Global Neobanking Market By Account Type (Business Account and Savings Account), By Application (Enterprises, Personal and Others), By Region, Industry Analysis and Forecast, 2020 - 2026

Published Date : 3-Feb-2021 | Pages: 146 | Formats: PDF |

COVID-19 Impact on the Neobanking Market

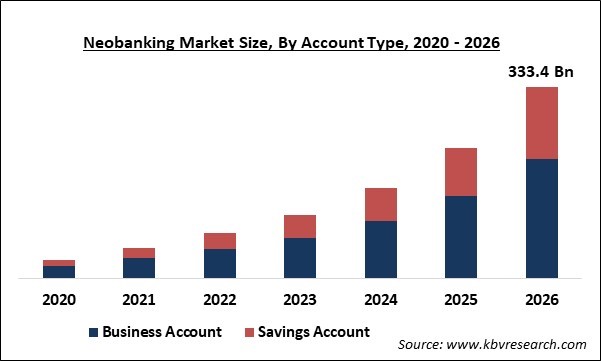

The Global Neobanking Market size is expected to reach $333.4 billion by 2026, rising at a market growth of 47.1% CAGR during the forecast period. Neobanks provides a broad range of banking solutions with no physical branches or offices. The rising demand for the comfort of customer in the banking industry is anticipated to boost the market growth. Neobanks are customer-centric and provide customized services to customers, which make them different from conventional banks. Neobank platforms help users to validate their service offerings in real-time with the help of mobile sites and online channels.

With the help of these platforms, the need for human interference is eliminated, hence decreasing errors related to the transaction. In addition, neobanking offers numerous advantages like quick servicing, healthy interest rates, and cost-effective banking, which are anticipated to boost the growth of the market during the forecast years. Neobanks have considerable growth potential which is boosted by its low-cost model for end-users with very low or no monthly fees for financial services like deposits, withdrawals, and balance maintenance.

The market potential for neobanks is driven by the rising penetration of internet and the smartphones across the globe. Also, the global market competition is boosted by the increasing customer interest, hence pushing neobanks to introduce various features like sign-up incentives and overdraft protection. Various neobanks work under a freemium model, under which they provide their services for free, hence appealing to a broad customer base. Customers are also extensively accepting neobanking services due to advantages like personal finance management features, such as low-interest rates, and enhanced user experience.

By Account Type

Based on Account Type, the market is segmented into Business Account and Savings Account. The market was dominated by the business account segment in 2019. Several businesses globally are adopting neobanking as the preferred method of payment for bulk payouts. Moreover, neobanking models smoothly incorporate banking into business workflows with developer-friendly banking Application Programming Interface (API) to boost the fast and scalable growth of businesses.

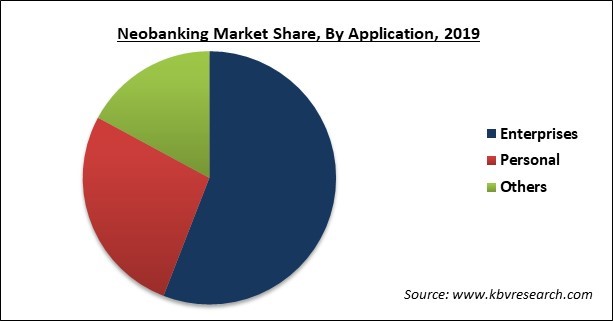

By Application

Based on Application, the market is segmented into Enterprises, Personal and Others. The personal application segment is expected to observe considerable growth over the forecast period. The massive penetration rate of smartphones has facilitated customers to extensively choose neobanking services due to convenience and ease of use. The services are provided utilizing mobile app interfaces, which further assist money transfers and payments with the help of the app. The comfort of opening and operating accounts efficiently is further expected to boost the adoption of neobanking over the forecast years.

| Report Attribute | Details |

|---|---|

| Market size value in 2019 | USD 34 Billion |

| Market size forecast in 2026 | USD 333.4 Billion |

| Base Year | 2019 |

| Historical Period | 2016 to 2018 |

| Forecast Period | 2020 to 2026 |

| Revenue Growth Rate | CAGR of 47.1% from 2020 to 2026 |

| Number of Pages | 146 |

| Number of Tables | 254 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling, Competitive Analysis |

| Segments covered | Account Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Free Valuable Insights: Global Neobanking Market to reach a market size of $333.4 billion by 2026

By Region

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific is anticipated to emerge as the highest growing market over the forecast period. The increasing adoption of internet services, along with the high utilization of smartphones, is anticipated to push the market growth. In order to accelerate modernization and innovation through competition, regional regulators are slowly creating neobanking systems for wider participation. New entrants are likely to explore avenues to introduce extremely related services in the region with an exceptional level of ease & comfort and low pricing.

