Europe Ceramide Market Size, Share & Trends Analysis Report By Application (Cosmetics, Food, and Others), By Process (Plant Extract, and Fermentation), By Type (Natural, and Synthetic), By Country and Growth Forecast, 2023 - 2030

Published Date : 29-Mar-2024 | Pages: 133 | Formats: PDF |

COVID-19 Impact on the Europe Ceramide Market

The Europe Ceramide Market would witness market growth of 4.9% CAGR during the forecast period (2023-2030). In the year 2020, the Europe market's volume surged to 79.48 tonnes, showcasing a growth of 2.1% (2019-2022).

In recent years, the utilization of ceramides in food products has gained attention due to their potential health benefits, particularly in promoting skin health and overall well-being. These are lipid molecules naturally found in the skin, but they can also be sourced from dietary sources such as wheat germ, rice bran, and soybeans. Incorporating into food products offers a convenient way to support skin hydration, elasticity, and barrier function from within. Therefore, the Germany market utilized 7.06 tonnes of Ceramide in food products in 2022.

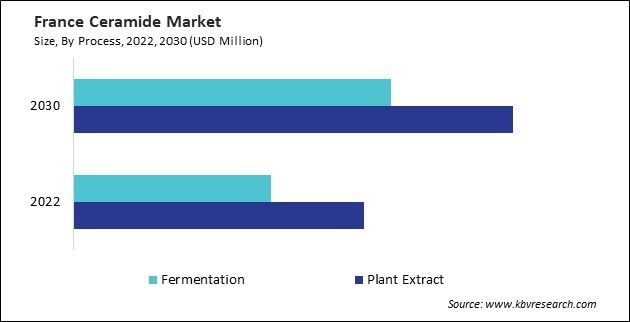

The Germany market dominated the Europe Ceramide Market, By Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $8,613.6 Thousands by 2030. The UK market is exhibiting a CAGR of 4% during (2023 - 2030). Additionally, The France market would experience a CAGR of 5.7% during (2023 - 2030).

Liposomal encapsulation involves entrapping it within lipid vesicles called liposomes, which mimic the structure of cell membranes. Liposomes act as carriers, facilitating the transport of ceramides across the skin barrier and enhancing their penetration into the epidermis and dermis. This delivery system protects ceramides from degradation and oxidation, prolonging their stability and bioavailability within skincare formulations.

Likewise, nano-emulsions consist of tiny droplets of its oil dispersed in water, resulting in a stable and homogeneous formulation with enhanced skin penetration properties. The small particle size of nano-emulsions allows deeper penetration into the skin, reaching the underlying layers where it exerts their therapeutic effects. Nano-emulsions offer advantages such as improved spreadability, faster absorption, and a non-greasy feel compared to traditional emulsions, enhancing the user experience of ceramide-based skincare products.

According to the International Trade Administration data, Belgium’s pharmaceutical industry spends $1.64 billion (€1.5 billion) on R&D every year, equivalent to 40 percent of all private investment in Belgium. As a result, Belgium is home to 29 of the world’s top 30 pharmaceutical companies, including important subsidiaries of major U.S. companies such as Johnson and Johnson and Pfizer. Hence, the growing pharmaceutical sector and increasing disposable income in Europe will drive the demand for ceramides in the region.

Free Valuable Insights: The Global Ceramide Market will Hit USD 146.0 Million by 2030, at a CAGR of 5.6%

Based on Application, the market is segmented into Cosmetics, Food, and Others. Based on Process, the market is segmented into Plant Extract, and Fermentation. Based on Type, the market is segmented into Natural, and Synthetic. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- Ashland Inc.

- Toyobo Co., Ltd.

- Doosan Corporation

- Arkema S.A.

- Evonik Industries AG (RAG-Stiftung)

- Cayman Chemical Company, Inc.

- Kao Corporation

- Croda International PLC

- Vantage Specialty Chemicals (H.I.G. Capital, LLC)

- Incospam Co., Ltd.

