Global Embedded Security Market Size, Share & Industry Trends Analysis Report By Application, By Offering (Software, Hardware, and Services), By Security Type, By Regional Outlook and Forecast, 2022 - 2028

Published Date : 31-May-2022 | Pages: 258 | Formats: PDF |

COVID-19 Impact on the Embedded Security Market

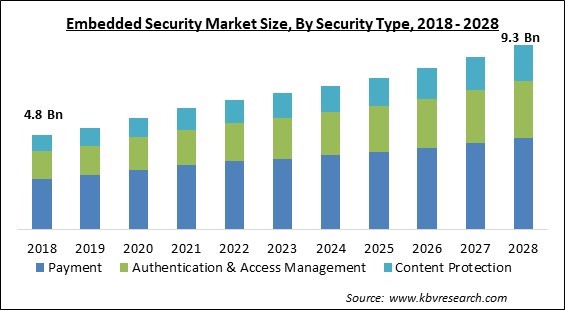

The Global Embedded Security Market size is expected to reach $9.3 billion by 2028, rising at a market growth of 6.0% CAGR during the forecast period.

An embedded system is a piece of programmable hardware that has software or an operating system built-in or linked to it. Consumer electronics, smart devices, IoT devices, cars, and other products use the system. Many embedded system software programs are vulnerable to external threats. Embedded security solutions safeguard embedded system software against a variety of threats.

Body electronics, steering and braking systems, navigation systems, traffic control, powertrain, chassis management, and mobile and e-Com access applications are examples of embedded security in the automotive industry. In some unique cases, such as decreasing IoT attack risks and security posture evaluation, embedded security plays a vital role in robotics for enhancing reliability and performance. In addition, embedded security solutions for automotive sector applications include immobilizer systems, increased vehicle safety, component identification, telematics, guard sensors, infotainment systems, and enhanced automotive reliability.

Manufacturers can use embedded security solutions to ensure that their products and gadgets are safe from cyber threats. In defense, a multi-layer security method is used to align security-based distinction in their offering. When the technology is mission-critical, the device must work with constant reliability and predictability, and data or security on the end-user system cannot be compromised. In the defense sector, various market players are focusing on an open source-based hypervisor, integrating Linux, and a secure boot solution. For example, In January 2020, a company called Wind River announced the acquisition of Star Lab. The acquisition expands Wind River's comprehensive offering in the defense sector by adding virtualization, software for Linux cybersecurity and anti-tamper, and cyber resiliency.

COVID-19 Impact Analysis

The COVID-19 pandemic caused a severe impact on various economies all over the world. Several businesses were significantly devastated as a result of the outbreak of the COVID-19 infection. In addition, the governments of several countries were forced to impose lockdowns in their nations. As a result, the manufacturing units of numerous goods were temporarily shut down. Moreover, these lockdowns also caused a major disruption in the supply chain of various goods. Further, the COVID-19 led the worldwide healthcare industry to a significant failure due to the shortage of beds and oxygen in hospitals. The COVID-19 pandemic has boosted the demand for embedded security. Due to the enforcement of lockdowns around the world, the pandemic has had an influence on the market due to remote working activities in almost all workplaces around the world.

Market Growth Factors:

The integration of payment functions in wearables

Clothing, smart glasses, jewelry, and virtual reality (VR) equipment are a few of the examples of wearable technology that are evolving and developing. Fitness tracking, health monitoring, and navigation are some of the possibilities for smart wearable technologies. Several of these applications, like smart home control and payments, require user consent to avoid misuse. To suit this niche market, a number of embedded security solution providers are introducing new embedded security solutions. For example, STMicroelectronics provides secure wearable solutions for a number of applications such as payment, transit, and contactless transactions.

Rising demand from the electric vehicles sector

Many automotive advancement are currently reliant on electronics and software, and IT is expected to account for a significant portion of the overall manufacturing cost. Because it has advantages over various other types of vehicles, electric vehicles are becoming highly demanded all over the world. EV charging, on the other hand, is far more than a one-step, plug-and-go process in terms of charging infrastructure. A significant amount of interaction between the charging point, the car, and the utility supplier is required to ensure that each and every electric vehicle on the grid receives the requisite amount of electrical and energy flow. In some cases, financial transactions, as well as personal data, should be handled responsibly and securely, especially when remote EV charging is provided for a fee.

Marketing Restraining Factor:

The Shortage of semiconductors

Embedded systems require a considerable number of semiconductors. Semiconductors are crucial components of embedded security solutions. In the past few years, there is a shortage in the supply of semiconductors all over the world. In addition, the inadequate supply of semiconductors is majorly affecting the deployment of embedded security solutions all over the world. The trade war between China and the United States has majorly disrupted the global supply chain of semiconductors. Both of the countries imposed tariffs and limitations on each other, which is generating various kinds of demand and supply problems across the world.

Application Outlook

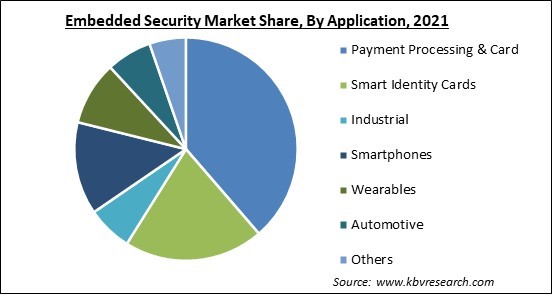

Based on Application, the market is segmented into Payment Processing & Card, Smart Identity Cards, Industrial, Smartphones, Wearables, Automotive, and Others. In 2021, the smartphone segment garnered a promising revenue share in the embedded security market. The constantly accelerating growth of this segment is due to the increasing penetration of smartphones all over the world. There is a significant number of people that are using smartphones across the world. Moreover, smartphones comprise a big amount of sensitive data related to the user. Therefore, in order to protect this data from any kind of unauthorized accesses, the deployment of embedded security solution is rising. This factor is augmenting the growth of this segment.

Offering Outlook

Based on Offering, the market is segmented into Software, Hardware, and Services. In 2021, the software segment acquired the largest revenue share of the embedded security market. The increasing growth of this segment is owing to the rising number of technological developments that are rapidly being introduced all over the world. Software plays a crucial role in the operation of embedded security devices as it works as a link among embedded systems. Hence, the growth of the segment is being augmented.

Security Type Outlook

Based on Security Type, the market is segmented into Payment, Authentication & Access Management, and Content Protection. In 2021, the payment segment procured the largest revenue share of the embedded security market. The increasing growth of the segment is owing to the constantly increasing digitalization all over the world. In the modern era, people are increasingly adopting various digital technologies, including digital payments. These digital payment platforms are usually third-party platforms, which redirect a user’s payment to the receiver. In order to prevent privacy and safety related risks, the demand for embedded security solution is rising in the payment segment. Therefore, the growth of this segment is rapidly accelerating.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 6.1 Billion |

| Market size forecast in 2028 | USD 9.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6% from 2022 to 2028 |

| Number of Pages | 260 |

| Number of Tables | 393 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Security Type, Offering, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific procured the largest revenue share in the embedded security market in 2021. Many of the emerging economies across the region, such as India, Singapore, China, and Japan, are concerned about cybersecurity. India holds a significant position in the world for overall DNS hijackings, with a rapid increase in cybercrime registrations. Moreover, in this region, where highly sensitive data along with a considerable number of devices are connected to the Internet of Things, security is a huge problem. Further, there is a rising tendency of cyber-attacks through ransomware and malware in the context of the COVID-19 outbreak, forcing organizations to adopt cybersecurity solutions while numerous have already shifted to remote working environments during the lockdown in various countries. These factors would drive the adoption of embedded security solutions across the region and the regional market would observe significant growth over the forecast period.

