Europe Logic IC Market Size, Share & Industry Analysis Report By Type, By General-Purpose Logic ICs Type (Buffers / Drivers, Flip-Flops, Transceivers, and Multiplexers (MUX)), By Technology (CMOS, Bipolar, and BiCMOS), By Application (Consumer Electronics, Computer, IT & Telecommunication, Automotive, and Other Application), By Country and Growth Forecast, 2025 - 2032

Published Date : 16-Oct-2025 |

Pages: 210 |

Report Format: PDF + Excel |

COVID-19 Impact on the Europe Logic IC Market

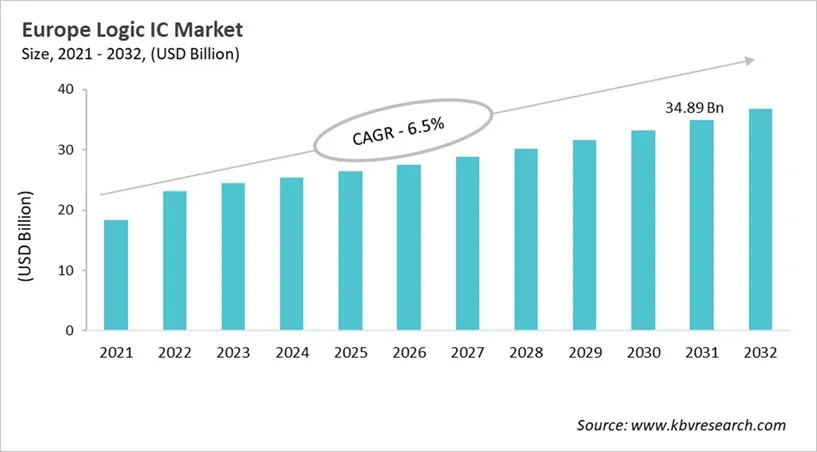

The Europe Logic IC Market would witness market growth of 4.8% CAGR during the forecast period (2025-2032).

The Germany market dominated the Europe Logic IC Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $7,832.7 million by 2032. The UK market is exhibiting a CAGR of 3.6% during (2025 - 2032). Additionally, The France market would experience a CAGR of 5.8% during (2025 - 2032). The Germany and UK led the Europe Logic IC Market by Country with a market share of 23.5% and 15% in 2024. The Spain market is expected to witness a CAGR of 6.3% during throughout the forecast period.

The European logic integrated circuit (IC) market has changed a lot because of new technologies, strategic policy initiatives, and a growing interest in specialized applications. Europe used to be the leader in semiconductor innovation, but it lost its manufacturing edge because of increased competition from Asia and the U.S. But programs like the European Chips Act are trying to make the market more competitive again by increasing research and development spending, building advanced manufacturing facilities, and encouraging partnerships between the public and private sectors. The market is now being driven by the growing use of AI, 5G, and automotive electronics, which need high-performance, energy-efficient, and application-specific logic ICs made for industries like telecommunications and industrial automation.

STMicroelectronics, Infineon Technologies, and NXP Semiconductors are some of the top companies in the industry that are using new ideas, forming strategic partnerships, and following sustainability standards to improve their market position. Europe's focus on customization, performance optimization, and environmental responsibility is in line with what regulators and consumers expect. This is why there has been a shift toward application-specific logic ICs. General-purpose logic ICs are still important parts of standard electronic systems, but specialized ICs make more money because they are more efficient, reliable, and can be used with new technologies. This shows that Europe is moving toward a semiconductor ecosystem that is high-value and driven by innovation.

Technology Outlook

Based on Technology, the market is segmented into CMOS, Bipolar, and BiCMOS. With a compound annual growth rate (CAGR) of 5.5% over the projection period, the CMOS Market, dominate the France Logic IC Market by Technology in 2024 and would be a prominent market until 2032. From 2025 to 2032 The BiCMOS market is expected to witness a CAGR of 9.8% during (2025 - 2032).

