Asia Pacific Crop Insurance Market Size, Share & Industry Analysis Report By Type (Multi-peril Crop Insurance (MPCI), Crop-hail Insurance, and Revenue Insurance), By Coverage (Revenue Protection, Yield Protection, and Price Protection), By Distribution Channel (Government Agencies, Insurance Companies, and Other Distribution Channel), By Country and Growth Forecast, 2025 - 2032

Published Date : 18-Jun-2025 |

Pages: 129 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific Crop Insurance Market

The Asia Pacific Crop Insurance Market would witness market growth of 6.6% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Crop Insurance Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $4,509.9 million by 2032. The Japan market is registering a CAGR of 5.3% during (2025 - 2032). Additionally, The India market would showcase a CAGR of 7.1% during (2025 - 2032).

The adoption of crop insurance has grown significantly over the years, driven by increasing awareness of its benefits and supportive government policies. In many countries, governments play a pivotal role in promoting crop insurance through subsidies, public-private partnerships, and regulatory frameworks that make policies more accessible and affordable.

In countries like India, government-backed schemes have expanded access to crop insurance for millions of smallholder farmers, enabling them to protect their livelihoods against climate-induced risks. The adoption of crop insurance is also influenced by the growing recognition of its role in enhancing food security and rural development. By providing a financial buffer, crop insurance enables farmers to invest in improved seeds, fertilizers, and technologies without the fear of catastrophic losses.

The Asia Pacific region hosts some of the world’s largest agricultural economies, including China, India, and Indonesia, along with a vast population dependent on farming for livelihood. However, the market here is highly fragmented and at various stages of development across different countries. While advanced economies such as Japan and Australia have more structured insurance systems, developing nations are increasingly leveraging government schemes and parametric insurance models to provide coverage to smallholder farmers. The region faces high exposure to climate risks like floods, typhoons, and droughts, making crop insurance essential for food security and income stabilization.

Digital transformation and the use of satellite and weather-based data are emerging as key trends to expand coverage and improve efficiency. Across Asia-Pacific, governments remain central players in subsidizing crop insurance and promoting awareness among farmers. Technological innovation is a shared theme—remote sensing, AI, and blockchain are being incorporated to streamline underwriting and claim processing. Competitive landscapes vary, with China and India featuring both domestic giants and international reinsurers, while Japan's system is dominated by cooperative banks and government-linked institutions.

India's crop insurance landscape is significantly shaped by its vast agricultural base, which contributes 18.3% to the country’s gross value added (GVA) as of FY 2022–23, according to Invest India. The government-led Pradhan Mantri Fasal Bima Yojana (PMFBY) remains a cornerstone initiative, offering widespread coverage for crops across different regions. With the rapid expansion of digital infrastructure in rural areas, insurers are deploying mobile applications, drones, and satellite imaging for faster claims settlement and policy enrollment. In Japan, agriculture holds a strategic role despite the country's limited arable land. In 2022, Japan ranked as the fourth-largest export market for agriculture and related products, valued at $16.8 billion, per the International Trade Administration.

The country's crop insurance model is government-backed through the Norinchukin Bank and JA Insurance Group. The market in Japan is mature and highly regulated, with strong focus on risk reduction and resilience. Recent trends include diversification of insurance products to cover specific risks such as typhoons, floods, and droughts. In conclusion, Asia Pacific shows rapid growth in crop insurance, driven by climate urgency and digital tools, despite regional development gaps.

Free Valuable Insights: The Global Crop Insurance Market is Predict to reach USD 59.32 Billion by 2032, at a CAGR of 5.8 %

Based on Type, the market is segmented into Multi-peril Crop Insurance (MPCI), Crop-hail Insurance, and Revenue Insurance. Based on Coverage, the market is segmented into Revenue Protection, Yield Protection, and Price Protection. Based on Distribution Channel, the market is segmented into Government Agencies, Insurance Companies, and Other Distribution Channel. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- USI Insurance Services, LLC

- QBE Insurance Group Limited

- Chubb Limited

- Zurich Insurance Group Ltd.