Free Valuable Insights: Global Embedded Security Market size to reach USD 9.3 Billion by 2028

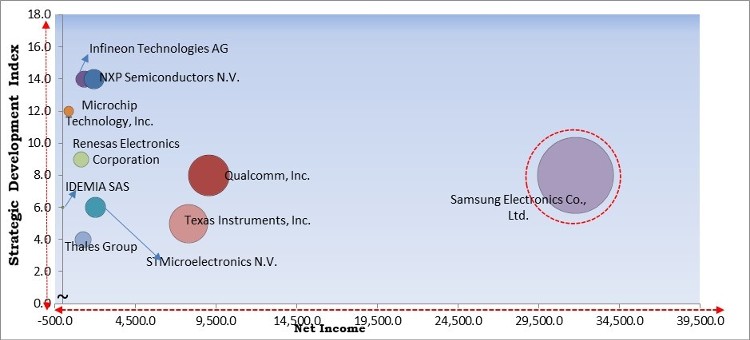

KBV Cardinal Matrix - Embedded Security Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Samsung Electronics Co., Ltd. are the forerunners in the Embedded Security Market. Companies such as Qualcomm, Inc., Texas Instruments, Inc., NXP Semiconductors N.V. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Renesas Electronics Corporation, STMicroelectronics N.V., Infineon Technologies AG, NXP Semiconductors N.V., Texas Instruments, Inc., Samsung Electronics Co., Ltd. (Samsung Group), Thales Group S.A., IDEMIA SAS (Advent International, Inc.), Qualcomm, Inc., and Microchip Technology, Inc.

Recent Strategies Deployed in Embedded Security Market

» Partnerships, Collaborations and Agreements:

- Jan-2022: Qualcomm teamed up with Cybertrust Japan and SB Technology. This collaboration aimed to accelerate the deployment of smart solutions via the Qualcomm IoT Services Suite portfolio in order to help entities and businesses seeking to adopt and incorporate smart solutions across the world, initially in Japan.

- Dec-2021: NXP Semiconductors entered into a partnership with Foxconn Industrial Internet, a subsidy of the Foxconn group. Following this partnership, the companies aimed to transfer the car into the ultimate edge device.

- Dec-2021: IDEMIA entered into a partnership with SHODEN and Genetec. Through this partnership, the companies aimed to implement 3D facial recognition access control across Japan. Further, this partnership would also integrate the VisionPass device of IDEMIA and patented Genetec Security Center into the security infrastructure portfolio of SHODEN.

- Oct-2021: Qualcomm collaborated with NXP, a Dutch semiconductor designer and manufacturer. Through this collaboration, the companies would introduce NXP’s SN110U and SN110U. In addition, the companies would incorporate NXP’s eSIM solutions into Qualcomm’s Snapdragon Wear platform-based wearable devices.

- Oct-2021: Renesas Electronics came into a multi-year licensing agreement with wolfSSL, a leader in providing embedded security solutions. This acquisition would allow Renesas' 32-bit MCU offerings customers to receive a free commercial license for the wolfSSL TLS integrated Renesas hardware security engine.

- Apr-2021: Infineon teamed up with Eurotech, GlobalSign, and Microsoft. This collaboration aimed to streamline secure large-scale launches of connected devices. Moreover, this collaboration would provide assurance by extending the secured device identity chain from the edge to the cloud.

- Nov-2020: Texas Instruments joined hands with Xilinx, an American technology and semiconductor company. This collaboration aimed to design adaptable and scalable digital front-end solutions to offer more energy efficiency of lower antenna count radios. In addition, the new solutions would leverage Xilinx's adaptable IP to improve the RF performance as well as the power efficiency of outdoor and indoor radio applications.

- Jun-2020: Infineon Technologies came into an agreement with Blumio, the first cuffless blood pressure monitor in the world. This agreement aimed to co-develop a non-invasive wearable Infineon’s XENSIV radar chipset-based blood pressure sensor. Moreover, this partnership would integrate a 60 GHz radar chipset and system of Infineon with Blumio’s expertise in cardiovascular health monitoring in order to rapidly introduce new products to the market.

- Jun-2020: Samsung Electronics partnered with Trustonic, a leading provider of cybersecurity technology. This partnership aimed to accelerate the customer experience for the mutual partners and customers of the companies. In addition, this partnership would integrate Samsung’s device-embedded Knox security platform into the security platform of Trustonic.

- Jan-2020: Microchip Technology teamed up with Arrow, an American Fortune 500 company. Through this collaboration, the companies aimed to streamline security and connectivity across the smart building, industrial, and energy markets.

» Approvals and Trials:

- Jan-2022: Abbott Laboratories received approval from the FDA for the EnSite X EP System with EnSite Omnipolar Technology (OT). This product is a new cardiac mapping platform that is made available in the US and all over Europe, it is made to assist physicians to treat abnormal heart rhythms in enhanced manner, which is also termed as cardiac arrhythmias. Created with input from electrophysiologists from all over the world, the system displays accurately detailed three-dimensional maps of the heart to assist the physicians identify & then treat areas of the heart where abnormal rhythms take place.

- Feb-2022: Medtronic recieved approval from FDA for Freezor & Freezor Xtra Cardiac Cryoablation Catheters. It is the sole ablation catheters approved to treat rising presence of pediatric Atrioventricular Nodal Reentrant Tachycardia (AVNRT).

- Jun-2021: Siemens Healthineers received an approval from CE for AcuNav Volume ICE (Intracardiac Echocardiography) catheter. It is a therapy-enabling imaging guide that gives real-time, wide-angle visualization of heart anatomy during the procedure of Structural Heart and Electrophysiology.

- May-2021: Acutus Medical received an approval from CE for for a large suite of EP products. These products would comprise the AcQCross family of universal transseptal crossing devices, the next generation AcQGuide MAX & VUE large bore delivery sheaths & the next generation AcQMap mapping catheter. These products are created in a way to streamline procedural workflow in all left heart procedures & further enhance ease-of-use of Acutus’ proprietary non-contact mapping technology, which enables electrophysiologists to swiftly and precisely map the most complex atrial arrhythmias in minutes.

- Nov-2020: Abbott received approval from CE in Australia for EnSite X EP System, and launched the system all over Australia & Europe. This device is the sole system that provides the choice to traverse inside the cardiac anatomy two different ways on one platform. This cardiac mapping platform builds upon the company’s electrophysiology portfolio & is created to better in a manner physicians deliver ablation therapy to treat abnormal heart rhythms.

