Asia Pacific Emulsion Polymers Market Size, Share & Industry Analysis Report By Type, By Application (Paints & Coatings, Adhesives & Sealants, Paper & Paperboard, and Other Application), By End-use, By Country and Growth Forecast, 2025 - 2032

Published Date : 23-May-2025 |

Pages: 147 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific Emulsion Polymers Market

The Asia Pacific Emulsion Polymers Market would witness market growth of 6.6% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Emulsion Polymers Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $6,061.3 million by 2032. The Japan market is showcasing a CAGR of 5.7% during (2025 - 2032). Additionally, The India market would register a CAGR of 7.3% during (2025 - 2032).

The applications of emulsion polymers are vast and span a wide range of industries, reflecting their adaptability and functionality. In the coatings industry, emulsion polymers serve as the backbone of water-based paints and coatings, offering excellent film-forming properties, durability, and resistance to environmental factors. These polymers are widely used in architectural coatings for residential and commercial buildings, providing aesthetically pleasing finishes with long-lasting protection. In the adhesives and sealants, emulsion polymers deliver strong bonding capabilities, making them ideal for packaging, construction, and automotive applications.

Moreover, their ability to form cohesive films ensures reliable adhesion across diverse substrates, from paper and wood to metals and plastics. The textile industry leverages emulsion polymers for fabric finishing, imparting properties such as softness, water repellency, and stain resistance, which enhance the durability and appeal of garments and home textiles. In the paper and packaging industry, these polymers are used for coatings that improve printability, gloss, and barrier properties, ensuring high-quality labels, cartons, and flexible packaging outputs.

In China, the robust performance of the textile and apparel industry is a major driver for the market. From January to May 2022, the 13,053 largest textile manufacturers in China generated a total profit of 561.1 billion yuan (approx. $83.9 billion), reflecting a 6.1% year-on-year growth. Additionally, exports of apparel and accessories rose by 10.2% to $62.2 billion. Emulsion polymers are essential in textile applications, particularly fabric finishing, printing pastes, and binders. The continued expansion of China’s textile industry directly translates into increased demand for high-quality emulsion polymers that enhance fabric properties and meet global environmental standards.

Free Valuable Insights: The Global Emulsion Polymers Market is Predict to reach USD 52.74 Billion by 2032, at a CAGR of 6.2%

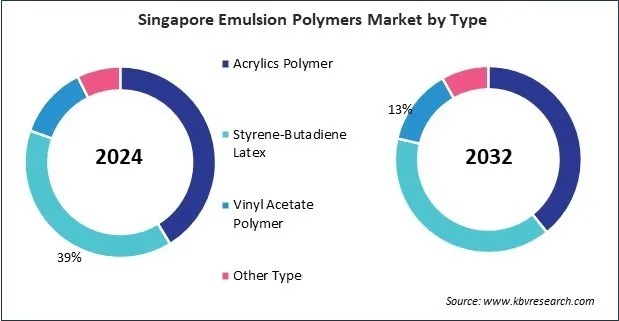

Based on Type, the market is segmented into Acrylics Polymer, Styrene-Butadiene Latex, Vinyl Acetate Polymer, and Other Type. Based on Application, the market is segmented into Paints & Coatings, Adhesives & Sealants, Paper & Paperboard, and Other Application. Based on End-use, the market is segmented into Building & Construction, Automotive, Textile & Coatings, Chemicals, and Other End-use. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- BASF SE

- Synthomer PLC (William Blythe Ltd.)

- Allnex GMBH (PTT Global Chemical Public Company Limited)

- Arkema S.A.

- DIC Corporation

- Celanese Corporation

- Wacker Chemie AG

- Momentive Performance Materials, Inc. (Hexion, Inc.)

