Germany Abrasive Blasting Nozzle Market Size, Share & IndUStry Trends Analysis Report By Type, By Material (Carbide Tips, Ceramic Tips, and Steel Tips), By Bore Size (3/8 Inch, 5/16 Inch, 7/16 Inch), By End-USe, Growth Forecast, 2023 - 2030

Published Date : 14-Feb-2024 | Pages: 52 | Formats: PDF |

COVID-19 Impact on the Germany Abrasive Blasting Nozzle Market

The Germany Abrasive Blasting Nozzle Market size is expected to reach $15 million by 2030, rising at a market growth of 3.2% CAGR during the forecast period.

Germany's abrasive blasting nozzle market is likely shaped by the country's robust industrial sector, including manufacturing, automotive, construction, and metalworking industries. Germany's reputation for engineering excellence and high manufacturing standards suggests a strong demand for advanced surface preparation technologies, with abrasive blasting playing a crucial role in enhancing the quality of surfaces in various applications.

Technological advancements are expected to be a key driver as manufacturers continually strive to improve abrasive blasting processes' precision, efficiency, and environmental sustainability. This may involve the development of nozzles designed for optimal performance and using eco-friendly abrasive materials, aligning with Germany's commitment to environmental responsibility. Moreover, Germany's stringent regulatory environment, particularly regarding environmental protection and occupational safety, likely influences the abrasive blasting nozzle market. Manufacturers in this sector are likely compelled to adhere to strict standards, ensuring that their products meet or exceed safety and sustainability requirements. The engineering excellence and emphasis on innovation within Germany's industrial sectors have created an environment where the demand for advanced surface preparation technologies continues to grow.

In the German construction industry, characterized by a stringent emphasis on durability and aesthetics, the abrasive blasting nozzle market plays a pivotal role in surface preparation for a spectrum of structures, from buildings to bridges. The widespread integration of abrasive blasting nozzles within the German construction industry serves as a testament to their adaptability, showcasing their relevance across diverse industrial segments within the country.

According to the International Trade Administration, by 2025, 84 percent of German manufacturers intend to invest EUR 10 billion (USD 10.52 billion) annually in smart manufacturing technologies. This includes approximately 1.2 billion annually for the automotive industry, 1.5 billion for machinery and equipment and plant engineering and construction, approximately 817 million annually for the electronics and microelectronics industry, and 424 million annually for the metalworking industry. This increment will also result in a higher demand for abrasive blasting nozzles.

Market Trends

Expansion of the automotive industry

Germany's automotive industry benefits from a rich engineering excellence and innovation tradition. As automakers strive to produce vehicles with superior quality and advanced features, efficient surface preparation becomes paramount. The abrasive blasting nozzle market plays a crucial role in automotive manufacturing by providing a precise and effective method for cleaning, pre-treatment, and coating applications. The demand for high-performance abrasive blasting nozzles aligns with the automotive industry's commitment to delivering vehicles with impeccable finishes and enhanced durability.

Moreover, the expansion of Germany's automotive sector is fueled by a robust emphasis on research and development. As the industry integrates cutting-edge technologies and materials, abrasive blasting nozzles have evolved to meet the changing requirements. Advanced nozzle designs capable of providing consistent and controlled abrasive blasting contribute to the efficiency and precision demanded in modern automotive manufacturing processes. According to Germany Trade and Invest, Germany's automotive industry is the country's most innovative sector, generating 34.1 percent of total German industry R&D expenditure of around EUR 71 billion in 2020.

Additionally, the emphasis on lightweight materials and advanced alloys in modern automotive design contributes to the growing demand for specialized abrasive blasting nozzle market in Germany. As automakers explore innovative materials to enhance fuel efficiency and overall performance, precise and tailored surface preparation tools are increasingly critical. Thus, Germany's automotive industry relies on advanced abrasive blasting nozzles to uphold its commitment to superior quality and innovation, with a strong emphasis on research and development. The growing demand for specialized nozzles, particularly lightweight materials, underscores the industry's pursuit of fuel efficiency and cutting-edge performance.

Growth in silicon carbide production

One significant factor driving the use of silicon carbide in abrasive blasting nozzles in Germany is its exceptional abrasion resistance. As industries demand longer nozzle lifespans and resistance to wear and tear, silicon carbide provides a superior solution, making it well-suited for harsh abrasive blasting environments. This expanded durability translates into cost savings for businesses as they benefit from longer-lasting nozzles that require less frequent replacement.