- Mar-2020: Stereotaxis received an approval from FDS for Genesis RMN System. It is used for robotic navigation of magnetic ablation catheters to treat heart rhythm disorders. This newly approved system is build upon the established advantages & reliability of RMN in an innovative architecture that is quicker, smaller, lighter & more flexible. It uses smaller magnets rotated with their center-of-mass for raised speed & control.

» Product Launches and Product Expansions:

- Oct-2021: Infineon Technologies rolled out the SLS37 V2X hardware security module, a plug-and-play security solution. The new product aimed to protect the integrity and authenticity of messages along with the sender's privacy. The new product is based on a highly secure and tamper-resistant microcontroller in order to meet the security requirements in V2X applications within telematics control units.

- Jun-2021: Texas Instruments released the new Sitara AM2x MCUs, a range of new high-performance microcontrollers. The new product range aimed to enable engineers to achieve faster computing capability than conventional flash-based MCUs. Moreover, the new product range would also allow designers to improve applications like robotics, factory automation, and automotive systems.

- May-2021: Microchip Technology introduced enhancements to its Trust Platform Design range. The new TPDS v2 software aimed to allow Microchip partners in order to add use cases to its rich security solutions and onboarding ecosystem intending to expand developers’ options for deploying best-in-class security.

- Feb-2021: Renesas Electronics introduced 12 new RA4M2 Group MCUs into its RA4 Series microcontrollers. The new products aimed to offer a seamless combination of extremely low power consumption, enhanced security features, and high performance to the customers.

- Feb-2021: NXP Semiconductors rolled out EdgeLock 2GO, an IoT service platform. Following this launch, the new product would be integrated into NXP’s Common Criteria EAL 6+ certified EdgeLock SE050 secure element in order to protect IoT devices at the edge while securely connecting them to one or more clouds as well as service providers.

- Oct-2020: Microchip Technology rolled out WFI32E01PC, a Wi-Fi microcontroller module with Trust&GO-enabled verifiable and unique identity of Microchip. The new product is a highly integrated Wi-Fi MCU module that is pre-provisioned for cloud platforms.

- May-2020: Samsung Electronics released EAL 6+ certified-SE chip, a standalone turnkey security solution. The new product would deliver protection for challenging tasks like accelerating mobile payment, isolated storage, and other applications.

- Jun-2020: NXP Semiconductors launched MIFARE DESFire EV3 IC. Through this launch, the company aimed to provide several multiple value propositions for the software development, rapid prototyping efforts, and the evaluation of the S32G processor.

- Feb-2020: Samsung Electronics rolled out Common Criteria Evaluation Assurance Level 5+ certified Secure Element turnkey solution for mobile devices. The new product aimed to provide a robust security solution, including a security chip (S3K250AF) along with optimized software, that fully protects private data on isolated data storage.

» Acquisitions and Mergers:

- Dec-2021: Renesas Electronics took over Celeno Communications, a leading provider of innovative and smart Wi-Fi solutions. This acquisition aimed to strengthen the software development and engineering talent base of Renesas to enable the company to introduce expanded and seamless services to customers across the world.

- May-2021: STMicroelectronics acquired Cartesiam, a French machine learning startup. Through this acquisition, the company aimed to integrate Cartesiam's NanoEdge into its STM32Cube. In addition, the acquisition would also reinforce its AI strategy and technology portfolio in order to address the full spectrum of embedded machine-learning requirements.

- Mar-2021: Qualcomm Technologies acquired NUVIA, a world-class technology, and CPU design company. Following this acquisition, the company would integrate advanced CPUs from NUVIA into its portfolio.

- Oct-2020: Microchip Technology completed its acquisition of Tekron International, a leading developer of accurate GPS/GLONASS clocks and time synchronization solutions. This acquisition aimed to integrate Tekron’s knowledgeable products and team into its synchronization and timing portfolio.

- Apr-2020: Infineon Technologies acquired Cypress Semiconductor, an American semiconductor manufacturing, and design company. Through this acquisition, the company aimed to increase its focus on the structural growth drivers as well as a wider line of applications.

Scope of the Study

Market Segments Covered in the Report:

By Application

- Payment Processing & Card

- Smart Identity Cards

- Industrial

- Smartphones

- Wearables

- Automotive

- Others

By Offering

- Software

- Hardware

- Services

By Security Type

- Payment

- Authentication & Access Management

- Content Protection

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Texas Instruments, Inc.

- Samsung Electronics Co., Ltd. (Samsung Group)

- Thales Group S.A.

- IDEMIA SAS (Advent International, Inc.)

- Qualcomm, Inc.

- Microchip Technology, Inc.

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Embedded Security Market, by Application

1.4.2 Global Embedded Security Market, by Offering

1.4.3 Global Embedded Security Market, by Security Type

1.4.4 Global Embedded Security Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.1 Market Share Analysis, 2020

3.2 Top Winning Strategies

3.2.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.2.2 Key Strategic Move: (Partnerships, Collaborations, and Agreements: 2018, Apr – 2022, Jan) Leading Players

