LAMEA C4ISR Market Size, Share & Industry Analysis Report By Type (New Installation, and Retrofit), By Vertical (Defense & Military, Government, and Commercial), By End Use (Air, Naval, Ground, and Space), By Application, By Component (Hardware, Software, and Services), By Country and Growth Forecast, 2025 - 2032

Published Date : 29-Jul-2025 |

Pages: 202 |

Report Format: PDF + Excel |

COVID-19 Impact on the LAMEA C4ISR Market

The Latin America, Middle East and Africa C4ISR Market would witness market growth of 5.3% CAGR during the forecast period (2025-2032).

The Saudi Arabia market dominated the LAMEA C4ISR Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $6,604.8 Million by 2032. The Argentina market is showcasing a CAGR of 7.2% during (2025 - 2032). Additionally, The UAE market would register a CAGR of 4.5% during (2025 - 2032).

The LAMEA (Latin America, Middle East, and Africa) C4ISR market has changed a lot in the last twenty years. This happened because of growing political tensions, safety problems inside countries, and efforts to make their defense forces better. In the past, many countries in this region mostly used old defense methods and depended a lot on other countries for intelligence and communication systems. Now, they are trying to build stronger and smarter systems on their own.

Free Valuable Insights: The Worldwide C4ISR Market is Projected to reach USD 181.49 Billion by 2032, at a CAGR of 4.7%

Growing Investments in Digital Defense

- Countries like Brazil, Saudi Arabia, South Africa, and the UAE are putting a lot of money into digital defense systems.

- Brazil has made its border watching stronger along the Amazon by using radar and flying ISR systems.

- The UAE is working on new command centers that can bring in live data and help make quick choices.

Role of New Technology

- New tools like better communication satellites are helping defense work better.

- Unmanned drones are being used more for watching and gathering information.

- Stronger cyber defense steps are also shaping how this market is growing.

Market Trends:

1. Integration of Artificial Intelligence (AI) and Machine Learning (ML) into C4ISR Systems

In the LAMEA region, armies and defense groups are using AI and machines increasingly learning to make better choices and handle important C4ISR tasks faster. AI tools help look through huge amounts of ISR data, like video, sensors, and satellite images, much quicker than people can do by hand. For example, AI programs can find patterns and spot anything strange right away, which helps guess threats and plan. Countries like the UAE are leading the way by using AI in their defense plans, with groups like the EDGE Group putting money into self-working and AI-based military systems. These new ideas help plan missions, check threats in real time, and make better command choices with less help from people.

2. Rising Emphasis on Cybersecurity in Military Networks

As defense systems in the LAMEA region become more digital, keeping C4ISR systems safe from cyber-attacks has become very important. Countries like Saudi Arabia, Brazil, and South Africa are making their defense networks better, but they now worry more about data leaks, hacking, and electronic attacks. So, governments are spending more money on strong data locks, cyber safety tools, and safe network setups. Armies are also training special cyber teams and setting up groups that only handle cybersecurity. The main goal is to keep data safe when it moves between command centers, moving units, and unmanned systems, especially during big joint missions.

State of Competition:

The LAMEA (Latin America, Middle East, and Africa) region is seeing big changes in its defense and security setup because of rising threats, local fights, border safety needs, and the tough nature of modern battles. Because of this, the C4ISR market in LAMEA has become very important to help armies stay ready and strong. Countries here now depend more on real-time information, strong cyber safety, and better teamwork between defense tools. All this shows how important C4ISR systems are for the region’s plan to make their military better and safer.

1. Presence of Global Defense Majors with Strategic Partnerships

The LAMEA C4ISR market is mostly shaped by big global defense companies like Lockheed Martin, BAE Systems, Thales Group, Leonardo, and Northrop Grumman. These companies bring smart technology and strong know-how, giving full C4ISR solutions to many governments in this region. Because buying defense tools can be tricky and politics play a part, these big companies often team up with local companies to win deals. For example, Thales has worked closely with defense groups in the UAE and Saudi Arabia to build local skills and make sure their systems work well with old ones. This way, they can enter the market and also meet special local rules that are common in the Middle East.

