Asia Pacific Saccharin Market Size, Share & Industry Analysis Report By Distribution Channel (Offline, and Online), By Product (Sodium Saccharin, Calcium Saccharin, and Liquid Saccharin), By Application (Food & Beverage, Pharmaceuticals, Tabletop Sweetener, and Other Application), By Country and Growth Forecast, 2025 - 2032

Published Date : 07-Jul-2025 |

Pages: 133 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific Saccharin Market

The Asia Pacific Saccharin Market would witness market growth of 5.9% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Saccharin Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $146.6 million by 2032. The Japan market is registering a CAGR of 4.5% during (2025 - 2032). Additionally, The India market would showcase a CAGR of 6.6% during (2025 - 2032).

The Asia Pacific saccharin market has experienced significant growth, driven by increasing health consciousness and the demand for low-calorie sweeteners. Saccharin, a high-intensity artificial sweetener, is widely used in various industries, including food and beverages, pharmaceuticals, and personal care products. Its stability, cost-effectiveness, and non-caloric nature make it a preferred choice for manufacturers aiming to reduce sugar content in their products.

China stands as the largest producer and exporter of saccharin in the region, supplying to various countries within Asia and beyond. The market's growth is further supported by the increasing prevalence of lifestyle-related diseases, prompting consumers to seek healthier alternatives to sugar. Regulatory approvals and safety assessments by agencies such as the U.S. Food and Drug Administration (FDA) have affirmed saccharin's safety for consumption within specified limits, bolstering its adoption across multiple sectors.

China dominates the global saccharin market as both the largest producer and exporter, supported by its robust industrial base and access to cost-efficient raw materials. Saccharin, a synthetic, non-nutritive sweetener, has long been used in the Chinese market across a variety of sectors, including food and beverages, pharmaceuticals, personal care products, and electroplating. Given its intense sweetness and stability under heat and acidic conditions, saccharin continues to find strong demand in China’s manufacturing ecosystems, particularly as the population grows more health-conscious and regulations evolve toward sugar reduction. As of 2024, China produced over 23,000 metric tons of saccharin, and its market is projected to grow at a steady pace in the coming decade.

Japan’s saccharin market reflects the country’s long-standing emphasis on food safety, quality, and innovation, with non-nutritive sweeteners like saccharin occupying a niche yet significant role in various industries. While the country does not produce saccharin at the scale of China or South Korea, it imports and utilizes saccharin primarily in food and beverage formulations, pharmaceuticals, and personal care products. Japan’s strict food regulations and consumer preference for high-quality, safe, and well-researched products shape the dynamics of the saccharin market, ensuring that only rigorously tested and certified ingredients make their way into commercial products.

India’s saccharin market has been witnessing steady growth over the past decade, driven by increasing awareness of sugar-related health issues and a booming food processing industry. As a synthetic, non-caloric sweetener, saccharin holds a significant position in India’s portfolio of sugar alternatives, particularly within food, pharmaceutical, and personal care industries. With a growing population, rapid urbanization, and rising prevalence of diabetes and obesity, the demand for low-calorie sweeteners like saccharin is accelerating. India’s evolving dietary patterns, supported by regulatory clarity and expanding manufacturing capabilities, further underpin the positive outlook for the saccharin market. Thus, Asia Pacific remains the most dynamic saccharin market globally, driven by production dominance, rising health awareness, and diverse industrial applications.

Free Valuable Insights: The Global Saccharin Market is Predict to reach USD 1.03 Billion by 2032, at a CAGR of 5.5%

Based on Distribution Channel, the market is segmented into Offline, and Online. Based on Product, the market is segmented into Sodium Saccharin, Calcium Saccharin, and Liquid Saccharin. Based on Application, the market is segmented into Food & Beverage, Pharmaceuticals, Tabletop Sweetener, and Other Application. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Kaifeng Xinghua Fine Chemical LTD

- Shanghai Merry yang Enterprise Co.,Ltd.

