Asia Pacific Core Banking Software Market Size, Share & Industry Analysis Report By Deployment (Cloud and On-premise), By End Use, By Component, By Country and Growth Forecast, 2025 - 2032

Published Date : 22-May-2025 |

Pages: 163 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific Core Banking Software Market

The Asia Pacific Core Banking Software Market would witness market growth of 10.6% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Core Banking Software Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $1,519.2 million by 2032, growing at a CAGR of 8.3 % during the forecast period. The Japan market is registering a CAGR of 9.4% during (2025 - 2032). Additionally, The India market would showcase a CAGR of 11.3% during (2025 - 2032).

The rising demand for inclusive banking has propelled the development of solutions tailored to underserved markets, incorporating mobile-first designs, multilingual interfaces, and offline functionality. As digital identity, real-time payments, and decentralized finance continue to shape the financial services landscape, core banking software plays a foundational role in enabling institutions to remain competitive, agile, and compliant.

The market is characterized by intense competition, with traditional technology providers and new-age disruptors vying to deliver solutions that combine reliability, speed, and customization. Partnerships between core platform providers and cloud hyperscalers, cybersecurity firms, and regtech companies are further enriching the value proposition of these systems. As institutions pursue transformation agendas centered on customer empowerment and operational excellence, the demand for adaptive, intelligent, and integrative core banking platforms is expected to remain strong.

This Market in Asia Pacific is experiencing dynamic growth, driven by the region’s vast unbanked population, rapid smartphone penetration, and the rise of digital-first economies. Countries such as India, Indonesia, Vietnam, and the Philippines are witnessing a surge in digital banking initiatives, supported by government policies promoting financial inclusion and real-time payment infrastructures. A notable trend across the region is the expansion of mobile-centric banking systems, particularly in emerging economies where mobile devices often serve as the primary gateway to financial services. Core banking platforms are increasingly being designed to accommodate high transaction volumes, multilingual interfaces, and scalable cloud deployments to support these market demands. the Asia Pacific market is expected to see increased cross-border collaborations, particularly in ASEAN, for unified payment and settlement systems. Therefore, Asia Pacific’s core banking software market stands at the intersection of financial inclusion, digital innovation, and regional integration, promising significant opportunities for forward-thinking providers.

Free Valuable Insights: The Global Core Banking Software Market is Predict to reach USD 25.10 Billion by 2032, at a CAGR of 10.0%

Based on Deployment, the market is segmented into Cloud and On-premise. Based on End Use, the market is segmented into Banks, Financial Institutions, and Other End Use. Based on Component, the market is segmented into Solution (Deposits, Loans, Enterprise Customer Solutions, and Other Solution Type) and Service (Professional Service and Managed Service). Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Capgemini SE

- Finastra Group Holdings Limited (Vista Equity Partners)

- Temenos AG

- HCL Technologies Ltd.

- Oracle Corporation

- Fiserv, Inc.

- Infosys Limited

- SAP SE

- Tata Consultancy Services Ltd.

- Jack Henry & Associates, Inc.

Asia Pacific Core Banking Software Market Report Segmentation

By Deployment

- Cloud

- On-premise

By End Use

- Banks

- Financial Institutions

- Other End Use

By Component

- Solution

- Deposits

- Loans

- Enterprise Customer Solutions

- Other Solution Type

- Service

- Professional Service

- Managed Service

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Core Banking Software Market, by Deployment