- Solvay SA

- Clariant AG

Asia Pacific Emulsion Polymers Market Report Segmentation

By Type

- Acrylics Polymer

- Styrene-Butadiene Latex

- Vinyl Acetate Polymer

- Other Type

By Application

- Paints & Coatings

- Adhesives & Sealants

- Paper & Paperboard

- Other Application

By End-use

- Building & Construction

- Automotive

- Textile & Coatings

- Chemicals

- Other End-use

By Country

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Emulsion Polymers Market, by Type

1.4.2 Asia Pacific Emulsion Polymers Market, by Application

1.4.3 Asia Pacific Emulsion Polymers Market, by End-use

1.4.4 Asia Pacific Emulsion Polymers Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.2.4 Geographical Expansion

4.3 Top Winning Strategies

4.3.1 Key Leading Strategies: Percentage Distribution (2021-2025)

4.4 Porter Five Forces Analysis

Chapter 5. Asia Pacific Emulsion Polymers Market by Type

5.1 Asia Pacific Acrylics Polymer Market by Country

5.2 Asia Pacific Styrene-Butadiene Latex Market by Country

5.3 Asia Pacific Vinyl Acetate Polymer Market by Country

5.4 Asia Pacific Other Type Market by Country

Chapter 6. Asia Pacific Emulsion Polymers Market by Application

6.1 Asia Pacific Paints & Coatings Market by Country

6.2 Asia Pacific Adhesives & Sealants Market by Country

6.3 Asia Pacific Paper & Paperboard Market by Country

6.4 Asia Pacific Other Application Market by Country

Chapter 7. Asia Pacific Emulsion Polymers Market by End-use

7.1 Asia Pacific Building & Construction Market by Country

7.2 Asia Pacific Automotive Market by Country

7.3 Asia Pacific Textile & Coatings Market by Country

7.4 Asia Pacific Chemicals Market by Country

7.5 Asia Pacific Other End-use Market by Country

Chapter 8. Asia Pacific Emulsion Polymers Market by Country

8.1 China Emulsion Polymers Market

8.1.1 China Emulsion Polymers Market by Type

8.1.2 China Emulsion Polymers Market by Application

8.1.3 China Emulsion Polymers Market by End-use

8.2 Japan Emulsion Polymers Market

8.2.1 Japan Emulsion Polymers Market by Type

8.2.2 Japan Emulsion Polymers Market by Application

8.2.3 Japan Emulsion Polymers Market by End-use

8.3 India Emulsion Polymers Market

8.3.1 India Emulsion Polymers Market by Type

8.3.2 India Emulsion Polymers Market by Application

8.3.3 India Emulsion Polymers Market by End-use

8.4 South Korea Emulsion Polymers Market

8.4.1 South Korea Emulsion Polymers Market by Type

8.4.2 South Korea Emulsion Polymers Market by Application

8.4.3 South Korea Emulsion Polymers Market by End-use

8.5 Australia Emulsion Polymers Market

8.5.1 Australia Emulsion Polymers Market by Type

8.5.2 Australia Emulsion Polymers Market by Application

8.5.3 Australia Emulsion Polymers Market by End-use

8.6 Malaysia Emulsion Polymers Market

8.6.1 Malaysia Emulsion Polymers Market by Type

8.6.2 Malaysia Emulsion Polymers Market by Application

8.6.3 Malaysia Emulsion Polymers Market by End-use

8.7 Rest of Asia Pacific Emulsion Polymers Market

8.7.1 Rest of Asia Pacific Emulsion Polymers Market by Type

8.7.2 Rest of Asia Pacific Emulsion Polymers Market by Application

8.7.3 Rest of Asia Pacific Emulsion Polymers Market by End-use

Chapter 9. Company Profiles

9.1 BASF SE

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 Recent strategies and developments:

9.1.5.1 Partnerships, Collaborations, and Agreements:

9.1.5.2 Product Launches and Product Expansions:

9.1.6 SWOT Analysis

9.2 Synthomer PLC (William Blythe Ltd.)

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Research & Development Expenses

9.2.5 Recent strategies and developments:

9.2.5.1 Partnerships, Collaborations, and Agreements:

9.3 Allnex GMBH (PTT Global Chemical Public Company Limited)

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Recent strategies and developments:

