Europe Glass Interposers Market Size, Share & Industry Analysis Report By Wafer Size, By Application (2.5D Packaging, 3D Packaging, and Fan-Out Packaging), By Substrate Technology (Through-Glass Vias (TGV), Redistribution Layer (RDL)-First/Last, and Glass Panel Level Packaging (PLP)), By End Use Industry, By Country and Growth Forecast, 2025 - 2032

Published Date : 12-Aug-2025 |

Pages: 169 |

Report Format: PDF + Excel |

COVID-19 Impact on the Europe Glass Interposers Market

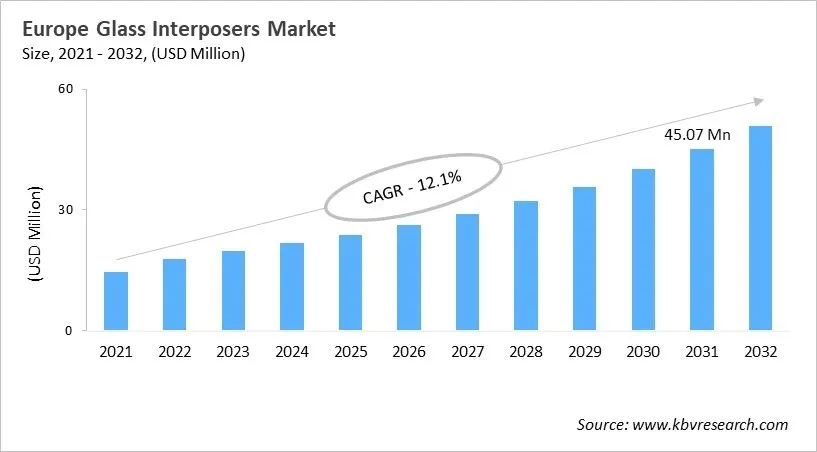

The Europe Glass Interposers Market would witness market growth of 11.5% CAGR during the forecast period (2025-2032).

The Germany market dominated the Europe Glass Interposers Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $12.2 million by 2032. The UK market is exhibiting a CAGR of 10% during (2025 - 2032). Additionally, The France market would experience a CAGR of 12.4% during (2025 - 2032). The Germany and UK led the Europe Glass Interposers Market by Country with a market share of 26.3% and 12.9% in 2024.

Europe’s adoption of glass interposers is gradually increasing, supported by its strong presence in automotive, industrial automation, and energy-efficient electronics sectors. As smart mobility and digital technologies advance, European industries are leveraging glass interposers for their precision, reliability, and suitability in safety-critical applications. This technology is becoming integral in automotive radar, LiDAR, and ADAS systems where thermal stability and dimensional accuracy are crucial for performance.

Regional efforts are focused on enhancing local substrate design and embedding these capabilities into Europe’s semiconductor value chains. Public funding and collaborative innovation projects emphasize developing sustainable, scalable packaging solutions with glass interposers at the core. Influencing factors include strict EU regulations on device reliability and emissions, the drive for zero-defect automotive electronics, and strategic priorities to bolster domestic semiconductor production as part of broader digital and green transitions.

Wafer Size Outlook

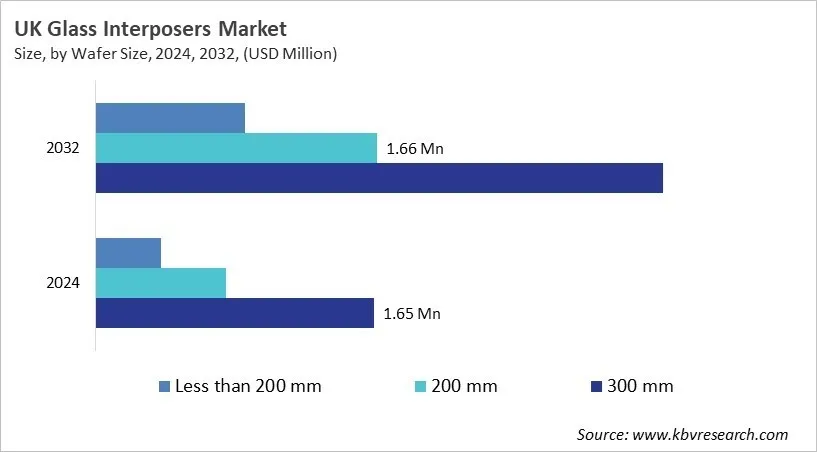

Based on Wafer Size, the market is segmented into 300 mm, 200 mm, and Less than 200 mm. Among various UK Glass Interposers Market by Wafer Size; The 300 mm market achieved a market size of USD $3.3 Million in 2024 and is expected to grow at a CAGR of 9.5 % during the forecast period. The Less than 200 mm market is predicted to experience a CAGR of 11.1% throughout the forecast period from (2025 - 2032).