Chapter 4. Global Embedded Security Market by Application

4.1 Global Payment Processing & Card Market by Region

4.2 Global Smart Identity Cards Market by Region

4.3 Global Industrial Market by Region

4.4 Global Smartphones Market by Region

4.5 Global Wearables Market by Region

4.6 Global Automotive Market by Region

4.7 Global Others Market by Region

Chapter 5. Global Embedded Security Market by Offering

5.1 Global Software Market by Region

5.2 Global Hardware Market by Region

5.3 Global Services Market by Region

Chapter 6. Global Embedded Security Market by Security Type

6.1 Global Payment Market by Region

6.2 Global Authentication & Access Management Market by Region

6.3 Global Content Protection Market by Region

Chapter 7. Global Embedded Security Market by Region

7.1 North America Embedded Security Market

7.1.1 North America Embedded Security Market by Application

7.1.1.1 North America Payment Processing & Card Market by Country

7.1.1.2 North America Smart Identity Cards Market by Country

7.1.1.3 North America Industrial Market by Country

7.1.1.4 North America Smartphones Market by Country

7.1.1.5 North America Wearables Market by Country

7.1.1.6 North America Automotive Market by Country

7.1.1.7 North America Others Market by Country

7.1.2 North America Embedded Security Market by Offering

7.1.2.1 North America Software Market by Country

7.1.2.2 North America Hardware Market by Country

7.1.2.3 North America Services Market by Country

7.1.3 North America Embedded Security Market by Security Type

7.1.3.1 North America Payment Market by Country

7.1.3.2 North America Authentication & Access Management Market by Country

7.1.3.3 North America Content Protection Market by Country

7.1.4 North America Embedded Security Market by Country

7.1.4.1 US Embedded Security Market

7.1.4.1.1 US Embedded Security Market by Application

7.1.4.1.2 US Embedded Security Market by Offering

7.1.4.1.3 US Embedded Security Market by Security Type

7.1.4.2 Canada Embedded Security Market

7.1.4.2.1 Canada Embedded Security Market by Application

7.1.4.2.2 Canada Embedded Security Market by Offering

7.1.4.2.3 Canada Embedded Security Market by Security Type

7.1.4.3 Mexico Embedded Security Market

7.1.4.3.1 Mexico Embedded Security Market by Application

7.1.4.3.2 Mexico Embedded Security Market by Offering

7.1.4.3.3 Mexico Embedded Security Market by Security Type

7.1.4.4 Rest of North America Embedded Security Market

7.1.4.4.1 Rest of North America Embedded Security Market by Application

7.1.4.4.2 Rest of North America Embedded Security Market by Offering

7.1.4.4.3 Rest of North America Embedded Security Market by Security Type

7.2 Europe Embedded Security Market

7.2.1 Europe Embedded Security Market by Application

7.2.1.1 Europe Payment Processing & Card Market by Country

7.2.1.2 Europe Smart Identity Cards Market by Country

7.2.1.3 Europe Industrial Market by Country

7.2.1.4 Europe Smartphones Market by Country

7.2.1.5 Europe Wearables Market by Country

7.2.1.6 Europe Automotive Market by Country

7.2.1.7 Europe Others Market by Country

7.2.2 Europe Embedded Security Market by Offering

7.2.2.1 Europe Software Market by Country

7.2.2.2 Europe Hardware Market by Country

7.2.2.3 Europe Services Market by Country

7.2.3 Europe Embedded Security Market by Security Type

7.2.3.1 Europe Payment Market by Country

7.2.3.2 Europe Authentication & Access Management Market by Country

7.2.3.3 Europe Content Protection Market by Country

7.2.4 Europe Embedded Security Market by Country

7.2.4.1 Germany Embedded Security Market

7.2.4.1.1 Germany Embedded Security Market by Application

7.2.4.1.2 Germany Embedded Security Market by Offering

7.2.4.1.3 Germany Embedded Security Market by Security Type

7.2.4.2 UK Embedded Security Market

7.2.4.2.1 UK Embedded Security Market by Application

7.2.4.2.2 UK Embedded Security Market by Offering

7.2.4.2.3 UK Embedded Security Market by Security Type

7.2.4.3 France Embedded Security Market

7.2.4.3.1 France Embedded Security Market by Application

7.2.4.3.2 France Embedded Security Market by Offering

7.2.4.3.3 France Embedded Security Market by Security Type

7.2.4.4 Russia Embedded Security Market

7.2.4.4.1 Russia Embedded Security Market by Application

7.2.4.4.2 Russia Embedded Security Market by Offering

7.2.4.4.3 Russia Embedded Security Market by Security Type

7.2.4.5 Spain Embedded Security Market

7.2.4.5.1 Spain Embedded Security Market by Application

7.2.4.5.2 Spain Embedded Security Market by Offering

7.2.4.5.3 Spain Embedded Security Market by Security Type

7.2.4.6 Italy Embedded Security Market

7.2.4.6.1 Italy Embedded Security Market by Application

7.2.4.6.2 Italy Embedded Security Market by Offering

7.2.4.6.3 Italy Embedded Security Market by Security Type

7.2.4.7 Rest of Europe Embedded Security Market

7.2.4.7.1 Rest of Europe Embedded Security Market by Application

7.2.4.7.2 Rest of Europe Embedded Security Market by Offering

7.2.4.7.3 Rest of Europe Embedded Security Market by Security Type

7.3 Asia Pacific Embedded Security Market

7.3.1 Asia Pacific Embedded Security Market by Application

7.3.1.1 Asia Pacific Payment Processing & Card Market by Country

7.3.1.2 Asia Pacific Smart Identity Cards Market by Country

7.3.1.3 Asia Pacific Industrial Market by Country

7.3.1.4 Asia Pacific Smartphones Market by Country

7.3.1.5 Asia Pacific Wearables Market by Country

7.3.1.6 Asia Pacific Automotive Market by Country

7.3.1.7 Asia Pacific Others Market by Country

7.3.2 Asia Pacific Embedded Security Market by Offering

7.3.2.1 Asia Pacific Software Market by Country

7.3.2.2 Asia Pacific Hardware Market by Country

7.3.2.3 Asia Pacific Services Market by Country

7.3.3 Asia Pacific Embedded Security Market by Security Type

7.3.3.1 Asia Pacific Payment Market by Country

7.3.3.2 Asia Pacific Authentication & Access Management Market by Country

7.3.3.3 Asia Pacific Content Protection Market by Country

7.3.4 Asia Pacific Embedded Security Market by Country

7.3.4.1 China Embedded Security Market

7.3.4.1.1 China Embedded Security Market by Application

7.3.4.1.2 China Embedded Security Market by Offering

7.3.4.1.3 China Embedded Security Market by Security Type

7.3.4.2 Japan Embedded Security Market

7.3.4.2.1 Japan Embedded Security Market by Application

7.3.4.2.2 Japan Embedded Security Market by Offering

7.3.4.2.3 Japan Embedded Security Market by Security Type

7.3.4.3 India Embedded Security Market

7.3.4.3.1 India Embedded Security Market by Application

7.3.4.3.2 India Embedded Security Market by Offering

7.3.4.3.3 India Embedded Security Market by Security Type

7.3.4.4 South Korea Embedded Security Market

7.3.4.4.1 South Korea Embedded Security Market by Application

7.3.4.4.2 South Korea Embedded Security Market by Offering

7.3.4.4.3 South Korea Embedded Security Market by Security Type

7.3.4.5 Singapore Embedded Security Market

7.3.4.5.1 Singapore Embedded Security Market by Application

7.3.4.5.2 Singapore Embedded Security Market by Offering

7.3.4.5.3 Singapore Embedded Security Market by Security Type

7.3.4.6 Malaysia Embedded Security Market

7.3.4.6.1 Malaysia Embedded Security Market by Application

7.3.4.6.2 Malaysia Embedded Security Market by Offering

7.3.4.6.3 Malaysia Embedded Security Market by Security Type

7.3.4.7 Rest of Asia Pacific Embedded Security Market

7.3.4.7.1 Rest of Asia Pacific Embedded Security Market by Application

7.3.4.7.2 Rest of Asia Pacific Embedded Security Market by Offering

7.3.4.7.3 Rest of Asia Pacific Embedded Security Market by Security Type

7.4 LAMEA Embedded Security Market

7.4.1 LAMEA Embedded Security Market by Application

7.4.1.1 LAMEA Payment Processing & Card Market by Country

7.4.1.2 LAMEA Smart Identity Cards Market by Country

7.4.1.3 LAMEA Industrial Market by Country

