Japan Intermittent Catheter Market Size, Share & Trends Analysis Report By Product (Uncoated, and Coated), By Coated Type (Hydrophilic, Antimicrobial, and Others), By Indication, By End User, By Category, Outlook and Forecast, 2023 - 2030

Published Date : 20-Mar-2024 | Pages: 74 | Formats: PDF |

COVID-19 Impact on the Japan Intermittent Catheter Market

The Japan Intermittent Catheter Market size is expected to reach $158.9 million by 2030, rising at a market growth of 4.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 35,451.8 thousand units, experiencing a growth of 5.2% (2019-2022).

The intermittent catheter market in Japan has been experiencing significant growth in recent years, driven by various factors that contribute to the increasing demand for these medical devices. Intermittent catheters are crucial in managing urinary retention and relieving individuals with various medical conditions. There has been a concerted effort in Japan to raise awareness about urological conditions and the available treatment options, including intermittent catheters. Healthcare professionals and organizations have been actively educating patients and caregivers about the benefits of intermittent catheterization, fostering a greater understanding and acceptance of these devices.

Cultural factors play a significant role in shaping healthcare preferences and practices in Japan. The emphasis on personal hygiene and the cultural importance of maintaining one's health has contributed to the acceptance of intermittent catheters to manage urological conditions. The cultural openness to innovative healthcare solutions has facilitated the integration of intermittent catheters into the daily lives of individuals requiring these devices.

Japan's economic development has increased healthcare spending, allowing for greater investment in medical technologies and infrastructure. This economic stability has positively impacted the intermittent catheter market by enabling healthcare providers to offer state-of-the-art products and services. As disposable income levels rise, individuals are more willing to invest in high-quality medical devices, including intermittent catheters.

Market Trends

Rise in home medical care

The intermittent catheter market in Japan has witnessed a significant surge, driven in part by the increasing trend of home medical care. As the country faces the challenges posed by an aging population and a growing number of individuals with chronic health conditions, there has been a notable shift toward providing medical care in the comfort of patients' homes. Intermittent catheters play a crucial role in this paradigm, offering a convenient and hygienic solution for individuals requiring regular catheterization. The preference for home-based care is fueled by the desire to enhance patient comfort, reduce healthcare costs, and improve overall quality of life.

The rise in home medical care in Japan has prompted manufacturers to develop intermittent catheters that are effective and user-friendly for patients and caregivers. This shift aligns with the broader global movement towards patient-centric healthcare, emphasizing empowering individuals to manage their health conditions independently. The intermittent catheter market in Japan is adapting to this evolving healthcare landscape, focusing on delivering products that cater to the needs of patients opting for home-based care, ultimately contributing to the industry's continued growth.

Japan is now the world's fastest aging country, and the Government of Japan (GOJ) has actively started promoting the home medical care industry for the country's senior citizens. The National Institute of Population and Social Security Research (IPSS) released its most recent population projection in April 2023. It predicted that by 2025, about 8 million baby boomers—those born between 1947 and 1949—will be over 75 years old in Japan, accounting for 17.5% of the country's total population. This issue is known as the "2025 Problem" in Japan. By 2040, approximately 35% of the total population will be elderly, with the population continuously declining and the number of elderly rising.

In light of these demographic trends, the intermittent catheter market in Japan is likely to play a crucial role in addressing the healthcare challenges associated with an aging population. Intermittent catheters are essential for individuals with various medical conditions, including those prevalent among the elderly. As the demand for home medical care rises, the industry for intermittent catheters is expected to grow, reflecting the need for effective and manageable solutions for seniors.

Increasing incidence of spinal cord injuries

In recent years, Japan has witnessed a concerning surge in the incidence of spinal cord injuries, propelling an increased demand for intermittent catheter market in the medical industry. Spinal cord injuries, often resulting from accidents, trauma, or degenerative conditions, lead to complications such as neurogenic bladder dysfunction, necessitating specialized urinary management. As the population ages and lifestyles evolve, the prevalence of spinal cord injuries has become a critical health concern in Japan. The growing awareness of the importance of effective bladder care has led to a heightened demand for intermittent catheters, devices designed to assist individuals in emptying their bladders safely and efficiently.

The intermittent catheter market in Japan has responded dynamically to this escalating need for advanced urological solutions. Technological advancements and innovations in catheter design have played a pivotal role in improving the quality of life for individuals with spinal cord injuries. The industry has witnessed the introduction of user-friendly and discreet catheterization options, offered greater convenience, and reduced the stigma associated with these medical devices. Additionally, healthcare providers and manufacturers have collaborated to enhance patient education and accessibility, ensuring that those in need can readily access information and products that facilitate proper bladder management. Therefore, as the country addresses the evolving healthcare landscape and prioritizes effective bladder care, the intermittent catheter market continues to play a crucial role in improving the lives of individuals with spinal cord injuries.

