Global Cultured Meat Market Size, Share & Industry Trends Analysis Report By Source (Poultry, Beef, Pork, Duck, and Seafood), By End Use (Burgers, Nuggets, Sausages, Meatballs, and Hot Dogs), By Regional Outlook and Forecast, 2022 - 2028

Published Date : 31-May-2022 | Pages: 165 | Formats: PDF |

COVID-19 Impact on the Cultured Meat Market

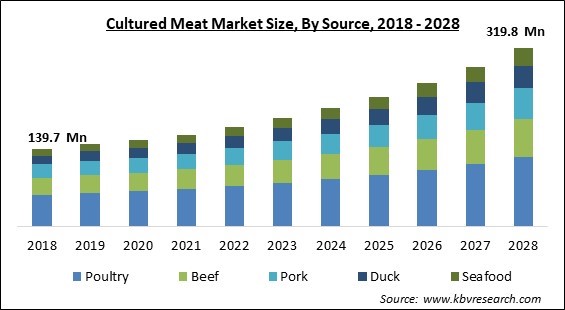

The Global Cultured Meat Market size is expected to reach $319.8 million by 2028, rising at a market growth of 10.2% CAGR during the forecast period.

Cultured meat, also referred to as in vitro meat, is a sort of artificial meat made using tissue engineering and cellular agriculture techniques. Meat has long been used to fulfill human nutritional needs since it is an excellent source of vitamin B12, omega-3 fatty acids, protein, and iron. In vitro meat is created in the lab by putting animal muscle cells into culture conditions for development and proliferation.

The cultured meat market is growing because of a number of factors, comprising low environmental impact, the elimination of the need to raise animals, and a reduction in public health hazards. Alternative protein sources include cultured meat. Consumers are changing the attention to adopting a more healthy diet that promotes a more sustainable lifestyle and reduces reliance on animal proteins. Additionally, people who are allergic to animal-based proteins make up the majority of alternative protein buyers. The increased inclination of consumers for a protein-rich diet as well as the rising dependence on omega-3 fatty acids to meet the demand for critical nutrients is likely to lead to market growth.

The increased demand for nutritious components in developing and improvements in cellular agriculture, as well as an high predisposition toward environmental sustainability and animal welfare, are all anticipated to propel the cultured meat market. At the moment, the market's major participants are concentrating on meat production without slaughter.

COVID-19 Impact Analysis

The increasing worries about food safety in the consumer products industry are expected to support market growth. This is because of the rising desire for healthful food during the COVID-19 pandemic, demand for in-vitro meat climbed slightly. During the COVID-19 era, in-vitro meat acquired a lot of attention as a way to expand the healthy diet. The industry is growing because of increasing consumer issues about boosting immunity and incorporating nutritional elements into meals. The COVID-19 pandemic had a significant impact on meat production, meat pricing, and the supply chain, resulting in a major socio-economic catastrophe around the world.

Market Growth Factors

No animal torture and suffering

The animals population has grown in the previous fifty years, meat consumption has tripled. Animals on farms are subjected to both psychological and physical torture. The reality that billions of animals are reared in deplorable conditions just to serve human taste buds can only be described as brutal and inhumane. The children will definitely look down on slaughters for adopting production-scale animal mistreatment, just as people look down on the forefathers for holding slaves and condoning rampant sexism.

Better long term health for human beings

Aside from the apparent advantages for animal welfare, lab-grown meat also has advantages for human health. Antibiotic resistance is yet another big issue of the day that cultured meat could help to address. In addition, antibiotics are fed in high quantities to farm animals as a preventative precaution. As humans ingest farm animal flesh, people unnecessarily take antibiotics, allowing bacteria to develop resistance to it. These antibiotic resistance kills a large number of people every year in various region alone, and the scenario is only expected to get worse. Lesser the consumption of meat and meat-based product, lessen the chances of contracting any animal transmitted diseases.

Marketing Restraining Factor:

Availability of more healthy alternatives

Customers are being encouraged to consume more legumes, fruits, vegetables, seeds, and nuts as a result of the growing popularity of plant-based products. Additionally, such plant-based goods provide many health benefits, which is engaging more customers. Many people have now increased intake of animal-based meat to diet-related disorders such as heart disease, obesity, type 2 diabetes, and cancer. Plant-based goods, on the other hand, do not induce such diseases, making them a suitable and healthier option for consumers. Many places do not have much preference of consuming meat or artificial meat, hence such population prefer other vegetarian meal to fulfill the nutritional requirements.

Source Outlook

Based on Source, the market is segmented into Poultry, Beef, Pork, Duck, and Seafood. The pork segment garnered a significant revenue share in the cultured meat market in 2021. It is due to rising demand; the pork segment will see the most growth over the forecast period. This is because of the excellent flavor and high nutritious value. L-carnitine is abundant in cultured beef. The segment's expansion is attributable to customers' growing worries about food safety. Beef flesh eliminates toxins while also meeting the desire for nutritional nourishment.

