North America Connected Car Market Size, Share & Industry Analysis Report By Technology (Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I)), By Sales Channel (OEM and Aftermarket), By Connectivity Solution (Integrated, Embedded and Tethered), By Technology (4G/LTE, 5G, Satellite and Other Technology) By Application, By Country and Growth Forecast, 2025 - 2032

Published Date : 08-Jan-2026 |

Pages: 200 |

Report Format: PDF + Excel |

COVID-19 Impact on the North America Connected Car Market

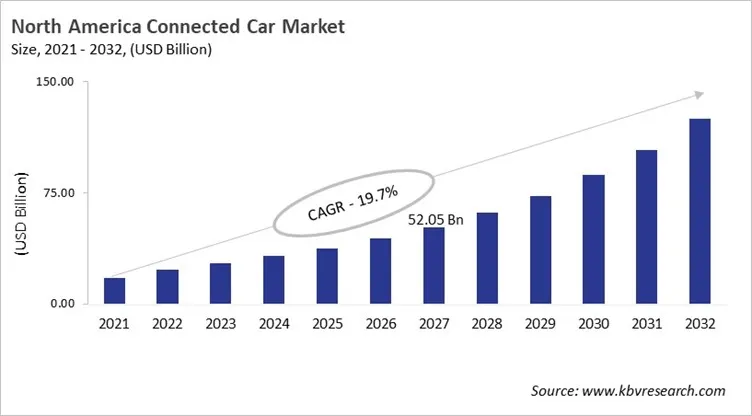

The North America Connected Car Market would witness market growth of 18.6% CAGR during the forecast period (2025-2032).

The US market dominated the North America Connected Car Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $87,632.7 million by 2032. The Canada market is experiencing a CAGR of 21% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 19.9% during (2025 - 2032). The US and Canada led the North America Connected Car Market by Country with a market share of 74.1% and 12.9% in 2024.

The connected car market in North America has grown from simple telematics to a complex digital mobility ecosystem that includes real-time connectivity, cloud platforms, and advanced safety systems. Early advances like embedded telematics made today's connected cars possible. These cars can now do things like navigate, provide entertainment, diagnose problems from a distance, get updates over the air, and use ADAS features. The U.S., Canada, and Mexico have all adopted V2X standards more quickly because the government supports them and there is a lot of money going into 4G and 5G infrastructure. OEMs have been pushed to make connectivity a standard feature in cars because consumers want personalized digital experiences in their cars. Increasingly, the market sees connected cars as data-driven platforms instead of just products. As connectivity grows, cybersecurity and data privacy have also become very important. In general, connectivity has gone from being an optional extra to a key part of modern cars.

The North American connected car market is very competitive and includes companies from many different fields, such as automotive OEMs, tech companies, telecom operators, and startups. Traditional OEMs use their size and built-in platforms to offer combined safety and entertainment services, while tech companies use software ecosystems to change how users interact with their products. Telecom companies compete on how reliable their networks are and how well they support 5G, which makes low-latency apps like V2X and real-time analytics possible. Strategic partnerships between automakers, cloud providers, and semiconductor companies are key to making new things and growing. Data monetization models and subscription-based services are changing how companies make money in ways other than selling cars. Regulatory and cybersecurity factors are having a bigger impact on how companies compete. These factors all work together to create a fast-moving, innovation-driven connected car market in North America.

Application Outlook

Based on Application, the market is segmented into Vehicle Management, Driver Assistance, Safety, Mobility Management, Entertainment and Other Application. Among various US Connected Car Market by Application; The Vehicle Management market achieved a market size of USD $6829.8 Million in 2024 and is expected to grow at a CAGR of 16.8 % during the forecast period. The Driver Assistance market is predicted to experience a CAGR of 17.1% throughout the forecast period from (2025 - 2032).

