Japan Photoelectric Sensors Market Size, Share & Industry Trends Analysis Report By Technology, By Application (Automotive, Electronics & Semiconductor, Packaging, Military & Aerospace, and Others), Outlook and Forecast, 2023 - 2030

Published Date : 26-Mar-2024 | Pages: 87 | Formats: PDF |

COVID-19 Impact on the Japan Photoelectric Sensors Market

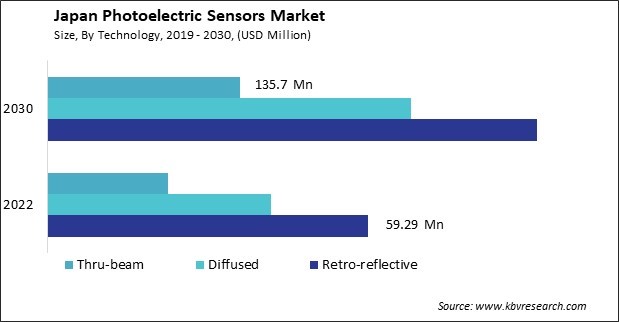

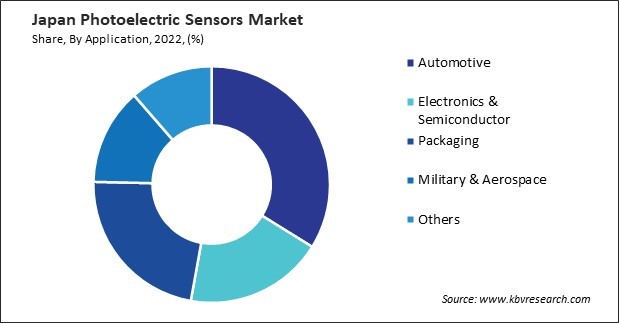

The Japan Photoelectric Sensors Market size is expected to reach $193.30 million by 2030, rising at a market growth of 5.9% CAGR during the forecast period. In the year 2022, the market attained a volume of 2,674.81 thousand units, experiencing a growth of 6.2% (2019-2022).

The photoelectric sensors market in Japan has been witnessing significant growth, driven by advancements in automation, industrialization, and the integration of smart technologies across various industries. Photoelectric sensors play a crucial role in industrial automation, offering precise and reliable detection capabilities and contributing to increased efficiency and productivity.

Technological innovation is a hallmark of Japan's industrial landscape for developing and applying photoelectric sensors. The country has been at the forefront of pioneering advancements in sensor technology, ensuring that Japanese companies remain competitive on the global stage. The continuous pursuit of cutting-edge solutions has led to the creation of highly sophisticated photoelectric sensors with improved accuracy, reliability, and adaptability to diverse industrial applications.

The application of photoelectric sensors in robotics has been a key contributor to the market's growth in Japan. With the country's strong emphasis on robotics and automation, these sensors are integral to the functionality of robots for tasks such as navigation, object avoidance, and precise manipulation. As the robotics industry continues to expand, driven by advancements in artificial intelligence and machine learning, the demand for sophisticated photoelectric sensors will likely experience a corresponding uptick.

According to the International Trade Administration, Japan is home to some of the world's leading manufacturers and robotics companies. Japan-based companies have manufactured or designed 45 percent of all industrial robots worldwide as of 2022. Japanese manufacturers won a record $7.35 billion in orders for industrial robots in 2022, an increase of 1.6% over the previous year. An all-time high of 5.6% was reached in production. In food, logistics, and pharmaceuticals, the trend toward automating packaging and transportation has increased. In 2021, 10,000 humans were complemented by 631 robots in the manufacturing sector of Japan. Japan's trajectory in robotics not only highlights its current achievements but also signals a future where technology, including photoelectric sensors, will play a pivotal role in reshaping global industrial landscapes.

Market Trends

Increasing demand in the packaging industry

The packaging industry in Japan is experiencing a significant surge in demand for photoelectric sensors, driven by various factors contributing to improved efficiency, reliability, and overall performance in packaging processes. With the increasing emphasis on automation and efficiency in packaging processes, the demand for photoelectric sensors has witnessed a notable upswing. These sensors contribute to enhanced accuracy in detecting package presence, position, and quality, ultimately optimizing the overall packaging operations. Manufacturers in Japan are increasingly adopting advanced packaging technologies, and photoelectric sensors are integral to ensuring seamless and error-free packaging processes.

The photoelectric sensors market is widely utilized for object detection, distance measurement, and product counting in the packaging industry in Japan. These sensors use light beams to detect the presence, absence, or position of objects in a packaging line, enabling precise control over the movement and placement of packages. The high level of precision offered by photoelectric sensors is essential for maintaining quality standards and preventing errors in packaging operations. Photoelectric sensors are crucial in packaging and sorting processes in the food and beverage sector to ensure product quality and safety.