7.4.1.4 LAMEA Smartphones Market by Country

7.4.1.5 LAMEA Wearables Market by Country

7.4.1.6 LAMEA Automotive Market by Country

7.4.1.7 LAMEA Others Market by Country

7.4.2 LAMEA Embedded Security Market by Offering

7.4.2.1 LAMEA Software Market by Country

7.4.2.2 LAMEA Hardware Market by Country

7.4.2.3 LAMEA Services Market by Country

7.4.3 LAMEA Embedded Security Market by Security Type

7.4.3.1 LAMEA Payment Market by Country

7.4.3.2 LAMEA Authentication & Access Management Market by Country

7.4.3.3 LAMEA Content Protection Market by Country

7.4.4 LAMEA Embedded Security Market by Country

7.4.4.1 Brazil Embedded Security Market

7.4.4.1.1 Brazil Embedded Security Market by Application

7.4.4.1.2 Brazil Embedded Security Market by Offering

7.4.4.1.3 Brazil Embedded Security Market by Security Type

7.4.4.2 Argentina Embedded Security Market

7.4.4.2.1 Argentina Embedded Security Market by Application

7.4.4.2.2 Argentina Embedded Security Market by Offering

7.4.4.2.3 Argentina Embedded Security Market by Security Type

7.4.4.3 UAE Embedded Security Market

7.4.4.3.1 UAE Embedded Security Market by Application

7.4.4.3.2 UAE Embedded Security Market by Offering

7.4.4.3.3 UAE Embedded Security Market by Security Type

7.4.4.4 Saudi Arabia Embedded Security Market

7.4.4.4.1 Saudi Arabia Embedded Security Market by Application

7.4.4.4.2 Saudi Arabia Embedded Security Market by Offering

7.4.4.4.3 Saudi Arabia Embedded Security Market by Security Type

7.4.4.5 South Africa Embedded Security Market

7.4.4.5.1 South Africa Embedded Security Market by Application

7.4.4.5.2 South Africa Embedded Security Market by Offering

7.4.4.5.3 South Africa Embedded Security Market by Security Type

7.4.4.6 Nigeria Embedded Security Market

7.4.4.6.1 Nigeria Embedded Security Market by Application

7.4.4.6.2 Nigeria Embedded Security Market by Offering

7.4.4.6.3 Nigeria Embedded Security Market by Security Type

7.4.4.7 Rest of LAMEA Embedded Security Market

7.4.4.7.1 Rest of LAMEA Embedded Security Market by Application

7.4.4.7.2 Rest of LAMEA Embedded Security Market by Offering

7.4.4.7.3 Rest of LAMEA Embedded Security Market by Security Type

Chapter 8. Company Profiles

8.1 Renesas Electronics Corporation

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expense

8.1.5 Recent strategies and developments:

8.1.5.1 Partnerships, Collaborations, and Agreements:

8.1.5.2 Product Launches and Product Expansions:

8.1.5.3 Acquisition and Mergers:

8.2 STMicroelectronics N.V.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.2.5 Recent strategies and developments:

8.2.5.1 Partnerships, Collaborations, and Agreements:

8.2.5.2 Acquisition and Mergers:

8.2.6 SWOT Analysis

8.3 Infineon Technologies AG

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Partnerships, Collaborations, and Agreements:

8.3.5.2 Product Launches and Product Expansions:

8.3.5.3 Acquisition and Mergers:

8.3.6 SWOT Analysis

8.4 NXP Semiconductors N.V.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Regional Analysis

8.4.4 Research & Development Expense

8.4.5 Recent strategies and developments:

8.4.5.1 Partnerships, Collaborations, and Agreements:

8.4.5.2 Product Launches and Product Expansions:

8.4.5.3 Acquisition and Mergers:

8.4.6 SWOT Analysis

8.5 Texas Instruments, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expense

8.5.5 Recent strategies and developments:

8.5.5.1 Partnerships, Collaborations, and Agreements:

8.5.5.2 Product Launches and Product Expansions:

8.5.6 SWOT Analysis

8.6 Samsung Electronics Co., Ltd. (Samsung Group)

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expenses

8.6.5 Recent strategies and developments:

8.6.5.1 Partnerships, Collaborations, and Agreements:

8.6.5.2 Product Launches and Product Expansions:

8.6.6 SWOT Analysis

8.7 Thales Group S.A.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research and Development Expense

8.7.5 Recent strategies and developments:

8.7.5.1 Acquisition and Mergers:

8.8 IDEMIA SAS (Advent International, Inc.)

8.8.1 Company Overview

8.8.2 Recent strategies and developments:

8.8.2.1 Partnerships, Collaborations, and Agreements:

8.9 Qualcomm, Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.9.4 Research & Development Expense

8.9.5 Recent strategies and developments:

8.9.5.1 Partnerships, Collaborations, and Agreements:

8.9.5.2 Acquisition and Mergers:

8.9.6 SWOT Analysis

8.10. Microchip Technology, Inc.

8.10.1 Company overview

8.10.2 Financial Analysis

8.10.3 Segmental and Regional Analysis

8.10.4 Research & Development Expenses

8.10.5 Recent strategies and developments:

8.10.5.1 Partnerships, Collaborations, and Agreements:

8.10.5.2 Product Launches and Product Expansions:

8.10.5.3 Acquisition and Mergers:

TABLE 2 Global Embedded Security Market, 2022 - 2028, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Embedded Security Market

TABLE 4 Product Launches And Product Expansions– Embedded Security Market

TABLE 5 Acquisition and Mergers– Embedded Security Market

TABLE 6 Global Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 7 Global Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 8 Global Payment Processing & Card Market by Region, 2018 - 2021, USD Million

TABLE 9 Global Payment Processing & Card Market by Region, 2022 - 2028, USD Million

TABLE 10 Global Smart Identity Cards Market by Region, 2018 - 2021, USD Million

TABLE 11 Global Smart Identity Cards Market by Region, 2022 - 2028, USD Million

TABLE 12 Global Industrial Market by Region, 2018 - 2021, USD Million

TABLE 13 Global Industrial Market by Region, 2022 - 2028, USD Million

TABLE 14 Global Smartphones Market by Region, 2018 - 2021, USD Million

TABLE 15 Global Smartphones Market by Region, 2022 - 2028, USD Million

TABLE 16 Global Wearables Market by Region, 2018 - 2021, USD Million

TABLE 17 Global Wearables Market by Region, 2022 - 2028, USD Million

TABLE 18 Global Automotive Market by Region, 2018 - 2021, USD Million

TABLE 19 Global Automotive Market by Region, 2022 - 2028, USD Million

TABLE 20 Global Others Market by Region, 2018 - 2021, USD Million

TABLE 21 Global Others Market by Region, 2022 - 2028, USD Million

TABLE 22 Global Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 23 Global Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 24 Global Software Market by Region, 2018 - 2021, USD Million

TABLE 25 Global Software Market by Region, 2022 - 2028, USD Million

TABLE 26 Global Hardware Market by Region, 2018 - 2021, USD Million

TABLE 27 Global Hardware Market by Region, 2022 - 2028, USD Million

TABLE 28 Global Services Market by Region, 2018 - 2021, USD Million

TABLE 29 Global Services Market by Region, 2022 - 2028, USD Million

TABLE 30 Global Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 31 Global Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 32 Global Payment Market by Region, 2018 - 2021, USD Million

TABLE 33 Global Payment Market by Region, 2022 - 2028, USD Million

TABLE 34 Global Authentication & Access Management Market by Region, 2018 - 2021, USD Million

TABLE 35 Global Authentication & Access Management Market by Region, 2022 - 2028, USD Million

TABLE 36 Global Content Protection Market by Region, 2018 - 2021, USD Million

TABLE 37 Global Content Protection Market by Region, 2022 - 2028, USD Million

TABLE 38 Global Embedded Security Market by Region, 2018 - 2021, USD Million

TABLE 39 Global Embedded Security Market by Region, 2022 - 2028, USD Million

TABLE 40 North America Embedded Security Market, 2018 - 2021, USD Million

TABLE 41 North America Embedded Security Market, 2022 - 2028, USD Million

TABLE 42 North America Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 43 North America Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 44 North America Payment Processing & Card Market by Country, 2018 - 2021, USD Million

