Asia Pacific Payment Card Skimming Market Size, Share & Trends Analysis Report By Component, By Organization Size (Large Enterprise, and Small & Medium-Sized Enterprises), By Deployment Type (On-Premises, and Cloud), By Application, By Country and Growth Forecast, 2023 - 2030

Published Date : 22-Mar-2024 | Pages: 104 | Formats: PDF |

COVID-19 Impact on the Asia Pacific Payment Card Skimming Market

The Asia Pacific Payment Card Skimming Market would witness market growth of 10.6% CAGR during the forecast period (2023-2030).

The China market dominated the Asia Pacific Payment Card Skimming Market, By Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $451.4 million by 2030. The Japan market is registering a CAGR of 9.9% during (2023 - 2030). Additionally, The India market would showcase a CAGR of 11.2% during (2023 - 2030).

ML algorithms and artificial intelligence (AI) techniques are being deployed to analyze vast amounts of transaction data, detect patterns indicative of fraudulent activity, and identify anomalies or deviations from normal behavior. By leveraging machine learning and AI capabilities, financial institutions and payment processors can detect and prevent real-time skimming attacks, enabling proactive intervention and fraud mitigation.

Also, blockchain technology offers inherent security features, such as cryptographic encryption, decentralized consensus mechanisms, and immutable transaction records, making it resistant to tampering and fraud. By leveraging blockchain technology, payment systems can enhance transparency, traceability, and trust in financial transactions, reducing the risk of payment card skimming and enhancing the integrity of payment networks. Blockchain-based payment solutions offer enhanced security and resilience against cyber threats, providing consumers and businesses with greater confidence in the safety and reliability of digital payments.

With the rise in cyber scams, including phishing, identity theft, and online fraud, there is likely to be increased awareness among businesses and consumers in Singapore about the importance of cybersecurity measures, including protection against it. As per the State Council Information Office of the People's Republic of China, 2021 e-commerce transactions in China surged by 19.6%, reaching a transaction volume of 42.3 trillion yuan (approximately 6.15 trillion U.S. dollars). Additionally, China plans to designate 14 e-commerce industrial parks as e-commerce demonstration bases, bringing the total number to 155. Hence, the increasing e-commerce transactions and growing cybercrimes in the region propel the market's growth.

Free Valuable Insights: The Global Payment Card Skimming Market is Predict to reach USD 5.6 Billion by 2030, at a CAGR of 9.6%

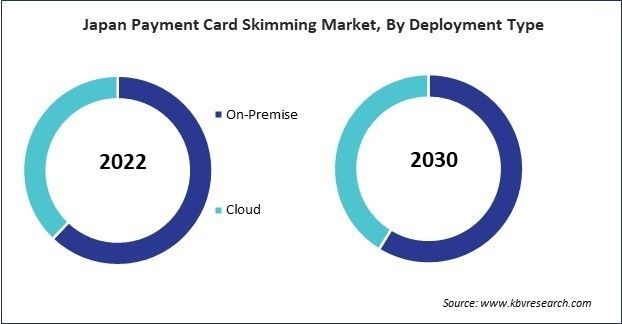

Based on Organization Size, the market is segmented into Large Enterprise, and Small & Medium-Sized Enterprises. Based on Deployment Type, the market is segmented into On-Premise, and Cloud. Based on Application, the market is segmented into Identity Theft, ATMs, Payment Fraud, Money Laundering, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Fiserv, Inc. (Clover Network, Inc.)

- InvestEdge, Inc. (Featheringill Capital)

- C2C SmartCompliance LLC

- Sesame Software (Speridian Technologies)

- SAI360 Inc. (BWise)

- Matrix IFS (Matrix Business IT)

- Rivial Data Security LLC

- Riskskill

- Compliance Forge, LLC

- NCR Atleos Corporation (NCR Corporation)

Asia Pacific Payment Card Skimming Market Report Segmentation

By Component

- Solution

- Services

By Organization Size

- Large Enterprise

- Small & Medium-Sized Enterprises

By Deployment Type

- On-Premises

- Cloud

By Application

- Identity Theft

- ATMs

- Payment Fraud

- Money Laundering

- Others

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Payment Card Skimming Market, by Component

1.4.2 Asia Pacific Payment Card Skimming Market, by Organization Size

1.4.3 Asia Pacific Payment Card Skimming Market, by Deployment Type

1.4.4 Asia Pacific Payment Card Skimming Market, by Application

1.4.5 Asia Pacific Payment Card Skimming Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. Asia Pacific Payment Card Skimming Market, By Component