2. Growing Role of Indigenous Defense Firms and Sovereign Capabilities

The LAMEA C4ISR market is strongly shaped by big global defense companies like Lockheed Martin, BAE Systems, Thales Group, Leonardo, and Northrop Grumman. These companies bring in new technology and strong know-how, giving full C4ISR solutions to many governments in the region. Because buying defense systems can be tricky and involves politics, these global companies often join hands with local companies to win deals. For example, Thales has worked with defense groups in the UAE and Saudi Arabia to build local skills and make sure their systems work well with what is already there. This plan not only helps them enter the market but also meets local rules that are common in the Middle East.

Type Outlook

Based on Type, the market is segmented into New Installation and Retrofit.

New Installation

The LAMEA C4ISR market is strongly shaped by big global defense companies like Lockheed Martin, BAE Systems, Thales Group, Leonardo, and Northrop Grumman. These companies bring in new technology and years of experience, giving full C4ISR solutions to many governments in the area. Because buying defense tools can be tricky and depends on politics, these big companies often work together with local firms to win deals. For example, Thales has teamed up with defense groups in the UAE and Saudi Arabia to build local skills and make sure their systems work well with old ones. This way, they can enter the market more easily and meet rules that need them to create local jobs, which is common in the Middle East.

In 2024, Saudi Arabia and the United Arab Emirates (UAE) were two of the biggest supporters of this area, matching their Vision 2030 plans to make their defense work better. Saudi Arabia worked with big defense companies like Lockheed Martin and BAE Systems to set up new air defense and battle communication centers. At the same time, EDGE Group in the UAE kept showing new home-made C4ISR systems. These new systems are mostly used to watch borders and keep cities safe.

Retrofit

The Retrofit part means improving or adding new technology to old C4ISR systems. This can include changing old analog communication to digital, adding AI to surveillance tools, or upgrading old radar systems with real-time data and encryption. Retrofitting helps countries update their systems step by step without needing to replace everything, which is useful for those with limited money or resources.

In 2024, South Africa started several projects to update its old radar and communication systems that were first used in the 1990s. Local companies like Reutech Communications took the lead in updating airbase control centers with new digital voice and data radios, along with better tactical communication tools. The South African Navy also began upgrading the ISR systems on its MEKO-class ships by adding modern electro-optical sensors and improved communication equipment.

Vertical Outlook

Based on Vertical, the market is segmented into Defense & Military, Government, and Commercial.

1. Defense & Military

The Defense & Military part is the main reason why C4ISR is being used more in LAMEA. Countries in this area are using better command and control systems, real-time information gathering, and different types of surveillance to fight both regular and unusual threats. From stopping missiles to fighting against rebels, C4ISR tools are very important for important military actions.

In 2024, Saudi Arabia and the United Arab Emirates spent the most on defense in the region, focusing on building their own full-range ISR systems. The UAE’s EDGE Group, for example, introduced a set of AI-powered ISR drones and communication tools for the battlefield through its HALCON and SIGNAL teams. Saudi Arabia kept growing its National Defense C4I Center to help its air, land, and navy forces work better together. These projects also involved working with international companies like Lockheed Martin, Northrop Grumman, and Leonardo.

2. Government

The Government sector mainly covers public safety, border protection, disaster help, intelligence, and homeland security work. C4ISR tools are now being used more by interior ministries, national police, and disaster teams to watch in real time, share information between groups, and keep an eye on possible threats.

For example, Brazil’s Ministry of Justice set up a system with surveillance towers, satellite images, and central command centers to watch for illegal border crossings and environmental crimes in the Amazon. This system, called SIPAM (Amazon Protection System), is run by the government but uses C4ISR technology that allows easy sharing of information with the military when needed.