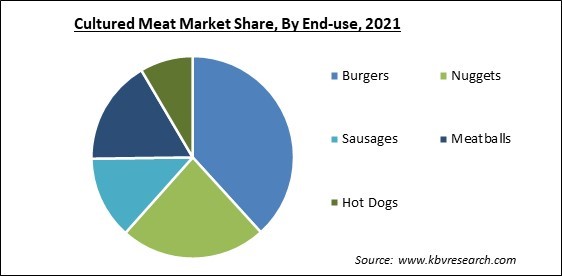

End Use Outlook

Based on End Use, the market is segmented into Burgers, Nuggets, Sausages, Meatballs, and Hot Dogs. The burger segment witnessed the highest revenue share in the cultured meat market in 2021. This is due to the increased demand among consumers for clean beef in dishes like burgers. The growing preference for hamburgers is expected to fuel category expansion. The growing popularity of high-protein is driving market demand. It is because of its lower environmental effect and ethical concerns, cultured meat burgers are the most popular alternative to traditional beef burgers.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 164.7 Million |

| Market size forecast in 2028 | USD 319.8 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.2% from 2022 to 2028 |

| Number of Pages | 165 |

| Number of Tables | 302 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Source, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Egypt, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America emerged as the leading region in the cultured meat market with the largest revenue share in 2021. It is due to rising demand for in-vitro meat in the United States and Canada. The regional market is recording rising meat and meat product consumption, as well as the accompanying nutritional benefits. There are many key firms based in the United States, which are concentrating on forming strategic partnerships in trying to entice a broad consumer base.

Free Valuable Insights: Global Cultured Meat Market size to reach USD 319.8 Million by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Upside Foods, Inc., Mosa Meat BV, Supermeat The Essence of Meat Ltd., Eat Just, Inc., Integriculture Co. Ltd., Aleph Farms, Finless Foods, Inc., Avant Meats Company Limited, and Future Meat Technologies Ltd.

Recent Strategies deployed in Cultured Meat Market

» Partnership, Collaboration and Agreement:

- Mar-2022: Future Meat Technologies came into a partnership with Charoen Pokphand Foods Public Company Limited (CPF), one of the leading unified agro-industrial and food businesses. This partnership aimed to create hybrid cultured meat products for the Asian market, meeting the dynamic consumer tastes and preferences of the Asian continent and enhancing the company's knowledge of the market demands and wide distribution network in the region.

- Mar-2022: SuperMeat formed a partnership with Ajinomoto, a Japanese multinational food and biotechnology corporation. This partnership aimed to fasten up and enhance the development of cultivated meat products. Under this partnership, Ajinomoto's entered into cellular agriculture, with biotech investing in SuperMeat.

- Mar-2022: SuperMeat entered into an agreement with PHW Group, one of Europe's largest poultry producers. This agreement aimed to strengthen the brands' joint mission to bring cultivated meat products, comprising turkey, chicken, and duck, to European consumers. Under this agreement, the companies would work together to gather EU authorization for the products, and be the first to create, manufacture, and distribute cultivated meat at a large scale for consumers.

- Dec-2021: Aleph Farms joined hands with WACKER, a supplier of leading protein production technologies. This collaboration aimed to cultivate meat companies to gather the same affordable proteins, without utilizing fetal bovine serum (FBS) or animal-derived ingredients.

- Jul-2021: Future Meat Technologies joined hands with Nestlé, the world's largest food and beverage company. This collaboration aimed to explore the potential of cell-based meat and make a significant move in the field poised to enhance the market, securing the future of future generations.

- Apr-2021: Avant Meats Company came into a partnership with Archer Daniels Midland Co (ADM), the U.S. agricultural commodities and food processing leader. This partnership aimed to broaden the production of fish analogs and plant-based meat in the region and emphasize developing new nutritious products to aid fulfill the growing demand for food and beverage in the Asia-Pacific region.

- Apr-2021: Eat Just joined hands with Foodpanda, an online food and grocery delivery platform owned by Delivery Hero. This collaboration aimed to introduce the world’s first home delivery of cultured meat dishes. On the eve of Earth Day, three limited-edition dishes would be revealed on the online food delivery platform in Singapore, completely made with the food tech’s chicken that is cultured directly from cells.

- Mar-2021: Aleph Farms came into a partnership with BRF, global Brazilian meat, and food company. This partnership aimed to release its lab-grown meat products in Latin America's largest country. Under this partnership, the companies would co-develop and produce cultivated meat utilizing Aleph's patented production platforms, BioFarms, and provide cultivated beef products in Brazil.

