Europe Agriculture Biologicals Testing Market Size, Share & Trends Analysis Report By End-User, By Product Type (Biopesticides, Biofertilizers and Biostimulants), By Country and Growth Forecast, 2023 - 2030

Published Date : 22-Mar-2024 | Pages: 101 | Formats: PDF |

COVID-19 Impact on the Europe Agriculture Biologicals Testing Market

The Europe Agriculture Biologicals Testing Market would witness market growth of 6.8% CAGR during the forecast period (2023-2030).

The Germany market dominated the Europe Agriculture Biologicals Testing Market, by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $269.7 Million by 2030. The UK market is exhibiting a CAGR of 5.8% during (2023 - 2030). Additionally, The France market would experience a CAGR of 7.6% during (2023 - 2030).

The adoption of agriculture biologicals testing ensures that these products meet regulatory standards and consumer expectations, providing a reliable solution for farmers looking to produce safe and high-quality food. The adoption of this is closely tied to the proven benefits of biological inputs in enhancing crop productivity and soil health. Biofertilizers, for example, promote nutrient uptake and improve soil fertility, contributing to higher yields.

Agriculture biologicals testing verifies the efficacy of these products, providing farmers with the confidence to integrate them into their crop management strategies for sustainable and productive farming. The dissemination of knowledge about the benefits of agricultural biologicals and the importance of testing has been a key driver of adoption. Farmers are increasingly accessing information about the positive experiences of their peers who have successfully integrated biological inputs.

France increasingly emphasizes sustainable agricultural practices driven by environmental concerns and consumer preferences. The adoption of organic farming practices is on the rise in France, driven by consumer demand for organic products. Integrated Pest Management (IPM) practices are gaining traction in France, and seed treatment is an integral component of these strategies. The environmental impact of chemical inputs in agriculture is becoming increasingly recognized in France. Thus, all these factors will uplift the regional market’s expansion in the coming years.

Free Valuable Insights: The Global Agriculture Biologicals Testing Market will Hit USD 4.3 Billion by 2030, at a CAGR of 6.9%

Based on End-User, the market is segmented into Biological Product Manufacturers, Government Agencies, Outsourced Contract Research Organization and Plant Breeders. Based on Product Type, the market is segmented into Biopesticides, Biofertilizers and Biostimulants. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- LAUS GmbH

- Eurofins Scientific SE

- R J Hill Laboratories Limited

- ALS Group

- Société Générale de Surveillance SA. (SGS SA)

- Bionema Group Limited

- Anadiag Group

- SynTech Research Group

- Lallemand Inc.

- The Mosaic Company

Europe Agriculture Biologicals Testing Market Report Segmentation

By End-User

- Biological Product Manufacturers

- Government Agencies

- Outsourced Contract Research Organization

- Plant Breeders

By Product Type

- Biopesticides

- Biofertilizers

- Biostimulants

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Europe Agriculture Biologicals Testing Market, by End-User

1.4.2 Europe Agriculture Biologicals Testing Market, by Product Type

1.4.3 Europe Agriculture Biologicals Testing Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. Europe Agriculture Biologicals Testing Market, by End-User

