Asia Pacific Video As A Sensor Market Size, Share & Industry Analysis Report By Offering (Hardware, Software, and Services), By Product (Video Surveillance, Machine Vision & Monitoring, Thermal Imaging, and Hyperspectral Imaging), By End-Use (Commercial, Industrial, Government, and Other End-Use), By Application, By Country and Growth Forecast, 2025 - 2032

Published Date : 28-Jul-2025 |

Pages: 195 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific Video As A Sensor Market

The Asia Pacific Video as a Sensor Market would witness market growth of 8.6% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Video As A Sensor Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $13,911.8 million by 2032. The Japan market is registering a CAGR of 7.9% during (2025 - 2032). Additionally, The India market would showcase a CAGR of 9.4% during (2025 - 2032).

Government-supported smart city schemes and OEM innovation have changed the video surveillance scene in Asia Pacific into an intelligent, sensor-driven ecosystem. The Smart Nation Sensor Platform in Singapore is a great example of this. It was part of the country's Smart Nation effort, which started in November 2014. This platform combines video with data from various sensors on lampposts and transportation hubs to help with mobility, safety monitoring, and city administration.

Free Valuable Insights: The Global Video As A Sensor Market is Predict to reach USD 131.73 Billion by 2032, at a CAGR of 8.1%

Government-Side Smart Surveillance Efforts

- Better Use of Video Systems: Government agencies are increasingly employing networked video systems to not only record, but also evaluate topics like air quality, traffic, and crowds in real time.

- Real-Time Action Through a Central Hub: The Smart Nation Operations Centre handles all of this data, which enables officials swiftly respond to things like traffic congestion or public events.

Panasonic’s Innovation in Camera Technology

- AI Built Right Into Cameras: i-PRO, a Panasonic spin-off, makes cameras that can find people or events on their own without having a central computer. This saves time and energy.

Key Market Trends in the Asia Pacific Video as a Sensor Market

1. Smart Cities Driving Demand for Edge-Based Video Sensing

Governments across the Asia Pacific region are investing heavily in smart city infrastructure, integrating advanced video sensing technologies for public safety, traffic management, and urban planning. Countries like Singapore, China, South Korea, and Japan have been front-runners in deploying edge-enabled video surveillance systems. These systems use embedded AI to process video data in real time, enabling instant threat detection and predictive analytics without centralized cloud dependency.

For instance:

- Singapore’s Safe City Test Bed project, launched in partnership with Hitachi and NEC, uses edge-based video analytics for real-time monitoring in urban centers.

- Year: Initiated in 2017 and expanded in phases up to 2023.

2. Automotive and Mobility Sector Adopting Vision-Based Sensors

With the rise of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles in Japan, South Korea, and China, the need for video sensors embedded in cars has surged. Automotive OEMs like Hyundai Mobis, Toyota, and BYD are integrating multi-modal camera systems for lane detection, pedestrian recognition, and traffic sign interpretation.

For instance:

- Hyundai Mobis announced in 2023 the mass production of AI-based front-facing camera sensors for global car models, starting from their Ulsan facility in South Korea.

State of Competition in the Asia Pacific Video as a Sensor Market

The Asia Pacific Video as a Sensor market is characterized by intense competition, driven by rapid urbanization, smart city initiatives, and increasing security investments. The region blends global technology giants with strong local manufacturers and a fast-growing ecosystem of AI-driven startups. Regulatory shifts, especially those tied to data sovereignty and cybersecurity, are reshaping vendor preferences and intensifying the need for locally compliant solutions.

1. Dominant Players and Market Share Dynamics

The APAC market features global OEMs with established supply chains and growing influence, including Hikvision and Dahua Technology (China), Axis Communications (Sweden), Bosch Security Systems (Germany), and Hanwha Vision (South Korea). These firms offer comprehensive video sensing platforms, integrating IP cameras with embedded AI and cloud analytics.

- Hikvision and Dahua Technology dominate much of East and Southeast Asia’s surveillance infrastructure, offering cost-effective and AI-integrated systems. Both firms are expanding their smart city and industrial solutions footprint across the region.

- Hanwha Vision, through edge-based AI analytics, is expanding in South Korea and other parts of Southeast Asia via telecom partnerships, such as with KT Corp.