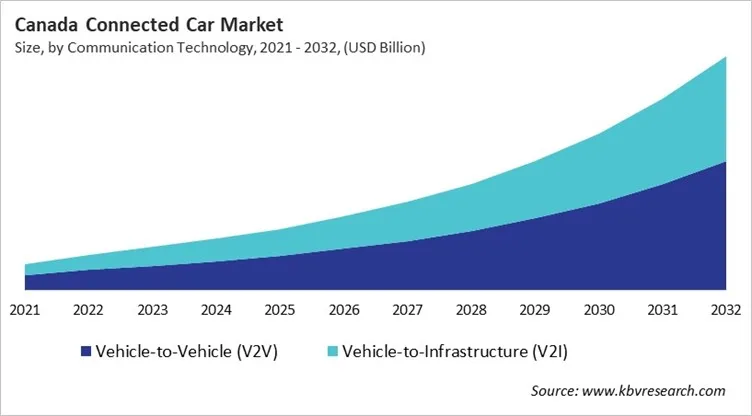

Communication Technology Outlook

Based on communication Technology, the market is segmented into Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I). The Vehicle-to-Vehicle (V2V) market segment dominated the Canada Connected Car Market by Communication Technology is expected to grow at a CAGR of 20.6 % during the forecast period thereby continuing its dominance until 2032. Also, The Vehicle-to-Infrastructure (V2I) market is anticipated to grow as a CAGR of 21.5 % during the forecast period during (2025 - 2032).

Free Valuable Insights: The Connected Car Market is Predicted to reach USD 396.71 Billion by 2032, at a CAGR of 19.3%

Country Outlook

The US connected car market is the biggest and most advanced in North America. This is because the automotive industry is well-established, the digital infrastructure is strong, and people started using connected cars early on. Telematics, over-the-air updates, advanced driver assistance systems (ADAS), infotainment, and new vehicle-to-everything (V2X) features all work together in connected cars in the U.S. to make them safer, more convenient, and more efficient. People really want digital and safety features, and 4G and 5G networks are everywhere, which keeps people using them. Government programs that encourage smart mobility and connected infrastructure speed up market growth even more. Some important trends are embedded connectivity in all types of vehicles, services that work with 5G, and data-driven features like predictive maintenance and subscription options. Automakers, tech companies, and telecom companies all work together on integrated platforms to stay ahead of the game. Even though there are problems with data privacy and cybersecurity, the U.S. is still a global leader in connected mobility because it keeps investing.

List of Key Companies Profiled

- Continental AG

- AT&T, Inc.

- HARMAN International Industries, Inc. (Samsung Electronics Co., Ltd.)

- Robert Bosch GmbH

- TomTom N.V.

- Ford Motor Company

- Mercedes-Benz Group AG

- Visteon Corporation

- Tesla, Inc.

- General Motors Co.

North America Connected Car Market Report Segmentation

By Communication Technology

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

By Sales Channel

- OEM

- Aftermarket

By Connectivity Solution

- Integrated

- Embedded

- Tethered

By Technology

- 4G/LTE

- 5G

- Satellite

- Other Technology

By Application

- Vehicle Management

- Driver Assistance

- Safety

- Mobility Management

- Entertainment

- Other Application

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Connected Car Market, by Communication Technology

1.4.2 North America Connected Car Market, by Sales Channel

1.4.3 North America Connected Car Market, by Connectivity Solution

1.4.4 North America Connected Car Market, by Technology

1.4.5 North America Connected Car Market, by Application

1.4.6 North America Connected Car Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Market Trends – North America Connected Car Market

