Europe C4ISR Market Size, Share & Industry Analysis Report By Type (New Installation, and Retrofit), By Vertical (Defense & Military, Government, and Commercial), By End Use (Air, Naval, Ground, and Space), By Application, By Component (Hardware, Software, and Services), By Country and Growth Forecast, 2025 - 2032

Published Date : 28-Jul-2025 |

Pages: 212 |

Report Format: PDF + Excel |

COVID-19 Impact on the Europe C4ISR Market

The Europe C4ISR Market is expected to witness a 4.5% CAGR during the forecast period (2025-2032).

The UK market dominated the Europe C4ISR Market by Country in 2024 and is expected to continue as a dominant market until 2032, thereby achieving a market value of USD 8,035.5 million by 2032. The Germany market is exhibiting a CAGR of 3.5% during (2025 - 2032). Additionally, The France market would experience a CAGR of 5.1% during (2025 - 2032).

Driven by NATO initiatives, advanced technologies, and the growing need for interoperability among European countries, the European C4ISR Market is experiencing rapid evolution. Firstly, delayed by remote national systems, the requirement for synchronized command and control frameworks was highlighted by the joint operations. Initiatives such as NATO’s Allied Command Transformation and ACCS, along with the efforts of the European Defence Agency, paved the way for coordinated, real-time situational awareness. Regional battles and hybrid threats, such as cyberattacks, have fueled investments in next-generation C4ISR systems. The European Defence Funds and PESCO are making significant investments to enable cross-border research and development activities and joint procurement, thereby reinforcing operational readiness.

Significant trends redefining the market include the integration of Artificial Intelligence for quicker threat exposure, improved cybersecurity frameworks, and substantial investments in space-based C4ISR platforms such as Skynet and GOVSATCOM. Major companies, such as Thales, BAE Systems, Rheinmetall, and Leonardo, are leveraging AI, multi-sensor fusion, and integrated designs to achieve interoperability and secure NATO contracts. Joint projects, such as the Future Combat Air System and MALE RPAS, focus on innovation with export prospects in non-EU markets, further fueling competitiveness. The technological drive, public-private joint initiatives, and the quest for dominance through superior information define the market growth.

Free Valuable Insights: The Global C4ISR Market will Hit USD 181.49 Billion by 2032, at a CAGR of 4.7%

Europe Market Trends:

The European C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) market is now a vital component of modern military operations. The growing threats and security concerns, regional conflicts, and the need to lead in the technological arena are strong motives for the deployment of C4ISR systems in the region. European countries are making efforts to enhance their battlefield surveillance capabilities, enabling them to make quick decisions and coordinate efficiently among military groups. As a solution, C4ISR systems are now considered indispensable tools for reshaping and strengthening defense plans in Europe.

Integration of Multi-Domain Operations (MDO) into C4ISR Frameworks

The C4ISR systems are gaining popularity in the European market. The changing scenarios for the development and utilization of these systems, along with the capabilities of Multi-Domain Operations (MDO), which enable the synchronization of operations across land, sea, air, space, and cyber domains, are driving market growth. With the advancements in the complexity of threats and their spread, the armies in Europe are working on information sharing and operating in synchronization across all domains. For instance, a major European initiative called the Future Combat Air System (FCAS) envisions the use of a Combat Cloud to connect aircraft, both manned and unmanned, as well as command hubs. Such a plan creates demand for C4ISR systems to collect data from cyber tools, satellites, sea sensors, and aircraft, all of which are integrated into a single center to ensure synchronization.

State of Competition – Europe:

Emerging Role of Mid-Tier and Tech-Driven Companies

The C4ISR market is known to be dominated by large companies leading larger projects; however, several mid-sized European companies and technology companies struggle to garner significant roles. These companies are gaining recognition in areas such as tactical communication, cyber defense, and battlefield IT. Rohde & Schwarz, Secunet in Germany, and Atos in France are important names in this arena. Such companies can bring new concepts & ideas, as well as smart software, to support the shift to digital systems. The big players are also partnering with them to implement new technologies, primarily for civil and military purposes.

Type Outlook

Based on Type, the market is segmented into New Installation and Retrofit.