Application Outlook

Based on Application, the market is segmented into 2.5D Packaging, 3D Packaging, and Fan-Out Packaging. The 2.5D Packaging market segment dominated the Germany Glass Interposers Market by Application is expected to grow at a CAGR of 9.7 % during the forecast period thereby continuing its dominance until 2032. Also, The Fan-Out Packaging market is anticipated to grow as a CAGR of 11.3 % during the forecast period during (2025 - 2032).

Free Valuable Insights: The Global Glass Interposers Market will Hit USD 303.45 Million by 2032, at a CAGR of 12.1%

Country Outlook

Germany’s glass interposers market is in an early but promising phase, driven by its leadership in automotive electronics, industrial automation, and aerospace. The focus is on upstream development with strong research institutions advancing through-glass via (TGV) technology and wafer-level packaging. Key strengths lie in precision glass suppliers and niche pilot projects for photonic, sensor, and telecom applications. Collaboration between research institutes and global firms supports innovation, despite challenges like high capital costs and competition from silicon and organic interposers. Germany is well-positioned for growth in specialized, high-value sectors such as automotive sensors and industrial packaging as global demand rises.

List of Key Companies Profiled

- Corning Incorporated

- AGC Inc.

- Schott AG (Carl-Zeiss-Stiftung)

- Dai Nippon Printing Co., Ltd.

- Tecnisco, LTD. (Disco Corporation)

- Samtec, Inc.

- RENA Technologies GmbH

- PLANOPTIK AG

- 3DGS Inc.

- Workshop of Photonics

Europe Glass Interposers Market Report Segmentation

By Wafer Size

- 300 mm

- 200 mm

- Less than 200 mm

By Application

- 2.5D Packaging

- 3D Packaging

- Fan-Out Packaging

By Substrate Technology

- Through-Glass Vias (TGV)

- Redistribution Layer (RDL)-First/Last

- Glass Panel Level Packaging (PLP)

By End Use Industry

- Consumer Electronics

- Telecommunications

- Automotive

- Defense & Aerospace

- Healthcare

- Other End Use Industry

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Europe Glass Interposers Market, by Wafer Size

