Asia Pacific Power Sports Market Size, Share & Trends Analysis Report By Application (Off-Road, and On-Road), By Propulsion (Gasoline, Electric, and Diesel), By Vehicle Type, By Country and Growth Forecast, 2023 - 2030

Published Date : 29-Mar-2024 | Pages: 135 | Formats: PDF |

COVID-19 Impact on the Asia Pacific Power Sports Market

The Asia Pacific Power Sports Market would witness market growth of 7.9% CAGR during the forecast period (2023-2030). In the year 2021, the Asia Pacific market's volume surged to 46.7 Quintal, showcasing a growth of 2% (2019-2022).

The China market dominated the Asia Pacific Power Sports Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $3,164.7 million by 2030. The Japan market is registering a CAGR of 7.1% during (2023 - 2030). Additionally, The India market would showcase a CAGR of 8.5% during (2023 - 2030).

Snowmobiles are indispensable vehicles for winter enthusiasts seeking to explore snowy landscapes, access remote areas, and enjoy recreational activities such as snowmobiling, ice fishing, and backcountry skiing. With their powerful engines and rugged construction, snowmobiles provide unmatched performance and agility in snow-covered terrain. In addition, ATVs and UTVs are essential tools for farmers, ranchers, and agricultural workers, facilitating tasks such as herding livestock, transporting equipment and supplies, and maintaining rural properties. These vehicles offer versatility, reliability, and off-road capabilities, allowing operators to navigate challenging terrain and maximize productivity.

Additionally, specialized off-road vehicles such as tracked ATVs and side-by-side utility vehicles are used in forestry and land management operations to conduct surveys, monitor wildlife, and perform timber harvesting activities. These vehicles provide access to remote forested areas and rugged terrain, enabling workers to perform essential conservation and management tasks. Likewise, search and rescue teams and emergency responders utilize ATVs, UTVs, and off-road motorcycles to access remote or inaccessible areas during rescue missions, natural disasters, and wilderness emergencies. These vehicles provide mobility, agility, and off-road capabilities to navigate challenging terrain and conduct search and rescue operations effectively.

With the rise in outdoor recreation in China, there may be an increased demand for rental services and tour packages, including sports activities. Tour operators and adventure companies can capitalize on this trend by offering experiences tailored to outdoor enthusiasts. Furthermore, tourism in Australia boosts supporting services for the market, including maintenance and repair facilities, accessories and gear retailers, and training programs for tourists interested in participating in sports activities safely. According to the Australian Bureau of Statistics, there were 103,500 overseas trips estimated in June 2021. In January 2024, short-term visitor arrivals reached 603,770, reflecting a yearly increase of 191,360 trips, while total arrivals for the same period amounted to 2,122,070, showing an annual rise of 514,060 trips. Hence, rising outdoor activities and increasing regional tourism propel the market’s growth.

Free Valuable Insights: The Global Power Sports Market is Predict to reach USD 49.8 Billion by 2030, at a CAGR of 7.0%

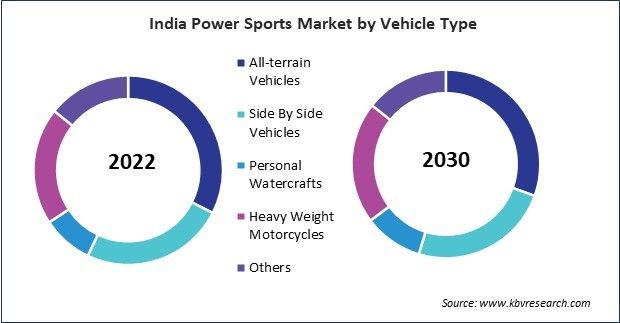

Based on Application, the market is segmented into Off-Road, and On-Road. Based on Propulsion, the market is segmented into Gasoline, Electric, and Diesel. Based on Vehicle Type, the market is segmented into All-terrain Vehicles, Side By Side Vehicles, Personal Watercrafts, Heavy Weight Motorcycles, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Yamaha Motor Co., Ltd.

- Zhejiang CFMoto Power Co., Ltd.

- Bombardier Recreational Products (BRP) Inc.