- Jan-2021: Aleph Farms entered into an agreement with Mitsubishi, a global provider of food-related products to consumers. This agreement aimed to enable Aleph Farms to deliver its BioFarm manufacturing platform for the cultivation of whole-muscle steaks. In addition, Mitsubishi would give its expertise in biotechnology processes, branded food manufacturing, and local distribution channels in Japan.

- Jan-2021: Avant Meats Company formed a partnership with Vinh Hoan, the world's largest pangasius fish producer located in Vietnam. This partnership aimed for Avant Meats to enhance VHC’s comprehensive sales network and manufacturing capabilities and fasten the commercialization of its cultivated fish products.

- Jul-2020: Integriculture entered into collaboration with Shiok Meats, a cultivated meat, and seafood company. This collaboration aimed to enhance the production of the latter’s flagship product: cultured shrimp meat. Under this collaboration, the companies would develop inexpensive cultured serum for growing shrimp meat in the lab.

- Jan-2020: Mosa Meat came into a partnership with Nutreco, a leading animal nutrition company. This partnership aimed to fasten the commercial introduction of its lab-grown meat and emphasize creating its cultured meat products commercially available and offer a sustainable and healthier substitute on a large scale.

» Product Launches and Product Expansions:

- Apr-2022: IntergriCulture unveiled I-MEM, a basal medium. This product launch aimed to make cultivated meat without the inclusion of animal-derived growth factors. The Japanese cellular agricultural startup has successfully swapped out all of the research-grade elements of its medium, I-MEM, with food-grade replacements-preparing the product for commercial sale.

» Geographical Expansions:

- Dec-2020: Eat Just expanded its geographical footprint by offering lab-grown chicken meat in Singapore after receiving regulatory approval from Singapore Food Agency (SFA). This geographical expansion aimed at the cell-cultured chicken to be produced within Eat Just’s new GOOD Meat brand by partnerships with local manufacturers and go on sale to restaurants prior to it being available to consumers.

Scope of the Study

Market Segments Covered in the Report:

By Source

- Poultry

- Beef

- Pork

- Duck

- Seafood

By End Use

- Burgers

- Nuggets

- Sausages

- Meatballs

- Hot Dogs

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Egypt

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Upside Foods, Inc.

- Mosa Meat BV

- Supermeat The Essence of Meat Ltd.

- Eat Just, Inc.

- Integriculture Co. Ltd.

- Aleph Farms

- Finless Foods, Inc.

- Avant Meats Company Limited

- Future Meat Technologies Ltd.

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Cultured Meat Market, by Source

1.4.2 Global Cultured Meat Market, by End Use

1.4.3 Global Cultured Meat Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 Recent Industry Wide Strategic Developments

3.1.1 Partnerships, Collaborations and Agreements

3.1.2 Product Launches and Product Expansions

3.1.3 Geographical Expansions

3.2 Top Winning Strategies

3.2.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.2.2 Key Strategic Move: (Partnerships, Collaborations and Agreements : 2020, Jan – 2022, Mar) Leading Players

