Global Automotive Thermal System Market Size, Share & Industry Trends Analysis Report By Propulsion (ICE Vehicles and Electric & Hybrid Vehicles), By Application, By Vehicle Type, By Regional Outlook and Forecast, 2022 - 2028

Published Date : 31-May-2022 | Pages: 228 | Formats: PDF |

COVID-19 Impact on the Automotive Thermal System Market

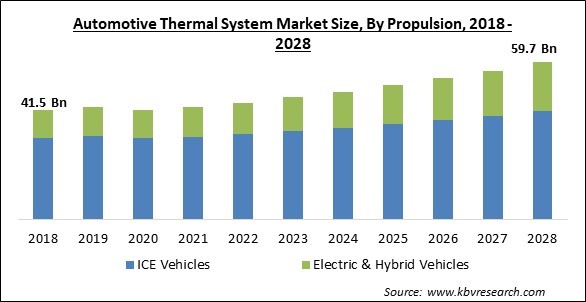

The Global Automotive Thermal System Market size is expected to reach $59.7 billion by 2028, rising at a market growth of 5.0% CAGR during the forecast period.

Automotive thermal system is a system that regulates and controls the temperature of prime automotive components through alternative engine block monitoring temperatures and reduced temperature component fluctuations. It regulates the temperature of numerous components in automobiles, including the battery, motor, and cabin, to improve performance, fuel economy, and comfort. Through seat heaters, front air-conditioning system, and rear air conditioning, improved heat management allows automotive components to work in the optimal temperature range while also providing greater comfort in the vehicle interior.

The demand for this technology would surge as more people choose electric vehicles as a result of increasing concern for the environment and the enforcement of strict emission standards as well as rising prices of fuels. Electric vehicles are adopted by several countries throughout the world to meet their net zero-emission targets. Furthermore, incorporating a thermal system into an electric vehicle improves battery performance and effective range. In addition, the automotive industry is emphasizing the need for greater driving qualities and heat shielding for cabin comfort. Due to heat dissipation, the ever-increasing number of electrical components within vehicles needs stronger thermal management systems.

Automobile manufacturers across the world are focusing on the development of electric and hybrid vehicles. Several manufacturers have started to produce electrical equipment such as electric compressors and battery cooling equipment for electric and hybrid vehicles in the context of electric vehicles. For example, Johnson Electric introduced a high-power electric compressor in August 2021, which helps to reduce heat produced by the batteries while high-rate fast-charging stations for electric vehicles.

COVID-19 Impact Analysis

The COVID-19 crisis caused market uncertainty, a severe slowdown in the supply chain, a drop in corporate confidence, and an increase in panic among client segments. Governments in various regions imposed complete lockdown as well as temporary suspension of operations among organizations, negatively impacting overall automobile thermal system production and sales. In addition, the supply chain disruptions caused by the pandemic resulted in a shutdown of automotive production facilities, which caused poor passenger car sales around the world.

Market Growth Factors:

Electric vehicle demand is on the rise

The automobile industry all over the world has shifted its focus toward producing efficient, inexpensive, long-range battery-powered passenger cars that can compete with and eventually replace fossil-fuel vehicles in recent years. However, the design of battery electric vehicles (BEVs) and the infrastructure requirements for mixed and plug-in hybrid and electric vehicles are being developed. Fast charging methods would also aid in the development of long-range batteries with easy access to charging infrastructure. It's crucial that auxiliary loads like cabin heating and cooling, and electric car components, do not degrade vehicle range. Because the amount of wasted heat energy in BEVs is so minimal, these cars demand more efficient auxiliary systems.

Increasing Demand for luxury vehicles with enhanced features and comfort

Luxury automobiles come with high levels of safety and modern technology. They are equipped with features such as heated and cold airbags, seats, and heated steering wheels. The demand for luxury vehicles has increased as disposable income and living standards have improved. Advanced thermal systems are being integrated into luxury automobiles to enhance performance and energy efficiency. As a result, the automotive thermal system market is projected to grow at a rapid pace. The electric grid and its automotive integrated thermal management system have received broad attention as essential components of modern vehicle technology are pursuing high performance and lightweight in automobile design.

Marketing Restraining Factor:

The lack of consistency in automotive thermal system

Local or regional producers must adhere to the regulating body's emission regulations or norms. However, since emission restrictions vary according to the area and region, a lack of standardization might make it difficult to export thermal systems. In addition, emission reduction is required in numerous developed and underdeveloped countries. In undeveloped countries, however, such regulation does not exist. As a result of the absence of standardization, producers are unable to source raw materials or inventory, hampering the export business. Low-volume production by manufacturers results in high production costs. Engine technology must be upgraded according to the particular standards that are imposed by the administration of the country.

Propulsion Outlook

Based on Propulsion, the market is segmented into ICE Vehicles and Electric & Hybrid Vehicles. The ICE segment acquired the highest revenue share in the Thermal System Market in 2021. The rising growth of this segment is attributed to the fact that internal combustion engines (ICE) are the most popular type of heat engine, with applications in ships, boats, aero planes, trains, and automobiles. They are increasingly gaining popularity because gas is burned for the engine to run. The same fuel and air mixture is ejected as exhaust. A piston or a turbine can be used to accomplish this. Internal combustion heat engines are based on the ideal gas law, which states that increasing the temperature of gas raises the pressure, causing the gas to expand. In an internal combustion engine, fuel is introduced to a chamber, which ignites to enhance the temperature of the gas.