Application Outlook

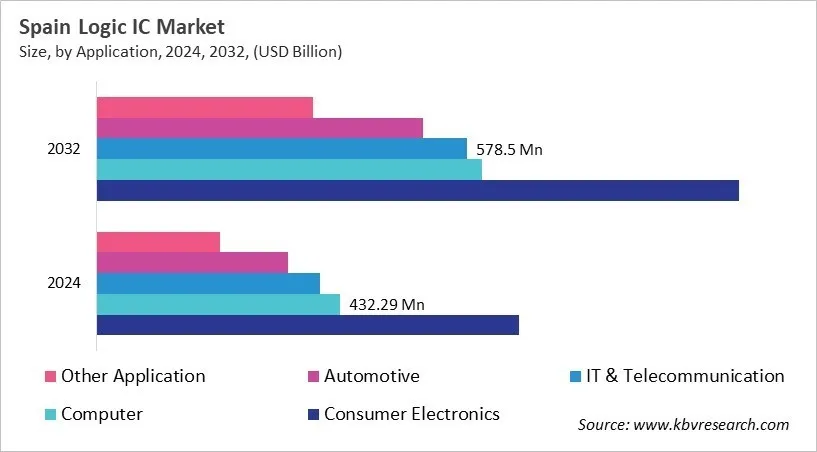

Based on Application, the market is segmented into Consumer Electronics, Computer, IT & Telecommunication, Automotive, and Other Application. Among various Spain Logic IC Market by Application; The Consumer Electronics market achieved a market size of USD $747.4 Million in 2024 and is expected to grow at a CAGR of 5.5 % during the forecast period. The Automotive market is predicted to experience a CAGR of 7% throughout the forecast period from (2025 - 2032).

Free Valuable Insights: The Global Logic IC Market will reach USD 200.84 Billion by 2032, at a CAGR of 5.9%

Country Outlook

Germany is the leader in the European logic IC market thanks to its strong automotive industry, advanced industrial base, and dedication to digital transformation. More people are using electric and self-driving cars, Industry 4.0 techniques, and AI-powered manufacturing, which has greatly increased the need for both general-purpose and application-specific logic ICs. The market is also stronger because of government-backed R&D projects, goals for sustainable manufacturing, and a strong educational system. Germany's innovation landscape is shaped by trends like miniaturization, energy efficiency, and AI-enabled chip designs. Germany is still a major center for semiconductor advancement in Europe, with major companies like Infineon Technologies and NXP Semiconductors, and new startups.

List of Key Companies Profiled

- Texas Instruments, Inc.

- STMicroelectronics N.V.

- Microchip Technology Incorporated

- NXP Semiconductors N.V.

- Intel Corporation

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- Broadcom, Inc.

- Infineon Technologies AG

- Renesas Electronics Corporation

- Advanced Micro Devices, Inc.

Europe Logic IC Market Report Segmentation

By Type

- Application-Specific Logic ICs

- General-Purpose Logic ICs

- Buffers / Drivers

- Flip-Flops

- Transceivers

- Multiplexers (MUX)

By Technology

- CMOS

- Bipolar

- BiCMOS

By Application

- Consumer Electronics

- Computer

- IT & Telecommunication

- Automotive

- Other Application

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Europe Logic IC Market, by Type