Chapter 4. Global Cultured Meat Market by Source

4.1 Global Poultry Market by Region

4.2 Global Beef Market by Region

4.3 Global Pork Market by Region

4.4 Global Duck Market by Region

4.5 Global Seafood Market by Region

Chapter 5. Global Cultured Meat Market by End-use

5.1 Global Burgers Market by Region

5.2 Global Nuggets Market by Region

5.3 Global Sausages Market by Region

5.4 Global Meatballs Market by Region

5.5 Global Hot Dogs Market by Region

Chapter 6. Global Cultured Meat Market by Region

6.1 North America Cultured Meat Market

6.1.1 North America Cultured Meat Market by Source

6.1.1.1 North America Poultry Market by Country

6.1.1.2 North America Beef Market by Country

6.1.1.3 North America Pork Market by Country

6.1.1.4 North America Duck Market by Country

6.1.1.5 North America Seafood Market by Country

6.1.2 North America Cultured Meat Market by End-use

6.1.2.1 North America Burgers Market by Country

6.1.2.2 North America Nuggets Market by Country

6.1.2.3 North America Sausages Market by Country

6.1.2.4 North America Meatballs Market by Country

6.1.2.5 North America Hot Dogs Market by Country

6.1.3 North America Cultured Meat Market by Country

6.1.3.1 US Cultured Meat Market

6.1.3.1.1 US Cultured Meat Market by Source

6.1.3.1.2 US Cultured Meat Market by End-use

6.1.3.2 Canada Cultured Meat Market

6.1.3.2.1 Canada Cultured Meat Market by Source

6.1.3.2.2 Canada Cultured Meat Market by End-use

6.1.3.3 Mexico Cultured Meat Market

6.1.3.3.1 Mexico Cultured Meat Market by Source

6.1.3.3.2 Mexico Cultured Meat Market by End-use

6.1.3.4 Rest of North America Cultured Meat Market

6.1.3.4.1 Rest of North America Cultured Meat Market by Source

6.1.3.4.2 Rest of North America Cultured Meat Market by End-use

6.2 Europe Cultured Meat Market

6.2.1 Europe Cultured Meat Market by Source

6.2.1.1 Europe Poultry Market by Country

6.2.1.2 Europe Beef Market by Country

6.2.1.3 Europe Pork Market by Country

6.2.1.4 Europe Duck Market by Country

6.2.1.5 Europe Seafood Market by Country

6.2.2 Europe Cultured Meat Market by End-use

6.2.2.1 Europe Burgers Market by Country

6.2.2.2 Europe Nuggets Market by Country

6.2.2.3 Europe Sausages Market by Country

6.2.2.4 Europe Meatballs Market by Country

6.2.2.5 Europe Hot Dogs Market by Country

6.2.3 Europe Cultured Meat Market by Country

6.2.3.1 Germany Cultured Meat Market

6.2.3.1.1 Germany Cultured Meat Market by Source

6.2.3.1.2 Germany Cultured Meat Market by End-use

6.2.3.2 UK Cultured Meat Market

6.2.3.2.1 UK Cultured Meat Market by Source

6.2.3.2.2 UK Cultured Meat Market by End-use

6.2.3.3 France Cultured Meat Market

6.2.3.3.1 France Cultured Meat Market by Source

6.2.3.3.2 France Cultured Meat Market by End-use

6.2.3.4 Russia Cultured Meat Market

6.2.3.4.1 Russia Cultured Meat Market by Source

6.2.3.4.2 Russia Cultured Meat Market by End-use

6.2.3.5 Spain Cultured Meat Market

6.2.3.5.1 Spain Cultured Meat Market by Source

6.2.3.5.2 Spain Cultured Meat Market by End-use

6.2.3.6 Italy Cultured Meat Market

6.2.3.6.1 Italy Cultured Meat Market by Source

6.2.3.6.2 Italy Cultured Meat Market by End-use

6.2.3.7 Rest of Europe Cultured Meat Market

6.2.3.7.1 Rest of Europe Cultured Meat Market by Source

6.2.3.7.2 Rest of Europe Cultured Meat Market by End-use

6.3 Asia Pacific Cultured Meat Market

6.3.1 Asia Pacific Cultured Meat Market by Source

6.3.1.1 Asia Pacific Poultry Market by Country

6.3.1.2 Asia Pacific Beef Market by Country

6.3.1.3 Asia Pacific Pork Market by Country

6.3.1.4 Asia Pacific Duck Market by Country

6.3.1.5 Asia Pacific Seafood Market by Country

6.3.2 Asia Pacific Cultured Meat Market by End-use

6.3.2.1 Asia Pacific Burgers Market by Country

6.3.2.2 Asia Pacific Nuggets Market by Country

6.3.2.3 Asia Pacific Sausages Market by Country

6.3.2.4 Asia Pacific Meatballs Market by Country

6.3.2.5 Asia Pacific Hot Dogs Market by Country

6.3.3 Asia Pacific Cultured Meat Market by Country

6.3.3.1 China Cultured Meat Market

6.3.3.1.1 China Cultured Meat Market by Source

6.3.3.1.2 China Cultured Meat Market by End-use

6.3.3.2 Japan Cultured Meat Market

6.3.3.2.1 Japan Cultured Meat Market by Source

6.3.3.2.2 Japan Cultured Meat Market by End-use

6.3.3.3 India Cultured Meat Market

6.3.3.3.1 India Cultured Meat Market by Source

6.3.3.3.2 India Cultured Meat Market by End-use

6.3.3.4 South Korea Cultured Meat Market

6.3.3.4.1 South Korea Cultured Meat Market by Source

6.3.3.4.2 South Korea Cultured Meat Market by End-use

