Japan Aloe Vera Drinks Market Size, Share & Trends Analysis Report By Flavor, By Type (RTD Juice, Juice Concentrates, and Others), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy, Online, and Others), and Forecast, 2023 - 2030

Published Date : 19-Apr-2024 | Pages: 55 | Formats: PDF |

COVID-19 Impact on the Japan Aloe Vera Drinks Market

The Japan Aloe Vera Drinks Market size is expected to reach $15.7 Million by 2030, rising at a market growth of 10.5% CAGR during the forecast period. In the year 2022, the market attained a volume of 821.55 thousand litres, experiencing a growth of 10.5% (2019-2022).

In recent years, the beverage landscape in Japan has witnessed a notable surge in the popularity of aloe vera drinks market. Sleek and eco-friendly packaging designs, coupled with clear communication of the health benefits of aloe vera, have contributed to the success of aloe vera drinks products in the competitive Japanese beverage industry.

One of the key factors fueling the growth of the aloe vera drinks market in Japan is the rising health consciousness among consumers. With an increasing focus on well-being and a desire for natural and functional ingredients, aloe vera drinks have gained traction as a refreshing and healthful choice. Japanese consumers, known for their discerning taste and preference for innovative products, have embraced aloe vera drinks as a part of their daily beverage repertoire.

Aloe vera drinks have become common in supermarkets, convenience stores, and vending machines across Japan. The convenience factor is crucial in their widespread adoption, making it easy for consumers to grab a healthy and refreshing beverage. Furthermore, the shift towards online shopping and home delivery services, accelerated by the COVID-19 pandemic, has influenced the distribution channels for aloe vera drinks in Japan. The packaging of aloe vera drinks has also played a crucial role in capturing the attention of Japanese consumers.

Market Trends

Rising awareness of beauty and skincare benefits

In recent years, Japan has witnessed a significant surge in the popularity of aloe vera drinks, particularly attributed to the rising awareness of beauty and skincare benefits associated with this natural ingredient. Aloe vera, known for its soothing properties, has become a key player in the Japanese beverage industry as consumers increasingly seek functional and health-oriented options.

Japanese consumers, renowned for their discerning taste and inclination towards wellness trends, have embraced aloe vera drinks for their refreshing taste and their purported beauty and skincare advantages. Aloe vera is rich in vitamins, minerals, and antioxidants that contribute to overall skin health. Its hydrating properties are particularly appealing in a country where skincare routines hold great cultural significance.

The beauty-conscious Japanese demographic has fueled the demand for aloe vera-infused beverages, considering it a convenient and enjoyable way to supplement their skincare regimen. Manufacturers have responded to this trend by introducing a variety of aloe vera drinks, often combining the natural benefits of aloe vera with other ingredients known for promoting skin radiance. In addition to beauty benefits, the perceived health advantages of aloe vera, such as aiding digestion and boosting the immune system, have contributed to the growing popularity of these drinks. Japanese consumers increasingly seek holistic wellness solutions, and aloe vera drinks align well with this holistic approach.

According to the International Trade Administration, in 2019, Japan's cosmetics and personal care products industry reached approximately USD 35 billion, with the nation hosting around 3,000 beauty care companies. Skincare products played a predominant role, constituting 53% of the Japanese cosmetics industry. This robust presence reflects the Japanese industry’s heightened awareness and appreciation for beauty and skincare benefits. Thus, as a parallel trend, this awareness extends to the aloe vera drinks market in Japan, where a rising consciousness of beauty and skincare advantages has contributed to the growth of this particular segment.

Adoption of innovative formulations of aloe vera drinks

In recent years, Japan has witnessed a notable surge in the adoption of innovative formulations within the aloe vera drinks market, reflecting a growing trend towards healthier beverage choices among consumers. Aloe vera, with its purported benefits for digestion, skin health, and immune support, aligns well with the wellness-focused preferences of Japanese consumers. In response to this demand, beverage companies in Japan have been introducing innovative formulations of aloe vera drinks. These formulations often include additional functional ingredients, such as vitamins, antioxidants, and natural sweeteners, to enhance the overall nutritional profile of the beverages. This approach caters to Japanese consumers' desire for holistic and functional beverages that contribute to their well-being.

Green tea, deeply ingrained in Japanese culture, serves as an ideal base for incorporating aloe vera. The combination not only capitalizes on the inherent health benefits of both ingredients but also resonates with the local preference for beverages that offer both refreshment and well-being. These aloe vera-infused green teas have quickly become popular among health-conscious consumers, providing a harmonious blend of tradition and innovation. Hence, the rising popularity of aloe vera drinks in Japan underscores a shift towards health-conscious choices and a preference for a holistic approach to well-being.