- Blue Jet Healthcare Ltd.

- Vishnu Chemicals Limited

- N.S.Chemicals

- Jeil Moolsan Company(JMC) Corporation

- PMC Specialties Group (PMC Co., Ltd.)

- PRODUCTOS ADITIVOS, S.A.

- Foodchem International Corporation

- Merck KGaA

Asia Pacific Saccharin Market Report Segmentation

By Distribution Channel

- Offline

- Online

By Product

- Sodium Saccharin

- Calcium Saccharin

- Liquid Saccharin

By Application

- Food & Beverage

- Pharmaceuticals

- Tabletop Sweetener

- Other Application

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Saccharin Market, by Distribution Channel

1.4.2 Asia Pacific Saccharin Market, by Product

1.4.3 Asia Pacific Saccharin Market, by Application

1.4.4 Asia Pacific Saccharin Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis – Global

4.1 Market Share Analysis, 2024

4.2 Porter Five Forces Analysis

Chapter 5. Value Chain Analysis of Saccharin Market

5.1 Raw Material Procurement

5.2 Manufacturing & Processing

5.3 Packaging & Quality Assurance

5.4 Marketing & Sales

5.5 Distribution & Logistics

5.6 End-Use Applications

5.7 Post-Sales Support & Feedback Loop

Chapter 6. Key Costumer Criteria of Saccharin Market

Chapter 7. Asia Pacific Saccharin Market by Distribution Channel

7.1 Asia Pacific Offline Market by Country

7.2 Asia Pacific Online Market by Country

Chapter 8. Asia Pacific Saccharin Market by Product

8.1 Asia Pacific Sodium Saccharin Market by Country

8.2 Asia Pacific Calcium Saccharin Market by Country

8.3 Asia Pacific Liquid Saccharin Market by Country

Chapter 9. Asia Pacific Saccharin Market by Application

9.1 Asia Pacific Food & Beverage Market by Country

9.2 Asia Pacific Pharmaceuticals Market by Country

9.3 Asia Pacific Tabletop Sweetener Market by Country

9.4 Asia Pacific Other Application Market by Country

Chapter 10. Asia Pacific Saccharin Market by Country

10.1 China Saccharin Market

10.1.1 China Saccharin Market by Distribution Channel

10.1.2 China Saccharin Market by Product

10.1.3 China Saccharin Market by Application

10.2 Japan Saccharin Market

10.2.1 Japan Saccharin Market by Distribution Channel

10.2.2 Japan Saccharin Market by Product

10.2.3 Japan Saccharin Market by Application

10.3 India Saccharin Market

10.3.1 India Saccharin Market by Distribution Channel

10.3.2 India Saccharin Market by Product

10.3.3 India Saccharin Market by Application

10.4 South Korea Saccharin Market

10.4.1 South Korea Saccharin Market by Distribution Channel

10.4.2 South Korea Saccharin Market by Product

10.4.3 South Korea Saccharin Market by Application

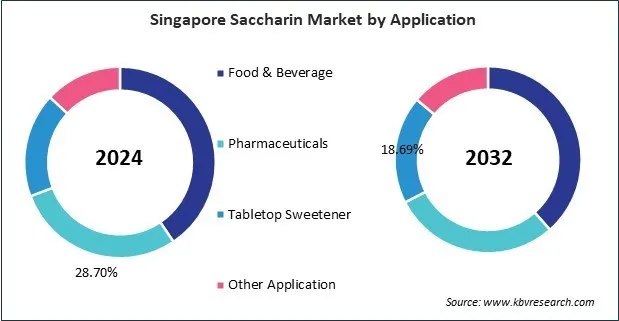

10.5 Singapore Saccharin Market

10.5.1 Singapore Saccharin Market by Distribution Channel

10.5.2 Singapore Saccharin Market by Product

10.5.3 Singapore Saccharin Market by Application

10.6 Malaysia Saccharin Market

10.6.1 Malaysia Saccharin Market by Distribution Channel

10.6.2 Malaysia Saccharin Market by Product

10.6.3 Malaysia Saccharin Market by Application