1.4.2 Europe Logic IC Market, by Technology

1.4.3 Europe Logic IC Market, by Application

1.4.4 Europe Logic IC Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Market Trends – Europe Logic IC Market

Chapter 5. State of Competition – Europe Logic IC Market

Chapter 6. Value Chain Analysis of Logic IC Market

Chapter 7. Product Life Cycle (PLC) – Logic IC Market

Chapter 8. Market Consolidation – Logic IC Market

Chapter 9. Key Customer Criteria – Logic IC Market

Chapter 10. Competition Analysis - Global

10.1 KBV Cardinal Matrix

10.2 Recent Industry Wide Strategic Developments

10.2.1 Partnerships, Collaborations and Agreements

10.2.2 Product Launches and Product Expansions

10.2.3 Acquisition and Mergers

10.3 Market Share Analysis, 2024

10.4 Top Winning Strategies

10.4.1 Key Leading Strategies: Percentage Distribution (2021-2025)

10.4.2 Key Strategic Move: (Product Launches and Product Expansions : 2024, Oct – 2025, Jun) Leading Players

10.5 Porter Five Forces Analysis

Chapter 11. Europe Logic IC Market by Type

11.1 Europe Application-Specific Logic ICs Market by Country

11.2 Europe General-Purpose Logic ICs Market by Country

11.3 Europe Logic IC Market by General-Purpose Logic ICs Type

11.3.1 Europe Buffers / Drivers Market by Country

11.3.2 Europe Flip-Flops Market by Country

11.3.3 Europe Transceivers Market by Country

11.3.4 Europe Multiplexers (MUX) Market by Country

Chapter 12. Europe Logic IC Market by Technology

12.1 Europe CMOS Market by Country

12.2 Europe Bipolar Market by Country

12.3 Europe BiCMOS Market by Country

Chapter 13. Europe Logic IC Market by Application

13.1 Europe Consumer Electronics Market by Country

13.2 Europe Computer Market by Country

13.3 Europe IT & Telecommunication Market by Country

13.4 Europe Automotive Market by Country

13.5 Europe Other Application Market by Country

Chapter 14. Europe Logic IC Market by Country

14.1 Germany Logic IC Market

14.1.1 Germany Logic IC Market by Type

14.1.1.1 Germany Logic IC Market by General-Purpose Logic ICs Type

14.1.2 Germany Logic IC Market by Technology

14.1.3 Germany Logic IC Market by Application

14.2 UK Logic IC Market

14.2.1 UK Logic IC Market by Type

14.2.1.1 UK Logic IC Market by General-Purpose Logic ICs Type

14.2.2 UK Logic IC Market by Technology

14.2.3 UK Logic IC Market by Application

14.3 France Logic IC Market

14.3.1 France Logic IC Market by Type

14.3.1.1 France Logic IC Market by General-Purpose Logic ICs Type

14.3.2 France Logic IC Market by Technology

14.3.3 France Logic IC Market by Application

14.4 Russia Logic IC Market

14.4.1 Russia Logic IC Market by Type

14.4.1.1 Russia Logic IC Market by General-Purpose Logic ICs Type

14.4.2 Russia Logic IC Market by Technology

14.4.3 Russia Logic IC Market by Application

14.5 Spain Logic IC Market

14.5.1 Spain Logic IC Market by Type

14.5.1.1 Spain Logic IC Market by General-Purpose Logic ICs Type

14.5.2 Spain Logic IC Market by Technology

14.5.3 Spain Logic IC Market by Application

14.6 Italy Logic IC Market

14.6.1 Italy Logic IC Market by Type

14.6.1.1 Italy Logic IC Market by General-Purpose Logic ICs Type

14.6.2 Italy Logic IC Market by Technology

14.6.3 Italy Logic IC Market by Application

14.7 Rest of Europe Logic IC Market

14.7.1 Rest of Europe Logic IC Market by Type

14.7.1.1 Rest of Europe Logic IC Market by General-Purpose Logic ICs Type

14.7.2 Rest of Europe Logic IC Market by Technology

14.7.3 Rest of Europe Logic IC Market by Application

Chapter 15. Company Profiles

15.1 Texas Instruments, Inc.

15.1.1 Company Overview

15.1.2 Financial Analysis

15.1.3 Segmental and Regional Analysis