Competition Analysis

The intermittent catheter market in Japan is a critical segment within the broader medical devices industry, addressing the needs of individuals with conditions such as urinary retention and incontinence. Terumo, headquartered in Tokyo, is a global medical device company with a strong presence in the intermittent catheter market. The company is known for its innovative healthcare solutions and has been a key contributor to advancing urological care in Japan. Terumo's intermittent catheters are designed to provide comfort and ease of use for patients with various urological conditions.

Olympus, a renowned Japanese optical and precision equipment manufacturer, has diversified into the medical device sector. The company offers a range of urological products, including intermittent catheters, to address the specific needs of patients. Olympus is recognized for its commitment to quality and patient-centric solutions in urology. Similarly, Fuji Systems, based in Tokyo, specializes in developing and manufacturing medical devices, including intermittent catheters. The company has gained recognition for its commitment to quality assurance and adherence to international standards. Fuji Systems' catheters are designed to meet the diverse needs of patients with urological challenges.

Sewoon Medical is a Japanese company that manufactures and distributes medical devices, including urological products such as intermittent catheters. The company aims to improve patient's quality of life by providing effective and reliable medical solutions. These companies emphasize user-friendly designs and adhere to stringent quality standards, reflecting Japan's commitment to advancing healthcare solutions for its aging population. As the industry continues to evolve, these companies are playing a pivotal role in shaping the future of urological care in the country.

List of Key Companies Profiled

- Becton, Dickinson, and Company

- B. Braun Melsungen AG

- Coloplast Group

- Hollister, Inc.

- Teleflex Incorporated

- ConvaTec Group PLC

- Cook Medical, Inc. (Cook Group)

- Wellspect Healthcare AB

- Adapta Medical, Inc.

- Pennine Healthcare

Japan Intermittent Catheter Market Report Segmentation

By Product

- Uncoated

- Coated

- Hydrophilic

- Antimicrobial

- Others

By Indication

- Urinary Incontinence

- Spinal Cord Injuries

- General Surgery

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Medical Research Centers

By Category

- Female Length Catheter

- Male Length Catheter

- Kid Length Catheter

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Intermittent Catheter Market, by Product

1.4.2 Japan Intermittent Catheter Market, by Indication

1.4.3 Japan Intermittent Catheter Market, by End User

1.4.4 Japan Intermittent Catheter Market, by Category

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.3 Porter Five Forces Analysis

Chapter 3. Japan Intermittent Catheter Market

3.1 Japan Intermittent Catheter Market by Product

3.2 Japan Intermittent Catheter Market by Coated Type

3.3 Japan Intermittent Catheter Market by Indication

3.4 Japan Intermittent Catheter Market by End User

3.5 Japan Intermittent Catheter Market by Category

Chapter 4. Company Profiles – Global Leaders

4.1 Becton, Dickinson, and Company

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental and Regional Analysis

4.1.4 Research & Development Expense

4.1.5 SWOT Analysis

4.2 B. Braun Melsungen AG

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental and Regional Analysis

4.2.4 Research & Development Expenses

4.2.5 SWOT Analysis

4.3 Coloplast Group

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Segmental and Regional Analysis

4.3.4 Research & Development Expense

4.3.5 SWOT Analysis

4.4 Hollister, Inc.

4.4.1 Company Overview

4.4.2 SWOT Analysis

4.5 Teleflex Incorporated

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Segmental Analysis

4.5.4 Research & Development Expense

4.5.5 SWOT Analysis

4.6 ConvaTec Group PLC

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 SWOT Analysis

4.7 Cook Medical, Inc. (Cook Group)

4.7.1 Company Overview

4.7.2 SWOT Analysis

4.8 Wellspect Healthcare AB

4.8.1 Company Overview

4.8.2 SWOT Analysis

4.9 Pennine Healthcare

4.9.1 Company Overview

TABLE 2 Japan Intermittent Catheter Market, 2023 - 2030, USD Million

TABLE 3 Japan Intermittent Catheter Market, 2019 - 2022, Thousand Units

TABLE 4 Japan Intermittent Catheter Market, 2023 - 2030, Thousand Units

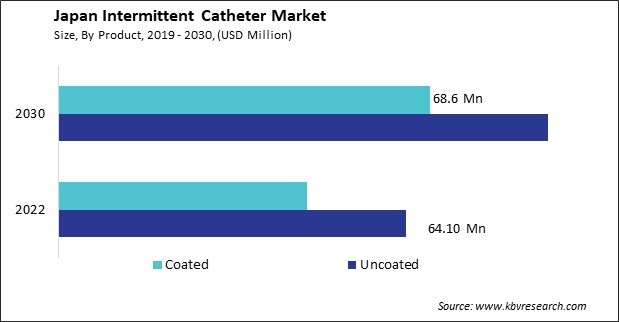

TABLE 5 Japan Intermittent Catheter Market by Product, 2019 - 2022, USD Million

TABLE 6 Japan Intermittent Catheter Market by Product, 2023 - 2030, USD Million

TABLE 7 Japan Intermittent Catheter Market by Product, 2019 - 2022, Thousand Units