- Axis Communications and Bosch maintain robust market share in enterprise and retail applications, benefiting from brand trust, GDPR-style compliance, and European R&D credentials.

These leaders remain competitive through economies of scale, diverse product portfolios, and well-established reseller and system integrator channels.

2. Strategic Collaborations and Innovation

Strategic alliances between sensor hardware firms, AI startups, and telecom providers are fueling innovation across APAC. Key developments include:

- Dahua’s launch of AI-powered Cooper-I XVR units with Smart Motion Detection, specifically targeted at APAC markets.

- Hanwha Vision’s edge AI initiative through partnerships with Korean telecom providers, accelerating rollout of real-time, on-device video analytics for public safety.

- SenseTime, one of China’s leading AI unicorns, integrates advanced facial recognition and video pattern analysis into urban surveillance systems across Hong Kong and mainland China.

- In India, firms like CP Plus partner with local authorities to deploy cost-effective, high-volume smart surveillance, especially under “Make in India” policy initiatives.

These collaborations allow for localization of features, language support, and compliance with country-specific mandates.

Offering Outlook

Based on Offering, the market is segmented into Hardware, Software, and Services.

Hardware

Trend: Widespread deployment of AI‑powered, high‑resolution traffic and smart‑city cameras

For instance, Nagpur, India is piloting a comprehensive Integrated Intelligent Traffic Management System (IITMS) with AI‑based traffic signals, high‑resolution cameras, ANPR, and smart sensors at 10 major intersections. While e-challan issuance awaits regulatory integration, the surveillance infrastructure is fully established.

Software

Trend: Adoption of AI video‑analytics platforms for smart‑infrastructure and safety

For instance, viAct, a Hong Kong startup, raised US$7.3 million in Series A funding to boost its AI video‑analytics platform used in smart‑city, construction safety, and industrial monitoring. It's actively expanding in Singapore, Hong Kong, and India.

Product Outlook

Based on Product, the market is segmented into Video Surveillance, Machine Vision & Monitoring, Thermal Imaging, and Hyperspectral Imaging.

1. Video Surveillance

Trend: AI-enhanced video systems are being widely deployed for traffic and public safety in city infrastructures.

For instance:

- Nagpur, India has launched an Integrated Intelligent Traffic Management System featuring high-resolution cameras, AI-powered traffic signals, ANPR systems, and smart sensors at 10 major junctions. While enforcement (e-challans) remains pending regulatory approval, the infrastructure—including its Command and Control Centre—is live and operational.

2. Hyperspectral Imaging

Trend: Drone and satellite-based hyperspectral imaging is growing in agriculture, environmental monitoring, and defense solutions.

For instance:

- BharatRohan, an Indian drone-Agritech startup, uses UAV-mounted hyperspectral sensors to deliver detailed crop insights, marking a shift toward data-driven agriculture.

- Pixxel, an Indian space-tech company backed by Google, launched three hyperspectral satellites (with three more planned) to support agriculture, mining, and environmental monitoring—underscoring private-sector investment in the region.

End-Use Outlook

Based on End-Use, the market is segmented into Commercial, Industrial, Government, and Other End-Use.

Government Segment

Trend: National Security Drives Surveillance Overhaul

Governments in Asia Pacific are tightening control over surveillance infrastructure due to rising geopolitical tensions and espionage risks. Policies now focus on localizing hardware and auditing foreign-manufactured cameras, particularly from China.

For instance:

- India mandated in May 2025 that all internet-connected CCTV cameras undergo lab certification to prevent foreign espionage. Only 35 models passed testing, halting widespread imports.

Commercial Segment

Trend: AI Video Analytics Expansion through Mergers

Companies are consolidating video analytics platforms and hardware to offer end-to-end intelligent video solutions in commercial sectors.

For instance:

- In 2024, Canon-owned Milestone merged with BriefCam and Arcules to deliver integrated AI-based video solutions across Asia Pacific.

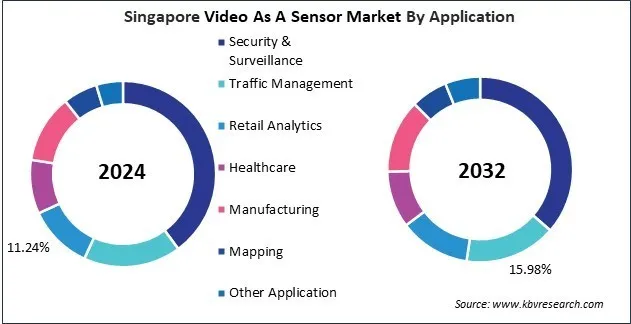

Application Outlook

Based on Application, the market is segmented into Security & Surveillance, Traffic Management, Retail Analytics, Healthcare, Manufacturing, Mapping, and Other Application.