Chapter 5. State of Competition – North America Connected Car Market

Chapter 6. Market Consolidation – North America Connected Car Market

Chapter 7. Key Customer Criteria – North America Connected Car Market

Chapter 8. Value Chain Analysis of Connected Car Market

Chapter 9. Competition Analysis - Global

9.1 KBV Cardinal Matrix

9.2 Recent Industry Wide Strategic Developments

9.2.1 Partnerships, Collaborations and Agreements

9.2.2 Product Launches and Product Expansions

9.3 Market Share Analysis, 2024

9.4 Top Winning Strategies

9.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

9.4.2 Key Strategic Move: (Product Launches and Product Expansions : 2017, Jun – 2021, Jun) Leading Players

9.5 Porter Five Forces Analysis

Chapter 10. Product Life Cycle – Connected Car Market

Chapter 11. North America Connected Car Market by Communication Technology

11.1 North America Vehicle-to-Vehicle (V2V) Market by Region

11.2 North America Vehicle-to-Infrastructure (V2I) Market by Region

Chapter 12. North America Connected Car Market by Sales Channel

12.1 North America OEM Market by Country

12.2 North America Aftermarket Market by Country

Chapter 13. North America Connected Car Market by Connectivity Solution

13.1 North America Integrated Market by Country

13.2 North America Embedded Market by Country

13.3 North America Tethered Market by Country

Chapter 14. North America Connected Car Market by Technology

14.1 North America 4G/LTE Market by Country

14.2 North America 5G Market by Country

14.3 North America Satellite Market by Country

14.4 North America Other Technology Market by Country

Chapter 15. North America Connected Car Market by Application

15.1 North America Vehicle Management Market by Country

15.2 North America Driver Assistance Market by Country

15.3 North America Safety Market by Country

15.4 North America Mobility Management Market by Country

15.5 North America Entertainment Market by Country

15.6 North America Other Application Market by Country

Chapter 16. North America Connected Car Market by Country

16.1 US Connected Car Market

16.1.1 US Connected Car Market by Communication Technology

16.1.2 US Connected Car Market by Sales Channel

16.1.3 US Connected Car Market by Connectivity Solution

16.1.4 US Connected Car Market by Technology

16.1.5 US Connected Car Market by Application

16.2 Canada Connected Car Market

16.2.1 Canada Connected Car Market by Communication Technology

16.2.2 Canada Connected Car Market by Sales Channel

16.2.3 Canada Connected Car Market by Connectivity Solution

16.2.4 Canada Connected Car Market by Technology

16.2.5 Canada Connected Car Market by Application

16.3 Mexico Connected Car Market

16.3.1 Mexico Connected Car Market by Communication Technology

16.3.2 Mexico Connected Car Market by Sales Channel

16.3.3 Mexico Connected Car Market by Connectivity Solution

16.3.4 Mexico Connected Car Market by Technology

16.3.5 Mexico Connected Car Market by Application

16.4 Rest of North America Connected Car Market

16.4.1 Rest of North America Connected Car Market by Communication Technology

16.4.2 Rest of North America Connected Car Market by Sales Channel

16.4.3 Rest of North America Connected Car Market by Connectivity Solution

16.4.4 Rest of North America Connected Car Market by Technology

16.4.5 Rest of North America Connected Car Market by Application

Chapter 17. Company Profiles

17.1 Continental AG

17.1.1 Company Overview

17.1.2 Financial Analysis

17.1.3 Segmental and Regional Analysis

17.1.4 Research & Development Expense

17.1.5 Recent strategies and developments:

17.1.5.1 Partnerships, Collaborations, and Agreements:

17.1.6 SWOT Analysis

17.2 AT&T, Inc.

17.2.1 Company Overview

17.2.2 Financial Analysis

17.2.3 Segmental and Regional Analysis

17.2.4 Research & Development Expense

17.2.5 Recent strategies and developments:

17.2.5.1 Product Launches and Product Expansions:

17.2.6 SWOT Analysis

17.3 HARMAN International Industries, Inc. (Samsung Electronics Co., Ltd.)

17.3.1 Company Overview

17.3.2 Financial Analysis

17.3.3 Segmental and Regional Analysis

17.3.4 Research & Development Expenses

17.3.5 Recent strategies and developments:

17.3.5.1 Partnerships, Collaborations, and Agreements:

17.3.6 SWOT Analysis

17.4 Robert Bosch GmbH

17.4.1 Company Overview

17.4.2 Financial Analysis

17.4.3 Segmental and Regional Analysis

17.4.4 Research & Development Expense

17.4.5 Recent strategies and developments:

17.4.5.1 Product Launches and Product Expansions:

17.4.6 SWOT Analysis

17.5 TomTom N.V.

17.5.1 Company Overview

17.5.2 Financial Analysis

17.5.3 Segmental and Regional Analysis

17.5.4 Research & Development Expenses