Application Outlook

Based on Application, the market is segmented into HVAC, Powertrain Cooling, Fluid Transport, and Others. The Powertrain Cooling segment witnessed a significant revenue share in the Automotive Thermal System Market in 2021. Thermal management is important for reducing emissions, increasing efficiency, and extending the range of conventional combustion, hybrid, and electric vehicles. Its primary role is temperature management in the engine cooling system, but it also controls the temperature of many other components in the drive train, including turbo cooling, gearbox cooling, transmission cooling, and indoor temperature. Because the thermal module is adjacent to the engine, it must operate over a wide temperature range of -40°C to 160°C without leaking. In addition, for accurate valve control, very minimal friction and no stick-slip are necessary. Due to this, the demand for this segment is increasing.

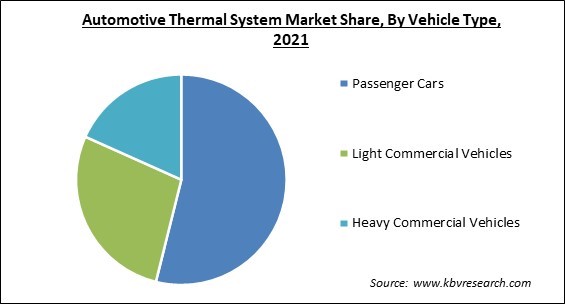

Vehicle Type Outlook

Based on Vehicle Type, the market is segmented into Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. The passenger car segment garnered the largest revenue share in the Automotive Thermal System Market in 2021. The increasing growth of this segment is attributed to the increased penetration of sophisticated comfort features, strict government requirements for vehicle emissions, and advancements in thermal system solutions. In addition, increased per capita disposable income and a higher standard of living are two major reasons driving passenger car sales in many countries. Moreover, the market is likely to be driven by a growing demand for comfort and luxury, as well as increased demand for advanced amenities such as heated steering, heated/ventilated seats, and rear air conditioning.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 42.8 Billion |

| Market size forecast in 2028 | USD 59.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5% from 2022 to 2028 |

| Number of Pages | 227 |

| Number of Tables | 354 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Propulsion, Vehicle Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, Asia Pacific procured the largest revenue share in the Automotive Thermal System Market. The rising growth of this region is owing to the growth of the region as a manufacturing hub for automobiles. OEMs have increased automotive manufacturing in the region due to evolving consumer demands, rising middle-class per capita income, and cost benefits. As a result, automobile production in India, China, and Japan has increased significantly. The region's vast vehicle production presents major great potential for the automotive thermal system market. The Asia Pacific is also a suitable market for automobile OEMs due to the favorable investing and the availability of low-cost labor. In this region, increased demand for premium cars with improved cabin comfort has boosted the consumption of automotive thermal systems.

Free Valuable Insights: Global Automotive Thermal System Market size to reach USD 59.7 Billion by 2028

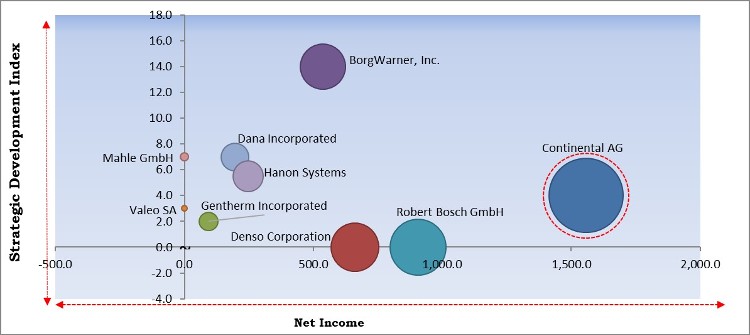

KBV Cardinal Matrix - Automotive Thermal System Market Competition Analysis

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Continental AG is the major forerunner in the Automotive Thermal System Market. Companies such as BorgWarner, Inc., Dana Incorporated and Mahle GmbH are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include BorgWarner, Inc., Robert Bosch GmbH, Continental AG, Denso Corporation, Dana Incorporated, Valeo SA, Hanon Systems, Mahle GmbH, Gentherm Incorporated, and Grayson Automotive Services Limited.

Recent Strategies Deployed in Automotive Thermal System Market

» Partnerships, Collaborations and Agreements:

- Aug-2021: BorgWarner came into a partnership with ZEEKR Intelligent Technology, a new electric mobility technology, and solutions brand. Through this partnership, the companies aimed to enhance battery-operated collection by commanding the battery temperature at an ideal level while also improving traveler comfort by providing an optimum internal climate.

» Acquisitions and Mergers:

- Apr-2022: BorgWarner took over Santroll Automotive Components, a carve-out of Santroll’s eMotor enterprise. Through this acquisition, the company aimed to reinforce BorgWarner’s vertical scale, combination and offering depth in light vehicle e-motors while enabling for growing pace to market.

- Feb-2022: BorgWarner took over AKASOL, a German manufacturer of batteries for electric vehicles. Under this acquisition, the company is predicted to bolster the enterprise's commercial vehicle and organizational electrification abilities, which positions the enterprise to exploit what it believes to be a rapidly growing battery systems market.