TABLE 45 North America Payment Processing & Card Market by Country, 2022 - 2028, USD Million

TABLE 46 North America Smart Identity Cards Market by Country, 2018 - 2021, USD Million

TABLE 47 North America Smart Identity Cards Market by Country, 2022 - 2028, USD Million

TABLE 48 North America Industrial Market by Country, 2018 - 2021, USD Million

TABLE 49 North America Industrial Market by Country, 2022 - 2028, USD Million

TABLE 50 North America Smartphones Market by Country, 2018 - 2021, USD Million

TABLE 51 North America Smartphones Market by Country, 2022 - 2028, USD Million

TABLE 52 North America Wearables Market by Country, 2018 - 2021, USD Million

TABLE 53 North America Wearables Market by Country, 2022 - 2028, USD Million

TABLE 54 North America Automotive Market by Country, 2018 - 2021, USD Million

TABLE 55 North America Automotive Market by Country, 2022 - 2028, USD Million

TABLE 56 North America Others Market by Country, 2018 - 2021, USD Million

TABLE 57 North America Others Market by Country, 2022 - 2028, USD Million

TABLE 58 North America Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 59 North America Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 60 North America Software Market by Country, 2018 - 2021, USD Million

TABLE 61 North America Software Market by Country, 2022 - 2028, USD Million

TABLE 62 North America Hardware Market by Country, 2018 - 2021, USD Million

TABLE 63 North America Hardware Market by Country, 2022 - 2028, USD Million

TABLE 64 North America Services Market by Country, 2018 - 2021, USD Million

TABLE 65 North America Services Market by Country, 2022 - 2028, USD Million

TABLE 66 North America Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 67 North America Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 68 North America Payment Market by Country, 2018 - 2021, USD Million

TABLE 69 North America Payment Market by Country, 2022 - 2028, USD Million

TABLE 70 North America Authentication & Access Management Market by Country, 2018 - 2021, USD Million

TABLE 71 North America Authentication & Access Management Market by Country, 2022 - 2028, USD Million

TABLE 72 North America Content Protection Market by Country, 2018 - 2021, USD Million

TABLE 73 North America Content Protection Market by Country, 2022 - 2028, USD Million

TABLE 74 North America Embedded Security Market by Country, 2018 - 2021, USD Million

TABLE 75 North America Embedded Security Market by Country, 2022 - 2028, USD Million

TABLE 76 US Embedded Security Market, 2018 - 2021, USD Million

TABLE 77 US Embedded Security Market, 2022 - 2028, USD Million

TABLE 78 US Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 79 US Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 80 US Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 81 US Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 82 US Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 83 US Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 84 Canada Embedded Security Market, 2018 - 2021, USD Million

TABLE 85 Canada Embedded Security Market, 2022 - 2028, USD Million

TABLE 86 Canada Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 87 Canada Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 88 Canada Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 89 Canada Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 90 Canada Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 91 Canada Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 92 Mexico Embedded Security Market, 2018 - 2021, USD Million

TABLE 93 Mexico Embedded Security Market, 2022 - 2028, USD Million

TABLE 94 Mexico Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 95 Mexico Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 96 Mexico Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 97 Mexico Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 98 Mexico Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 99 Mexico Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 100 Rest of North America Embedded Security Market, 2018 - 2021, USD Million

TABLE 101 Rest of North America Embedded Security Market, 2022 - 2028, USD Million

TABLE 102 Rest of North America Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 103 Rest of North America Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 104 Rest of North America Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 105 Rest of North America Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 106 Rest of North America Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 107 Rest of North America Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 108 Europe Embedded Security Market, 2018 - 2021, USD Million

TABLE 109 Europe Embedded Security Market, 2022 - 2028, USD Million

TABLE 110 Europe Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 111 Europe Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 112 Europe Payment Processing & Card Market by Country, 2018 - 2021, USD Million

TABLE 113 Europe Payment Processing & Card Market by Country, 2022 - 2028, USD Million

TABLE 114 Europe Smart Identity Cards Market by Country, 2018 - 2021, USD Million

TABLE 115 Europe Smart Identity Cards Market by Country, 2022 - 2028, USD Million

TABLE 116 Europe Industrial Market by Country, 2018 - 2021, USD Million

TABLE 117 Europe Industrial Market by Country, 2022 - 2028, USD Million

TABLE 118 Europe Smartphones Market by Country, 2018 - 2021, USD Million

TABLE 119 Europe Smartphones Market by Country, 2022 - 2028, USD Million

TABLE 120 Europe Wearables Market by Country, 2018 - 2021, USD Million

TABLE 121 Europe Wearables Market by Country, 2022 - 2028, USD Million

TABLE 122 Europe Automotive Market by Country, 2018 - 2021, USD Million

TABLE 123 Europe Automotive Market by Country, 2022 - 2028, USD Million

TABLE 124 Europe Others Market by Country, 2018 - 2021, USD Million

TABLE 125 Europe Others Market by Country, 2022 - 2028, USD Million

TABLE 126 Europe Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 127 Europe Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 128 Europe Software Market by Country, 2018 - 2021, USD Million

TABLE 129 Europe Software Market by Country, 2022 - 2028, USD Million

TABLE 130 Europe Hardware Market by Country, 2018 - 2021, USD Million

TABLE 131 Europe Hardware Market by Country, 2022 - 2028, USD Million

TABLE 132 Europe Services Market by Country, 2018 - 2021, USD Million

TABLE 133 Europe Services Market by Country, 2022 - 2028, USD Million

TABLE 134 Europe Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 135 Europe Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 136 Europe Payment Market by Country, 2018 - 2021, USD Million

TABLE 137 Europe Payment Market by Country, 2022 - 2028, USD Million

TABLE 138 Europe Authentication & Access Management Market by Country, 2018 - 2021, USD Million

TABLE 139 Europe Authentication & Access Management Market by Country, 2022 - 2028, USD Million

TABLE 140 Europe Content Protection Market by Country, 2018 - 2021, USD Million

TABLE 141 Europe Content Protection Market by Country, 2022 - 2028, USD Million

TABLE 142 Europe Embedded Security Market by Country, 2018 - 2021, USD Million

TABLE 143 Europe Embedded Security Market by Country, 2022 - 2028, USD Million

TABLE 144 Germany Embedded Security Market, 2018 - 2021, USD Million

TABLE 145 Germany Embedded Security Market, 2022 - 2028, USD Million

TABLE 146 Germany Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 147 Germany Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 148 Germany Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 149 Germany Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 150 Germany Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 151 Germany Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 152 UK Embedded Security Market, 2018 - 2021, USD Million

TABLE 153 UK Embedded Security Market, 2022 - 2028, USD Million

TABLE 154 UK Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 155 UK Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 156 UK Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 157 UK Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 158 UK Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 159 UK Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 160 France Embedded Security Market, 2018 - 2021, USD Million

TABLE 161 France Embedded Security Market, 2022 - 2028, USD Million

TABLE 162 France Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 163 France Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 164 France Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 165 France Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 166 France Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 167 France Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 168 Russia Embedded Security Market, 2018 - 2021, USD Million

