Japan Household Induction Cooktops Market Size, Share & Industry Trends Analysis Report By Type (Built-In, and Free-Standing & Portable), By Distribution Channel (Offline, and Online) Growth Forecast, 2023 - 2030

Published Date : 15-Feb-2024 | Pages: 84 | Formats: PDF |

COVID-19 Impact on the Japan Household Induction Cooktops Market

The Japan Household Induction Cooktops Market size is expected to reach $1.2 billion by 2030, rising at a market growth of 7.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,492.3 thousand units, experiencing a growth of 8.0% (2019-2022).

Japan's Household induction cooktops market is dynamically changing due to evolving consumer preferences, rapid technological development, and a growing focus on kitchen efficiency. As a nation renowned for its culinary traditions and cutting-edge technology, Japan's Household induction cooktops market is characterized by a blend of traditional culinary precision and an emotional embrace of innovative kitchen solutions.

Technological innovation stands at the forefront of the market, with Japanese consumers increasingly gravitating towards Household induction cooktops with advanced features and smart functionalities. Precise temperature control, rapid heating capabilities, and programmable cooking modes are becoming standard expectations as consumers seek appliances that streamline their cooking processes and align with the meticulous and detail-oriented approach to food preparation ingrained in Japanese culinary practices.

The Japanese market showcases a notable trend towards compact and space-saving designs, a response to the unique challenges posed by urban living where kitchen spaces are often limited. Manufacturers are developing Household induction cooktops with sleek profiles, minimalist aesthetics, and multifunctionality to cater to the spatial constraints of modern Japanese homes. This emphasis on design extends beyond physical dimensions to include intuitive interfaces, touch controls, and portable options, providing a harmonious blend of form and function.

Energy efficiency is a major factor in the Japanese Household induction cooktops market. With an increasing awareness of environmental impact, consumers are opting for appliances that offer efficient cooking and adhere to eco-friendly standards. Manufacturers are responding by incorporating energy-efficient technologies, eco-friendly materials, and production practices that resonate with Japan's commitment to environmental sustainability.

Market Trends

Compact and space-saving designs

Japan's Household induction cooktops market has witnessed a notable increase in the popularity of compact and space-saving designs, driven by the country's unique housing constraints and lifestyle preferences. Compact kitchen appliances have gained immense traction in Japanese homes, where space optimization is a key consideration. The demand for smaller living spaces, such as apartments and condominiums, has led to a paradigm shift in kitchen design, prompting manufacturers in the Household induction cooktops market to focus on compact solutions.

The trend towards compact Household induction cooktops in Japan aligns with the cultural emphasis on efficiency and functionality in daily life. Japanese consumers prioritize appliances that deliver superior performance and seamlessly integrate into limited kitchen spaces. As a result, manufacturers have responded by introducing sleek and space-saving designs catering to modern Japanese homes' spatial constraints. Furthermore, the rise of single-person Households and the increasing number of dual-income families in Japan have contributed to the demand for smaller, more manageable kitchen appliances. Compact Household induction cooktops are well-suited for the needs of individuals or smaller families, offering a practical solution without compromising cooking capabilities. These designs often feature innovative technologies, such as multi-zone cooking surfaces and touch controls, to maximize functionality within a confined space.

The compact trend also aligns with urban dwellers' evolving lifestyles, prioritizing convenience and modern aesthetics. Compact Household induction cooktops seamlessly blend with contemporary kitchen designs, providing a stylish and efficient solution for those seeking performance and aesthetics in their homes. In conclusion, the surge in compact and space-saving designs in Japan's Household induction cooktops market reflects a response to the specific spatial constraints and lifestyle preferences prevalent in the country.

Expansion of online sales channels

The surge in online sales channels for Household induction cooktops in Japan can be attributed to several factors uniquely aligned with the preferences and habits of Japanese consumers. Firstly, the tech-savvy nature of the Japanese population has significantly influenced the adoption of online platforms for shopping. With a culture that values efficiency and advanced technology, Japanese consumers find the convenience of browsing and purchasing Household induction cooktops online particularly appealing. The impact of the COVID-19 pandemic has been pronounced in Japan, prompting a heightened emphasis on safety and social distancing. In this context, online sales channels have become a convenient and safer alternative to traditional in-store shopping. Health considerations remain paramount, so consumers increasingly turn to online platforms for Household appliance needs.

The diversity of choices and competitive pricing found on Japanese e-commerce platforms adds to the appeal of online shopping. Consumers appreciate the ability to explore various brands and models, comparing features and prices to find the best-suited Household induction cooktop for their needs. The online marketplace encourages healthy competition among retailers, driving them to offer attractive deals and promotions, further motivating Japanese consumers to opt for online channels.