10.7 Rest of Asia Pacific Saccharin Market

10.7.1 Rest of Asia Pacific Saccharin Market by Distribution Channel

10.7.2 Rest of Asia Pacific Saccharin Market by Product

10.7.3 Rest of Asia Pacific Saccharin Market by Application

Chapter 11. Company Profiles

11.1 Kaifeng Xinghua Fine Chemical LTD

11.1.1 Company Overview

11.2 Shanghai Merry yang Enterprise Co.,Ltd.

11.2.1 Company Overview

11.3 Blue Jet Healthcare Ltd.

11.3.1 Company Overview

11.3.2 Financial Analysis

11.3.3 Regional Analysis

11.4 Vishnu Chemicals Limited

11.4.1 Company Overview

11.4.2 Financial Analysis

11.4.3 Regional Analysis

11.5 N.S.Chemicals

11.5.1 Company Overview

11.6 Jeil Moolsan Company(JMC) Corporation

11.6.1 Company Overview

11.7 PMC Specialties Group (PMC Co., Ltd.)

11.7.1 Company Overview

11.8 PRODUCTOS ADITIVOS, S.A.

11.8.1 Company Overview

11.9 Foodchem International Corporation

11.9.1 Company Overview

11.9.2 SWOT Analysis

11.10. Merck KGaA

11.10.1 Company Overview

11.10.2 Financial Analysis

11.10.3 Segmental and Regional Analysis

11.10.4 Research & Development Expense

11.10.5 SWOT Analysis

TABLE 2 Asia Pacific Saccharin Market, 2025 - 2032, USD Million

TABLE 3 Key Costumer Criteria of Saccharin Market

TABLE 4 Asia Pacific Saccharin Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 5 Asia Pacific Saccharin Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 6 Asia Pacific Offline Market by Country, 2021 - 2024, USD Million

TABLE 7 Asia Pacific Offline Market by Country, 2025 - 2032, USD Million

TABLE 8 Asia Pacific Online Market by Country, 2021 - 2024, USD Million

TABLE 9 Asia Pacific Online Market by Country, 2025 - 2032, USD Million

TABLE 10 Use Case 1: In-store Sweetener Integration for Processed Food Brands (2025)

TABLE 11 Use Case 2: Direct-to-Consumer (DTC) E-commerce for Specialty Saccharin Blends (2025)

TABLE 12 Asia Pacific Saccharin Market by Product, 2021 - 2024, USD Million

TABLE 13 Asia Pacific Saccharin Market by Product, 2025 - 2032, USD Million

TABLE 14 Asia Pacific Sodium Saccharin Market by Country, 2021 - 2024, USD Million

TABLE 15 Asia Pacific Sodium Saccharin Market by Country, 2025 - 2032, USD Million

TABLE 16 Asia Pacific Calcium Saccharin Market by Country, 2021 - 2024, USD Million

TABLE 17 Asia Pacific Calcium Saccharin Market by Country, 2025 - 2032, USD Million

TABLE 18 Asia Pacific Liquid Saccharin Market by Country, 2021 - 2024, USD Million

TABLE 19 Asia Pacific Liquid Saccharin Market by Country, 2025 - 2032, USD Million

TABLE 20 Use Case 1: Industrial-Scale Application of Sodium Saccharin in Electroplating (2025)

TABLE 21 Use Case 2: Calcium Saccharin Fortification in Pediatric Syrups (2025)

TABLE 22 Use Case 3: Liquid Saccharin Integration in Beverage Manufacturing (2025)

TABLE 23 Asia Pacific Saccharin Market by Application, 2021 - 2024, USD Million

TABLE 24 Asia Pacific Saccharin Market by Application, 2025 - 2032, USD Million

TABLE 25 Asia Pacific Food & Beverage Market by Country, 2021 - 2024, USD Million

