Germany Toaster Market Size, Share & Trends Analysis Report By Product (Pop-up, Conveyor, and Oven), By Distribution Channel (Offline, and Online), By Application (Residential, and Commercial), and Forecast, 2023 - 2031

Published Date : 22-Apr-2024 | Pages: 82 | Formats: PDF |

COVID-19 Impact on the Germany Toaster Market

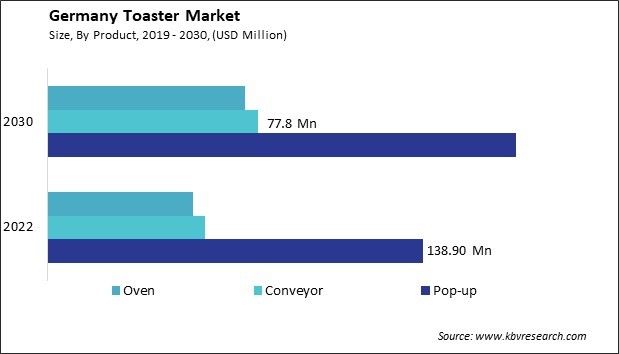

The Germany Toaster Market size is expected to reach $324.1 Million by 2030, rising at a market growth of 3.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 2533.4 thousand units, experiencing a growth of 3.3% (2019-2022).

The toaster market in Germany showcases a dynamic landscape influenced by the country's culinary traditions, technological advancements, and a growing preference for convenient kitchen appliances. German consumers, known for appreciating quality and efficiency, have embraced toasters as essential kitchen equipment. The industry offers diverse toasters, from traditional pop-up models to those featuring cutting-edge technologies and sleek designs.

One of the driving factors in the German toaster market is the country's rich bread culture. Germans are renowned for their artisanal bread varieties, and toasters are crucial in enjoying freshly toasted slices. As a result, manufacturers cater to the German preference for a wide range of bread styles, including whole grain, rye, and artisanal loaves. The toaster market is characterized by an emphasis on durability, energy efficiency, and precision toasting, reflecting the discerning tastes of German consumers.

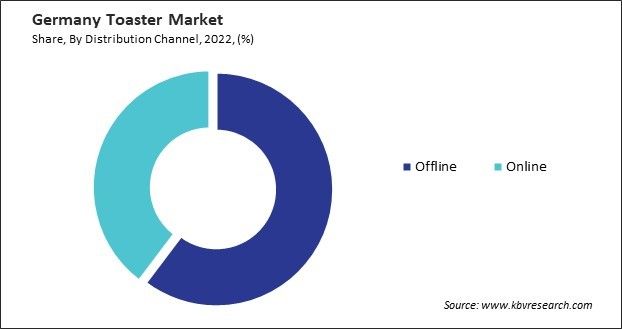

The COVID-19 pandemic has significantly impacted consumer behavior in Germany, including their approach to shopping for household appliances like toasters. With lockdowns and social distancing measures in place, online shopping has gained prominence. E-commerce platforms have become a convenient and safe alternative for consumers to purchase toasters and other kitchen essentials from the comfort of their homes.

Market Trends

Increasing sales of home appliances

Germany's toaster market has witnessed a notable surge in sales of home appliances, reflecting a growing trend in consumer preferences and lifestyle changes. One key factor contributing to the increased sales is the rising demand for multifunctional toasters beyond conventional bread toasting. German consumers seek versatile appliances with additional features like defrosting, reheating, and adjustable browning settings. As breakfast habits evolve, the demand for toasters that accommodate various types of bread and offer customization options is rising.

Furthermore, integrating smart technology into home appliances has captured the interest of tech-savvy German consumers. Smart toasters with connectivity features have gained popularity, allowing users to control settings through mobile applications or voice commands. The convenience offered by these advanced toasters aligns with the fast-paced lifestyles of many Germans.

In recent years, the aesthetic appeal of kitchen appliances has become a significant consideration for German consumers. Sleek and modern designs, along with a variety of color options, are influencing purchasing decisions. Manufacturers prioritizing functionality and aesthetics will likely attract a larger share of the German toaster market.

According to the GFU Consumer & Home Electronics, overall sales in Germany exhibited relative stability in the realm of home appliances, reaching 17.6 billion euros in 2021. Notably, there was a modest uptick in the sales of major domestic appliances, with a year-on-year increase of 0.6%, resulting in a total of nearly 10.5 billion euros.

This positive trend also extends to the toaster market, contributing to the overall resilience and growth observed in the home appliances sector. Thus, the German toaster market is experiencing a surge in sales driven by the increasing demand for multifunctional and technologically advanced appliances, including smart toasters with connectivity features.

Rise of pop-up toasters in Germany

In Germany, the toaster market has witnessed significant growth in the popularity of pop-up toasters in recent years. One key driver of the growth in pop-up toasters is the cultural shift towards a faster-paced lifestyle. With an increasing number of Germans adopting a busy routine, there is a growing demand for quick and convenient breakfast options. Pop-up toasters offer a time-efficient solution for toasting bread, providing consumers with a convenient way to prepare a quick and delicious breakfast.