6.3.3.5 Singapore Cultured Meat Market

6.3.3.5.1 Singapore Cultured Meat Market by Source

6.3.3.5.2 Singapore Cultured Meat Market by End-use

6.3.3.6 Malaysia Cultured Meat Market

6.3.3.6.1 Malaysia Cultured Meat Market by Source

6.3.3.6.2 Malaysia Cultured Meat Market by End-use

6.3.3.7 Rest of Asia Pacific Cultured Meat Market

6.3.3.7.1 Rest of Asia Pacific Cultured Meat Market by Source

6.3.3.7.2 Rest of Asia Pacific Cultured Meat Market by End-use

6.4 LAMEA Cultured Meat Market

6.4.1 LAMEA Cultured Meat Market by Source

6.4.1.1 LAMEA Poultry Market by Country

6.4.1.2 LAMEA Beef Market by Country

6.4.1.3 LAMEA Pork Market by Country

6.4.1.4 LAMEA Duck Market by Country

6.4.1.5 LAMEA Seafood Market by Country

6.4.2 LAMEA Cultured Meat Market by End-use

6.4.2.1 LAMEA Burgers Market by Country

6.4.2.2 LAMEA Nuggets Market by Country

6.4.2.3 LAMEA Sausages Market by Country

6.4.2.4 LAMEA Meatballs Market by Country

6.4.2.5 LAMEA Hot Dogs Market by Country

6.4.3 LAMEA Cultured Meat Market by Country

6.4.3.1 Brazil Cultured Meat Market

6.4.3.1.1 Brazil Cultured Meat Market by Source

6.4.3.1.2 Brazil Cultured Meat Market by End-use

6.4.3.2 Argentina Cultured Meat Market

6.4.3.2.1 Argentina Cultured Meat Market by Source

6.4.3.2.2 Argentina Cultured Meat Market by End-use

6.4.3.3 UAE Cultured Meat Market

6.4.3.3.1 UAE Cultured Meat Market by Source

6.4.3.3.2 UAE Cultured Meat Market by End-use

6.4.3.4 Egypt Cultured Meat Market

6.4.3.4.1 Egypt Cultured Meat Market by Source

6.4.3.4.2 Egypt Cultured Meat Market by End-use

6.4.3.5 South Africa Cultured Meat Market

6.4.3.5.1 South Africa Cultured Meat Market by Source

6.4.3.5.2 South Africa Cultured Meat Market by End-use

6.4.3.6 Nigeria Cultured Meat Market

6.4.3.6.1 Nigeria Cultured Meat Market by Source

6.4.3.6.2 Nigeria Cultured Meat Market by End-use

6.4.3.7 Rest of LAMEA Cultured Meat Market

6.4.3.7.1 Rest of LAMEA Cultured Meat Market by Source

6.4.3.7.2 Rest of LAMEA Cultured Meat Market by End-use

Chapter 7. Company Profiles

7.1 Eat Just, Inc.

7.1.1 Company Overview

7.1.2 Recent strategies and developments:

7.1.2.1 Partnerships, Collaborations, and Agreements:

7.1.2.2 Geographical Expansions:

7.2 Integriculture Co., Ltd.

7.2.1 Company Overview

7.2.2 Recent strategies and developments:

7.2.2.1 Partnerships, Collaborations, and Agreements:

7.2.2.2 Product Launches and Product Expansions:

7.3 Avant Meats Company Limited

7.3.1 Company Overview

7.3.2 Recent strategies and developments:

7.3.2.1 Partnerships, Collaborations, and Agreements:

7.4 Future Meat Technologies Ltd.

7.4.2 Recent strategies and developments:

7.4.2.1 Partnerships, Collaborations, and Agreements:

7.5 Mosa Meat BV

7.5.1 Company Overview

7.5.2 Recent strategies and developments:

7.5.2.1 Partnerships, Collaborations, and Agreements:

7.6 Supermeat The Essence of Meat Ltd.

7.6.1 Company Overview

7.6.2 Recent strategies and developments:

7.6.2.1 Partnerships, Collaborations, and Agreements:

7.7 Aleph Farms

7.7.1 Company Overview

7.7.2 Recent strategies and developments:

7.7.2.1 Partnerships, Collaborations, and Agreements:

7.8 Finless Foods, Inc.

7.8.1 Company Overview

7.9 Upside Foods, Inc.

7.9.1 Company Overview

TABLE 2 Global Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 3 Partnerships, Collaborations and Agreements– Cultured Meat Market

TABLE 4 Product Launches And Product Expansions– Cultured Meat Market

TABLE 5 Geographical Expansions– Cultured Meat Market

TABLE 6 Global Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 7 Global Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 8 Global Poultry Market by Region, 2018 - 2021, USD Thousands

TABLE 9 Global Poultry Market by Region, 2022 - 2028, USD Thousands

TABLE 10 Global Beef Market by Region, 2018 - 2021, USD Thousands

TABLE 11 Global Beef Market by Region, 2022 - 2028, USD Thousands

TABLE 12 Global Pork Market by Region, 2018 - 2021, USD Thousands

TABLE 13 Global Pork Market by Region, 2022 - 2028, USD Thousands

TABLE 14 Global Duck Market by Region, 2018 - 2021, USD Thousands

TABLE 15 Global Duck Market by Region, 2022 - 2028, USD Thousands

TABLE 16 Global Seafood Market by Region, 2018 - 2021, USD Thousands

TABLE 17 Global Seafood Market by Region, 2022 - 2028, USD Thousands

TABLE 18 Global Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 19 Global Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 20 Global Burgers Market by Region, 2018 - 2021, USD Thousands

