LAMEA Video As A Sensor Market Size, Share & Industry Analysis Report By Offering (Hardware, Software, and Services), By Product (Video Surveillance, Machine Vision & Monitoring, Thermal Imaging, and Hyperspectral Imaging), By End-Use (Commercial, Industrial, Government, and Other End-Use), By Application, By Country and Growth Forecast, 2025 - 2032

Published Date : 28-Jul-2025 |

Pages: 193 |

Report Format: PDF + Excel |

COVID-19 Impact on the LAMEA Video As A Sensor Market

The Latin America, Middle East and Africa Video as a Sensor Market would witness market growth of 9.5% CAGR during the forecast period (2025-2032).

The Brazil market dominated the LAMEA Video As A Sensor Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $2,625.3 million by 2032. The Argentina market is showcasing a CAGR of 10.9% during (2025 - 2032). Additionally, The UAE market would register a CAGR of 8.7% during (2025 - 2032).

The Video-as-a-Sensor (VaaS) business in LAMEA has grown slowly through projects that focus on public safety, smart cities, and infrastructure surveillance. It has changed from analog systems to smart sensor networks that work in real time. In Latin America, early adoption was driven by rising crime rates in cities. This led to government-supported monitoring systems in countries like Chile, Brazil, and Mexico. This change is shown by Chile's work with Lenovo's AI-powered video surveillance systems.

Free Valuable Insights: The Worldwide Video As A Sensor Market is Projected to reach USD 131.73 Billion by 2032, at a CAGR of 8.1%

Smart Video for Safer Cities

- Crime Prevention and Public Safety: Smart video systems are used by cities like San Fernando to stop crimes before they happen. Cameras with analytics help keep an eye on places in real time and let the police know when something seems off.

- Emergency Response Made Faster: These systems also help during emergencies, like accidents or medical problems, by showing live video so that the right help can be sent right away.

Big Cities, Big Camera Networks

- Advanced Monitoring in São Paulo and Mexico City: In big cities, thousands of security cameras are used not only to watch but also to find strange behavior or patterns using AI. This helps the police and city officials act faster and more wisely.

Key Market Trends in the LAMEA Video as a Sensor Market

1. Growing Adoption in Public Safety and Urban Surveillance

The LAMEA region is witnessing increasing adoption of video-as-a-sensor technologies for urban surveillance and public safety initiatives. Governments in countries such as Brazil, the UAE, and South Africa are implementing smart surveillance systems for crime detection, crowd control, and traffic management.

For Instance:

- In São Paulo, Brazil, the city’s Detecta surveillance system, integrated with video analytics, has been in use since 2014 and has continued evolving with AI-based facial and behavioral recognition to enhance crime prediction capabilities.

- In the UAE, Dubai Police launched AI-powered surveillance patrols in 2022, using real-time video sensors for license plate detection and traffic violation alerts.

2. Integration with Smart City Initiatives

Several LAMEA nations are embedding video sensors in smart city infrastructures. These sensors are integrated with IoT platforms for monitoring urban infrastructure, energy consumption, and environmental conditions.

For Instance:

- Saudi Arabia’s NEOM project, a $500 billion smart city initiative, is deploying extensive video sensing for infrastructure security, autonomous mobility, and intelligent traffic systems. As of 2023, NEOM has partnered with multiple global technology firms to incorporate edge-based video processing.

State of Competition in the LAMEA Video as a Sensor Market

The LAMEA (Latin America, Middle East, and Africa) Video as a Sensor market is witnessing evolving competition, driven by the intersection of national security imperatives, smart city initiatives, and infrastructural modernization. The region presents a fragmented competitive landscape, with a mix of global surveillance and imaging vendors competing alongside regional integrators and specialized technology firms. The pace of adoption varies widely, with the Middle East leading in investment intensity compared to Latin America and Africa.

1. Dominant Players and Market Share Dynamics

Global leaders such as Hikvision, Dahua Technology, Bosch Security Systems, Axis Communications, and Honeywell International maintain a significant presence across the LAMEA region, especially in the Middle East. These firms often operate via partnerships, system integrators, or through government tenders.