17.5.5 Recent strategies and developments:

17.5.5.1 Partnerships, Collaborations, and Agreements:

17.5.5.2 Product Launches and Product Expansions:

17.6 Ford Motor Company

17.6.1 Company Overview

17.6.2 Financial Analysis

17.6.3 Segmental and Regional Analysis

17.6.4 Engineering, research, and development expenses

17.6.5 Recent strategies and developments:

17.6.5.1 Partnerships, Collaborations, and Agreements:

17.6.5.2 Product Launches and Product Expansions:

17.6.6 SWOT Analysis

17.7 Mercedes-Benz Group AG

17.7.1 Company Overview

17.7.2 Financial Analysis

17.7.3 Segmental and Regional Analysis

17.7.4 Research & Development Expense

17.7.5 Recent strategies and developments:

17.7.5.1 Product Launches and Product Expansions:

17.7.6 SWOT Analysis

17.8 Visteon Corporation

17.8.1 Company overview

17.8.2 Financial Analysis

17.8.3 Regional Analysis

17.8.4 Research & Development Expenses

17.8.5 Recent strategies and developments:

17.8.5.1 Product Launches and Product Expansions:

17.8.6 SWOT Analysis

17.9 Tesla, Inc.

17.9.1 Company Overview

17.9.2 Financial Analysis

17.9.3 Segmental and Regional Analysis

17.9.4 Research & Development Expense

17.9.5 Recent strategies and developments:

17.9.5.1 Product Launches and Product Expansions:

17.9.6 SWOT Analysis

17.10. General Motors Co.

17.10.1 Company Overview

17.10.2 Financial Analysis

17.10.3 Segmental and Regional Analysis

17.10.4 Regional analysis

17.10.5 Research & Development Expense

17.10.6 Recent strategies and developments:

17.10.6.1 Product Launches and Product Expansions:

TABLE 2 North America Connected Car Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria – North America Connected Car Market

TABLE 4 Partnerships, Collaborations and Agreements– Connected Car Market

TABLE 5 Product Launches And Product Expansions– Connected Car Market

TABLE 6 North America Connected Car Market by Communication Technology, 2021 - 2024, USD Million

TABLE 7 North America Connected Car Market by Communication Technology, 2025 - 2032, USD Million

TABLE 8 North America Vehicle-to-Vehicle (V2V) Market by Region, 2021 - 2024, USD Million

TABLE 9 North America Vehicle-to-Vehicle (V2V) Market by Region, 2025 - 2032, USD Million

TABLE 10 North America Vehicle-to-Infrastructure (V2I) Market by Region, 2021 - 2024, USD Million

TABLE 11 North America Vehicle-to-Infrastructure (V2I) Market by Region, 2025 - 2032, USD Million

TABLE 12 North America Connected Car Market by Sales Channel, 2021 - 2024, USD Million

TABLE 13 North America Connected Car Market by Sales Channel, 2025 - 2032, USD Million

TABLE 14 North America OEM Market by Country, 2021 - 2024, USD Million

TABLE 15 North America OEM Market by Country, 2025 - 2032, USD Million

TABLE 16 North America Aftermarket Market by Country, 2021 - 2024, USD Million

TABLE 17 North America Aftermarket Market by Country, 2025 - 2032, USD Million

TABLE 18 North America Connected Car Market by Connectivity Solution, 2021 - 2024, USD Million

TABLE 19 North America Connected Car Market by Connectivity Solution, 2025 - 2032, USD Million

TABLE 20 North America Integrated Market by Country, 2021 - 2024, USD Million

TABLE 21 North America Integrated Market by Country, 2025 - 2032, USD Million

TABLE 22 North America Embedded Market by Country, 2021 - 2024, USD Million

TABLE 23 North America Embedded Market by Country, 2025 - 2032, USD Million

TABLE 24 North America Tethered Market by Country, 2021 - 2024, USD Million

TABLE 25 North America Tethered Market by Country, 2025 - 2032, USD Million

TABLE 26 North America Connected Car Market by Technology, 2021 - 2024, USD Million

TABLE 27 North America Connected Car Market by Technology, 2025 - 2032, USD Million

TABLE 28 North America 4G/LTE Market by Country, 2021 - 2024, USD Million

TABLE 29 North America 4G/LTE Market by Country, 2025 - 2032, USD Million

TABLE 30 North America 5G Market by Country, 2021 - 2024, USD Million

TABLE 31 North America 5G Market by Country, 2025 - 2032, USD Million

TABLE 32 North America Satellite Market by Country, 2021 - 2024, USD Million

TABLE 33 North America Satellite Market by Country, 2025 - 2032, USD Million

TABLE 34 North America Other Technology Market by Country, 2021 - 2024, USD Million

TABLE 35 North America Other Technology Market by Country, 2025 - 2032, USD Million

TABLE 36 North America Connected Car Market by Application, 2021 - 2024, USD Million

TABLE 37 North America Connected Car Market by Application, 2025 - 2032, USD Million

TABLE 38 North America Vehicle Management Market by Country, 2021 - 2024, USD Million

TABLE 39 North America Vehicle Management Market by Country, 2025 - 2032, USD Million