Competition Analysis

Japan's aloe vera drinks market has witnessed notable growth in recent years, driven by changing consumer preferences towards healthier and functional beverages. Several key players have emerged to cater to the demand for aloe vera-infused drinks in the Japanese industry, offering a diverse range of products to capture the attention of health-conscious consumers.

One of the prominent Japanese aloe vera drinks market companies is Sapporo Beverage Co., Ltd. Sapporo, a well-known beverage manufacturer in Japan, has introduced aloe vera drinks as part of its product portfolio. The company's aloe vera beverages often feature a combination of aloe vera gel and fruit flavors, providing a refreshing and hydrating option for consumers seeking a unique beverage experience. Sapporo's established presence in the Japanese industry positions it as a significant player in the growing functional and health-oriented drinks segment.

Another key player in the Japanese aloe vera drinks industry is Ito En, Ltd. Ito En is a major beverage company that has diversified its product offerings to include aloe vera-infused drinks. The company focuses on creating beverages that taste good and promote wellness. Ito En's aloe vera drinks often emphasize natural ingredients and are marketed as a source of hydration with potential health benefits, aligning with the preferences of health-conscious Japanese consumers.

Pokka Sapporo Food & Beverage Ltd. is a subsidiary of Pokka Sapporo Holdings, a well-established food and beverage company in Japan. Pokka Sapporo offers aloe vera drinks as part of its extensive beverage lineup. The company combines aloe vera with various fruit flavors to create delicious and health-oriented beverages. Pokka Sapporo's distribution network and brand recognition influence the Japanese aloe vera drinks market.

Morinaga & Co., Ltd. is another notable player in the Japanese aloe vera drinks segment. The company, recognized for its diverse food and beverage products, has introduced aloe vera drinks that appeal to the Japanese palate. Morinaga's approach often involves incorporating aloe vera gel into beverages with subtle sweetness, offering a unique taste experience for consumers seeking alternatives to traditional soft drinks.

Otsuka Pharmaceutical Co., Ltd. is a Japanese company that has ventured into the aloe vera drinks market, focusing on functionality. Otsuka's aloe vera beverages are designed to provide hydration and potential health benefits. The company leverages its expertise in the healthcare and wellness sector to position its aloe vera drinks as part of a broader commitment to consumer well-being. These companies operate in a market where consumer preferences are evolving, with a growing emphasis on health and wellness.

List of Key Companies Profiled

- Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

- Patanjali Ayurved Limited

- Nature's Way Products LLC (Dr. Willmar Schwabe GmbH & Co. KG)

- Aloe Farms, Inc.

- Tulip International Inc.

- OKF Corporation

- AloeCure (American Global Health Group, LLC)

- Akiva Superfoods

- ALO Drink (SPI West Port Group)

- Nam Viet Foods & Beverage Co., LTD

Japan Aloe Vera Drinks Market Report Segmentation

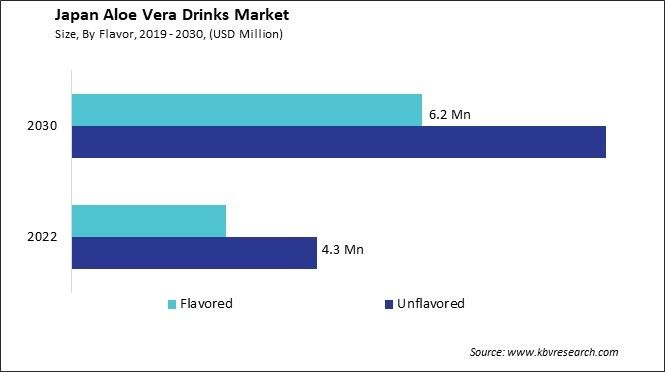

By Flavor

- Unflavored

- Flavored

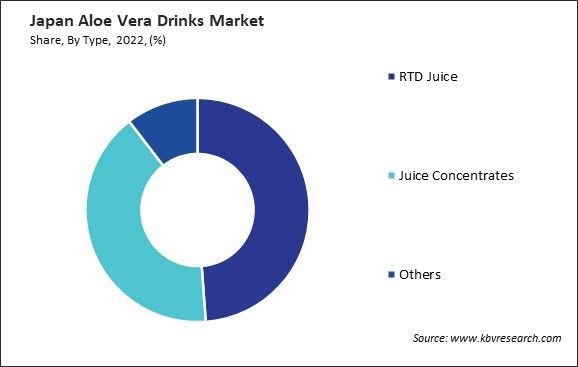

By Type

- RTD Juice

- Juice Concentrates

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Pharmacy

- Online

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Aloe Vera Drinks Market, by Flavor

1.4.2 Japan Aloe Vera Drinks Market, by Type

1.4.3 Japan Aloe Vera Drinks Market, by Distribution Channel

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities:

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. Japan Aloe Vera Drinks Market