Moreover, the thermal conductivity of silicon carbide is a critical factor contributing to its rise in the abrasive blasting nozzle market in Germany. The material's ability to efficiently dissipate heat generated during the abrasive blasting helps prevent overheating, ensuring consistent performance over extended usage periods. This thermal stability is particularly valuable in industrial applications where high temperatures can impact the efficiency and lifespan of equipment.

Another key driver is the demand for higher precision and enhanced performance in surface preparation processes. Silicon carbide's hardness and resistance to deformation make it an ideal material for producing abrasive blasting nozzles that deliver precise and controlled abrasive flow, resulting in more effective and efficient surface cleaning and preparation. Hence, the widespread adoption of silicon carbide in Germany's abrasive blasting nozzle market is driven by its exceptional abrasion resistance, thermal conductivity, and hardness, offering businesses cost savings through prolonged nozzle lifespans, efficient heat dissipation, and superior precision in surface preparation processes.

Competition Analysis

Several German companies are pivotal in the abrasive blasting nozzle market, offering specialized solutions for diverse industries. SAPI is a German company known for its high-quality abrasive blasting nozzles, which provide a comprehensive range tailored for various surface preparation and cleaning applications. Similarly, SCHMIDT Technology distinguishes itself by offering innovative surface treatment technology, including abrasive blasting systems and nozzles, contributing to its reputation as a key player in the industrial equipment sector.

Another noteworthy contributor to the market is RUEZ GmbH, a German company specializing in surface treatment equipment, particularly the abrasive blasting nozzle market. Their focus on automotive, aerospace, and metal fabrication industries underscores their commitment to delivering tailored solutions for diverse applications. Additionally, WIWA, specializing in coating technology, extends its expertise to surface preparation equipment, including abrasive blasting nozzles. Serving industries like automotive, shipbuilding, and corrosion protection, WIWA's offerings align with the evolving needs of these sectors.

These German companies collectively showcase the nation's prowess in manufacturing advanced abrasive blasting nozzles and related equipment. Their commitment to quality, innovation, and industry-specific solutions positions them as significant contributors to the growth and development of Germany's abrasive blasting nozzle market.

List of Key Companies Profiled

- Kennametal Inc.

- Graco Inc. (Newell Brands Inc.)

- Elcometer Limited

- NLB Corporation (Interpump Group S.p.A.)

- Airblast B.V

- Sponge-Jet, Inc.

- Clemco Industries Corporation

- KEIR Manufacturing, Inc.

- AGSCO Corporation

Germany Abrasive Blasting Nozzle Market Report Segmentation

By Type

- Venturi Nozzle

- Straight Bore Nozzle

- Wide Throat Nozzle

- Others

By Material

- Carbide Tips

- Ceramic Tips

- Steel Tips

By Bore Size

- 3/8 Inch

- 5/16 Inch

- 7/16 Inch

- Others

By End-use

- Marine (Shipyard)

- Automotive

- Construction

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany Abrasive Blasting Nozzle Market, by Type

1.4.2 Germany Abrasive Blasting Nozzle Market, by Material

1.4.3 Germany Abrasive Blasting Nozzle Market, by Bore Size

1.4.4 Germany Abrasive Blasting Nozzle Market, by End-use

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.3 Porter’s Five Forces Analysis

Chapter 3. Germany Abrasive Blasting Nozzle Market

3.1 Germany Abrasive Blasting Nozzle Market by Type

3.2 Germany Abrasive Blasting Nozzle Market by Material

3.3 Germany Abrasive Blasting Nozzle Market by Bore Size

3.4 Germany Abrasive Blasting Nozzle Market by End-use

Chapter 4. Company Profiles – Global Leaders

4.1 Kennametal Inc.

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental and Regional Analysis

4.1.4 Research & Development Expenses

4.1.5 SWOT Analysis

4.2 Graco Inc. (Newell Brands Inc.)

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Regional & Segmental Analysis