15.1.4 Research & Development Expense

15.1.5 Recent strategies and developments:

15.1.5.1 Product Launches and Product Expansions:

15.1.6 SWOT Analysis

15.2 STMicroelectronics N.V.

15.2.1 Company Overview

15.2.2 Financial Analysis

15.2.3 Segmental and Regional Analysis

15.2.4 Research & Development Expense

15.2.5 Recent strategies and developments:

15.2.5.1 Product Launches and Product Expansions:

15.2.6 SWOT Analysis

15.3 Microchip Technology Incorporated

15.3.1 Company Overview

15.3.2 Financial Analysis

15.3.3 Segmental and Regional Analysis

15.3.4 Research & Development Expenses

15.3.5 SWOT Analysis

15.4 NXP Semiconductors N.V.

15.4.1 Company Overview

15.4.2 Financial Analysis

15.4.3 Segmental and Regional Analysis

15.4.4 Research & Development Expenses

15.4.5 Recent strategies and developments:

15.4.5.1 Product Launches and Product Expansions:

15.4.5.2 Acquisition and Mergers:

15.4.6 SWOT Analysis

15.5 Intel Corporation

15.5.1 Company Overview

15.5.2 Financial Analysis

15.5.3 Segmental and Regional Analysis

15.5.4 Research & Development Expenses

15.5.5 Recent strategies and developments:

15.5.5.1 Partnerships, Collaborations, and Agreements:

15.5.6 SWOT Analysis

15.6 Qualcomm Incorporated (Qualcomm Technologies, Inc.)

15.6.1 Company Overview

15.6.2 Financial Analysis

15.6.3 Segmental and Regional Analysis

15.6.4 Research & Development Expense

15.6.5 Recent strategies and developments:

15.6.5.1 Acquisition and Mergers:

15.6.6 SWOT Analysis

15.7 Broadcom, Inc.

15.7.1 Company Overview

15.7.2 Financial Analysis

15.7.3 Segmental and Regional Analysis

15.7.4 Research & Development Expense

15.7.5 Recent strategies and developments:

15.7.5.1 Partnerships, Collaborations, and Agreements:

15.7.5.2 Product Launches and Product Expansions:

15.7.6 SWOT Analysis

15.8 Infineon Technologies AG

15.8.1 Company Overview

15.8.2 Financial Analysis

15.8.3 Segmental and Regional Analysis

15.8.4 Research & Development Expense

15.8.5 Recent strategies and developments:

15.8.5.1 Partnerships, Collaborations, and Agreements:

15.8.6 SWOT Analysis

15.9 Renesas Electronics Corporation

15.9.1 Company Overview

15.9.2 Financial Analysis

15.9.3 Segmental and Regional Analysis

15.9.4 Research & Development Expense

15.9.5 Recent strategies and developments:

15.9.5.1 Partnerships, Collaborations, and Agreements:

15.9.5.2 Product Launches and Product Expansions:

15.9.6 SWOT Analysis

15.10. Advanced Micro Devices, Inc.

15.10.1 Company Overview

15.10.2 Financial Analysis

15.10.3 Segmental and Regional Analysis

15.10.4 Research & Development Expenses

15.10.5 Recent strategies and developments:

15.10.5.1 Product Launches and Product Expansions:

TABLE 2 Europe Logic IC Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria – Logic IC Market

TABLE 4 Partnerships, Collaborations and Agreements– Logic IC Market

TABLE 5 Product Launches And Product Expansions– Logic IC Market

TABLE 6 Acquisition and Mergers– Logic IC Market

TABLE 7 Europe Logic IC Market by Type, 2021 - 2024, USD Million

TABLE 8 Europe Logic IC Market by Type, 2025 - 2032, USD Million

TABLE 9 Europe Application-Specific Logic ICs Market by Country, 2021 - 2024, USD Million

TABLE 10 Europe Application-Specific Logic ICs Market by Country, 2025 - 2032, USD Million

TABLE 11 Europe General-Purpose Logic ICs Market by Country, 2021 - 2024, USD Million

TABLE 12 Europe General-Purpose Logic ICs Market by Country, 2025 - 2032, USD Million

TABLE 13 Europe Logic IC Market by General-Purpose Logic ICs Type, 2021 - 2024, USD Million

TABLE 14 Europe Logic IC Market by General-Purpose Logic ICs Type, 2025 - 2032, USD Million