1.4.2 Europe Glass Interposers Market, by Application

1.4.3 Europe Glass Interposers Market, by Substrate Technology

1.4.4 Europe Glass Interposers Market, by End Use Industry

1.4.5 Europe Glass Interposers Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.2 Market Drivers

3.1.3 Market Restraints

3.1.4 Market Opportunities

3.1.5 Market Challenges

Chapter 4. Market Trends Europe Glass Interposers Market

Chapter 5. State of Competition - Europe Glass Interposers Market

Chapter 6. Competition Analysis – Global

6.1 Market Share Analysis, 2024

6.2 Recent Strategies Deployed in Glass Interposers Market

6.3 Porter Five Forces Analysis

Chapter 7. PLC (Product Life Cycle) Glass Interposers Market

Chapter 8. Market Consolidation - Glass Interposers Market

Chapter 9. Value Chain Analysis of Glass Interposers Market

Chapter 10. Key Customer Criteria - Glass Interposers Market

Chapter 11. Europe Glass Interposers Market by Wafer Size

11.1 Europe 300 mm Market by Country

11.2 Europe 200 mm Market by Country

11.3 Europe Less than 200 mm Market by Country

Chapter 12. Europe Glass Interposers Market by Application

12.1 Europe 2.5D Packaging Market by Country

12.2 Europe 3D Packaging Market by Country

12.3 Europe Fan-Out Packaging Market by Country

Chapter 13. Europe Glass Interposers Market by Substrate Technology

13.1 Europe Through-Glass Vias (TGV) Market by Country

13.2 Europe Redistribution Layer (RDL)-First/Last Market by Country

13.3 Europe Glass Panel Level Packaging (PLP) Market by Country

Chapter 14. Europe Glass Interposers Market by End Use Industry

14.1 Europe Consumer Electronics Market by Country

14.2 Europe Telecommunications Market by Country

14.3 Europe Automotive Market by Country

14.4 Europe Defense & Aerospace Market by Country

14.5 Europe Healthcare Market by Country

14.6 Europe Other End Use Industry Market by Country

Chapter 15. Europe Glass Interposers Market by Country

15.1 Germany Glass Interposers Market

15.1.1 Germany Glass Interposers Market by Wafer Size

15.1.2 Germany Glass Interposers Market by Application

15.1.3 Germany Glass Interposers Market by Substrate Technology

15.1.4 Germany Glass Interposers Market by End Use Industry

15.2 UK Glass Interposers Market

15.2.1 UK Glass Interposers Market by Wafer Size

15.2.2 UK Glass Interposers Market by Application

15.2.3 UK Glass Interposers Market by Substrate Technology

15.2.4 UK Glass Interposers Market by End Use Industry

15.3 France Glass Interposers Market

15.3.1 France Glass Interposers Market by Wafer Size

15.3.2 France Glass Interposers Market by Application

15.3.3 France Glass Interposers Market by Substrate Technology

15.3.4 France Glass Interposers Market by End Use Industry

15.4 Russia Glass Interposers Market

15.4.1 Russia Glass Interposers Market by Wafer Size

15.4.2 Russia Glass Interposers Market by Application

15.4.3 Russia Glass Interposers Market by Substrate Technology

15.4.4 Russia Glass Interposers Market by End Use Industry

15.5 Spain Glass Interposers Market

15.5.1 Spain Glass Interposers Market by Wafer Size

15.5.2 Spain Glass Interposers Market by Application

15.5.3 Spain Glass Interposers Market by Substrate Technology

15.5.4 Spain Glass Interposers Market by End Use Industry

15.6 Italy Glass Interposers Market

15.6.1 Italy Glass Interposers Market by Wafer Size

15.6.2 Italy Glass Interposers Market by Application

15.6.3 Italy Glass Interposers Market by Substrate Technology

15.6.4 Italy Glass Interposers Market by End Use Industry

15.7 Rest of Europe Glass Interposers Market

15.7.1 Rest of Europe Glass Interposers Market by Wafer Size

15.7.2 Rest of Europe Glass Interposers Market by Application

15.7.3 Rest of Europe Glass Interposers Market by Substrate Technology

15.7.4 Rest of Europe Glass Interposers Market by End Use Industry

Chapter 16. Company Profiles

16.1 Corning Incorporated

16.1.1 Company Overview

16.1.2 Financial Analysis

16.1.3 Segmental and Regional Analysis

16.1.4 Research & Development Expenses

16.1.5 Recent strategies and developments:

16.1.5.1 Partnerships, Collaborations, and Agreements:

16.1.6 SWOT Analysis

16.2 AGC, Inc.

16.2.1 Company Overview

16.2.2 Financial Analysis

16.2.3 Segmental Analysis

16.2.4 Research & Development Expenses

16.2.5 SWOT Analysis

16.3 Schott AG (Carl-Zeiss-Stiftung)

16.3.1 Company Overview

16.3.2 Financial Analysis

16.3.3 Segmental and Regional Analysis

16.3.4 Research & Development Expenses

16.3.5 Recent strategies and developments:

16.3.5.1 Product Launches and Product Expansions:

16.3.6 SWOT Analysis

16.4 Dai Nippon Printing Co., Ltd.

16.4.1 Company Overview

16.4.2 Financial Analysis

16.4.3 Segmental and Regional Analysis

16.4.4 Research & Development Expenses

16.4.5 Recent strategies and developments:

16.4.5.1 Product Launches and Product Expansions:

16.5 Tecnisco, LTD. (Disco Corporation)

16.5.1 Company Overview

16.5.2 Financial Analysis

16.6 Samtec, Inc.

16.6.1 Company Overview

16.6.2 SWOT Analysis

16.7 RENA Technologies GmbH

16.7.1 Company Overview

16.8 PLANOPTIK AG

16.8.1 Company Overview

16.8.2 Financial Analysis

16.8.3 Research & Development Expenses

16.8.4 Recent strategies and developments:

16.8.4.1 Product Launches and Product Expansions:

16.9 3DGS Inc.