TABLE 26 Asia Pacific Food & Beverage Market by Country, 2025 - 2032, USD Million

TABLE 27 Asia Pacific Pharmaceuticals Market by Country, 2021 - 2024, USD Million

TABLE 28 Asia Pacific Pharmaceuticals Market by Country, 2025 - 2032, USD Million

TABLE 29 Asia Pacific Tabletop Sweetener Market by Country, 2021 - 2024, USD Million

TABLE 30 Asia Pacific Tabletop Sweetener Market by Country, 2025 - 2032, USD Million

TABLE 31 Asia Pacific Other Application Market by Country, 2021 - 2024, USD Million

TABLE 32 Asia Pacific Other Application Market by Country, 2025 - 2032, USD Million

TABLE 33 Use Case 1: Reformulation of Carbonated Beverages Using Saccharin Blend (2025)

TABLE 34 Use Case 2: Saccharin-Based Taste Enhancement in Pediatric Antibiotics (2025)

TABLE 35 Use Case 3: Launch of Organic-Certified Tabletop Sweeteners with Saccharin (2025)

TABLE 36 Use Case 4: Saccharin Use in Animal Feed Additives for Palatability (2025)

TABLE 37 Asia Pacific Saccharin Market by Country, 2021 - 2024, USD Million

TABLE 38 Asia Pacific Saccharin Market by Country, 2025 - 2032, USD Million

TABLE 39 China Saccharin Market, 2021 - 2024, USD Million

TABLE 40 China Saccharin Market, 2025 - 2032, USD Million

TABLE 41 China Saccharin Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 42 China Saccharin Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 43 China Saccharin Market by Product, 2021 - 2024, USD Million

TABLE 44 China Saccharin Market by Product, 2025 - 2032, USD Million

TABLE 45 China Saccharin Market by Application, 2021 - 2024, USD Million

TABLE 46 China Saccharin Market by Application, 2025 - 2032, USD Million

TABLE 47 Japan Saccharin Market, 2021 - 2024, USD Million

TABLE 48 Japan Saccharin Market, 2025 - 2032, USD Million

TABLE 49 Japan Saccharin Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 50 Japan Saccharin Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 51 Japan Saccharin Market by Product, 2021 - 2024, USD Million

TABLE 52 Japan Saccharin Market by Product, 2025 - 2032, USD Million

TABLE 53 Japan Saccharin Market by Application, 2021 - 2024, USD Million

TABLE 54 Japan Saccharin Market by Application, 2025 - 2032, USD Million

TABLE 55 India Saccharin Market, 2021 - 2024, USD Million

TABLE 56 India Saccharin Market, 2025 - 2032, USD Million

TABLE 57 India Saccharin Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 58 India Saccharin Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 59 India Saccharin Market by Product, 2021 - 2024, USD Million

TABLE 60 India Saccharin Market by Product, 2025 - 2032, USD Million

TABLE 61 India Saccharin Market by Application, 2021 - 2024, USD Million

TABLE 62 India Saccharin Market by Application, 2025 - 2032, USD Million

TABLE 63 South Korea Saccharin Market, 2021 - 2024, USD Million

TABLE 64 South Korea Saccharin Market, 2025 - 2032, USD Million

TABLE 65 South Korea Saccharin Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 66 South Korea Saccharin Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 67 South Korea Saccharin Market by Product, 2021 - 2024, USD Million

TABLE 68 South Korea Saccharin Market by Product, 2025 - 2032, USD Million

TABLE 69 South Korea Saccharin Market by Application, 2021 - 2024, USD Million

TABLE 70 South Korea Saccharin Market by Application, 2025 - 2032, USD Million

TABLE 71 Singapore Saccharin Market, 2021 - 2024, USD Million

TABLE 72 Singapore Saccharin Market, 2025 - 2032, USD Million

TABLE 73 Singapore Saccharin Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 74 Singapore Saccharin Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 75 Singapore Saccharin Market by Product, 2021 - 2024, USD Million