4.1 Europe Biological Product Manufacturers Market, by Country

4.2 Europe Government Agencies Market, by Country

4.3 Europe Outsourced Contract Research Organization Market, by Country

4.4 Europe Plant Breeders Market, by Country

Chapter 5. Europe Agriculture Biologicals Testing Market, by Product Type

5.1 Europe Biopesticides Market, by Country

5.2 Europe Biofertilizers Market, by Country

5.3 Europe Biostimulants Market, by Country

Chapter 6. Europe Agriculture Biologicals Testing Market, by Country

6.1 Germany Agriculture Biologicals Testing Market

6.1.1 Germany Agriculture Biologicals Testing Market, by End-User

6.1.2 Germany Agriculture Biologicals Testing Market, by Product Type

6.2 UK Agriculture Biologicals Testing Market

6.2.1 UK Agriculture Biologicals Testing Market, by End-User

6.2.2 UK Agriculture Biologicals Testing Market, by Product Type

6.3 France Agriculture Biologicals Testing Market

6.3.1 France Agriculture Biologicals Testing Market, by End-User

6.3.2 France Agriculture Biologicals Testing Market, by Product Type

6.4 Russia Agriculture Biologicals Testing Market

6.4.1 Russia Agriculture Biologicals Testing Market, by End-User

6.4.2 Russia Agriculture Biologicals Testing Market, by Product Type

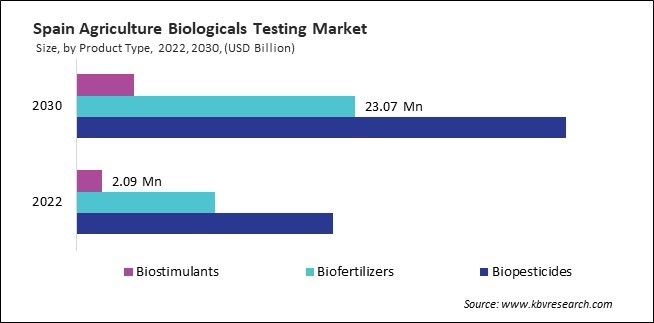

6.5 Spain Agriculture Biologicals Testing Market

6.5.1 Spain Agriculture Biologicals Testing Market, by End-User

6.5.2 Spain Agriculture Biologicals Testing Market, by Product Type

6.6 Italy Agriculture Biologicals Testing Market

6.6.1 Italy Agriculture Biologicals Testing Market, by End-User

6.6.2 Italy Agriculture Biologicals Testing Market, by Product Type

6.7 Rest of Europe Agriculture Biologicals Testing Market

6.7.1 Rest of Europe Agriculture Biologicals Testing Market, by End-User

6.7.2 Rest of Europe Agriculture Biologicals Testing Market, by Product Type

Chapter 7. Company Profiles

7.1 LAUS GmbH

7.1.1 Company Overview

7.1.2 SWOT Analysis

7.2 Eurofins Scientific SE

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Regional Analysis

7.2.4 SWOT Analysis

7.3 R J Hill Laboratories Limited

7.3.1 Company Overview

7.3.2 SWOT Analysis

7.4 ALS Group

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Segmental and Regional Analysis

7.4.4 SWOT Analysis

7.5 Société Générale de Surveillance SA. (SGS SA)

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Segmental and Regional Analysis

7.5.4 Recent strategies and developments:

7.5.4.1 Partnerships, Collaborations, and Agreements:

7.5.4.2 Acquisition and Mergers:

7.5.5 SWOT Analysis

7.6 Bionema Group Limited

7.6.1 Company Overview

7.6.2 SWOT Analysis

7.7 Anadiag Group

7.7.1 Company Overview

7.7.2 SWOT Analysis

7.8 SynTech Research Group

7.8.1 Company Overview

7.8.2 SWOT Analysis

7.9 Lallemand, Inc.

7.9.1 Company Overview

7.9.2 SWOT Analysis

7.10. The Mosaic Company

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Segmental and Regional Analysis

7.10.4 SWOT Analysis

TABLE 2 Europe Agriculture Biologicals Testing Market, 2023 - 2030, USD Million

TABLE 3 Europe Agriculture Biologicals Testing Market, by End-User, 2019 - 2022, USD Million

TABLE 4 Europe Agriculture Biologicals Testing Market, by End-User, 2023 - 2030, USD Million

TABLE 5 Europe Biological Product Manufacturers Market, by Country, 2019 - 2022, USD Million

TABLE 6 Europe Biological Product Manufacturers Market, by Country, 2023 - 2030, USD Million

TABLE 7 Europe Government Agencies Market, by Country, 2019 - 2022, USD Million

TABLE 8 Europe Government Agencies Market, by Country, 2023 - 2030, USD Million

TABLE 9 Europe Outsourced Contract Research Organization Market, by Country, 2019 - 2022, USD Million

TABLE 10 Europe Outsourced Contract Research Organization Market, by Country, 2023 - 2030, USD Million