- Great American Insurance Company (American Financial Group, Inc.)

- American International Group, Inc. (AIG)

- Nationwide Mutual Insurance Company

- ICICI Lombard General Insurance Company Limited (ICICI Bank Limited)

- AXA SA

- Bajaj Allianz General Insurance Company

Asia Pacific Crop Insurance Market Report Segmentation

By Type

- Multi-peril Crop Insurance (MPCI)

- Crop-hail Insurance

- Revenue Insurance

By Coverage

- Revenue Protection

- Yield Protection

- Price Protection

By Distribution Channel

- Government Agencies

- Insurance Companies

- Other Distribution Channel

By Country

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Crop Insurance Market, by Type

1.4.2 Asia Pacific Crop Insurance Market, by Coverage

1.4.3 Asia Pacific Crop Insurance Market, by Distribution Channel

1.4.4 Asia Pacific Crop Insurance Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter Five Forces Analysis

Chapter 4. Value Chain Analysis of Crop Insurance Market

4.1 Product Development

4.2 Regulatory & Compliance Management

4.3 Marketing & Awareness

4.4 Distribution & Sales

4.5 Policy Underwriting

4.6 Premium Collection & Payment Systems

4.7 Monitoring & Risk Assessment

4.8 Claims Management

4.9 Customer Service & Support

4.10. Feedback & Product Improvement

Chapter 5. Key Customer Criteria of Crop Insurance Market

5.1 Coverage & Risk Protection

5.2 Premium Affordability

5.3 Claim Settlement Speed & Ease

5.4 Customization & Flexibility

5.5 Reputation & Reliability

5.6 Government Support & Subsidies

5.7 Technology & Data Use

5.8 Ease of Purchase & Access

5.9 Customer Service & Support

5.10. Policy Transparency

Chapter 6. Asia Pacific Crop Insurance Market by Type

6.1 Asia Pacific Multi-peril Crop Insurance (MPCI) Market by Country

6.2 Asia Pacific Crop-hail Insurance Market by Country

6.3 Asia Pacific Revenue Insurance Market by Country

Chapter 7. Asia Pacific Crop Insurance Market by Coverage

7.1 Asia Pacific Revenue Protection Market by Country

7.2 Asia Pacific Yield Protection Market by Country

7.3 Asia Pacific Price Protection Market by Country

Chapter 8. Asia Pacific Crop Insurance Market by Distribution Channel

8.1 Asia Pacific Government Agencies Market by Country

8.2 Asia Pacific Insurance Companies Market by Country

8.3 Asia Pacific Other Distribution Channel Market by Country

Chapter 9. Asia Pacific Crop Insurance Market by Country

9.1 China Crop Insurance Market

9.1.1 China Crop Insurance Market by Type

9.1.2 China Crop Insurance Market by Coverage

9.1.3 China Crop Insurance Market by Distribution Channel

9.2 Japan Crop Insurance Market

9.2.1 Japan Crop Insurance Market by Type

9.2.2 Japan Crop Insurance Market by Coverage

9.2.3 Japan Crop Insurance Market by Distribution Channel

9.3 India Crop Insurance Market

9.3.1 India Crop Insurance Market by Type

9.3.2 India Crop Insurance Market by Coverage

9.3.3 India Crop Insurance Market by Distribution Channel

9.4 South Korea Crop Insurance Market

9.4.1 South Korea Crop Insurance Market by Type

9.4.2 South Korea Crop Insurance Market by Coverage

9.4.3 South Korea Crop Insurance Market by Distribution Channel

