Asia Pacific Native Advertising Market Size, Share & Industry Analysis Report By Platform, By Content Format (In-Feed Native Ads, In-Video Native Ads, Sponsored Content and In-Image Native Ads), By End Use (Retail & eCommerce, Media & Entertainment, BFSI, Travel & Hospitality, Healthcare, Telecom & IT, Automotive, Education and Other End Uses), By Country and Growth Forecast, 2025 - 2032

Published Date : 05-Dec-2025 |

Pages: 157 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific Native Advertising Market

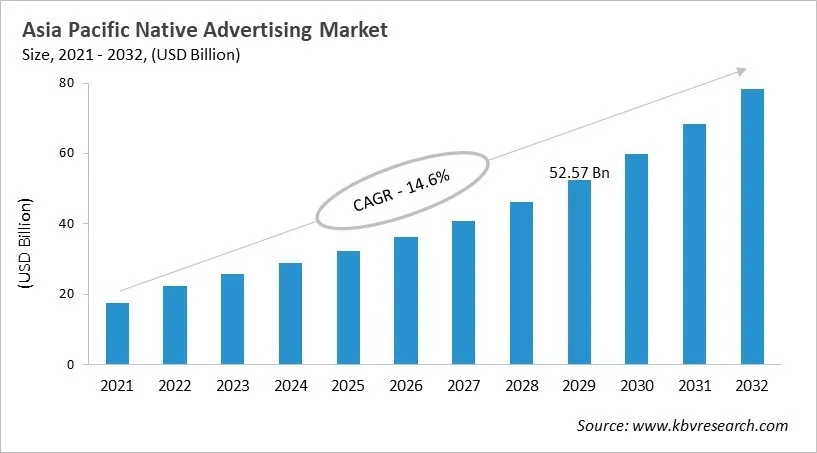

The Asia Pacific Native Advertising Market would witness market growth of 13.6% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Native Advertising Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $24,237.9 million by 2032. The Japan market is registering a CAGR of 12.9% during (2025 - 2032). Additionally, The India market would showcase a CAGR of 14.3% during (2025 - 2032). The China and Japan led the Asia Pacific Native Advertising Market by Country with a market share of 34.9% and 15.5% in 2024. The Australia market is expected to witness a CAGR of 15.6% during throughout the forecast period.

Native advertising in the Asia-Pacific region has changed from simple sponsored content to a complex, tech-driven part of digital marketing that seamlessly blends promotional messages with editorial context. Mobile-first consumption, the growth of programmatic and in-app inventory, and platform investments in native tools and measurement have all helped this change happen. Modern native formats, such as sponsored articles, in-feed social placements, and connected TV units, focus on contextual relevance, component-based creativity, and clear disclosure. They try to find a balance between user experience and business goals. Advertisers in APAC are putting more emphasis on engagement-driven results like dwell time and scroll depth instead of just impressions. They are also using AI and automation to improve creative variants and programmatic delivery on a large scale.

In APAC, market strategies are based on three main pillars: standardized, component-based creative for consistency across devices; following disclosure and regulatory rules to keep trust; and forming strategic partnerships with local publishers to make content more relevant to the context. Global platforms give you the ability to measure and scale, while regional publishers give you trusted editorial spaces, and specialist networks let you tell stories quickly and in a way that fits your audience. As attention spans get shorter and there are more platforms, advertisers are focusing on high-quality, market-specific native placements that combine global assets with local execution. As a result, the competitive landscape favors integrated solutions that provide reliable, open, and quantifiable results. This makes native a popular, performance-based channel in APAC.

