Asia Pacific Glass Interposers Market Size, Share & Industry Analysis Report By Wafer Size, By Application (2.5D Packaging, 3D Packaging, and Fan-Out Packaging), By Substrate Technology (Through-Glass Vias (TGV), Redistribution Layer (RDL)-First/Last, and Glass Panel Level Packaging (PLP)), By End Use Industry, By Country and Growth Forecast, 2025 - 2032

Published Date : 12-Aug-2025 |

Pages: 167 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific Glass Interposers Market

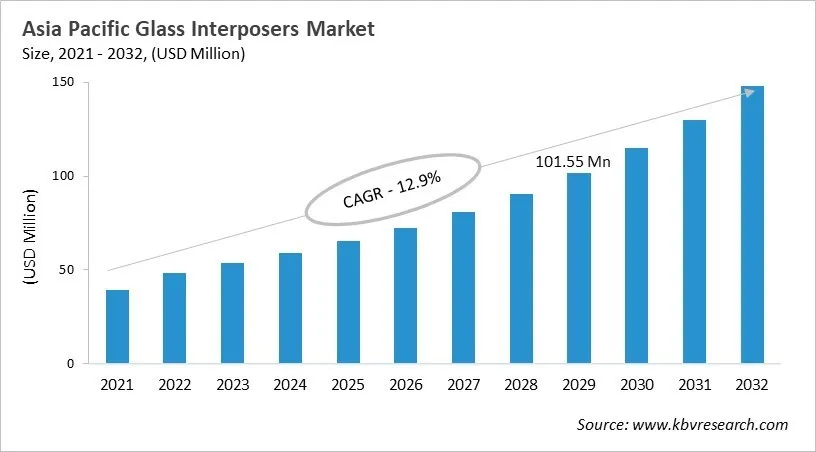

The Asia Pacific Glass Interposers Market would witness market growth of 12.4% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Glass Interposers Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $46.6 million by 2032. The Japan market is registering a CAGR of 11.7% during (2025 - 2032). Additionally, The India market would showcase a CAGR of 13.7% during (2025 - 2032). The China and Japan led the Asia Pacific Glass Interposers Market by Country with a market share of 35.4% and 19.2% in 2024.

The Asia Pacific region leads the global glass interposers market, driven by its large-scale electronics manufacturing, strong foundry networks, and high demand from consumer electronics, telecom, and computing sectors. The region is at the forefront of adopting advanced wafer-level and panel-level packaging technologies, with glass interposers playing a key role in supporting these innovations. Growing trends include 2.5D and 3D integration, especially for devices requiring high input/output density, efficient heat dissipation, and low latency, fueling demand for applications like high-bandwidth memory and RF front-end modules.

Strategically, Asia Pacific focuses on enhancing local precision glass processing capabilities, improving through-glass via (TGV) yields, and investing in thin glass handling for cost-effective mass production. Advances in substrate polishing, panel bonding, and managing thermal expansion are critical to these developments. Supported by government initiatives and a growing semiconductor packaging market, the region is positioned for robust growth, driven by increasing requirements for high-performance, affordable interposers to meet expanding data and device ecosystem needs.

Wafer Size Outlook

Based on Wafer Size, the market is segmented into 300 mm, 200 mm, and Less than 200 mm. The 300 mm market segment dominated the China Glass Interposers Market by Wafer Size is expected to grow at a CAGR of 10.3 % during the forecast period thereby continuing its dominance until 2032. Also, The Less than 200 mm market is anticipated to grow as a CAGR of 11.8 % during the forecast period during (2025 - 2032).