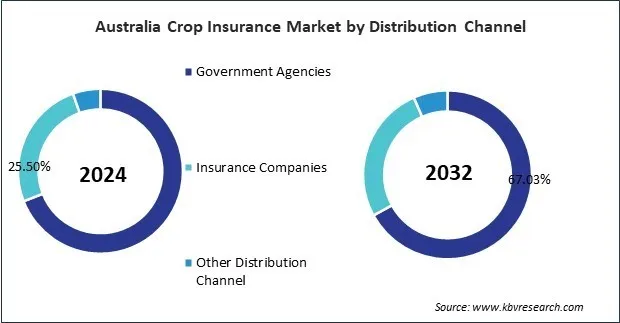

9.5 Australia Crop Insurance Market

9.5.1 Australia Crop Insurance Market by Type

9.5.2 Australia Crop Insurance Market by Coverage

9.5.3 Australia Crop Insurance Market by Distribution Channel

9.6 Malaysia Crop Insurance Market

9.6.1 Malaysia Crop Insurance Market by Type

9.6.2 Malaysia Crop Insurance Market by Coverage

9.6.3 Malaysia Crop Insurance Market by Distribution Channel

9.7 Rest of Asia Pacific Crop Insurance Market

9.7.1 Rest of Asia Pacific Crop Insurance Market by Type

9.7.2 Rest of Asia Pacific Crop Insurance Market by Coverage

9.7.3 Rest of Asia Pacific Crop Insurance Market by Distribution Channel

Chapter 10. Company Profiles

10.1 USI Insurance Services, LLC

10.1.1 Company Overview

10.2 QBE Insurance Group Limited

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Regional Analysis

10.3 Chubb Limited

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Segmental and Regional Analysis

10.3.4 SWOT Analysis

10.4 Zurich Insurance Group Ltd.

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 SWOT Analysis

10.5 Great American Insurance Company (American Financial Group, Inc.)

10.5.1 Company Overview

10.5.2 Financial Analysis

10.6 American International Group, Inc. (AIG)

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Regional Analysis

10.6.4 SWOT Analysis

10.7 Nationwide Mutual Insurance Company

10.7.1 Company Overview

10.8 ICICI Lombard General Insurance Company Limited (ICICI Bank Limited)

10.8.1 Company Overview

10.8.2 Financial Analysis

10.9 AXA SA

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Segmental and Regional Analysis

10.9.4 SWOT Analysis

10.10. Bajaj Allianz General Insurance Company

10.10.1 Company Overview

10.10.2 Financial Analysis

TABLE 2 Asia Pacific Crop Insurance Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria of Crop Insurance Market

TABLE 4 Asia Pacific Crop Insurance Market by Type, 2021 - 2024, USD Million

TABLE 5 Asia Pacific Crop Insurance Market by Type, 2025 - 2032, USD Million

TABLE 6 Asia Pacific Multi-peril Crop Insurance (MPCI) Market by Country, 2021 - 2024, USD Million

TABLE 7 Asia Pacific Multi-peril Crop Insurance (MPCI) Market by Country, 2025 - 2032, USD Million

TABLE 8 Asia Pacific Crop-hail Insurance Market by Country, 2021 - 2024, USD Million

TABLE 9 Asia Pacific Crop-hail Insurance Market by Country, 2025 - 2032, USD Million

TABLE 10 Asia Pacific Revenue Insurance Market by Country, 2021 - 2024, USD Million

TABLE 11 Asia Pacific Revenue Insurance Market by Country, 2025 - 2032, USD Million

TABLE 12 Asia Pacific Crop Insurance Market by Coverage, 2021 - 2024, USD Million

TABLE 13 Asia Pacific Crop Insurance Market by Coverage, 2025 - 2032, USD Million

TABLE 14 Asia Pacific Revenue Protection Market by Country, 2021 - 2024, USD Million

TABLE 15 Asia Pacific Revenue Protection Market by Country, 2025 - 2032, USD Million

TABLE 16 Asia Pacific Yield Protection Market by Country, 2021 - 2024, USD Million

TABLE 17 Asia Pacific Yield Protection Market by Country, 2025 - 2032, USD Million

TABLE 18 Asia Pacific Price Protection Market by Country, 2021 - 2024, USD Million