TABLE 21 Global Burgers Market by Region, 2022 - 2028, USD Thousands

TABLE 22 Global Nuggets Market by Region, 2018 - 2021, USD Thousands

TABLE 23 Global Nuggets Market by Region, 2022 - 2028, USD Thousands

TABLE 24 Global Sausages Market by Region, 2018 - 2021, USD Thousands

TABLE 25 Global Sausages Market by Region, 2022 - 2028, USD Thousands

TABLE 26 Global Meatballs Market by Region, 2018 - 2021, USD Thousands

TABLE 27 Global Meatballs Market by Region, 2022 - 2028, USD Thousands

TABLE 28 Global Hot Dogs Market by Region, 2018 - 2021, USD Thousands

TABLE 29 Global Hot Dogs Market by Region, 2022 - 2028, USD Thousands

TABLE 30 Global Cultured Meat Market by Region, 2018 - 2021, USD Thousands

TABLE 31 Global Cultured Meat Market by Region, 2022 - 2028, USD Thousands

TABLE 32 North America Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 33 North America Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 34 North America Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 35 North America Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 36 North America Poultry Market by Country, 2018 - 2021, USD Thousands

TABLE 37 North America Poultry Market by Country, 2022 - 2028, USD Thousands

TABLE 38 North America Beef Market by Country, 2018 - 2021, USD Thousands

TABLE 39 North America Beef Market by Country, 2022 - 2028, USD Thousands

TABLE 40 North America Pork Market by Country, 2018 - 2021, USD Thousands

TABLE 41 North America Pork Market by Country, 2022 - 2028, USD Thousands

TABLE 42 North America Duck Market by Country, 2018 - 2021, USD Thousands

TABLE 43 North America Duck Market by Country, 2022 - 2028, USD Thousands

TABLE 44 North America Seafood Market by Country, 2018 - 2021, USD Thousands

TABLE 45 North America Seafood Market by Country, 2022 - 2028, USD Thousands

TABLE 46 North America Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 47 North America Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 48 North America Burgers Market by Country, 2018 - 2021, USD Thousands

TABLE 49 North America Burgers Market by Country, 2022 - 2028, USD Thousands

TABLE 50 North America Nuggets Market by Country, 2018 - 2021, USD Thousands

TABLE 51 North America Nuggets Market by Country, 2022 - 2028, USD Thousands

TABLE 52 North America Sausages Market by Country, 2018 - 2021, USD Thousands

TABLE 53 North America Sausages Market by Country, 2022 - 2028, USD Thousands

TABLE 54 North America Meatballs Market by Country, 2018 - 2021, USD Thousands

TABLE 55 North America Meatballs Market by Country, 2022 - 2028, USD Thousands

TABLE 56 North America Hot Dogs Market by Country, 2018 - 2021, USD Thousands

TABLE 57 North America Hot Dogs Market by Country, 2022 - 2028, USD Thousands

TABLE 58 North America Cultured Meat Market by Country, 2018 - 2021, USD Thousands

TABLE 59 North America Cultured Meat Market by Country, 2022 - 2028, USD Thousands

TABLE 60 US Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 61 US Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 62 US Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 63 US Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 64 US Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 65 US Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 66 Canada Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 67 Canada Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 68 Canada Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 69 Canada Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 70 Canada Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 71 Canada Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 72 Mexico Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 73 Mexico Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 74 Mexico Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 75 Mexico Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 76 Mexico Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 77 Mexico Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 78 Rest of North America Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 79 Rest of North America Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 80 Rest of North America Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 81 Rest of North America Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 82 Rest of North America Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 83 Rest of North America Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 84 Europe Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 85 Europe Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 86 Europe Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 87 Europe Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 88 Europe Poultry Market by Country, 2018 - 2021, USD Thousands

TABLE 89 Europe Poultry Market by Country, 2022 - 2028, USD Thousands

TABLE 90 Europe Beef Market by Country, 2018 - 2021, USD Thousands

TABLE 91 Europe Beef Market by Country, 2022 - 2028, USD Thousands

TABLE 92 Europe Pork Market by Country, 2018 - 2021, USD Thousands

TABLE 93 Europe Pork Market by Country, 2022 - 2028, USD Thousands

TABLE 94 Europe Duck Market by Country, 2018 - 2021, USD Thousands

TABLE 95 Europe Duck Market by Country, 2022 - 2028, USD Thousands

TABLE 96 Europe Seafood Market by Country, 2018 - 2021, USD Thousands

TABLE 97 Europe Seafood Market by Country, 2022 - 2028, USD Thousands

TABLE 98 Europe Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 99 Europe Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 100 Europe Burgers Market by Country, 2018 - 2021, USD Thousands