Platform Outlook

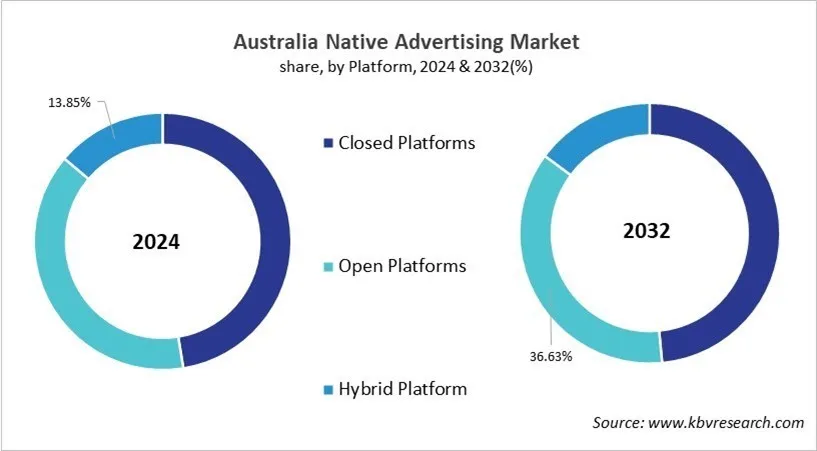

Based on Platform, the market is segmented into Closed Platforms, Open Platforms and Hybrid Platform. The Closed Platforms market segment dominated the Australia Native Advertising Market by Platform is expected to grow at a CAGR of 15.9 % during the forecast period thereby continuing its dominance until 2032. Also, The Hybrid Platform market is anticipated to grow as a CAGR of 16.7 % during the forecast period during (2025 - 2032).

End Use Outlook

Based on End Use, the market is segmented into Retail & eCommerce, Media & Entertainment, BFSI, Travel & Hospitality, Healthcare, Telecom & IT, Automotive, Education and Other End Uses. Among various Japan Native Advertising Market by End Use; The Retail & eCommerce market achieved a market size of USD $1571.3 Million in 2024 and is expected to grow at a CAGR of 10.9 % during the forecast period. The Education market is predicted to experience a CAGR of 14.5% throughout the forecast period from (2025 - 2032).

Free Valuable Insights: The Native Advertising Market is Predicted to reach USD 263.84 Billion by 2032, at a CAGR of 13.0%

Country Outlook

China's native advertising market does well in a digital-first world with highly engaged mobile users, platforms full of content, and apps that work together. The high demand is due to how well ads fit in with user experiences on lifestyle portals, social feeds, video platforms, and app interfaces. The market is shaped by a number of important factors, such as advanced digital infrastructure, widespread mobile payments, high user interaction, and a culture that values content. Regulatory guidelines also affect messaging and disclosure. Trends right now focus on immersive formats, AI-driven personalization, interactive storytelling, and designs that work best on mobile devices. Domestic digital platforms and multi-functional apps are the most popular in the competition. Advertisers focus on making their ads more relevant to the context, using integrated multi-touch strategies, and getting the most people to interact with their ads in unified digital ecosystems.

List of Key Companies Profiled

- Teads Holding Co. (Outbrain Inc.)

- TABOOLA.COM LTD.

- MGID Inc.

- RevContent, LLC (Star Mountain Fund Management, LLC)

- Nativo, Inc.

- Yahoo Inc.

- Triple Lift, Inc. (Vista Equity Partners Management, LLC)

- adMarketplace Inc.

- ADYOULIKE SA (Open Web Technologies Ltd.)

- Sharethrough Inc.

Asia Pacific Native Advertising Market Report Segmentation

By Platform

- Closed Platforms

- Open Platforms

- Hybrid Platform

By Content Format

- In-Feed Native Ads

- In-Video Native Ads

- Sponsored Content

- In-Image Native Ads

By End Use

- Retail & eCommerce

- Media & Entertainment

- BFSI

- Travel & Hospitality

- Healthcare

- Telecom & IT

- Automotive

- Education

- Other End Uses

By Country

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Native Advertising Market, by Platform

1.4.2 Asia Pacific Native Advertising Market, by Content Format

1.4.3 Asia Pacific Native Advertising Market, by End Use

1.4.4 Asia Pacific Native Advertising Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Market Trends – Asia Pacific Native Advertising Market