- Hikvision and Dahua, despite regulatory scrutiny in Western markets, remain key suppliers in Africa and the Gulf Cooperation Council (GCC) due to cost competitiveness and rapid deployment capability.

- Bosch Security Systems has provided AI-enabled cameras for critical infrastructure and industrial facilities in South Africa and the UAE.

- Honeywell has implemented intelligent video analytics and sensor networks in major airports and petroleum infrastructure across Saudi Arabia and Qatar.

The presence of these players is reinforced by local alliances, enabling adaptation to national procurement requirements and standards.

2. Strategic Collaborations and Innovation

In the Middle East, smart cities like Neom (Saudi Arabia) and Lusail City (Qatar) are driving demand for integrated video analytics. These projects heavily incorporate partnerships with global firms:

- Thales Group and Huawei have collaborated with regional governments for border surveillance and critical infrastructure monitoring using video as a sensor networks.

- Honeywell partnered with Etisalat Digital to integrate AI-enabled video analytics across UAE smart city projects.

In Latin America, innovation is more fragmented but growing. In Brazil, firms like Digifort offer competitive video management systems used in urban and retail monitoring. Startups focusing on AI and behavior analytics, such as Axon, are emerging to address violence detection and public safety challenges.

Offering Outlook

Based on Offering, the market is segmented into Hardware, Software, and Services.

Hardware

Trend: Deployment of AI-enhanced surveillance hardware (cameras, vehicles)

For instance, Dubai Police’s “Oyoon” smart city initiative utilizes thousands of AI-powered cameras across the metropolis, integrated with facial recognition and ANPR systems, resulting in the arrest of over 300 suspects in a single year.

Software

Trend: Growth of unified AI-driven video management and analytics systems

For instance:

Genetec was reaffirmed as a global leader in VMS and VSaaS, particularly highlighting its continued momentum in EMEA, including the Middle East and Africa.

Product Outlook

Based on Product, the market is segmented into Video Surveillance, Machine Vision & Monitoring, Thermal Imaging, and Hyperspectral Imaging.

1. Video Surveillance

Trend: Expansion of AI-enabled public surveillance systems in urban centers.

For instance:

In Buenos Aires, facial recognition and AI-driven surveillance—part of the city’s "rebooted" system—have led to the arrest of over 1,600 fugitives, demonstrating both operational impact and rising integration in public safety measures.

The city’s residents and rights groups are engaged in dynamic policy dialogue regarding data privacy and usage—highlighting the technology’s societal implications.

2. Hyperspectral Imaging

Trend: Adoption of drone- and satellite-based hyperspectral systems in agriculture and environmental monitoring efforts.

For instance:

the USGS has developed global hyperspectral libraries and is expanding use of airborne and spaceborne hyperspectral sensors in agricultural monitoring—technology increasingly shared with Latin American nations.

Drone-mounted hyperspectral systems are being actively deployed in fields like agriculture, mining, and forestry—across Africa, including LAMEA regions like South Africa.

End-Use Outlook

Based on End-Use, the market is segmented into Commercial, Industrial, Government, and Other End-Use.

1. Government Segment

Trend: Expansion of Smart City Surveillance Initiatives

Governments across the LAMEA region are increasingly implementing video surveillance systems as part of smart city projects to enhance public safety and urban management.

For instance:

In March 2025, Rabat, Morocco, launched a smart city project incorporating AI-powered surveillance, including a wide network of smart cameras and the construction of two central control centers to manage the system.

2. Commercial Segment

Trend: Adoption of AI-Driven Video Analytics in Commercial Spaces

Businesses in the LAMEA region are integrating AI-powered video analytics to enhance security, customer experience, and operational efficiency.

For instance: In January 2025, Dahua Technology unveiled its comprehensive Smart City solutions in the Middle East and North Africa, integrating AI and IoT technologies to enhance urban security and efficiency.

Application Outlook

Based on Application, the market is segmented into Security & Surveillance, Traffic Management, Retail Analytics, Healthcare, Manufacturing, Mapping, and Other Application.

Security & Surveillance

Trend: Retailers and municipalities across LAMEA are deploying video-as-a-sensor systems with AI-powered gesture and behavior recognition, enhancing security while respecting privacy norms.