4.1 Asia Pacific Solution Market, By Country

4.2 Asia Pacific Services Market, By Country

Chapter 5. Asia Pacific Payment Card Skimming Market, By Organization Size

5.1 Asia Pacific Large Enterprise Market, By Country

5.2 Asia Pacific Small & Medium-Sized Enterprises Market, By Country

Chapter 6. Asia Pacific Payment Card Skimming Market, By Deployment Type

6.1 Asia Pacific On-Premise Market, By Country

6.2 Asia Pacific Cloud Market, By Country

Chapter 7. Asia Pacific Payment Card Skimming Market, By Application

7.1 Asia Pacific Identity Theft Market, By Country

7.2 Asia Pacific ATMs Market, By Country

7.3 Asia Pacific Payment Fraud Market, By Country

7.4 Asia Pacific Money Laundering Market, By Country

7.5 Asia Pacific Others Market, By Country

Chapter 8. Asia Pacific Payment Card Skimming Market, By Country

8.1 China Payment Card Skimming Market

8.1.1 China Payment Card Skimming Market, By Component

8.1.2 China Payment Card Skimming Market, By Organization Size

8.1.3 China Payment Card Skimming Market, By Deployment Type

8.1.4 China Payment Card Skimming Market, By Application

8.2 Japan Payment Card Skimming Market

8.2.1 Japan Payment Card Skimming Market, By Component

8.2.2 Japan Payment Card Skimming Market, By Organization Size

8.2.3 Japan Payment Card Skimming Market, By Deployment Type

8.2.4 Japan Payment Card Skimming Market, By Application

8.3 India Payment Card Skimming Market

8.3.1 India Payment Card Skimming Market, By Component

8.3.2 India Payment Card Skimming Market, By Organization Size

8.3.3 India Payment Card Skimming Market, By Deployment Type

8.3.4 India Payment Card Skimming Market, By Application

8.4 South Korea Payment Card Skimming Market

8.4.1 South Korea Payment Card Skimming Market, By Component

8.4.2 South Korea Payment Card Skimming Market, By Organization Size

8.4.3 South Korea Payment Card Skimming Market, By Deployment Type

8.4.4 South Korea Payment Card Skimming Market, By Application

8.5 Singapore Payment Card Skimming Market

8.5.1 Singapore Payment Card Skimming Market, By Component

8.5.2 Singapore Payment Card Skimming Market, By Organization Size

8.5.3 Singapore Payment Card Skimming Market, By Deployment Type

8.5.4 Singapore Payment Card Skimming Market, By Application

8.6 Malaysia Payment Card Skimming Market

8.6.1 Malaysia Payment Card Skimming Market, By Component

8.6.2 Malaysia Payment Card Skimming Market, By Organization Size

8.6.3 Malaysia Payment Card Skimming Market, By Deployment Type

8.6.4 Malaysia Payment Card Skimming Market, By Application

8.7 Rest of Asia Pacific Payment Card Skimming Market

8.7.1 Rest of Asia Pacific Payment Card Skimming Market, By Component

8.7.2 Rest of Asia Pacific Payment Card Skimming Market, By Organization Size

8.7.3 Rest of Asia Pacific Payment Card Skimming Market, By Deployment Type

8.7.4 Rest of Asia Pacific Payment Card Skimming Market, By Application

Chapter 9. Company Profiles

9.1 Fiserv, Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Recent strategies and developments:

9.1.4.1 Partnerships, Collaborations, and Agreements:

9.1.4.2 Acquisition and Mergers:

9.1.5 SWOT Analysis

9.2 InvestEdge, Inc. (Featheringill Capital)

9.2.1 Company Overview

9.3 C2C SmartCompliance LLC

9.3.1 Company Overview

9.3.2 Recent strategies and developments:

9.3.2.1 Product Launches and Product Expansions:

9.4 Sesame Software (Speridian Technologies)

9.4.1 Company Overview

9.5 SAI360 Inc. (BWise)

9.5.1 Company Overview

9.5.2 Recent strategies and developments:

9.5.2.1 Product Launches and Product Expansions:

9.5.3 SWOT Analysis

9.6 Matrix IFS (Matrix Business IT)

9.6.1 Company Overview

9.7 Rivial Data Security LLC

9.7.1 Company Overview

9.7.2 SWOT Analysis

9.8 Riskskill

9.8.1 Company Overview

9.9 Compliance Forge, LLC

9.9.1 Company Overview

9.10. NCR Atleos Corporation (NCR Corporation)

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Segmental and Regional Analysis

