Japan Dental Chair Market Size, Share & Industry Trends Analysis Report By Product Type, By Type, By Component (Chair, Dental Cuspidor, Dental Chair Handpiece, and Others), By End User, By Application, Outlook and Forecast, 2023 - 2030

Published Date : 20-Mar-2024 | Pages: 87 | Formats: PDF |

COVID-19 Impact on the Japan Dental Chair Market

The Japan Dental Chair Market size is expected to reach $70.7 million by 2030, rising at a market growth of 5.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 18.4 thousand units, experiencing a growth of 4.9% (2019-2022).

In Japan, the dental chair market is characterized by a focus on advanced technology, ergonomic design, and high-quality manufacturing. The market is driven by factors such as the aging population, technological advancements, and a strong emphasis on healthcare quality and patient comfort. The Ministry of Health, Labor and Welfare stated that the percentage of people who achieved the 8020 (Hachimaru-ni-maru) goal of having 20 or more teeth even at 80 increased from 40.2% in the previous survey to 51.2%. Based on these results, the Ministry will continue to promote dental and oral health measures, including the "8020 Campaign."

One notable trend in the Japanese dental chair market is the integration of digital technology into dental chairs. This includes features such as digital imaging systems, intraoral cameras, and integrated patient record management systems, which enhance the efficiency and accuracy of dental procedures. Japanese dental chair manufacturers are known for their innovation in this area, constantly developing new technologies to improve patient care and streamline workflow for dental practitioners.

The country's healthcare policies and regulations also influence the Japanese dental chair market. The Japanese government has stringent standards for medical devices, including dental chairs, to ensure patient safety and quality of care. This has led to a market environment where manufacturers must meet high quality and performance standards to compete effectively.

In response to the COVID-19 pandemic, there is an increased emphasis on infection control in dental practices. This has led to a demand for dental chairs with features that facilitate effective disinfection and sterilization, such as smooth surfaces that are easy to clean and materials resistant to microbial growth. In recent years, there has been a growing demand for dental chairs in Japan due to increasing awareness of oral health and a greater willingness among the population to invest in dental care. This trend is expected to continue, driving further innovation and competition in the Japanese dental chair market.

Market Trends

Increasing demand for dental chairs with ergonomic design

In Japan, there is a rising demand for dental chairs that prioritize ergonomic design to enhance patient comfort during dental treatments. Dental practitioners in Japan are increasingly recognizing the impact of a comfortable and relaxing treatment environment on patient satisfaction and the overall success of dental treatments. As dental treatments become more advanced, the need for patients to remain in a comfortable position for extended periods becomes more crucial.

Japanese dental chairs are designed with a range of adjustable settings, including headrests, armrests, and footrests, to accommodate patients of different sizes and treatment needs. By customizing the experience, dental professionals can offer each patient a more pleasant and individualized journey, ultimately resulting in improved outcomes and increased levels of patient contentment.

Additionally, the emphasis on ergonomic design in dental chairs aligns with broader trends in healthcare toward patient-centered care and the promotion of comfort and well-being. Patients today are more informed and discerning about their healthcare experiences, and dental practices in Japan are responding by investing in equipment, such as ergonomic dental chairs, that prioritize patient comfort and satisfaction. As dental practices in Japan strive to distinguish themselves by providing patients with superior comfort and care, this trend is likely to persist.

Rising number of visits to dental clinics

In recent years, Japan has seen a rising number of dental clinic visits, reflecting several trends and factors shaping the country's dental healthcare landscape. The primary consequence of the demographic transition towards an aging population is an increased need for dental services, which has consequently led to a greater frequency of visits to dental clinics throughout the nation. Another contributing factor is the increasing awareness of the importance of oral health in Japan. This awareness has led to a greater number of people seeking dental care on a routine basis, contributing to the overall rise in dental clinic visits.

According to a population-based study published by the National Library of Medicine in 2023, the proportion of the Japanese population making dental visits for preventive care was 18.6%. The highest percentage was 32.8% to 34.0% in the 5- to 9-year-old age group. 59,709,084 participants visited dental clinics, with children aged 5 to 9 having the highest proportion. In Japan, dental checkups (only checkups and no procedures) not covered by health insurance are provided in some communities, workplaces, and schools. Students from elementary school to high school can receive free dental checkups every year from a dentist at their school.

Furthermore, changes in healthcare policies and insurance coverage have made dental care more accessible to the population, encouraging more people to visit dental clinics for their oral health needs. Increased awareness of dental insurance benefits and coverage for dental treatments has incentivized individuals to seek timely dental care, leading to a higher number of clinic visits. Thus, as these trends continue, the demand for dental services is expected to grow, further shaping the landscape of dental healthcare in Japan.

Competition Analysis

In Japan, several companies are known for manufacturing and supplying dental chairs and other dental equipment. These organizations have gained acclaim for their dedication to excellence and originality and for catering to the distinct requirements of the Japanese dental industry. Some prominent dental chair companies in Japan include Takara Belmont Corporation, Morita Corporation, Nakanishi Inc., A-dec Japan, GC Corporation, Shinhung Co., Ltd, etc.