Security & Surveillance

Trend: Asia Pacific is rapidly adopting AI-based gesture recognition and behavior detection in retail and public venues, enhancing security while preserving privacy and avoiding facial recognition.

For instance:

- Retail theft prevention: Major retailers in India and Southeast Asia have begun deploying AI systems similar to Veesion’s, which analyze shopper gestures—such as concealment or suspicious motions—to detect potential theft, without capturing identities. This gesture-centric approach supports quiet, privacy-preserving surveillance and has been reported to reduce shrinkage while respecting customer anonymity.

Traffic Management

Trend: Across Asia Pacific, cities and municipalities are deploying AI-integrated traffic cameras and signal systems to enforce road rules, reduce congestion, and improve driver and pedestrian safety.

For instance:

- Nagpur, India has introduced an Intelligent Traffic Management System with AI-enhanced lights and ANPR cameras across ten major junctions. Although signal intelligence is operational, actual enforcement via e-challans is still pending, and initial tests have highlighted network latency challenges and legal integration delays.

Based on Offering, the market is segmented into Hardware, Software, and Services. Based on Product, the market is segmented into Video Surveillance, Machine Vision & Monitoring, Thermal Imaging, and Hyperspectral Imaging. Based on End-Use, the market is segmented into Commercial, Industrial, Government, and Other End-Use. Based on Application, the market is segmented into Security & Surveillance, Traffic Management, Retail Analytics, Healthcare, Manufacturing, Mapping, and Other Application. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Axis Communications AB (Canon, Inc.)

- Motorola Solutions, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Bosch Sicherheitssysteme GmbH (Robert Bosch GmbH)

- Zhejiang Dahua Technology Co., Ltd.

- Sony Semiconductor Solutions Corporation (Sony Corporation)

- Honeywell International Inc.

- Johnson Controls International PLC

- OmniVision Technologies, Inc.

- i-PRO Co., Ltd.

Asia Pacific Video As A Sensor Market Report Segmentation

By Offering

- Hardware

- Software

- Services

By Product

- Video Surveillance

- Machine Vision & Monitoring

- Thermal Imaging

- Hyperspectral Imaging

By End-Use

- Commercial

- Industrial

- Government

- Other End-Use

By Application

- Security & Surveillance

- Traffic Management

- Retail Analytics

- Healthcare

- Manufacturing

- Mapping

- Other Application

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Video As A Sensor Market, by Offering