TABLE 40 North America Driver Assistance Market by Country, 2021 - 2024, USD Million

TABLE 41 North America Driver Assistance Market by Country, 2025 - 2032, USD Million

TABLE 42 North America Safety Market by Country, 2021 - 2024, USD Million

TABLE 43 North America Safety Market by Country, 2025 - 2032, USD Million

TABLE 44 North America Mobility Management Market by Country, 2021 - 2024, USD Million

TABLE 45 North America Mobility Management Market by Country, 2025 - 2032, USD Million

TABLE 46 North America Entertainment Market by Country, 2021 - 2024, USD Million

TABLE 47 North America Entertainment Market by Country, 2025 - 2032, USD Million

TABLE 48 North America Other Application Market by Country, 2021 - 2024, USD Million

TABLE 49 North America Other Application Market by Country, 2025 - 2032, USD Million

TABLE 50 North America Connected Car Market by Country, 2021 - 2024, USD Million

TABLE 51 North America Connected Car Market by Country, 2025 - 2032, USD Million

TABLE 52 US Connected Car Market, 2021 - 2024, USD Million

TABLE 53 US Connected Car Market, 2025 - 2032, USD Million

TABLE 54 US Connected Car Market by Communication Technology, 2021 - 2024, USD Million

TABLE 55 US Connected Car Market by Communication Technology, 2025 - 2032, USD Million

TABLE 56 US Connected Car Market by Sales Channel, 2021 - 2024, USD Million

TABLE 57 US Connected Car Market by Sales Channel, 2025 - 2032, USD Million

TABLE 58 US Connected Car Market by Connectivity Solution, 2021 - 2024, USD Million

TABLE 59 US Connected Car Market by Connectivity Solution, 2025 - 2032, USD Million

TABLE 60 US Connected Car Market by Technology, 2021 - 2024, USD Million

TABLE 61 US Connected Car Market by Technology, 2025 - 2032, USD Million

TABLE 62 US Connected Car Market by Application, 2021 - 2024, USD Million

TABLE 63 US Connected Car Market by Application, 2025 - 2032, USD Million

TABLE 64 Canada Connected Car Market, 2021 - 2024, USD Million

TABLE 65 Canada Connected Car Market, 2025 - 2032, USD Million

TABLE 66 Canada Connected Car Market by Communication Technology, 2021 - 2024, USD Million

TABLE 67 Canada Connected Car Market by Communication Technology, 2025 - 2032, USD Million

TABLE 68 Canada Connected Car Market by Sales Channel, 2021 - 2024, USD Million

TABLE 69 Canada Connected Car Market by Sales Channel, 2025 - 2032, USD Million

TABLE 70 Canada Connected Car Market by Connectivity Solution, 2021 - 2024, USD Million

TABLE 71 Canada Connected Car Market by Connectivity Solution, 2025 - 2032, USD Million

TABLE 72 Canada Connected Car Market by Technology, 2021 - 2024, USD Million

TABLE 73 Canada Connected Car Market by Technology, 2025 - 2032, USD Million

TABLE 74 Canada Connected Car Market by Application, 2021 - 2024, USD Million

TABLE 75 Canada Connected Car Market by Application, 2025 - 2032, USD Million

TABLE 76 Mexico Connected Car Market, 2021 - 2024, USD Million

TABLE 77 Mexico Connected Car Market, 2025 - 2032, USD Million

TABLE 78 Mexico Connected Car Market by Communication Technology, 2021 - 2024, USD Million

TABLE 79 Mexico Connected Car Market by Communication Technology, 2025 - 2032, USD Million

TABLE 80 Mexico Connected Car Market by Sales Channel, 2021 - 2024, USD Million

TABLE 81 Mexico Connected Car Market by Sales Channel, 2025 - 2032, USD Million

TABLE 82 Mexico Connected Car Market by Connectivity Solution, 2021 - 2024, USD Million

TABLE 83 Mexico Connected Car Market by Connectivity Solution, 2025 - 2032, USD Million

TABLE 84 Mexico Connected Car Market by Technology, 2021 - 2024, USD Million

TABLE 85 Mexico Connected Car Market by Technology, 2025 - 2032, USD Million

TABLE 86 Mexico Connected Car Market by Application, 2021 - 2024, USD Million

TABLE 87 Mexico Connected Car Market by Application, 2025 - 2032, USD Million

TABLE 88 Rest of North America Connected Car Market, 2021 - 2024, USD Million

TABLE 89 Rest of North America Connected Car Market, 2025 - 2032, USD Million

TABLE 90 Rest of North America Connected Car Market by Communication Technology, 2021 - 2024, USD Million