For instance:

- VSaaS.ai, a Chilean startup, has rolled out an AI-powered cloud video analytics service across smart city projects in Latin America, providing real-time threat detection and behavior analysis in public spaces.

- In Mexico, interactive retail kiosks propose gesture-based customer engagement tools that anticipate consumers’ needs through movement detection, hinting at emerging privacy-sensitive in-store analytics.

Traffic Management

Trend: Major LAMEA cities are integrating AI-driven traffic cameras and ANPR systems with edge computing for real-time enforcement and safer road management.

For instance:

- In Brazil, Splice Group operates over 1,700 smart cameras across more than 10 cities, collecting license plate, speed, and vehicle-type data to support traffic management and law enforcement.

- Mexico is at the forefront of smart factory infrastructure, but similar video-sensor integrations are enabling automated traffic signal control and monitoring—intended to reduce congestion and enhance safety.

Based on Offering, the market is segmented into Hardware, Software, and Services. Based on Product, the market is segmented into Video Surveillance, Machine Vision & Monitoring, Thermal Imaging, and Hyperspectral Imaging. Based on End-Use, the market is segmented into Commercial, Industrial, Government, and Other End-Use. Based on Application, the market is segmented into Security & Surveillance, Traffic Management, Retail Analytics, Healthcare, Manufacturing, Mapping, and Other Application. Based on countries, the market is segmented into Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria, and Rest of LAMEA.

List of Key Companies Profiled

- Axis Communications AB (Canon, Inc.)

- Motorola Solutions, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Bosch Sicherheitssysteme GmbH (Robert Bosch GmbH)

- Zhejiang Dahua Technology Co., Ltd.

- Sony Semiconductor Solutions Corporation (Sony Corporation)

- Honeywell International Inc.

- Johnson Controls International PLC

- OmniVision Technologies, Inc.

- i-PRO Co., Ltd.

LAMEA Video As A Sensor Market Report Segmentation

By Offering

- Hardware

- Software

- Services

By Product

- Video Surveillance

- Machine Vision & Monitoring

- Thermal Imaging

- Hyperspectral Imaging

By End-Use

- Commercial

- Industrial

- Government

- Other End-Use

By Application

- Security & Surveillance

- Traffic Management

- Retail Analytics

- Healthcare

- Manufacturing

- Mapping

- Other Application

By Country

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 LAMEA Video As A Sensor Market, by Offering

1.4.2 LAMEA Video As A Sensor Market, by Product

1.4.3 LAMEA Video As A Sensor Market, by End-Use

1.4.4 LAMEA Video As A Sensor Market, by Application

1.4.5 LAMEA Video As A Sensor Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario:

3.2 Key Factors Impacting

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Key Market Trends in the LAMEA Video As A Sensor Market