1.4.2 Asia Pacific Video As A Sensor Market, by Product

1.4.3 Asia Pacific Video As A Sensor Market, by End-Use

1.4.4 Asia Pacific Video As A Sensor Market, by Application

1.4.5 Asia Pacific Video As A Sensor Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario:

3.2 Key Factors Impacting

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunites

3.2.4 Market Challenges

Chapter 4. Key Market Trends in the Asia Pacific Video As A Sensor Market

Chapter 5. State of Competition in the Asia Pacific Video As A Sensor Market

Chapter 6. Market Consolidation Analysis in Video As A Sensor Market

Chapter 7. Product Life Cycle Analysis - Video as a Sensor Market

Chapter 8. Competition Analysis - Global

8.1 KBV Cardinal Matrix

8.2 Recent Industry Wide Strategic Developments

8.2.1 Partnerships, Collaborations and Agreements

8.2.2 Product Launches and Product Expansions

8.2.3 Acquisition and Mergers

8.3 Market Share Analysis, 2024

8.4 Top Winning Strategies

8.4.1 Key Leading Strategies: Percentage Distribution (2021-2025)

8.4.2 Key Strategic Move: (Product Launches and Product Expansions: 2021, Feb – 2025, Jun) Leading Players

8.5 Porter Five Forces Analysis

Chapter 9. Value Chain Analysis of Video As A Sensor Market

9.1 R&D and Technology Development

9.2 Component Manufacturing

9.3 System Integration

9.4 Software & Analytics Development

9.5 Distribution & Sales

9.6 Deployment & Installation

9.7 Operations & Services

9.8 End-Use Applications

Chapter 10. Key Customer Criteria – Asia Pacific Video As A Sensor Market

Chapter 11. Asia Pacific Video As A Sensor Market by Offering

11.1 Asia Pacific Hardware Market by Country

11.2 Asia Pacific Software Market by Country

11.3 Asia Pacific Services Market by Country

Chapter 12. Asia Pacific Video As A Sensor Market by Product

12.1 Asia Pacific Video Surveillance Market by Country

12.2 Asia Pacific Machine Vision & Monitoring Market by Country

12.3 Asia Pacific Thermal Imaging Market by Country

12.4 Asia Pacific Hyperspectral Imaging Market by Country

Chapter 13. Asia Pacific Video As A Sensor Market by End-Use

13.1 Asia Pacific Commercial Market by Country

13.2 Asia Pacific Industrial Market by Country

13.3 Asia Pacific Government Market by Country

13.4 Asia Pacific Other End-Use Market by Country

Chapter 14. Asia Pacific Video As A Sensor Market by Application

14.1 Asia Pacific Security & Surveillance Market by Country

14.2 Asia Pacific Traffic Management Market by Country

14.3 Asia Pacific Retail Analytics Market by Country

14.4 Asia Pacific Healthcare Market by Country

14.5 Asia Pacific Manufacturing Market by Country

14.6 Asia Pacific Mapping Market by Country

14.7 Asia Pacific Other Application Market by Country

Chapter 15. Asia Pacific Video As A Sensor Market by Country

15.1 China Video As A Sensor Market

15.1.1 China Video As A Sensor Market by Offering

15.1.2 China Video As A Sensor Market by Product

15.1.3 China Video As A Sensor Market by End-Use

15.1.4 China Video As A Sensor Market by Application

15.2 Japan Video As A Sensor Market

15.2.1 Japan Video As A Sensor Market by Offering

15.2.2 Japan Video As A Sensor Market by Product

15.2.3 Japan Video As A Sensor Market by End-Use

15.2.4 Japan Video As A Sensor Market by Application

15.3 India Video As A Sensor Market

15.3.1 India Video As A Sensor Market by Offering

15.3.2 India Video As A Sensor Market by Product

15.3.3 India Video As A Sensor Market by End-Use

15.3.4 India Video As A Sensor Market by Application

15.4 South Korea Video As A Sensor Market

15.4.1 South Korea Video As A Sensor Market by Offering

15.4.2 South Korea Video As A Sensor Market by Product

15.4.3 South Korea Video As A Sensor Market by End-Use

15.4.4 South Korea Video As A Sensor Market by Application

15.5 Singapore Video As A Sensor Market

15.5.1 Singapore Video As A Sensor Market by Offering

15.5.2 Singapore Video As A Sensor Market by Product

15.5.3 Singapore Video As A Sensor Market by End-Use

15.5.4 Singapore Video As A Sensor Market by Application

15.6 Malaysia Video As A Sensor Market

15.6.1 Malaysia Video As A Sensor Market by Offering

15.6.2 Malaysia Video As A Sensor Market by Product

15.6.3 Malaysia Video As A Sensor Market by End-Use

15.6.4 Malaysia Video As A Sensor Market by Application

15.7 Rest of Asia Pacific Video As A Sensor Market

15.7.1 Rest of Asia Pacific Video As A Sensor Market by Offering

15.7.2 Rest of Asia Pacific Video As A Sensor Market by Product