Chapter 5. State of Competition – Asia Pacific Native Advertising Market

Chapter 6. Value Chain Analysis of Native Advertising Market

Chapter 7. Competition Analysis – Global

7.1 Market Share Analysis, 2024

7.2 Recent Strategies Deployed in Native Advertising Market

7.3 Porter Five Forces Analysis

Chapter 8. Product Life Cycle (PLC) – Native Advertising Market

Chapter 9. Market Consolidation – Native Advertising Market

Chapter 10. Key Customer Criteria – Native Advertising Market

Chapter 11. Asia Pacific Native Advertising Market by Platform

11.1 Asia Pacific Closed Platforms Market by Country

11.2 Asia Pacific Open Platforms Market by Country

11.3 Asia Pacific Hybrid Platform Market by Country

Chapter 12. Asia Pacific Native Advertising Market by Content Format

12.1 Asia Pacific In-Feed Native Ads Market by Country

12.2 Asia Pacific In-Video Native Ads Market by Country

12.3 Asia Pacific Sponsored Content Market by Country

12.4 Asia Pacific In-Image Native Ads Market by Country

Chapter 13. Asia Pacific Native Advertising Market by End Use

13.1 Asia Pacific Retail & eCommerce Market by Country

13.2 Asia Pacific Media & Entertainment Market by Country

13.3 Asia Pacific BFSI Market by Country

13.4 Asia Pacific Travel & Hospitality Market by Country

13.5 Asia Pacific Healthcare Market by Country

13.6 Asia Pacific Telecom & IT Market by Country

13.7 Asia Pacific Automotive Market by Country

13.8 Asia Pacific Education Market by Country

13.9 Asia Pacific Other End Uses Market by Country

Chapter 14. Asia Pacific Native Advertising Market by Country

14.1 China Native Advertising Market

14.1.1 China Native Advertising Market by Platform

14.1.2 China Native Advertising Market by Content Format

14.1.3 China Native Advertising Market by End Use

14.2 Japan Native Advertising Market

14.2.1 Japan Native Advertising Market by Platform

14.2.2 Japan Native Advertising Market by Content Format

14.2.3 Japan Native Advertising Market by End Use

14.3 India Native Advertising Market

14.3.1 India Native Advertising Market by Platform

14.3.2 India Native Advertising Market by Content Format

14.3.3 India Native Advertising Market by End Use

14.4 South Korea Native Advertising Market

14.4.1 South Korea Native Advertising Market by Platform

14.4.2 South Korea Native Advertising Market by Content Format

14.4.3 South Korea Native Advertising Market by End Use

14.5 Australia Native Advertising Market

14.5.1 Australia Native Advertising Market by Platform

14.5.2 Australia Native Advertising Market by Content Format

14.5.3 Australia Native Advertising Market by End Use

14.6 Malaysia Native Advertising Market

14.6.1 Malaysia Native Advertising Market by Platform

14.6.2 Malaysia Native Advertising Market by Content Format

14.6.3 Malaysia Native Advertising Market by End Use

14.7 Rest of Asia Pacific Native Advertising Market

14.7.1 Rest of Asia Pacific Native Advertising Market by Platform

14.7.2 Rest of Asia Pacific Native Advertising Market by Content Format

14.7.3 Rest of Asia Pacific Native Advertising Market by End Use

Chapter 15. Company Profiles

15.1 Teads Holding Co. (Outbrain Inc.)

15.1.1 Company Overview

15.1.2 Financial Analysis

15.1.3 Research & Development Expenses

15.1.4 Recent strategies and developments:

15.1.4.1 Partnerships, Collaborations, and Agreements:

15.2 TABOOLA.COM LTD.

15.2.1 Company Overview

15.2.2 Financial Analysis

15.2.3 Regional Analysis

15.2.4 Research & Development Expenses

15.2.5 Recent strategies and developments:

15.2.5.1 Product Launches and Product Expansions:

15.3 MGID Inc.

15.3.1 Company Overview

15.3.2 Recent strategies and developments:

15.3.2.1 Partnerships, Collaborations, and Agreements:

15.3.2.2 Product Launches and Product Expansions:

15.3.2.3 Acquisition and Mergers:

15.4 RevContent, LLC (Star Mountain Fund Management, LLC)

15.4.1 Company Overview

15.5 Nativo, Inc.

15.5.1 Company Overview

15.5.2 Recent strategies and developments:

15.5.2.1 Product Launches and Product Expansions:

15.6 Yahoo, Inc.

15.6.1 Company Overview

15.6.2 SWOT Analysis

15.7 Triple Lift, Inc. (Vista Equity Partners Management, LLC)

15.7.1 Company Overview

15.8 adMarketplace Inc.