Chapter 5. State of Competition in the LAMEA Video As A Sensor Market

Chapter 6. Market Consolidation Analysis in Video As A Sensor Market

Chapter 7. Product Life Cycle Analysis - Video as a Sensor Market

Chapter 8. Competition Analysis - Global

8.1 KBV Cardinal Matrix

8.2 Recent Industry Wide Strategic Developments

8.2.1 Partnerships, Collaborations and Agreements

8.2.2 Product Launches and Product Expansions

8.2.3 Acquisition and Mergers

8.3 Market Share Analysis, 2024

8.4 Top Winning Strategies

8.4.1 Key Leading Strategies: Percentage Distribution (2021-2025)

8.4.2 Key Strategic Move: (Product Launches and Product Expansions: 2021, Feb – 2025, Jun) Leading Players

8.5 Porter Five Forces Analysis

Chapter 9. Value Chain Analysis of Video As A Sensor Market

9.1 R&D and Technology Development

9.2 Component Manufacturing

9.3 System Integration

9.4 Software & Analytics Development

9.5 Distribution & Sales

9.6 Deployment & Installation

9.7 Operations & Services

9.8 End-Use Applications

Chapter 10. Key Customer Criteria – LAMEA Video As A Sensor Market

Chapter 11. LAMEA Video As A Sensor Market by Offering

11.1 LAMEA Hardware Market by Country

11.2 LAMEA Software Market by Country

11.3 LAMEA Services Market by Country

Chapter 12. LAMEA Video As A Sensor Market by Product

12.1 LAMEA Video Surveillance Market by Country

12.2 LAMEA Machine Vision & Monitoring Market by Country

12.3 LAMEA Thermal Imaging Market by Country

12.4 LAMEA Hyperspectral Imaging Market by Country

Chapter 13. LAMEA Video As A Sensor Market by End-Use

13.1 LAMEA Commercial Market by Country

13.2 LAMEA Industrial Market by Country

13.3 LAMEA Government Market by Country

13.4 LAMEA Other End-Use Market by Country

Chapter 14. LAMEA Video As A Sensor Market by Application

14.1 LAMEA Security & Surveillance Market by Country

14.2 LAMEA Traffic Management Market by Country

14.3 LAMEA Retail Analytics Market by Country

14.4 LAMEA Healthcare Market by Country

14.5 LAMEA Manufacturing Market by Country

14.6 LAMEA Mapping Market by Country

14.7 LAMEA Other Application Market by Country

Chapter 15. LAMEA Video As A Sensor Market by Country

15.1 Brazil Video As A Sensor Market

15.1.1 Brazil Video As A Sensor Market by Offering

15.1.2 Brazil Video As A Sensor Market by Product

15.1.3 Brazil Video As A Sensor Market by End-Use

15.1.4 Brazil Video As A Sensor Market by Application

15.2 Argentina Video As A Sensor Market

15.2.1 Argentina Video As A Sensor Market by Offering

15.2.2 Argentina Video As A Sensor Market by Product

15.2.3 Argentina Video As A Sensor Market by End-Use

15.2.4 Argentina Video As A Sensor Market by Application

15.3 UAE Video As A Sensor Market

15.3.1 UAE Video As A Sensor Market by Offering

15.3.2 UAE Video As A Sensor Market by Product

15.3.3 UAE Video As A Sensor Market by End-Use

15.3.4 UAE Video As A Sensor Market by Application

15.4 Saudi Arabia Video As A Sensor Market

15.4.1 Saudi Arabia Video As A Sensor Market by Offering

15.4.2 Saudi Arabia Video As A Sensor Market by Product

15.4.3 Saudi Arabia Video As A Sensor Market by End-Use

15.4.4 Saudi Arabia Video As A Sensor Market by Application

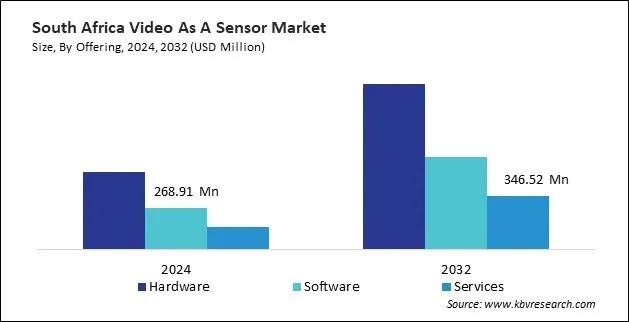

15.5 South Africa Video As A Sensor Market

15.5.1 South Africa Video As A Sensor Market by Offering

15.5.2 South Africa Video As A Sensor Market by Product

15.5.3 South Africa Video As A Sensor Market by End-Use

15.5.4 South Africa Video As A Sensor Market by Application

15.6 Nigeria Video As A Sensor Market

15.6.1 Nigeria Video As A Sensor Market by Offering

15.6.2 Nigeria Video As A Sensor Market by Product

15.6.3 Nigeria Video As A Sensor Market by End-Use

15.6.4 Nigeria Video As A Sensor Market by Application

15.7 Rest of LAMEA Video As A Sensor Market

15.7.1 Rest of LAMEA Video As A Sensor Market by Offering

15.7.2 Rest of LAMEA Video As A Sensor Market by Product

15.7.3 Rest of LAMEA Video As A Sensor Market by End-Use