15.7.3 Rest of Asia Pacific Video As A Sensor Market by End-Use

15.7.4 Rest of Asia Pacific Video As A Sensor Market by Application

Chapter 16. Company Profiles

16.1 Axis Communications AB (Canon, Inc.)

16.1.1 Company Overview

16.1.2 Financial Analysis

16.1.3 Segmental and Regional Analysis

16.1.4 Research & Development Expenses

16.1.5 Recent strategies and developments:

16.1.5.1 Partnerships, Collaborations, and Agreements:

16.1.5.2 Product Launches and Product Expansions:

16.1.6 SWOT Analysis

16.2 Motorola Solutions, Inc.

16.2.1 Company Overview

16.2.2 Financial Analysis

16.2.3 Regional & Segmental Analysis

16.2.4 Research & Development Expenses

16.2.5 Recent strategies and developments:

16.2.5.1 Product Launches and Product Expansions:

16.2.5.2 Acquisition and Mergers:

16.2.6 SWOT Analysis

16.3 Hangzhou Hikvision Digital Technology Co., Ltd.

16.3.1 Company Overview

16.3.2 Financial Analysis

16.3.3 Regional Analysis

16.3.4 Research & Development Expenses

16.3.5 Recent strategies and developments:

16.3.5.1 Partnerships, Collaborations, and Agreements:

16.3.5.2 Product Launches and Product Expansions:

16.3.6 SWOT Analysis

16.4 Bosch Sicherheitssysteme GmbH (Robert Bosch GmbH)

16.4.1 Company Overview

16.4.2 Financial Analysis

16.4.3 Segmental and Regional Analysis

16.4.4 Research & Development Expense

16.4.5 Recent strategies and developments:

16.4.5.1 Product Launches and Product Expansions:

16.4.5.2 Acquisition and Mergers:

16.5 Zhejiang Dahua Technology Co., Ltd.

16.5.1 Company Overview

16.5.2 Financial Analysis

16.5.3 Regional Analysis

16.5.4 Product Development Expenses

16.5.5 Recent strategies and developments:

16.5.5.1 Product Launches and Product Expansions:

16.5.6 SWOT Analysis

16.6 Sony Semiconductor Solutions Corporation (Sony Corporation)

16.6.1 Company Overview

16.6.2 Financial Analysis

16.6.3 Segmental and Regional Analysis

16.6.4 Research & Development Expenses

16.6.5 Recent strategies and developments:

16.6.5.1 Partnerships, Collaborations, and Agreements:

16.7 Honeywell International, Inc.

16.7.1 Company Overview

16.7.2 Financial Analysis

16.7.3 Segmental and Regional Analysis

16.7.4 Research & Development Expenses

16.7.5 Recent strategies and developments:

16.7.5.1 Product Launches and Product Expansions:

16.7.6 SWOT Analysis

16.8 Johnson Controls International PLC

16.8.1 Company Overview

16.8.2 Financial Analysis

16.8.3 Segmental & Regional Analysis

16.8.4 Research & Development Expenses

16.8.5 Recent strategies and developments:

16.8.5.1 Product Launches and Product Expansions:

16.8.6 SWOT Analysis

16.9 OmniVision Technologies, Inc.

16.9.1 Company Overview

16.9.2 Recent strategies and developments:

16.9.2.1 Product Launches and Product Expansions:

16.9.3 SWOT Analysis

16.10. i-PRO Co., Ltd.

16.10.1 Company Overview

16.10.2 Recent strategies and developments:

16.10.2.1 Product Launches and Product Expansions:

TABLE 2 Asia Pacific Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 3 Evaluation of Parameters: Video As A Sensor Market

TABLE 4 Partnerships, Collaborations and Agreements– Video As A Sensor Market

TABLE 5 Product Launches And Product Expansions– Video As A Sensor Market

TABLE 6 Acquisition and Mergers– Video As A Sensor Market

TABLE 7 Key Customer Criteria – Asia Pacific Video As A Sensor Market

TABLE 8 Asia Pacific Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 9 Asia Pacific Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 10 Asia Pacific Hardware Market by Country, 2021 - 2024, USD Million

TABLE 11 Asia Pacific Hardware Market by Country, 2025 - 2032, USD Million

TABLE 12 Asia Pacific Software Market by Country, 2021 - 2024, USD Million

TABLE 13 Asia Pacific Software Market by Country, 2025 - 2032, USD Million

TABLE 14 Asia Pacific Services Market by Country, 2021 - 2024, USD Million

TABLE 15 Asia Pacific Services Market by Country, 2025 - 2032, USD Million

TABLE 16 Asia Pacific Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 17 Asia Pacific Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 18 Asia Pacific Video Surveillance Market by Country, 2021 - 2024, USD Million

TABLE 19 Asia Pacific Video Surveillance Market by Country, 2025 - 2032, USD Million

TABLE 20 Asia Pacific Machine Vision & Monitoring Market by Country, 2021 - 2024, USD Million

TABLE 21 Asia Pacific Machine Vision & Monitoring Market by Country, 2025 - 2032, USD Million