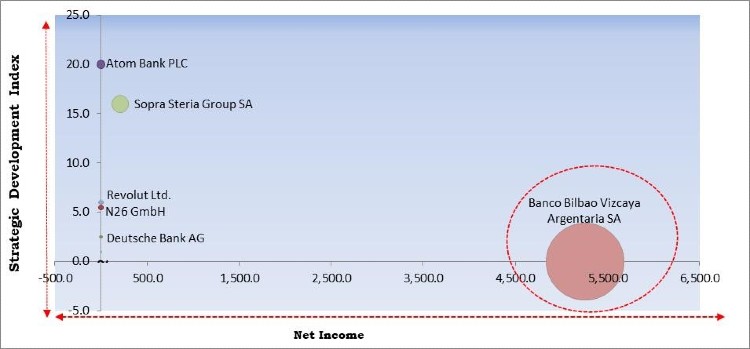

KBV Cardinal Matrix - Neobanking Market Competition Analysis

The major strategies followed by the market participants are Product Launches and Partnerships. Based on the Analysis presented in the Cardinal matrix; Banco Bilbao Vizcaya Argentaria SA is the forerunner in the Neobanking Market. Companies such as Atom Bank PLC, Sopra Steria Group SA, and Revolut Ltd., N26 GmbH, and Deutsche Bank AG are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Atom Bank PLC, Monzo Bank Ltd., Moven Enterprises, N26 GmbH, Revolut Ltd., Ubank Limited, WeBank Co., Ltd., Banco Bilbao Vizcaya Argentaria SA (Simple Finance Technology), Deutsche Bank AG, and Sopra Steria Group SA (Fidor Solutions AG).

Recent Strategies Deployed in Neobanking Market

» Partnerships, Collaborations, and Agreements:

- Nov-2020: Atom came into partnership with Codat, an API platform connecting small businesses to banks and other financial institutions. Under this partnership, Codat delivers their universal API, which allows Atom to directly join hands with business customer’s accounting platforms that removes the requirement for manual submissions.

- Nov-2020: Deutsche Bank announced a collaboration with Daimler Treasury. In this collaboration, Deutsche is executing an electronic banking signature solution together with Daimler Treasury in Singapore with potential use in markets in Asia for the company's treasury functions.

- Oct-2020: Atom bank collaborated with SurePay, an escrow web-mobile app. In this collaboration, SurePay implemented its UK Confirmation of Payee solution for Atom bank, which helps Atom to protect their customers from fraud.

- Jun-2020: N26 expanded its partnership agreement with TransferWise, a global technology leader in international payments. The partnership aimed to offer a broad range of options for foreign currency transfers.

- Mar-2020: Revolut came into a partnership with Metropolitan Commercial Bank. In this partnership, Revolut launched its financial super app, an innovative digital banking platform trusted and used by more than 10 million people globally, to customers in the US.

- May-2019: Atom bank partnered with TruNarrative, a company in the risk & financial crime management space. The partnership aimed to provide an AML transaction, monitoring, and financial crime customer screening and monitoring solution.

- Feb-2019: Fidor formed a collaboration with Finn AI, the world’s leading AI-powered conversational banking technology provider. Under this collaboration, Fidor launched its new banking chatbot, designed in collaboration with Finn AI. This launch distinguished Fidor as the first digital banking service provider to fix a virtual assistant within its technology stack.

» Acquisition and Mergers:

- Mar-2016: Atom took over Grasp, a digital design agency specialized in building user interfaces for the gaming market. The acquisition aimed to bring together user-interface expertise from the banking industry with experience from the video games industry.

» Product Launches and Product Expansion:

- Dec-2020: Revolut shifted from mobile-only to an online model. It allowed its 13 million customers around the world to reach their accounts from a desktop PC or laptop.