Retrofit

While the new installation part has the largest share, the retrofit part is also growing rapidly as many countries seek to extend the lifespan of their old equipment. Adding C4ISR systems to older tools and machines is a cost-effective way to upgrade without replacing everything. Countries in Europe, such as Italy, Greece, and Romania, which still use outdated systems, are now paying more attention to retrofit plans to improve the performance of their equipment.

For example, Leonardo S.p.A. is working on upgrade projects across Europe, like improving Italian navy ships with new surveillance radars and electronic warfare systems. Similarly, Saab AB has provided enhanced C4ISR solutions to countries in Eastern Europe by integrating digital battlefield software into their existing armored vehicles.

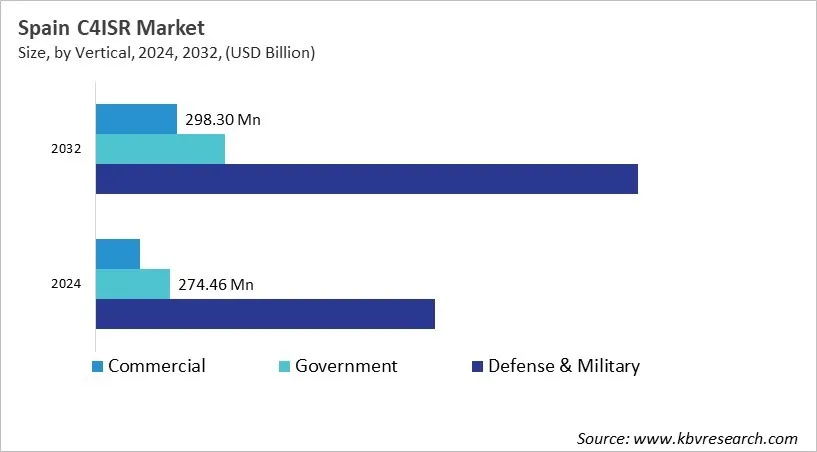

Vertical Outlook

Based on Vertical, the market is segmented into defense and military, Government, and Commercial.

Defense & Military

In 2024, the Defense and Military segment contributed the major share towards the market revenue. With the rising cross-border conflicts, plans to upgrade old systems, and higher spending budgets, the NATO-led Defense and Military segment is expected to register the largest share. European defense leaders have strong plans to build joint systems to connect land, sea, air, and cyber operations for efficient coordination. In addition, having effective real-time information about war zones requires more ISR satellites in space to maintain surveillance and facilitate data sharing, leading to the transformation of the C4ISR landscape.

For instance, the old Bowman communication system will be replaced by the new C4ISR system, the United Kingdom’s Project Morpheus. The system utilizes open designs and software tools for improved functionality. Similarly, in France, the C4ISR system, known as the Scorpion program, has provided better tools to facilitate vehicle communication and command for the military.

List of Key Companies Profiled

- Axis Communications AB (Canon, Inc.)

- Motorola Solutions, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Bosch Sicherheitssysteme GmbH (Robert Bosch GmbH)

- Zhejiang Dahua Technology Co., Ltd.

- Sony Semiconductor Solutions Corporation (Sony Corporation)

- Honeywell International Inc.

- Johnson Controls International PLC

- OmniVision Technologies, Inc.

- i-PRO Co., Ltd.

Europe C4ISR Market Report Segmentation

By Type

- New Installation

- Retrofit

By Vertical

- Defense & Military

- Government

- Commercial

By End Use

- Air

- Naval

- Ground

- Space

By Application

- Intelligence, Surveillance and Reconnaissance (ISR)

- Command & Control

- Communications

- Electronic Warfare

- Computers

By Component

- Hardware

- Software

- Services

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Europe C4ISR Market, by Type

1.4.2 Europe C4ISR Market, by Vertical

1.4.3 Europe C4ISR Market, by End Use

1.4.4 Europe C4ISR Market, by Application

1.4.5 Europe C4ISR Market, by Component

1.4.6 Europe C4ISR Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.2 Key Influencing Factors

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Market Trends Europe C4ISR Market

Chapter 5. State of Competition – Europe C4ISR Market

Chapter 6. Competition Analysis - Global

6.1 KBV Cardinal Matrix

6.2 Recent Industry Wide Strategic Developments

6.2.1 Partnerships, Collaborations and Agreements

6.2.2 Product Launches and Product Expansions

6.2.3 Acquisition and Mergers

6.2.4 Geographical Expansion

6.3 Market Share Analysis, 2024

6.4 Top Winning Strategies

6.4.1 Key Leading Strategies: Percentage Distribution (2021-2025)

6.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2021, Sep – 2025, Jun) Leading Players