End Use Outlook

Based on End Use, the market is segmented into Air, Naval, Ground, and Space.

Air Segment

The air segment continues to play a central role in the deployment of C4ISR technologies, with regional air forces and allied defense organizations prioritizing aerial superiority and situational awareness. Nations such as the United Arab Emirates and Saudi Arabia have invested significantly in airborne early warning and control systems (AWACS) and real-time surveillance assets.

For instance, Leonardo supplied its Falcon Shield counter-drone system and Skyward-G electronic support measures to enhance aerial defense capabilities in Middle Eastern countries.

Naval Segment

Maritime security challenges in the Gulf of Guinea, the Red Sea, and the Persian Gulf have heightened demand for C4ISR applications in the naval domain. LAMEA’s coastal nations are modernizing naval fleets to counter piracy, smuggling, and regional disputes.

Brazil’s Navy collaborated with Embraer and Atech to develop integrated naval command systems that link onboard sensors with national maritime surveillance networks.

Application Outlook

Based on Application, the market is segmented into Intelligence, Surveillance and Reconnaissance (ISR), Command & Control, Communications, Electronic Warfare, and Computers.

1. Intelligence, Surveillance and Reconnaissance (ISR)

ISR is the backbone of any modern defense strategy, providing real-time situational awareness through data gathering, processing, and dissemination. In the LAMEA region, countries like the UAE, Saudi Arabia, and South Africa have strengthened ISR capabilities to monitor vast borders and maritime zones.

Example:

Israel Aerospace Industries (IAI) supplies advanced ISR drones like the Heron TP to multiple countries.

2. Command & Control

Command & Control (C2) systems are vital for managing operations, coordinating units, and executing missions effectively. Governments across LAMEA are modernizing their C2 infrastructure to enable network-centric warfare.

Example:

In 2024, Thales Group upgraded the Saudi Arabian National Guard’s command centers with its Command & Control Integrated System (CCIS) to enhance border and urban security operations.

Component Outlook

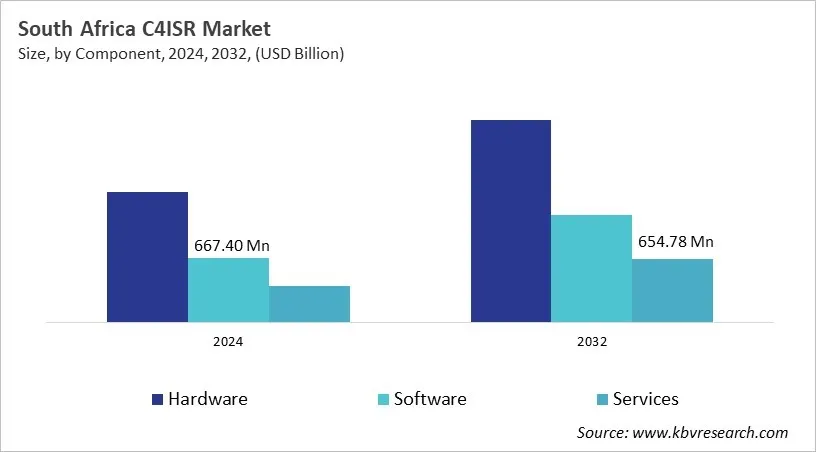

Based on Component, the market is segmented into Hardware, Software, and Services.

Hardware

The Hardware part is the top in the LAMEA C4ISR market because countries like Saudi Arabia, the UAE, Brazil, and South Africa are working hard to update their defense systems. These countries are spending a lot of money on buying new communication and surveillance equipment, such as radar systems, drones, ground radars, and tough computers. For example, Brazil is improving its border security with the SISFRON program, which invests a lot in communication tools, sensors, and command centers.

Software

Software is becoming more and more important for making different systems work together and helping different areas coordinate in C4ISR setups. Although hardware has a bigger share in the market, software is growing fast because it uses new tools like artificial intelligence (AI), machine learning (ML), and ways to combine data. New AI systems that find threats and tools that use location data are changing how leaders make decisions in the LAMEA region.

