 North America Other Industry Market by Country, 2021 - 2024, USD Million

TABLE 35 North America Other Industry Market by Country, 2025 - 2032, USD Million

TABLE 36 North America Energy-efficient Industrial Cooling Systems Market by Country, 2021 - 2024, USD Million

TABLE 37 North America Energy-efficient Industrial Cooling Systems Market by Country, 2025 - 2032, USD Million

TABLE 38 US Energy-efficient Industrial Cooling Systems Market, 2021 - 2024, USD Million

TABLE 39 US Energy-efficient Industrial Cooling Systems Market, 2025 - 2032, USD Million

TABLE 40 US Energy-efficient Industrial Cooling Systems Market by Deployment, 2021 - 2024, USD Million

TABLE 41 US Energy-efficient Industrial Cooling Systems Market by Deployment, 2025 - 2032, USD Million

TABLE 42 US Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2021 - 2024, USD Million

TABLE 43 US Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2025 - 2032, USD Million

TABLE 44 US Energy-efficient Industrial Cooling Systems Market by Industry, 2021 - 2024, USD Million

TABLE 45 US Energy-efficient Industrial Cooling Systems Market by Industry, 2025 - 2032, USD Million

TABLE 46 Canada Energy-efficient Industrial Cooling Systems Market, 2021 - 2024, USD Million

TABLE 47 Canada Energy-efficient Industrial Cooling Systems Market, 2025 - 2032, USD Million

TABLE 48 Canada Energy-efficient Industrial Cooling Systems Market by Deployment, 2021 - 2024, USD Million

TABLE 49 Canada Energy-efficient Industrial Cooling Systems Market by Deployment, 2025 - 2032, USD Million

TABLE 50 Canada Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2021 - 2024, USD Million

TABLE 51 Canada Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2025 - 2032, USD Million

TABLE 52 Canada Energy-efficient Industrial Cooling Systems Market by Industry, 2021 - 2024, USD Million

TABLE 53 Canada Energy-efficient Industrial Cooling Systems Market by Industry, 2025 - 2032, USD Million

TABLE 54 Mexico Energy-efficient Industrial Cooling Systems Market, 2021 - 2024, USD Million

TABLE 55 Mexico Energy-efficient Industrial Cooling Systems Market, 2025 - 2032, USD Million

TABLE 56 Mexico Energy-efficient Industrial Cooling Systems Market by Deployment, 2021 - 2024, USD Million

TABLE 57 Mexico Energy-efficient Industrial Cooling Systems Market by Deployment, 2025 - 2032, USD Million

TABLE 58 Mexico Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2021 - 2024, USD Million

TABLE 59 Mexico Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2025 - 2032, USD Million

TABLE 60 Mexico Energy-efficient Industrial Cooling Systems Market by Industry, 2021 - 2024, USD Million

TABLE 61 Mexico Energy-efficient Industrial Cooling Systems Market by Industry, 2025 - 2032, USD Million

TABLE 62 Rest of North America Energy-efficient Industrial Cooling Systems Market, 2021 - 2024, USD Million

TABLE 63 Rest of North America Energy-efficient Industrial Cooling Systems Market, 2025 - 2032, USD Million

TABLE 64 Rest of North America Energy-efficient Industrial Cooling Systems Market by Deployment, 2021 - 2024, USD Million

TABLE 65 Rest of North America Energy-efficient Industrial Cooling Systems Market by Deployment, 2025 - 2032, USD Million

TABLE 66 Rest of North America Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2021 - 2024, USD Million

TABLE 67 Rest of North America Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2025 - 2032, USD Million

TABLE 68 Rest of North America Energy-efficient Industrial Cooling Systems Market by Industry, 2021 - 2024, USD Million

TABLE 69 Rest of North America Energy-efficient Industrial Cooling Systems Market by Industry, 2025 - 2032, USD Million

TABLE 70 Key Information – Johnson Controls International PLC

TABLE 71 Key Information – ABB Ltd.

TABLE 72 Key Information – Schneider Electric SE

TABLE 73 Key Information – Trane Technologies PLC

TABLE 74 Key Information – Vertiv Group Corp.

TABLE 75 Key Information – daikin industries ltd.

TABLE 76 Key Information – Emerson Electric Co.

TABLE 77 Key Information – LG Electronics, Inc.

TABLE 78 Key Information – Honeywell International, Inc.

TABLE 79 Key Information – Fujitsu Limited

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Energy-efficient Industrial Cooling Systems Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Energy-efficient Industrial Cooling Systems Market

FIG 4 Key Customer Criteria - Energy-efficient Industrial Cooling Systems Market

FIG 5 Market Share Analysis, 2024

FIG 6 Porter’s Five Forces Analysis – Energy-efficient Industrial Cooling Systems Market

FIG 7 Value Chain Analysis of Energy-efficient Industrial Cooling Systems Market

FIG 8 North America Energy-efficient Industrial Cooling Systems Market share by Deployment, 2024

FIG 9 North America Energy-efficient Industrial Cooling Systems Market share by Deployment, 2032

FIG 10 North America Energy-efficient Industrial Cooling Systems Market by Deployment, 2021 - 2032, USD Million

FIG 11 North America Energy-efficient Industrial Cooling Systems Market share by Cooling Capacity, 2024

FIG 12 North America Energy-efficient Industrial Cooling Systems Market share by Cooling Capacity, 2032

FIG 13 North America Energy-efficient Industrial Cooling Systems Market by Cooling Capacity, 2021 - 2032, USD Million

FIG 14 North America Energy-efficient Industrial Cooling Systems Market share by Industry, 2024

FIG 15 North America Energy-efficient Industrial Cooling Systems Market share by Industry, 2032

FIG 16 North America Energy-efficient Industrial Cooling Systems Market by Industry, 2021 - 2032, USD Million

FIG 17 North America Energy-efficient Industrial Cooling Systems Market by Country, 2021

FIG 18 North America Energy-efficient Industrial Cooling Systems Market by Country, 2021

FIG 19 North America Energy-efficient Industrial Cooling Systems Market by Country, 2025 - 2032, USD Million

FIG 20 Recent strategies and developments: Johnson Controls International PLC

FIG 21 SWOT Analysis: Johnson Controls International PLC

FIG 22 SWOT Analysis: ABB ltd.

FIG 23 Recent strategies and developments: Schneider Electric SE

FIG 24 SWOT Analysis: Schneider Electric SE

FIG 25 Swot Analysis: Trane Technologies PLC

FIG 26 Swot Analysis: Daikin Industries Ltd.

FIG 27 Swot Analysis: EMERSON ELECTRIC CO.

FIG 28 SWOT Analysis: LG Electronics, Inc.

FIG 29 SWOT Analysis: Honeywell international, inc.

FIG 30 Swot analysis: Fujitsu Limited