15.7.4 Rest of LAMEA Video As A Sensor Market by Application

Chapter 16. Company Profiles

16.1 Axis Communications AB (Canon, Inc.)

16.1.1 Company Overview

16.1.2 Financial Analysis

16.1.3 Segmental and Regional Analysis

16.1.4 Research & Development Expenses

16.1.5 Recent strategies and developments:

16.1.5.1 Partnerships, Collaborations, and Agreements:

16.1.5.2 Product Launches and Product Expansions:

16.1.6 SWOT Analysis

16.2 Motorola Solutions, Inc.

16.2.1 Company Overview

16.2.2 Financial Analysis

16.2.3 Regional & Segmental Analysis

16.2.4 Research & Development Expenses

16.2.5 Recent strategies and developments:

16.2.5.1 Product Launches and Product Expansions:

16.2.5.2 Acquisition and Mergers:

16.2.6 SWOT Analysis

16.3 Hangzhou Hikvision Digital Technology Co., Ltd.

16.3.1 Company Overview

16.3.2 Financial Analysis

16.3.3 Regional Analysis

16.3.4 Research & Development Expenses

16.3.5 Recent strategies and developments:

16.3.5.1 Partnerships, Collaborations, and Agreements:

16.3.5.2 Product Launches and Product Expansions:

16.3.6 SWOT Analysis

16.4 Bosch Sicherheitssysteme GmbH (Robert Bosch GmbH)

16.4.1 Company Overview

16.4.2 Financial Analysis

16.4.3 Segmental and Regional Analysis

16.4.4 Research & Development Expense

16.4.5 Recent strategies and developments:

16.4.5.1 Product Launches and Product Expansions:

16.4.5.2 Acquisition and Mergers:

16.5 Zhejiang Dahua Technology Co., Ltd.

16.5.1 Company Overview

16.5.2 Financial Analysis

16.5.3 Regional Analysis

16.5.4 Product Development Expenses

16.5.5 Recent strategies and developments:

16.5.5.1 Product Launches and Product Expansions:

16.5.6 SWOT Analysis

16.6 Sony Semiconductor Solutions Corporation (Sony Corporation)

16.6.1 Company Overview

16.6.2 Financial Analysis

16.6.3 Segmental and Regional Analysis

16.6.4 Research & Development Expenses

16.6.5 Recent strategies and developments:

16.6.5.1 Partnerships, Collaborations, and Agreements:

16.7 Honeywell International, Inc.

16.7.1 Company Overview

16.7.2 Financial Analysis

16.7.3 Segmental and Regional Analysis

16.7.4 Research & Development Expenses

16.7.5 Recent strategies and developments:

16.7.5.1 Product Launches and Product Expansions:

16.7.6 SWOT Analysis

16.8 Johnson Controls International PLC

16.8.1 Company Overview

16.8.2 Financial Analysis

16.8.3 Segmental & Regional Analysis

16.8.4 Research & Development Expenses

16.8.5 Recent strategies and developments:

16.8.5.1 Product Launches and Product Expansions:

16.8.6 SWOT Analysis

16.9 OmniVision Technologies, Inc.

16.9.1 Company Overview

16.9.2 Recent strategies and developments:

16.9.2.1 Product Launches and Product Expansions:

16.9.3 SWOT Analysis

16.10. i-PRO Co., Ltd.

16.10.1 Company Overview

16.10.2 Recent strategies and developments:

16.10.2.1 Product Launches and Product Expansions:

TABLE 2 LAMEA Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 3 Evaluation of Parameters: Video As A Sensor Market

TABLE 4 Partnerships, Collaborations and Agreements– Video As A Sensor Market

TABLE 5 Product Launches And Product Expansions– Video As A Sensor Market

TABLE 6 Acquisition and Mergers– Video As A Sensor Market

TABLE 7 Key Customer Criteria – LAMEA Video As A Sensor Market

TABLE 8 LAMEA Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 9 LAMEA Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 10 LAMEA Hardware Market by Country, 2021 - 2024, USD Million

TABLE 11 LAMEA Hardware Market by Country, 2025 - 2032, USD Million

TABLE 12 LAMEA Software Market by Country, 2021 - 2024, USD Million

TABLE 13 LAMEA Software Market by Country, 2025 - 2032, USD Million

TABLE 14 LAMEA Services Market by Country, 2021 - 2024, USD Million

TABLE 15 LAMEA Services Market by Country, 2025 - 2032, USD Million

TABLE 16 LAMEA Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 17 LAMEA Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 18 LAMEA Video Surveillance Market by Country, 2021 - 2024, USD Million