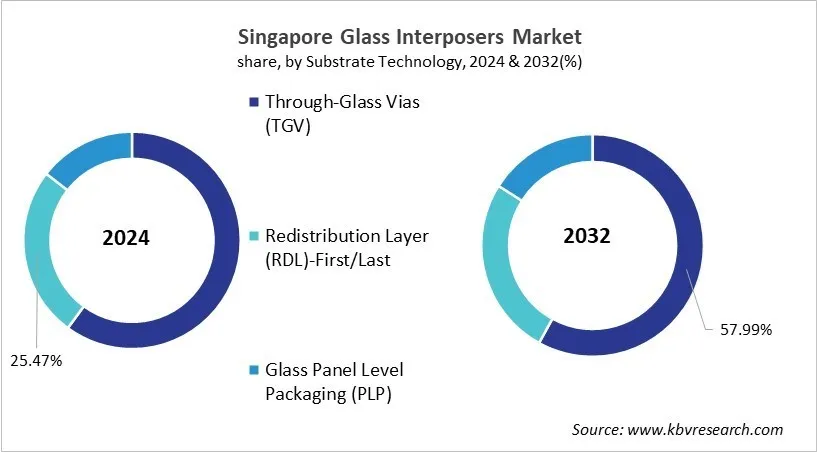

Substrate Technology Outlook

Based on Substrate Technology, the market is segmented into Through-Glass Vias (TGV), Redistribution Layer (RDL)-First/Last, and Glass Panel Level Packaging (PLP). With a market value of $5.1 Million by 2032, and a compound annual growth rate (CAGR) of 13.9% over the projection period, the Through-Glass Vias (TGV) Market, dominate the Singapore Glass Interposers Market by Substrate Technology in 2024 and would be a prominent market until 2032. From 2025 to 2032 The Glass Panel Level Packaging (PLP) market is expected to witness a CAGR of 15.9% during (2025 - 2032).

Free Valuable Insights: The Global Glass Interposers Market is Predict to reach USD 303.45 Million by 2032, at a CAGR of 12.1%

Country Outlook

China dominates the Asia Pacific glass interposers market, driven by its vast semiconductor ecosystem, strong OSAT capacity, and booming consumer and telecom electronics sectors. Supported by aggressive government initiatives, China is rapidly adopting 2.5D packaging, fan-out wafer level packaging, and panel-level production for AI, 5G, and automotive applications. Collaboration between local and global firms fuels innovation despite high fabrication costs and supply chain challenges. With ongoing R&D and pilot production scaling, China is set to maintain its leading regional position in glass interposer technology.

List of Key Companies Profiled

- Corning Incorporated

- AGC Inc.

- Schott AG (Carl-Zeiss-Stiftung)

- Dai Nippon Printing Co., Ltd.

- Tecnisco, LTD. (Disco Corporation)

- Samtec, Inc.

- RENA Technologies GmbH

- PLANOPTIK AG

- 3DGS Inc.

- Workshop of Photonics

Asia Pacific Glass Interposers Market Report Segmentation

By Wafer Size

- 300 mm

- 200 mm

- Less than 200 mm

By Application

- 2.5D Packaging

- 3D Packaging

- Fan-Out Packaging

By Substrate Technology

- Through-Glass Vias (TGV)

- Redistribution Layer (RDL)-First/Last

- Glass Panel Level Packaging (PLP)

By End Use Industry

- Consumer Electronics

- Telecommunications

- Automotive

- Defense & Aerospace

- Healthcare

- Other End Use Industry

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Glass Interposers Market, by Wafer Size