TABLE 76 Singapore Saccharin Market by Product, 2025 - 2032, USD Million

TABLE 77 Singapore Saccharin Market by Application, 2021 - 2024, USD Million

TABLE 78 Singapore Saccharin Market by Application, 2025 - 2032, USD Million

TABLE 79 Malaysia Saccharin Market, 2021 - 2024, USD Million

TABLE 80 Malaysia Saccharin Market, 2025 - 2032, USD Million

TABLE 81 Malaysia Saccharin Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 82 Malaysia Saccharin Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 83 Malaysia Saccharin Market by Product, 2021 - 2024, USD Million

TABLE 84 Malaysia Saccharin Market by Product, 2025 - 2032, USD Million

TABLE 85 Malaysia Saccharin Market by Application, 2021 - 2024, USD Million

TABLE 86 Malaysia Saccharin Market by Application, 2025 - 2032, USD Million

TABLE 87 Rest of Asia Pacific Saccharin Market, 2021 - 2024, USD Million

TABLE 88 Rest of Asia Pacific Saccharin Market, 2025 - 2032, USD Million

TABLE 89 Rest of Asia Pacific Saccharin Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 90 Rest of Asia Pacific Saccharin Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 91 Rest of Asia Pacific Saccharin Market by Product, 2021 - 2024, USD Million

TABLE 92 Rest of Asia Pacific Saccharin Market by Product, 2025 - 2032, USD Million

TABLE 93 Rest of Asia Pacific Saccharin Market by Application, 2021 - 2024, USD Million

TABLE 94 Rest of Asia Pacific Saccharin Market by Application, 2025 - 2032, USD Million

TABLE 95 Key Information – Kaifeng Xinghua Fine Chemical LTD

TABLE 96 Key Information – Shanghai Merry yang Enterprise Co.,Ltd.

TABLE 97 Key Information – Blue Jet Healthcare Ltd.

TABLE 98 Key Information – Vishnu Chemicals Limited

TABLE 99 Key Information – N.S.Chemicals

TABLE 100 Key Information – Jeil Moolsan Company(JMC) Corporation

TABLE 101 Key Information – PMC Specialties Group

TABLE 102 Key Information – PRODUCTOS ADITIVOS, S.A.

TABLE 103 Key Information – Foodchem International Corporation

TABLE 104 key Information – Merck KGaA

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Saccharin Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Saccharin Market

FIG 4 Market Share Analysis, 2024

FIG 5 Porter’s Five Forces Analysis – Saccharin Market

FIG 6 Value Chain Analysis of Saccharin Market

FIG 7 Key Costumer Criteria of Saccharin Market

FIG 8 Asia Pacific Saccharin Market share by Distribution Channel, 2024

FIG 9 Asia Pacific Saccharin Market share by Distribution Channel, 2032

FIG 10 Asia Pacific Saccharin Market by Distribution Channel, 2021 - 2032, USD Million

FIG 11 Asia Pacific Saccharin Market share by Product, 2024

FIG 12 Asia Pacific Saccharin Market share by Product, 2032

FIG 13 Asia Pacific Saccharin Market by Product, 2021 - 2032, USD Million

FIG 14 Asia Pacific Saccharin Market share by Application, 2024

FIG 15 Asia Pacific Saccharin Market share by Application, 2032

FIG 16 Asia Pacific Saccharin Market by Application, 2021 - 2032, USD Million

FIG 17 Asia Pacific Saccharin Market share by Country, 2024

FIG 18 Asia Pacific Saccharin Market share by Country, 2032

FIG 19 Asia Pacific Saccharin Market by Country, 2021 - 2032, USD Million

FIG 20 Swot Analysis: Foodchem International Corporation

FIG 21 Swot Analysis: Merck KGaA