- Kawasaki Heavy Industries, Ltd.

- Textron, Inc.

- Polaris, Inc.

- Suzuki Motor Corporation

- Honda Motor Co. Ltd.

- KTM AG (PIERER Mobility AG)

- Volkswagen AG

Asia Pacific Power Sports Market Report Segmentation

By Application

- Off-Road

- On-Road

By Propulsion

- Gasoline

- Electric

- Diesel

By Vehicle Type

- All-terrain Vehicles

- Side By Side Vehicles

- Personal Watercrafts

- Heavy Weight Motorcycles

- Others

By Country

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Power Sports Market, by Application

1.4.2 Asia Pacific Power Sports Market, by Propulsion

1.4.3 Asia Pacific Power Sports Market, by Vehicle Type

1.4.4 Asia Pacific Power Sports Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Top Winning Strategies

4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

4.3.2 Key Strategic Move: (Product Launches and Product Expansions: 2022, Jan – 2024, Feb) Leading Players

4.4 Porter’s Five Forces Analysis

Chapter 5. Asia Pacific Power Sports Market by Application

5.1 Asia Pacific Off-Road Market by Country

5.2 Asia Pacific On-Road Market by Country

Chapter 6. Asia Pacific Power Sports Market by Propulsion

6.1 Asia Pacific Gasoline Market by Country

6.2 Asia Pacific Electric Market by Country

6.3 Asia Pacific Diesel Market by Country

Chapter 7. Asia Pacific Power Sports Market by Vehicle Type

7.1 Asia Pacific All-terrain Vehicles Market by Country

7.2 Asia Pacific Side By Side Vehicles Market by Country

7.3 Asia Pacific Personal Watercrafts Market by Country

7.4 Asia Pacific Heavy Weight Motorcycles Market by Country

7.5 Asia Pacific Others Market by Country

Chapter 8. Asia Pacific Power Sports Market by Country

8.1 China Power Sports Market

8.1.1 China Power Sports Market by Application

8.1.2 China Power Sports Market by Propulsion

8.1.3 China Power Sports Market by Vehicle Type

8.2 Japan Power Sports Market

8.2.1 Japan Power Sports Market by Application

8.2.2 Japan Power Sports Market by Propulsion

8.2.3 Japan Power Sports Market by Vehicle Type

8.3 India Power Sports Market

8.3.1 India Power Sports Market by Application

8.3.2 India Power Sports Market by Propulsion

8.3.3 India Power Sports Market by Vehicle Type

8.4 South Korea Power Sports Market

8.4.1 South Korea Power Sports Market by Application

8.4.2 South Korea Power Sports Market by Propulsion

8.4.3 South Korea Power Sports Market by Vehicle Type

8.5 Australia Power Sports Market

8.5.1 Australia Power Sports Market by Application

8.5.2 Australia Power Sports Market by Propulsion

8.5.3 Australia Power Sports Market by Vehicle Type

8.6 Malaysia Power Sports Market

8.6.1 Malaysia Power Sports Market by Application

8.6.2 Malaysia Power Sports Market by Propulsion

8.6.3 Malaysia Power Sports Market by Vehicle Type

8.7 Rest of Asia Pacific Power Sports Market

8.7.1 Rest of Asia Pacific Power Sports Market by Application

8.7.2 Rest of Asia Pacific Power Sports Market by Propulsion

8.7.3 Rest of Asia Pacific Power Sports Market by Vehicle Type

Chapter 9. Company Profiles

9.1 Yamaha Motor Co., Ltd.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expense

9.1.5 Recent strategies and developments:

9.1.5.1 Product Launches and Product Expansions:

9.1.6 SWOT Analysis

9.2 Zhejiang CFMoto Power Co., Ltd.

9.2.1 Company Overview

9.2.2 Recent strategies and developments:

9.2.2.1 Partnerships, Collaborations, and Agreements:

9.2.2.2 Product Launches and Product Expansions:

9.2.2.3 Acquisition and Mergers:

9.2.3 SWOT Analysis

9.3 Bombardier Recreational Products (BRP) Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Regional Analysis

9.3.4 Recent strategies and developments:

9.3.4.1 Product Launches and Product Expansions:

9.3.4.2 Acquisition and Mergers:

9.3.5 SWOT Analysis

9.4 Kawasaki Heavy Industries, Ltd.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expense

9.4.5 Recent strategies and developments:

9.4.5.1 Product Launches and Product Expansions:

9.4.6 SWOT Analysis

9.5 Textron, Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 SWOT Analysis

9.6 Polaris, Inc.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expenses

9.6.5 Recent strategies and developments:

9.6.5.1 Partnerships, Collaborations, and Agreements:

9.6.5.2 Product Launches and Product Expansions:

9.6.6 SWOT Analysis

9.7 Suzuki Motor Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expenses

9.7.5 Recent strategies and developments:

9.7.5.1 Product Launches and Product Expansions:

9.7.5.2 Acquisition and Mergers:

9.7.6 SWOT Analysis

9.8 Honda Motor Co. Ltd.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Research & Development Expense

9.8.5 Recent strategies and developments:

9.8.5.1 Product Launches and Product Expansions:

9.8.6 SWOT Analysis

9.9 KTM AG (PIERER Mobility AG)

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Research & Development Expenses

9.9.5 Recent strategies and developments:

9.9.5.1 Product Launches and Product Expansions:

9.9.6 SWOT Analysis

9.10. Volkswagen AG

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Segmental and Regional Analysis

9.10.4 Research & Development Expense

9.10.5 Recent strategies and developments:

9.10.5.1 Product Launches and Product Expansions:

9.10.6 SWOT Analysis

TABLE 2 Asia Pacific Power Sports Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Power Sports Market

TABLE 4 Product Launches And Product Expansions– Power Sports Market

TABLE 5 Acquisition and Mergers– Power Sports Market

TABLE 6 Asia Pacific Power Sports Market by Application, 2019 - 2022, USD Million

TABLE 7 Asia Pacific Power Sports Market by Application, 2023 - 2030, USD Million

TABLE 8 Asia Pacific Off-Road Market by Country, 2019 - 2022, USD Million

TABLE 9 Asia Pacific Off-Road Market by Country, 2023 - 2030, USD Million

TABLE 10 Asia Pacific On-Road Market by Country, 2019 - 2022, USD Million

TABLE 11 Asia Pacific On-Road Market by Country, 2023 - 2030, USD Million

TABLE 12 Asia Pacific Power Sports Market by Propulsion, 2019 - 2022, USD Million

TABLE 13 Asia Pacific Power Sports Market by Propulsion, 2023 - 2030, USD Million

TABLE 14 Asia Pacific Gasoline Market by Country, 2019 - 2022, USD Million

TABLE 15 Asia Pacific Gasoline Market by Country, 2023 - 2030, USD Million

TABLE 16 Asia Pacific Electric Market by Country, 2019 - 2022, USD Million

TABLE 17 Asia Pacific Electric Market by Country, 2023 - 2030, USD Million

TABLE 18 Asia Pacific Diesel Market by Country, 2019 - 2022, USD Million

TABLE 19 Asia Pacific Diesel Market by Country, 2023 - 2030, USD Million

TABLE 20 Asia Pacific Power Sports Market by Vehicle Type, 2019 - 2022, USD Million

TABLE 21 Asia Pacific Power Sports Market by Vehicle Type, 2023 - 2030, USD Million

TABLE 22 Asia Pacific All-terrain Vehicles Market by Country, 2019 - 2022, USD Million

TABLE 23 Asia Pacific All-terrain Vehicles Market by Country, 2023 - 2030, USD Million

TABLE 24 Asia Pacific Side By Side Vehicles Market by Country, 2019 - 2022, USD Million

TABLE 25 Asia Pacific Side By Side Vehicles Market by Country, 2023 - 2030, USD Million

TABLE 26 Asia Pacific Personal Watercrafts Market by Country, 2019 - 2022, USD Million

TABLE 27 Asia Pacific Personal Watercrafts Market by Country, 2023 - 2030, USD Million

TABLE 28 Asia Pacific Heavy Weight Motorcycles Market by Country, 2019 - 2022, USD Million