- Nov-2020: N26 introduced a subscription-based digital banking suite. This suite helps individuals and businesses to manage their savings and expenses in a better way. The premium subscription solutions, N26 Smart and N26 Business integrated new money management features such as Round-Ups and dedicated phone support.

- Sep-2020: Atom Bank introduced Instant Saver, with a highly competitive interest rate of 0.75% AER, which is 75 times more than the high street banks. It is the first product to be launched on the startup’s cloud-native banking platform.

» Geographical Expansions:

- Nov-2020: Revolut announced the launch of Google Pay for its customers in Bulgaria, Austria, Estonia, Greece, Latvia, Lithuania, Hungary, Portugal, Netherlands, and Romania. Google Pay allows Android users to make fast and simple payments online, in-store, in-app, and more.

- Jul-2020: Deutsche Bank launched Blue Bot 'Yi' to unify customers in China. Blue Bot provides real-time customized transaction reports and cash pooling reports, and for processing direct client enquiries.

- Jul-2019: N26 expanding its geographical footprints by launching its banking app in the US. This launch helped N26 to change banking globally and reach more than 50 million customers in the future.

- Jun-2019: Revolut announced the launch of Apple Pay support to its customers in 12 additional countries. Apple Pay delivers Revolut customers with easy and secure access to pay in stores, in-app, and online through Apple devices.

Scope of the Study

Market Segments Covered in the Report:

By Account Type

- Business Account

- Savings Account

By Application

- Enterprises

- Personal

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Atom Bank PLC

- Monzo Bank Ltd.

- Moven Enterprises

- N26 GmbH

- Revolut Ltd.

- Ubank Limited

- WeBank Co., Ltd.

- Banco Bilbao Vizcaya Argentaria SA (Simple Finance Technology)

- Deutsche Bank AG

- Sopra Steria Group SA (Fidor Solutions AG)

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Neobanking Market, by Account Type

1.4.2 Global Neobanking Market, by Application

1.4.3 Global Neobanking Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.2 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Geographical Expansions

3.2.4 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2016-2020)

