Germany Optical Sensors Market Size, Share & Trends Analysis Report By Type (Intrinsic Sensor, and Extrinsic Sensor), By Application, By Sensor Type, By End-use, and Forecast, 2023 - 2031

Published Date : 22-Apr-2024 | Pages: 96 | Formats: PDF |

COVID-19 Impact on the Germany Optical Sensors Market

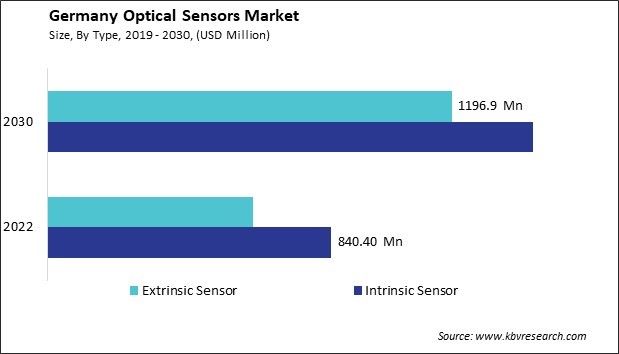

The Germany Optical Sensors Market size is expected to reach $2.6 Billion by 2030, rising at a market growth of 7.9% CAGR during the forecast period.

Renowned for its technological prowess and industrial innovation, Germany is a key player in the global optical sensors market. The manufacturing sector in Germany has been a pioneer in Industry 4.0, the fourth industrial revolution characterized by smart factories and interconnected systems. Optical sensors play a crucial role in smart manufacturing by providing data for process optimization, quality control, and predictive maintenance. As German industries continue to embrace digitalization, the demand for optical sensors as integral components of smart systems is expected to grow.

Consumer electronics is another sector where Germany has made significant contributions, with companies producing high-quality devices and gadgets. Optical sensors find applications in smartphones, cameras, and wearables, enhancing user experiences through features like facial recognition, gesture control, and augmented reality. The constant innovation in consumer electronics drives the demand for advanced optical sensor technologies.

The positive impact of COVID-19 on the optical sensors market in Germany has been notable. The pandemic accelerated the digitization of industries, with companies seeking innovative solutions to ensure business continuity. This shift towards digital transformation has increased the demand for optical sensors, especially in contactless sensing and monitoring areas. The healthcare sector, in particular, witnessed a surge in demand for medical devices equipped with optical sensors to aid in remote patient monitoring and diagnostics, aligning with the need to reduce physical contact.

Market Trends

Increasing demand for extrinsic optical sensors

Germany has witnessed a substantial surge in the demand for extrinsic optical sensors, establishing a robust presence in the country's thriving optical sensors market. One of the key drivers behind the increasing demand for extrinsic optical sensors in Germany is the nation's commitment to advanced manufacturing and Industry 4.0 initiatives. As a global leader in industrial automation, Germany has embraced smart manufacturing technologies that heavily rely on sensors for data acquisition and process optimization.

Moreover, the emphasis on sustainability and environmental monitoring in Germany has fueled the adoption of extrinsic optical sensors. These sensors are deployed in environmental monitoring systems to measure air and water quality, contributing to the nation's commitment to ecological conservation and sustainable development. Germany's healthcare industry has also contributed to the rising demand for extrinsic optical sensors. With advancements in medical technology, these sensors are utilized in various diagnostic and monitoring applications, ranging from blood glucose monitoring to imaging equipment.

The automotive sector has significantly contributed to the demand for extrinsic optical sensors. The need for high-performance optical sensors has escalated as vehicles become more advanced and incorporate features like adaptive cruise control, collision avoidance, and autonomous driving capabilities. Extrinsic optical sensors enable precise distance measurement and object detection, enhancing the safety and functionality of modern vehicles in Germany.

According to Germany Trade & Invest, German automobile manufacturers produced over 15.6 million vehicles in 2021. Notably, Germany emerged as the European leader in car production, with German plants producing more than 3.1 million passenger cars and 351,000 commercial vehicles in 2021. This dominance extends beyond traditional manufacturing, as Germany's influence in the automotive sector extends to cutting-edge technologies. One such expansion area is the integration of optical sensors in the German automobile industry. As the industry continues to evolve, these sensors play a crucial role, contributing to advancements in safety, automation, and overall vehicle performance.

Rising demand for photoelectric sensor

In recent years, Germany has witnessed a significant rise in the adoption of photoelectric sensors, contributing to the burgeoning optical sensors market in the country. The ongoing trend toward smart manufacturing and the widespread implementation of Industry 4.0 principles have fueled the demand for photoelectric sensors. These sensors enable real-time data acquisition and communication in manufacturing systems, aligning with Germany's strategic focus on achieving interconnected and adaptive production environments.

The German manufacturing sector has been a key driver in the increased adoption of photoelectric sensors. With a strong emphasis on Industry 4.0, German industries are integrating these sensors into their automated production lines. Photoelectric sensors, renowned for their versatility in detecting various materials, are vital in ensuring precision and efficiency in manufacturing processes.

