Germany Aloe Vera Drinks Market Size, Share & Trends Analysis Report By Flavor, By Type (RTD Juice, Juice Concentrates, and Others), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy, Online, and Others), and Forecast, 2023 - 2030

Published Date : 19-Apr-2024 | Pages: 53 | Formats: PDF |

COVID-19 Impact on the Germany Aloe Vera Drinks Market

The Germany Aloe Vera Drinks Market size is expected to reach $13.3 Million by 2030, rising at a market growth of 9.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 603.00 thousand litres, experiencing a growth of 9.5% (2019-2022).

In Germany, the aloe vera drinks market has experienced significant growth in recent years, reflecting the country's increasing focus on health and wellness. The demand for aloe vera drinks in Germany is driven by various factors, including the growing awareness of the plant's purported health benefits. Aloe vera is believed to have digestive and skin health benefits, which appeal to health-conscious consumers. In a country where organic and natural products are highly valued, aloe vera drinks are positioned as a refreshing and health-enhancing beverage option.

Manufacturers responded by innovating and introducing new products that catered to changing consumer preferences in Germany. Aloe vera drinks with added functional ingredients, natural sweeteners, and unique flavor profiles gained traction. Companies also invested in online marketing and e-commerce channels to reach consumers directly, capitalizing on the surge in online shopping during the pandemic.

Additionally, during COVID-19 pandemic, there was a growing preference for immunity-boosting products, and aloe vera drinks, with their perceived health benefits, gained traction in Germany. The pandemic prompted manufacturers to emphasize hygiene and safety in production processes, further influencing consumer choices in the German aloe vera drinks market.

Market Trends

Expansion of the e-commerce industry

The e-commerce industry has witnessed a remarkable surge in Germany's aloe vera drinks market, reflecting a growing consumer preference for health-conscious and natural beverages. This trend can be attributed to several factors that highlight the unique characteristics of the German industry. The convenience offered by e-commerce platforms has played a pivotal role in the increased popularity of aloe Vera drinks in Germany. Online shopping has become an integral part of the German lifestyle, especially with the ease of access and the wide variety of products available on digital platforms. Consumers can now explore and purchase aloe vera drinks from the comfort of their homes, providing a hassle-free experience that resonates well with the German preference for efficiency.

The e-commerce platforms have also facilitated introducing a diverse range of aloe vera drink brands and flavors to the German industry. This variety caters to consumers' evolving tastes and preferences, allowing them to explore different options and find products that suit their needs. The online space is a marketplace for established brands and emerging players, fostering healthy competition and driving innovation in the aloe vera drinks market.

German consumers are increasingly valuing transparency and sustainability in their purchasing decisions. E-commerce platforms provide a channel for aloe vera drinks brands to communicate their commitment to quality, sourcing practices, and eco-friendly packaging. This information is crucial for gaining the trust of environmentally conscious German consumers who prioritize ethical considerations in their buying choices.

According to the International Trade Administration, Germany is experiencing significant growth, with total sales estimated at USD 141.2 billion in 2022, reflecting an impressive 11 percent increase compared to 2021. Anticipating a rise in the online population from 62.4 million in 2020 to 68.4 million in 2025, the e-commerce sector is a key driver of this expansion. In 2022, the e-commerce penetration rate reached a remarkable 80 percent in the German market, ranking it as the third highest globally. This surge in online presence is reshaping the aloe vera drinks industry, showcasing a notable trend towards digital platforms for sales and distribution.

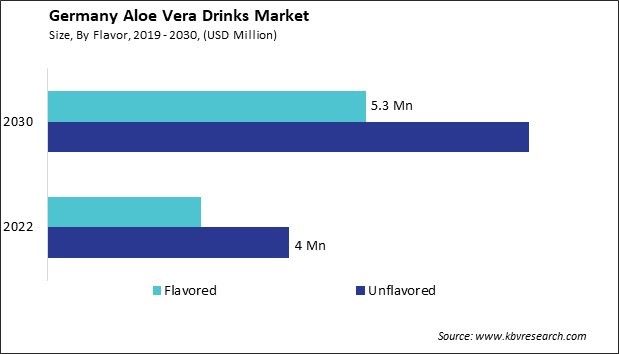

Domination of unflavored aloe vera drinks

In the dynamic landscape of the German aloe vera drinks market, unflavored aloe vera drinks have emerged as the largest and most influential product segment. The rising consumer preference for natural and unadulterated beverages has significantly contributed to the prominence of unflavored aloe vera drinks across the country. These beverages harness the inherent health benefits of aloe vera without the addition of artificial flavors, appealing to a growing segment of health-conscious German consumers.