Moreover, the German penchant for quality and efficiency is reflected in the design and features of modern pop-up toasters. Manufacturers have responded to the German consumer's demand for durable, high-performance appliances. Many pop-up toasters in the industry come equipped with advanced features such as adjustable browning settings, wide slots to accommodate various bread sizes and even special functions for defrosting or warming.

The emphasis on health-conscious choices also plays a role in the popularity of pop-up toasters. Consumers in Germany are increasingly opting for whole-grain and artisanal bread, and pop-up toasters allow them to enjoy these varieties with customizable toasting options. The ability to control the toasting level ensures that individuals achievesachieve the desired crispiness without compromising on the nutritional value of their bread. Hence, the surge in pop-up toaster popularity in Germany is attributed to the alignment with the fast-paced lifestyle, emphasis on quality and efficiency, and the versatility to cater to health-conscious choices by providing customizable toasting options for various bread types.

Competition Analysis

The German toaster market is a robust industry shaped by a combination of renowned global brands and domestic companies known for their commitment to quality and innovation. These companies cater to the German consumer's preference for efficiency, durability, and advanced technology in kitchen appliances.

One of the prominent players in the German toaster market is Siemens, a well-established German brand known for its high-quality home appliances. Siemens toasters are recognized for their sleek designs and innovative features. The brand often integrates advanced toasting technologies, such as sensor-controlled browning and extra-wide slots to accommodate various types of bread. Siemens' reputation for reliability has contributed to its success in Germany.

Another influential participant is Bosch, a brand synonymous with German engineering excellence. Bosch toasters are popular for their durability and precision. The company offers a range of toasters with features like automatic shut-off, multiple toasting settings, and easy-to-clean designs. Bosch's commitment to energy efficiency aligns well with the environmentally conscious preferences of German consumers.

Miele, a German manufacturer known for its premium household appliances, is also a key player in the German toaster market. Miele toasters are celebrated for their combination of cutting-edge technology and elegant design. The brand often incorporates intuitive controls and sensor-based toasting systems to ensure consistent results. Miele's focus on delivering a superior user experience has appealed to discerning German consumers.

Krups, a German brand of the French Groupe SEB, has a strong presence in the German toaster market. The company’s toasters are recognized for their modern designs and user-friendly features. The brand caters to a wide range of consumers, offering basic toasters with essential functions and more advanced models with additional features like bagel toasting and defrost settings.

Braun, a German consumer products company, is also actively involved in the toaster market. Their minimalist design and functional efficiency characterize Braun toasters. The company often incorporates innovative heating elements and temperature control mechanisms into its toasters, ensuring precise and even toasting. Braun's reputation for quality and reliability resonates well with German consumers seeking long-lasting kitchen appliances.

Emerging players like Rommelsbacher have also gained traction in the German toaster market. Rommelsbacher, a German brand specializing in small kitchen appliances, offers a range of toasters that combine traditional craftsmanship with modern technology. The brand's toasters often feature customizable browning levels and durable construction, catering to consumers looking for reliable and versatile appliances. Thus, the toaster market in Germany is characterized by a diverse range of companies catering to different consumer preferences.

List of Key Companies Profiled

- Panasonic Holdings Corporation

- LG Electronics, Inc. (LG Corporation)

- Samsung Electronics Co., Ltd. (Samsung Group)

- Haier Smart Home Co., Ltd. (Haier Group Corporation)

- Hisense International Co., Ltd.

- Breville Group Limited

- Koninklijke Philips N.V.

- Dualit Ltd

- Hamilton Beach Brands, Inc. (Hamilton Beach Brands Holding Company)

- Whirlpool Corporation

Germany Toaster Market Report Segmentation

By Product

- Pop-up

- Conveyor

- Oven

By Distribution Channel

- Offline

- Online

By Application

- Residential

- Commercial

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany Toaster Market, by Product

1.4.2 Germany Toaster Market, by Distribution Channel

1.4.3 Germany Toaster Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.1 Market Trends

2.3 Porter Five Forces Analysis

Chapter 3. Strategies Deployed in Toaster Market

Chapter 4. Germany Toaster Market

4.1 Germany Toaster Market, By Product

4.2 Germany Toaster Market, By Distribution Channel

4.3 Germany Toaster Market, By Application

Chapter 5. Company Profiles – Global Leaders

5.1 Panasonic Holdings Corporation

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 Recent strategies and developments:

5.1.5.1 Partnerships, Collaborations, and Agreements:

5.1.6 SWOT Analysis

5.2 LG Electronics, Inc. (LG Corporation)

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Regional & Segmental Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Partnerships, Collaborations, and Agreements:

5.2.5.2 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 Samsung Electronics Co., Ltd. (Samsung Group)

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 SWOT Analysis

5.4 Haier Smart Home Co., Ltd. (Haier Group Corporation)

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expense

5.4.5 SWOT Analysis

5.5 Hisense International Co., Ltd.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Regional Analysis

5.5.4 SWOT Analysis

5.6 Breville Group Limited

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Recent strategies and developments:

5.6.4.1 Acquisition and Mergers:

5.6.5 SWOT Analysis

5.7 Koninklijke Philips N.V.

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expense

5.7.5 SWOT Analysis

5.8 Hamilton Beach Brands, Inc. (Hamilton Beach Brands Holding Company)

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Product and Regional Analysis

5.8.4 Regional Analysis

5.8.5 SWOT Analysis

5.9 Whirlpool Corporation

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Regional Analysis

5.9.4 Research & Development Expense

5.9.5 SWOT Analysis

TABLE 2 Germany Toaster Market, 2023 - 2030, USD Million

TABLE 3 Germany Toaster Market, 2019 - 2022, ThoUSnd Units

TABLE 4 Germany Toaster Market, 2023 - 2030, ThoUSnd Units

TABLE 5 Germany Toaster Market, By Product, 2019 - 2022, USD Million

TABLE 6 Germany Toaster Market, By Product, 2023 - 2030, USD Million

TABLE 7 Germany Toaster Market, By Product, 2019 - 2022, ThoUSnd Units

TABLE 8 Germany Toaster Market, By Product, 2023 - 2030, ThoUSnd Units

TABLE 9 Germany Toaster Market, By Distribution Channel, 2019 - 2022, USD Million

TABLE 10 Germany Toaster Market, By Distribution Channel, 2023 - 2030, USD Million

TABLE 11 Germany Toaster Market, By Distribution Channel, 2019 - 2022, ThoUSnd Units

TABLE 12 Germany Toaster Market, By Distribution Channel, 2023 - 2030, ThoUSnd Units

TABLE 13 Germany Toaster Market, By Application, 2019 - 2022, USD Million

TABLE 14 Germany Toaster Market, By Application, 2023 - 2030, USD Million

TABLE 15 Germany Toaster Market, By Application, 2019 - 2022, ThoUSnd Units

TABLE 16 Germany Toaster Market, By Application, 2023 - 2030, ThoUSnd Units

TABLE 17 Key Information – Panasonic Holdings Corporation

TABLE 18 Key Information – LG Electronics, Inc.

TABLE 19 Key Information – Samsung Electronics Co., Ltd.

TABLE 20 key information – Haier Smart Home Co., Ltd.

TABLE 21 Key Information – Hisense International Co., Ltd.

TABLE 22 Key Information – Breville Group Limited

TABLE 23 Key Information – Koninklijke Philips N.V.

TABLE 24 Key Information – Hamilton Beach Brands, Inc.

TABLE 25 Key information – Whirlpool Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany Toaster Market, 2019 - 2022, USD Million

FIG 3 Key Factors Impacting toaster Market

FIG 4 Porter’s Five Forces Analysis – Toaster Market

FIG 5 Germany Toaster Market Share, By Product, 2022

FIG 6 Germany Toaster Market Share, By Product, 2030

FIG 7 Germany Toaster Market, By Product, 2019 - 2030, USD Million

FIG 8 Germany Toaster Market Share, By Product, 2022

FIG 9 Germany Toaster Market Share, By Product, 2030

FIG 10 Germany Toaster Market, By Product, 2019 - 2030, ThoUSnd Units

FIG 11 Germany Toaster Market Share, By Distribution Channel, 2022

FIG 12 Germany Toaster Market Share, By Distribution Channel, 2030

FIG 13 Germany Toaster Market, By Distribution Channel, 2019 - 2030, USD Million

FIG 14 Germany Toaster Market Share, By Distribution Channel, 2022

FIG 15 Germany Toaster Market Share, By Distribution Channel, 2030

FIG 16 Germany Toaster Market, By Distribution Channel, 2019 - 2030, ThoUSnd Units

FIG 17 Germany Toaster Market Share, By Application, 2022

FIG 18 Germany Toaster Market Share, By Application, 2030

FIG 19 Germany Toaster Market, By Application, 2019 - 2030, USD Million

FIG 20 Germany Toaster Market Share, By Application, 2022

FIG 21 Germany Toaster Market Share, By Application, 2030

FIG 22 Germany Toaster Market, By Application, 2019 - 2030, ThoUSnd Units

FIG 23 SWOT Analysis: Panasonic Holdings Corporation

FIG 24 Recent strategies and developments: LG Electronics, Inc.

FIG 25 SWOT Analysis: LG Electronics, Inc.

FIG 26 SWOT Analysis: Samsung Electronics Co., Ltd.

FIG 27 SWOT Analysis: HAIER SMART HOME CO., LTD.

FIG 28 SWOT Analysis: Hisense International Co., Ltd.

FIG 29 SWOT Analysis: Breville Group Limited

FIG 30 SWOT Analysis: Koninklijke Philips N.V.

FIG 31 SWOT Analysis: Hamilton Beach Brands, Inc.

FIG 32 SWOT Analysis: Whirlpool Corporation