1.4.2 Asia Pacific Core Banking Software Market, by End Use

1.4.3 Asia Pacific Core Banking Software Market, by Component

1.4.4 Asia Pacific Core Banking Software Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Scenario and Composition

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis – Global

4.1 Market Share Analysis, 2024

4.2 Strategies Deployed in Core Banking Software Market

4.3 Porter Five Forces Analysis

Chapter 5. Key Customer Criteria – Asia Pacific Core Banking Software Market

5.1 Scalability and Performance

5.2 Modularity and Flexibility

5.3 Cloud-Readiness and Deployment Flexibility

5.4 API Ecosystem and Open Banking Integration

5.5 Security, Privacy, and Regulatory Compliance

5.6 Total Cost of Ownership (TCO)

5.7 Speed of Implementation and Ease of Upgrades

5.8 User Experience (UX) for Staff and Customers

5.9 Vendor Reputation, Industry Expertise, and References

5.10. Localization, Support, and Post-Sales Service

Chapter 6. Asia Pacific Core Banking Software Market by Deployment

6.1 Asia Pacific Cloud Market by Country

6.2 Asia Pacific On-premise Market by Country

Chapter 7. Asia Pacific Core Banking Software Market by End Use

7.1 Asia Pacific Banks Market by Country

7.2 Asia Pacific Financial Institutions Market by Country

7.3 Asia Pacific Other End Use Market by Country

Chapter 8. Asia Pacific Core Banking Software Market by Component

8.1 Asia Pacific Solution Market by Country

8.2 Asia Pacific Core Banking Software Market by Solution Type

8.2.1 Asia Pacific Deposits Market by Country

8.2.2 Asia Pacific Loans Market by Country

8.2.3 Asia Pacific Enterprise Customer Solutions Market by Country

8.2.4 Asia Pacific Other Solution Type Market by Country

8.3 Asia Pacific Service Market by Country

8.4 Asia Pacific Core Banking Software Market by Service Type

8.4.1 Asia Pacific Professional Service Market by Country

8.4.2 Asia Pacific Managed Service Market by Country

Chapter 9. Asia Pacific Core Banking Software Market by Country

9.1 China Core Banking Software Market

9.1.1 China Core Banking Software Market by Deployment

9.1.2 China Core Banking Software Market by End Use

9.1.3 China Core Banking Software Market by Component

9.1.3.1 China Core Banking Software Market by Solution Type

9.1.3.2 China Core Banking Software Market by Service Type

9.2 Japan Core Banking Software Market

9.2.1 Japan Core Banking Software Market by Deployment

9.2.2 Japan Core Banking Software Market by End Use

9.2.3 Japan Core Banking Software Market by Component

9.2.3.1 Japan Core Banking Software Market by Solution Type

9.2.3.2 Japan Core Banking Software Market by Service Type

9.3 India Core Banking Software Market

9.3.1 India Core Banking Software Market by Deployment

9.3.2 India Core Banking Software Market by End Use

9.3.3 India Core Banking Software Market by Component

9.3.3.1 India Core Banking Software Market by Solution Type

9.3.3.2 India Core Banking Software Market by Service Type

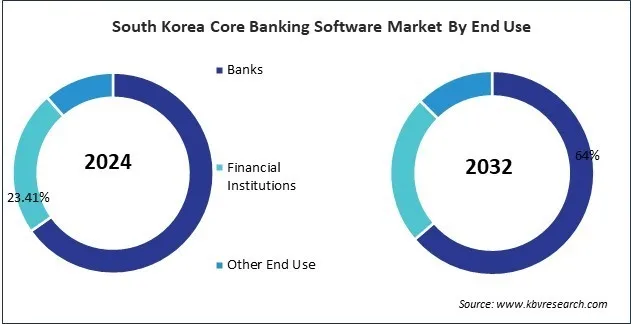

9.4 South Korea Core Banking Software Market

9.4.1 South Korea Core Banking Software Market by Deployment

9.4.2 South Korea Core Banking Software Market by End Use

9.4.3 South Korea Core Banking Software Market by Component

9.4.3.1 South Korea Core Banking Software Market by Solution Type

9.4.3.2 South Korea Core Banking Software Market by Service Type

9.5 Singapore Core Banking Software Market

9.5.1 Singapore Core Banking Software Market by Deployment

9.5.2 Singapore Core Banking Software Market by End Use