The success of unflavored aloe vera drinks is attributed to the perceived purity and authenticity they offer. Consumers are increasingly drawn to products that are free from artificial additives, preservatives, and sweeteners, and unflavored aloe vera drinks align perfectly with this trend. The minimalist approach to formulation resonates well with those seeking a clean and simple ingredient list, reinforcing the natural and wholesome image of the product.

Manufacturers in the aloe vera drinks sector are continuing innovating within the unflavored segment, exploring ways to enhance the natural attributes of aloe vera and meet the evolving preferences of the German consumer. As this aloe cera drinks market segment continues to thrive, it is indicative of a larger trend where simplicity and authenticity in product offerings resonate strongly with today's discerning consumers in Germany. Therefore, the surge in popularity of unflavored aloe vera drinks in Germany underscores a significant shift towards natural and authentic beverage choices.Top of Form

Competition Analysis

Germany's aloe vera drinks market has experienced steady growth in recent years, driven by the country's health-conscious consumers seeking functional and natural beverage options. One of the notable companies in the German aloe vera drinks market is Voelkel GmbH. Voelkel, a German organic beverage manufacturer, has incorporated aloe vera into its product portfolio, aligning with the country's organic and natural products trend. The company's aloe vera drinks often emphasize high-quality, organic ingredients and are positioned as refreshing beverages with potential health benefits. Voelkel's commitment to sustainability and organic farming resonates well with environmentally conscious German consumers.

Another significant player in the German aloe vera drinks industry is Hohes C, a brand under Eckes-Granini Group GmbH. The company is recognized for its fruit-based beverages, and the brand has introduced aloe vera drinks to its lineup. Leveraging its strong industry presence, Eckes-Granini has successfully positioned Hohes C aloe vera drinks as a refreshing and healthy choice, appealing to German consumers looking for functional and flavorful beverages.

Grace Germany GmbH is a subsidiary of GraceKennedy Limited, a global food and beverage conglomerate. Grace Germany focuses on Caribbean and ethnic foods, and it has ventured into the aloe vera drinks market with a unique tropical twist. The company's aloe vera drinks often combine aloe vera with exotic fruit flavors, catering to German consumers' interest in diverse and globally inspired beverage options.

True Fruits GmbH, known for its innovative and colorful smoothie creations, has also made a mark in the German aloe vera drinks market. The company's aloe vera beverages often feature creative blends of fruits and vegetables and aloe vera, targeting health-conscious consumers who appreciate taste and nutritional value.

German supermarket chains, such as Aldi and Lidl, have also played a role in popularizing aloe vera drinks. These retailers offer private-label aloe vera beverages, providing affordable options for a broad consumer base. The availability of private-label aloe vera drinks in major supermarkets has contributed to the mainstream acceptance of these products in the German industry. As consumer preferences in Germany continue to evolve towards healthier beverage choices, these companies adapt to meet the demand for natural and functional drinks.

List of Key Companies Profiled

- Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

- Patanjali Ayurved Limited

- Nature's Way Products LLC (Dr. Willmar Schwabe GmbH & Co. KG)

- Aloe Farms, Inc.

- Tulip International Inc.

- OKF Corporation

- AloeCure (American Global Health Group, LLC)

- Akiva Superfoods

- ALO Drink (SPI West Port Group)

- Nam Viet Foods & Beverage Co., LTD

Germany Aloe Vera Drinks Market Report Segmentation

By Flavor

- Unflavored

- Flavored

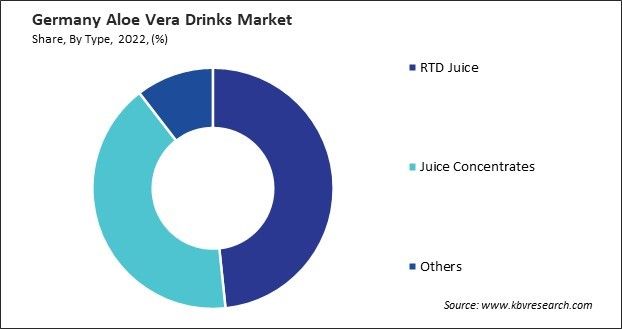

By Type

- RTD Juice

- Juice Concentrates

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Pharmacy

- Online

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany Aloe Vera Drinks Market, by Flavor

1.4.2 Germany Aloe Vera Drinks Market, by Type

1.4.3 Germany Aloe Vera Drinks Market, by Distribution Channel

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities:

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. Germany Aloe Vera Drinks Market

