Asia Pacific Maritime Safety System Market Size, Share & Industry Analysis Report By System (Automatic Identification Systems (AIS), Global Maritime Distress & Safety (GMDSS), Navigation & Surveillance Systems, Ship Security Alert Systems (SSAS), and Other System), By Application, By End Use, By Component, By Country and Growth Forecast, 2025 - 2032

Published Date : 01-Aug-2025 |

Pages: 213 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific Maritime Safety System Market

The Asia Pacific Maritime Safety System Market would witness market growth of 10.2% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Maritime Safety System Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $4,512.9 million by 2032. The Japan market is registering a CAGR of 9.4% during (2025 - 2032). Additionally, The India market would showcase a CAGR of 10.9% during (2025 - 2032).

The Asia Pacific region has seen a major shift in maritime safety due to more ship traffic, fast economic growth and high risks such as illegal fishing, piracy, and geographical conflicts. Regulation agreements such as The Asia-Pacific Heads of Maritime Safety Agencies (APHoMSA) and the ReCAAP agreement are facilitating and helping in the cooperation, information sharing, and maintaining rules. Technological advancements like VMMS, GMDSS, and AIS has made tracking and communication simple and easy. Additionally, the international standards set by IMO promotes consistency ad effectiveness.

Moreover, Asia Pacific region has countries with one of the largest coastlines in the world for example, as per the Australian Government, Australia has 13.86 million square kilometres of marine waters in 3 of the world’s 4 major oceans. These vast coastlines need high level of safety and security, which contributes in the demand of maritime safety systems. Furthermore, the increasing digital transformation in the region is spreading into the marine industry. Ports use AI, IoT, and automation. For instance, According to the Ministry of Ports, Shipping and Waterways of India, as part of Amrit Kaal Vision 2047, a total of 17 initiatives are identified of which, the key initiatives includes implementing technology initiatives such as improving operational efficiency through E-gate 2.0 at all ports based on computer vision & OCR technologies. These developments show the dedication of the region towards marine safety and security. Also, the collaboration between different organizations and different companies ensures safe and secure waters.

Free Valuable Insights: The Global Maritime Safety System Market is Predict to reach USD 60.49 Billion by 2032, at a CAGR of 9.7%

Country Outlook

Marine safety system market in China is growing rapidly because of it rising dominance across all sectors in the world from manufacturing and technology to defence and global trade, this growth increases the demand for the marine safety system. The government's strong focus on digital transformation is also supporting this growth. For instance, as per the National Data Administration, the added value of core industries of the digital economy accounted for about 10% of GDP in 2024. In addition, China's strategic investments in the South China Sea underscore its deep commitment to safeguarding sovereignty and enhancing maritime security. According to the State Council of People Republic of China, in 2022, China's ports handled about 15.7 billion metric tons of cargo, up 33% from 2012, and nearly 300 million containers, an increase of 56% during the same period. Meanwhile, China’s move towards sustainability, both state-owned and private enterprises are adopting new eco-friendly techniques, resulting in the growth of the market.

Japan’s vulnerable geography and dependency of its economy on the sea, contributes to the strong emphasis on maritime safety and growth of the maritime safety system market. The country’s usage of cutting edge technology such as Smart Ports, AI-driven analytics, and strong early detection systems are supporting its economic growth. As per the International Trade Administration (ITA), Japan’s ultimate goal is to deploy fully autonomous ships. However, by 2025, Japan is aiming to deploy “Phase II” autonomous operating ships. “Phase II” ships would be deployed with onboard equipment & integrated systems, advanced data analytics, and AI technology to communicate with and advise seafarers the best courses of action. Japan intends to make half of its cargo transporting domestic ships unmanned by 2040. Furthermore, Japan promotes environmentally friendly marine innovations, such as LNG-compatible safety systems, and complies with international safety standards. Due to collaboration of industries and government Japan Is a leading region in maritime safety innovation.