Europe Ceramide Market Report Segmentation

By Application (Volume, Tonnes, USD Million, 2019-2030)

- Cosmetics

- Food

- Others

By Process

- Plant Extract

- Fermentation

By Type (Volume, Tonnes, USD Million, 2019-2030)

- Natural

- Synthetic

By Country (Volume, Tonnes, USD Million, 2019-2030)

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Europe Ceramide Market, by Application

1.4.2 Europe Ceramide Market, by Process

1.4.3 Europe Ceramide Market, by Type

1.4.4 Europe Ceramide Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Opportunities

3.2.3 Market Restraints

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. Strategies Deployed in Ceramide Market

Chapter 5. Europe Ceramide Market, By Application

5.1 Europe Cosmetics Market, By Country

5.2 Europe Food Market, By Country

5.3 Europe Others Market, By Country

Chapter 6. Europe Ceramide Market, By Process

6.1 Europe Plant Extract Market, By Country

6.2 Europe Fermentation Market, By Country

Chapter 7. Europe Ceramide Market, By Type

7.1 Europe Natural Market, By Country

7.2 Europe Synthetic Market, By Country

Chapter 8. Europe Ceramide Market, By Country

8.1 Germany Ceramide Market

8.1.1 Germany Ceramide Market, By Application

8.1.2 Germany Ceramide Market, By Process

8.1.3 Germany Ceramide Market, By Type

8.2 UK Ceramide Market

8.2.1 UK Ceramide Market, By Application

8.2.2 UK Ceramide Market, By Process

8.2.3 UK Ceramide Market, By Type

8.3 France Ceramide Market

8.3.1 France Ceramide Market, By Application

8.3.2 France Ceramide Market, By Process

8.3.3 France Ceramide Market, By Type

8.4 Russia Ceramide Market

8.4.1 Russia Ceramide Market, By Application

8.4.2 Russia Ceramide Market, By Process

8.4.3 Russia Ceramide Market, By Type

8.5 Spain Ceramide Market

8.5.1 Spain Ceramide Market, By Application

8.5.2 Spain Ceramide Market, By Process

8.5.3 Spain Ceramide Market, By Type

8.6 Italy Ceramide Market

8.6.1 Italy Ceramide Market, By Application

8.6.2 Italy Ceramide Market, By Process

8.6.3 Italy Ceramide Market, By Type

8.7 Rest of Europe Ceramide Market

8.7.1 Rest of Europe Ceramide Market, By Application

8.7.2 Rest of Europe Ceramide Market, By Process

8.7.3 Rest of Europe Ceramide Market, By Type

Chapter 9. Company Profiles

9.1 Ashland Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 SWOT Analysis

9.2 Toyobo Co., Ltd.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 SWOT Analysis

9.3 Doosan Corporation

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 SWOT Analysis

9.4 Arkema S.A.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expenses

9.4.5 Recent strategies and developments:

9.4.5.1 Acquisition and Mergers:

9.4.6 SWOT Analysis

9.5 Evonik Industries AG (RAG-Stiftung)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 Recent strategies and developments:

9.5.5.1 Product Launches and Product Expansions:

9.5.5.2 Geographical Expansions:

9.5.6 SWOT Analysis

9.6 Cayman Chemical Company, Inc.

9.6.1 Company Overview

9.6.2 SWOT Analysis

9.7 Kao Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expenses

9.7.5 Recent strategies and developments:

9.7.5.1 Product Launches and Product Expansions:

9.7.6 SWOT Analysis

9.8 Croda International PLC

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Recent strategies and developments:

9.8.4.1 Acquisition and Mergers:

9.8.5 SWOT Analysis

9.9 Vantage Specialty Chemicals (H.I.G. Capital, LLC)

9.9.1 Company Overview

9.9.2 Recent strategies and developments:

9.9.2.1 Partnerships, Collaborations, and Agreements:

9.9.2.2 Geographical Expansions:

9.9.3 SWOT Analysis

9.10. Incospam Co., Ltd.

9.10.1 Company Overview

9.10.2 SWOT Analysis

TABLE 2 Europe Ceramide Market, 2023 - 2030, USD Thousands

TABLE 3 Europe Ceramide Market, 2019 - 2022, Tonnes

TABLE 4 Europe Ceramide Market, 2023 - 2030, Tonnes

TABLE 5 Europe Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 6 Europe Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 7 Europe Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 8 Europe Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 9 Europe Cosmetics Market, By Country, 2019 - 2022, USD Thousands