Companies like Rafael Advanced Defense Systems have created software that combines information from different places, helping to predict and improve air and missile defense.

List of Key Companies Profiled

- Axis Communications AB (Canon, Inc.)

- Motorola Solutions, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Bosch Sicherheitssysteme GmbH (Robert Bosch GmbH)

- Zhejiang Dahua Technology Co., Ltd.

- Sony Semiconductor Solutions Corporation (Sony Corporation)

- Honeywell International Inc.

- Johnson Controls International PLC

- OmniVision Technologies, Inc.

- i-PRO Co., Ltd.

LAMEA C4ISR Market Report Segmentation

By Type

- New Installation

- Retrofit

By Vertical

- Defense & Military

- Government

- Commercial

By End Use

- Air

- Naval

- Ground

- Space

By Application

- Intelligence, Surveillance and Reconnaissance (ISR)

- Command & Control

- Communications

- Electronic Warfare

- Computers

By Component

- Hardware

- Software

- Services

By Country

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 LAMEA C4ISR Market, by Type

1.4.2 LAMEA C4ISR Market, by Vertical

1.4.3 LAMEA C4ISR Market, by End Use

1.4.4 LAMEA C4ISR Market, by Application

1.4.5 LAMEA C4ISR Market, by Component

1.4.6 LAMEA C4ISR Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.2 Key Influencing Factors

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Market Trends - LAMEA C4ISR Market

Chapter 5. State of Competition: LAMEA C4ISR Market

Chapter 6. Competition Analysis - Global

6.1 KBV Cardinal Matrix

6.2 Recent Industry Wide Strategic Developments

6.2.1 Partnerships, Collaborations and Agreements

6.2.2 Product Launches and Product Expansions

6.2.3 Acquisition and Mergers

6.2.4 Geographical Expansion

6.3 Market Share Analysis, 2024

6.4 Top Winning Strategies

6.4.1 Key Leading Strategies: Percentage Distribution (2021-2025)

6.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2021, Sep – 2025, Jun) Leading Players