15.8.1 Company Overview

15.9 ADYOULIKE SA (Open Web Technologies Ltd.)

15.9.1 Company Overview

15.10. Sharethrough Inc.

15.10.1 Company Overview

TABLE 2 Asia Pacific Native Advertising Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria – Native Advertising Market

TABLE 4 Asia Pacific Native Advertising Market by Platform, 2021 - 2024, USD Million

TABLE 5 Asia Pacific Native Advertising Market by Platform, 2025 - 2032, USD Million

TABLE 6 Asia Pacific Closed Platforms Market by Country, 2021 - 2024, USD Million

TABLE 7 Asia Pacific Closed Platforms Market by Country, 2025 - 2032, USD Million

TABLE 8 Asia Pacific Open Platforms Market by Country, 2021 - 2024, USD Million

TABLE 9 Asia Pacific Open Platforms Market by Country, 2025 - 2032, USD Million

TABLE 10 Asia Pacific Hybrid Platform Market by Country, 2021 - 2024, USD Million

TABLE 11 Asia Pacific Hybrid Platform Market by Country, 2025 - 2032, USD Million

TABLE 12 Asia Pacific Native Advertising Market by Content Format, 2021 - 2024, USD Million

TABLE 13 Asia Pacific Native Advertising Market by Content Format, 2025 - 2032, USD Million

TABLE 14 Asia Pacific In-Feed Native Ads Market by Country, 2021 - 2024, USD Million

TABLE 15 Asia Pacific In-Feed Native Ads Market by Country, 2025 - 2032, USD Million

TABLE 16 Asia Pacific In-Video Native Ads Market by Country, 2021 - 2024, USD Million

TABLE 17 Asia Pacific In-Video Native Ads Market by Country, 2025 - 2032, USD Million

TABLE 18 Asia Pacific Sponsored Content Market by Country, 2021 - 2024, USD Million

TABLE 19 Asia Pacific Sponsored Content Market by Country, 2025 - 2032, USD Million

TABLE 20 Asia Pacific In-Image Native Ads Market by Country, 2021 - 2024, USD Million

TABLE 21 Asia Pacific In-Image Native Ads Market by Country, 2025 - 2032, USD Million

TABLE 22 Asia Pacific Native Advertising Market by End Use, 2021 - 2024, USD Million

TABLE 23 Asia Pacific Native Advertising Market by End Use, 2025 - 2032, USD Million

TABLE 24 Asia Pacific Retail & eCommerce Market by Country, 2021 - 2024, USD Million

TABLE 25 Asia Pacific Retail & eCommerce Market by Country, 2025 - 2032, USD Million

TABLE 26 Asia Pacific Media & Entertainment Market by Country, 2021 - 2024, USD Million

TABLE 27 Asia Pacific Media & Entertainment Market by Country, 2025 - 2032, USD Million

TABLE 28 Asia Pacific BFSI Market by Country, 2021 - 2024, USD Million

TABLE 29 Asia Pacific BFSI Market by Country, 2025 - 2032, USD Million

TABLE 30 Asia Pacific Travel & Hospitality Market by Country, 2021 - 2024, USD Million

TABLE 31 Asia Pacific Travel & Hospitality Market by Country, 2025 - 2032, USD Million