3.3.2 Key Strategic Move: (Partnerships, Collaborations, and Agreements : 2016, May – 2020, Nov) Leading Players

Chapter 4. Global Neobanking Market by Account Type

4.1 Global Neobanking Market Business Account Market by Region

4.2 Global Neobanking Market Savings Account Market by Region

Chapter 5. Global Neobanking Market by Application

5.1 Global Enterprises Market by Region

5.2 Global Personal Market by Region

5.3 Global Others Market by Region

Chapter 6. Global Neobanking Market by Region

6.1 North America Neobanking Market

6.1.1 North America Neobanking Market by Account Type

6.1.1.1 North America Neobanking Market Business Account Market by Country

6.1.1.2 North America Neobanking Market Savings Account Market by Country

6.1.2 North America Neobanking Market by Application

6.1.2.1 North America Enterprises Market by Country

6.1.2.2 North America Personal Market by Country

6.1.2.3 North America Others Market by Country

6.1.3 North America Neobanking Market by Country

6.1.3.1 US Neobanking Market

6.1.3.1.1 US Neobanking Market by Account Type

6.1.3.1.2 US Neobanking Market by Application

6.1.3.2 Canada Neobanking Market

6.1.3.2.1 Canada Neobanking Market by Account Type

6.1.3.2.2 Canada Neobanking Market by Application

6.1.3.3 Mexico Neobanking Market

6.1.3.3.1 Mexico Neobanking Market by Account Type

6.1.3.3.2 Mexico Neobanking Market by Application

6.1.3.4 Rest of North America Neobanking Market

6.1.3.4.1 Rest of North America Neobanking Market by Account Type

6.1.3.4.2 Rest of North America Neobanking Market by Application

6.2 Europe Neobanking Market

6.2.1 Europe Neobanking Market by Account Type

6.2.1.1 Europe Neobanking Market Business Account Market by Country

6.2.1.2 Europe Neobanking Market Savings Account Market by Country

6.2.2 Europe Neobanking Market by Application

6.2.2.1 Europe Enterprises Market by Country

6.2.2.2 Europe Personal Market by Country

6.2.2.3 Europe Others Market by Country

6.2.3 Europe Neobanking Market by Country

6.2.3.1 Germany Neobanking Market

6.2.3.1.1 Germany Neobanking Market by Account Type

6.2.3.1.2 Germany Neobanking Market by Application

6.2.3.2 UK Neobanking Market

6.2.3.2.1 UK Neobanking Market by Account Type

6.2.3.2.2 UK Neobanking Market by Application

6.2.3.3 France Neobanking Market

6.2.3.3.1 France Neobanking Market by Account Type

6.2.3.3.2 France Neobanking Market by Application

6.2.3.4 Russia Neobanking Market

6.2.3.4.1 Russia Neobanking Market by Account Type

6.2.3.4.2 Russia Neobanking Market by Application

6.2.3.5 Spain Neobanking Market

6.2.3.5.1 Spain Neobanking Market by Account Type

6.2.3.5.2 Spain Neobanking Market by Application

6.2.3.6 Italy Neobanking Market

6.2.3.6.1 Italy Neobanking Market by Account Type

6.2.3.6.2 Italy Neobanking Market by Application

6.2.3.7 Rest of Europe Neobanking Market

6.2.3.7.1 Rest of Europe Neobanking Market by Account Type

6.2.3.7.2 Rest of Europe Neobanking Market by Application

6.3 Asia Pacific Neobanking Market

6.3.1 Asia Pacific Neobanking Market by Account Type

6.3.1.1 Asia Pacific Neobanking Market Business Account Market by Country

6.3.1.2 Asia Pacific Neobanking Market Savings Account Market by Country

6.3.2 Asia Pacific Neobanking Market by Application

6.3.2.1 Asia Pacific Enterprises Market by Country

6.3.2.2 Asia Pacific Personal Market by Country

6.3.2.3 Asia Pacific Others Market by Country

6.3.3 Asia Pacific Neobanking Market by Country

6.3.3.1 China Neobanking Market

6.3.3.1.1 China Neobanking Market by Account Type

6.3.3.1.2 China Neobanking Market by Application

6.3.3.2 Japan Neobanking Market

6.3.3.2.1 Japan Neobanking Market by Account Type

6.3.3.2.2 Japan Neobanking Market by Application

6.3.3.3 India Neobanking Market

6.3.3.3.1 India Neobanking Market by Account Type

6.3.3.3.2 India Neobanking Market by Application

6.3.3.4 South Korea Neobanking Market

6.3.3.4.1 South Korea Neobanking Market by Account Type

6.3.3.4.2 South Korea Neobanking Market by Application

6.3.3.5 Singapore Neobanking Market

6.3.3.5.1 Singapore Neobanking Market by Account Type

6.3.3.5.2 Singapore Neobanking Market by Application

6.3.3.6 Malaysia Neobanking Market

6.3.3.6.1 Malaysia Neobanking Market by Account Type

6.3.3.6.2 Malaysia Neobanking Market by Application

6.3.3.7 Rest of Asia Pacific Neobanking Market

6.3.3.7.1 Rest of Asia Pacific Neobanking Market by Account Type

6.3.3.7.2 Rest of Asia Pacific Neobanking Market by Application

6.4 LAMEA Neobanking Market

6.4.1 LAMEA Neobanking Market by Account Type

6.4.1.1 LAMEA Neobanking Market Business Account Market by Country

6.4.1.2 LAMEA Neobanking Market Savings Account Market by Country