TABLE 19 Asia Pacific Price Protection Market by Country, 2025 - 2032, USD Million

TABLE 20 Asia Pacific Crop Insurance Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 21 Asia Pacific Crop Insurance Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 22 Asia Pacific Government Agencies Market by Country, 2021 - 2024, USD Million

TABLE 23 Asia Pacific Government Agencies Market by Country, 2025 - 2032, USD Million

TABLE 24 Asia Pacific Insurance Companies Market by Country, 2021 - 2024, USD Million

TABLE 25 Asia Pacific Insurance Companies Market by Country, 2025 - 2032, USD Million

TABLE 26 Asia Pacific Other Distribution Channel Market by Country, 2021 - 2024, USD Million

TABLE 27 Asia Pacific Other Distribution Channel Market by Country, 2025 - 2032, USD Million

TABLE 28 Asia Pacific Crop Insurance Market by Country, 2021 - 2024, USD Million

TABLE 29 Asia Pacific Crop Insurance Market by Country, 2025 - 2032, USD Million

TABLE 30 China Crop Insurance Market, 2021 - 2024, USD Million

TABLE 31 China Crop Insurance Market, 2025 - 2032, USD Million

TABLE 32 China Crop Insurance Market by Type, 2021 - 2024, USD Million

TABLE 33 China Crop Insurance Market by Type, 2025 - 2032, USD Million

TABLE 34 China Crop Insurance Market by Coverage, 2021 - 2024, USD Million

TABLE 35 China Crop Insurance Market by Coverage, 2025 - 2032, USD Million

TABLE 36 China Crop Insurance Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 37 China Crop Insurance Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 38 Japan Crop Insurance Market, 2021 - 2024, USD Million

TABLE 39 Japan Crop Insurance Market, 2025 - 2032, USD Million

TABLE 40 Japan Crop Insurance Market by Type, 2021 - 2024, USD Million

TABLE 41 Japan Crop Insurance Market by Type, 2025 - 2032, USD Million

TABLE 42 Japan Crop Insurance Market by Coverage, 2021 - 2024, USD Million

TABLE 43 Japan Crop Insurance Market by Coverage, 2025 - 2032, USD Million

TABLE 44 Japan Crop Insurance Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 45 Japan Crop Insurance Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 46 India Crop Insurance Market, 2021 - 2024, USD Million

TABLE 47 India Crop Insurance Market, 2025 - 2032, USD Million

TABLE 48 India Crop Insurance Market by Type, 2021 - 2024, USD Million

TABLE 49 India Crop Insurance Market by Type, 2025 - 2032, USD Million

TABLE 50 India Crop Insurance Market by Coverage, 2021 - 2024, USD Million

TABLE 51 India Crop Insurance Market by Coverage, 2025 - 2032, USD Million

TABLE 52 India Crop Insurance Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 53 India Crop Insurance Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 54 South Korea Crop Insurance Market, 2021 - 2024, USD Million

TABLE 55 South Korea Crop Insurance Market, 2025 - 2032, USD Million

TABLE 56 South Korea Crop Insurance Market by Type, 2021 - 2024, USD Million

TABLE 57 South Korea Crop Insurance Market by Type, 2025 - 2032, USD Million

TABLE 58 South Korea Crop Insurance Market by Coverage, 2021 - 2024, USD Million

TABLE 59 South Korea Crop Insurance Market by Coverage, 2025 - 2032, USD Million

TABLE 60 South Korea Crop Insurance Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 61 South Korea Crop Insurance Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 62 Australia Crop Insurance Market, 2021 - 2024, USD Million

TABLE 63 Australia Crop Insurance Market, 2025 - 2032, USD Million

TABLE 64 Australia Crop Insurance Market by Type, 2021 - 2024, USD Million

TABLE 65 Australia Crop Insurance Market by Type, 2025 - 2032, USD Million

TABLE 66 Australia Crop Insurance Market by Coverage, 2021 - 2024, USD Million

TABLE 67 Australia Crop Insurance Market by Coverage, 2025 - 2032, USD Million

TABLE 68 Australia Crop Insurance Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 69 Australia Crop Insurance Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 70 Malaysia Crop Insurance Market, 2021 - 2024, USD Million