6.5 Porter Five Forces Analysis

Chapter 7. Value Chain Analysis of C4ISR Market

7.1 Research & Development (R&D)

7.2 Component Manufacturing

7.3 System Integration

7.4 Deployment & Installation

7.5 Operation & Maintenance

7.6 End-User Services & Feedback Loop

Chapter 8. Key Customer Criteria: C4ISR Market

Chapter 9. Market Consolidation Analysis – Global C4ISR Market

Chapter 10. LAMEA C4ISR Market by Type

10.1 LAMEA New Installation Market by Country

10.2 LAMEA Retrofit Market by Country

Chapter 11. LAMEA C4ISR Market by Vertical

11.1 LAMEA Defense & Military Market by Country

11.2 LAMEA Government Market by Country

11.3 LAMEA Commercial Market by Country

Chapter 12. LAMEA C4ISR Market by End Use

12.1 LAMEA Air Market by Country

12.2 LAMEA Naval Market by Country

12.3 LAMEA Ground Market by Country

12.4 LAMEA Space Market by Country

Chapter 13. LAMEA C4ISR Market by Application

13.1 LAMEA Intelligence, Surveillance and Reconnaissance (ISR) Market by Country

13.1.1.1 LAMEA Command & Control Market by Country

13.2 LAMEA Communications Market by Country

13.3 LAMEA Electronic Warfare Market by Country

13.4 LAMEA Computers Market by Country

Chapter 14. LAMEA C4ISR Market by Component

14.1 LAMEA Hardware Market by Country

14.2 LAMEA Software Market by Country

14.3 LAMEA Services Market by Country

Chapter 15. LAMEA C4ISR Market by Country

15.1 Saudi Arabia C4ISR Market

15.1.1 Saudi Arabia C4ISR Market by Type

15.1.2 Saudi Arabia C4ISR Market by Vertical

15.1.3 Saudi Arabia C4ISR Market by End Use

15.1.4 Saudi Arabia C4ISR Market by Application

15.1.5 Saudi Arabia C4ISR Market by Component

15.2 Argentina C4ISR Market

15.2.1 Argentina C4ISR Market by Type

15.2.2 Argentina C4ISR Market by Vertical

15.2.3 Argentina C4ISR Market by End Use

15.2.4 Argentina C4ISR Market by Application

15.2.5 Argentina C4ISR Market by Component

15.3 UAE C4ISR Market

15.3.1 UAE C4ISR Market by Type

15.3.2 UAE C4ISR Market by Vertical

15.3.3 UAE C4ISR Market by End Use

15.3.4 UAE C4ISR Market by Application

15.3.5 UAE C4ISR Market by Component

15.4 Brazil C4ISR Market

15.4.1 Brazil C4ISR Market by Type

15.4.2 Brazil C4ISR Market by Vertical

15.4.3 Brazil C4ISR Market by End Use

15.4.4 Brazil C4ISR Market by Application

15.4.5 Brazil C4ISR Market by Component

15.5 South Africa C4ISR Market

15.5.1 South Africa C4ISR Market by Type

15.5.2 South Africa C4ISR Market by Vertical

15.5.3 South Africa C4ISR Market by End Use

15.5.4 South Africa C4ISR Market by Application

15.5.5 South Africa C4ISR Market by Component

15.6 Nigeria C4ISR Market

15.6.1 Nigeria C4ISR Market by Type

15.6.2 Nigeria C4ISR Market by Vertical

15.6.3 Nigeria C4ISR Market by End Use

15.6.4 Nigeria C4ISR Market by Application

15.6.5 Nigeria C4ISR Market by Component

15.7 Rest of LAMEA C4ISR Market

15.7.1 Rest of LAMEA C4ISR Market by Type

15.7.2 Rest of LAMEA C4ISR Market by Vertical

15.7.3 Rest of LAMEA C4ISR Market by End Use

15.7.4 Rest of LAMEA C4ISR Market by Application

15.7.5 Rest of LAMEA C4ISR Market by Component

Chapter 16. Company Profiles

16.1 Lockheed Martin Corporation

16.1.1 Company Overview

16.1.2 Financial Analysis

16.1.3 Segmental and Regional Analysis

16.1.4 Research & Development Expense

16.1.5 Recent strategies and developments:

16.1.5.1 Partnerships, Collaborations, and Agreements:

16.1.5.2 Acquisition and Mergers:

16.1.6 SWOT Analysis

16.2 Northrop Grumman Corporation

16.2.1 Company Overview

16.2.2 Financial Analysis

16.2.3 Segmental and Regional Analysis

16.2.4 Research & Development Expenses

16.2.5 Recent strategies and developments:

16.2.5.1 Partnerships, Collaborations, and Agreements:

16.2.6 SWOT Analysis

16.3 RTX Corporation

16.3.1 Company Overview

16.3.2 Financial Analysis

16.3.3 Segmental and Regional Analysis

16.3.4 Research & Development Expense

16.3.5 SWOT Analysis

16.4 BAE Systems PLC

16.4.1 Company Overview

16.4.2 Financial Analysis

16.4.3 Segmental and Regional Analysis