9.5.3 Singapore Core Banking Software Market by Component

9.5.3.1 Singapore Core Banking Software Market by Solution Type

9.5.3.2 Singapore Core Banking Software Market by Service Type

9.6 Malaysia Core Banking Software Market

9.6.1 Malaysia Core Banking Software Market by Deployment

9.6.2 Malaysia Core Banking Software Market by End Use

9.6.3 Malaysia Core Banking Software Market by Component

9.6.3.1 Malaysia Core Banking Software Market by Solution Type

9.6.3.2 Malaysia Core Banking Software Market by Service Type

9.7 Rest of Asia Pacific Core Banking Software Market

9.7.1 Rest of Asia Pacific Core Banking Software Market by Deployment

9.7.2 Rest of Asia Pacific Core Banking Software Market by End Use

9.7.3 Rest of Asia Pacific Core Banking Software Market by Component

9.7.3.1 Rest of Asia Pacific Core Banking Software Market by Solution Type

9.7.3.2 Rest of Asia Pacific Core Banking Software Market by Service Type

Chapter 10. Company Profiles

10.1 Capgemini SE

10.1.1 Company Overview

10.1.2 Financial Analysis

10.1.3 Regional Analysis

10.1.4 SWOT Analysis

10.2 Finastra Group Holdings Limited (Vista Equity Partners)

10.2.1 Company Overview

10.2.2 Recent strategies and developments:

10.2.2.1 Partnerships, Collaborations, and Agreements:

10.3 Temenos AG

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Segmental and Regional Analysis

10.3.4 Recent strategies and developments:

10.3.4.1 Partnerships, Collaborations, and Agreements:

10.3.5 SWOT Analysis

10.4 HCL Technologies Ltd. (HCL Enterprises)

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Segmental and Regional Analysis

10.4.4 Research & Development Expenses

10.4.5 Recent strategies and developments:

10.4.5.1 Partnerships, Collaborations, and Agreements:

10.4.5.2 Acquisition and Mergers:

10.4.6 SWOT Analysis

10.5 Oracle Corporation

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Segmental and Regional Analysis

10.5.4 Research & Development Expense

10.5.5 SWOT Analysis

10.6 Fiserv, Inc.

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Segmental and Regional Analysis

10.6.4 Recent strategies and developments:

10.6.4.1 Partnerships, Collaborations, and Agreements:

10.7 Infosys Limited

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Segmental and Regional Analysis

10.7.4 Research & Development Expense

10.7.5 SWOT Analysis

10.8 SAP SE

10.8.1 Company Overview

10.8.2 Financial Analysis

10.8.3 Regional Analysis

10.8.4 Research & Development Expense

10.8.5 SWOT Analysis

10.9 Tata Consultancy Services Ltd.

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Segmental and Regional Analysis

10.9.4 Research & Development Expenses

10.9.5 SWOT Analysis

10.10. Jack Henry & Associates, Inc.

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Research & Development Expenses

TABLE 2 Asia Pacific Core Banking Software Market, 2025 - 2032, USD Million

TABLE 3 Key Customer Criteria – Asia Pacific Core Banking Software Market

TABLE 4 Asia Pacific Core Banking Software Market by Deployment, 2021 - 2024, USD Million

TABLE 5 Asia Pacific Core Banking Software Market by Deployment, 2025 - 2032, USD Million

TABLE 6 Asia Pacific Cloud Market by Country, 2021 - 2024, USD Million

TABLE 7 Asia Pacific Cloud Market by Country, 2025 - 2032, USD Million

TABLE 8 Asia Pacific On-premise Market by Country, 2021 - 2024, USD Million

TABLE 9 Asia Pacific On-premise Market by Country, 2025 - 2032, USD Million

TABLE 10 Asia Pacific Core Banking Software Market by End Use, 2021 - 2024, USD Million