1.4.2 Asia Pacific Glass Interposers Market, by Application

1.4.3 Asia Pacific Glass Interposers Market, by Substrate Technology

1.4.4 Asia Pacific Glass Interposers Market, by End Use Industry

1.4.5 Asia Pacific Glass Interposers Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.2 Market Drivers

3.1.3 Market Restraints

3.1.4 Market Opportunities

3.1.5 Market Challenges

Chapter 4. Market Trends - Asia Pacific Glass Interposers Market

Chapter 5. State of Competition Asia Pacific Glass Interposers Market

Chapter 6. Competition Analysis – Global

6.1 Market Share Analysis, 2024

6.2 Recent Strategies Deployed in Glass Interposers Market

6.3 Porter Five Forces Analysis

Chapter 7. PLC (Product Life Cycle) Glass Interposers Market

Chapter 8. Market Consolidation - Glass Interposers Market

Chapter 9. Value Chain Analysis of Glass Interposers Market

Chapter 10. Key Customer Criteria - Glass Interposers Market

Chapter 11. Asia Pacific Glass Interposers Market by Wafer Size

11.1 Asia Pacific 300 mm Market by Country

11.2 Asia Pacific 200 mm Market by Country

11.3 Asia Pacific Less than 200 mm Market by Country

Chapter 12. Asia Pacific Glass Interposers Market by Application

12.1 Asia Pacific 2.5D Packaging Market by Country

12.2 Asia Pacific 3D Packaging Market by Country

12.3 Asia Pacific Fan-Out Packaging Market by Country

Chapter 13. Asia Pacific Glass Interposers Market by Substrate Technology

13.1 Asia Pacific Through-Glass Vias (TGV) Market by Country

13.2 Asia Pacific Redistribution Layer (RDL)-First/Last Market by Country

13.3 Asia Pacific Glass Panel Level Packaging (PLP) Market by Country

Chapter 14. Asia Pacific Glass Interposers Market by End Use Industry

14.1 Asia Pacific Consumer Electronics Market by Country

14.2 Asia Pacific Telecommunications Market by Country

14.3 Asia Pacific Automotive Market by Country

14.4 Asia Pacific Defense & Aerospace Market by Country

14.5 Asia Pacific Healthcare Market by Country

14.6 Asia Pacific Other End Use Industry Market by Country

Chapter 15. Asia Pacific Glass Interposers Market by Country

15.1 China Glass Interposers Market

15.1.1 China Glass Interposers Market by Wafer Size

15.1.2 China Glass Interposers Market by Application

15.1.3 China Glass Interposers Market by Substrate Technology

15.1.4 China Glass Interposers Market by End Use Industry

15.2 Japan Glass Interposers Market

15.2.1 Japan Glass Interposers Market by Wafer Size

15.2.2 Japan Glass Interposers Market by Application

15.2.3 Japan Glass Interposers Market by Substrate Technology

15.2.4 Japan Glass Interposers Market by End Use Industry

15.3 India Glass Interposers Market

15.3.1 India Glass Interposers Market by Wafer Size

15.3.2 India Glass Interposers Market by Application

15.3.3 India Glass Interposers Market by Substrate Technology

15.3.4 India Glass Interposers Market by End Use Industry

15.4 South Korea Glass Interposers Market

15.4.1 South Korea Glass Interposers Market by Wafer Size

15.4.2 South Korea Glass Interposers Market by Application

15.4.3 South Korea Glass Interposers Market by Substrate Technology

15.4.4 South Korea Glass Interposers Market by End Use Industry

15.5 Singapore Glass Interposers Market

15.5.1 Singapore Glass Interposers Market by Wafer Size

15.5.2 Singapore Glass Interposers Market by Application

15.5.3 Singapore Glass Interposers Market by Substrate Technology

15.5.4 Singapore Glass Interposers Market by End Use Industry

15.6 Malaysia Glass Interposers Market

15.6.1 Malaysia Glass Interposers Market by Wafer Size

15.6.2 Malaysia Glass Interposers Market by Application

15.6.3 Malaysia Glass Interposers Market by Substrate Technology

15.6.4 Malaysia Glass Interposers Market by End Use Industry

15.7 Rest of Asia Pacific Glass Interposers Market

15.7.1 Rest of Asia Pacific Glass Interposers Market by Wafer Size

15.7.2 Rest of Asia Pacific Glass Interposers Market by Application

15.7.3 Rest of Asia Pacific Glass Interposers Market by Substrate Technology

15.7.4 Rest of Asia Pacific Glass Interposers Market by End Use Industry

Chapter 16. Company Profiles

16.1 Corning Incorporated

16.1.1 Company Overview

16.1.2 Financial Analysis

16.1.3 Segmental and Regional Analysis

16.1.4 Research & Development Expenses

16.1.5 Recent strategies and developments:

16.1.5.1 Partnerships, Collaborations, and Agreements:

16.1.6 SWOT Analysis

16.2 AGC, Inc.

16.2.1 Company Overview

16.2.2 Financial Analysis

16.2.3 Segmental Analysis

16.2.4 Research & Development Expenses

16.2.5 SWOT Analysis

16.3 Schott AG (Carl-Zeiss-Stiftung)

16.3.1 Company Overview

16.3.2 Financial Analysis

16.3.3 Segmental and Regional Analysis

16.3.4 Research & Development Expenses

16.3.5 Recent strategies and developments:

16.3.5.1 Product Launches and Product Expansions:

16.3.6 SWOT Analysis

16.4 Dai Nippon Printing Co., Ltd.

16.4.1 Company Overview

16.4.2 Financial Analysis

16.4.3 Segmental and Regional Analysis

16.4.4 Research & Development Expenses

16.4.5 Recent strategies and developments:

16.4.5.1 Product Launches and Product Expansions:

16.5 Tecnisco, LTD. (Disco Corporation)

16.5.1 Company Overview

16.5.2 Financial Analysis

16.6 Samtec, Inc.

16.6.1 Company Overview

16.6.2 SWOT Analysis

16.7 RENA Technologies GmbH

16.7.1 Company Overview

16.8 PLANOPTIK AG

16.8.1 Company Overview

16.8.2 Financial Analysis

16.8.3 Research & Development Expenses

16.8.4 Recent strategies and developments:

16.8.4.1 Product Launches and Product Expansions:

16.9 3DGS Inc.