4.2.4 SWOT Analysis

4.3 Elcometer Limited

4.3.1 Company Overview

4.3.2 Recent strategies and developments:

4.3.2.1 Acquisition and Mergers:

4.4 NLB Corporation (Interpump Group S.p.A.)

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental and Regional Analysis

4.5 Airblast B.V.

4.5.1 Company Overview

4.6 Sponge-Jet, Inc.

4.6.1 Company Overview

4.7 Clemco Industries Corporation

4.7.1 Company Overview

4.8 KEIR Manufacturing, Inc.

4.8.1 Company Overview

TABLE 2 Germany Abrasive Blasting Nozzle Market, 2023 - 2030, USD Thousands

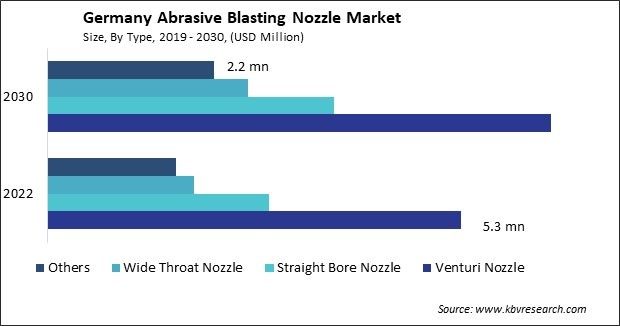

TABLE 3 Germany Abrasive Blasting Nozzle Market by Type, 2019 - 2022, USD Thousands

TABLE 4 Germany Abrasive Blasting Nozzle Market by Type, 2023 - 2030, USD Thousands

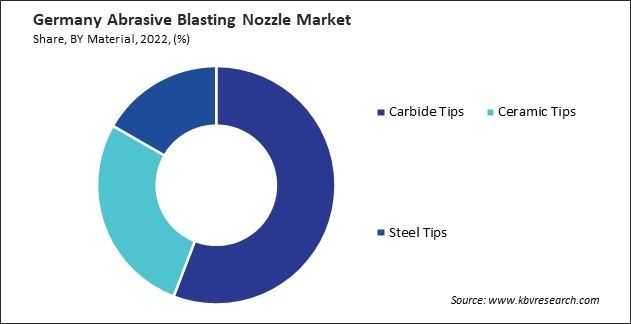

TABLE 5 Germany Abrasive Blasting Nozzle Market by Material, 2019 - 2022, USD Thousands

TABLE 6 Germany Abrasive Blasting Nozzle Market by Material, 2023 - 2030, USD Thousands

TABLE 7 Germany Abrasive Blasting Nozzle Market by Bore Size, 2019 - 2022, USD Thousands

TABLE 8 Germany Abrasive Blasting Nozzle Market by Bore Size, 2023 - 2030, USD Thousands

TABLE 9 Germany Abrasive Blasting Nozzle Market by End-use, 2019 - 2022, USD Thousands

TABLE 10 Germany Abrasive Blasting Nozzle Market by End-use, 2023 - 2030, USD Thousands

TABLE 11 Key Information – Kennametal Inc.

TABLE 12 Key information – Graco Inc.

TABLE 13 Key Information – Elcometer Limited

TABLE 14 Key Information – NLB Corporation

TABLE 15 Key Information – Airblast B.V.

TABLE 16 Key Information – Sponge-Jet, Inc.

TABLE 17 Key Information – Clemco Industries Corporation

TABLE 18 Key Information – KEIR Manufacturing, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany Abrasive Blasting Nozzle Market, 2019 - 2030, USD Thousands

FIG 3 Key Factors Impacting Abrasive Blasting Nozzle Market

FIG 4 Porter’s Five Forces Analysis – Abrasive Blasting Nozzle Market

FIG 5 Germany Abrasive Blasting Nozzle Market share by Type, 2022

FIG 6 Germany Abrasive Blasting Nozzle Market share by Type, 2030

FIG 7 Germany Abrasive Blasting Nozzle Market by Type, 2019 - 2030, USD Thousands

FIG 8 Germany Abrasive Blasting Nozzle Market share by Material, 2022

FIG 9 Germany Abrasive Blasting Nozzle Market share by Material, 2030

FIG 10 Germany Abrasive Blasting Nozzle Market by Material, 2019 - 2030, USD Thousands

FIG 11 Germany Abrasive Blasting Nozzle Market share by Bore Size, 2022

FIG 12 Germany Abrasive Blasting Nozzle Market share by Bore Size, 2030

FIG 13 Germany Abrasive Blasting Nozzle Market by Bore Size, 2019 - 2030, USD Thousands

FIG 14 Germany Abrasive Blasting Nozzle Market share by End-use, 2022

FIG 15 Germany Abrasive Blasting Nozzle Market share by End-use, 2022

FIG 16 Germany Abrasive Blasting Nozzle Market by End-use, 2019- 2030, USD Thousands

FIG 17 SWOT Analysis: Kennametal Inc.

FIG 18 SWOT Analysis: Graco Inc.