TABLE 11 Asia Pacific Core Banking Software Market by End Use, 2025 - 2032, USD Million

TABLE 12 Asia Pacific Banks Market by Country, 2021 - 2024, USD Million

TABLE 13 Asia Pacific Banks Market by Country, 2025 - 2032, USD Million

TABLE 14 Asia Pacific Financial Institutions Market by Country, 2021 - 2024, USD Million

TABLE 15 Asia Pacific Financial Institutions Market by Country, 2025 - 2032, USD Million

TABLE 16 Asia Pacific Other End Use Market by Country, 2021 - 2024, USD Million

TABLE 17 Asia Pacific Other End Use Market by Country, 2025 - 2032, USD Million

TABLE 18 Asia Pacific Core Banking Software Market by Component, 2021 - 2024, USD Million

TABLE 19 Asia Pacific Core Banking Software Market by Component, 2025 - 2032, USD Million

TABLE 20 Asia Pacific Solution Market by Country, 2021 - 2024, USD Million

TABLE 21 Asia Pacific Solution Market by Country, 2025 - 2032, USD Million

TABLE 22 Asia Pacific Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

TABLE 23 Asia Pacific Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

TABLE 24 Asia Pacific Deposits Market by Country, 2021 - 2024, USD Million

TABLE 25 Asia Pacific Deposits Market by Country, 2025 - 2032, USD Million

TABLE 26 Asia Pacific Loans Market by Country, 2021 - 2024, USD Million

TABLE 27 Asia Pacific Loans Market by Country, 2025 - 2032, USD Million

TABLE 28 Asia Pacific Enterprise Customer Solutions Market by Country, 2021 - 2024, USD Million

TABLE 29 Asia Pacific Enterprise Customer Solutions Market by Country, 2025 - 2032, USD Million

TABLE 30 Asia Pacific Other Solution Type Market by Country, 2021 - 2024, USD Million

TABLE 31 Asia Pacific Other Solution Type Market by Country, 2025 - 2032, USD Million

TABLE 32 Asia Pacific Service Market by Country, 2021 - 2024, USD Million

TABLE 33 Asia Pacific Service Market by Country, 2025 - 2032, USD Million

TABLE 34 Asia Pacific Core Banking Software Market by Service Type, 2021 - 2024, USD Million

TABLE 35 Asia Pacific Core Banking Software Market by Service Type, 2025 - 2032, USD Million

TABLE 36 Asia Pacific Professional Service Market by Country, 2021 - 2024, USD Million

TABLE 37 Asia Pacific Professional Service Market by Country, 2025 - 2032, USD Million

TABLE 38 Asia Pacific Managed Service Market by Country, 2021 - 2024, USD Million

TABLE 39 Asia Pacific Managed Service Market by Country, 2025 - 2032, USD Million

TABLE 40 Asia Pacific Core Banking Software Market by Country, 2021 - 2024, USD Million

TABLE 41 Asia Pacific Core Banking Software Market by Country, 2025 - 2032, USD Million

TABLE 42 China Core Banking Software Market, 2021 - 2024, USD Million

TABLE 43 China Core Banking Software Market, 2025 - 2032, USD Million

TABLE 44 China Core Banking Software Market by Deployment, 2021 - 2024, USD Million

TABLE 45 China Core Banking Software Market by Deployment, 2025 - 2032, USD Million

TABLE 46 China Core Banking Software Market by End Use, 2021 - 2024, USD Million

TABLE 47 China Core Banking Software Market by End Use, 2025 - 2032, USD Million

TABLE 48 China Core Banking Software Market by Component, 2021 - 2024, USD Million

TABLE 49 China Core Banking Software Market by Component, 2025 - 2032, USD Million

TABLE 50 China Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

TABLE 51 China Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

TABLE 52 China Core Banking Software Market by Service Type, 2021 - 2024, USD Million

TABLE 53 China Core Banking Software Market by Service Type, 2025 - 2032, USD Million