6.4.2 LAMEA Neobanking Market by Application

6.4.2.1 LAMEA Enterprises Market by Country

6.4.2.2 LAMEA Personal Market by Country

6.4.2.3 LAMEA Others Market by Country

6.4.3 LAMEA Neobanking Market by Country

6.4.3.1 Brazil Neobanking Market

6.4.3.1.1 Brazil Neobanking Market by Account Type

6.4.3.1.2 Brazil Neobanking Market by Application

6.4.3.2 Argentina Neobanking Market

6.4.3.2.1 Argentina Neobanking Market by Account Type

6.4.3.2.2 Argentina Neobanking Market by Application

6.4.3.3 UAE Neobanking Market

6.4.3.3.1 UAE Neobanking Market by Account Type

6.4.3.3.2 UAE Neobanking Market by Application

6.4.3.4 Saudi Arabia Neobanking Market

6.4.3.4.1 Saudi Arabia Neobanking Market by Account Type

6.4.3.4.2 Saudi Arabia Neobanking Market by Application

6.4.3.5 South Africa Neobanking Market

6.4.3.5.1 South Africa Neobanking Market by Account Type

6.4.3.5.2 South Africa Neobanking Market by Application

6.4.3.6 Nigeria Neobanking Market

6.4.3.6.1 Nigeria Neobanking Market by Account Type

6.4.3.6.2 Nigeria Neobanking Market by Application

6.4.3.7 Rest of LAMEA Neobanking Market

6.4.3.7.1 Rest of LAMEA Neobanking Market by Account Type

6.4.3.7.2 Rest of LAMEA Neobanking Market by Application

Chapter 7. Company Profiles

7.1 Atom Bank PLC

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Recent strategies and developments:

7.1.3.1 Partnerships, Collaborations, and Agreements:

7.1.3.2 Acquisition and Mergers:

7.1.3.3 Product Launches and Product Expansions:

7.2 Monzo Bank Ltd.

7.2.1 Company Overview

7.3 Moven Enterprise

7.3.1 Company Overview

7.4 N26 GmbH

7.4.1 Company Overview

7.4.2 Recent strategies and developments:

7.4.2.1 Partnerships, Collaborations, and Agreements:

7.4.2.2 Product Launches and Product Expansions:

7.4.2.3 Geographical Expansions:

7.5 Revolut Ltd.

7.5.1 Company Overview

7.5.2 Recent strategies and developments:

7.5.2.1 Partnerships, Collaborations, and Agreements:

7.5.2.2 Product Launches and Product Expansions:

7.5.2.3 Geographical Expansions:

7.6 Ubank Limited

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Research & Development Expense

7.7 WeBank Co., Ltd.

7.7.1 Company Overview

7.8 Banco Bilbao Vizcaya Argentaria SA (Simple Finance Technology)

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Regional Analysis

7.9 Deutsche Bank AG

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Segmental and Regional Analysis

7.9.4 Recent strategies and developments:

7.9.4.1 Partnerships, Collaborations, and Agreements:

7.9.4.2 Geographical Expansions:

7.10. Sopra Steria Group SA (Fidor Solutions AG)

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Segmental and Regional Analysis

7.10.4 Research & Development Expense

7.10.5 Recent strategies and developments:

7.10.5.1 Partnerships, Collaborations, and Agreements:

TABLE 2 Global Neobanking Market, 2020 - 2026, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Neobanking Market

TABLE 4 Product Launches And Product Expansions– Neobanking Market

TABLE 5 Geographical Expansions– Neobanking Market

TABLE 6 Acquisition and Mergers– Neobanking Market

TABLE 7 Global Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 8 Global Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 9 Global Neobanking Market Business Account Market by Region, 2016 - 2019, USD Million

TABLE 10 Global Neobanking Market Business Account Market by Region, 2020 - 2026, USD Million

TABLE 11 Global Neobanking Market Savings Account Market by Region, 2016 - 2019, USD Million

TABLE 12 Global Neobanking Market Savings Account Market by Region, 2020 - 2026, USD Million

TABLE 13 Global Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 14 Global Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 15 Global Enterprises Market by Region, 2016 - 2019, USD Million

TABLE 16 Global Enterprises Market by Region, 2020 - 2026, USD Million

TABLE 17 Global Personal Market by Region, 2016 - 2019, USD Million

TABLE 18 Global Personal Market by Region, 2020 - 2026, USD Million

TABLE 19 Global Others Market by Region, 2016 - 2019, USD Million

TABLE 20 Global Others Market by Region, 2020 - 2026, USD Million

TABLE 21 Global Neobanking Market by Region, 2016 - 2019, USD Million

TABLE 22 Global Neobanking Market by Region, 2020 - 2026, USD Million

TABLE 23 North America Neobanking Market, 2016 - 2019, USD Million

TABLE 24 North America Neobanking Market, 2020 - 2026, USD Million

TABLE 25 North America Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 26 North America Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 27 North America Neobanking Market Business Account Market by Country, 2016 - 2019, USD Million

