Japan Toaster Market Size, Share & Trends Analysis Report By Product (Pop-up, Conveyor, and Oven), By Distribution Channel (Offline, and Online), By Application (Residential, and Commercial), and Forecast, 2023 - 2032

Published Date : 22-Apr-2024 | Pages: 80 | Formats: PDF |

COVID-19 Impact on the Japan Toaster Market

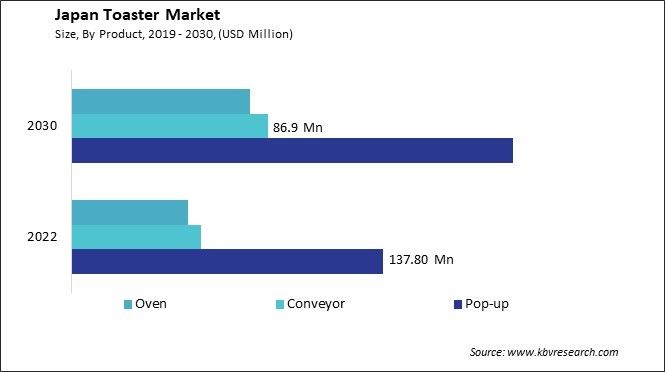

The Japan Toaster Market size is expected to reach $360.8 Million by 2030, rising at a market growth of 5.0% CAGR during the forecast period. In the year 2022, the market attained a volume of 2769.7 thousand units, experiencing a growth of 5.0% (2019-2022).

The toaster market in Japan has undergone significant evolution over the years, reflecting consumers' changing lifestyles and preferences. Toasters, once considered a luxury item, have become common in Japanese households. The industry is characterized by diverse products catering to various consumer needs and preferences. While the toaster market in Japan has shown resilience and adaptability, the COVID-19 pandemic has inevitably left its mark. The e-commerce sector has experienced significant changes due to the pandemic. As lockdowns and social distancing measures became prevalent, consumers turned to online shopping to fulfill their needs, including kitchen appliances like toasters.

The e-commerce landscape in Japan has witnessed a notable uptick in toaster sales during the pandemic. With the convenience of doorstep delivery and the necessity of minimizing physical contact, online platforms have become a preferred channel for purchasing household appliances. E-commerce retailers have responded by enhancing their product listings, providing detailed specifications, and implementing user-friendly interfaces to facilitate smooth online transactions.

According to the International Trade Administration, in 2021, the e-commerce sector witnessed a notable growth of 8.6% in sales of goods, reaching a total industry valuation of USD 188.1 billion in Japan. This represents a substantial increase of 32.2% compared to the pre-COVID year 2019. To draw a parallel, the surge in the toaster market in Japan mirrored this upward trend, experiencing a commendable rise in sales during the same period.

Market Trends

Rising popularity of conveyor toasters in Japan

Japan has witnessed a significant rise in the conveyor toaster market in recent years, reflecting a growing trend in the country's culinary landscape. Japanese consumers are known for their appreciation of efficiency and precision, which is mirrored in the popularity of conveyor toasters. These devices offer a seamless and automated toasting experience, aligning with Japan's commitment to convenience in daily life. The fast-paced lifestyle in urban areas and a strong work ethic have elevated the demand for quick and efficient kitchen appliances, making conveyor toasters an ideal choice for busy households and commercial kitchens alike.

Moreover, the conveyor toaster market in Japan has seen a surge due to the country's vibrant food culture. Toast, or "tōsuto" as it is known locally, holds a special place in Japanese breakfast traditions. With a conveyor toaster, individuals and businesses can effortlessly produce consistent and perfectly toasted slices, meeting the high standards set by Japanese culinary enthusiasts.

Japanese technology companies have also played a crucial role in driving the conveyor toaster market. Innovations in design, energy efficiency, and user-friendly interfaces have made these appliances particularly appealing to the tech-savvy Japanese consumer. Integrating smart features and advanced controls aligns with Japan's reputation as a tech-forward nation.

Furthermore, the rise in the use of conveyor toasters in Japan is wider than residential usage. The hospitality and food service industry has embraced this trend, with many hotels, restaurants, and institutional incorporating conveyor toasters into their kitchen setups to meet the demand for efficiently prepared and consistently toasted bread.

According to the U.S. Department of Agriculture, in 2020, the total sales for of the hotel, restaurant and institutional (HRI) food service industry amounted to JP¥25,517 billion (US$239.1 billion). This growth mirrors the rising popularity of conveyor toasters within Japan's culinary landscape. Therefore, the surge in the conveyor toaster market in Japan can be attributed to a combination of cultural preferences, a fast-paced lifestyle, and the integration of cutting-edge technology.

Adoption of breakfast culture among households

Japan is witnessing a remarkable surge in the adoption of breakfast culture, significantly impacting the toaster market. Traditionally, Japanese breakfasts were characterized by rice, miso soup, and pickled vegetables, with the toaster playing a minimal role in the culinary landscape. However, evolving lifestyles, increased exposure to Western influences, and a growing focus on convenience have led to a paradigm shift in breakfast habits.