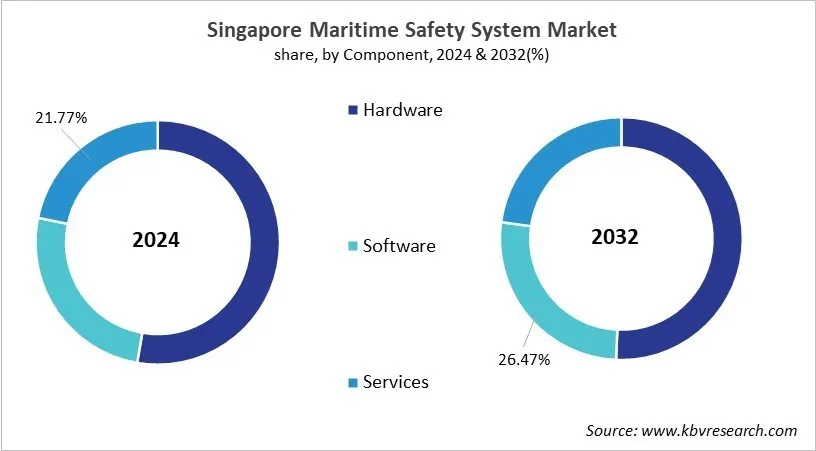

Based on System, the market is segmented into Automatic Identification Systems (AIS), Global Maritime Distress & Safety (GMDSS), Navigation & Surveillance Systems, Ship Security Alert Systems (SSAS), and Other System. Based on Application, the market is segmented into Port & Vessel Security, Search & Rescue, Communication & Emergency Response, Environmental & Accident Monitoring, and Other Application. Based on End Use, the market is segmented into Commercial Shipping, Naval Forces & Coast Guards, Oil & Gas (Offshore), Port Authorities, and Other End Use. Based on Component, the market is segmented into Hardware, Software, and Services. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- BAE Systems PLC

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- Honeywell International, Inc.

- ABB Ltd.

- Northrop Grumman Corporation

- Saab AB

- Kongsberg Group

- Smiths Group PLC

- Thales Group S.A.

Asia Pacific Maritime Safety System Market Report Segmentation

By System

- Automatic Identification Systems (AIS)

- Global Maritime Distress & Safety (GMDSS)

- Navigation & Surveillance Systems

- Ship Security Alert Systems (SSAS)

- Other System

By Application

- Port & Vessel Security

- Search & Rescue

- Communication & Emergency Response

- Environmental & Accident Monitoring

- Other Application

By End Use

- Commercial Shipping

- Naval Forces & Coast Guards

- Oil & Gas (Offshore)

- Port Authorities

- Other End Use

By Component

- Hardware

- Software

- Services

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Maritime Safety System Market, by System