- Feb-2021: MAHLE completed the acquisition of Keihin Corporation, a Japanese automotive and motorcycle parts company. Through this acquisition, the companies aimed to reinforce their existence and consumer affiliation in Asia and North America in an enterprise area that would become even more crucial not only for ordinary drives but specifically for alternative drives.

- Oct-2020: BorgWarner acquired Delphi Techno, which delivers a comprehensive range of proven software solutions. This acquisition aimed to reinforce BorgWarner’s electronics and power electronics abilities, products, and scale.

- Aug-2020: Continental formed a joint venture with aft automotive, the suppliers for the modern automotive industry. Through this joint venture, the companies aimed to produce integration made of high-performance plastics for future flexibility. Additionally, the joint venture would improve skills as a system provider and allow us to constantly expand technological competence in efficient plastics for the future.

» Product Launches and Product Expansions:

- Sep-2021: MAHLE unveiled its entire new cooling system for batteries. Under this launch, an electrically nonconductive coolant flows around the cells, thus ensuring that the maximum temperature of the battery drops markedly while charging and overall temperature is fragmented much more homogeneously. In addition, Immersion cooling woul reduce the charging times in electric cars significantly.

- Nov-2020: Valeo unveiled a fully combined dense electric powertrain system in India. The enhanced powertrain technology from Valeo would aid electrification at an economical price for tiny flexibility vehicles, two and three-wheelers that are completely utilized for the first and last mile in accordance in the country.

» Geographical Expansions:

- Mar-2022: Hanon Systems expanded its new plant in Hubei, China to strengthen the enterprise growing support to manufacturers in the electrified vehicle segment. This expansion would start the production of heating, ventilation, and air conditioning component for electric vehicles.

- Sep-2021: Hanon Systems expanded its two-site inaugurations in Hungary, a new greenfield production facility in Pécs, and a building expansion in Rétság. The new expansion facility offers 22,464 square meters of production space and contains gears such as welding, brazing, bending, and forming assembly lines and a trial for automotive air conditioning lines.

- Mar-2021: Hanon Systems expanded its construction of the fifth site in Korea. This expansion aimed to manufacture a range of solutions such as coolant valve assemblies and heat pump modules to support electric vehicles for the Genesis brand and Ioniq 5 representation of the Hyundai Motor Group. Additionally, Hanon Systems predict the Gyeongju facility would provide ecological solutions on around 300,000 electric vehicles by 2024.

Scope of the Study

Market Segments Covered in the Report:

By Propulsion

- ICE Vehicles

- Electric & Hybrid Vehicles

By Application

- HVAC

- Powertrain Cooling

- Fluid Transport

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- BorgWarner, Inc.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Dana Incorporated

- Valeo SA

- Hanon Systems

- Mahle GmbH

- Gentherm Incorporated

- Grayson Automotive Services Limited

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Automotive Thermal System Market, by Propulsion

1.4.2 Global Automotive Thermal System Market, by Application

1.4.3 Global Automotive Thermal System Market, by Vehicle Type

1.4.4 Global Automotive Thermal System Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.2.4 Geographical Expansions

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.3.2 Key Strategic Move: (Acquisitions and Mergers: 2019, Mar – 2022, Apr) Leading Players