The International Trade Administration states that the online retail industry in Japan has been expanding gradually, with $163.5 billion in sales in 2018. eCommerce increased 89% in Japan between 2012 and 2018, from $86.5 billion (3.4% of total retail sales) to $163.5 billion (6.2% of total retail sales). The latest survey shows Japanese consumers who buy products/services online spent an average of Yen 33,536 (approximately $305) in January 2020, a 13.7% increase from Yen 29,499 (approximately $268) spent in January 2018. The amount spent and the number of Households who purchased products/services online increased from 36.3% to 42.8%. Hence, the Japan-centric shift toward online purchasing reflects a significant transformation in the country's consumer behavior and retail landscape for essential kitchen appliances.

Competition Analysis

In the vibrant landscape of Japan's Household induction cooktops market, fierce competition unfolds among both local powerhouses and global contenders. The competitive dynamics extend beyond these industry giants, with domestic players and new entrants contributing to the vibrant marketplace. Brands like Mitsubishi Electric and Hitachi are prominent contenders, offering Household induction cooktops focusing on energy efficiency, space optimization, and Japanese design aesthetics. Mitsubishi Electric, for instance, integrates intuitive controls and safety features into its cooktops, catering to consumers who prioritize functionality without compromising style.

Innovative newcomers are disrupting the market, bringing fresh perspectives and cutting-edge features. Brands like Zojirushi and Iris Ohyama are gaining traction by introducing Household induction cooktops that cater to evolving consumer needs. Zojirushi focuses on compact designs and multifunctional capabilities, appealing to urban dwellers with limited kitchen space. Iris Ohyama, known for its innovative home appliances, offers Household induction cooktops that prioritize simplicity, ease of use, and affordability, addressing a broader consumer base in Japan.

Retail dynamics play a pivotal role, with major appliance retailers such as Yodobashi Camera and Bic Camera influencing consumer choices through extensive displays and promotional strategies in Japan. These retailers showcase various Household induction cooktop models, providing consumers with hands-on experiences and expert guidance to facilitate informed purchasing decisions.

The Japanese market's emphasis on sustainability and eco-friendly practices shapes competition, with brands integrating energy-efficient technologies and adhering to environmental standards. Toshiba, for example, promotes Household induction cooktops with energy-saving features, resonating with environmentally conscious consumers who seek appliances that align with their commitment to sustainability. The pricing strategy is another critical factor influencing competition. While established brands position themselves as premium choices, brands like Iris Ohyama strategically target budget-conscious consumers by offering affordable yet feature-rich Household induct

List of Key Companies Profiled

- Whirlpool Corporation

- LG Corporation

- Panasonic Holdings Corporation

- Sub-Zero Group, Inc.

- Haier Smart Home Co., Ltd. (Haier Group Corporation)

- Koninklijke Philips N.V

- Robert Bosch GmbH

- SMEG S.p.A.

- AB Electrolux

- Miele & Cie. KG

Japan Household Induction Cooktops Market Report Segmentation

By Type

- Built-In

- Free-Standing & Portable

By Distribution Channel

- Offline

- Online

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Household Induction Cooktops Market, by Type

1.4.2 Japan Household Induction Cooktops Market, by Distribution Channel

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.3 Porter’s Five Forces Analysis

Chapter 3. Japan Household Induction Cooktops Market

3.1 Japan Household Induction Cooktops Market, By Type

3.2 Japan Household Induction Cooktops Market, By Distribution Channel

Chapter 4. Company Profiles – Global Leaders

4.1 Whirlpool Corporation

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Regional Analysis

4.1.4 Research & Development Expense

4.1.5 SWOT Analysis

4.2 LG Corporation

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental and Regional Analysis

4.2.4 Research & Development Expenses

4.2.5 SWOT Analysis

4.3 Panasonic Holdings Corporation

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Segmental and Regional Analysis

4.3.4 Research & Development Expenses

4.3.5 SWOT Analysis

4.4 Sub-Zero Group, Inc.

4.4.1 Company Overview

4.4.2 SWOT Analysis

4.5 Haier Smart Home Co., Ltd. (Haier Group Corporation)

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Segmental and Regional Analysis

4.5.4 Research & Development Expense

4.5.5 SWOT Analysis

4.6 Koninklijke Philips N.V.

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 Segmental and Regional Analysis