1.4.2 Asia Pacific Maritime Safety System Market, by Application

1.4.3 Asia Pacific Maritime Safety System Market, by End Use

1.4.4 Asia Pacific Maritime Safety System Market, by Component

1.4.5 Asia Pacific Maritime Safety System Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis – Global

4.1 Market Share Analysis, 2024

4.2 Porter Five Forces Analysis

Chapter 5. Value Chain Analysis of Maritime Safety System Market

5.1 Research and Development (R&D)

5.2 Product Design and Engineering

5.3 Regulatory Certification & Compliance Validation

5.4 Manufacturing and Testing

5.5 Deployment and Physical Installation

5.6 System Integration and Commissioning

5.7 Marketing and Sales

5.8 Customer Support and Lifecycle Maintenance

Chapter 6. Key Consumer Criteria of Maritime Safety System Market

Chapter 7. Asia Pacific Maritime Safety System Market by System

7.1 Asia Pacific Automatic Identification Systems (AIS) Market by Country

7.2 Asia Pacific Global Maritime Distress & Safety (GMDSS) Market by Country

7.3 Asia Pacific Navigation & Surveillance Systems Market by Country

7.4 Asia Pacific Ship Security Alert Systems (SSAS) Market by Country

7.5 Asia Pacific Other System Market by Country

Chapter 8. Asia Pacific Maritime Safety System Market by Application

8.1 Asia Pacific Port & Vessel Security Market by Country

8.2 Asia Pacific Search & Rescue Market by Country

8.3 Asia Pacific Communication & Emergency Response Market by Country

8.4 Asia Pacific Environmental & Accident Monitoring Market by Country

8.5 Asia Pacific Other Application Market by Country

Chapter 9. Asia Pacific Maritime Safety System Market by End Use

9.1 Asia Pacific Commercial Shipping Market by Country

9.2 Asia Pacific Naval Forces & Coast Guards Market by Country

9.3 Asia Pacific Oil & Gas (Offshore) Market by Country

9.4 Asia Pacific Port Authorities Market by Country

9.5 Asia Pacific Other End Use Market by Country

Chapter 10. Asia Pacific Maritime Safety System Market by Component

10.1 Asia Pacific Hardware Market by Country

10.2 Asia Pacific Software Market by Country

10.3 Asia Pacific Services Market by Country

Chapter 11. Asia Pacific Maritime Safety System Market by Country

11.1 China Maritime Safety System Market

11.1.1 China Maritime Safety System Market by System

11.1.2 China Maritime Safety System Market by Application

11.1.3 China Maritime Safety System Market by End Use

11.1.4 China Maritime Safety System Market by Component

11.2 Japan Maritime Safety System Market

11.2.1 Japan Maritime Safety System Market by System

11.2.2 Japan Maritime Safety System Market by Application

11.2.3 Japan Maritime Safety System Market by End Use

11.2.4 Japan Maritime Safety System Market by Component

11.3 India Maritime Safety System Market

11.3.1 India Maritime Safety System Market by System

11.3.2 India Maritime Safety System Market by Application

11.3.3 India Maritime Safety System Market by End Use

11.3.4 India Maritime Safety System Market by Component

11.4 South Korea Maritime Safety System Market

11.4.1 South Korea Maritime Safety System Market by System

11.4.2 South Korea Maritime Safety System Market by Application

11.4.3 South Korea Maritime Safety System Market by End Use

11.4.4 South Korea Maritime Safety System Market by Component

11.5 Singapore Maritime Safety System Market

11.5.1 Singapore Maritime Safety System Market by System

11.5.2 Singapore Maritime Safety System Market by Application

11.5.3 Singapore Maritime Safety System Market by End Use

11.5.4 Singapore Maritime Safety System Market by Component

11.6 Malaysia Maritime Safety System Market

11.6.1 Malaysia Maritime Safety System Market by System

11.6.2 Malaysia Maritime Safety System Market by Application

11.6.3 Malaysia Maritime Safety System Market by End Use

11.6.4 Malaysia Maritime Safety System Market by Component

11.7 Rest of Asia Pacific Maritime Safety System Market

11.7.1 Rest of Asia Pacific Maritime Safety System Market by System

11.7.2 Rest of Asia Pacific Maritime Safety System Market by Application

11.7.3 Rest of Asia Pacific Maritime Safety System Market by End Use

11.7.4 Rest of Asia Pacific Maritime Safety System Market by Component

Chapter 12. Company Profiles

12.1 BAE Systems PLC

12.1.1 Company Overview

12.1.2 Financial Analysis

12.1.3 Segmental and Regional Analysis

12.1.4 Research & Development Expenses

12.1.5 SWOT Analysis