TABLE 15 Europe Buffers / Drivers Market by Country, 2021 - 2024, USD Million

TABLE 16 Europe Buffers / Drivers Market by Country, 2025 - 2032, USD Million

TABLE 17 Europe Flip-Flops Market by Country, 2021 - 2024, USD Million

TABLE 18 Europe Flip-Flops Market by Country, 2025 - 2032, USD Million

TABLE 19 Europe Transceivers Market by Country, 2021 - 2024, USD Million

TABLE 20 Europe Transceivers Market by Country, 2025 - 2032, USD Million

TABLE 21 Europe Multiplexers (MUX) Market by Country, 2021 - 2024, USD Million

TABLE 22 Europe Multiplexers (MUX) Market by Country, 2025 - 2032, USD Million

TABLE 23 Europe Logic IC Market by Technology, 2021 - 2024, USD Million

TABLE 24 Europe Logic IC Market by Technology, 2025 - 2032, USD Million

TABLE 25 Europe CMOS Market by Country, 2021 - 2024, USD Million

TABLE 26 Europe CMOS Market by Country, 2025 - 2032, USD Million

TABLE 27 Europe Bipolar Market by Country, 2021 - 2024, USD Million

TABLE 28 Europe Bipolar Market by Country, 2025 - 2032, USD Million

TABLE 29 Europe BiCMOS Market by Country, 2021 - 2024, USD Million

TABLE 30 Europe BiCMOS Market by Country, 2025 - 2032, USD Million

TABLE 31 Europe Logic IC Market by Application, 2021 - 2024, USD Million

TABLE 32 Europe Logic IC Market by Application, 2025 - 2032, USD Million

TABLE 33 Europe Consumer Electronics Market by Country, 2021 - 2024, USD Million

TABLE 34 Europe Consumer Electronics Market by Country, 2025 - 2032, USD Million

TABLE 35 Europe Computer Market by Country, 2021 - 2024, USD Million

TABLE 36 Europe Computer Market by Country, 2025 - 2032, USD Million

TABLE 37 Europe IT & Telecommunication Market by Country, 2021 - 2024, USD Million

TABLE 38 Europe IT & Telecommunication Market by Country, 2025 - 2032, USD Million

TABLE 39 Europe Automotive Market by Country, 2021 - 2024, USD Million

TABLE 40 Europe Automotive Market by Country, 2025 - 2032, USD Million

TABLE 41 Europe Other Application Market by Country, 2021 - 2024, USD Million

TABLE 42 Europe Other Application Market by Country, 2025 - 2032, USD Million

TABLE 43 Europe Logic IC Market by Country, 2021 - 2024, USD Million

TABLE 44 Europe Logic IC Market by Country, 2025 - 2032, USD Million

TABLE 45 Germany Logic IC Market, 2021 - 2024, USD Million

TABLE 46 Germany Logic IC Market, 2025 - 2032, USD Million

TABLE 47 Germany Logic IC Market by Type, 2021 - 2024, USD Million

TABLE 48 Germany Logic IC Market by Type, 2025 - 2032, USD Million

TABLE 49 Germany Logic IC Market by General-Purpose Logic ICs Type, 2021 - 2024, USD Million

TABLE 50 Germany Logic IC Market by General-Purpose Logic ICs Type, 2025 - 2032, USD Million

TABLE 51 Germany Logic IC Market by Technology, 2021 - 2024, USD Million

TABLE 52 Germany Logic IC Market by Technology, 2025 - 2032, USD Million

TABLE 53 Germany Logic IC Market by Application, 2021 - 2024, USD Million

TABLE 54 Germany Logic IC Market by Application, 2025 - 2032, USD Million

TABLE 55 UK Logic IC Market, 2021 - 2024, USD Million

TABLE 56 UK Logic IC Market, 2025 - 2032, USD Million

TABLE 57 UK Logic IC Market by Type, 2021 - 2024, USD Million

TABLE 58 UK Logic IC Market by Type, 2025 - 2032, USD Million

TABLE 59 UK Logic IC Market by General-Purpose Logic ICs Type, 2021 - 2024, USD Million

TABLE 60 UK Logic IC Market by General-Purpose Logic ICs Type, 2025 - 2032, USD Million