TABLE 28 North America Neobanking Market Business Account Market by Country, 2020 - 2026, USD Million

TABLE 29 North America Neobanking Market Savings Account Market by Country, 2016 - 2019, USD Million

TABLE 30 North America Neobanking Market Savings Account Market by Country, 2020 - 2026, USD Million

TABLE 31 North America Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 32 North America Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 33 North America Enterprises Market by Country, 2016 - 2019, USD Million

TABLE 34 North America Enterprises Market by Country, 2020 - 2026, USD Million

TABLE 35 North America Personal Market by Country, 2016 - 2019, USD Million

TABLE 36 North America Personal Market by Country, 2020 - 2026, USD Million

TABLE 37 North America Others Market by Country, 2016 - 2019, USD Million

TABLE 38 North America Others Market by Country, 2020 - 2026, USD Million

TABLE 39 North America Neobanking Market by Country, 2016 - 2019, USD Million

TABLE 40 North America Neobanking Market by Country, 2020 - 2026, USD Million

TABLE 41 US Neobanking Market, 2016 - 2019, USD Million

TABLE 42 US Neobanking Market, 2020 - 2026, USD Million

TABLE 43 US Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 44 US Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 45 US Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 46 US Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 47 Canada Neobanking Market, 2016 - 2019, USD Million

TABLE 48 Canada Neobanking Market, 2020 - 2026, USD Million

TABLE 49 Canada Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 50 Canada Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 51 Canada Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 52 Canada Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 53 Mexico Neobanking Market, 2016 - 2019, USD Million

TABLE 54 Mexico Neobanking Market, 2020 - 2026, USD Million

TABLE 55 Mexico Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 56 Mexico Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 57 Mexico Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 58 Mexico Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 59 Rest of North America Neobanking Market, 2016 - 2019, USD Million

TABLE 60 Rest of North America Neobanking Market, 2020 - 2026, USD Million

TABLE 61 Rest of North America Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 62 Rest of North America Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 63 Rest of North America Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 64 Rest of North America Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 65 Europe Neobanking Market, 2016 - 2019, USD Million

TABLE 66 Europe Neobanking Market, 2020 - 2026, USD Million

TABLE 67 Europe Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 68 Europe Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 69 Europe Neobanking Market Business Account Market by Country, 2016 - 2019, USD Million

TABLE 70 Europe Neobanking Market Business Account Market by Country, 2020 - 2026, USD Million

TABLE 71 Europe Neobanking Market Savings Account Market by Country, 2016 - 2019, USD Million

TABLE 72 Europe Neobanking Market Savings Account Market by Country, 2020 - 2026, USD Million

TABLE 73 Europe Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 74 Europe Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 75 Europe Enterprises Market by Country, 2016 - 2019, USD Million

TABLE 76 Europe Enterprises Market by Country, 2020 - 2026, USD Million

TABLE 77 Europe Personal Market by Country, 2016 - 2019, USD Million

TABLE 78 Europe Personal Market by Country, 2020 - 2026, USD Million

TABLE 79 Europe Others Market by Country, 2016 - 2019, USD Million

TABLE 80 Europe Others Market by Country, 2020 - 2026, USD Million

TABLE 81 Europe Neobanking Market by Country, 2016 - 2019, USD Million

TABLE 82 Europe Neobanking Market by Country, 2020 - 2026, USD Million

TABLE 83 Germany Neobanking Market, 2016 - 2019, USD Million

TABLE 84 Germany Neobanking Market, 2020 - 2026, USD Million

TABLE 85 Germany Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 86 Germany Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 87 Germany Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 88 Germany Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 89 UK Neobanking Market, 2016 - 2019, USD Million

TABLE 90 UK Neobanking Market, 2020 - 2026, USD Million

TABLE 91 UK Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 92 UK Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 93 UK Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 94 UK Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 95 France Neobanking Market, 2016 - 2019, USD Million

TABLE 96 France Neobanking Market, 2020 - 2026, USD Million

TABLE 97 France Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 98 France Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 99 France Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 100 France Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 101 Russia Neobanking Market, 2016 - 2019, USD Million

TABLE 102 Russia Neobanking Market, 2020 - 2026, USD Million

TABLE 103 Russia Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 104 Russia Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 105 Russia Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 106 Russia Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 107 Spain Neobanking Market, 2016 - 2019, USD Million