3.1 Japan Aloe Vera Drinks Market by Flavor

3.2 Japan Aloe Vera Drinks Market by Type

3.3 Japan Aloe Vera Drinks Market by Distribution Channel

Chapter 4. Company Profiles – Global Leaders

4.1 Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

4.1.1 Company Overview

4.1.2 SWOT Analysis

4.2 Patanjali Ayurved Limited

4.2.1 Company Overview

4.2.2 SWOT Analysis

4.3 Nature's Way Products LLC (Dr. Willmar Schwabe GmbH & Co. KG)

4.3.1 Company Overview

4.3.2 SWOT Analysis

4.4 Tulip International Inc.

4.4.1 Company Overview

4.5 OKF Corporation

4.5.1 Company Overview

4.5.2 SWOT Analysis

4.6 AloeCure (American Global Health Group, LLC)

4.6.1 Company Overview

4.7 Akiva Superfoods

4.7.1 Company Overview

4.8 Nam Viet Foods & Beverage Co., LTD

4.8.1 Company Overview

4.8.2 SWOT Analysis

TABLE 2 Japan Aloe Vera Drinks Market, 2023 - 2030, USD ThoUSnds

TABLE 3 Japan Aloe Vera Drinks Market, 2019 - 2022, ThoUSnd Litres

TABLE 4 Japan Aloe Vera Drinks Market, 2023 - 2030, ThoUSnd Litres

TABLE 5 Japan Aloe Vera Drinks Market by Flavor, 2019 - 2022, USD ThoUSnds

TABLE 6 Japan Aloe Vera Drinks Market by Flavor, 2023 - 2030, USD ThoUSnds

TABLE 7 Japan Aloe Vera Drinks Market by Flavor, 2019 - 2022, ThoUSnd Litres

TABLE 8 Japan Aloe Vera Drinks Market by Flavor, 2023 - 2030, ThoUSnd Litres

TABLE 9 Japan Aloe Vera Drinks Market by Type, 2019 - 2022, USD ThoUSnds

TABLE 10 Japan Aloe Vera Drinks Market by Type, 2023 - 2030, USD ThoUSnds

TABLE 11 Japan Aloe Vera Drinks Market by Type, 2019 - 2022, ThoUSnd Litres

TABLE 12 Japan Aloe Vera Drinks Market by Type, 2023 - 2030, ThoUSnd Litres

TABLE 13 Japan Aloe Vera Drinks Market by Distribution Channel, 2019 - 2022, USD ThoUSnds

TABLE 14 Japan Aloe Vera Drinks Market by Distribution Channel, 2023 - 2030, USD ThoUSnds

TABLE 15 Japan Aloe Vera Drinks Market by Distribution Channel, 2019 - 2022, ThoUSnd Litres

TABLE 16 Japan Aloe Vera Drinks Market by Distribution Channel, 2023 - 2030, ThoUSnd Litres

TABLE 17 Key Information – Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

TABLE 18 Key Information – Patanjali Ayurved Limited

TABLE 19 Key Information – Nature's Way Products LLC

TABLE 20 Key Information – Tulip International Inc.

TABLE 21 Key Information – OKF Corporation

TABLE 22 Key Information – AloeCure

TABLE 23 Key Information – Akiva Superfoods

TABLE 24 Key Information – Nam Viet Foods & Beverage Co., LTD

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Aloe Vera Drinks Market, 2019 - 2030, USD ThoUSnds

FIG 3 Key Factors Impacting Aloe Vera Drinks Market

FIG 4 Porter’s Five Forces Analysis - Aloe Vera Drinks Market

FIG 5 Japan Aloe Vera Drinks Market share by Flavor, 2022

FIG 6 Japan Aloe Vera Drinks Market share by Flavor, 2030

FIG 7 Japan Aloe Vera Drinks Market by Flavor, 2019- 2030, USD ThoUSnds

FIG 8 Japan Aloe Vera Drinks Market share by Type, 2022

FIG 9 Japan Aloe Vera Drinks Market share by Type, 2030

FIG 10 Japan Aloe Vera Drinks Market by Type, 2019 - 2030, USD ThoUSnds

FIG 11 Japan Aloe Vera Drinks Market share by Distribution Channel, 2022

FIG 12 Japan Aloe Vera Drinks Market share by Distribution Channel, 2030

FIG 13 Japan Aloe Vera Drinks Market by Distribution Channel, 2019 - 2030, USD ThoUSnds

FIG 14 SWOT Analysis: Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

FIG 15 SWOT Analysis: Patanjali Ayurved Limited

FIG 16 SWOT Analysis: Nature's Way Products, LLC

FIG 17 SWOT Analysis: OKF Corporation

FIG 18 SWOT Analysis: Nam Viet Foods & Beverage Co., LTD