Chapter 4. Global Automotive Thermal System Market by Propulsion

4.1 Global ICE Vehicles Market by Region

4.2 Global Electric & Hybrid Vehicles Market by Region

Chapter 5. Global Automotive Thermal System Market by Application

5.1 Global HVAC Market by Region

5.2 Global Powertrain Cooling Market by Region

5.3 Global Fluid Transport Market by Region

5.4 Global Others Market by Region

Chapter 6. Global Automotive Thermal System Market by Vehicle Type

6.1 Global Passenger Cars Market by Region

6.2 Global Light Commercial Vehicles Market by Region

6.3 Global Heavy Commercial Vehicles Market by Region

Chapter 7. Global Automotive Thermal System Market by Region

7.1 North America Automotive Thermal System Market

7.1.1 North America Automotive Thermal System Market by Propulsion

7.1.1.1 North America ICE Vehicles Market by Country

7.1.1.2 North America Electric & Hybrid Vehicles Market by Country

7.1.2 North America Automotive Thermal System Market by Application

7.1.2.1 North America HVAC Market by Country

7.1.2.2 North America Powertrain Cooling Market by Country

7.1.2.3 North America Fluid Transport Market by Country

7.1.2.4 North America Others Market by Country

7.1.3 North America Automotive Thermal System Market by Vehicle Type

7.1.3.1 North America Passenger Cars Market by Country

7.1.3.2 North America Light Commercial Vehicles Market by Country

7.1.3.3 North America Heavy Commercial Vehicles Market by Country

7.1.4 North America Automotive Thermal System Market by Country

7.1.4.1 US Automotive Thermal System Market

7.1.4.1.1 US Automotive Thermal System Market by Propulsion

7.1.4.1.2 US Automotive Thermal System Market by Application

7.1.4.1.3 US Automotive Thermal System Market by Vehicle Type

7.1.4.2 Canada Automotive Thermal System Market

7.1.4.2.1 Canada Automotive Thermal System Market by Propulsion

7.1.4.2.2 Canada Automotive Thermal System Market by Application

7.1.4.2.3 Canada Automotive Thermal System Market by Vehicle Type

7.1.4.3 Mexico Automotive Thermal System Market

7.1.4.3.1 Mexico Automotive Thermal System Market by Propulsion

7.1.4.3.2 Mexico Automotive Thermal System Market by Application

7.1.4.3.3 Mexico Automotive Thermal System Market by Vehicle Type

7.1.4.4 Rest of North America Automotive Thermal System Market

7.1.4.4.1 Rest of North America Automotive Thermal System Market by Propulsion

7.1.4.4.2 Rest of North America Automotive Thermal System Market by Application

7.1.4.4.3 Rest of North America Automotive Thermal System Market by Vehicle Type

7.2 Europe Automotive Thermal System Market

7.2.1 Europe Automotive Thermal System Market by Propulsion

7.2.1.1 Europe ICE Vehicles Market by Country

7.2.1.2 Europe Electric & Hybrid Vehicles Market by Country

7.2.2 Europe Automotive Thermal System Market by Application

7.2.2.1 Europe HVAC Market by Country

7.2.2.2 Europe Powertrain Cooling Market by Country

7.2.2.3 Europe Fluid Transport Market by Country

7.2.2.4 Europe Others Market by Country

7.2.3 Europe Automotive Thermal System Market by Vehicle Type

7.2.3.1 Europe Passenger Cars Market by Country

7.2.3.2 Europe Light Commercial Vehicles Market by Country

7.2.3.3 Europe Heavy Commercial Vehicles Market by Country

7.2.4 Europe Automotive Thermal System Market by Country

7.2.4.1 Germany Automotive Thermal System Market

7.2.4.1.1 Germany Automotive Thermal System Market by Propulsion

7.2.4.1.2 Germany Automotive Thermal System Market by Application

7.2.4.1.3 Germany Automotive Thermal System Market by Vehicle Type

7.2.4.2 UK Automotive Thermal System Market

7.2.4.2.1 UK Automotive Thermal System Market by Propulsion

7.2.4.2.2 UK Automotive Thermal System Market by Application

7.2.4.2.3 UK Automotive Thermal System Market by Vehicle Type

7.2.4.3 France Automotive Thermal System Market

7.2.4.3.1 France Automotive Thermal System Market by Propulsion

7.2.4.3.2 France Automotive Thermal System Market by Application

7.2.4.3.3 France Automotive Thermal System Market by Vehicle Type

7.2.4.4 Russia Automotive Thermal System Market

7.2.4.4.1 Russia Automotive Thermal System Market by Propulsion

7.2.4.4.2 Russia Automotive Thermal System Market by Application

7.2.4.4.3 Russia Automotive Thermal System Market by Vehicle Type

7.2.4.5 Spain Automotive Thermal System Market

7.2.4.5.1 Spain Automotive Thermal System Market by Propulsion

7.2.4.5.2 Spain Automotive Thermal System Market by Application

7.2.4.5.3 Spain Automotive Thermal System Market by Vehicle Type

7.2.4.6 Italy Automotive Thermal System Market

7.2.4.6.1 Italy Automotive Thermal System Market by Propulsion

7.2.4.6.2 Italy Automotive Thermal System Market by Application

7.2.4.6.3 Italy Automotive Thermal System Market by Vehicle Type

7.2.4.7 Rest of Europe Automotive Thermal System Market

7.2.4.7.1 Rest of Europe Automotive Thermal System Market by Propulsion

7.2.4.7.2 Rest of Europe Automotive Thermal System Market by Application

7.2.4.7.3 Rest of Europe Automotive Thermal System Market by Vehicle Type

7.3 Asia Pacific Automotive Thermal System Market

7.3.1 Asia Pacific Automotive Thermal System Market by Propulsion

7.3.1.1 Asia Pacific ICE Vehicles Market by Country

7.3.1.2 Asia Pacific Electric & Hybrid Vehicles Market by Country

7.3.2 Asia Pacific Automotive Thermal System Market by Application

7.3.2.1 Asia Pacific HVAC Market by Country

7.3.2.2 Asia Pacific Powertrain Cooling Market by Country

7.3.2.3 Asia Pacific Fluid Transport Market by Country

7.3.2.4 Asia Pacific Others Market by Country

7.3.3 Asia Pacific Automotive Thermal System Market by Vehicle Type

7.3.3.1 Asia Pacific Passenger Cars Market by Country

7.3.3.2 Asia Pacific Light Commercial Vehicles Market by Country

7.3.3.3 Asia Pacific Heavy Commercial Vehicles Market by Country