TABLE 169 Russia Embedded Security Market, 2022 - 2028, USD Million

TABLE 170 Russia Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 171 Russia Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 172 Russia Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 173 Russia Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 174 Russia Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 175 Russia Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 176 Spain Embedded Security Market, 2018 - 2021, USD Million

TABLE 177 Spain Embedded Security Market, 2022 - 2028, USD Million

TABLE 178 Spain Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 179 Spain Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 180 Spain Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 181 Spain Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 182 Spain Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 183 Spain Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 184 Italy Embedded Security Market, 2018 - 2021, USD Million

TABLE 185 Italy Embedded Security Market, 2022 - 2028, USD Million

TABLE 186 Italy Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 187 Italy Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 188 Italy Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 189 Italy Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 190 Italy Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 191 Italy Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 192 Rest of Europe Embedded Security Market, 2018 - 2021, USD Million

TABLE 193 Rest of Europe Embedded Security Market, 2022 - 2028, USD Million

TABLE 194 Rest of Europe Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 195 Rest of Europe Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 196 Rest of Europe Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 197 Rest of Europe Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 198 Rest of Europe Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 199 Rest of Europe Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 200 Asia Pacific Embedded Security Market, 2018 - 2021, USD Million

TABLE 201 Asia Pacific Embedded Security Market, 2022 - 2028, USD Million

TABLE 202 Asia Pacific Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 203 Asia Pacific Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 204 Asia Pacific Payment Processing & Card Market by Country, 2018 - 2021, USD Million

TABLE 205 Asia Pacific Payment Processing & Card Market by Country, 2022 - 2028, USD Million

TABLE 206 Asia Pacific Smart Identity Cards Market by Country, 2018 - 2021, USD Million

TABLE 207 Asia Pacific Smart Identity Cards Market by Country, 2022 - 2028, USD Million

TABLE 208 Asia Pacific Industrial Market by Country, 2018 - 2021, USD Million

TABLE 209 Asia Pacific Industrial Market by Country, 2022 - 2028, USD Million

TABLE 210 Asia Pacific Smartphones Market by Country, 2018 - 2021, USD Million

TABLE 211 Asia Pacific Smartphones Market by Country, 2022 - 2028, USD Million

TABLE 212 Asia Pacific Wearables Market by Country, 2018 - 2021, USD Million

TABLE 213 Asia Pacific Wearables Market by Country, 2022 - 2028, USD Million

TABLE 214 Asia Pacific Automotive Market by Country, 2018 - 2021, USD Million

TABLE 215 Asia Pacific Automotive Market by Country, 2022 - 2028, USD Million

TABLE 216 Asia Pacific Others Market by Country, 2018 - 2021, USD Million

TABLE 217 Asia Pacific Others Market by Country, 2022 - 2028, USD Million

TABLE 218 Asia Pacific Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 219 Asia Pacific Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 220 Asia Pacific Software Market by Country, 2018 - 2021, USD Million

TABLE 221 Asia Pacific Software Market by Country, 2022 - 2028, USD Million

TABLE 222 Asia Pacific Hardware Market by Country, 2018 - 2021, USD Million

TABLE 223 Asia Pacific Hardware Market by Country, 2022 - 2028, USD Million

TABLE 224 Asia Pacific Services Market by Country, 2018 - 2021, USD Million

TABLE 225 Asia Pacific Services Market by Country, 2022 - 2028, USD Million

TABLE 226 Asia Pacific Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 227 Asia Pacific Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 228 Asia Pacific Payment Market by Country, 2018 - 2021, USD Million

TABLE 229 Asia Pacific Payment Market by Country, 2022 - 2028, USD Million

TABLE 230 Asia Pacific Authentication & Access Management Market by Country, 2018 - 2021, USD Million

TABLE 231 Asia Pacific Authentication & Access Management Market by Country, 2022 - 2028, USD Million

TABLE 232 Asia Pacific Content Protection Market by Country, 2018 - 2021, USD Million

TABLE 233 Asia Pacific Content Protection Market by Country, 2022 - 2028, USD Million

TABLE 234 Asia Pacific Embedded Security Market by Country, 2018 - 2021, USD Million

TABLE 235 Asia Pacific Embedded Security Market by Country, 2022 - 2028, USD Million

TABLE 236 China Embedded Security Market, 2018 - 2021, USD Million

TABLE 237 China Embedded Security Market, 2022 - 2028, USD Million

TABLE 238 China Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 239 China Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 240 China Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 241 China Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 242 China Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 243 China Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 244 Japan Embedded Security Market, 2018 - 2021, USD Million

TABLE 245 Japan Embedded Security Market, 2022 - 2028, USD Million

TABLE 246 Japan Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 247 Japan Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 248 Japan Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 249 Japan Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 250 Japan Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 251 Japan Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 252 India Embedded Security Market, 2018 - 2021, USD Million

TABLE 253 India Embedded Security Market, 2022 - 2028, USD Million

TABLE 254 India Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 255 India Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 256 India Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 257 India Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 258 India Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 259 India Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 260 South Korea Embedded Security Market, 2018 - 2021, USD Million

TABLE 261 South Korea Embedded Security Market, 2022 - 2028, USD Million

TABLE 262 South Korea Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 263 South Korea Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 264 South Korea Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 265 South Korea Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 266 South Korea Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 267 South Korea Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 268 Singapore Embedded Security Market, 2018 - 2021, USD Million

TABLE 269 Singapore Embedded Security Market, 2022 - 2028, USD Million

TABLE 270 Singapore Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 271 Singapore Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 272 Singapore Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 273 Singapore Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 274 Singapore Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 275 Singapore Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 276 Malaysia Embedded Security Market, 2018 - 2021, USD Million

TABLE 277 Malaysia Embedded Security Market, 2022 - 2028, USD Million

TABLE 278 Malaysia Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 279 Malaysia Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 280 Malaysia Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 281 Malaysia Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 282 Malaysia Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 283 Malaysia Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 284 Rest of Asia Pacific Embedded Security Market, 2018 - 2021, USD Million

TABLE 285 Rest of Asia Pacific Embedded Security Market, 2022 - 2028, USD Million

TABLE 286 Rest of Asia Pacific Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 287 Rest of Asia Pacific Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 288 Rest of Asia Pacific Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 289 Rest of Asia Pacific Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 290 Rest of Asia Pacific Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 291 Rest of Asia Pacific Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 292 LAMEA Embedded Security Market, 2018 - 2021, USD Million

TABLE 293 LAMEA Embedded Security Market, 2022 - 2028, USD Million

TABLE 294 LAMEA Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 295 LAMEA Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 296 LAMEA Payment Processing & Card Market by Country, 2018 - 2021, USD Million

TABLE 297 LAMEA Payment Processing & Card Market by Country, 2022 - 2028, USD Million

TABLE 298 LAMEA Smart Identity Cards Market by Country, 2018 - 2021, USD Million

TABLE 299 LAMEA Smart Identity Cards Market by Country, 2022 - 2028, USD Million

TABLE 300 LAMEA Industrial Market by Country, 2018 - 2021, USD Million

TABLE 301 LAMEA Industrial Market by Country, 2022 - 2028, USD Million

TABLE 302 LAMEA Smartphones Market by Country, 2018 - 2021, USD Million

TABLE 303 LAMEA Smartphones Market by Country, 2022 - 2028, USD Million

TABLE 304 LAMEA Wearables Market by Country, 2018 - 2021, USD Million

TABLE 305 LAMEA Wearables Market by Country, 2022 - 2028, USD Million

TABLE 306 LAMEA Automotive Market by Country, 2018 - 2021, USD Million

TABLE 307 LAMEA Automotive Market by Country, 2022 - 2028, USD Million

TABLE 308 LAMEA Others Market by Country, 2018 - 2021, USD Million

TABLE 309 LAMEA Others Market by Country, 2022 - 2028, USD Million

TABLE 310 LAMEA Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 311 LAMEA Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 312 LAMEA Software Market by Country, 2018 - 2021, USD Million