TABLE 108 Spain Neobanking Market, 2020 - 2026, USD Million

TABLE 109 Spain Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 110 Spain Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 111 Spain Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 112 Spain Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 113 Italy Neobanking Market, 2016 - 2019, USD Million

TABLE 114 Italy Neobanking Market, 2020 - 2026, USD Million

TABLE 115 Italy Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 116 Italy Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 117 Italy Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 118 Italy Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 119 Rest of Europe Neobanking Market, 2016 - 2019, USD Million

TABLE 120 Rest of Europe Neobanking Market, 2020 - 2026, USD Million

TABLE 121 Rest of Europe Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 122 Rest of Europe Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 123 Rest of Europe Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 124 Rest of Europe Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 125 Asia Pacific Neobanking Market, 2016 - 2019, USD Million

TABLE 126 Asia Pacific Neobanking Market, 2020 - 2026, USD Million

TABLE 127 Asia Pacific Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 128 Asia Pacific Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 129 Asia Pacific Neobanking Market Business Account Market by Country, 2016 - 2019, USD Million

TABLE 130 Asia Pacific Neobanking Market Business Account Market by Country, 2020 - 2026, USD Million

TABLE 131 Asia Pacific Neobanking Market Savings Account Market by Country, 2016 - 2019, USD Million

TABLE 132 Asia Pacific Neobanking Market Savings Account Market by Country, 2020 - 2026, USD Million

TABLE 133 Asia Pacific Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 134 Asia Pacific Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 135 Asia Pacific Enterprises Market by Country, 2016 - 2019, USD Million

TABLE 136 Asia Pacific Enterprises Market by Country, 2020 - 2026, USD Million

TABLE 137 Asia Pacific Personal Market by Country, 2016 - 2019, USD Million

TABLE 138 Asia Pacific Personal Market by Country, 2020 - 2026, USD Million

TABLE 139 Asia Pacific Others Market by Country, 2016 - 2019, USD Million

TABLE 140 Asia Pacific Others Market by Country, 2020 - 2026, USD Million

TABLE 141 Asia Pacific Neobanking Market by Country, 2016 - 2019, USD Million

TABLE 142 Asia Pacific Neobanking Market by Country, 2020 - 2026, USD Million

TABLE 143 China Neobanking Market, 2016 - 2019, USD Million

TABLE 144 China Neobanking Market, 2020 - 2026, USD Million

TABLE 145 China Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 146 China Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 147 China Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 148 China Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 149 Japan Neobanking Market, 2016 - 2019, USD Million

TABLE 150 Japan Neobanking Market, 2020 - 2026, USD Million

TABLE 151 Japan Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 152 Japan Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 153 Japan Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 154 Japan Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 155 India Neobanking Market, 2016 - 2019, USD Million

TABLE 156 India Neobanking Market, 2020 - 2026, USD Million

TABLE 157 India Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 158 India Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 159 India Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 160 India Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 161 South Korea Neobanking Market, 2016 - 2019, USD Million

TABLE 162 South Korea Neobanking Market, 2020 - 2026, USD Million

TABLE 163 South Korea Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 164 South Korea Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 165 South Korea Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 166 South Korea Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 167 Singapore Neobanking Market, 2016 - 2019, USD Million

TABLE 168 Singapore Neobanking Market, 2020 - 2026, USD Million

TABLE 169 Singapore Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 170 Singapore Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 171 Singapore Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 172 Singapore Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 173 Malaysia Neobanking Market, 2016 - 2019, USD Million

TABLE 174 Malaysia Neobanking Market, 2020 - 2026, USD Million

TABLE 175 Malaysia Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 176 Malaysia Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 177 Malaysia Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 178 Malaysia Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 179 Rest of Asia Pacific Neobanking Market, 2016 - 2019, USD Million

TABLE 180 Rest of Asia Pacific Neobanking Market, 2020 - 2026, USD Million

TABLE 181 Rest of Asia Pacific Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 182 Rest of Asia Pacific Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 183 Rest of Asia Pacific Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 184 Rest of Asia Pacific Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 185 LAMEA Neobanking Market, 2016 - 2019, USD Million

TABLE 186 LAMEA Neobanking Market, 2020 - 2026, USD Million

TABLE 187 LAMEA Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 188 LAMEA Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 189 LAMEA Neobanking Market Business Account Market by Country, 2016 - 2019, USD Million