TABLE 29 Asia Pacific Heavy Weight Motorcycles Market by Country, 2023 - 2030, USD Million

TABLE 30 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

TABLE 31 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

TABLE 32 Asia Pacific Power Sports Market by Country, 2019 - 2022, USD Million

TABLE 33 Asia Pacific Power Sports Market by Country, 2023 - 2030, USD Million

TABLE 34 China Power Sports Market, 2019 - 2022, USD Million

TABLE 35 China Power Sports Market, 2023 - 2030, USD Million

TABLE 36 China Power Sports Market by Application, 2019 - 2022, USD Million

TABLE 37 China Power Sports Market by Application, 2023 - 2030, USD Million

TABLE 38 China Power Sports Market by Propulsion, 2019 - 2022, USD Million

TABLE 39 China Power Sports Market by Propulsion, 2023 - 2030, USD Million

TABLE 40 China Power Sports Market by Vehicle Type, 2019 - 2022, USD Million

TABLE 41 China Power Sports Market by Vehicle Type, 2023 - 2030, USD Million

TABLE 42 Japan Power Sports Market, 2019 - 2022, USD Million

TABLE 43 Japan Power Sports Market, 2023 - 2030, USD Million

TABLE 44 Japan Power Sports Market by Application, 2019 - 2022, USD Million

TABLE 45 Japan Power Sports Market by Application, 2023 - 2030, USD Million

TABLE 46 Japan Power Sports Market by Propulsion, 2019 - 2022, USD Million

TABLE 47 Japan Power Sports Market by Propulsion, 2023 - 2030, USD Million

TABLE 48 Japan Power Sports Market by Vehicle Type, 2019 - 2022, USD Million

TABLE 49 Japan Power Sports Market by Vehicle Type, 2023 - 2030, USD Million

TABLE 50 India Power Sports Market, 2019 - 2022, USD Million

TABLE 51 India Power Sports Market, 2023 - 2030, USD Million

TABLE 52 India Power Sports Market by Application, 2019 - 2022, USD Million

TABLE 53 India Power Sports Market by Application, 2023 - 2030, USD Million

TABLE 54 India Power Sports Market by Propulsion, 2019 - 2022, USD Million

TABLE 55 India Power Sports Market by Propulsion, 2023 - 2030, USD Million

TABLE 56 India Power Sports Market by Vehicle Type, 2019 - 2022, USD Million

TABLE 57 India Power Sports Market by Vehicle Type, 2023 - 2030, USD Million

TABLE 58 South Korea Power Sports Market, 2019 - 2022, USD Million

TABLE 59 South Korea Power Sports Market, 2023 - 2030, USD Million

TABLE 60 South Korea Power Sports Market by Application, 2019 - 2022, USD Million

TABLE 61 South Korea Power Sports Market by Application, 2023 - 2030, USD Million

TABLE 62 South Korea Power Sports Market by Propulsion, 2019 - 2022, USD Million

TABLE 63 South Korea Power Sports Market by Propulsion, 2023 - 2030, USD Million

TABLE 64 South Korea Power Sports Market by Vehicle Type, 2019 - 2022, USD Million

TABLE 65 South Korea Power Sports Market by Vehicle Type, 2023 - 2030, USD Million