TABLE 54 Japan Core Banking Software Market, 2021 - 2024, USD Million

TABLE 55 Japan Core Banking Software Market, 2025 - 2032, USD Million

TABLE 56 Japan Core Banking Software Market by Deployment, 2021 - 2024, USD Million

TABLE 57 Japan Core Banking Software Market by Deployment, 2025 - 2032, USD Million

TABLE 58 Japan Core Banking Software Market by End Use, 2021 - 2024, USD Million

TABLE 59 Japan Core Banking Software Market by End Use, 2025 - 2032, USD Million

TABLE 60 Japan Core Banking Software Market by Component, 2021 - 2024, USD Million

TABLE 61 Japan Core Banking Software Market by Component, 2025 - 2032, USD Million

TABLE 62 Japan Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

TABLE 63 Japan Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

TABLE 64 Japan Core Banking Software Market by Service Type, 2021 - 2024, USD Million

TABLE 65 Japan Core Banking Software Market by Service Type, 2025 - 2032, USD Million

TABLE 66 India Core Banking Software Market, 2021 - 2024, USD Million

TABLE 67 India Core Banking Software Market, 2025 - 2032, USD Million

TABLE 68 India Core Banking Software Market by Deployment, 2021 - 2024, USD Million

TABLE 69 India Core Banking Software Market by Deployment, 2025 - 2032, USD Million

TABLE 70 India Core Banking Software Market by End Use, 2021 - 2024, USD Million

TABLE 71 India Core Banking Software Market by End Use, 2025 - 2032, USD Million

TABLE 72 India Core Banking Software Market by Component, 2021 - 2024, USD Million

TABLE 73 India Core Banking Software Market by Component, 2025 - 2032, USD Million

TABLE 74 India Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

TABLE 75 India Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

TABLE 76 India Core Banking Software Market by Service Type, 2021 - 2024, USD Million

TABLE 77 India Core Banking Software Market by Service Type, 2025 - 2032, USD Million

TABLE 78 South Korea Core Banking Software Market, 2021 - 2024, USD Million

TABLE 79 South Korea Core Banking Software Market, 2025 - 2032, USD Million

TABLE 80 South Korea Core Banking Software Market by Deployment, 2021 - 2024, USD Million

TABLE 81 South Korea Core Banking Software Market by Deployment, 2025 - 2032, USD Million

TABLE 82 South Korea Core Banking Software Market by End Use, 2021 - 2024, USD Million

TABLE 83 South Korea Core Banking Software Market by End Use, 2025 - 2032, USD Million

TABLE 84 South Korea Core Banking Software Market by Component, 2021 - 2024, USD Million

TABLE 85 South Korea Core Banking Software Market by Component, 2025 - 2032, USD Million

TABLE 86 South Korea Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

TABLE 87 South Korea Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

TABLE 88 South Korea Core Banking Software Market by Service Type, 2021 - 2024, USD Million

TABLE 89 South Korea Core Banking Software Market by Service Type, 2025 - 2032, USD Million

TABLE 90 Singapore Core Banking Software Market, 2021 - 2024, USD Million

TABLE 91 Singapore Core Banking Software Market, 2025 - 2032, USD Million

TABLE 92 Singapore Core Banking Software Market by Deployment, 2021 - 2024, USD Million

TABLE 93 Singapore Core Banking Software Market by Deployment, 2025 - 2032, USD Million

TABLE 94 Singapore Core Banking Software Market by End Use, 2021 - 2024, USD Million

TABLE 95 Singapore Core Banking Software Market by End Use, 2025 - 2032, USD Million

TABLE 96 Singapore Core Banking Software Market by Component, 2021 - 2024, USD Million

TABLE 97 Singapore Core Banking Software Market by Component, 2025 - 2032, USD Million

TABLE 98 Singapore Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

TABLE 99 Singapore Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

TABLE 100 Singapore Core Banking Software Market by Service Type, 2021 - 2024, USD Million