7.3.4 Asia Pacific Automotive Thermal System Market by Country

7.3.4.1 China Automotive Thermal System Market

7.3.4.1.1 China Automotive Thermal System Market by Propulsion

7.3.4.1.2 China Automotive Thermal System Market by Application

7.3.4.1.3 China Automotive Thermal System Market by Vehicle Type

7.3.4.2 Japan Automotive Thermal System Market

7.3.4.2.1 Japan Automotive Thermal System Market by Propulsion

7.3.4.2.2 Japan Automotive Thermal System Market by Application

7.3.4.2.3 Japan Automotive Thermal System Market by Vehicle Type

7.3.4.3 India Automotive Thermal System Market

7.3.4.3.1 India Automotive Thermal System Market by Propulsion

7.3.4.3.2 India Automotive Thermal System Market by Application

7.3.4.3.3 India Automotive Thermal System Market by Vehicle Type

7.3.4.4 South Korea Automotive Thermal System Market

7.3.4.4.1 South Korea Automotive Thermal System Market by Propulsion

7.3.4.4.2 South Korea Automotive Thermal System Market by Application

7.3.4.4.3 South Korea Automotive Thermal System Market by Vehicle Type

7.3.4.5 Singapore Automotive Thermal System Market

7.3.4.5.1 Singapore Automotive Thermal System Market by Propulsion

7.3.4.5.2 Singapore Automotive Thermal System Market by Application

7.3.4.5.3 Singapore Automotive Thermal System Market by Vehicle Type

7.3.4.6 Malaysia Automotive Thermal System Market

7.3.4.6.1 Malaysia Automotive Thermal System Market by Propulsion

7.3.4.6.2 Malaysia Automotive Thermal System Market by Application

7.3.4.6.3 Malaysia Automotive Thermal System Market by Vehicle Type

7.3.4.7 Rest of Asia Pacific Automotive Thermal System Market

7.3.4.7.1 Rest of Asia Pacific Automotive Thermal System Market by Propulsion

7.3.4.7.2 Rest of Asia Pacific Automotive Thermal System Market by Application

7.3.4.7.3 Rest of Asia Pacific Automotive Thermal System Market by Vehicle Type

7.4 LAMEA Automotive Thermal System Market

7.4.1 LAMEA Automotive Thermal System Market by Propulsion

7.4.1.1 LAMEA ICE Vehicles Market by Country

7.4.1.2 LAMEA Electric & Hybrid Vehicles Market by Country

7.4.2 LAMEA Automotive Thermal System Market by Application

7.4.2.1 LAMEA HVAC Market by Country

7.4.2.2 LAMEA Powertrain Cooling Market by Country

7.4.2.3 LAMEA Fluid Transport Market by Country

7.4.2.4 LAMEA Others Market by Country

7.4.3 LAMEA Automotive Thermal System Market by Vehicle Type

7.4.3.1 LAMEA Passenger Cars Market by Country

7.4.3.2 LAMEA Light Commercial Vehicles Market by Country

7.4.3.3 LAMEA Heavy Commercial Vehicles Market by Country

7.4.4 LAMEA Automotive Thermal System Market by Country

7.4.4.1 Brazil Automotive Thermal System Market

7.4.4.1.1 Brazil Automotive Thermal System Market by Propulsion

7.4.4.1.2 Brazil Automotive Thermal System Market by Application

7.4.4.1.3 Brazil Automotive Thermal System Market by Vehicle Type

7.4.4.2 Argentina Automotive Thermal System Market

7.4.4.2.1 Argentina Automotive Thermal System Market by Propulsion

7.4.4.2.2 Argentina Automotive Thermal System Market by Application

7.4.4.2.3 Argentina Automotive Thermal System Market by Vehicle Type

7.4.4.3 UAE Automotive Thermal System Market

7.4.4.3.1 UAE Automotive Thermal System Market by Propulsion

7.4.4.3.2 UAE Automotive Thermal System Market by Application

7.4.4.3.3 UAE Automotive Thermal System Market by Vehicle Type

7.4.4.4 Saudi Arabia Automotive Thermal System Market

7.4.4.4.1 Saudi Arabia Automotive Thermal System Market by Propulsion

7.4.4.4.2 Saudi Arabia Automotive Thermal System Market by Application

7.4.4.4.3 Saudi Arabia Automotive Thermal System Market by Vehicle Type

7.4.4.5 South Africa Automotive Thermal System Market

7.4.4.5.1 South Africa Automotive Thermal System Market by Propulsion

7.4.4.5.2 South Africa Automotive Thermal System Market by Application

7.4.4.5.3 South Africa Automotive Thermal System Market by Vehicle Type

7.4.4.6 Nigeria Automotive Thermal System Market

7.4.4.6.1 Nigeria Automotive Thermal System Market by Propulsion

7.4.4.6.2 Nigeria Automotive Thermal System Market by Application

7.4.4.6.3 Nigeria Automotive Thermal System Market by Vehicle Type

7.4.4.7 Rest of LAMEA Automotive Thermal System Market

7.4.4.7.1 Rest of LAMEA Automotive Thermal System Market by Propulsion

7.4.4.7.2 Rest of LAMEA Automotive Thermal System Market by Application

7.4.4.7.3 Rest of LAMEA Automotive Thermal System Market by Vehicle Type

Chapter 8. Company Profiles

8.1 BorgWarner, Inc.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Regional & Segmental Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Partnerships, Collaborations, and Agreements:

8.1.5.2 Acquisition and Mergers:

8.2 Robert Bosch GmbH

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.3 Continental AG

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Acquisition and Mergers:

8.3.6 SWOT Analysis

8.4 Denso Corporation

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Regional Analysis

8.4.4 Research & Development Expense

8.5 Dana Incorporated

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expenses

8.5.5 Recent strategies and developments:

8.5.5.1 Product Launches and Product Expansions:

8.5.5.2 Acquisition and Mergers:

8.6 Valeo SA

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expense

8.6.5 Recent strategies and developments:

8.6.5.1 Product Launches and Product Expansions:

8.7 Hanon Systems (Hahn & Co. Auto Holdings Co., Ltd.)

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Regional Analysis

8.7.4 Research & Development Expense

8.7.5 Recent strategies and developments:

8.7.5.1 Acquisition and Mergers:

8.7.5.2 Geographical Expansions:

8.8 Mahle GmbH (Mahle Stiftung GmbH)

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.8.4 Research & Development Expense