9.3.4.1 Partnerships, Collaborations, and Agreements:

9.3.5 SWOT Analysis

9.4 Arkema S.A.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expenses

9.4.5 Recent strategies and developments:

9.4.5.1 Product Launches and Product Expansions:

9.4.5.2 Acquisition and Mergers:

9.4.6 SWOT Analysis

9.5 DIC Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 SWOT Analysis

9.6 Celanese Corporation

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expenses

9.6.5 SWOT Analysis

9.7 Wacker Chemie AG

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expenses

9.7.5 Recent strategies and developments:

9.7.5.1 Product Launches and Product Expansions:

9.7.5.2 Geographical Expansions:

9.7.6 SWOT Analysis

9.8 Momentive Performance Materials, Inc. (Hexion, Inc.)

9.8.1 Company Overview

9.8.2 SWOT Analysis

9.9 Solvay SA

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental Regional Analysis

9.9.4 Research & Development Expenses

9.9.5 Recent strategies and developments:

9.9.5.1 Product Launches and Product Expansions:

9.9.6 SWOT Analysis

9.10. Clariant AG

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Segmental and Regional Analysis

9.10.4 Research & Development Expenses

9.10.5 Recent strategies and developments:

9.10.5.1 Partnerships, Collaborations, and Agreements:

9.10.6 SWOT Analysis

TABLE 2 Asia Pacific Emulsion Polymers Market, 2025 - 2032, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Emulsion Polymers Market

TABLE 4 Product Launches And Product Expansions– Emulsion Polymers Market

TABLE 5 Acquisition and Mergers– Emulsion Polymers Market

TABLE 6 Geographical Expansion– Emulsion Polymers Market

TABLE 7 Asia Pacific Emulsion Polymers Market by Type, 2021 - 2024, USD Million

TABLE 8 Asia Pacific Emulsion Polymers Market by Type, 2025 - 2032, USD Million

TABLE 9 Asia Pacific Acrylics Polymer Market by Country, 2021 - 2024, USD Million

TABLE 10 Asia Pacific Acrylics Polymer Market by Country, 2025 - 2032, USD Million

TABLE 11 Asia Pacific Styrene-Butadiene Latex Market by Country, 2021 - 2024, USD Million

TABLE 12 Asia Pacific Styrene-Butadiene Latex Market by Country, 2025 - 2032, USD Million

TABLE 13 Asia Pacific Vinyl Acetate Polymer Market by Country, 2021 - 2024, USD Million

TABLE 14 Asia Pacific Vinyl Acetate Polymer Market by Country, 2025 - 2032, USD Million

TABLE 15 Asia Pacific Other Type Market by Country, 2021 - 2024, USD Million

TABLE 16 Asia Pacific Other Type Market by Country, 2025 - 2032, USD Million

TABLE 17 Asia Pacific Emulsion Polymers Market by Application, 2021 - 2024, USD Million

TABLE 18 Asia Pacific Emulsion Polymers Market by Application, 2025 - 2032, USD Million

TABLE 19 Asia Pacific Paints & Coatings Market by Country, 2021 - 2024, USD Million

TABLE 20 Asia Pacific Paints & Coatings Market by Country, 2025 - 2032, USD Million

TABLE 21 Asia Pacific Adhesives & Sealants Market by Country, 2021 - 2024, USD Million

TABLE 22 Asia Pacific Adhesives & Sealants Market by Country, 2025 - 2032, USD Million

TABLE 23 Asia Pacific Paper & Paperboard Market by Country, 2021 - 2024, USD Million

TABLE 24 Asia Pacific Paper & Paperboard Market by Country, 2025 - 2032, USD Million

TABLE 25 Asia Pacific Other Application Market by Country, 2021 - 2024, USD Million

TABLE 26 Asia Pacific Other Application Market by Country, 2025 - 2032, USD Million

TABLE 27 Asia Pacific Emulsion Polymers Market by End-use, 2021 - 2024, USD Million

TABLE 28 Asia Pacific Emulsion Polymers Market by End-use, 2025 - 2032, USD Million

TABLE 29 Asia Pacific Building & Construction Market by Country, 2021 - 2024, USD Million

TABLE 30 Asia Pacific Building & Construction Market by Country, 2025 - 2032, USD Million

TABLE 31 Asia Pacific Automotive Market by Country, 2021 - 2024, USD Million

TABLE 32 Asia Pacific Automotive Market by Country, 2025 - 2032, USD Million

TABLE 33 Asia Pacific Textile & Coatings Market by Country, 2021 - 2024, USD Million

TABLE 34 Asia Pacific Textile & Coatings Market by Country, 2025 - 2032, USD Million