6.5 Porter Five Forces Analysis

Chapter 7. Value Chain Analysis of C4ISR Market

7.1 Research & Development (R&D)

7.2 Component Manufacturing

7.3 System Integration

7.4 Deployment & Installation

7.5 Operation & Maintenance

7.6 End-User Services & Feedback Loop

Chapter 8. Key Customer Criteria: C4ISR Market

Chapter 9. Market Consolidation Analysis – Global C4ISR Market

Chapter 10. Europe C4ISR Market by Type

10.1 Europe New Installation Market by Country

10.2 Europe Retrofit Market by Country

Chapter 11. Europe C4ISR Market by Vertical

11.1 Europe Defense & Military Market by Country

11.2 Europe Government Market by Country

11.3 Europe Commercial Market by Country

Chapter 12. Europe C4ISR Market by End Use

12.1 Europe Air Market by Country

12.2 Europe Naval Market by Country

12.3 Europe Ground Market by Country

12.4 Europe Space Market by Country

Chapter 13. Europe C4ISR Market by Application

13.1 Europe Intelligence, Surveillance and Reconnaissance (ISR) Market by Country

13.2 Europe Command & Control Market by Country

13.3 Europe Communications Market by Country

13.4 Europe Electronic Warfare Market by Country

13.5 Europe Computers Market by Country

Chapter 14. Europe C4ISR Market by Component

14.1 Europe Hardware Market by Country

14.2 Europe Software Market by Country

14.3 Europe Services Market by Country

Chapter 15. Europe C4ISR Market by Country

15.1 UK C4ISR Market

15.1.1 UK C4ISR Market by Type

15.1.2 UK C4ISR Market by Vertical

15.1.3 UK C4ISR Market by End Use

15.1.4 UK C4ISR Market by Application

15.1.5 UK C4ISR Market by Component

15.2 Germany C4ISR Market

15.2.1 Germany C4ISR Market by Type

15.2.2 Germany C4ISR Market by Vertical

15.2.3 Germany C4ISR Market by End Use

15.2.4 Germany C4ISR Market by Application

15.2.5 Germany C4ISR Market by Component

15.3 France C4ISR Market

15.3.1 France C4ISR Market by Type

15.3.2 France C4ISR Market by Vertical

15.3.3 France C4ISR Market by End Use

15.3.4 France C4ISR Market by Application

15.3.5 France C4ISR Market by Component

15.4 Russia C4ISR Market

15.4.1 Russia C4ISR Market by Type

15.4.2 Russia C4ISR Market by Vertical

15.4.3 Russia C4ISR Market by End Use

15.4.4 Russia C4ISR Market by Application

15.4.5 Russia C4ISR Market by Component

15.5 Spain C4ISR Market

15.5.1 Spain C4ISR Market by Type

15.5.2 Spain C4ISR Market by Vertical

15.5.3 Spain C4ISR Market by End Use

15.5.4 Spain C4ISR Market by Application

15.5.5 Spain C4ISR Market by Component

15.6 Italy C4ISR Market

15.6.1 Italy C4ISR Market by Type

15.6.2 Italy C4ISR Market by Vertical

15.6.3 Italy C4ISR Market by End Use

15.6.4 Italy C4ISR Market by Application

15.6.5 Italy C4ISR Market by Component

15.7 Rest of Europe C4ISR Market

15.7.1 Rest of Europe C4ISR Market by Type

15.7.2 Rest of Europe C4ISR Market by Vertical

15.7.3 Rest of Europe C4ISR Market by End Use

15.7.4 Rest of Europe C4ISR Market by Application

15.7.5 Rest of Europe C4ISR Market by Component

Chapter 16. Company Profiles

16.1 Lockheed Martin Corporation

16.1.1 Company Overview

16.1.2 Financial Analysis

16.1.3 Segmental and Regional Analysis

16.1.4 Research & Development Expense

16.1.5 Recent strategies and developments:

16.1.5.1 Partnerships, Collaborations, and Agreements:

16.1.5.2 Acquisition and Mergers:

16.1.6 SWOT Analysis

16.2 Northrop Grumman Corporation

16.2.1 Company Overview

16.2.2 Financial Analysis

16.2.3 Segmental and Regional Analysis

16.2.4 Research & Development Expenses

16.2.5 Recent strategies and developments:

16.2.5.1 Partnerships, Collaborations, and Agreements:

16.2.6 SWOT Analysis

16.3 RTX Corporation

16.3.1 Company Overview

16.3.2 Financial Analysis

16.3.3 Segmental and Regional Analysis

16.3.4 Research & Development Expense

16.3.5 SWOT Analysis

16.4 BAE Systems PLC

16.4.1 Company Overview

16.4.2 Financial Analysis

16.4.3 Segmental and Regional Analysis

16.4.4 Research & Development Expenses

16.4.5 SWOT Analysis

16.5 General Dynamics Corporation

16.5.1 Company Overview

16.5.2 Financial Analysis

16.5.3 Segmental and Regional Analysis

16.5.4 Research & Development Expenses

16.5.5 SWOT Analysis

16.6 Thales Group S.A.

16.6.1 Company Overview

16.6.2 Financial Analysis

16.6.3 Segmental Analysis

16.6.4 Research & Development Expenses

16.6.5 Recent strategies and developments:

16.6.5.1 Partnerships, Collaborations, and Agreements:

16.6.5.2 Product Launches and Product Expansions:

16.6.6 SWOT Analysis

16.7 The Boeing Company

16.7.1 Company Overview

16.7.2 Financial Analysis

16.7.3 Segmental and Regional Analysis

16.7.4 Research & Development Expenses

16.7.5 SWOT Analysis

16.8 Leonardo SpA (Leonardo DRS, Inc.)

16.8.1 Company Overview

16.8.2 Financial Analysis

16.8.3 Segmental and Regional Analysis

16.8.4 Recent strategies and developments:

16.8.4.1 Partnerships, Collaborations, and Agreements:

16.8.4.2 Geographical Expansions:

16.8.5 SWOT Analysis

16.9 L3Harris Technologies, Inc.

16.9.1 Company Overview

16.9.2 Financial Analysis

16.9.3 Segmental and Regional Analysis

16.9.4 Recent strategies and developments:

16.9.4.1 Partnerships, Collaborations, and Agreements:

16.9.4.2 Product Launches and Product Expansions:

16.9.5 SWOT Analysis

16.10. Elbit Systems Ltd.

16.10.1 Company Overview

16.10.2 Financial Analysis

16.10.3 Segmental and Regional Analysis

16.10.4 Research & Development Expenses

16.10.5 Recent strategies and developments:

16.10.5.1 Product Launches and Product Expansions:

16.10.6 SWOT Analysis

TABLE 2 Europe C4ISR Market, 2025 - 2032, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– C4ISR Market

TABLE 4 Product Launches And Product Expansions– C4ISR Market

TABLE 5 Acquisition and Mergers– C4ISR Market

TABLE 6 Geographical Expansion– C4ISR Market

TABLE 7 Key Customer Criteria: C4ISR Market

TABLE 8 Key Parameters defining Market Consolidation:

TABLE 9 Europe C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 10 Europe C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 11 Europe New Installation Market by Country, 2021 - 2024, USD Million

TABLE 12 Europe New Installation Market by Country, 2025 - 2032, USD Million

TABLE 13 Europe Retrofit Market by Country, 2021 - 2024, USD Million

TABLE 14 Europe Retrofit Market by Country, 2025 - 2032, USD Million

TABLE 15 Europe C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 16 Europe C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 17 Europe Defense & Military Market by Country, 2021 - 2024, USD Million

TABLE 18 Europe Defense & Military Market by Country, 2025 - 2032, USD Million

TABLE 19 Europe Government Market by Country, 2021 - 2024, USD Million

TABLE 20 Europe Government Market by Country, 2025 - 2032, USD Million

TABLE 21 Europe Commercial Market by Country, 2021 - 2024, USD Million

TABLE 22 Europe Commercial Market by Country, 2025 - 2032, USD Million

TABLE 23 Europe C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 24 Europe C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 25 Europe Air Market by Country, 2021 - 2024, USD Million