Shinhung Co., Ltd. is known for its commitment to research and development, offering innovative dental chairs and units that incorporate the latest technologies and ergonomic designs. In keeping with its emphasis on efficiency and user satisfaction, the organization develops products that offer exceptional comfort for patients and ergonomic assistance for dental practitioners.

Takara Belmont Corporation is one of the most prominent manufacturers of dental chairs in Japan. The company's dental chairs are known for their advanced features, customizable options, and durability, making them popular among dental professionals across Japan.

Nakanishi Inc. is recognized for its precision engineering and high-quality dental equipment, including dental chairs designed to provide comfort, durability, and optimal performance. By prioritizing customer satisfaction and innovation, the organization has managed to establish a formidable foothold in the dental chair market in Japan.

GC Corporation, a leading manufacturer of dental materials and equipment, also offers a range of dental chairs designed to meet the highest quality and functionality standards. The dental chairs produced by this company have gained recognition for their dependable nature, user-friendliness, and sophisticated functionalities that optimize the effectiveness of dental procedures. These companies represent a diverse range of offerings in the Japanese dental chair market, catering to the unique needs and preferences of dental practices across the country. By prioritizing quality, innovation, as well as customer satisfaction, these corporations consistently propel the progress of dental care in Japan by supplying state-of-the-art dental chairs and equipment.

List of Key Companies Profiled

- A-dec, Inc.

- Danaher Corporation

- DENTALEZ, Inc.

- Dentsply Sirona, Inc

- Institut Straumann AG

- Koninklijke Philips N.V.

- Midmark Corporation

- Planmeca Oy

- Henry Schein, Inc.

- XO CARE A/S

Japan Dental Chair Market Report Segmentation

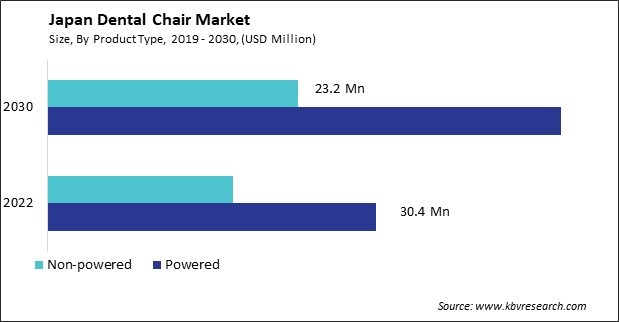

By Product Type

- Powered

- Non-powered

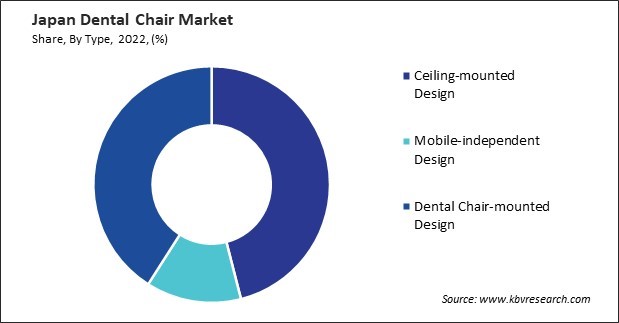

By Type

- Ceiling-mounted Design

- Mobile-independent Design

- Dental Chair-mounted Design

By Component

- Chair

- Dental Cuspidor

- Dental Chair Handpiece

- Others

by End User

- Hospitals

- Dental Clinics

- Research & Academic Institutes

By Application

- Examination

- Surgery

- Orthodontic Applications

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Dental Chair Market, by Product Type

1.4.2 Japan Dental Chair Market, by Type

1.4.3 Japan Dental Chair Market, by Component

1.4.4 Japan Dental Chair Market, by End User

1.4.5 Japan Dental Chair Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.3 Porter’s Five Force Analysis

Chapter 3. Strategies Deployed in Dental Chair Market

Chapter 4. Japan Dental Chair Market

4.1 Japan Dental Chair Market by Product Type

4.2 Japan Dental Chair Market by Type

4.3 Japan Dental Chair Market by Component

4.4 Japan Dental Chair Market by End User

4.5 Japan Dental Chair Market by Application

Chapter 5. Company Profiles – Global Leaders

5.1 A-dec, Inc.

5.1.1 Company overview

5.1.2 Recent strategies and developments:

5.1.2.1 Partnerships, Collaborations, and Agreements:

5.1.2.2 Product Launches and Product Expansions:

5.1.3 SWOT Analysis

5.2 Danaher Corporation

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expense

5.2.5 SWOT Analysis

5.3 DENTALEZ, Inc.

5.3.1 Company Overview

5.3.2 Recent strategies and developments:

5.3.2.1 Product Launches and Product Expansions:

5.3.3 SWOT Analysis

5.4 Dentsply Sirona, Inc.

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Regional & Segmental Analysis

5.4.4 Research & Development Expenses

5.4.5 Recent strategies and developments:

5.4.5.1 Partnerships, Collaborations, and Agreements:

5.4.6 SWOT Analysis

5.5 Institut Straumann AG

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Partnerships, Collaborations, and Agreements:

5.5.6 SWOT Analysis

5.6 Koninklijke Philips N.V.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expense

5.6.5 Recent strategies and developments:

5.6.5.1 Partnerships, Collaborations, and Agreements:

5.6.6 SWOT Analysis

5.7 Midmark Corporation

5.7.1 Company Overview

5.7.2 Recent strategies and developments:

5.7.2.1 Partnerships, Collaborations, and Agreements:

5.7.3 SWOT Analysis

5.8 Planmeca Oy

5.8.1 Company Overview

5.8.2 SWOT Analysis

5.9 Henry Schein, Inc.

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Recent strategies and developments:

5.9.4.1 Acquisition and Mergers:

5.9.5 SWOT Analysis

5.10. XO CARE A/S

5.10.1 Company Overview

5.10.2 SWOT Analysis

TABLE 2 Japan Dental Chair Market, 2023 - 2030, USD Million

TABLE 3 Japan Dental Chair Market, 2019 - 2022, Thousand Units

TABLE 4 Japan Dental Chair Market, 2023 - 2030, Thousand Units

TABLE 5 Japan Dental Chair Market by Product Type, 2019 - 2022, USD Million

TABLE 6 Japan Dental Chair Market by Product Type, 2023 - 2030, USD Million

TABLE 7 Japan Dental Chair Market by Product Type, 2019 - 2022, Thousand Units

TABLE 8 Japan Dental Chair Market by Product Type, 2023 - 2030, Thousand Units

TABLE 9 Japan Dental Chair Market by Type, 2019 - 2022, USD Million

TABLE 10 Japan Dental Chair Market by Type, 2023 - 2030, USD Million

TABLE 11 Japan Dental Chair Market by Type, 2019 - 2022, Thousand Units

TABLE 12 Japan Dental Chair Market by Type, 2023 - 2030, Thousand Units

TABLE 13 Japan Dental Chair Market by Component, 2019 - 2022, USD Million

TABLE 14 Japan Dental Chair Market by Component, 2023 - 2030, USD Million

TABLE 15 Japan Dental Chair Market by End User, 2019 - 2022, USD Million

TABLE 16 Japan Dental Chair Market by End User, 2023 - 2030, USD Million

TABLE 17 Japan Dental Chair Market by End User, 2019 - 2022, Thousand Units

TABLE 18 Japan Dental Chair Market by End User, 2023 - 2030, Thousand Units

TABLE 19 Japan Dental Chair Market by Application, 2019 - 2022, USD Million

TABLE 20 Japan Dental Chair Market by Application, 2023 - 2030, USD Million

TABLE 21 Key information – A-dec, Inc.

TABLE 22 Key information – Danaher Corporation

TABLE 23 Key Information – DENTALEZ, Inc.

TABLE 24 key Information – Dentsply Sirona, Inc.

TABLE 25 Key information – Institut Straumann AG

TABLE 26 Key Information – Koninklijke Philips N.V.

TABLE 27 Key Information – Midmark Corporation

TABLE 28 Key Information – Planmeca Oy

TABLE 29 Key Information – Henry Schein, Inc.

TABLE 30 Key Information – XO CARE A/S

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Dental Chair Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting the Dental Chair Market

FIG 4 Porter’s Five Force Analysis: Dental Chair Market

FIG 5 Japan Dental Chair Market Share by Product Type, 2022

FIG 6 Japan Dental Chair Market Share by Product Type, 2030

FIG 7 Japan Dental Chair Market by Product Type, 2019 - 2030, USD Million

FIG 8 Japan Dental Chair Market Share by Type, 2022

FIG 9 Japan Dental Chair Market Share by Type, 2030

FIG 10 Japan Dental Chair Market by Type, 2019 - 2030, USD Million

FIG 11 Japan Dental Chair Market Share by Component, 2022

FIG 12 Japan Dental Chair Market Share by Component, 2030

FIG 13 Japan Dental Chair Market by Component, 2019 - 2030, USD Million

FIG 14 Japan Dental Chair Market Share by End User, 2022

FIG 15 Japan Dental Chair Market Share by End User, 2030

FIG 16 Japan Dental Chair Market by End User, 2019 - 2030, USD Million

FIG 17 Japan Dental Chair Market Share by Application, 2022

FIG 18 Japan Dental Chair Market Share by Application, 2030

FIG 19 Japan Dental Chair Market by Application, 2019 - 2030, USD Million

FIG 20 Recent strategies and developments: A-dec, Inc.

FIG 21 SWOT Analysis: A-dec, Inc.

FIG 22 SWOT Analysis: Danaher Corporation

FIG 23 SWOT Analysis: DENTALEZ, Inc.

FIG 24 Swot Analysis: Dentsply Sirona, Inc.

FIG 25 Swot Analysis: Institut Straumann AG

FIG 26 SWOT Analysis: Koninklijke Philips N.V.

FIG 27 SWOT Analysis: Midmark Corporation

FIG 28 Swot Analysis: Planmeca Oy

FIG 29 Swot Analysis: Henry Schein, Inc.

FIG 30 Swot Analysis: XO CARE A/S