TABLE 19 LAMEA Video Surveillance Market by Country, 2025 - 2032, USD Million

TABLE 20 LAMEA Machine Vision & Monitoring Market by Country, 2021 - 2024, USD Million

TABLE 21 LAMEA Machine Vision & Monitoring Market by Country, 2025 - 2032, USD Million

TABLE 22 LAMEA Thermal Imaging Market by Country, 2021 - 2024, USD Million

TABLE 23 LAMEA Thermal Imaging Market by Country, 2025 - 2032, USD Million

TABLE 24 LAMEA Hyperspectral Imaging Market by Country, 2021 - 2024, USD Million

TABLE 25 LAMEA Hyperspectral Imaging Market by Country, 2025 - 2032, USD Million

TABLE 26 LAMEA Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 27 LAMEA Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 28 LAMEA Commercial Market by Country, 2021 - 2024, USD Million

TABLE 29 LAMEA Commercial Market by Country, 2025 - 2032, USD Million

TABLE 30 LAMEA Industrial Market by Country, 2021 - 2024, USD Million

TABLE 31 LAMEA Industrial Market by Country, 2025 - 2032, USD Million

TABLE 32 LAMEA Government Market by Country, 2021 - 2024, USD Million

TABLE 33 LAMEA Government Market by Country, 2025 - 2032, USD Million

TABLE 34 LAMEA Other End-Use Market by Country, 2021 - 2024, USD Million

TABLE 35 LAMEA Other End-Use Market by Country, 2025 - 2032, USD Million

TABLE 36 LAMEA Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 37 LAMEA Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 38 LAMEA Security & Surveillance Market by Country, 2021 - 2024, USD Million

TABLE 39 LAMEA Security & Surveillance Market by Country, 2025 - 2032, USD Million

TABLE 40 LAMEA Traffic Management Market by Country, 2021 - 2024, USD Million

TABLE 41 LAMEA Traffic Management Market by Country, 2025 - 2032, USD Million

TABLE 42 LAMEA Retail Analytics Market by Country, 2021 - 2024, USD Million

TABLE 43 LAMEA Retail Analytics Market by Country, 2025 - 2032, USD Million

TABLE 44 LAMEA Healthcare Market by Country, 2021 - 2024, USD Million

TABLE 45 LAMEA Healthcare Market by Country, 2025 - 2032, USD Million

TABLE 46 LAMEA Manufacturing Market by Country, 2021 - 2024, USD Million

TABLE 47 LAMEA Manufacturing Market by Country, 2025 - 2032, USD Million

TABLE 48 LAMEA Mapping Market by Country, 2021 - 2024, USD Million

TABLE 49 LAMEA Mapping Market by Country, 2025 - 2032, USD Million

TABLE 50 LAMEA Other Application Market by Country, 2021 - 2024, USD Million

TABLE 51 LAMEA Other Application Market by Country, 2025 - 2032, USD Million

TABLE 52 LAMEA Video As A Sensor Market by Country, 2021 - 2024, USD Million

TABLE 53 LAMEA Video As A Sensor Market by Country, 2025 - 2032, USD Million

TABLE 54 Brazil Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 55 Brazil Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 56 Brazil Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 57 Brazil Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 58 Brazil Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 59 Brazil Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 60 Brazil Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 61 Brazil Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 62 Brazil Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 63 Brazil Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 64 Argentina Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 65 Argentina Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 66 Argentina Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 67 Argentina Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 68 Argentina Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 69 Argentina Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 70 Argentina Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 71 Argentina Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 72 Argentina Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 73 Argentina Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 74 UAE Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 75 UAE Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 76 UAE Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 77 UAE Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 78 UAE Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 79 UAE Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 80 UAE Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 81 UAE Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 82 UAE Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 83 UAE Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 84 Saudi Arabia Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 85 Saudi Arabia Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 86 Saudi Arabia Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 87 Saudi Arabia Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 88 Saudi Arabia Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 89 Saudi Arabia Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 90 Saudi Arabia Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 91 Saudi Arabia Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 92 Saudi Arabia Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 93 Saudi Arabia Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 94 South Africa Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 95 South Africa Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 96 South Africa Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 97 South Africa Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 98 South Africa Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 99 South Africa Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 100 South Africa Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 101 South Africa Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 102 South Africa Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 103 South Africa Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 104 Nigeria Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 105 Nigeria Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 106 Nigeria Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 107 Nigeria Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 108 Nigeria Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 109 Nigeria Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 110 Nigeria Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 111 Nigeria Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 112 Nigeria Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 113 Nigeria Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 114 Rest of LAMEA Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 115 Rest of LAMEA Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 116 Rest of LAMEA Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 117 Rest of LAMEA Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 118 Rest of LAMEA Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 119 Rest of LAMEA Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 120 Rest of LAMEA Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 121 Rest of LAMEA Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 122 Rest of LAMEA Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 123 Rest of LAMEA Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 124 Key Information – Axis Communications AB