According to the International Trade Administration in 2020, the Japanese food packaging machinery industry was worth $4.5 billion (¥516 billion), an 8 percent increase from 2015. In 2020, approximately 38 percent of the population lived in single-person households, a 13 percent increase from 2015. This significant lifestyle change inevitably impacts consumers' purchasing habits, especially regarding food. In contrast to bulk packaged food, compact packaged food is in greater demand due to the decline in the frequency of large family gatherings for meals. Hence, the growing demand for photoelectric sensors in the U.S. packaging industry emphasizes faster and error-free packaging solutions, underscoring the indispensable role of photoelectric sensors in enhancing reliability and speed within the sector.

Rising dominance in electronics and semiconductor manufacturing

Japan holds a prominent position in the global electronics and semiconductor manufacturing landscape, contributing significantly to the photoelectric sensors market. Renowned companies like Sony, Panasonic, and Toshiba have been pivotal in driving innovation in sensor technologies. Leveraging a history of technological prowess, Japanese firms focus on research and development, continually advancing semiconductor materials and manufacturing processes. The global industry presence of Japanese electronics companies ensures the widespread adoption of their photoelectric sensors, further solidifying Japan's role as a key player in this industry.

Additionally, Japan's commitment to sustainability and energy efficiency reflects in the development of photoelectric sensors with lower power consumption and eco-friendly features. As industries worldwide prioritize environmental considerations, Japanese manufacturers are at the forefront of creating sensor technologies that align with these global sustainability goals. In recent years, there has also been a growing focus on expanding the application of photoelectric sensors beyond traditional industrial uses. The integration of these sensors into emerging technologies such as autonomous vehicles, smart cities, and healthcare devices showcases Japan's adaptability and forward-thinking approach in leveraging sensor technology for various sectors. Therefore, Japan's influential role in electronics and semiconductor manufacturing, coupled with a commitment to sustainability and innovation, cements its position as a global leader in the photoelectric sensors market.

Competition Analysis

The Japanese photoelectric sensors market is characterized by several key companies contributing significantly to the industry's growth. Prominent players in this sector include Omron Corporation, Keyence Corporation, Panasonic Corporation, SICK AG (Japan branch), Autonics Corporation, Balluff Japan, and Takex (Ricoh Industrial Solutions Inc.).

Omron Corporation, a major player in Japan's automation and sensing landscape, is recognized for its innovative solutions, particularly in photoelectric sensors. Offering a diverse range of sensors, Omron caters to the specific needs of the Japanese industrial automation sector, where precision and reliability are paramount.

Panasonic Corporation, a well-known electronics company, actively develops and produces various photoelectric sensors. Panasonic's sensors cater to different industries, contributing to the automation and reliability of manufacturing processes. The company's dedication to innovative solutions has established its presence in the Japanese industry.

Keyence Corporation, a leading provider of automation and inspection equipment in Japan, specializes in high-precision and photoelectric sensors. Renowned for its cutting-edge technology, Keyence plays a crucial role in the Japanese market by offering tailored solutions for manufacturing and industrial automation applications.

Specializing in optoelectronics and photonics, Hamamatsu Photonics is a Japanese company that provides a wide range of photoelectric sensors. The company's sensors are widely used in medical equipment, scientific instrumentation, and industrial automation applications. Hamamatsu Photonics' commitment to cutting-edge technology positions it as a significant player in the Japanese photoelectric sensors market.

Mitsubishi Electric Corporation is a well-established Japanese company with a strong presence in the photoelectric sensor sector. Based in Tokyo, Mitsubishi Electric is known for its diverse range of products, including industrial automation systems and electronic components. The company's photoelectric sensors are utilized in industrial applications for accurate detection and positioning, contributing to increased efficiency in manufacturing processes.

List of Key Companies Profiled

- Omron Corporation

- Panasonic Holdings Corporation

- Rockwell Automation, Inc.

- Eaton Corporation PLC

- Keyence Corporation

- Schneider Electric SE

- Autonics Corporation

- Sick AG

- Balluff GmbH

- IFM Electronics GmbH

Japan Photoelectric Sensors Market Report Segmentation

By Technology

- Retro-reflective

- Diffused

- Thru-beam

By Application

- Automotive

- Electronics & Semiconductor

- Packaging

- Military & Aerospace

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Photoelectric Sensors Market, by Technology

1.4.2 Japan Photoelectric Sensors Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.3.2 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2020, Jul – 2023, Oct) Leading Players

3.4 Porter’s Five Forces Analysis

Chapter 4. Japan Photoelectric Sensors Market

4.1 Japan Photoelectric Sensors Market by Technology

4.2 Japan Photoelectric Sensors Market by Application

Chapter 5. Company Profiles – Global Leaders

5.1 Omron Corporation

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 SWOT Analysis

5.2 Panasonic Holdings Corporation

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 Rockwell Automation, Inc.