TABLE 32 Asia Pacific Healthcare Market by Country, 2021 - 2024, USD Million

TABLE 33 Asia Pacific Healthcare Market by Country, 2025 - 2032, USD Million

TABLE 34 Asia Pacific Telecom & IT Market by Country, 2021 - 2024, USD Million

TABLE 35 Asia Pacific Telecom & IT Market by Country, 2025 - 2032, USD Million

TABLE 36 Asia Pacific Automotive Market by Country, 2021 - 2024, USD Million

TABLE 37 Asia Pacific Automotive Market by Country, 2025 - 2032, USD Million

TABLE 38 Asia Pacific Education Market by Country, 2021 - 2024, USD Million

TABLE 39 Asia Pacific Education Market by Country, 2025 - 2032, USD Million

TABLE 40 Asia Pacific Other End Uses Market by Country, 2021 - 2024, USD Million

TABLE 41 Asia Pacific Other End Uses Market by Country, 2025 - 2032, USD Million

TABLE 42 Asia Pacific Native Advertising Market by Country, 2021 - 2024, USD Million

TABLE 43 Asia Pacific Native Advertising Market by Country, 2025 - 2032, USD Million

TABLE 44 China Native Advertising Market, 2021 - 2024, USD Million

TABLE 45 China Native Advertising Market, 2025 - 2032, USD Million

TABLE 46 China Native Advertising Market by Platform, 2021 - 2024, USD Million

TABLE 47 China Native Advertising Market by Platform, 2025 - 2032, USD Million

TABLE 48 China Native Advertising Market by Content Format, 2021 - 2024, USD Million

TABLE 49 China Native Advertising Market by Content Format, 2025 - 2032, USD Million

TABLE 50 China Native Advertising Market by End Use, 2021 - 2024, USD Million

TABLE 51 China Native Advertising Market by End Use, 2025 - 2032, USD Million

TABLE 52 Japan Native Advertising Market, 2021 - 2024, USD Million

TABLE 53 Japan Native Advertising Market, 2025 - 2032, USD Million

TABLE 54 Japan Native Advertising Market by Platform, 2021 - 2024, USD Million

TABLE 55 Japan Native Advertising Market by Platform, 2025 - 2032, USD Million

TABLE 56 Japan Native Advertising Market by Content Format, 2021 - 2024, USD Million

TABLE 57 Japan Native Advertising Market by Content Format, 2025 - 2032, USD Million

TABLE 58 Japan Native Advertising Market by End Use, 2021 - 2024, USD Million

TABLE 59 Japan Native Advertising Market by End Use, 2025 - 2032, USD Million

TABLE 60 India Native Advertising Market, 2021 - 2024, USD Million

TABLE 61 India Native Advertising Market, 2025 - 2032, USD Million

TABLE 62 India Native Advertising Market by Platform, 2021 - 2024, USD Million

TABLE 63 India Native Advertising Market by Platform, 2025 - 2032, USD Million

TABLE 64 India Native Advertising Market by Content Format, 2021 - 2024, USD Million

TABLE 65 India Native Advertising Market by Content Format, 2025 - 2032, USD Million

TABLE 66 India Native Advertising Market by End Use, 2021 - 2024, USD Million

TABLE 67 India Native Advertising Market by End Use, 2025 - 2032, USD Million

TABLE 68 South Korea Native Advertising Market, 2021 - 2024, USD Million

TABLE 69 South Korea Native Advertising Market, 2025 - 2032, USD Million

TABLE 70 South Korea Native Advertising Market by Platform, 2021 - 2024, USD Million

TABLE 71 South Korea Native Advertising Market by Platform, 2025 - 2032, USD Million

TABLE 72 South Korea Native Advertising Market by Content Format, 2021 - 2024, USD Million

TABLE 73 South Korea Native Advertising Market by Content Format, 2025 - 2032, USD Million

TABLE 74 South Korea Native Advertising Market by End Use, 2021 - 2024, USD Million

TABLE 75 South Korea Native Advertising Market by End Use, 2025 - 2032, USD Million

TABLE 76 Australia Native Advertising Market, 2021 - 2024, USD Million

TABLE 77 Australia Native Advertising Market, 2025 - 2032, USD Million

TABLE 78 Australia Native Advertising Market by Platform, 2021 - 2024, USD Million

TABLE 79 Australia Native Advertising Market by Platform, 2025 - 2032, USD Million

TABLE 80 Australia Native Advertising Market by Content Format, 2021 - 2024, USD Million