TABLE 125 Key Information – Motorola Solutions, Inc.

TABLE 126 Key Information – Hangzhou Hikvision Digital Technology Co., Ltd.

TABLE 127 Key Information – Bosch Sicherheitssysteme GmbH

TABLE 128 Key Information – Zhejiang Dahua Technology Co., Ltd.

TABLE 129 Key Information – Sony Semiconductor Solutions Corporation

TABLE 130 Key Information – Honeywell International, Inc.

TABLE 131 Key Information – Johnson Controls International PLC

TABLE 132 Key Information – OmniVision Technologies, Inc.

TABLE 133 Key Information – i-PRO Co., Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 LAMEA Video As A Sensor Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting in LAMEA Video As A Sensor Market

FIG 4 Market Consolidation Analysis

FIG 5 Product Life Cycle Analysis - Video as a Sensor Market

FIG 6 KBV Cardinal Matrix

FIG 7 Market Share Analysis, 2024

FIG 8 Key Leading Strategies: Percentage Distribution (2021-2025)

FIG 9 Key Strategic Move: (Product Launches and Product Expansions: 2021, Feb – 2025, Jun) Leading Players

FIG 10 Porter’s Five Forces Analysis – Video As A Sensor Market

FIG 11 Value Chain Analysis of Video As A Sensor Market

FIG 12 Key Customer Criteria – LAMEA Video As A Sensor Market

FIG 13 LAMEA Video As A Sensor Market share by Offering, 2024

FIG 14 LAMEA Video As A Sensor Market share by Offering, 2032

FIG 15 LAMEA Video As A Sensor Market by Offering, 2021 - 2032, USD Million

FIG 16 LAMEA Video As A Sensor Market share by Product, 2024

FIG 17 LAMEA Video As A Sensor Market share by Product, 2032

FIG 18 LAMEA Video As A Sensor Market by Product, 2021 - 2032, USD Million

FIG 19 LAMEA Video As A Sensor Market share by End-Use, 2024

FIG 20 LAMEA Video As A Sensor Market share by End-Use, 2032

FIG 21 LAMEA Video As A Sensor Market by End-Use, 2021 - 2032, USD Million

FIG 22 LAMEA Video As A Sensor Market share by Application, 2024

FIG 23 LAMEA Video As A Sensor Market share by Application, 2032

FIG 24 LAMEA Video As A Sensor Market by Application, 2021 - 2032, USD Million

FIG 25 LAMEA Video As A Sensor Market share by Country, 2024

FIG 26 LAMEA Video As A Sensor Market share by Country, 2032

FIG 27 LAMEA Video As A Sensor Market by Country, 2021 - 2032, USD Million

FIG 28 Recent strategies and developments: Axis Communications AB

FIG 29 SWOT Analysis: Axis Communications AB

FIG 30 Recent strategies and developments: Motorola Solutions, Inc.

FIG 31 Swot Analysis: Motorola Solutions, Inc.

FIG 32 Recent strategies and developments: Hangzhou Hikvision Digital Technology Co., Ltd.

FIG 33 SWOT Analysis: Hangzhou Hikvision Digital Technology Co., Ltd.

FIG 34 Recent strategies and developments: Bosch Sicherheitssysteme GmbH

FIG 35 SWOT Analysis: Zhejiang Dahua Technology Co., Ltd.

FIG 36 SWOT Analysis: Honeywell international, inc.

FIG 37 SWOT Analysis: Johnson Controls International PLC

FIG 38 SWOT Analysis: OmniVision Technologies, Inc.