TABLE 66 Australia Power Sports Market, 2019 - 2022, USD Million

TABLE 67 Australia Power Sports Market, 2023 - 2030, USD Million

TABLE 68 Australia Power Sports Market by Application, 2019 - 2022, USD Million

TABLE 69 Australia Power Sports Market by Application, 2023 - 2030, USD Million

TABLE 70 Australia Power Sports Market by Propulsion, 2019 - 2022, USD Million

TABLE 71 Australia Power Sports Market by Propulsion, 2023 - 2030, USD Million

TABLE 72 Australia Power Sports Market by Vehicle Type, 2019 - 2022, USD Million

TABLE 73 Australia Power Sports Market by Vehicle Type, 2023 - 2030, USD Million

TABLE 74 Malaysia Power Sports Market, 2019 - 2022, USD Million

TABLE 75 Malaysia Power Sports Market, 2023 - 2030, USD Million

TABLE 76 Malaysia Power Sports Market by Application, 2019 - 2022, USD Million

TABLE 77 Malaysia Power Sports Market by Application, 2023 - 2030, USD Million

TABLE 78 Malaysia Power Sports Market by Propulsion, 2019 - 2022, USD Million

TABLE 79 Malaysia Power Sports Market by Propulsion, 2023 - 2030, USD Million

TABLE 80 Malaysia Power Sports Market by Vehicle Type, 2019 - 2022, USD Million

TABLE 81 Malaysia Power Sports Market by Vehicle Type, 2023 - 2030, USD Million

TABLE 82 Rest of Asia Pacific Power Sports Market, 2019 - 2022, USD Million

TABLE 83 Rest of Asia Pacific Power Sports Market, 2023 - 2030, USD Million

TABLE 84 Rest of Asia Pacific Power Sports Market by Application, 2019 - 2022, USD Million

TABLE 85 Rest of Asia Pacific Power Sports Market by Application, 2023 - 2030, USD Million

TABLE 86 Rest of Asia Pacific Power Sports Market by Propulsion, 2019 - 2022, USD Million

TABLE 87 Rest of Asia Pacific Power Sports Market by Propulsion, 2023 - 2030, USD Million

TABLE 88 Rest of Asia Pacific Power Sports Market by Vehicle Type, 2019 - 2022, USD Million

TABLE 89 Rest of Asia Pacific Power Sports Market by Vehicle Type, 2023 - 2030, USD Million

TABLE 90 Key Information – Yamaha Motor Co., Ltd.

TABLE 91 Key information – Zhejiang CFMoto Power Co., Ltd.

TABLE 92 Key Information – Bombardier recreational products (brp) inc.

TABLE 93 Key Information – Kawasaki Heavy Industries, Ltd.

TABLE 94 Key Information – Textron, Inc.

TABLE 95 Key information – Polaris, Inc.

TABLE 96 Key information – Suzuki Motor Corporation

TABLE 97 key Information – Honda Motor Co. Ltd.

TABLE 98 Key Information – KTM AG

TABLE 99 key Information – Volkswagen AG

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Power Sports Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Power Sports Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Product Launches and Product Expansions: 2022, Jan – 2024, Feb) Leading Players

FIG 7 Porter’s Five Forces Analysis – Power Sports Market

FIG 8 Asia Pacific Power Sports Market share by Application, 2022

FIG 9 Asia Pacific Power Sports Market share by Application, 2030

FIG 10 Asia Pacific Power Sports Market by Application, 2019 - 2030, USD Million

FIG 11 Asia Pacific Power Sports Market share by Propulsion, 2022

FIG 12 Asia Pacific Power Sports Market share by Propulsion, 2030

FIG 13 Asia Pacific Power Sports Market by Propulsion, 2019 - 2030, USD Million

FIG 14 Asia Pacific Power Sports Market share by Vehicle Type, 2022

FIG 15 Asia Pacific Power Sports Market share by Vehicle Type, 2030

FIG 16 Asia Pacific Power Sports Market by Vehicle Type, 2019 - 2030, USD Million

FIG 17 Asia Pacific Power Sports Market share by Country, 2022

FIG 18 Asia Pacific Power Sports Market share by Country, 2030

FIG 19 Asia Pacific Power Sports Market by Country, 2019 - 2030, USD Million

FIG 20 SWOT Analysis: Yamaha Motor Co., Ltd.

FIG 21 Recent strategies and developments: Zhejiang CFMoto Power Co., Ltd.

FIG 22 SWOT Analysis: Zhejiang CFMoto Power Co., Ltd.

FIG 23 SWOT Analysis: Bombardier Recreational Products (BRP) Inc.

FIG 24 SWOT Analysis: Kawasaki Heavy Industries, Ltd.

FIG 25 SWOT Analysis: Textron, Inc.

FIG 26 SWOT Analysis: Polaris, Inc.

FIG 27 SWOT Analysis: Suzuki Motor Corporation

FIG 28 SWOT Analysis: Honda Motor Co. Ltd.

FIG 29 SWOT Analysis: KTM AG

FIG 30 SWOT Analysis: Volkswagen AG