8.8.5 Recent strategies and developments:

8.8.5.1 Product Launches and Product Expansions:

8.8.5.2 Acquisition and Mergers:

8.9 Gentherm Incorporated

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.9.4 Research & Development Expenses

8.9.5 Recent strategies and developments:

8.9.5.1 Partnerships, Collaborations, and Agreements:

8.10. Grayson Automotive Services Limited

8.10.1 Company Overview

TABLE 2 Global Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 3 Partnerships, Collaborations and Agreements – Automotive Thermal System Market

TABLE 4 Product Launches And Product Expansions – Automotive Thermal System Market

TABLE 5 Acquisition and Mergers – Automotive Thermal System Market

TABLE 6 Geographical Expansions – Automotive Thermal System Market

TABLE 7 Global Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 8 Global Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 9 Global ICE Vehicles Market by Region, 2018 - 2021, USD Million

TABLE 10 Global ICE Vehicles Market by Region, 2022 - 2028, USD Million

TABLE 11 Global Electric & Hybrid Vehicles Market by Region, 2018 - 2021, USD Million

TABLE 12 Global Electric & Hybrid Vehicles Market by Region, 2022 - 2028, USD Million

TABLE 13 Global Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 14 Global Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 15 Global HVAC Market by Region, 2018 - 2021, USD Million

TABLE 16 Global HVAC Market by Region, 2022 - 2028, USD Million

TABLE 17 Global Powertrain Cooling Market by Region, 2018 - 2021, USD Million

TABLE 18 Global Powertrain Cooling Market by Region, 2022 - 2028, USD Million

TABLE 19 Global Fluid Transport Market by Region, 2018 - 2021, USD Million

TABLE 20 Global Fluid Transport Market by Region, 2022 - 2028, USD Million

TABLE 21 Global Others Market by Region, 2018 - 2021, USD Million

TABLE 22 Global Others Market by Region, 2022 - 2028, USD Million

TABLE 23 Global Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 24 Global Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 25 Global Passenger Cars Market by Region, 2018 - 2021, USD Million

TABLE 26 Global Passenger Cars Market by Region, 2022 - 2028, USD Million

TABLE 27 Global Light Commercial Vehicles Market by Region, 2018 - 2021, USD Million

TABLE 28 Global Light Commercial Vehicles Market by Region, 2022 - 2028, USD Million

TABLE 29 Global Heavy Commercial Vehicles Market by Region, 2018 - 2021, USD Million

TABLE 30 Global Heavy Commercial Vehicles Market by Region, 2022 - 2028, USD Million

TABLE 31 Global Automotive Thermal System Market by Region, 2018 - 2021, USD Million

TABLE 32 Global Automotive Thermal System Market by Region, 2022 - 2028, USD Million

TABLE 33 North America Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 34 North America Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 35 North America Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 36 North America Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 37 North America ICE Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 38 North America ICE Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 39 North America Electric & Hybrid Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 40 North America Electric & Hybrid Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 41 North America Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 42 North America Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 43 North America HVAC Market by Country, 2018 - 2021, USD Million

TABLE 44 North America HVAC Market by Country, 2022 - 2028, USD Million

TABLE 45 North America Powertrain Cooling Market by Country, 2018 - 2021, USD Million

TABLE 46 North America Powertrain Cooling Market by Country, 2022 - 2028, USD Million

TABLE 47 North America Fluid Transport Market by Country, 2018 - 2021, USD Million

TABLE 48 North America Fluid Transport Market by Country, 2022 - 2028, USD Million

TABLE 49 North America Others Market by Country, 2018 - 2021, USD Million

TABLE 50 North America Others Market by Country, 2022 - 2028, USD Million

TABLE 51 North America Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 52 North America Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 53 North America Passenger Cars Market by Country, 2018 - 2021, USD Million

TABLE 54 North America Passenger Cars Market by Country, 2022 - 2028, USD Million

TABLE 55 North America Light Commercial Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 56 North America Light Commercial Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 57 North America Heavy Commercial Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 58 North America Heavy Commercial Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 59 North America Automotive Thermal System Market by Country, 2018 - 2021, USD Million

TABLE 60 North America Automotive Thermal System Market by Country, 2022 - 2028, USD Million

TABLE 61 US Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 62 US Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 63 US Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 64 US Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 65 US Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 66 US Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 67 US Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 68 US Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 69 Canada Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 70 Canada Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 71 Canada Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 72 Canada Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 73 Canada Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 74 Canada Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 75 Canada Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 76 Canada Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 77 Mexico Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 78 Mexico Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 79 Mexico Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 80 Mexico Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 81 Mexico Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 82 Mexico Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 83 Mexico Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 84 Mexico Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 85 Rest of North America Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 86 Rest of North America Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 87 Rest of North America Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 88 Rest of North America Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 89 Rest of North America Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 90 Rest of North America Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 91 Rest of North America Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 92 Rest of North America Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 93 Europe Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 94 Europe Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 95 Europe Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 96 Europe Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 97 Europe ICE Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 98 Europe ICE Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 99 Europe Electric & Hybrid Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 100 Europe Electric & Hybrid Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 101 Europe Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 102 Europe Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 103 Europe HVAC Market by Country, 2018 - 2021, USD Million