9.10.4 Research & Development Expenses

9.10.5 SWOT Analysis

TABLE 2 Asia Pacific Payment Card Skimming Market, 2023 - 2030, USD Million

TABLE 3 Asia Pacific Payment Card Skimming Market, By Component, 2019 - 2022, USD Million

TABLE 4 Asia Pacific Payment Card Skimming Market, By Component, 2023 - 2030, USD Million

TABLE 5 Asia Pacific Solution Market, By Country, 2019 - 2022, USD Million

TABLE 6 Asia Pacific Solution Market, By Country, 2023 - 2030, USD Million

TABLE 7 Asia Pacific Services Market, By Country, 2019 - 2022, USD Million

TABLE 8 Asia Pacific Services Market, By Country, 2023 - 2030, USD Million

TABLE 9 Asia Pacific Payment Card Skimming Market, By Organization Size, 2019 - 2022, USD Million

TABLE 10 Asia Pacific Payment Card Skimming Market, By Organization Size, 2023 - 2030, USD Million

TABLE 11 Asia Pacific Large Enterprise Market, By Country, 2019 - 2022, USD Million

TABLE 12 Asia Pacific Large Enterprise Market, By Country, 2023 - 2030, USD Million

TABLE 13 Asia Pacific Small & Medium-Sized Enterprises Market, By Country, 2019 - 2022, USD Million

TABLE 14 Asia Pacific Small & Medium-Sized Enterprises Market, By Country, 2023 - 2030, USD Million

TABLE 15 Asia Pacific Payment Card Skimming Market, By Deployment Type, 2019 - 2022, USD Million

TABLE 16 Asia Pacific Payment Card Skimming Market, By Deployment Type, 2023 - 2030, USD Million

TABLE 17 Asia Pacific On-Premise Market, By Country, 2019 - 2022, USD Million

TABLE 18 Asia Pacific On-Premise Market, By Country, 2023 - 2030, USD Million

TABLE 19 Asia Pacific Cloud Market, By Country, 2019 - 2022, USD Million

TABLE 20 Asia Pacific Cloud Market, By Country, 2023 - 2030, USD Million

TABLE 21 Asia Pacific Payment Card Skimming Market, By Application, 2019 - 2022, USD Million

TABLE 22 Asia Pacific Payment Card Skimming Market, By Application, 2023 - 2030, USD Million

TABLE 23 Asia Pacific Identity Theft Market, By Country, 2019 - 2022, USD Million

TABLE 24 Asia Pacific Identity Theft Market, By Country, 2023 - 2030, USD Million

TABLE 25 Asia Pacific ATMs Market, By Country, 2019 - 2022, USD Million

TABLE 26 Asia Pacific ATMs Market, By Country, 2023 - 2030, USD Million

TABLE 27 Asia Pacific Payment Fraud Market, By Country, 2019 - 2022, USD Million

TABLE 28 Asia Pacific Payment Fraud Market, By Country, 2023 - 2030, USD Million

TABLE 29 Asia Pacific Money Laundering Market, By Country, 2019 - 2022, USD Million

TABLE 30 Asia Pacific Money Laundering Market, By Country, 2023 - 2030, USD Million

TABLE 31 Asia Pacific Others Market, By Country, 2019 - 2022, USD Million

TABLE 32 Asia Pacific Others Market, By Country, 2023 - 2030, USD Million

TABLE 33 Asia Pacific Payment Card Skimming Market, By Country, 2019 - 2022, USD Million

TABLE 34 Asia Pacific Payment Card Skimming Market, By Country, 2023 - 2030, USD Million

TABLE 35 China Payment Card Skimming Market, 2019 - 2022, USD Million

TABLE 36 China Payment Card Skimming Market, 2023 - 2030, USD Million

TABLE 37 China Payment Card Skimming Market, By Component, 2019 - 2022, USD Million

TABLE 38 China Payment Card Skimming Market, By Component, 2023 - 2030, USD Million

TABLE 39 China Payment Card Skimming Market, By Organization Size, 2019 - 2022, USD Million

TABLE 40 China Payment Card Skimming Market, By Organization Size, 2023 - 2030, USD Million

TABLE 41 China Payment Card Skimming Market, By Deployment Type, 2019 - 2022, USD Million

TABLE 42 China Payment Card Skimming Market, By Deployment Type, 2023 - 2030, USD Million