16.9.1 Company Overview

16.9.2 Recent strategies and developments:

16.9.2.1 Product Launches and Product Expansions:

16.10. Workshop of Photonics

16.10.1 Company Overview

TABLE 2 Asia Pacific Glass Interposers Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria Glass Interposers Market

TABLE 4 Asia Pacific Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 5 Asia Pacific Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 6 Asia Pacific 300 mm Market by Country, 2021 - 2024, USD Million

TABLE 7 Asia Pacific 300 mm Market by Country, 2025 - 2032, USD Million

TABLE 8 Asia Pacific 200 mm Market by Country, 2021 - 2024, USD Million

TABLE 9 Asia Pacific 200 mm Market by Country, 2025 - 2032, USD Million

TABLE 10 Asia Pacific Less than 200 mm Market by Country, 2021 - 2024, USD Million

TABLE 11 Asia Pacific Less than 200 mm Market by Country, 2025 - 2032, USD Million

TABLE 12 Asia Pacific Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 13 Asia Pacific Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 14 Asia Pacific 2.5D Packaging Market by Country, 2021 - 2024, USD Million

TABLE 15 Asia Pacific 2.5D Packaging Market by Country, 2025 - 2032, USD Million

TABLE 16 Asia Pacific 3D Packaging Market by Country, 2021 - 2024, USD Million

TABLE 17 Asia Pacific 3D Packaging Market by Country, 2025 - 2032, USD Million

TABLE 18 Asia Pacific Fan-Out Packaging Market by Country, 2021 - 2024, USD Million

TABLE 19 Asia Pacific Fan-Out Packaging Market by Country, 2025 - 2032, USD Million

TABLE 20 Asia Pacific Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 21 Asia Pacific Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 22 Asia Pacific Through-Glass Vias (TGV) Market by Country, 2021 - 2024, USD Million

TABLE 23 Asia Pacific Through-Glass Vias (TGV) Market by Country, 2025 - 2032, USD Million

TABLE 24 Asia Pacific Redistribution Layer (RDL)-First/Last Market by Country, 2021 - 2024, USD Million

TABLE 25 Asia Pacific Redistribution Layer (RDL)-First/Last Market by Country, 2025 - 2032, USD Million

TABLE 26 Asia Pacific Glass Panel Level Packaging (PLP) Market by Country, 2021 - 2024, USD Million

TABLE 27 Asia Pacific Glass Panel Level Packaging (PLP) Market by Country, 2025 - 2032, USD Million

TABLE 28 Asia Pacific Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 29 Asia Pacific Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 30 Asia Pacific Consumer Electronics Market by Country, 2021 - 2024, USD Million

TABLE 31 Asia Pacific Consumer Electronics Market by Country, 2025 - 2032, USD Million

TABLE 32 Asia Pacific Telecommunications Market by Country, 2021 - 2024, USD Million

TABLE 33 Asia Pacific Telecommunications Market by Country, 2025 - 2032, USD Million

TABLE 34 Asia Pacific Automotive Market by Country, 2021 - 2024, USD Million

TABLE 35 Asia Pacific Automotive Market by Country, 2025 - 2032, USD Million

TABLE 36 Asia Pacific Defense & Aerospace Market by Country, 2021 - 2024, USD Million

TABLE 37 Asia Pacific Defense & Aerospace Market by Country, 2025 - 2032, USD Million

TABLE 38 Asia Pacific Healthcare Market by Country, 2021 - 2024, USD Million

TABLE 39 Asia Pacific Healthcare Market by Country, 2025 - 2032, USD Million

TABLE 40 Asia Pacific Other End Use Industry Market by Country, 2021 - 2024, USD Million

TABLE 41 Asia Pacific Other End Use Industry Market by Country, 2025 - 2032, USD Million

TABLE 42 Asia Pacific Glass Interposers Market by Country, 2021 - 2024, USD Million

TABLE 43 Asia Pacific Glass Interposers Market by Country, 2025 - 2032, USD Million

TABLE 44 China Glass Interposers Market, 2021 - 2024, USD Million

TABLE 45 China Glass Interposers Market, 2025 - 2032, USD Million

TABLE 46 China Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 47 China Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 48 China Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 49 China Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 50 China Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 51 China Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 52 China Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 53 China Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 54 Japan Glass Interposers Market, 2021 - 2024, USD Million

TABLE 55 Japan Glass Interposers Market, 2025 - 2032, USD Million

TABLE 56 Japan Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 57 Japan Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 58 Japan Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 59 Japan Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 60 Japan Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 61 Japan Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 62 Japan Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 63 Japan Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 64 India Glass Interposers Market, 2021 - 2024, USD Million