TABLE 22 Asia Pacific Thermal Imaging Market by Country, 2021 - 2024, USD Million

TABLE 23 Asia Pacific Thermal Imaging Market by Country, 2025 - 2032, USD Million

TABLE 24 Asia Pacific Hyperspectral Imaging Market by Country, 2021 - 2024, USD Million

TABLE 25 Asia Pacific Hyperspectral Imaging Market by Country, 2025 - 2032, USD Million

TABLE 26 Asia Pacific Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 27 Asia Pacific Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 28 Asia Pacific Commercial Market by Country, 2021 - 2024, USD Million

TABLE 29 Asia Pacific Commercial Market by Country, 2025 - 2032, USD Million

TABLE 30 Asia Pacific Industrial Market by Country, 2021 - 2024, USD Million

TABLE 31 Asia Pacific Industrial Market by Country, 2025 - 2032, USD Million

TABLE 32 Asia Pacific Government Market by Country, 2021 - 2024, USD Million

TABLE 33 Asia Pacific Government Market by Country, 2025 - 2032, USD Million

TABLE 34 Asia Pacific Other End-Use Market by Country, 2021 - 2024, USD Million

TABLE 35 Asia Pacific Other End-Use Market by Country, 2025 - 2032, USD Million

TABLE 36 Asia Pacific Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 37 Asia Pacific Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 38 Asia Pacific Security & Surveillance Market by Country, 2021 - 2024, USD Million

TABLE 39 Asia Pacific Security & Surveillance Market by Country, 2025 - 2032, USD Million

TABLE 40 Asia Pacific Traffic Management Market by Country, 2021 - 2024, USD Million

TABLE 41 Asia Pacific Traffic Management Market by Country, 2025 - 2032, USD Million

TABLE 42 Asia Pacific Retail Analytics Market by Country, 2021 - 2024, USD Million

TABLE 43 Asia Pacific Retail Analytics Market by Country, 2025 - 2032, USD Million

TABLE 44 Asia Pacific Healthcare Market by Country, 2021 - 2024, USD Million

TABLE 45 Asia Pacific Healthcare Market by Country, 2025 - 2032, USD Million

TABLE 46 Asia Pacific Manufacturing Market by Country, 2021 - 2024, USD Million

TABLE 47 Asia Pacific Manufacturing Market by Country, 2025 - 2032, USD Million

TABLE 48 Asia Pacific Mapping Market by Country, 2021 - 2024, USD Million

TABLE 49 Asia Pacific Mapping Market by Country, 2025 - 2032, USD Million

TABLE 50 Asia Pacific Other Application Market by Country, 2021 - 2024, USD Million

TABLE 51 Asia Pacific Other Application Market by Country, 2025 - 2032, USD Million

TABLE 52 Asia Pacific Video As A Sensor Market by Country, 2021 - 2024, USD Million

TABLE 53 Asia Pacific Video As A Sensor Market by Country, 2025 - 2032, USD Million

TABLE 54 China Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 55 China Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 56 China Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 57 China Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 58 China Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 59 China Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 60 China Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 61 China Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 62 China Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 63 China Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 64 Japan Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 65 Japan Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 66 Japan Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 67 Japan Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 68 Japan Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 69 Japan Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 70 Japan Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 71 Japan Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 72 Japan Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 73 Japan Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 74 India Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 75 India Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 76 India Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 77 India Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 78 India Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 79 India Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 80 India Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 81 India Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 82 India Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 83 India Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 84 South Korea Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 85 South Korea Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 86 South Korea Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 87 South Korea Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 88 South Korea Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 89 South Korea Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 90 South Korea Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 91 South Korea Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 92 South Korea Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 93 South Korea Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 94 Singapore Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 95 Singapore Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 96 Singapore Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 97 Singapore Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 98 Singapore Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 99 Singapore Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 100 Singapore Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 101 Singapore Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 102 Singapore Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 103 Singapore Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 104 Malaysia Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 105 Malaysia Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 106 Malaysia Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 107 Malaysia Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 108 Malaysia Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 109 Malaysia Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 110 Malaysia Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 111 Malaysia Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 112 Malaysia Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 113 Malaysia Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 114 Rest of Asia Pacific Video As A Sensor Market, 2021 - 2024, USD Million

TABLE 115 Rest of Asia Pacific Video As A Sensor Market, 2025 - 2032, USD Million

TABLE 116 Rest of Asia Pacific Video As A Sensor Market by Offering, 2021 - 2024, USD Million