TABLE 101 Europe Burgers Market by Country, 2022 - 2028, USD Thousands

TABLE 102 Europe Nuggets Market by Country, 2018 - 2021, USD Thousands

TABLE 103 Europe Nuggets Market by Country, 2022 - 2028, USD Thousands

TABLE 104 Europe Sausages Market by Country, 2018 - 2021, USD Thousands

TABLE 105 Europe Sausages Market by Country, 2022 - 2028, USD Thousands

TABLE 106 Europe Meatballs Market by Country, 2018 - 2021, USD Thousands

TABLE 107 Europe Meatballs Market by Country, 2022 - 2028, USD Thousands

TABLE 108 Europe Hot Dogs Market by Country, 2018 - 2021, USD Thousands

TABLE 109 Europe Hot Dogs Market by Country, 2022 - 2028, USD Thousands

TABLE 110 Europe Cultured Meat Market by Country, 2018 - 2021, USD Thousands

TABLE 111 Europe Cultured Meat Market by Country, 2022 - 2028, USD Thousands

TABLE 112 Germany Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 113 Germany Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 114 Germany Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 115 Germany Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 116 Germany Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 117 Germany Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 118 UK Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 119 UK Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 120 UK Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 121 UK Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 122 UK Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 123 UK Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 124 France Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 125 France Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 126 France Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 127 France Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 128 France Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 129 France Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 130 Russia Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 131 Russia Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 132 Russia Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 133 Russia Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 134 Russia Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 135 Russia Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 136 Spain Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 137 Spain Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 138 Spain Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 139 Spain Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 140 Spain Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 141 Spain Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 142 Italy Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 143 Italy Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 144 Italy Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 145 Italy Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 146 Italy Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 147 Italy Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 148 Rest of Europe Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 149 Rest of Europe Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 150 Rest of Europe Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 151 Rest of Europe Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 152 Rest of Europe Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 153 Rest of Europe Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 154 Asia Pacific Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 155 Asia Pacific Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 156 Asia Pacific Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 157 Asia Pacific Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 158 Asia Pacific Poultry Market by Country, 2018 - 2021, USD Thousands

TABLE 159 Asia Pacific Poultry Market by Country, 2022 - 2028, USD Thousands

TABLE 160 Asia Pacific Beef Market by Country, 2018 - 2021, USD Thousands

TABLE 161 Asia Pacific Beef Market by Country, 2022 - 2028, USD Thousands

TABLE 162 Asia Pacific Pork Market by Country, 2018 - 2021, USD Thousands

TABLE 163 Asia Pacific Pork Market by Country, 2022 - 2028, USD Thousands

TABLE 164 Asia Pacific Duck Market by Country, 2018 - 2021, USD Thousands

TABLE 165 Asia Pacific Duck Market by Country, 2022 - 2028, USD Thousands

TABLE 166 Asia Pacific Seafood Market by Country, 2018 - 2021, USD Thousands

TABLE 167 Asia Pacific Seafood Market by Country, 2022 - 2028, USD Thousands

TABLE 168 Asia Pacific Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 169 Asia Pacific Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 170 Asia Pacific Burgers Market by Country, 2018 - 2021, USD Thousands

TABLE 171 Asia Pacific Burgers Market by Country, 2022 - 2028, USD Thousands

TABLE 172 Asia Pacific Nuggets Market by Country, 2018 - 2021, USD Thousands

TABLE 173 Asia Pacific Nuggets Market by Country, 2022 - 2028, USD Thousands

TABLE 174 Asia Pacific Sausages Market by Country, 2018 - 2021, USD Thousands

TABLE 175 Asia Pacific Sausages Market by Country, 2022 - 2028, USD Thousands

TABLE 176 Asia Pacific Meatballs Market by Country, 2018 - 2021, USD Thousands

TABLE 177 Asia Pacific Meatballs Market by Country, 2022 - 2028, USD Thousands

TABLE 178 Asia Pacific Hot Dogs Market by Country, 2018 - 2021, USD Thousands

TABLE 179 Asia Pacific Hot Dogs Market by Country, 2022 - 2028, USD Thousands

TABLE 180 Asia Pacific Cultured Meat Market by Country, 2018 - 2021, USD Thousands

TABLE 181 Asia Pacific Cultured Meat Market by Country, 2022 - 2028, USD Thousands

TABLE 182 China Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 183 China Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 184 China Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 185 China Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 186 China Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 187 China Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 188 Japan Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 189 Japan Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 190 Japan Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 191 Japan Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 192 Japan Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 193 Japan Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 194 India Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 195 India Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 196 India Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 197 India Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 198 India Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 199 India Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 200 South Korea Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 201 South Korea Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 202 South Korea Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 203 South Korea Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 204 South Korea Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 205 South Korea Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 206 Singapore Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 207 Singapore Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 208 Singapore Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 209 Singapore Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 210 Singapore Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 211 Singapore Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 212 Malaysia Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 213 Malaysia Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 214 Malaysia Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 215 Malaysia Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 216 Malaysia Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 217 Malaysia Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 218 Rest of Asia Pacific Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 219 Rest of Asia Pacific Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 220 Rest of Asia Pacific Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 221 Rest of Asia Pacific Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 222 Rest of Asia Pacific Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 223 Rest of Asia Pacific Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 224 LAMEA Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 225 LAMEA Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 226 LAMEA Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 227 LAMEA Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 228 LAMEA Poultry Market by Country, 2018 - 2021, USD Thousands