TABLE 71 Malaysia Crop Insurance Market, 2025 - 2032, USD Million

TABLE 72 Malaysia Crop Insurance Market by Type, 2021 - 2024, USD Million

TABLE 73 Malaysia Crop Insurance Market by Type, 2025 - 2032, USD Million

TABLE 74 Malaysia Crop Insurance Market by Coverage, 2021 - 2024, USD Million

TABLE 75 Malaysia Crop Insurance Market by Coverage, 2025 - 2032, USD Million

TABLE 76 Malaysia Crop Insurance Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 77 Malaysia Crop Insurance Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 78 Rest of Asia Pacific Crop Insurance Market, 2021 - 2024, USD Million

TABLE 79 Rest of Asia Pacific Crop Insurance Market, 2025 - 2032, USD Million

TABLE 80 Rest of Asia Pacific Crop Insurance Market by Type, 2021 - 2024, USD Million

TABLE 81 Rest of Asia Pacific Crop Insurance Market by Type, 2025 - 2032, USD Million

TABLE 82 Rest of Asia Pacific Crop Insurance Market by Coverage, 2021 - 2024, USD Million

TABLE 83 Rest of Asia Pacific Crop Insurance Market by Coverage, 2025 - 2032, USD Million

TABLE 84 Rest of Asia Pacific Crop Insurance Market by Distribution Channel, 2021 - 2024, USD Million

TABLE 85 Rest of Asia Pacific Crop Insurance Market by Distribution Channel, 2025 - 2032, USD Million

TABLE 86 Key information – USI Insurance Services, LLC

TABLE 87 Key Information – QBE Insurance Group Limited

TABLE 88 Key Information – Chubb Limited

TABLE 89 Key Information – Zurich Insurance Group Ltd.

TABLE 90 Key Information – Great American insurance company

TABLE 91 Key Information – American International Group, Inc. (AIG)

TABLE 92 Key Information – Nationwide Mutual Insurance Company

TABLE 93 Key Information – ICICI Lombard General Insurance Company Limited

TABLE 94 key information – AXA SA

TABLE 95 Key Information – Bajaj Allianz General Insurance Company

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Crop Insurance Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Crop Insurance Market

FIG 4 Porter’s Five Forces Analysis – Crop Insurance Market

FIG 5 Value Chain Analysis of Crop Insurance Market

FIG 6 Key Customer Criteria of Crop Insurance Market

FIG 7 Asia Pacific Crop Insurance Market share by Type, 2024

FIG 8 Asia Pacific Crop Insurance Market share by Type, 2032

FIG 9 Asia Pacific Crop Insurance Market by Type, 2021 - 2032, USD Million

FIG 10 Asia Pacific Crop Insurance Market share by Coverage, 2024

FIG 11 Asia Pacific Crop Insurance Market share by Coverage, 2032

FIG 12 Asia Pacific Crop Insurance Market by Coverage, 2021 - 2032, USD Million

FIG 13 Asia Pacific Crop Insurance Market share by Distribution Channel, 2024

FIG 14 Asia Pacific Crop Insurance Market share by Distribution Channel, 2032

FIG 15 Asia Pacific Crop Insurance Market by Distribution Channel, 2021 - 2032, USD Million

FIG 16 Asia Pacific Crop Insurance Market share by Country, 2024

FIG 17 Asia Pacific Crop Insurance Market share by Country, 2032

FIG 18 Asia Pacific Crop Insurance Market by Country, 2021 - 2032, USD Million

FIG 19 SWOT Analysis: Chubb Limited

FIG 20 SWOT Analysis: Zurich Insurance Group Ltd.

FIG 21 SWOT Analysis: American International Group, Inc. (AIG)

FIG 22 SWOT Analysis: AXA SA