TABLE 35 Asia Pacific Chemicals Market by Country, 2021 - 2024, USD Million

TABLE 36 Asia Pacific Chemicals Market by Country, 2025 - 2032, USD Million

TABLE 37 Asia Pacific Other End-use Market by Country, 2021 - 2024, USD Million

TABLE 38 Asia Pacific Other End-use Market by Country, 2025 - 2032, USD Million

TABLE 39 Asia Pacific Emulsion Polymers Market by Country, 2021 - 2024, USD Million

TABLE 40 Asia Pacific Emulsion Polymers Market by Country, 2025 - 2032, USD Million

TABLE 41 China Emulsion Polymers Market, 2021 - 2024, USD Million

TABLE 42 China Emulsion Polymers Market, 2025 - 2032, USD Million

TABLE 43 China Emulsion Polymers Market by Type, 2021 - 2024, USD Million

TABLE 44 China Emulsion Polymers Market by Type, 2025 - 2032, USD Million

TABLE 45 China Emulsion Polymers Market by Application, 2021 - 2024, USD Million

TABLE 46 China Emulsion Polymers Market by Application, 2025 - 2032, USD Million

TABLE 47 China Emulsion Polymers Market by End-use, 2021 - 2024, USD Million

TABLE 48 China Emulsion Polymers Market by End-use, 2025 - 2032, USD Million

TABLE 49 Japan Emulsion Polymers Market, 2021 - 2024, USD Million

TABLE 50 Japan Emulsion Polymers Market, 2025 - 2032, USD Million

TABLE 51 Japan Emulsion Polymers Market by Type, 2021 - 2024, USD Million

TABLE 52 Japan Emulsion Polymers Market by Type, 2025 - 2032, USD Million

TABLE 53 Japan Emulsion Polymers Market by Application, 2021 - 2024, USD Million

TABLE 54 Japan Emulsion Polymers Market by Application, 2025 - 2032, USD Million

TABLE 55 Japan Emulsion Polymers Market by End-use, 2021 - 2024, USD Million

TABLE 56 Japan Emulsion Polymers Market by End-use, 2025 - 2032, USD Million

TABLE 57 India Emulsion Polymers Market, 2021 - 2024, USD Million

TABLE 58 India Emulsion Polymers Market, 2025 - 2032, USD Million

TABLE 59 India Emulsion Polymers Market by Type, 2021 - 2024, USD Million

TABLE 60 India Emulsion Polymers Market by Type, 2025 - 2032, USD Million

TABLE 61 India Emulsion Polymers Market by Application, 2021 - 2024, USD Million

TABLE 62 India Emulsion Polymers Market by Application, 2025 - 2032, USD Million

TABLE 63 India Emulsion Polymers Market by End-use, 2021 - 2024, USD Million

TABLE 64 India Emulsion Polymers Market by End-use, 2025 - 2032, USD Million

TABLE 65 South Korea Emulsion Polymers Market, 2021 - 2024, USD Million

TABLE 66 South Korea Emulsion Polymers Market, 2025 - 2032, USD Million

TABLE 67 South Korea Emulsion Polymers Market by Type, 2021 - 2024, USD Million

TABLE 68 South Korea Emulsion Polymers Market by Type, 2025 - 2032, USD Million

TABLE 69 South Korea Emulsion Polymers Market by Application, 2021 - 2024, USD Million

TABLE 70 South Korea Emulsion Polymers Market by Application, 2025 - 2032, USD Million

TABLE 71 South Korea Emulsion Polymers Market by End-use, 2021 - 2024, USD Million

TABLE 72 South Korea Emulsion Polymers Market by End-use, 2025 - 2032, USD Million

TABLE 73 Australia Emulsion Polymers Market, 2021 - 2024, USD Million

TABLE 74 Australia Emulsion Polymers Market, 2025 - 2032, USD Million

TABLE 75 Australia Emulsion Polymers Market by Type, 2021 - 2024, USD Million

TABLE 76 Australia Emulsion Polymers Market by Type, 2025 - 2032, USD Million

TABLE 77 Australia Emulsion Polymers Market by Application, 2021 - 2024, USD Million

TABLE 78 Australia Emulsion Polymers Market by Application, 2025 - 2032, USD Million