TABLE 81 Australia Native Advertising Market by Content Format, 2025 - 2032, USD Million

TABLE 82 Australia Native Advertising Market by End Use, 2021 - 2024, USD Million

TABLE 83 Australia Native Advertising Market by End Use, 2025 - 2032, USD Million

TABLE 84 Malaysia Native Advertising Market, 2021 - 2024, USD Million

TABLE 85 Malaysia Native Advertising Market, 2025 - 2032, USD Million

TABLE 86 Malaysia Native Advertising Market by Platform, 2021 - 2024, USD Million

TABLE 87 Malaysia Native Advertising Market by Platform, 2025 - 2032, USD Million

TABLE 88 Malaysia Native Advertising Market by Content Format, 2021 - 2024, USD Million

TABLE 89 Malaysia Native Advertising Market by Content Format, 2025 - 2032, USD Million

TABLE 90 Malaysia Native Advertising Market by End Use, 2021 - 2024, USD Million

TABLE 91 Malaysia Native Advertising Market by End Use, 2025 - 2032, USD Million

TABLE 92 Rest of Asia Pacific Native Advertising Market, 2021 - 2024, USD Million

TABLE 93 Rest of Asia Pacific Native Advertising Market, 2025 - 2032, USD Million

TABLE 94 Rest of Asia Pacific Native Advertising Market by Platform, 2021 - 2024, USD Million

TABLE 95 Rest of Asia Pacific Native Advertising Market by Platform, 2025 - 2032, USD Million

TABLE 96 Rest of Asia Pacific Native Advertising Market by Content Format, 2021 - 2024, USD Million

TABLE 97 Rest of Asia Pacific Native Advertising Market by Content Format, 2025 - 2032, USD Million

TABLE 98 Rest of Asia Pacific Native Advertising Market by End Use, 2021 - 2024, USD Million

TABLE 99 Rest of Asia Pacific Native Advertising Market by End Use, 2025 - 2032, USD Million

TABLE 100 Key Information – Teads Holding Co.

TABLE 101 Key Information – TABOOLA.COM LTD.

TABLE 102 Key Information – MGID Inc.

TABLE 103 Key Information – RevContent, LLC

TABLE 104 Key Information – Nativo, Inc.

TABLE 105 Key Information – Yahoo, Inc.

TABLE 106 Key Information – Triple Lift, Inc.

TABLE 107 Key Information – adMarketplace Inc.

TABLE 108 Key Information – ADYOULIKE SA

TABLE 109 Key Information – Sharethrough Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Native Advertising Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Asia Pacific Native Advertising Market

FIG 4 Value Chain Analysis of Native Advertising Market

FIG 5 Market Share Analysis, 2024

FIG 6 Porter’s Five Forces Analysis – Native Advertising Market

FIG 7 Product Life Cycle (PLC) – Native Advertising Market

FIG 8 Market Consolidation – Native Advertising Market

FIG 9 Key Customer Criteria – Native Advertising Market

FIG 10 Asia Pacific Native Advertising Market Share by Platform, 2024

FIG 11 Asia Pacific Native Advertising Market Share by Platform, 2032

FIG 12 Asia Pacific Native Advertising Market by Platform, 2021 - 2032, USD Million

FIG 13 Asia Pacific Native Advertising Market Share by Content Format, 2024

FIG 14 Asia Pacific Native Advertising Market Share by Content Format, 2032

FIG 15 Asia Pacific Native Advertising Market by Content Format, 2021 - 2032, USD Million

FIG 16 Asia Pacific Native Advertising Market Share by End Use, 2024

FIG 17 Asia Pacific Native Advertising Market Share by End Use, 2032

FIG 18 Asia Pacific Native Advertising Market by End Use, 2021 - 2032, USD Million

FIG 19 Asia Pacific Native Advertising Market Share by Country, 2024

FIG 20 Asia Pacific Native Advertising Market Share by Country, 2032

FIG 21 Asia Pacific Native Advertising Market by Country, 2021 - 2032, USD Million

FIG 22 Recent strategies and developments: MGID Inc.

FIG 23 SWOT analysis: Yahoo, Inc.