TABLE 10 Europe Cosmetics Market, By Country, 2023 - 2030, USD Thousands

TABLE 11 Europe Cosmetics Market, By Country, 2019 - 2022, Tonnes

TABLE 12 Europe Cosmetics Market, By Country, 2023 - 2030, Tonnes

TABLE 13 Europe Food Market, By Country, 2019 - 2022, USD Thousands

TABLE 14 Europe Food Market, By Country, 2023 - 2030, USD Thousands

TABLE 15 Europe Food Market, By Country, 2019 - 2022, Tonnes

TABLE 16 Europe Food Market, By Country, 2023 - 2030, Tonnes

TABLE 17 Europe Others Market, By Country, 2019 - 2022, USD Thousands

TABLE 18 Europe Others Market, By Country, 2023 - 2030, USD Thousands

TABLE 19 Europe Others Market, By Country, 2019 - 2022, Tonnes

TABLE 20 Europe Others Market, By Country, 2023 - 2030, Tonnes

TABLE 21 Europe Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 22 Europe Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 23 Europe Plant Extract Market, By Country, 2019 - 2022, USD Thousands

TABLE 24 Europe Plant Extract Market, By Country, 2023 - 2030, USD Thousands

TABLE 25 Europe Fermentation Market, By Country, 2019 - 2022, USD Thousands

TABLE 26 Europe Fermentation Market, By Country, 2023 - 2030, USD Thousands

TABLE 27 Europe Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 28 Europe Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 29 Europe Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 30 Europe Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 31 Europe Natural Market, By Country, 2019 - 2022, USD Thousands

TABLE 32 Europe Natural Market, By Country, 2023 - 2030, USD Thousands

TABLE 33 Europe Natural Market, By Country, 2019 - 2022, Tonnes

TABLE 34 Europe Natural Market, By Country, 2023 - 2030, Tonnes

TABLE 35 Europe Synthetic Market, By Country, 2019 - 2022, USD Thousands

TABLE 36 Europe Synthetic Market, By Country, 2023 - 2030, USD Thousands

TABLE 37 Europe Synthetic Market, By Country, 2019 - 2022, Tonnes

TABLE 38 Europe Synthetic Market, By Country, 2023 - 2030, Tonnes

TABLE 39 Europe Ceramide Market, By Country, 2019 - 2022, USD Thousands

TABLE 40 Europe Ceramide Market, By Country, 2023 - 2030, USD Thousands

TABLE 41 Europe Ceramide Market, By Country, 2019 - 2022, Tonnes

TABLE 42 Europe Ceramide Market, By Country, 2023 - 2030, Tonnes

TABLE 43 Germany Ceramide Market, 2019 - 2022, USD Thousands

TABLE 44 Germany Ceramide Market, 2023 - 2030, USD Thousands

TABLE 45 Germany Ceramide Market, 2019 - 2022, Tonnes

TABLE 46 Germany Ceramide Market, 2023 - 2030, Tonnes

TABLE 47 Germany Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 48 Germany Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 49 Germany Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 50 Germany Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 51 Germany Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 52 Germany Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 53 Germany Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 54 Germany Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 55 Germany Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 56 Germany Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 57 UK Ceramide Market, 2019 - 2022, USD Thousands

TABLE 58 UK Ceramide Market, 2023 - 2030, USD Thousands

TABLE 59 UK Ceramide Market, 2019 - 2022, Tonnes

TABLE 60 UK Ceramide Market, 2023 - 2030, Tonnes

TABLE 61 UK Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 62 UK Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 63 UK Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 64 UK Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 65 UK Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 66 UK Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 67 UK Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 68 UK Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 69 UK Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 70 UK Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 71 France Ceramide Market, 2019 - 2022, USD Thousands

TABLE 72 France Ceramide Market, 2023 - 2030, USD Thousands

TABLE 73 France Ceramide Market, 2019 - 2022, Tonnes

TABLE 74 France Ceramide Market, 2023 - 2030, Tonnes

TABLE 75 France Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 76 France Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 77 France Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 78 France Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 79 France Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 80 France Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 81 France Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 82 France Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 83 France Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 84 France Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 85 Russia Ceramide Market, 2019 - 2022, USD Thousands