TABLE 104 Europe HVAC Market by Country, 2022 - 2028, USD Million

TABLE 105 Europe Powertrain Cooling Market by Country, 2018 - 2021, USD Million

TABLE 106 Europe Powertrain Cooling Market by Country, 2022 - 2028, USD Million

TABLE 107 Europe Fluid Transport Market by Country, 2018 - 2021, USD Million

TABLE 108 Europe Fluid Transport Market by Country, 2022 - 2028, USD Million

TABLE 109 Europe Others Market by Country, 2018 - 2021, USD Million

TABLE 110 Europe Others Market by Country, 2022 - 2028, USD Million

TABLE 111 Europe Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 112 Europe Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 113 Europe Passenger Cars Market by Country, 2018 - 2021, USD Million

TABLE 114 Europe Passenger Cars Market by Country, 2022 - 2028, USD Million

TABLE 115 Europe Light Commercial Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 116 Europe Light Commercial Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 117 Europe Heavy Commercial Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 118 Europe Heavy Commercial Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 119 Europe Automotive Thermal System Market by Country, 2018 - 2021, USD Million

TABLE 120 Europe Automotive Thermal System Market by Country, 2022 - 2028, USD Million

TABLE 121 Germany Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 122 Germany Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 123 Germany Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 124 Germany Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 125 Germany Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 126 Germany Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 127 Germany Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 128 Germany Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 129 UK Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 130 UK Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 131 UK Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 132 UK Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 133 UK Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 134 UK Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 135 UK Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 136 UK Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 137 France Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 138 France Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 139 France Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 140 France Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 141 France Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 142 France Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 143 France Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 144 France Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 145 Russia Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 146 Russia Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 147 Russia Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 148 Russia Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 149 Russia Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 150 Russia Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 151 Russia Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 152 Russia Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 153 Spain Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 154 Spain Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 155 Spain Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 156 Spain Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 157 Spain Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 158 Spain Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 159 Spain Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 160 Spain Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 161 Italy Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 162 Italy Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 163 Italy Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 164 Italy Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 165 Italy Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 166 Italy Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 167 Italy Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 168 Italy Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 169 Rest of Europe Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 170 Rest of Europe Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 171 Rest of Europe Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 172 Rest of Europe Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 173 Rest of Europe Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 174 Rest of Europe Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 175 Rest of Europe Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 176 Rest of Europe Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 177 Asia Pacific Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 178 Asia Pacific Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 179 Asia Pacific Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 180 Asia Pacific Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 181 Asia Pacific ICE Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 182 Asia Pacific ICE Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 183 Asia Pacific Electric & Hybrid Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 184 Asia Pacific Electric & Hybrid Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 185 Asia Pacific Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 186 Asia Pacific Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 187 Asia Pacific HVAC Market by Country, 2018 - 2021, USD Million

TABLE 188 Asia Pacific HVAC Market by Country, 2022 - 2028, USD Million

TABLE 189 Asia Pacific Powertrain Cooling Market by Country, 2018 - 2021, USD Million

TABLE 190 Asia Pacific Powertrain Cooling Market by Country, 2022 - 2028, USD Million

TABLE 191 Asia Pacific Fluid Transport Market by Country, 2018 - 2021, USD Million

TABLE 192 Asia Pacific Fluid Transport Market by Country, 2022 - 2028, USD Million

TABLE 193 Asia Pacific Others Market by Country, 2018 - 2021, USD Million

TABLE 194 Asia Pacific Others Market by Country, 2022 - 2028, USD Million

TABLE 195 Asia Pacific Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 196 Asia Pacific Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 197 Asia Pacific Passenger Cars Market by Country, 2018 - 2021, USD Million

TABLE 198 Asia Pacific Passenger Cars Market by Country, 2022 - 2028, USD Million

TABLE 199 Asia Pacific Light Commercial Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 200 Asia Pacific Light Commercial Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 201 Asia Pacific Heavy Commercial Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 202 Asia Pacific Heavy Commercial Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 203 Asia Pacific Automotive Thermal System Market by Country, 2018 - 2021, USD Million

TABLE 204 Asia Pacific Automotive Thermal System Market by Country, 2022 - 2028, USD Million

TABLE 205 China Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 206 China Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 207 China Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 208 China Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 209 China Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 210 China Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 211 China Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 212 China Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 213 Japan Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 214 Japan Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 215 Japan Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 216 Japan Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 217 Japan Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 218 Japan Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 219 Japan Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 220 Japan Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 221 India Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 222 India Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 223 India Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 224 India Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 225 India Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 226 India Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 227 India Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 228 India Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 229 South Korea Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 230 South Korea Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 231 South Korea Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 232 South Korea Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 233 South Korea Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 234 South Korea Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 235 South Korea Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 236 South Korea Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 237 Singapore Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 238 Singapore Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 239 Singapore Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 240 Singapore Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 241 Singapore Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 242 Singapore Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 243 Singapore Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 244 Singapore Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 245 Malaysia Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 246 Malaysia Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 247 Malaysia Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 248 Malaysia Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 249 Malaysia Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 250 Malaysia Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 251 Malaysia Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 252 Malaysia Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 253 Rest of Asia Pacific Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 254 Rest of Asia Pacific Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 255 Rest of Asia Pacific Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 256 Rest of Asia Pacific Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 257 Rest of Asia Pacific Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 258 Rest of Asia Pacific Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 259 Rest of Asia Pacific Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 260 Rest of Asia Pacific Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 261 LAMEA Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 262 LAMEA Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 263 LAMEA Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 264 LAMEA Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 265 LAMEA ICE Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 266 LAMEA ICE Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 267 LAMEA Electric & Hybrid Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 268 LAMEA Electric & Hybrid Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 269 LAMEA Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 270 LAMEA Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 271 LAMEA HVAC Market by Country, 2018 - 2021, USD Million