TABLE 117 Rest of Asia Pacific Video As A Sensor Market by Offering, 2025 - 2032, USD Million

TABLE 118 Rest of Asia Pacific Video As A Sensor Market by Product, 2021 - 2024, USD Million

TABLE 119 Rest of Asia Pacific Video As A Sensor Market by Product, 2025 - 2032, USD Million

TABLE 120 Rest of Asia Pacific Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

TABLE 121 Rest of Asia Pacific Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

TABLE 122 Rest of Asia Pacific Video As A Sensor Market by Application, 2021 - 2024, USD Million

TABLE 123 Rest of Asia Pacific Video As A Sensor Market by Application, 2025 - 2032, USD Million

TABLE 124 Key Information – Axis Communications AB

TABLE 125 Key Information – Motorola Solutions, Inc.

TABLE 126 Key Information – Hangzhou Hikvision Digital Technology Co., Ltd.

TABLE 127 Key Information – Bosch Sicherheitssysteme GmbH

TABLE 128 Key Information – Zhejiang Dahua Technology Co., Ltd.

TABLE 129 Key Information – Sony Semiconductor Solutions Corporation

TABLE 130 Key Information – Honeywell International, Inc.

TABLE 131 Key Information – Johnson Controls International PLC

TABLE 132 Key Information – OmniVision Technologies, Inc.

TABLE 133 Key Information – i-PRO Co., Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Video As A Sensor Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting in Asia Pacific Video As A Sensor Market

FIG 4 Market Consolidation Analysis

FIG 5 Product Life Cycle Analysis - Video as a Sensor Market

FIG 6 KBV Cardinal Matrix

FIG 7 Market Share Analysis, 2024

FIG 8 Key Leading Strategies: Percentage Distribution (2021-2025)

FIG 9 Key Strategic Move: (Product Launches and Product Expansions: 2021, Feb – 2025, Jun) Leading Players

FIG 10 Porter’s Five Forces Analysis – Video As A Sensor Market

FIG 11 Value Chain Analysis of Video As A Sensor Market

FIG 12 Key Customer Criteria – Asia Pacific Video As A Sensor Market

FIG 13 Asia Pacific Video As A Sensor Market share by Offering, 2024

FIG 14 Asia Pacific Video As A Sensor Market share by Offering, 2032

FIG 15 Asia Pacific Video As A Sensor Market by Offering, 2021 - 2032, USD Million

FIG 16 Asia Pacific Video As A Sensor Market share by Product, 2024

FIG 17 Asia Pacific Video As A Sensor Market share by Product, 2032

FIG 18 Asia Pacific Video As A Sensor Market by Product, 2021 - 2032, USD Million

FIG 19 Asia Pacific Video As A Sensor Market share by End-Use, 2024

FIG 20 Asia Pacific Video As A Sensor Market share by End-Use, 2032

FIG 21 Asia Pacific Video As A Sensor Market by End-Use, 2021 - 2032, USD Million

FIG 22 Asia Pacific Video As A Sensor Market share by Application, 2024

FIG 23 Asia Pacific Video As A Sensor Market share by Application, 2032

FIG 24 Asia Pacific Video As A Sensor Market by Application, 2021 - 2032, USD Million

FIG 25 Asia Pacific Video As A Sensor Market share by Country, 2024

FIG 26 Asia Pacific Video As A Sensor Market share by Country, 2032

FIG 27 Asia Pacific Video As A Sensor Market by Country, 2021 - 2032, USD Million

FIG 28 Recent strategies and developments: Axis Communications AB

FIG 29 SWOT Analysis: Axis Communications AB

FIG 30 Recent strategies and developments: Motorola Solutions, Inc.

FIG 31 Swot Analysis: Motorola Solutions, Inc.

FIG 32 Recent strategies and developments: Hangzhou Hikvision Digital Technology Co., Ltd.

FIG 33 SWOT Analysis: Hangzhou Hikvision Digital Technology Co., Ltd.

FIG 34 Recent strategies and developments: Bosch Sicherheitssysteme GmbH

FIG 35 SWOT Analysis: Zhejiang Dahua Technology Co., Ltd.

FIG 36 SWOT Analysis: Honeywell international, inc.

FIG 37 SWOT Analysis: Johnson Controls International PLC

FIG 38 SWOT Analysis: OmniVision Technologies, Inc.