TABLE 79 Australia Emulsion Polymers Market by End-use, 2021 - 2024, USD Million

TABLE 80 Australia Emulsion Polymers Market by End-use, 2025 - 2032, USD Million

TABLE 81 Malaysia Emulsion Polymers Market, 2021 - 2024, USD Million

TABLE 82 Malaysia Emulsion Polymers Market, 2025 - 2032, USD Million

TABLE 83 Malaysia Emulsion Polymers Market by Type, 2021 - 2024, USD Million

TABLE 84 Malaysia Emulsion Polymers Market by Type, 2025 - 2032, USD Million

TABLE 85 Malaysia Emulsion Polymers Market by Application, 2021 - 2024, USD Million

TABLE 86 Malaysia Emulsion Polymers Market by Application, 2025 - 2032, USD Million

TABLE 87 Malaysia Emulsion Polymers Market by End-use, 2021 - 2024, USD Million

TABLE 88 Malaysia Emulsion Polymers Market by End-use, 2025 - 2032, USD Million

TABLE 89 Rest of Asia Pacific Emulsion Polymers Market, 2021 - 2024, USD Million

TABLE 90 Rest of Asia Pacific Emulsion Polymers Market, 2025 - 2032, USD Million

TABLE 91 Rest of Asia Pacific Emulsion Polymers Market by Type, 2021 - 2024, USD Million

TABLE 92 Rest of Asia Pacific Emulsion Polymers Market by Type, 2025 - 2032, USD Million

TABLE 93 Rest of Asia Pacific Emulsion Polymers Market by Application, 2021 - 2024, USD Million

TABLE 94 Rest of Asia Pacific Emulsion Polymers Market by Application, 2025 - 2032, USD Million

TABLE 95 Rest of Asia Pacific Emulsion Polymers Market by End-use, 2021 - 2024, USD Million

TABLE 96 Rest of Asia Pacific Emulsion Polymers Market by End-use, 2025 - 2032, USD Million

TABLE 97 Key Information – BASF SE

TABLE 98 Key Information – Synthomer PLC

TABLE 99 Key Information – Allnex GMBH

TABLE 100 Key information – Arkema S.A.

TABLE 101 Key Information – DIC Corporation

TABLE 102 Key Information – Celanese Corporation

TABLE 103 Key Information – Wacker Chemie AG

TABLE 104 Key Information – Momentive Performance Materials, Inc.

TABLE 105 Key Information – Solvay SA

TABLE 106 Key Information – Clariant AG

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Emulsion Polymers Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Emulsion Polymers Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2021-2025)

FIG 6 Porter’s Five Forces Analysis – Emulsion Polymers Market

FIG 7 Asia Pacific Emulsion Polymers Market share by Type, 2024

FIG 8 Asia Pacific Emulsion Polymers Market share by Type, 2032

FIG 9 Asia Pacific Emulsion Polymers Market by Type, 2021 - 2032, USD Million

FIG 10 Asia Pacific Emulsion Polymers Market share by Application, 2024

FIG 11 Asia Pacific Emulsion Polymers Market share by Application, 2032

FIG 12 Asia Pacific Emulsion Polymers Market by Application, 2021 - 2032, USD Million

FIG 13 Asia Pacific Emulsion Polymers Market share by End-use, 2024

FIG 14 Asia Pacific Emulsion Polymers Market share by End-use, 2032

FIG 15 Asia Pacific Emulsion Polymers Market by End-use, 2021 - 2032, USD Million

FIG 16 Asia Pacific Emulsion Polymers Market share by Country, 2024

FIG 17 Asia Pacific Emulsion Polymers Market share by Country, 2032

FIG 18 Asia Pacific Emulsion Polymers Market by Country, 2021 - 2032, USD Million

FIG 19 Recent strategies and developments: BASF SE

FIG 20 SWOT Analysis: BASF SE

FIG 21 Swot Analysis: Allnex GMBH

FIG 22 Recent strategies and developments: Arkema S.A.

FIG 23 SWOT Analysis: Arkema S.A.

FIG 24 SWOT Analysis: DIC Corporation

FIG 25 SWOT Analysis: Celanese Corporation

FIG 26 Recent strategies and developments: Wacker Chemie AG

FIG 27 Swot Analysis: Wacker Chemie AG

FIG 28 SWOT Analysis: Momentive Performance Materials, Inc.

FIG 29 SWOT Analysis: Solvay SA

FIG 30 SWOT Analysis: Clariant AG