12.2 L3Harris Technologies, Inc.

12.2.1 Company Overview

12.2.2 Financial Analysis

12.2.3 Segmental and Regional Analysis

12.2.4 SWOT Analysis

12.3 Elbit Systems Ltd.

12.3.1 Company Overview

12.3.2 Financial Analysis

12.3.3 Segmental and Regional Analysis

12.3.4 Research & Development Expenses

12.3.5 SWOT Analysis

12.4 Honeywell International, Inc.

12.4.1 Company Overview

12.4.2 Financial Analysis

12.4.3 Segmental and Regional Analysis

12.4.4 Research & Development Expenses

12.4.5 SWOT Analysis

12.5 ABB Ltd.

12.5.1 Company Overview

12.5.2 Financial Analysis

12.5.3 Segmental and Regional Analysis

12.5.4 Research & Development Expenses

12.5.5 SWOT Analysis

12.6 Northrop Grumman Corporation

12.6.1 Company Overview

12.6.2 Financial Analysis

12.6.3 Segmental and Regional Analysis

12.6.4 Research & Development Expenses

12.6.5 SWOT Analysis

12.7 Saab AB

12.7.1 Company Overview

12.7.2 Financial Analysis

12.7.3 Segmental and Regional Analysis

12.7.4 Research & Development Expenses

12.8 Kongsberg Group

12.8.1 Company Overview

12.8.2 Financial Analysis

12.8.3 Segmental and Regional Analysis

12.8.4 SWOT Analysis

12.9 Smiths Group PLC

12.9.1 Company Overview

12.9.2 Financial Analysis

12.9.3 Segmental and Regional Analysis

12.9.4 Research & Development Expenses

12.9.5 SWOT Analysis

12.10. Thales Group S.A.

12.10.1 Company Overview

12.10.2 Financial Analysis

12.10.3 Segmental Analysis

12.10.4 Research & Development Expenses

12.10.5 SWOT Analysis

TABLE 2 Asia Pacific Maritime Safety System Market, 2025 - 2032, USD Million

TABLE 3 Key Consumer Criteria of Maritime Safety System Market

TABLE 4 Asia Pacific Maritime Safety System Market by System, 2021 - 2024, USD Million

TABLE 5 Asia Pacific Maritime Safety System Market by System, 2025 - 2032, USD Million

TABLE 6 Asia Pacific Automatic Identification Systems (AIS) Market by Country, 2021 - 2024, USD Million

TABLE 7 Asia Pacific Automatic Identification Systems (AIS) Market by Country, 2025 - 2032, USD Million

TABLE 8 Asia Pacific Global Maritime Distress & Safety (GMDSS) Market by Country, 2021 - 2024, USD Million

TABLE 9 Asia Pacific Global Maritime Distress & Safety (GMDSS) Market by Country, 2025 - 2032, USD Million

TABLE 10 Asia Pacific Navigation & Surveillance Systems Market by Country, 2021 - 2024, USD Million

TABLE 11 Asia Pacific Navigation & Surveillance Systems Market by Country, 2025 - 2032, USD Million

TABLE 12 Asia Pacific Ship Security Alert Systems (SSAS) Market by Country, 2021 - 2024, USD Million

TABLE 13 Asia Pacific Ship Security Alert Systems (SSAS) Market by Country, 2025 - 2032, USD Million

TABLE 14 Asia Pacific Other System Market by Country, 2021 - 2024, USD Million

TABLE 15 Asia Pacific Other System Market by Country, 2025 - 2032, USD Million

TABLE 16 Use Case – 1: Predictive Port Coordination via Enhanced AIS (2025)

TABLE 17 Use Case – 2: Satellite-Enhanced GMDSS for Pacific Emergency Response (2025)

TABLE 18 Use Case – 3: AI-Powered Arctic Surveillance & Navigation (2025)

TABLE 19 Use Case – 4: AI-Integrated SSAS for Oil Tanker Threat Response (2025)

TABLE 20 Use Case – 5: Maritime Safety Intelligence Fusion Platform (2025)

TABLE 21 Asia Pacific Maritime Safety System Market by Application, 2021 - 2024, USD Million

TABLE 22 Asia Pacific Maritime Safety System Market by Application, 2025 - 2032, USD Million

TABLE 23 Asia Pacific Port & Vessel Security Market by Country, 2021 - 2024, USD Million

TABLE 24 Asia Pacific Port & Vessel Security Market by Country, 2025 - 2032, USD Million

TABLE 25 Asia Pacific Search & Rescue Market by Country, 2021 - 2024, USD Million

TABLE 26 Asia Pacific Search & Rescue Market by Country, 2025 - 2032, USD Million

TABLE 27 Asia Pacific Communication & Emergency Response Market by Country, 2021 - 2024, USD Million

TABLE 28 Asia Pacific Communication & Emergency Response Market by Country, 2025 - 2032, USD Million

TABLE 29 Asia Pacific Environmental & Accident Monitoring Market by Country, 2021 - 2024, USD Million

TABLE 30 Asia Pacific Environmental & Accident Monitoring Market by Country, 2025 - 2032, USD Million

TABLE 31 Asia Pacific Other Application Market by Country, 2021 - 2024, USD Million

TABLE 32 Asia Pacific Other Application Market by Country, 2025 - 2032, USD Million

TABLE 33 Use Case – 1: Smart Perimeter Surveillance for Port & Vessel Security (2025)