4.6.4 Research & Development Expense

4.6.5 SWOT Analysis

4.7 Robert Bosch GmbH

4.7.1 Company Overview

4.7.2 Financial Analysis

4.7.3 Segmental and Regional Analysis

4.7.4 Research & Development Expense

4.7.5 SWOT Analysis

4.8 SMEG S.p.A.

4.8.1 Company overview

4.8.2 SWOT Analysis

4.9 AB Electrolux

4.9.1 Company Overview

4.9.2 Financial Analysis

4.9.3 Regional Analysis

4.9.4 Research & Development Expenses

4.9.5 SWOT Analysis

4.10. Miele & Cie. KG

4.10.1 Company Overview

4.10.2 SWOT Analysis

TABLE 2 Japan Household Induction Cooktops Market, 2023 - 2030, USD Million

TABLE 3 Japan Household Induction Cooktops Market, 2019 - 2022, Thousand Units

TABLE 4 Japan Household Induction Cooktops Market, 2023 - 2030, Thousand Units

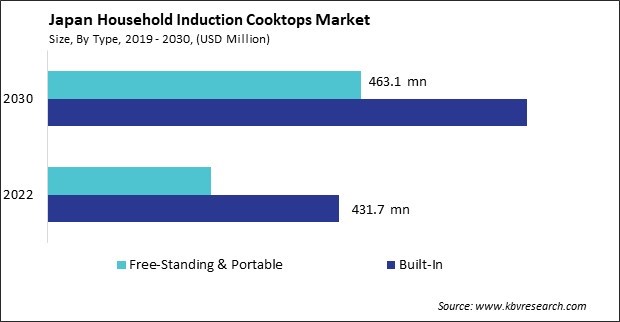

TABLE 5 Japan Household Induction Cooktops Market, By Type, 2019 - 2022, USD Million

TABLE 6 Japan Household Induction Cooktops Market, By Type, 2023 - 2030, USD Million

TABLE 7 Japan Household Induction Cooktops Market, By Type, 2019 - 2022, Thousand Units

TABLE 8 Japan Household Induction Cooktops Market, By Type, 2023 - 2030, Thousand Units

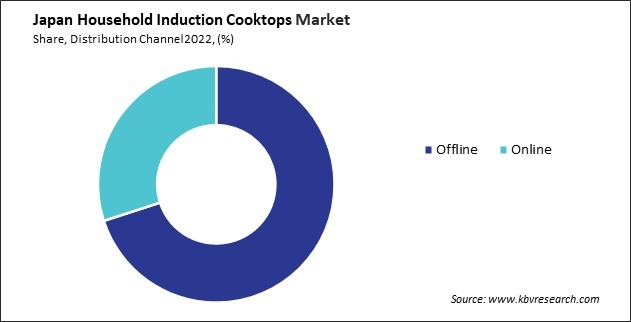

TABLE 9 Japan Household Induction Cooktops Market, By Distribution Channel, 2019 - 2022, USD Million

TABLE 10 Japan Household Induction Cooktops Market, By Distribution Channel, 2023 - 2030, USD Million

TABLE 11 Japan Household Induction Cooktops Market, By Distribution Channel, 2019 - 2022, Thousand Units

TABLE 12 Japan Household Induction Cooktops Market, By Distribution Channel, 2023 - 2030, Thousand Units

TABLE 13 Key information – Whirlpool Corporation

TABLE 14 Key Information – LG Corporation

TABLE 15 Key Information – panasonic holdings corporation

TABLE 16 Key Information – Sub-Zero Group, Inc.

TABLE 17 key information – Haier Smart Home Co., Ltd.

TABLE 18 Key Information – Koninklijke Philips N.V.

TABLE 19 Key Information – Robert Bosch GmbH

TABLE 20 Key Information – SMEG S.p.A.

TABLE 21 Key Information – AB Electrolux

TABLE 22 Key Information – Miele & Cie. KG

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Household Induction Cooktops Market, 2019 - 2030, USD million

FIG 3 Key Factors Impacting the Household Induction Cooktops Market

FIG 4 Porter’s Five Forces Analysis - Household Induction Cooktops Market

FIG 5 Japan Household Induction Cooktops Market share , By Type, 2022

FIG 6 Japan Household Induction Cooktops Market share , By Type, 2030

FIG 7 Japan Household Induction Cooktops Market, By Type, 2019 - 2030, USD million

FIG 8 Japan Household Induction Cooktops Market share, By Distribution Channel, 2022

FIG 9 Japan Household Induction Cooktops Market share, By Distribution Channel, 2030

FIG 10 Japan Household Induction Cooktops Market, By Distribution Channel, 2019 - 2030, USD million

FIG 11 SWOT Analysis: Whirlpool Corporation

FIG 12 SWOT Analysis: LG Corporation

FIG 13 SWOT Analysis: Panasonic Holdings Corporation

FIG 14 SWOT Analysis: Sub-Zero Group, Inc.

FIG 15 SWOT Analysis: HAIER SMART HOME CO., LTD.

FIG 16 SWOT Analysis: Koninklijke Philips N.V.

FIG 17 SWOT Analysis: Robert Bosch GmbH

FIG 18 SWOT Analysis: SMEG S.p.A.

FIG 19 SWOT Analysis: AB Electrolux

FIG 20 Swot analysis: Miele & Cie. KG