TABLE 91 Rest of North America Connected Car Market by Communication Technology, 2025 - 2032, USD Million

TABLE 92 Rest of North America Connected Car Market by Sales Channel, 2021 - 2024, USD Million

TABLE 93 Rest of North America Connected Car Market by Sales Channel, 2025 - 2032, USD Million

TABLE 94 Rest of North America Connected Car Market by Connectivity Solution, 2021 - 2024, USD Million

TABLE 95 Rest of North America Connected Car Market by Connectivity Solution, 2025 - 2032, USD Million

TABLE 96 Rest of North America Connected Car Market by Technology, 2021 - 2024, USD Million

TABLE 97 Rest of North America Connected Car Market by Technology, 2025 - 2032, USD Million

TABLE 98 Rest of North America Connected Car Market by Application, 2021 - 2024, USD Million

TABLE 99 Rest of North America Connected Car Market by Application, 2025 - 2032, USD Million

TABLE 100 Key Information – Continental AG

TABLE 101 Key Information – AT&T, Inc.

TABLE 102 Key Information – HARMAN International industries, Inc.

TABLE 103 Key Information – Robert Bosch GmbH

TABLE 104 Key information – TomTom N.V.

TABLE 105 key information – Ford Motor Company

TABLE 106 key information – Mercedes-Benz Group AG

TABLE 107 Key Information – Visteon Corporation

TABLE 108 key Information – Tesla, Inc.

TABLE 109 key Information – General Motors Co.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Connected Car Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting North America Connected Car Market

FIG 4 Market Consolidation – North America Connected Car Market

FIG 5 Key Customer Criteria – North America Connected Car Market

FIG 6 Value Chain Analysis of Connected Car Market

FIG 7 KBV Cardinal Matrix

FIG 8 Market Share Analysis, 2024

FIG 9 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 10 Key Strategic Move: (Product Launches and Product Expansions : 2017, Jun – 2021, Jun) Leading Players

FIG 11 Porter’s Five Forces Analysis – Connected Car Market

FIG 12 Product Life Cycle – Connected Car Market

FIG 13 North America Connected Car Market Share by Communication Technology, 2024

FIG 14 North America Connected Car Market Share by Communication Technology, 2032

FIG 15 North America Connected Car Market by Communication Technology, 2021 - 2032, USD Million

FIG 16 North America Connected Car Market Share by Sales Channel, 2024

FIG 17 North America Connected Car Market Share by Sales Channel, 2032

FIG 18 North America Connected Car Market by Sales Channel, 2021 - 2032, USD Million

FIG 19 North America Connected Car Market Share by Connectivity Solution, 2024

FIG 20 North America Connected Car Market Share by Connectivity Solution, 2032

FIG 21 North America Connected Car Market by Connectivity Solution, 2021 - 2032, USD Million

FIG 22 North America Connected Car Market Share by Technology, 2024

FIG 23 North America Connected Car Market Share by Technology, 2032

FIG 24 North America Connected Car Market by Technology, 2021 - 2032, USD Million

FIG 25 North America Connected Car Market Share by Application, 2024

FIG 26 North America Connected Car Market Share by Application, 2032

FIG 27 North America Connected Car Market by Application, 2021 - 2032, USD Million

FIG 28 North America Connected Car Market Share by Country, 2024

FIG 29 North America Connected Car Market Share by Country, 2021

FIG 30 North America Connected Car Market by Country, 2021 - 2032, USD Million

FIG 31 SWOT Analysis: Continental AG

FIG 32 SWOT Analysis: AT&T Inc.

FIG 33 SWOT Analysis: Harman International Industries, Inc.

FIG 34 SWOT Analysis: Robert Bosch GmbH

FIG 35 Recent strategies and developments: TomTom N.V.

FIG 36 Recent strategies and developments: Ford Motor Company

FIG 37 SWOT Analysis: Ford Motor Company

FIG 38 SWOT Analysis: Mercedes-Benz Group AG

FIG 39 SWOT Analysis: Visteon Corporation

FIG 40 SWOT Analysis: Tesla, Inc.