16.9.1 Company Overview

16.9.2 Recent strategies and developments:

16.9.2.1 Product Launches and Product Expansions:

16.10. Workshop of Photonics

16.10.1 Company Overview

TABLE 2 Europe Glass Interposers Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria Glass Interposers Market

TABLE 4 Europe Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 5 Europe Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 6 Europe 300 mm Market by Country, 2021 - 2024, USD Million

TABLE 7 Europe 300 mm Market by Country, 2025 - 2032, USD Million

TABLE 8 Europe 200 mm Market by Country, 2021 - 2024, USD Million

TABLE 9 Europe 200 mm Market by Country, 2025 - 2032, USD Million

TABLE 10 Europe Less than 200 mm Market by Country, 2021 - 2024, USD Million

TABLE 11 Europe Less than 200 mm Market by Country, 2025 - 2032, USD Million

TABLE 12 Europe Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 13 Europe Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 14 Europe 2.5D Packaging Market by Country, 2021 - 2024, USD Million

TABLE 15 Europe 2.5D Packaging Market by Country, 2025 - 2032, USD Million

TABLE 16 Europe 3D Packaging Market by Country, 2021 - 2024, USD Million

TABLE 17 Europe 3D Packaging Market by Country, 2025 - 2032, USD Million

TABLE 18 Europe Fan-Out Packaging Market by Country, 2021 - 2024, USD Million

TABLE 19 Europe Fan-Out Packaging Market by Country, 2025 - 2032, USD Million

TABLE 20 Europe Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 21 Europe Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 22 Europe Through-Glass Vias (TGV) Market by Country, 2021 - 2024, USD Million

TABLE 23 Europe Through-Glass Vias (TGV) Market by Country, 2025 - 2032, USD Million

TABLE 24 Europe Redistribution Layer (RDL)-First/Last Market by Country, 2021 - 2024, USD Million

TABLE 25 Europe Redistribution Layer (RDL)-First/Last Market by Country, 2025 - 2032, USD Million

TABLE 26 Europe Glass Panel Level Packaging (PLP) Market by Country, 2021 - 2024, USD Million

TABLE 27 Europe Glass Panel Level Packaging (PLP) Market by Country, 2025 - 2032, USD Million

TABLE 28 Europe Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 29 Europe Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 30 Europe Consumer Electronics Market by Country, 2021 - 2024, USD Million

TABLE 31 Europe Consumer Electronics Market by Country, 2025 - 2032, USD Million

TABLE 32 Europe Telecommunications Market by Country, 2021 - 2024, USD Million

TABLE 33 Europe Telecommunications Market by Country, 2025 - 2032, USD Million

TABLE 34 Europe Automotive Market by Country, 2021 - 2024, USD Million

TABLE 35 Europe Automotive Market by Country, 2025 - 2032, USD Million

TABLE 36 Europe Defense & Aerospace Market by Country, 2021 - 2024, USD Million

TABLE 37 Europe Defense & Aerospace Market by Country, 2025 - 2032, USD Million

TABLE 38 Europe Healthcare Market by Country, 2021 - 2024, USD Million

TABLE 39 Europe Healthcare Market by Country, 2025 - 2032, USD Million

TABLE 40 Europe Other End Use Industry Market by Country, 2021 - 2024, USD Million

TABLE 41 Europe Other End Use Industry Market by Country, 2025 - 2032, USD Million

TABLE 42 Europe Glass Interposers Market by Country, 2021 - 2024, USD Million

TABLE 43 Europe Glass Interposers Market by Country, 2025 - 2032, USD Million

TABLE 44 Germany Glass Interposers Market, 2021 - 2024, USD Million

TABLE 45 Germany Glass Interposers Market, 2025 - 2032, USD Million

TABLE 46 Germany Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 47 Germany Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 48 Germany Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 49 Germany Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 50 Germany Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 51 Germany Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 52 Germany Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 53 Germany Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 54 UK Glass Interposers Market, 2021 - 2024, USD Million