TABLE 34 Use Case – 2: Drone-Assisted Maritime Search & Rescue Operations (2025)

TABLE 35 Use Case – 3: Unified Maritime Communication for Emergency Coordination (2025)

TABLE 36 Use Case – 4: Real-Time Oil Spill & Marine Pollution Monitoring System (2025)

TABLE 37 Use Case – 5: Virtual Reality Training for Crew Maritime Safety (2025)

TABLE 38 Asia Pacific Maritime Safety System Market by End Use, 2021 - 2024, USD Million

TABLE 39 Asia Pacific Maritime Safety System Market by End Use, 2025 - 2032, USD Million

TABLE 40 Asia Pacific Commercial Shipping Market by Country, 2021 - 2024, USD Million

TABLE 41 Asia Pacific Commercial Shipping Market by Country, 2025 - 2032, USD Million

TABLE 42 Asia Pacific Naval Forces & Coast Guards Market by Country, 2021 - 2024, USD Million

TABLE 43 Asia Pacific Naval Forces & Coast Guards Market by Country, 2025 - 2032, USD Million

TABLE 44 Asia Pacific Oil & Gas (Offshore) Market by Country, 2021 - 2024, USD Million

TABLE 45 Asia Pacific Oil & Gas (Offshore) Market by Country, 2025 - 2032, USD Million

TABLE 46 Asia Pacific Port Authorities Market by Country, 2021 - 2024, USD Million

TABLE 47 Asia Pacific Port Authorities Market by Country, 2025 - 2032, USD Million

TABLE 48 Asia Pacific Other End Use Market by Country, 2021 - 2024, USD Million

TABLE 49 Asia Pacific Other End Use Market by Country, 2025 - 2032, USD Million

TABLE 50 Asia Pacific Maritime Safety System Market by Component, 2021 - 2024, USD Million

TABLE 51 Asia Pacific Maritime Safety System Market by Component, 2025 - 2032, USD Million

TABLE 52 Asia Pacific Hardware Market by Country, 2021 - 2024, USD Million

TABLE 53 Asia Pacific Hardware Market by Country, 2025 - 2032, USD Million

TABLE 54 Asia Pacific Software Market by Country, 2021 - 2024, USD Million

TABLE 55 Asia Pacific Software Market by Country, 2025 - 2032, USD Million

TABLE 56 Asia Pacific Services Market by Country, 2021 - 2024, USD Million

TABLE 57 Asia Pacific Services Market by Country, 2025 - 2032, USD Million

TABLE 58 Use Case – 1: Next-Gen Radar & AIS Hardware for High-Traffic Port Navigation (2025)

TABLE 59 Use Case – 2: AI-Based Maritime Incident Prediction & Compliance Software (2025)

TABLE 60 Use Case – 3: Integrated Maritime Safety Training & Remote Audit Services (2025)

TABLE 61 Asia Pacific Maritime Safety System Market by Country, 2021 - 2024, USD Million

TABLE 62 Asia Pacific Maritime Safety System Market by Country, 2025 - 2032, USD Million

TABLE 63 China Maritime Safety System Market, 2021 - 2024, USD Million

TABLE 64 China Maritime Safety System Market, 2025 - 2032, USD Million

TABLE 65 China Maritime Safety System Market by System, 2021 - 2024, USD Million

TABLE 66 China Maritime Safety System Market by System, 2025 - 2032, USD Million

TABLE 67 China Maritime Safety System Market by Application, 2021 - 2024, USD Million

TABLE 68 China Maritime Safety System Market by Application, 2025 - 2032, USD Million

TABLE 69 China Maritime Safety System Market by End Use, 2021 - 2024, USD Million

TABLE 70 China Maritime Safety System Market by End Use, 2025 - 2032, USD Million

TABLE 71 China Maritime Safety System Market by Component, 2021 - 2024, USD Million

TABLE 72 China Maritime Safety System Market by Component, 2025 - 2032, USD Million

TABLE 73 Japan Maritime Safety System Market, 2021 - 2024, USD Million

TABLE 74 Japan Maritime Safety System Market, 2025 - 2032, USD Million

TABLE 75 Japan Maritime Safety System Market by System, 2021 - 2024, USD Million

TABLE 76 Japan Maritime Safety System Market by System, 2025 - 2032, USD Million

TABLE 77 Japan Maritime Safety System Market by Application, 2021 - 2024, USD Million