The rising popularity of western-style breakfast items such as toast, bagels, and pastries has driven the demand for toasters across Japanese households. Urbanization and the fast-paced nature of modern life have contributed to the preference for quick and easy breakfast options, making toasters a vital kitchen appliance. Families are now embracing the simplicity and efficiency of toasters to prepare toasted bread, sandwiches, and other breakfast delights.

Moreover, the emergence of diverse toaster models tailored to meet the specific needs of Japanese consumers has fueled this trend. Manufacturers in the Japanese toaster market focus on innovation and product differentiation to cater to consumers' evolving preferences, seeking efficiency without compromising taste. The cultural significance of breakfast in Japan has also played a role in the growing adoption of toasters. Breakfast is increasingly seen as a shared family experience, fostering a sense of togetherness before the day begins.

Toasters have seamlessly integrated into this cultural shift, symbolizing modern breakfast rituals in Japanese households. Thus, the rising adoption of breakfast culture in Japan has spurred a notable increase in the demand for toasters. The intersection of convenience, changing lifestyles, and a cultural shift towards diverse breakfast options has transformed the toaster market, making it an integral part of Japanese kitchens and morning routines.

Competition Analysis

Japan's toaster market is a thriving industry characterized by a blend of traditional craftsmanship and cutting-edge technology. One of the key players in the Japanese toaster market is Panasonic. Panasonic is a well-established electronics brand with a strong presence in households across Japan. The company's toasters are known for their reliability and functionality. Panasonic offers a variety of toasters, including compact models for smaller kitchens and high-tech toasters with features like variable browning control and reheat functions.

Tiger Corporation is another prominent player in the Japanese toaster market. The company's toasters often feature unique designs and advanced toasting technologies, catering to consumers who prioritize functionality and aesthetics. Similarly, Zojirushi, a Japanese brand with a global presence, is recognized for its high-quality kitchen appliances, including toasters. The company’s toasters are celebrated for their precision and consistency in toasting. The brand incorporates innovative heating elements and temperature control mechanisms into its toasters, ensuring an even and perfect toast every time.

Toshiba, a diversified conglomerate, is actively engaged in the toaster market in Japan. Toshiba's toasters are designed with a focus on energy efficiency and user convenience. The company offers a range of toasters with features such as wide slots, multiple toasting options, and easy-to-clean designs. Toshiba's commitment to incorporating eco-friendly features resonates well with environmentally conscious consumers.

Japanese consumers also appreciate the craftsmanship and attention to detail offered by boutique brands like Balmuda. The company’s toasters are renowned for their minimalist design and advanced technology. The brand often integrates unique features, such as steam toasting, which helps to achieve a crispy exterior while maintaining the bread's moisture inside. Balmuda's toasters are sought after by consumers who appreciate a blend of innovation and aesthetics.

Emerging players like De'Longhi have made strides in the Japanese toaster market in recent years. The company has gained popularity for its stylish and functional toasters. The brand’s offerings often include toasters with various toasting options, including bagel and defrost settings. De'Longhi's commitment to blending Italian design with technological excellence appeals to consumers seeking a touch of European flair in their kitchen appliances. These companies contribute to the industry’s vibrancy by offering a wide array of toasters catering to the unique demands of Japanese consumers who value functionality and design in their kitchen appliances.

List of Key Companies Profiled

- Panasonic Holdings Corporation

- LG Electronics, Inc. (LG Corporation)

- Samsung Electronics Co., Ltd. (Samsung Group)

- Haier Smart Home Co., Ltd. (Haier Group Corporation)

- Hisense International Co., Ltd.

- Breville Group Limited

- Koninklijke Philips N.V.

- Dualit Ltd

- Hamilton Beach Brands, Inc. (Hamilton Beach Brands Holding Company)

- Whirlpool Corporation

Japan Toaster Market Report Segmentation

By Product

- Pop-up

- Conveyor

- Oven

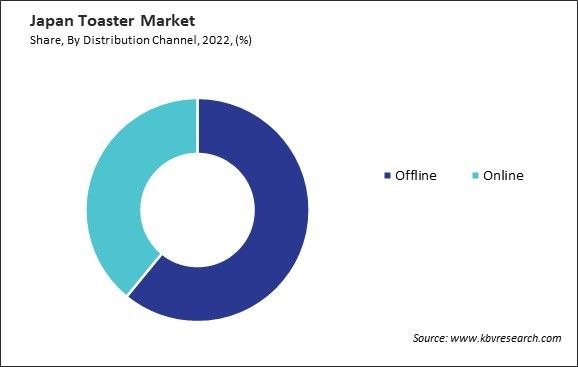

By Distribution Channel

- Offline

- Online

By Application

- Residential

- Commercial

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Toaster Market, by Product

1.4.2 Japan Toaster Market, by Distribution Channel

1.4.3 Japan Toaster Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.1 Market Trends

2.3 Porter Five Forces Analysis

Chapter 3. Strategies Deployed in Toaster Market

Chapter 4. Japan Toaster Market

4.1 Japan Toaster Market, By Product

4.2 Japan Toaster Market, By Distribution Channel

4.3 Japan Toaster Market, By Application

Chapter 5. Company Profiles – Global Leaders

5.1 Panasonic Holdings Corporation

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 Recent strategies and developments:

5.1.5.1 Partnerships, Collaborations, and Agreements:

5.1.6 SWOT Analysis

5.2 LG Electronics, Inc. (LG Corporation)

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Regional & Segmental Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Partnerships, Collaborations, and Agreements:

5.2.5.2 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 Samsung Electronics Co., Ltd. (Samsung Group)

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 SWOT Analysis

5.4 Haier Smart Home Co., Ltd. (Haier Group Corporation)

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expense

5.4.5 SWOT Analysis

5.5 Hisense International Co., Ltd.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Regional Analysis

5.5.4 SWOT Analysis

5.6 Breville Group Limited

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Recent strategies and developments:

5.6.4.1 Acquisition and Mergers:

5.6.5 SWOT Analysis

5.7 Koninklijke Philips N.V.

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expense

5.7.5 SWOT Analysis

5.8 Dualit Ltd

5.8.1 Company Overview

5.8.2 Recent strategies and developments:

5.8.2.1 Product Launches and Product Expansions:

5.8.3 SWOT Analysis

5.9 Hamilton Beach Brands, Inc. (Hamilton Beach Brands Holding Company)

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Product and Regional Analysis

5.9.4 Regional Analysis

5.9.5 SWOT Analysis

5.1 Whirlpool Corporation

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Regional Analysis

5.10.4 Research & Development Expense

5.10.5 SWOT Analysis

TABLE 2 Japan Toaster Market, 2023 - 2030, USD Million

TABLE 3 Japan Toaster Market, 2019 - 2022, ThoUSnd Units

TABLE 4 Japan Toaster Market, 2023 - 2030, ThoUSnd Units

TABLE 5 Japan Toaster Market, By Product, 2019 - 2022, USD Million

TABLE 6 Japan Toaster Market, By Product, 2023 - 2030, USD Million

TABLE 7 Japan Toaster Market, By Product, 2019 - 2022, ThoUSnd Units

TABLE 8 Japan Toaster Market, By Product, 2023 - 2030, ThoUSnd Units

TABLE 9 Japan Toaster Market, By Distribution Channel, 2019 - 2022, USD Million

TABLE 10 Japan Toaster Market, By Distribution Channel, 2023 - 2030, USD Million

TABLE 11 Japan Toaster Market, By Distribution Channel, 2019 - 2022, ThoUSnd Units

TABLE 12 Japan Toaster Market, By Distribution Channel, 2023 - 2030, ThoUSnd Units

TABLE 13 Japan Toaster Market, By Application, 2019 - 2022, USD Million

TABLE 14 Japan Toaster Market, By Application, 2023 - 2030, USD Million

TABLE 15 Japan Toaster Market, By Application, 2019 - 2022, ThoUSnd Units

TABLE 16 Japan Toaster Market, By Application, 2023 - 2030, ThoUSnd Units

TABLE 17 Key Information – Panasonic Holdings Corporation

TABLE 18 Key Information – LG Electronics, Inc.

TABLE 19 Key Information – Samsung Electronics Co., Ltd.

TABLE 20 key information – Haier Smart Home Co., Ltd.

TABLE 21 Key Information – Hisense International Co., Ltd.

TABLE 22 Key Information – Breville Group Limited

TABLE 23 Key Information – Koninklijke Philips N.V.

TABLE 24 Key Information – Dualit Ltd

TABLE 25 Key Information – Hamilton Beach Brands, Inc.

TABLE 26 Key information – Whirlpool Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Toaster Market, 2019 - 2022, USD Million

FIG 3 Key Factors Impacting toaster Market

FIG 4 Porter’s Five Forces Analysis – Toaster Market

FIG 5 Japan Toaster Market Share, By Product, 2022

FIG 6 Japan Toaster Market Share, By Product, 2030

FIG 7 Japan Toaster Market, By Product, 2019 - 2030, USD Million

FIG 8 Japan Toaster Market Share, By Distribution Channel, 2022

FIG 9 Japan Toaster Market Share, By Distribution Channel, 2030

FIG 10 Japan Toaster Market, By Distribution Channel, 2023 - 2030, USD Million

FIG 11 Japan Toaster Market Share, By Application, 2022

FIG 12 Japan Toaster Market Share, By Application, 2030

FIG 13 Japan Toaster Market, By Application, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: Panasonic Holdings Corporation

FIG 15 Recent strategies and developments: LG Electronics, Inc.

FIG 16 SWOT Analysis: LG Electronics, Inc.

FIG 17 SWOT Analysis: Samsung Electronics Co., Ltd.

FIG 18 SWOT Analysis: HAIER SMART HOME CO., LTD.

FIG 19 SWOT Analysis: Hisense International Co., Ltd.

FIG 20 SWOT Analysis: Breville Group Limited

FIG 21 SWOT Analysis: Koninklijke Philips N.V.

FIG 22 SWOT Analysis: Dualit Ltd

FIG 23 SWOT Analysis: Hamilton Beach Brands, Inc.

FIG 24 SWOT Analysis: Whirlpool Corporation