TABLE 55 UK Glass Interposers Market, 2025 - 2032, USD Million

TABLE 56 UK Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 57 UK Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 58 UK Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 59 UK Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 60 UK Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 61 UK Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 62 UK Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 63 UK Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 64 France Glass Interposers Market, 2021 - 2024, USD Million

TABLE 65 France Glass Interposers Market, 2025 - 2032, USD Million

TABLE 66 France Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 67 France Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 68 France Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 69 France Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 70 France Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 71 France Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 72 France Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 73 France Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 74 Russia Glass Interposers Market, 2021 - 2024, USD Million

TABLE 75 Russia Glass Interposers Market, 2025 - 2032, USD Million

TABLE 76 Russia Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 77 Russia Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 78 Russia Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 79 Russia Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 80 Russia Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 81 Russia Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 82 Russia Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 83 Russia Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 84 Spain Glass Interposers Market, 2021 - 2024, USD Million

TABLE 85 Spain Glass Interposers Market, 2025 - 2032, USD Million

TABLE 86 Spain Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 87 Spain Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 88 Spain Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 89 Spain Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 90 Spain Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 91 Spain Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 92 Spain Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 93 Spain Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 94 Italy Glass Interposers Market, 2021 - 2024, USD Million

TABLE 95 Italy Glass Interposers Market, 2025 - 2032, USD Million

TABLE 96 Italy Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 97 Italy Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 98 Italy Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 99 Italy Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 100 Italy Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 101 Italy Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 102 Italy Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 103 Italy Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 104 Rest of Europe Glass Interposers Market, 2021 - 2024, USD Million

TABLE 105 Rest of Europe Glass Interposers Market, 2025 - 2032, USD Million

TABLE 106 Rest of Europe Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 107 Rest of Europe Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 108 Rest of Europe Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 109 Rest of Europe Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 110 Rest of Europe Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 111 Rest of Europe Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 112 Rest of Europe Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 113 Rest of Europe Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 114 Key Information – Corning Incorporated

TABLE 115 Key Information – AGC, Inc.

TABLE 116 key Information – Schott AG

TABLE 117 Key Information – Dai Nippon Printing Co., Ltd.

TABLE 118 Key Information – Tecnisco, LTD.

TABLE 119 Key Information – Samtec, Inc.

TABLE 120 Key Information – RENA Technologies GmbH

TABLE 121 Key Information – PLANOPTIK AG

TABLE 122 Key Information – 3DGS Inc.

TABLE 123 Key Information – Workshop of Photonics

List of Figures

FIG 1 Methodology for the research

FIG 2 Europe Glass Interposers Market, 2021 - 2032, USD Million

FIG 3 Market Share Analysis, 2024

FIG 4 Porter’s Five Forces Analysis – Glass Interposers Market

FIG 5 Value Chain Analysis of Glass Interposers Market

FIG 6 Key Customer Criteria Glass Interposers Market

FIG 7 Europe Glass Interposers Market share by Wafer Size, 2024

FIG 8 Europe Glass Interposers Market share by Wafer Size, 2032

FIG 9 Europe Glass Interposers Market by Wafer Size, 2021 - 2032, USD Million

FIG 10 Europe Glass Interposers Market share by Application, 2024

FIG 11 Europe Glass Interposers Market share by Application, 2032

FIG 12 Europe Glass Interposers Market by Application, 2021 - 2032, USD Million

FIG 13 Europe Glass Interposers Market share by Substrate Technology, 2024

FIG 14 Europe Glass Interposers Market by Substrate Technology, 2032

FIG 15 Europe Glass Interposers Market by Substrate Technology, 2021 - 2032, USD Million

FIG 16 Europe Glass Interposers Market share by End Use Industry, 2024

FIG 17 Europe Glass Interposers Market share by End Use Industry, 2032

FIG 18 Europe Glass Interposers Market by End Use Industry, 2021 - 2032, USD Million

FIG 19 Europe Glass Interposers Market share by Country, 2024

FIG 20 Europe Glass Interposers Market share by Country, 2032

FIG 21 Europe Glass Interposers Market by Country, 2021 - 2032, USD Million

FIG 22 SWOT Analysis: Corning Incorporated

FIG 23 SWOT Analysis: AGC, Inc.

FIG 24 SWOT Analysis: Schott AG

FIG 25 SWOT Analysis: Samtec, Inc.