TABLE 78 Japan Maritime Safety System Market by Application, 2025 - 2032, USD Million

TABLE 79 Japan Maritime Safety System Market by End Use, 2021 - 2024, USD Million

TABLE 80 Japan Maritime Safety System Market by End Use, 2025 - 2032, USD Million

TABLE 81 Japan Maritime Safety System Market by Component, 2021 - 2024, USD Million

TABLE 82 Japan Maritime Safety System Market by Component, 2025 - 2032, USD Million

TABLE 83 India Maritime Safety System Market, 2021 - 2024, USD Million

TABLE 84 India Maritime Safety System Market, 2025 - 2032, USD Million

TABLE 85 India Maritime Safety System Market by System, 2021 - 2024, USD Million

TABLE 86 India Maritime Safety System Market by System, 2025 - 2032, USD Million

TABLE 87 India Maritime Safety System Market by Application, 2021 - 2024, USD Million

TABLE 88 India Maritime Safety System Market by Application, 2025 - 2032, USD Million

TABLE 89 India Maritime Safety System Market by End Use, 2021 - 2024, USD Million

TABLE 90 India Maritime Safety System Market by End Use, 2025 - 2032, USD Million

TABLE 91 India Maritime Safety System Market by Component, 2021 - 2024, USD Million

TABLE 92 India Maritime Safety System Market by Component, 2025 - 2032, USD Million

TABLE 93 South Korea Maritime Safety System Market, 2021 - 2024, USD Million

TABLE 94 South Korea Maritime Safety System Market, 2025 - 2032, USD Million

TABLE 95 South Korea Maritime Safety System Market by System, 2021 - 2024, USD Million

TABLE 96 South Korea Maritime Safety System Market by System, 2025 - 2032, USD Million

TABLE 97 South Korea Maritime Safety System Market by Application, 2021 - 2024, USD Million

TABLE 98 South Korea Maritime Safety System Market by Application, 2025 - 2032, USD Million

TABLE 99 South Korea Maritime Safety System Market by End Use, 2021 - 2024, USD Million

TABLE 100 South Korea Maritime Safety System Market by End Use, 2025 - 2032, USD Million

TABLE 101 South Korea Maritime Safety System Market by Component, 2021 - 2024, USD Million

TABLE 102 South Korea Maritime Safety System Market by Component, 2025 - 2032, USD Million

TABLE 103 Singapore Maritime Safety System Market, 2021 - 2024, USD Million

TABLE 104 Singapore Maritime Safety System Market, 2025 - 2032, USD Million

TABLE 105 Singapore Maritime Safety System Market by System, 2021 - 2024, USD Million

TABLE 106 Singapore Maritime Safety System Market by System, 2025 - 2032, USD Million

TABLE 107 Singapore Maritime Safety System Market by Application, 2021 - 2024, USD Million

TABLE 108 Singapore Maritime Safety System Market by Application, 2025 - 2032, USD Million

TABLE 109 Singapore Maritime Safety System Market by End Use, 2021 - 2024, USD Million

TABLE 110 Singapore Maritime Safety System Market by End Use, 2025 - 2032, USD Million

TABLE 111 Singapore Maritime Safety System Market by Component, 2021 - 2024, USD Million

TABLE 112 Singapore Maritime Safety System Market by Component, 2025 - 2032, USD Million

TABLE 113 Malaysia Maritime Safety System Market, 2021 - 2024, USD Million

TABLE 114 Malaysia Maritime Safety System Market, 2025 - 2032, USD Million

TABLE 115 Malaysia Maritime Safety System Market by System, 2021 - 2024, USD Million

TABLE 116 Malaysia Maritime Safety System Market by System, 2025 - 2032, USD Million

TABLE 117 Malaysia Maritime Safety System Market by Application, 2021 - 2024, USD Million

TABLE 118 Malaysia Maritime Safety System Market by Application, 2025 - 2032, USD Million

TABLE 119 Malaysia Maritime Safety System Market by End Use, 2021 - 2024, USD Million

TABLE 120 Malaysia Maritime Safety System Market by End Use, 2025 - 2032, USD Million