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Partnerships, Collaborations, and Agreements:

5.3.5.2 Acquisition and Mergers:

5.3.6 SWOT Analysis

5.4 Eaton Corporation PLC

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expense

5.4.5 Recent strategies and developments:

5.4.5.1 Acquisition and Mergers:

5.4.6 SWOT Analysis

5.5 Keyence Corporation

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Partnerships, Collaborations, and Agreements:

5.5.5.2 Product Launches and Product Expansions:

5.5.6 SWOT Analysis

5.6 Schneider Electric SE

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expense

5.6.5 Recent strategies and developments:

5.6.5.1 Partnerships, Collaborations, and Agreements:

5.6.5.2 Acquisition and Mergers:

5.6.6 SWOT Analysis

5.7 Autonics Corporation

5.7.1 Company Overview

5.7.2 SWOT Analysis

5.8 Sick AG

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expense

5.8.5 Recent strategies and developments:

5.8.5.1 Partnerships, Collaborations, and Agreements:

5.8.6 SWOT Analysis

5.9 Balluff GmbH

5.9.1 Company Overview

5.9.2 SWOT Analysis

5.10. IFM Electronics GmbH

5.10.1 Company Overview

5.10.2 Recent strategies and developments:

5.10.2.1 Partnerships, Collaborations, and Agreements:

5.10.3 SWOT Analysis

TABLE 2 Japan Photoelectric Sensors Market, 2023 - 2030, USD Million

TABLE 3 Japan Photoelectric Sensors Market, 2019 - 2022, Thousand Units

TABLE 4 Japan Photoelectric Sensors Market, 2023 - 2030, Thousand Units

TABLE 5 Partnerships, Collaborations and Agreements– Photoelectric Sensors Market

TABLE 6 Product Launches And Product Expansions– Photoelectric Sensors Market

TABLE 7 Acquisition and Mergers– Photoelectric Sensors Market

TABLE 8 Japan Photoelectric Sensors Market by Technology, 2019 - 2022, USD Million

TABLE 9 Japan Photoelectric Sensors Market by Technology, 2023 - 2030, USD Million

TABLE 10 Japan Photoelectric Sensors Market by Technology, 2019 - 2022, Thousand Units

TABLE 11 Japan Photoelectric Sensors Market by Technology, 2023 - 2030, Thousand Units

TABLE 12 Japan Photoelectric Sensors Market by Application, 2019 - 2022, USD Million

TABLE 13 Japan Photoelectric Sensors Market by Application, 2023 - 2030, USD Million

TABLE 14 Japan Photoelectric Sensors Market by Application, 2019 - 2022, Thousand Units

TABLE 15 Japan Photoelectric Sensors Market by Application, 2023 - 2030, Thousand Units

TABLE 16 Key Information – Omron Corporation

TABLE 17 Key Information – panasonic holdings corporation

TABLE 18 Key Information – Rockwell Automation, Inc.

TABLE 19 Key Information – Eaton Corporation PLC

TABLE 20 key information – Keyence Corporation

TABLE 21 Key Information – Schneider Electric SE

TABLE 22 Key Information – Autonics Corporation

TABLE 23 Key Information – Sick AG

TABLE 24 Key Information – Balluff GmbH

TABLE 25 Key Information – IFM Electronics GmbH

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Photoelectric Sensors Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting photoelectric sensors market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2020, Jul – 2023, Oct) Leading Players

FIG 7 Porter’s Five Forces Analysis - Photoelectric Sensors Market

FIG 8 Japan Photoelectric Sensors Market Share by Technology, 2022

FIG 9 Japan Photoelectric Sensors Market Share by Technology, 2030

FIG 10 Japan Photoelectric Sensors Market by Technology, 2019 - 2030, USD Million

FIG 11 Japan Photoelectric Sensors Market Share by Application, 2022

FIG 12 Japan Photoelectric Sensors Market Share by Application, 2030

FIG 13 Japan Photoelectric Sensors Market by Application, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: Omron Corporation

FIG 15 SWOT Analysis: Panasonic Holdings Corporation

FIG 16 SWOT Analysis: Rockwell Automation, Inc.

FIG 17 SWOT Analysis: Eaton Corporation PLC

FIG 18 SWOT Analysis: KEYENCE CORPORATION

FIG 19 Recent strategies and developments: SCHNEIDER ELECTRIC SE

FIG 20 SWOT Analysis: Schneider Electric SE

FIG 21 SWOT Analysis: AUTONICS CORPORATION

FIG 22 SWOT Analysis: Sick AG

FIG 23 SWOT Analysis: BALLUFF GMBH

FIG 24 SWOT Analysis: IFM Electronics GmbH