TABLE 8 Japan Intermittent Catheter Market by Product, 2023 - 2030, Thousand Units

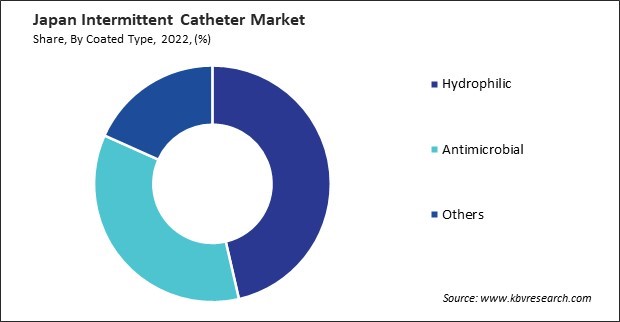

TABLE 9 Japan Intermittent Catheter Market by Coated Type, 2019 - 2022, USD Million

TABLE 10 Japan Intermittent Catheter Market by Coated Type, 2023 - 2030, USD Million

TABLE 11 Japan Intermittent Catheter Market by Indication, 2019 - 2022, USD Million

TABLE 12 Japan Intermittent Catheter Market by Indication, 2023 - 2030, USD Million

TABLE 13 Japan Intermittent Catheter Market by Indication, 2019 - 2022, Thousand Units

TABLE 14 Japan Intermittent Catheter Market by Indication, 2023 - 2030, Thousand Units

TABLE 15 Japan Intermittent Catheter Market by End User, 2019 - 2022, USD Million

TABLE 16 Japan Intermittent Catheter Market by End User, 2023 - 2030, USD Million

TABLE 17 Japan Intermittent Catheter Market by End User, 2019 - 2022, Thousand Units

TABLE 18 Japan Intermittent Catheter Market by End User, 2023 - 2030, Thousand Units

TABLE 19 Japan Intermittent Catheter Market by Category, 2019 - 2022, USD Million

TABLE 20 Japan Intermittent Catheter Market by Category, 2023 - 2030, USD Million

TABLE 21 Japan Intermittent Catheter Market by Category, 2019 - 2022, Thousand Units

TABLE 22 Japan Intermittent Catheter Market by Category, 2023 - 2030, Thousand Units

TABLE 23 Key Information – Becton, Dickinson and Company

TABLE 24 Key Information – B. Braun Melsungen AG

TABLE 25 key Information – Coloplast Group

TABLE 26 Key Information – Hollister, Inc.

TABLE 27 Key Information – Teleflex Incorporated

TABLE 28 Key Information – ConvaTec Group PLC

TABLE 29 Key Information – Cook Medical, Inc.

TABLE 30 Key Information – Wellspect healthcare ab

TABLE 31 Key Information – Pennine Healthcare

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Intermittent Catheter Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Intermittent Catheter Market

FIG 4 Porter’s Five Forces Analysis – Intermittent Catheter Market

FIG 5 Japan Intermittent Catheter Market Share by Product, 2022

FIG 6 Japan Intermittent Catheter Market Share by Product, 2030

FIG 7 Japan Intermittent Catheter Market by Product, 2019 - 2030, USD Million

FIG 8 Japan Intermittent Catheter Market Share by Coated Type, 2022

FIG 9 Japan Intermittent Catheter Market Share by Coated Type, 2030

FIG 10 Japan Intermittent Catheter Market by Coated Type, 2019 - 2030, USD Million

FIG 11 Japan Intermittent Catheter Market Share by Indication, 2022

FIG 12 Japan Intermittent Catheter Market Share by Indication, 2030

FIG 13 Japan Intermittent Catheter Market by Indication, 2019 - 2030, USD Million

FIG 14 Japan Intermittent Catheter Market Share by End User, 2022

FIG 15 Japan Intermittent Catheter Market Share by End User, 2030

FIG 16 Japan Intermittent Catheter Market by End User, 2019 - 2030, USD Million

FIG 17 Japan Intermittent Catheter Market Share by Category, 2022

FIG 18 Japan Intermittent Catheter Market Share by Category, 2030

FIG 19 Japan Intermittent Catheter Market by Category, 2019 - 2030, USD Million

FIG 20 SWOT Analysis: Becton, Dickinson and company

FIG 21 SWOT Analysis: B. Braun Melsungen AG

FIG 22 Swot Analysis: Coloplast Group

FIG 23 SWOT Analysis: Hollister, Inc.

FIG 24 SWOT Analysis: Teleflex INcorporated

FIG 25 SWOT Analysis: ConvaTec Group PLC

FIG 26 SWOT Analysis: Cook Medical, Inc

FIG 27 SWOT Analysis: Wellspect Healthcare AB