TABLE 121 Malaysia Maritime Safety System Market by Component, 2021 - 2024, USD Million

TABLE 122 Malaysia Maritime Safety System Market by Component, 2025 - 2032, USD Million

TABLE 123 Rest of Asia Pacific Maritime Safety System Market, 2021 - 2024, USD Million

TABLE 124 Rest of Asia Pacific Maritime Safety System Market, 2025 - 2032, USD Million

TABLE 125 Rest of Asia Pacific Maritime Safety System Market by System, 2021 - 2024, USD Million

TABLE 126 Rest of Asia Pacific Maritime Safety System Market by System, 2025 - 2032, USD Million

TABLE 127 Rest of Asia Pacific Maritime Safety System Market by Application, 2021 - 2024, USD Million

TABLE 128 Rest of Asia Pacific Maritime Safety System Market by Application, 2025 - 2032, USD Million

TABLE 129 Rest of Asia Pacific Maritime Safety System Market by End Use, 2021 - 2024, USD Million

TABLE 130 Rest of Asia Pacific Maritime Safety System Market by End Use, 2025 - 2032, USD Million

TABLE 131 Rest of Asia Pacific Maritime Safety System Market by Component, 2021 - 2024, USD Million

TABLE 132 Rest of Asia Pacific Maritime Safety System Market by Component, 2025 - 2032, USD Million

TABLE 133 Key Information – BAE Systems PLC

TABLE 134 Key information – L3Harris Technologies, Inc.

TABLE 135 Key Information – Elbit Systems Ltd.

TABLE 136 Key Information – Honeywell International, Inc.

TABLE 137 Key Information – ABB Ltd.

TABLE 138 Key Information – Northrop Grumman Corporation

TABLE 139 Key Information – Saab AB

TABLE 140 Key Information – Kongsberg Group

TABLE 141 Key Information – Smiths Group PLC

TABLE 142 Key Information – Thales Group S.A.

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Maritime Safety System Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Maritime Safety System Market

FIG 4 Market Share Analysis, 2024

FIG 5 Porter’s Five Forces Analysis – Maritime Safety System Market

FIG 6 Value Chain Analysis of Maritime Safety System Market

FIG 7 Key Consumer Criteria of Maritime Safety System Market

FIG 8 Asia Pacific Maritime Safety System Market share by System, 2024

FIG 9 Asia Pacific Maritime Safety System Market share by System, 2032

FIG 10 Asia Pacific Maritime Safety System Market by System, 2021 - 2032, USD Million

FIG 11 Asia Pacific Maritime Safety System Market share by Application, 2024

FIG 12 Asia Pacific Maritime Safety System Market share by Application, 2032

FIG 13 Asia Pacific Maritime Safety System Market by Application, 2021 - 2032, USD Million

FIG 14 Asia Pacific Maritime Safety System Market share by End Use, 2024

FIG 15 Asia Pacific Maritime Safety System Market share by End Use, 2032

FIG 16 Asia Pacific Maritime Safety System Market by End Use, 2021 - 2032, USD Million

FIG 17 Asia Pacific Maritime Safety System Market share by Component, 2024

FIG 18 Asia Pacific Maritime Safety System Market share by Component, 2032

FIG 19 Asia Pacific Maritime Safety System Market by Component, 2021 - 2032, USD Million

FIG 20 Asia Pacific Maritime Safety System Market share by Country, 2024

FIG 21 Asia Pacific Maritime Safety System Market share by Country, 2032

FIG 22 Asia Pacific Maritime Safety System Market by Country, 2021 - 2032, USD Million

FIG 23 SWOT Analysis: BAE SYSTEMS PLC

FIG 24 SWOT Analysis: L3Harris Technologies, Inc.

FIG 25 SWOT Analysis: Elbit Systems Ltd.

FIG 26 SWOT Analysis: Honeywell international, inc.

FIG 27 SWOT Analysis: ABB ltd.

FIG 28 SWOT Analysis: Northrop Grumman Corporation

FIG 29 SWOT Analysis: Kongsberg Group

FIG 30 SWOT Analysis: Smiths Group plc

FIG 31 SWOT Analysis: Thales Group S.A.