TABLE 272 LAMEA HVAC Market by Country, 2022 - 2028, USD Million

TABLE 273 LAMEA Powertrain Cooling Market by Country, 2018 - 2021, USD Million

TABLE 274 LAMEA Powertrain Cooling Market by Country, 2022 - 2028, USD Million

TABLE 275 LAMEA Fluid Transport Market by Country, 2018 - 2021, USD Million

TABLE 276 LAMEA Fluid Transport Market by Country, 2022 - 2028, USD Million

TABLE 277 LAMEA Others Market by Country, 2018 - 2021, USD Million

TABLE 278 LAMEA Others Market by Country, 2022 - 2028, USD Million

TABLE 279 LAMEA Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 280 LAMEA Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 281 LAMEA Passenger Cars Market by Country, 2018 - 2021, USD Million

TABLE 282 LAMEA Passenger Cars Market by Country, 2022 - 2028, USD Million

TABLE 283 LAMEA Light Commercial Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 284 LAMEA Light Commercial Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 285 LAMEA Heavy Commercial Vehicles Market by Country, 2018 - 2021, USD Million

TABLE 286 LAMEA Heavy Commercial Vehicles Market by Country, 2022 - 2028, USD Million

TABLE 287 LAMEA Automotive Thermal System Market by Country, 2018 - 2021, USD Million

TABLE 288 LAMEA Automotive Thermal System Market by Country, 2022 - 2028, USD Million

TABLE 289 Brazil Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 290 Brazil Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 291 Brazil Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 292 Brazil Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 293 Brazil Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 294 Brazil Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 295 Brazil Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 296 Brazil Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 297 Argentina Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 298 Argentina Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 299 Argentina Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 300 Argentina Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 301 Argentina Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 302 Argentina Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 303 Argentina Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 304 Argentina Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 305 UAE Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 306 UAE Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 307 UAE Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 308 UAE Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 309 UAE Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 310 UAE Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 311 UAE Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 312 UAE Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 313 Saudi Arabia Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 314 Saudi Arabia Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 315 Saudi Arabia Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 316 Saudi Arabia Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 317 Saudi Arabia Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 318 Saudi Arabia Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 319 Saudi Arabia Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 320 Saudi Arabia Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 321 South Africa Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 322 South Africa Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 323 South Africa Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 324 South Africa Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 325 South Africa Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 326 South Africa Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 327 South Africa Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 328 South Africa Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 329 Nigeria Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 330 Nigeria Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 331 Nigeria Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 332 Nigeria Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 333 Nigeria Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 334 Nigeria Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 335 Nigeria Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 336 Nigeria Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 337 Rest of LAMEA Automotive Thermal System Market, 2018 - 2021, USD Million

TABLE 338 Rest of LAMEA Automotive Thermal System Market, 2022 - 2028, USD Million

TABLE 339 Rest of LAMEA Automotive Thermal System Market by Propulsion, 2018 - 2021, USD Million

TABLE 340 Rest of LAMEA Automotive Thermal System Market by Propulsion, 2022 - 2028, USD Million

TABLE 341 Rest of LAMEA Automotive Thermal System Market by Application, 2018 - 2021, USD Million

TABLE 342 Rest of LAMEA Automotive Thermal System Market by Application, 2022 - 2028, USD Million

TABLE 343 Rest of LAMEA Automotive Thermal System Market by Vehicle Type, 2018 - 2021, USD Million

TABLE 344 Rest of LAMEA Automotive Thermal System Market by Vehicle Type, 2022 - 2028, USD Million

TABLE 345 Key Information – BorgWarner, Inc.

TABLE 346 key information – Robert Bosch GmbH

TABLE 347 Key Information – Continental AG

TABLE 348 key information – Denso Corporation

TABLE 349 Key Information – Dana Incorporated

TABLE 350 key information – Valeo SA

TABLE 351 Key information – Hanon Systems

TABLE 352 Key information – Mahle GmbH

TABLE 353 Key Information – Gentherm Incorporated

TABLE 354 Key Information – Grayson Automotive Services Limited

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2018-2022)

FIG 4 Key Strategic Move: (Acquisitions and Mergers: 2019, Mar – 2022, Apr) Leading Players

FIG 5 Global Automotive Thermal System Market Share by Propulsion, 2021

FIG 6 Global Automotive Thermal System Market Share by Propulsion, 2028

FIG 7 Global Automotive Thermal System Market by Propulsion, 2018 - 2028, USD Million

FIG 8 Global Automotive Thermal System Market Share by Application, 2021

FIG 9 Global Automotive Thermal System Market Share by Application, 2028

FIG 10 Global Automotive Thermal System Market by Application, 2018 - 2028, USD Million

FIG 11 Global Automotive Thermal System Market Share by Vehicle Type, 2021

FIG 12 Global Automotive Thermal System Market Share by Vehicle Type, 2028

FIG 13 Global Automotive Thermal System Market by Vehicle Type, 2018 - 2028, USD Million

FIG 14 Global Automotive Thermal System Market Share by Region, 2021

FIG 15 Global Automotive Thermal System Market Share by Region, 2028

FIG 16 Global Automotive Thermal System Market by Region, 2018 - 2028, USD Million

FIG 17 Recent strategies and developments: BorgWarner, Inc.

FIG 18 SWOT Analysis: Continental AG

FIG 19 Recent strategies and developments: Hanon Systems