TABLE 26 Europe Air Market by Country, 2025 - 2032, USD Million

TABLE 27 Europe Naval Market by Country, 2021 - 2024, USD Million

TABLE 28 Europe Naval Market by Country, 2025 - 2032, USD Million

TABLE 29 Europe Ground Market by Country, 2021 - 2024, USD Million

TABLE 30 Europe Ground Market by Country, 2025 - 2032, USD Million

TABLE 31 Europe Space Market by Country, 2021 - 2024, USD Million

TABLE 32 Europe Space Market by Country, 2025 - 2032, USD Million

TABLE 33 Europe C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 34 Europe C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 35 Europe Intelligence, Surveillance and Reconnaissance (ISR) Market by Country, 2021 - 2024, USD Million

TABLE 36 Europe Intelligence, Surveillance and Reconnaissance (ISR) Market by Country, 2025 - 2032, USD Million

TABLE 37 Europe Command & Control Market by Country, 2021 - 2024, USD Million

TABLE 38 Europe Command & Control Market by Country, 2025 - 2032, USD Million

TABLE 39 Europe Communications Market by Country, 2021 - 2024, USD Million

TABLE 40 Europe Communications Market by Country, 2025 - 2032, USD Million

TABLE 41 Europe Electronic Warfare Market by Country, 2021 - 2024, USD Million

TABLE 42 Europe Electronic Warfare Market by Country, 2025 - 2032, USD Million

TABLE 43 Europe Computers Market by Country, 2021 - 2024, USD Million

TABLE 44 Europe Computers Market by Country, 2025 - 2032, USD Million

TABLE 45 Europe C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 46 Europe C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 47 Europe Hardware Market by Country, 2021 - 2024, USD Million

TABLE 48 Europe Hardware Market by Country, 2025 - 2032, USD Million

TABLE 49 Europe Software Market by Country, 2021 - 2024, USD Million

TABLE 50 Europe Software Market by Country, 2025 - 2032, USD Million

TABLE 51 Europe Services Market by Country, 2021 - 2024, USD Million

TABLE 52 Europe Services Market by Country, 2025 - 2032, USD Million

TABLE 53 Europe C4ISR Market by Country, 2021 - 2024, USD Million

TABLE 54 Europe C4ISR Market by Country, 2025 - 2032, USD Million

TABLE 55 UK C4ISR Market, 2021 - 2024, USD Million

TABLE 56 UK C4ISR Market, 2025 - 2032, USD Million

TABLE 57 UK C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 58 UK C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 59 UK C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 60 UK C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 61 UK C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 62 UK C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 63 UK C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 64 UK C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 65 UK C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 66 UK C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 67 Germany C4ISR Market, 2021 - 2024, USD Million

TABLE 68 Germany C4ISR Market, 2025 - 2032, USD Million

TABLE 69 Germany C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 70 Germany C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 71 Germany C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 72 Germany C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 73 Germany C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 74 Germany C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 75 Germany C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 76 Germany C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 77 Germany C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 78 Germany C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 79 France C4ISR Market, 2021 - 2024, USD Million

TABLE 80 France C4ISR Market, 2025 - 2032, USD Million

TABLE 81 France C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 82 France C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 83 France C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 84 France C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 85 France C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 86 France C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 87 France C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 88 France C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 89 France C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 90 France C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 91 Russia C4ISR Market, 2021 - 2024, USD Million

TABLE 92 Russia C4ISR Market, 2025 - 2032, USD Million

TABLE 93 Russia C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 94 Russia C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 95 Russia C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 96 Russia C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 97 Russia C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 98 Russia C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 99 Russia C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 100 Russia C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 101 Russia C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 102 Russia C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 103 Spain C4ISR Market, 2021 - 2024, USD Million

TABLE 104 Spain C4ISR Market, 2025 - 2032, USD Million

TABLE 105 Spain C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 106 Spain C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 107 Spain C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 108 Spain C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 109 Spain C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 110 Spain C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 111 Spain C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 112 Spain C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 113 Spain C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 114 Spain C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 115 Italy C4ISR Market, 2021 - 2024, USD Million

TABLE 116 Italy C4ISR Market, 2025 - 2032, USD Million

TABLE 117 Italy C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 118 Italy C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 119 Italy C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 120 Italy C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 121 Italy C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 122 Italy C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 123 Italy C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 124 Italy C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 125 Italy C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 126 Italy C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 127 Rest of Europe C4ISR Market, 2021 - 2024, USD Million