TABLE 43 China Payment Card Skimming Market, By Application, 2019 - 2022, USD Million

TABLE 44 China Payment Card Skimming Market, By Application, 2023 - 2030, USD Million

TABLE 45 Japan Payment Card Skimming Market, 2019 - 2022, USD Million

TABLE 46 Japan Payment Card Skimming Market, 2023 - 2030, USD Million

TABLE 47 Japan Payment Card Skimming Market, By Component, 2019 - 2022, USD Million

TABLE 48 Japan Payment Card Skimming Market, By Component, 2023 - 2030, USD Million

TABLE 49 Japan Payment Card Skimming Market, By Organization Size, 2019 - 2022, USD Million

TABLE 50 Japan Payment Card Skimming Market, By Organization Size, 2023 - 2030, USD Million

TABLE 51 Japan Payment Card Skimming Market, By Deployment Type, 2019 - 2022, USD Million

TABLE 52 Japan Payment Card Skimming Market, By Deployment Type, 2023 - 2030, USD Million

TABLE 53 Japan Payment Card Skimming Market, By Application, 2019 - 2022, USD Million

TABLE 54 Japan Payment Card Skimming Market, By Application, 2023 - 2030, USD Million

TABLE 55 India Payment Card Skimming Market, 2019 - 2022, USD Million

TABLE 56 India Payment Card Skimming Market, 2023 - 2030, USD Million

TABLE 57 India Payment Card Skimming Market, By Component, 2019 - 2022, USD Million

TABLE 58 India Payment Card Skimming Market, By Component, 2023 - 2030, USD Million

TABLE 59 India Payment Card Skimming Market, By Organization Size, 2019 - 2022, USD Million

TABLE 60 India Payment Card Skimming Market, By Organization Size, 2023 - 2030, USD Million

TABLE 61 India Payment Card Skimming Market, By Deployment Type, 2019 - 2022, USD Million

TABLE 62 India Payment Card Skimming Market, By Deployment Type, 2023 - 2030, USD Million

TABLE 63 India Payment Card Skimming Market, By Application, 2019 - 2022, USD Million

TABLE 64 India Payment Card Skimming Market, By Application, 2023 - 2030, USD Million

TABLE 65 South Korea Payment Card Skimming Market, 2019 - 2022, USD Million

TABLE 66 South Korea Payment Card Skimming Market, 2023 - 2030, USD Million

TABLE 67 South Korea Payment Card Skimming Market, By Component, 2019 - 2022, USD Million

TABLE 68 South Korea Payment Card Skimming Market, By Component, 2023 - 2030, USD Million

TABLE 69 South Korea Payment Card Skimming Market, By Organization Size, 2019 - 2022, USD Million

TABLE 70 South Korea Payment Card Skimming Market, By Organization Size, 2023 - 2030, USD Million

TABLE 71 South Korea Payment Card Skimming Market, By Deployment Type, 2019 - 2022, USD Million

TABLE 72 South Korea Payment Card Skimming Market, By Deployment Type, 2023 - 2030, USD Million

TABLE 73 South Korea Payment Card Skimming Market, By Application, 2019 - 2022, USD Million

TABLE 74 South Korea Payment Card Skimming Market, By Application, 2023 - 2030, USD Million

TABLE 75 Singapore Payment Card Skimming Market, 2019 - 2022, USD Million

TABLE 76 Singapore Payment Card Skimming Market, 2023 - 2030, USD Million

TABLE 77 Singapore Payment Card Skimming Market, By Component, 2019 - 2022, USD Million

TABLE 78 Singapore Payment Card Skimming Market, By Component, 2023 - 2030, USD Million

TABLE 79 Singapore Payment Card Skimming Market, By Organization Size, 2019 - 2022, USD Million

TABLE 80 Singapore Payment Card Skimming Market, By Organization Size, 2023 - 2030, USD Million

TABLE 81 Singapore Payment Card Skimming Market, By Deployment Type, 2019 - 2022, USD Million

TABLE 82 Singapore Payment Card Skimming Market, By Deployment Type, 2023 - 2030, USD Million

TABLE 83 Singapore Payment Card Skimming Market, By Application, 2019 - 2022, USD Million

TABLE 84 Singapore Payment Card Skimming Market, By Application, 2023 - 2030, USD Million

TABLE 85 Malaysia Payment Card Skimming Market, 2019 - 2022, USD Million

TABLE 86 Malaysia Payment Card Skimming Market, 2023 - 2030, USD Million

TABLE 87 Malaysia Payment Card Skimming Market, By Component, 2019 - 2022, USD Million