TABLE 11 Europe Plant Breeders Market, by Country, 2019 - 2022, USD Million

TABLE 12 Europe Plant Breeders Market, by Country, 2023 - 2030, USD Million

TABLE 13 Europe Agriculture Biologicals Testing Market, by Product Type, 2019 - 2022, USD Million

TABLE 14 Europe Agriculture Biologicals Testing Market, by Product Type, 2023 - 2030, USD Million

TABLE 15 Europe Biopesticides Market, by Country, 2019 - 2022, USD Million

TABLE 16 Europe Biopesticides Market, by Country, 2023 - 2030, USD Million

TABLE 17 Europe Biofertilizers Market, by Country, 2019 - 2022, USD Million

TABLE 18 Europe Biofertilizers Market, by Country, 2023 - 2030, USD Million

TABLE 19 Europe Biostimulants Market, by Country, 2019 - 2022, USD Million

TABLE 20 Europe Biostimulants Market, by Country, 2023 - 2030, USD Million

TABLE 21 Europe Agriculture Biologicals Testing Market, by Country, 2019 - 2022, USD Million

TABLE 22 Europe Agriculture Biologicals Testing Market, by Country, 2023 - 2030, USD Million

TABLE 23 Germany Agriculture Biologicals Testing Market, 2019 - 2022, USD Million

TABLE 24 Germany Agriculture Biologicals Testing Market, 2023 - 2030, USD Million

TABLE 25 Germany Agriculture Biologicals Testing Market, by End-User, 2019 - 2022, USD Million

TABLE 26 Germany Agriculture Biologicals Testing Market, by End-User, 2023 - 2030, USD Million

TABLE 27 Germany Agriculture Biologicals Testing Market, by Product Type, 2019 - 2022, USD Million

TABLE 28 Germany Agriculture Biologicals Testing Market, by Product Type, 2023 - 2030, USD Million

TABLE 29 UK Agriculture Biologicals Testing Market, 2019 - 2022, USD Million

TABLE 30 UK Agriculture Biologicals Testing Market, 2023 - 2030, USD Million

TABLE 31 UK Agriculture Biologicals Testing Market, by End-User, 2019 - 2022, USD Million

TABLE 32 UK Agriculture Biologicals Testing Market, by End-User, 2023 - 2030, USD Million

TABLE 33 UK Agriculture Biologicals Testing Market, by Product Type, 2019 - 2022, USD Million

TABLE 34 UK Agriculture Biologicals Testing Market, by Product Type, 2023 - 2030, USD Million

TABLE 35 France Agriculture Biologicals Testing Market, 2019 - 2022, USD Million

TABLE 36 France Agriculture Biologicals Testing Market, 2023 - 2030, USD Million

TABLE 37 France Agriculture Biologicals Testing Market, by End-User, 2019 - 2022, USD Million

TABLE 38 France Agriculture Biologicals Testing Market, by End-User, 2023 - 2030, USD Million

TABLE 39 France Agriculture Biologicals Testing Market, by Product Type, 2019 - 2022, USD Million

TABLE 40 France Agriculture Biologicals Testing Market, by Product Type, 2023 - 2030, USD Million

TABLE 41 Russia Agriculture Biologicals Testing Market, 2019 - 2022, USD Million

TABLE 42 Russia Agriculture Biologicals Testing Market, 2023 - 2030, USD Million

TABLE 43 Russia Agriculture Biologicals Testing Market, by End-User, 2019 - 2022, USD Million

TABLE 44 Russia Agriculture Biologicals Testing Market, by End-User, 2023 - 2030, USD Million

TABLE 45 Russia Agriculture Biologicals Testing Market, by Product Type, 2019 - 2022, USD Million

TABLE 46 Russia Agriculture Biologicals Testing Market, by Product Type, 2023 - 2030, USD Million

TABLE 47 Spain Agriculture Biologicals Testing Market, 2019 - 2022, USD Million

TABLE 48 Spain Agriculture Biologicals Testing Market, 2023 - 2030, USD Million

TABLE 49 Spain Agriculture Biologicals Testing Market, by End-User, 2019 - 2022, USD Million