16.4.4 Research & Development Expenses

16.4.5 SWOT Analysis

16.5 General Dynamics Corporation

16.5.1 Company Overview

16.5.2 Financial Analysis

16.5.3 Segmental and Regional Analysis

16.5.4 Research & Development Expenses

16.5.5 SWOT Analysis

16.6 Thales Group S.A.

16.6.1 Company Overview

16.6.2 Financial Analysis

16.6.3 Segmental Analysis

16.6.4 Research & Development Expenses

16.6.5 Recent strategies and developments:

16.6.5.1 Partnerships, Collaborations, and Agreements:

16.6.5.2 Product Launches and Product Expansions:

16.6.6 SWOT Analysis

16.7 The Boeing Company

16.7.1 Company Overview

16.7.2 Financial Analysis

16.7.3 Segmental and Regional Analysis

16.7.4 Research & Development Expenses

16.7.5 SWOT Analysis

16.8 Leonardo SpA (Leonardo DRS, Inc.)

16.8.1 Company Overview

16.8.2 Financial Analysis

16.8.3 Segmental and Regional Analysis

16.8.4 Recent strategies and developments:

16.8.4.1 Partnerships, Collaborations, and Agreements:

16.8.4.2 Geographical Expansions:

16.8.5 SWOT Analysis

16.9 L3Harris Technologies, Inc.

16.9.1 Company Overview

16.9.2 Financial Analysis

16.9.3 Segmental and Regional Analysis

16.9.4 Recent strategies and developments:

16.9.4.1 Partnerships, Collaborations, and Agreements:

16.9.4.2 Product Launches and Product Expansions:

16.9.5 SWOT Analysis

16.10. Elbit Systems Ltd.

16.10.1 Company Overview

16.10.2 Financial Analysis

16.10.3 Segmental and Regional Analysis

16.10.4 Research & Development Expenses

16.10.5 Recent strategies and developments:

16.10.5.1 Product Launches and Product Expansions:

16.10.6 SWOT Analysis

TABLE 2 LAMEA C4ISR Market, 2025 - 2032, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– C4ISR Market

TABLE 4 Product Launches And Product Expansions– C4ISR Market

TABLE 5 Acquisition and Mergers– C4ISR Market

TABLE 6 Geographical Expansion– C4ISR Market

TABLE 7 Key Customer Criteria: C4ISR Market

TABLE 8 Key Parameters defining Market Consolidation:

TABLE 9 LAMEA C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 10 LAMEA C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 11 LAMEA New Installation Market by Country, 2021 - 2024, USD Million

TABLE 12 LAMEA New Installation Market by Country, 2025 - 2032, USD Million

TABLE 13 LAMEA Retrofit Market by Country, 2021 - 2024, USD Million

TABLE 14 LAMEA Retrofit Market by Country, 2025 - 2032, USD Million

TABLE 15 LAMEA C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 16 LAMEA C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 17 LAMEA Defense & Military Market by Country, 2021 - 2024, USD Million

TABLE 18 LAMEA Defense & Military Market by Country, 2025 - 2032, USD Million

TABLE 19 LAMEA Government Market by Country, 2021 - 2024, USD Million

TABLE 20 LAMEA Government Market by Country, 2025 - 2032, USD Million

TABLE 21 LAMEA Commercial Market by Country, 2021 - 2024, USD Million

TABLE 22 LAMEA Commercial Market by Country, 2025 - 2032, USD Million

TABLE 23 LAMEA C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 24 LAMEA C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 25 LAMEA Air Market by Country, 2021 - 2024, USD Million

TABLE 26 LAMEA Air Market by Country, 2025 - 2032, USD Million

TABLE 27 LAMEA Naval Market by Country, 2021 - 2024, USD Million

TABLE 28 LAMEA Naval Market by Country, 2025 - 2032, USD Million

TABLE 29 LAMEA Ground Market by Country, 2021 - 2024, USD Million

TABLE 30 LAMEA Ground Market by Country, 2025 - 2032, USD Million

TABLE 31 LAMEA Space Market by Country, 2021 - 2024, USD Million

TABLE 32 LAMEA Space Market by Country, 2025 - 2032, USD Million

TABLE 33 LAMEA C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 34 LAMEA C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 35 LAMEA Intelligence, Surveillance and Reconnaissance (ISR) Market by Country, 2021 - 2024, USD Million

TABLE 36 LAMEA Intelligence, Surveillance and Reconnaissance (ISR) Market by Country, 2025 - 2032, USD Million