TABLE 88 Malaysia Payment Card Skimming Market, By Component, 2023 - 2030, USD Million

TABLE 89 Malaysia Payment Card Skimming Market, By Organization Size, 2019 - 2022, USD Million

TABLE 90 Malaysia Payment Card Skimming Market, By Organization Size, 2023 - 2030, USD Million

TABLE 91 Malaysia Payment Card Skimming Market, By Deployment Type, 2019 - 2022, USD Million

TABLE 92 Malaysia Payment Card Skimming Market, By Deployment Type, 2023 - 2030, USD Million

TABLE 93 Malaysia Payment Card Skimming Market, By Application, 2019 - 2022, USD Million

TABLE 94 Malaysia Payment Card Skimming Market, By Application, 2023 - 2030, USD Million

TABLE 95 Rest of Asia Pacific Payment Card Skimming Market, 2019 - 2022, USD Million

TABLE 96 Rest of Asia Pacific Payment Card Skimming Market, 2023 - 2030, USD Million

TABLE 97 Rest of Asia Pacific Payment Card Skimming Market, By Component, 2019 - 2022, USD Million

TABLE 98 Rest of Asia Pacific Payment Card Skimming Market, By Component, 2023 - 2030, USD Million

TABLE 99 Rest of Asia Pacific Payment Card Skimming Market, By Organization Size, 2019 - 2022, USD Million

TABLE 100 Rest of Asia Pacific Payment Card Skimming Market, By Organization Size, 2023 - 2030, USD Million

TABLE 101 Rest of Asia Pacific Payment Card Skimming Market, By Deployment Type, 2019 - 2022, USD Million

TABLE 102 Rest of Asia Pacific Payment Card Skimming Market, By Deployment Type, 2023 - 2030, USD Million

TABLE 103 Rest of Asia Pacific Payment Card Skimming Market, By Application, 2019 - 2022, USD Million

TABLE 104 Rest of Asia Pacific Payment Card Skimming Market, By Application, 2023 - 2030, USD Million

TABLE 105 Key Information –Fiserv, Inc.

TABLE 106 Key Information – InvestEdge, Inc.

TABLE 107 Key Information – C2C SmartCompliance LLC

TABLE 108 Key Information – Sesame Software

TABLE 109 Key Information – SAI360 Inc.

TABLE 110 Key Information – Matrix IFS

TABLE 111 Key Information – Rivial Data Security LLC

TABLE 112 Key Information – Riskskill

TABLE 113 Key Information – Compliance Forge, LLC

TABLE 114 Key Information – NCR Atleos Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Payment Card Skimming Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Payment Card Skimming Market

FIG 4 Porter’s Five Forces Analysis - Payment Card Skimming Market

FIG 5 Asia Pacific Payment Card Skimming Market share, By Component, 2022

FIG 6 Asia Pacific Payment Card Skimming Market share, By Component, 2030

FIG 7 Asia Pacific Payment Card Skimming Market, By Component, 2019 - 2030, USD Million

FIG 8 Asia Pacific Payment Card Skimming Market share, By Organization Size, 2022

FIG 9 Asia Pacific Payment Card Skimming Market share, By Organization Size, 2030

FIG 10 Asia Pacific Payment Card Skimming Market, By Organization Size, 2019 - 2030, USD Million

FIG 11 Asia Pacific Payment Card Skimming Market share, By Deployment Type, 2022

FIG 12 Asia Pacific Payment Card Skimming Market share, By Deployment Type, 2030

FIG 13 Asia Pacific Payment Card Skimming Market, By Deployment Type, 2019 - 2030, USD Million

FIG 14 Asia Pacific Payment Card Skimming Market share, By Application, 2022

FIG 15 Asia Pacific Payment Card Skimming Market share, By Application, 2030

FIG 16 Asia Pacific Payment Card Skimming Market, By Application, 2019 - 2030, USD Million

FIG 17 Asia Pacific Payment Card Skimming Market share, By Country, 2022

FIG 18 Asia Pacific Payment Card Skimming Market share, By Country, 2030

FIG 19 Asia Pacific Payment Card Skimming Market, By Country, 2019 - 2030, USD Million

FIG 20 SWOT Analysis: Fiserv, Inc.

FIG 21 SWOT Analysis: SAI360 Inc.

FIG 22 SWOT Analysis: Rivial Data Security LLC

FIG 23 SWOT Analysis: NCR Atleos Corporation