TABLE 128 Rest of Europe C4ISR Market, 2025 - 2032, USD Million

TABLE 129 Rest of Europe C4ISR Market by Type, 2021 - 2024, USD Million

TABLE 130 Rest of Europe C4ISR Market by Type, 2025 - 2032, USD Million

TABLE 131 Rest of Europe C4ISR Market by Vertical, 2021 - 2024, USD Million

TABLE 132 Rest of Europe C4ISR Market by Vertical, 2025 - 2032, USD Million

TABLE 133 Rest of Europe C4ISR Market by End Use, 2021 - 2024, USD Million

TABLE 134 Rest of Europe C4ISR Market by End Use, 2025 - 2032, USD Million

TABLE 135 Rest of Europe C4ISR Market by Application, 2021 - 2024, USD Million

TABLE 136 Rest of Europe C4ISR Market by Application, 2025 - 2032, USD Million

TABLE 137 Rest of Europe C4ISR Market by Component, 2021 - 2024, USD Million

TABLE 138 Rest of Europe C4ISR Market by Component, 2025 - 2032, USD Million

TABLE 139 Key Information – Lockheed Martin Corporation

TABLE 140 Key Information – Northrop Grumman Corporation

TABLE 141 Key Information – RTX Corporation

TABLE 142 Key Information – BAE Systems PLC

TABLE 143 Key Information – General Dynamics Corporation

TABLE 144 Key Information – Thales Group S.A.

TABLE 145 Key Information – The Boeing Company

TABLE 146 Key information – Leonardo SpA

TABLE 147 Key information – L3Harris Technologies, Inc.

TABLE 148 Key Information – Elbit Systems Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 Europe C4ISR Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Europe C4ISR Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2024

FIG 6 Key Leading Strategies: Percentage Distribution (2021-2025)

FIG 7 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2021, sep – 2025, Jun) Leading Players

FIG 8 Porter’s Five Forces Analysis – C4ISR Market

FIG 9 Value Chain Analysis of C4ISR Market

FIG 10 Key Customer Criteria: C4ISR Market

FIG 11 Market Consolidation Analysis – Global C4ISR Market

FIG 12 Europe C4ISR Market share by Type, 2024

FIG 13 Europe C4ISR Market share by Type, 2032

FIG 14 Europe C4ISR Market by Type, 2021 - 2032, USD Million

FIG 15 Europe C4ISR Market by Vertical, 2024

FIG 16 Europe C4ISR Market by Vertical, 2032

FIG 17 Europe C4ISR Market by Vertical, 2021 - 2032, USD Million

FIG 18 Europe C4ISR Market share by End Use, 2024

FIG 19 Europe C4ISR Market share by End Use, 2032

FIG 20 Europe C4ISR Market by End Use, 2021- 2032, USD Million

FIG 21 Europe C4ISR Market share by Application, 2024

FIG 22 Europe C4ISR Market share by Application, 2032

FIG 23 Europe C4ISR Market by Application, 2021 - 2032, USD Million

FIG 24 Europe C4ISR Market share by Component, 2024

FIG 25 Europe C4ISR Market by Component, 2032

FIG 26 Europe C4ISR Market by Component, 2021 - 2032, USD Million

FIG 27 Europe C4ISR Market share by Country, 2024

FIG 28 Europe C4ISR Market share by Country, 2032

FIG 29 Europe C4ISR Market by Country, 2021 - 2032, USD Million

FIG 30 Recent strategies and developments: Lockheed Martin Corporation

FIG 31 SWOT Analysis: Lockheed Martin Corporation

FIG 32 SWOT Analysis: Northrop Grumman Corporation

FIG 33 SWOT Analysis: RTX Corporation

FIG 34 SWOT Analysis: BAE SYSTEMS PLC

FIG 35 SWOT Analysis: General Dynamics Corporation

FIG 36 Recent strategies and developments: Thales Group S.A.

FIG 37 SWOT Analysis: Thales Group S.A.

FIG 38 SWOT Analysis: The Boeing Company

FIG 39 Recent strategies and developments: Leonardo SpA

FIG 40 SWOT Analysis: Leonardo SpA

FIG 41 Recent strategies and developments: L3Harris Technologies, Inc.

FIG 42 SWOT Analysis: L3Harris Technologies, Inc.

FIG 43 SWOT Analysis: Elbit Systems Ltd.