3.1 Germany Aloe Vera Drinks Market by Flavor

3.2 Germany Aloe Vera Drinks Market by Type

3.3 Germany Aloe Vera Drinks Market by Distribution Channel

Chapter 4. Company Profiles

4.1 Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

4.1.1 Company Overview

4.1.2 SWOT Analysis

4.2 Patanjali Ayurved Limited

4.2.1 Company Overview

4.2.2 SWOT Analysis

4.3 Nature's Way Products LLC (Dr. Willmar Schwabe GmbH & Co. KG)

4.3.1 Company Overview

4.3.2 SWOT Analysis

4.4 Tulip International Inc.

4.4.1 Company Overview

4.5 OKF Corporation

4.5.1 Company Overview

4.5.2 SWOT Analysis

4.6 AloeCure (American Global Health Group, LLC)

4.6.1 Company Overview

4.7 Akiva Superfoods

4.7.1 Company Overview

4.8 Nam Viet Foods & Beverage Co., LTD

4.8.1 Company Overview

4.8.2 SWOT Analysis

TABLE 2 Germany Aloe Vera Drinks Market, 2023 - 2030, USD ThoUSnds

TABLE 3 Germany Aloe Vera Drinks Market, 2019 - 2022, ThoUSnd Litres

TABLE 4 Germany Aloe Vera Drinks Market, 2023 - 2030, ThoUSnd Litres

TABLE 5 Germany Aloe Vera Drinks Market by Flavor, 2019 - 2022, USD ThoUSnds

TABLE 6 Germany Aloe Vera Drinks Market by Flavor, 2023 - 2030, USD ThoUSnds

TABLE 7 Germany Aloe Vera Drinks Market by Flavor, 2019 - 2022, ThoUSnd Litres

TABLE 8 Germany Aloe Vera Drinks Market by Flavor, 2023 - 2030, ThoUSnd Litres

TABLE 9 Germany Aloe Vera Drinks Market by Type, 2019 - 2022, USD ThoUSnds

TABLE 10 Germany Aloe Vera Drinks Market by Type, 2023 - 2030, USD ThoUSnds

TABLE 11 Germany Aloe Vera Drinks Market by Type, 2019 - 2022, ThoUSnd Litres

TABLE 12 Germany Aloe Vera Drinks Market by Type, 2023 - 2030, ThoUSnd Litres

TABLE 13 Germany Aloe Vera Drinks Market by Distribution Channel, 2019 - 2022, USD ThoUSnds

TABLE 14 Germany Aloe Vera Drinks Market by Distribution Channel, 2023 - 2030, USD ThoUSnds

TABLE 15 Germany Aloe Vera Drinks Market by Distribution Channel, 2019 - 2022, ThoUSnd Litres

TABLE 16 Germany Aloe Vera Drinks Market by Distribution Channel, 2023 - 2030, ThoUSnd Litres

TABLE 17 Key Information – Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

TABLE 18 Key Information – Patanjali Ayurved Limited

TABLE 19 Key Information – Nature's Way Products LLC

TABLE 20 Key Information – Tulip International Inc.

TABLE 21 Key Information – OKF Corporation

TABLE 22 Key Information – AloeCure

TABLE 23 Key Information – Akiva Superfoods

TABLE 24 Key Information – Nam Viet Foods & Beverage Co., LTD

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany Aloe Vera Drinks Market, 2019 - 2030, USD ThoUSnds

FIG 3 Key Factors Impacting Aloe Vera Drinks Market

FIG 4 Porter’s Five Forces Analysis - Aloe Vera Drinks Market

FIG 5 Germany Aloe Vera Drinks Market share by Flavor, 2022

FIG 6 Germany Aloe Vera Drinks Market share by Flavor, 2030

FIG 7 Germany Aloe Vera Drinks Market by Flavor, 2019- 2030, USD ThoUSnds

FIG 8 Germany Aloe Vera Drinks Market share by Type, 2022

FIG 9 Germany Aloe Vera Drinks Market share by Type, 2030

FIG 10 Germany Aloe Vera Drinks Market by Type, 2019 - 2030, USD ThoUSnds

FIG 11 Germany Aloe Vera Drinks Market share by Distribution Channel, 2022

FIG 12 Germany Aloe Vera Drinks Market share by Distribution Channel, 2030

FIG 13 Germany Aloe Vera Drinks Market by Distribution Channel, 2019 - 2030, USD ThoUSnds

FIG 14 SWOT Analysis: Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

FIG 15 SWOT Analysis: Patanjali Ayurved Limited

FIG 16 SWOT Analysis: Nature's Way Products, LLC

FIG 17 SWOT Analysis: OKF Corporation

FIG 18 SWOT Analysis: Nam Viet Foods & Beverage Co., LTD