TABLE 65 India Glass Interposers Market, 2025 - 2032, USD Million

TABLE 66 India Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 67 India Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 68 India Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 69 India Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 70 India Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 71 India Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 72 India Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 73 India Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 74 South Korea Glass Interposers Market, 2021 - 2024, USD Million

TABLE 75 South Korea Glass Interposers Market, 2025 - 2032, USD Million

TABLE 76 South Korea Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 77 South Korea Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 78 South Korea Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 79 South Korea Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 80 South Korea Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 81 South Korea Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 82 South Korea Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 83 South Korea Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 84 Singapore Glass Interposers Market, 2021 - 2024, USD Million

TABLE 85 Singapore Glass Interposers Market, 2025 - 2032, USD Million

TABLE 86 Singapore Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 87 Singapore Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 88 Singapore Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 89 Singapore Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 90 Singapore Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 91 Singapore Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 92 Singapore Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 93 Singapore Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 94 Malaysia Glass Interposers Market, 2021 - 2024, USD Million

TABLE 95 Malaysia Glass Interposers Market, 2025 - 2032, USD Million

TABLE 96 Malaysia Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 97 Malaysia Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 98 Malaysia Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 99 Malaysia Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 100 Malaysia Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 101 Malaysia Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 102 Malaysia Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 103 Malaysia Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 104 Rest of Asia Pacific Glass Interposers Market, 2021 - 2024, USD Million

TABLE 105 Rest of Asia Pacific Glass Interposers Market, 2025 - 2032, USD Million

TABLE 106 Rest of Asia Pacific Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

TABLE 107 Rest of Asia Pacific Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

TABLE 108 Rest of Asia Pacific Glass Interposers Market by Application, 2021 - 2024, USD Million

TABLE 109 Rest of Asia Pacific Glass Interposers Market by Application, 2025 - 2032, USD Million

TABLE 110 Rest of Asia Pacific Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

TABLE 111 Rest of Asia Pacific Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

TABLE 112 Rest of Asia Pacific Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

TABLE 113 Rest of Asia Pacific Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

TABLE 114 Key Information – Corning Incorporated

TABLE 115 Key Information – AGC, Inc.

TABLE 116 key Information – Schott AG

TABLE 117 Key Information – Dai Nippon Printing Co., Ltd.

TABLE 118 Key Information – Tecnisco, LTD.

TABLE 119 Key Information – Samtec, Inc.

TABLE 120 Key Information – RENA Technologies GmbH

TABLE 121 Key Information – PLANOPTIK AG

TABLE 122 Key Information – 3DGS Inc.

TABLE 123 Key Information – Workshop of Photonics

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Glass Interposers Market, 2021 - 2032, USD Million

FIG 3 Market Share Analysis, 2024

FIG 4 Porter’s Five Forces Analysis – Glass Interposers Market

FIG 5 Value Chain Analysis of Glass Interposers Market

FIG 6 Key Customer Criteria Glass Interposers Market

FIG 7 Asia Pacific Glass Interposers Market share by Wafer Size, 2024

FIG 8 Asia Pacific Glass Interposers Market share by Wafer Size, 2032

FIG 9 Asia Pacific Glass Interposers Market by Wafer Size, 2021 - 2032, USD Million

FIG 10 Asia Pacific Glass Interposers Market share by Application, 2024

FIG 11 Asia Pacific Glass Interposers Market share by Application, 2032

FIG 12 Asia Pacific Glass Interposers Market by Application, 2021 - 2032, USD Million

FIG 13 Asia Pacific Glass Interposers Market share by Substrate Technology, 2024

FIG 14 Asia Pacific Glass Interposers Market by Substrate Technology, 2032

FIG 15 Asia Pacific Glass Interposers Market by Substrate Technology, 2021 - 2032, USD Million

FIG 16 Asia Pacific Glass Interposers Market share by End Use Industry, 2024

FIG 17 Asia Pacific Glass Interposers Market share by End Use Industry, 2032

FIG 18 Asia Pacific Glass Interposers Market by End Use Industry, 2021 - 2032, USD Million

FIG 19 Asia Pacific Glass Interposers Market share by Country, 2024

FIG 20 Asia Pacific Glass Interposers Market share by Country, 2032

FIG 21 Asia Pacific Glass Interposers Market by Country, 2021 - 2032, USD Million

FIG 22 SWOT Analysis: Corning Incorporated

FIG 23 SWOT Analysis: AGC, Inc.

FIG 24 SWOT Analysis: Schott AG

FIG 25 SWOT Analysis: Samtec, Inc.