TABLE 61 UK Logic IC Market by Technology, 2021 - 2024, USD Million

TABLE 62 UK Logic IC Market by Technology, 2025 - 2032, USD Million

TABLE 63 UK Logic IC Market by Application, 2021 - 2024, USD Million

TABLE 64 UK Logic IC Market by Application, 2025 - 2032, USD Million

TABLE 65 France Logic IC Market, 2021 - 2024, USD Million

TABLE 66 France Logic IC Market, 2025 - 2032, USD Million

TABLE 67 France Logic IC Market by Type, 2021 - 2024, USD Million

TABLE 68 France Logic IC Market by Type, 2025 - 2032, USD Million

TABLE 69 France Logic IC Market by General-Purpose Logic ICs Type, 2021 - 2024, USD Million

TABLE 70 France Logic IC Market by General-Purpose Logic ICs Type, 2025 - 2032, USD Million

TABLE 71 France Logic IC Market by Technology, 2021 - 2024, USD Million

TABLE 72 France Logic IC Market by Technology, 2025 - 2032, USD Million

TABLE 73 France Logic IC Market by Application, 2021 - 2024, USD Million

TABLE 74 France Logic IC Market by Application, 2025 - 2032, USD Million

TABLE 75 Russia Logic IC Market, 2021 - 2024, USD Million

TABLE 76 Russia Logic IC Market, 2025 - 2032, USD Million

TABLE 77 Russia Logic IC Market by Type, 2021 - 2024, USD Million

TABLE 78 Russia Logic IC Market by Type, 2025 - 2032, USD Million

TABLE 79 Russia Logic IC Market by General-Purpose Logic ICs Type, 2021 - 2024, USD Million

TABLE 80 Russia Logic IC Market by General-Purpose Logic ICs Type, 2025 - 2032, USD Million

TABLE 81 Russia Logic IC Market by Technology, 2021 - 2024, USD Million

TABLE 82 Russia Logic IC Market by Technology, 2025 - 2032, USD Million

TABLE 83 Russia Logic IC Market by Application, 2021 - 2024, USD Million

TABLE 84 Russia Logic IC Market by Application, 2025 - 2032, USD Million

TABLE 85 Spain Logic IC Market, 2021 - 2024, USD Million

TABLE 86 Spain Logic IC Market, 2025 - 2032, USD Million

TABLE 87 Spain Logic IC Market by Type, 2021 - 2024, USD Million

TABLE 88 Spain Logic IC Market by Type, 2025 - 2032, USD Million

TABLE 89 Spain Logic IC Market by General-Purpose Logic ICs Type, 2021 - 2024, USD Million

TABLE 90 Spain Logic IC Market by General-Purpose Logic ICs Type, 2025 - 2032, USD Million

TABLE 91 Spain Logic IC Market by Technology, 2021 - 2024, USD Million

TABLE 92 Spain Logic IC Market by Technology, 2025 - 2032, USD Million

TABLE 93 Spain Logic IC Market by Application, 2021 - 2024, USD Million

TABLE 94 Spain Logic IC Market by Application, 2025 - 2032, USD Million

TABLE 95 Italy Logic IC Market, 2021 - 2024, USD Million

TABLE 96 Italy Logic IC Market, 2025 - 2032, USD Million

TABLE 97 Italy Logic IC Market by Type, 2021 - 2024, USD Million

TABLE 98 Italy Logic IC Market by Type, 2025 - 2032, USD Million

TABLE 99 Italy Logic IC Market by General-Purpose Logic ICs Type, 2021 - 2024, USD Million

TABLE 100 Italy Logic IC Market by General-Purpose Logic ICs Type, 2025 - 2032, USD Million