Additionally, the heightened focus on energy efficiency and sustainability in Germany has led to the deployment of photoelectric sensors in lighting control systems. These sensors are crucial in optimizing energy consumption by adjusting lighting levels based on occupancy and ambient conditions. Thus, the surge in photoelectric sensor adoption within Germany's manufacturing sector, driven by Industry 4.0 initiatives and a commitment to energy efficiency, underscores these sensors' pivotal role in advancing precision, efficiency, and sustainability across diverse industrial applications.

Competition Analysis

The optical sensors market in Germany is a dynamic and thriving sector characterized by various companies at the forefront of technological innovation. These companies play a crucial role in shaping the landscape of optical sensor technology, catering to diverse industries such as automotive, healthcare, industrial automation, and consumer electronics.

One prominent player in the German optical sensors market is Bosch Sensortec GmbH, a subsidiary of the Bosch Group. Known for its cutting-edge sensor solutions, Bosch Sensortec specializes in micro-electro-mechanical systems (MEMS) technology. The company's optical sensors find applications in smartphones, wearables, and augmented reality devices, contributing to the growing demand for advanced sensing capabilities in consumer electronics.

Another key player is SICK AG, which has significantly contributed to the optical sensor market in Germany. Specializing in sensor intelligence and application solutions, SICK AG provides a wide range of optical sensors for industrial automation. These sensors are instrumental in enhancing the efficiency and safety of manufacturing processes, aligning with Germany's strong focus on advanced manufacturing and Industry 4.0 initiatives.

IFM Electronic GmbH is renowned for its sensor solutions that cater to various industries, including automotive, food and beverage, and packaging. The company's optical sensors play a crucial role in automation and control applications, contributing to optimizing industrial processes. IFM Electronic GmbH's presence in Germany underscores the country's position as a hub for innovative sensor technologies.

In the automotive sector, Osram Opto Semiconductors GmbH stands out as a key player in the German optical sensors market. The company specializes in optoelectronic semiconductors and offers automotive lighting, sensing, and visualization solutions. Osram's optical sensors contribute to advancements in automotive safety, driver assistance systems, and autonomous driving technologies.

First Sensor AG is recognized in the healthcare sector for its innovative sensor solutions, including optical sensors used in medical devices. The company's contributions align with Germany's emphasis on healthcare technology and innovation, playing a role in developing advanced medical equipment. From automotive to healthcare and industrial automation, these companies play a pivotal role in shaping the landscape of optical sensor technology, reflecting Germany's commitment to innovation and excellence in the field of optical sensor technology.

List of Key Companies Profiled

- Honeywell International, Inc.

- Keyence Corporation

- Amphenol Corporation

- Cisco Systems, Inc.

- Texas Instruments, Inc.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Rockwell Automation, Inc.

- Sick AG

- ams-OSRAM AG

Germany Optical Sensors Market Report Segmentation

By Type

- Intrinsic Sensor

- Extrinsic Sensor

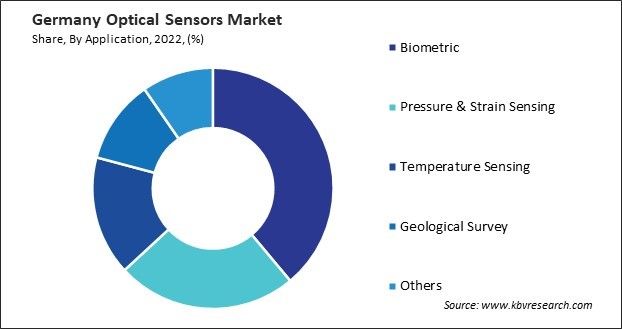

By Application

- Biometric

- Pressure & Strain Sensing

- Temperature Sensing

- Geological Survey

- Others

By Sensor Type

- Optical Temperature Sensors

- Photoelectric Sensor

- Fiber Optic Sensor

- Biomedical Sensors

- Displacement & Position Sensors

- Others

By End-use

- Consumer Electronics

- Healthcare

- Energy & Utility

- Manufacturing

- Automotive & Transportation

- Aerospace & Defense

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany Optical Sensors Market, by Type

1.4.2 Germany Optical Sensors Market, by Application

1.4.3 Germany Optical Sensors Market, by Sensor Type

1.4.4 Germany Optical Sensors Market, by End-use

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.1 Market Trends

Chapter 3. Competition Analysis – Global

3.1 Market Share Analysis, 2022

3.2 Porter’s Five Forces Analysis

Chapter 4. Germany Optical Sensors Market

4.1 Germany Optical Sensors Market by Type

4.2 Germany Optical Sensors Market by Application

4.3 Germany Optical Sensors Market by Sensor Type

4.4 Germany Optical Sensors Market by End-use

Chapter 5. Company Profiles

5.1 Honeywell International, Inc.

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 SWOT Analysis

5.2 Keyence Corporation

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 Amphenol Corporation

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Acquisition and Mergers:

5.3.6 SWOT Analysis

5.4 Cisco Systems, Inc.

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Regional Analysis

5.4.4 Research & Development Expense

5.4.5 SWOT Analysis

5.5 Texas Instruments, Inc.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expense

5.5.5 SWOT Analysis

5.6 Renesas Electronics Corporation

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expense

5.6.5 SWOT Analysis

5.7 STMicroelectronics N.V.

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expense

5.7.5 SWOT Analysis

5.8 Rockwell Automation, Inc.

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expenses

5.8.5 SWOT Analysis

5.9 Sick AG

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expense

5.9.5 Recent strategies and developments:

5.9.5.1 Product Launches and Product Expansions:

5.9.6 SWOT Analysis

5.1 ams-OSRAM AG

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expense

5.10.5 Recent strategies and developments:

5.10.5.1 Product Launches and Product Expansions:

5.10.6 SWOT Analysis

TABLE 2 Germany Optical Sensors Market, 2023 - 2030, USD Million

TABLE 3 Germany Optical Sensors Market by Type, 2019 - 2022, USD Million

TABLE 4 Germany Optical Sensors Market by Type, 2023 - 2030, USD Million

TABLE 5 Germany Optical Sensors Market by Type, 2019 - 2022, ThoUSnd Units

TABLE 6 Germany Optical Sensors Market by Type, 2023 - 2030, ThoUSnd Units

TABLE 7 Germany Optical Sensors Market by Application, 2019 - 2022, USD Million

TABLE 8 Germany Optical Sensors Market by Application, 2023 - 2030, USD Million

TABLE 9 Germany Optical Sensors Market by Sensor Type, 2019 - 2022, USD Million

TABLE 10 Germany Optical Sensors Market by Sensor Type, 2023 - 2030, USD Million

TABLE 11 Germany Optical Sensors Market by Sensor Type, 2019 - 2022, ThoUSnd Units

TABLE 12 Germany Optical Sensors Market by Sensor Type, 2023 - 2030, ThoUSnd Units

TABLE 13 Germany Optical Sensors Market by End-use, 2019 - 2022, USD Million

TABLE 14 Germany Optical Sensors Market by End-use, 2023 - 2030, USD Million

TABLE 15 Germany Optical Sensors Market by End-use, 2019 - 2022, ThoUSnd Units

TABLE 16 Germany Optical Sensors Market by End-use, 2023 - 2030, ThoUSnd Units

TABLE 17 Key Information – Honeywell International, Inc.

TABLE 18 key information – Keyence Corporation

TABLE 19 key information – Amphenol Corporation

TABLE 20 Key Information – Cisco Systems, Inc.

TABLE 21 Key Information – Texas Instruments, Inc.

TABLE 22 Key Information – Renesas Electronics Corporation

TABLE 23 Key Information – STMicroelectronics N.V.

TABLE 24 Key Information – Rockwell Automation, Inc.

TABLE 25 Key Information – Sick AG

TABLE 26 Key Information – ams-OSRAM AG

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany Optical Sensors Market, 2019 - 2022, USD Million

FIG 3 Key Factors Impacting Optical Sensors Market

FIG 4 Market Share Analysis, 2022

FIG 5 Porter’s Five Forces Analysis – Optical sensors market

FIG 6 Germany Optical Sensors Market Share by Type, 2022

FIG 7 Germany Optical Sensors Market Share by Type, 2030

FIG 8 Germany Optical Sensors Market by Type, 2019 - 2030, USD Million

FIG 9 Germany Optical Sensors Market share by Application, 2022

FIG 10 Germany Optical Sensors Market share by Application, 2030

FIG 11 Germany Optical Sensors Market by Application, 2019 - 2030, USD Million

FIG 12 Germany Optical Sensors Market Share by Sensor Type, 2022

FIG 13 Germany Optical Sensors Market Share by Sensor Type, 2030

FIG 14 Germany Optical Sensors Market by Sensor Type, 2019 - 2030, USD Million

FIG 15 Germany Optical Sensors Market Share by End-use, 2022

FIG 16 Germany Optical Sensors Market Share by End-use, 2030

FIG 17 Germany Optical Sensors Market by End-use, 2019 - 2030, USD Million

FIG 18 SWOT Analysis: Honeywell international, inc.

FIG 19 SWOT Analysis: KEYENCE CORPORATION

FIG 20 SWOT Analysis: Amphenol Corporation

FIG 21 SWOT Analysis: Cisco Systems, Inc.

FIG 22 SWOT Analysis: Texas Instruments, Inc.

FIG 23 SWOT Analysis: Renesas Electronics Corporation

FIG 24 SWOT Analysis: STMicroelectronics N.V.

FIG 25 SWOT Analysis: Rockwell Automation, Inc.

FIG 26 SWOT Analysis: Sick AG

FIG 27 SWOT Analysis: ams-OSRAM AG