TABLE 229 LAMEA Poultry Market by Country, 2022 - 2028, USD Thousands

TABLE 230 LAMEA Beef Market by Country, 2018 - 2021, USD Thousands

TABLE 231 LAMEA Beef Market by Country, 2022 - 2028, USD Thousands

TABLE 232 LAMEA Pork Market by Country, 2018 - 2021, USD Thousands

TABLE 233 LAMEA Pork Market by Country, 2022 - 2028, USD Thousands

TABLE 234 LAMEA Duck Market by Country, 2018 - 2021, USD Thousands

TABLE 235 LAMEA Duck Market by Country, 2022 - 2028, USD Thousands

TABLE 236 LAMEA Seafood Market by Country, 2018 - 2021, USD Thousands

TABLE 237 LAMEA Seafood Market by Country, 2022 - 2028, USD Thousands

TABLE 238 LAMEA Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 239 LAMEA Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 240 LAMEA Burgers Market by Country, 2018 - 2021, USD Thousands

TABLE 241 LAMEA Burgers Market by Country, 2022 - 2028, USD Thousands

TABLE 242 LAMEA Nuggets Market by Country, 2018 - 2021, USD Thousands

TABLE 243 LAMEA Nuggets Market by Country, 2022 - 2028, USD Thousands

TABLE 244 LAMEA Sausages Market by Country, 2018 - 2021, USD Thousands

TABLE 245 LAMEA Sausages Market by Country, 2022 - 2028, USD Thousands

TABLE 246 LAMEA Meatballs Market by Country, 2018 - 2021, USD Thousands

TABLE 247 LAMEA Meatballs Market by Country, 2022 - 2028, USD Thousands

TABLE 248 LAMEA Hot Dogs Market by Country, 2018 - 2021, USD Thousands

TABLE 249 LAMEA Hot Dogs Market by Country, 2022 - 2028, USD Thousands

TABLE 250 LAMEA Cultured Meat Market by Country, 2018 - 2021, USD Thousands

TABLE 251 LAMEA Cultured Meat Market by Country, 2022 - 2028, USD Thousands

TABLE 252 Brazil Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 253 Brazil Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 254 Brazil Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 255 Brazil Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 256 Brazil Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 257 Brazil Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 258 Argentina Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 259 Argentina Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 260 Argentina Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 261 Argentina Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 262 Argentina Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 263 Argentina Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 264 UAE Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 265 UAE Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 266 UAE Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 267 UAE Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 268 UAE Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 269 UAE Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 270 Egypt Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 271 Egypt Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 272 Egypt Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 273 Egypt Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 274 Egypt Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 275 Egypt Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 276 South Africa Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 277 South Africa Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 278 South Africa Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 279 South Africa Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 280 South Africa Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 281 South Africa Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 282 Nigeria Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 283 Nigeria Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 284 Nigeria Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 285 Nigeria Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 286 Nigeria Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 287 Nigeria Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 288 Rest of LAMEA Cultured Meat Market, 2018 - 2021, USD Thousands

TABLE 289 Rest of LAMEA Cultured Meat Market, 2022 - 2028, USD Thousands

TABLE 290 Rest of LAMEA Cultured Meat Market by Source, 2018 - 2021, USD Thousands

TABLE 291 Rest of LAMEA Cultured Meat Market by Source, 2022 - 2028, USD Thousands

TABLE 292 Rest of LAMEA Cultured Meat Market by End-use, 2018 - 2021, USD Thousands

TABLE 293 Rest of LAMEA Cultured Meat Market by End-use, 2022 - 2028, USD Thousands

TABLE 294 Key Information – Eat Just, Inc.

TABLE 295 Key Information – Integriculture Co., Ltd.

TABLE 296 Key Information – Avant Meats Company Limited

TABLE 297 Key Information – Future Meat Technologies Ltd.

TABLE 298 Key Information – Mosa Meat BV

TABLE 299 Key Information – Supermeat The Essence of Meat Ltd.

TABLE 300 Key Information – Aleph Farms

TABLE 301 Key Information – Finless Foods, Inc.

TABLE 302 Key Information – Upside Foods, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Key Leading Strategies: Percentage Distribution (2018-2022)

FIG 3 Key Strategic Move: (Partnerships, collaborations and agreements : 2020, Jan – 2022, mar) Leading Players

FIG 4 Global Cultured Meat Market Share by Source, 2021

FIG 5 Global Cultured Meat Market Share by Source, 2028

FIG 6 Global Cultured Meat Market by Source, 2018 - 2028, USD Thousands

FIG 7 Global Cultured Meat Market Share by End-use, 2021

FIG 8 Global Cultured Meat Market Share by End-use, 2028

FIG 9 Global Cultured Meat Market by End-use, 2018 - 2028, USD Thousands

FIG 10 Global Cultured Meat Market Share by Region, 2021

FIG 11 Global Cultured Meat Market Share by Region, 2028

FIG 12 Global Cultured Meat Market by Region, 2018 - 2028, USD Thousands

FIG 13 Recent strategies and developments: Eat Just, Inc.

FIG 14 Recent strategies and developments: Integriculture Co. Ltd.