TABLE 190 LAMEA Neobanking Market Business Account Market by Country, 2020 - 2026, USD Million

TABLE 191 LAMEA Neobanking Market Savings Account Market by Country, 2016 - 2019, USD Million

TABLE 192 LAMEA Neobanking Market Savings Account Market by Country, 2020 - 2026, USD Million

TABLE 193 LAMEA Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 194 LAMEA Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 195 LAMEA Enterprises Market by Country, 2016 - 2019, USD Million

TABLE 196 LAMEA Enterprises Market by Country, 2020 - 2026, USD Million

TABLE 197 LAMEA Personal Market by Country, 2016 - 2019, USD Million

TABLE 198 LAMEA Personal Market by Country, 2020 - 2026, USD Million

TABLE 199 LAMEA Others Market by Country, 2016 - 2019, USD Million

TABLE 200 LAMEA Others Market by Country, 2020 - 2026, USD Million

TABLE 201 LAMEA Neobanking Market by Country, 2016 - 2019, USD Million

TABLE 202 LAMEA Neobanking Market by Country, 2020 - 2026, USD Million

TABLE 203 Brazil Neobanking Market, 2016 - 2019, USD Million

TABLE 204 Brazil Neobanking Market, 2020 - 2026, USD Million

TABLE 205 Brazil Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 206 Brazil Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 207 Brazil Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 208 Brazil Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 209 Argentina Neobanking Market, 2016 - 2019, USD Million

TABLE 210 Argentina Neobanking Market, 2020 - 2026, USD Million

TABLE 211 Argentina Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 212 Argentina Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 213 Argentina Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 214 Argentina Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 215 UAE Neobanking Market, 2016 - 2019, USD Million

TABLE 216 UAE Neobanking Market, 2020 - 2026, USD Million

TABLE 217 UAE Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 218 UAE Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 219 UAE Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 220 UAE Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 221 Saudi Arabia Neobanking Market, 2016 - 2019, USD Million

TABLE 222 Saudi Arabia Neobanking Market, 2020 - 2026, USD Million

TABLE 223 Saudi Arabia Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 224 Saudi Arabia Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 225 Saudi Arabia Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 226 Saudi Arabia Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 227 South Africa Neobanking Market, 2016 - 2019, USD Million

TABLE 228 South Africa Neobanking Market, 2020 - 2026, USD Million

TABLE 229 South Africa Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 230 South Africa Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 231 South Africa Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 232 South Africa Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 233 Nigeria Neobanking Market, 2016 - 2019, USD Million

TABLE 234 Nigeria Neobanking Market, 2020 - 2026, USD Million

TABLE 235 Nigeria Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 236 Nigeria Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 237 Nigeria Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 238 Nigeria Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 239 Rest of LAMEA Neobanking Market, 2016 - 2019, USD Million

TABLE 240 Rest of LAMEA Neobanking Market, 2020 - 2026, USD Million

TABLE 241 Rest of LAMEA Neobanking Market by Account Type, 2016 - 2019, USD Million

TABLE 242 Rest of LAMEA Neobanking Market by Account Type, 2020 - 2026, USD Million

TABLE 243 Rest of LAMEA Neobanking Market by Application, 2016 - 2019, USD Million

TABLE 244 Rest of LAMEA Neobanking Market by Application, 2020 - 2026, USD Million

TABLE 245 Key Information –Atom Bank PLC

TABLE 246 Key Information – Monzo Bank Ltd.

TABLE 247 Key Information – Moven Enterprises

TABLE 248 Key Information – N26 GmbH

TABLE 249 Key Information – Revolut Ltd.

TABLE 250 key information – Ubank Limited

TABLE 251 key Information – WeBank Co., Ltd.

TABLE 252 Key Information – Banco Bilbao Vizcaya Argentaria SA

TABLE 253 key information – Deutsche Bank AG

TABLE 254 Key Information – Sopra Steria Group SA

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2016-2020)

FIG 4 Key Strategic Move: (Partnerships, Collaborations, and Agreements : 2016, May – 2020, Nov) Leading Players

FIG 5 Recent strategies and developments: Atom Bank PLC

FIG 6 Recent strategies and developments: N26 GmbH

FIG 7 Recent strategies and developments: Revolut Ltd.

FIG 8 Recent strategies and developments: Deutsche Bank AG