TABLE 37 LAMEA Command & Control Market by Country, 2021 - 2024, USD Million

TABLE 38 LAMEA Command & Control Market by Country, 2025 - 2032, USD Million

TABLE 39 LAMEA Communications Market by Country, 2021 - 2024, USD Million

TABLE 40 LAMEA Communications Market by Country, 2025 - 2032, USD Million

TABLE 41 LAMEA Electronic Warfare Market by Country, 2021 - 2024, USD Million

TABLE 42 LAMEA Electronic Warfare Market by Country, 2025 - 2032, USD Million

TABLE 43 LAMEA Computers Market by Country, 2021 - 2024, USD Million

TABLE 44 LAMEA Computers Market by Country, 2025 - 2032, USD Million

TABLE 45 LAMEA C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 46 LAMEA C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 47 LAMEA Hardware Market by Country, 2021 - 2024, USD Million

TABLE 48 LAMEA Hardware Market by Country, 2025 - 2032, USD Million

TABLE 49 LAMEA Software Market by Country, 2021 - 2024, USD Million

TABLE 50 LAMEA Software Market by Country, 2025 - 2032, USD Million

TABLE 51 LAMEA Services Market by Country, 2021 - 2024, USD Million

TABLE 52 LAMEA Services Market by Country, 2025 - 2032, USD Million

TABLE 53 LAMEA C4ISR Market by Country, 2021 - 2024, USD Million

TABLE 54 LAMEA C4ISR Market by Country, 2025 - 2032, USD Million

TABLE 55 Saudi Arabia C4ISR Market, 2021 - 2024, USD Million

TABLE 56 Saudi Arabia C4ISR Market, 2025 - 2032, USD Million

TABLE 57 Saudi Arabia C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 58 Saudi Arabia C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 59 Saudi Arabia C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 60 Saudi Arabia C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 61 Saudi Arabia C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 62 Saudi Arabia C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 63 Saudi Arabia C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 64 Saudi Arabia C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 65 Saudi Arabia C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 66 Saudi Arabia C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 67 Argentina C4ISR Market, 2021 - 2024, USD Million

TABLE 68 Argentina C4ISR Market, 2025 - 2032, USD Million

TABLE 69 Argentina C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 70 Argentina C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 71 Argentina C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 72 Argentina C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 73 Argentina C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 74 Argentina C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 75 Argentina C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 76 Argentina C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 77 Argentina C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 78 Argentina C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 79 UAE C4ISR Market, 2021 - 2024, USD Million

TABLE 80 UAE C4ISR Market, 2025 - 2032, USD Million

TABLE 81 UAE C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 82 UAE C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 83 UAE C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 84 UAE C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 85 UAE C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 86 UAE C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 87 UAE C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 88 UAE C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 89 UAE C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 90 UAE C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 91 Brazil C4ISR Market, 2021 - 2024, USD Million

TABLE 92 Brazil C4ISR Market, 2025 - 2032, USD Million

TABLE 93 Brazil C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 94 Brazil C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 95 Brazil C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 96 Brazil C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 97 Brazil C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 98 Brazil C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 99 Brazil C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 100 Brazil C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 101 Brazil C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 102 Brazil C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 103 South Africa C4ISR Market, 2021 - 2024, USD Million

TABLE 104 South Africa C4ISR Market, 2025 - 2032, USD Million

TABLE 105 South Africa C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 106 South Africa C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 107 South Africa C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 108 South Africa C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 109 South Africa C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 110 South Africa C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 111 South Africa C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 112 South Africa C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 113 South Africa C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 114 South Africa C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 115 Nigeria C4ISR Market, 2021 - 2024, USD Million

TABLE 116 Nigeria C4ISR Market, 2025 - 2032, USD Million

TABLE 117 Nigeria C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 118 Nigeria C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 119 Nigeria C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 120 Nigeria C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 121 Nigeria C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 122 Nigeria C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 123 Nigeria C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 124 Nigeria C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 125 Nigeria C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 126 Nigeria C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 127 Rest of LAMEA C4ISR Market, 2021 - 2024, USD Million