TABLE 101 Italy Logic IC Market by Technology, 2021 - 2024, USD Million

TABLE 102 Italy Logic IC Market by Technology, 2025 - 2032, USD Million

TABLE 103 Italy Logic IC Market by Application, 2021 - 2024, USD Million

TABLE 104 Italy Logic IC Market by Application, 2025 - 2032, USD Million

TABLE 105 Rest of Europe Logic IC Market, 2021 - 2024, USD Million

TABLE 106 Rest of Europe Logic IC Market, 2025 - 2032, USD Million

TABLE 107 Rest of Europe Logic IC Market by Type, 2021 - 2024, USD Million

TABLE 108 Rest of Europe Logic IC Market by Type, 2025 - 2032, USD Million

TABLE 109 Rest of Europe Logic IC Market by General-Purpose Logic ICs Type, 2021 - 2024, USD Million

TABLE 110 Rest of Europe Logic IC Market by General-Purpose Logic ICs Type, 2025 - 2032, USD Million

TABLE 111 Rest of Europe Logic IC Market by Technology, 2021 - 2024, USD Million

TABLE 112 Rest of Europe Logic IC Market by Technology, 2025 - 2032, USD Million

TABLE 113 Rest of Europe Logic IC Market by Application, 2021 - 2024, USD Million

TABLE 114 Rest of Europe Logic IC Market by Application, 2025 - 2032, USD Million

TABLE 115 Key Information – Texas Instruments, Inc.

TABLE 116 Key Information – STMicroelectronics N.V.

TABLE 117 Key Information – Microchip Technology Incorporated

TABLE 118 Key Information – NXP Semiconductors N.V.

TABLE 119 Key Information – Intel Corporation

TABLE 120 Key Information – Qualcomm Incorporated

TABLE 121 Key Information – Broadcom, Inc.

TABLE 122 Key Information – Infineon Technologies AG

TABLE 123 Key Information – Renesas Electronics Corporation

TABLE 124 Key information – Advanced Micro Devices, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Europe Logic IC Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Europe logic ic Market

FIG 4 Value Chain Analysis of Logic IC Market

FIG 5 Product Life Cycle (PLC) – Logic IC Market

FIG 6 Market Consolidation – Logic IC Market

FIG 7 Key Customer Criteria – Logic IC Market

FIG 8 KBV Cardinal Matrix

FIG 9 Market Share Analysis, 2024

FIG 10 Key Leading Strategies: Percentage Distribution (2021-2025)

FIG 11 Key Strategic Move: (Product Launches and Product Expansions : 2024, Oct – 2025, Jun) Leading Players

FIG 12 Porter’s Five Forces Analysis – Logic IC Market

FIG 13 Europe Logic IC Market share by Type, 2024

FIG 14 Europe Logic IC Market share by Type, 2032

FIG 15 Europe Logic IC Market by Type, 2021 - 2032, USD Million

FIG 16 Europe Logic IC Market share by Technology, 2024

FIG 17 Europe Logic IC Market share by Technology, 2032

FIG 18 Europe Logic IC Market by Technology, 2021 - 2032, USD Million

FIG 19 Europe Logic IC Market share by Application, 2024

FIG 20 Europe Logic IC Market share by Application, 2032

FIG 21 Europe Logic IC Market by Application, 2021 - 2032, USD Million

FIG 22 Europe Logic IC Market share by Country, 2024

FIG 23 Europe Logic IC Market share by Country, 2032

FIG 24 Europe Logic IC Market by Country, 2021 - 2032, USD Million

FIG 25 SWOT Analysis: Texas Instruments, Inc.

FIG 26 SWOT Analysis: STMicroelectronics N.V.

FIG 27 SWOT Analysis: Microchip Technology Incorporated

FIG 28 Recent strategies and developments: NXP Semiconductors N.V.

FIG 29 SWOT Analysis: NXP Semiconductors N.V.

FIG 30 SWOT Analysis: Intel corporation

FIG 31 SWOT Analysis: QUALCOMM Incorporated

FIG 32 Recent strategies and developments: Broadcom, Inc.

FIG 33 SWOT Analysis: Broadcom, Inc.

FIG 34 SWOT Analysis: Infineon Technologies AG

FIG 35 Recent strategies and developments: Renesas Electronics Corporation

FIG 36 SWOT Analysis: Renesas Electronics Corporation