TABLE 86 Russia Ceramide Market, 2023 - 2030, USD Thousands

TABLE 87 Russia Ceramide Market, 2019 - 2022, Tonnes

TABLE 88 Russia Ceramide Market, 2023 - 2030, Tonnes

TABLE 89 Russia Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 90 Russia Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 91 Russia Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 92 Russia Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 93 Russia Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 94 Russia Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 95 Russia Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 96 Russia Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 97 Russia Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 98 Russia Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 99 Spain Ceramide Market, 2019 - 2022, USD Thousands

TABLE 100 Spain Ceramide Market, 2023 - 2030, USD Thousands

TABLE 101 Spain Ceramide Market, 2019 - 2022, Tonnes

TABLE 102 Spain Ceramide Market, 2023 - 2030, Tonnes

TABLE 103 Spain Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 104 Spain Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 105 Spain Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 106 Spain Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 107 Spain Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 108 Spain Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 109 Spain Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 110 Spain Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 111 Spain Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 112 Spain Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 113 Italy Ceramide Market, 2019 - 2022, USD Thousands

TABLE 114 Italy Ceramide Market, 2023 - 2030, USD Thousands

TABLE 115 Italy Ceramide Market, 2019 - 2022, Tonnes

TABLE 116 Italy Ceramide Market, 2023 - 2030, Tonnes

TABLE 117 Italy Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 118 Italy Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 119 Italy Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 120 Italy Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 121 Italy Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 122 Italy Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 123 Italy Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 124 Italy Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 125 Italy Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 126 Italy Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 127 Rest of Europe Ceramide Market, 2019 - 2022, USD Thousands

TABLE 128 Rest of Europe Ceramide Market, 2023 - 2030, USD Thousands

TABLE 129 Rest of Europe Ceramide Market, 2019 - 2022, Tonnes

TABLE 130 Rest of Europe Ceramide Market, 2023 - 2030, Tonnes

TABLE 131 Rest of Europe Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 132 Rest of Europe Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 133 Rest of Europe Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 134 Rest of Europe Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 135 Rest of Europe Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 136 Rest of Europe Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 137 Rest of Europe Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 138 Rest of Europe Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 139 Rest of Europe Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 140 Rest of Europe Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 141 Key Information – Ashland Inc.

TABLE 142 Key Information – TOYOBO CO., LTD.

TABLE 143 Key Information – Doosan Corporation

TABLE 144 Key information – Arkema S.A.

TABLE 145 Key Information – Evonik Industries AG

TABLE 146 Key Information – Cayman Chmeical Company, Inc.

TABLE 147 Key Information – Kao Corporation

TABLE 148 Key Information – Croda International PLC

TABLE 149 Key Information – Vantage Specialty Chemicals

TABLE 150 Key Information – Incospam Co., Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 Europe Ceramide Market, 2019 - 2030, USD Thousands

FIG 3 Key Factors Impacting Ceramide Market

FIG 4 Porter’s Five Forces Analysis - Ceramide Market

FIG 5 Europe Ceramide Market share, By Application, 2022

FIG 6 Europe Ceramide Market share, By Application, 2030

FIG 7 Europe Ceramide Market, By Application, 2019 - 2030, USD Thousands

FIG 8 Europe Ceramide Market share, By Process, 2022

FIG 9 Europe Ceramide Market share, By Process, 2030

FIG 10 Europe Ceramide Market, By Process, 2019 - 2030, USD Thousands

FIG 11 Europe Ceramide Market share, By Type, 2022

FIG 12 Europe Ceramide Market share, By Type, 2030

FIG 13 Europe Ceramide Market, By Type, 2019 - 2030, USD Thousands

FIG 14 Europe Ceramide Market share, By Country, 2022

FIG 15 Europe Ceramide Market share, By Country, 2030

FIG 16 Europe Ceramide Market, By Country, 2019 - 2030, USD Thousands

FIG 17 Swot Analysis: Ashland Inc.

FIG 18 SWOT Analysis: Toyobo Co., Ltd.

FIG 19 SWOT Analysis: Doosan Corporation

FIG 20 SWOT Analysis: Arkema S.A.

FIG 21 SWOT Analysis: Evonik Industries AG

FIG 22 Swot Analysis: Cayman Chemical Company, Inc.

FIG 23 SWOT Analysis: Kao Corporation

FIG 24 SWOT Analysis: Croda International PLC

FIG 25 SWOT Analysis: Vantage Specialty Chemicals

FIG 26 SWOT Analysis: Incospam Co., Ltd.