TABLE 128 Rest of LAMEA C4ISR Market, 2025 - 2032, USD Million

TABLE 129 Rest of LAMEA C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 130 Rest of LAMEA C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 131 Rest of LAMEA C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 132 Rest of LAMEA C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 133 Rest of LAMEA C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 134 Rest of LAMEA C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 135 Rest of LAMEA C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 136 Rest of LAMEA C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 137 Rest of LAMEA C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 138 Rest of LAMEA C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 139 Key Information – Lockheed Martin Corporation

TABLE 140 Key Information – Northrop Grumman Corporation

TABLE 141 Key Information – RTX Corporation

TABLE 142 Key Information – BAE Systems PLC

TABLE 143 Key Information – General Dynamics Corporation

TABLE 144 Key Information – Thales Group S.A.

TABLE 145 Key Information – The Boeing Company

TABLE 146 Key information – Leonardo SpA

TABLE 147 Key information – L3Harris Technologies, Inc.

TABLE 148 Key Information – Elbit Systems Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 LAMEA C4ISR Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting LAMEA C4ISR Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2024

FIG 6 Key Leading Strategies: Percentage Distribution (2021-2025)

FIG 7 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2021, sep – 2025, Jun) Leading Players

FIG 8 Porter’s Five Forces Analysis – C4ISR Market

FIG 9 Value Chain Analysis of C4ISR Market

FIG 10 Key Customer Criteria: C4ISR Market

FIG 11 Market Consolidation Analysis – Global C4ISR Market

FIG 12 LAMEA C4ISR Market share by Type, 2024

FIG 13 LAMEA C4ISR Market share by Type, 2032

FIG 14 LAMEA C4ISR Market by Type, 2021 - 2032, USD Million

FIG 15 LAMEA C4ISR Market by Vertical, 2024

FIG 16 LAMEA C4ISR Market by Vertical, 2032

FIG 17 LAMEA C4ISR Market by Vertical, 2021 - 2032, USD Million

FIG 18 LAMEA C4ISR Market share by End Use, 2024

FIG 19 LAMEA C4ISR Market share by End Use, 2032

FIG 20 LAMEA C4ISR Market by End Use, 2021 - 2032, USD Million

FIG 21 LAMEA C4ISR Market share by Application, 2024

FIG 22 LAMEA C4ISR Market share by Application, 2032

FIG 23 LAMEA C4ISR Market by Application, 2021 - 2032, USD Million

FIG 24 LAMEA C4ISR Market share by Component, 2024

FIG 25 LAMEA C4ISR Market by Component, 2032

FIG 26 LAMEA C4ISR Market by Component, 2021 - 2032, USD Million

FIG 27 LAMEA C4ISR Market share by Country, 2024

FIG 28 LAMEA C4ISR Market share by Country, 2032

FIG 29 LAMEA C4ISR Market by Country, 2021 - 2032, USD Million

FIG 30 Recent strategies and developments: Lockheed Martin Corporation

FIG 31 SWOT Analysis: Lockheed Martin Corporation

FIG 32 SWOT Analysis: Northrop Grumman Corporation

FIG 33 SWOT Analysis: RTX Corporation

FIG 34 SWOT Analysis: BAE SYSTEMS PLC

FIG 35 SWOT Analysis: General Dynamics Corporation

FIG 36 Recent strategies and developments: Thales Group S.A.

FIG 37 SWOT Analysis: Thales Group S.A.

FIG 38 SWOT Analysis: The Boeing Company

FIG 39 Recent strategies and developments: Leonardo SpA

FIG 40 SWOT Analysis: Leonardo SpA

FIG 41 Recent strategies and developments: L3Harris Technologies, Inc.

FIG 42 SWOT Analysis: L3Harris Technologies, Inc.

FIG 43 SWOT Analysis: Elbit Systems Ltd.