TABLE 313 LAMEA Software Market by Country, 2022 - 2028, USD Million

TABLE 314 LAMEA Hardware Market by Country, 2018 - 2021, USD Million

TABLE 315 LAMEA Hardware Market by Country, 2022 - 2028, USD Million

TABLE 316 LAMEA Services Market by Country, 2018 - 2021, USD Million

TABLE 317 LAMEA Services Market by Country, 2022 - 2028, USD Million

TABLE 318 LAMEA Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 319 LAMEA Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 320 LAMEA Payment Market by Country, 2018 - 2021, USD Million

TABLE 321 LAMEA Payment Market by Country, 2022 - 2028, USD Million

TABLE 322 LAMEA Authentication & Access Management Market by Country, 2018 - 2021, USD Million

TABLE 323 LAMEA Authentication & Access Management Market by Country, 2022 - 2028, USD Million

TABLE 324 LAMEA Content Protection Market by Country, 2018 - 2021, USD Million

TABLE 325 LAMEA Content Protection Market by Country, 2022 - 2028, USD Million

TABLE 326 LAMEA Embedded Security Market by Country, 2018 - 2021, USD Million

TABLE 327 LAMEA Embedded Security Market by Country, 2022 - 2028, USD Million

TABLE 328 Brazil Embedded Security Market, 2018 - 2021, USD Million

TABLE 329 Brazil Embedded Security Market, 2022 - 2028, USD Million

TABLE 330 Brazil Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 331 Brazil Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 332 Brazil Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 333 Brazil Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 334 Brazil Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 335 Brazil Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 336 Argentina Embedded Security Market, 2018 - 2021, USD Million

TABLE 337 Argentina Embedded Security Market, 2022 - 2028, USD Million

TABLE 338 Argentina Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 339 Argentina Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 340 Argentina Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 341 Argentina Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 342 Argentina Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 343 Argentina Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 344 UAE Embedded Security Market, 2018 - 2021, USD Million

TABLE 345 UAE Embedded Security Market, 2022 - 2028, USD Million

TABLE 346 UAE Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 347 UAE Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 348 UAE Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 349 UAE Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 350 UAE Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 351 UAE Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 352 Saudi Arabia Embedded Security Market, 2018 - 2021, USD Million

TABLE 353 Saudi Arabia Embedded Security Market, 2022 - 2028, USD Million

TABLE 354 Saudi Arabia Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 355 Saudi Arabia Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 356 Saudi Arabia Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 357 Saudi Arabia Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 358 Saudi Arabia Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 359 Saudi Arabia Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 360 South Africa Embedded Security Market, 2018 - 2021, USD Million

TABLE 361 South Africa Embedded Security Market, 2022 - 2028, USD Million

TABLE 362 South Africa Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 363 South Africa Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 364 South Africa Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 365 South Africa Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 366 South Africa Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 367 South Africa Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 368 Nigeria Embedded Security Market, 2018 - 2021, USD Million

TABLE 369 Nigeria Embedded Security Market, 2022 - 2028, USD Million

TABLE 370 Nigeria Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 371 Nigeria Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 372 Nigeria Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 373 Nigeria Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 374 Nigeria Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 375 Nigeria Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 376 Rest of LAMEA Embedded Security Market, 2018 - 2021, USD Million

TABLE 377 Rest of LAMEA Embedded Security Market, 2022 - 2028, USD Million

TABLE 378 Rest of LAMEA Embedded Security Market by Application, 2018 - 2021, USD Million

TABLE 379 Rest of LAMEA Embedded Security Market by Application, 2022 - 2028, USD Million

TABLE 380 Rest of LAMEA Embedded Security Market by Offering, 2018 - 2021, USD Million

TABLE 381 Rest of LAMEA Embedded Security Market by Offering, 2022 - 2028, USD Million

TABLE 382 Rest of LAMEA Embedded Security Market by Security Type, 2018 - 2021, USD Million

TABLE 383 Rest of LAMEA Embedded Security Market by Security Type, 2022 - 2028, USD Million

TABLE 384 key information – Renesas Electronics Corporation

TABLE 385 Key Information – STMicroelectronics N.V.

TABLE 386 Key Information – Infineon Technologies AG

TABLE 387 Key Information – NXP Semiconductors N.V.

TABLE 388 Key Information – Texas Instruments, Inc.

TABLE 389 Key Information – Samsung Electronics Co., Ltd.

TABLE 390 key information – Thales Group S.A.

TABLE 391 Key Information – IDEMIA SAS

TABLE 392 Key Information – Qualcomm, Inc.

TABLE 393 Key Information – Microchip Technology, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Market Share Analysis, 2020

FIG 4 Key Leading Strategies: Percentage Distribution (2018-2022)

FIG 5 Key Strategic Move: (Partnerships, Collaborations, and Agreements : 2018, APR – 2022, Jan) Leading Players

FIG 6 Global Embedded Security Market Share by Application, 2021

FIG 7 Global Embedded Security Market Share by Application, 2028

FIG 8 Global Embedded Security Market by Application, 2018 - 2028, USD Million

FIG 9 Global Embedded Security Market Share by Offering, 2021

FIG 10 Global Embedded Security Market Share by Offering, 2028

FIG 11 Global Embedded Security Market by Offering, 2018 - 2028, USD Million

FIG 12 Global Embedded Security Market Share by Security Type, 2021

FIG 13 Global Embedded Security Market Share by Security Type, 2028

FIG 14 Global Embedded Security Market by Security Type, 2018 - 2028, USD Million

FIG 15 Global Embedded Security Market Share by Region, 2021

FIG 16 Global Embedded Security Market Share by Region, 2028

FIG 17 Global Embedded Security Market by Region, 2018 - 2028, USD Million

FIG 18 Recent strategies and developments: Renesas Electronics Corporation

FIG 19 Recent strategies and developments: STMicroelectronics N.V.

FIG 20 Swot analysis: stmicroelectronics n.v.

FIG 21 Recent strategies and developments: Infineon Technologies

FIG 22 Swot analysis: INFINEON TECHNOLOGIES AG

FIG 23 Recent strategies and developments: NXP Semiconductors N.V.

FIG 24 Swot analysis: NXP semiconductors N.V.

FIG 25 Recent strategies and developments: Texas Instruments, Inc.

FIG 26 SWOT Analysis: Texas Instruments, Inc.

FIG 27 Recent strategies and developments: Samsung Electronics Co., Ltd.

FIG 28 SWOT Analysis: Samsung Electronics CO. Ltd.

FIG 29 Recent strategies and developments: Qualcomm, Inc.

FIG 30 SWOT Analysis: Qualcomm, Inc.

FIG 31 Recent strategies and developments: Microchip Technology, Inc.