TABLE 50 Spain Agriculture Biologicals Testing Market, by End-User, 2023 - 2030, USD Million

TABLE 51 Spain Agriculture Biologicals Testing Market, by Product Type, 2019 - 2022, USD Million

TABLE 52 Spain Agriculture Biologicals Testing Market, by Product Type, 2023 - 2030, USD Million

TABLE 53 Italy Agriculture Biologicals Testing Market, 2019 - 2022, USD Million

TABLE 54 Italy Agriculture Biologicals Testing Market, 2023 - 2030, USD Million

TABLE 55 Italy Agriculture Biologicals Testing Market, by End-User, 2019 - 2022, USD Million

TABLE 56 Italy Agriculture Biologicals Testing Market, by End-User, 2023 - 2030, USD Million

TABLE 57 Italy Agriculture Biologicals Testing Market, by Product Type, 2019 - 2022, USD Million

TABLE 58 Italy Agriculture Biologicals Testing Market, by Product Type, 2023 - 2030, USD Million

TABLE 59 Rest of Europe Agriculture Biologicals Testing Market, 2019 - 2022, USD Million

TABLE 60 Rest of Europe Agriculture Biologicals Testing Market, 2023 - 2030, USD Million

TABLE 61 Rest of Europe Agriculture Biologicals Testing Market, by End-User, 2019 - 2022, USD Million

TABLE 62 Rest of Europe Agriculture Biologicals Testing Market, by End-User, 2023 - 2030, USD Million

TABLE 63 Rest of Europe Agriculture Biologicals Testing Market, by Product Type, 2019 - 2022, USD Million

TABLE 64 Rest of Europe Agriculture Biologicals Testing Market, by Product Type, 2023 - 2030, USD Million

TABLE 65 Key Information – LAUS GmbH

TABLE 66 Key Information – Eurofins Scientific SE

TABLE 67 Key Information – R J Hill Laboratories Limited

TABLE 68 Key Information – ALS Group

TABLE 69 Key Information – Société Générale de Surveillance SA. (SGS SA)

TABLE 70 Key Information – Bionema Group Limited

TABLE 71 Key Information – Anadiag Group

TABLE 72 Key Information – SynTech Research Group

TABLE 73 Key Information – LallemAnd, Inc.

TABLE 74 Key Information – The Mosaic Company

List of Figures

FIG 1 Methodology for the research

FIG 2 Europe Agriculture Biologicals Testing Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Agriculture Biologicals Testing Market

FIG 4 Porter’s Five Forces Analysis - Agriculture Biologicals Testing Market

FIG 5 Europe Agriculture Biologicals Testing Market share, by End-User, 2022

FIG 6 Europe Agriculture Biologicals Testing Market share, by End-User, 2030

FIG 7 Europe Agriculture Biologicals Testing Market, by End-User, 2019 - 2030, USD Million

FIG 8 Europe Agriculture Biologicals Testing Market share, by Product Type, 2022

FIG 9 Europe Agriculture Biologicals Testing Market share, by Product Type, 2030

FIG 10 Europe Agriculture Biologicals Testing Market, by Product Type, 2019 - 2030, USD Million

FIG 11 Europe Agriculture Biologicals Testing Market share, by Country, 2022

FIG 12 Europe Agriculture Biologicals Testing Market share, by Country, 2030

FIG 13 Europe Agriculture Biologicals Testing Market, by Country, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: LAUS GMBH

FIG 15 SWOT Analysis: Eurofins Scientific SE

FIG 16 SWOT Analysis: R J Hill Laboratories Limited

FIG 17 SWOT Analysis: ALS Group

FIG 18 SWOT Analysis: Société Générale de Surveillance SA.

FIG 19 SWOT Analysis: Bionema Group Limited

FIG 20 SWOT Analysis: Anadiag Group

FIG 21 SWOT Analysis: SynTech Research Group

FIG 22 SWOT Analysis: Lallemand, Inc.

FIG 23 SWOT Analysis: The Mosaic Company