TABLE 101 Singapore Core Banking Software Market by Service Type, 2025 - 2032, USD Million

TABLE 102 Malaysia Core Banking Software Market, 2021 - 2024, USD Million

TABLE 103 Malaysia Core Banking Software Market, 2025 - 2032, USD Million

TABLE 104 Malaysia Core Banking Software Market by Deployment, 2021 - 2024, USD Million

TABLE 105 Malaysia Core Banking Software Market by Deployment, 2025 - 2032, USD Million

TABLE 106 Malaysia Core Banking Software Market by End Use, 2021 - 2024, USD Million

TABLE 107 Malaysia Core Banking Software Market by End Use, 2025 - 2032, USD Million

TABLE 108 Malaysia Core Banking Software Market by Component, 2021 - 2024, USD Million

TABLE 109 Malaysia Core Banking Software Market by Component, 2025 - 2032, USD Million

TABLE 110 Malaysia Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

TABLE 111 Malaysia Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

TABLE 112 Malaysia Core Banking Software Market by Service Type, 2021 - 2024, USD Million

TABLE 113 Malaysia Core Banking Software Market by Service Type, 2025 - 2032, USD Million

TABLE 114 Rest of Asia Pacific Core Banking Software Market, 2021 - 2024, USD Million

TABLE 115 Rest of Asia Pacific Core Banking Software Market, 2025 - 2032, USD Million

TABLE 116 Rest of Asia Pacific Core Banking Software Market by Deployment, 2021 - 2024, USD Million

TABLE 117 Rest of Asia Pacific Core Banking Software Market by Deployment, 2025 - 2032, USD Million

TABLE 118 Rest of Asia Pacific Core Banking Software Market by End Use, 2021 - 2024, USD Million

TABLE 119 Rest of Asia Pacific Core Banking Software Market by End Use, 2025 - 2032, USD Million

TABLE 120 Rest of Asia Pacific Core Banking Software Market by Component, 2021 - 2024, USD Million

TABLE 121 Rest of Asia Pacific Core Banking Software Market by Component, 2025 - 2032, USD Million

TABLE 122 Rest of Asia Pacific Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

TABLE 123 Rest of Asia Pacific Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

TABLE 124 Rest of Asia Pacific Core Banking Software Market by Service Type, 2021 - 2024, USD Million

TABLE 125 Rest of Asia Pacific Core Banking Software Market by Service Type, 2025 - 2032, USD Million

TABLE 126 Key Information – Capgemini SE

TABLE 127 Key Information – Finastra Group Holdings Limited

TABLE 128 Key Information – Temenos AG

TABLE 129 Key Information – HCL Technologies Ltd.

TABLE 130 Key Information – Oracle Corporation

TABLE 131 Key Information – Fiserv, Inc.

TABLE 132 Key Information – Infosys Limited

TABLE 133 Key Information – SAP SE

TABLE 134 Key Information – Tata Consultancy Services Ltd.

TABLE 135 Key Information – Jack Henry & Associates, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Core Banking Software Market, 2021 - 2032, USD Million

FIG 3 Key Factors Impacting Core Banking Software Market

FIG 4 Market Share Analysis, 2024

FIG 5 Porter’s Five Forces Analysis – Core Banking Software Market

FIG 6 Key Customer Criteria – Asia Pacific Core Banking Software Market

FIG 7 Asia Pacific Core Banking Software Market share by Deployment, 2024

FIG 8 Asia Pacific Core Banking Software Market share by Deployment, 2032

FIG 9 Asia Pacific Core Banking Software Market by Deployment, 2021 - 2032, USD Million

FIG 10 Asia Pacific Core Banking Software Market share by End Use, 2024

FIG 11 Asia Pacific Core Banking Software Market share by End Use, 2032

FIG 12 Asia Pacific Core Banking Software Market by End Use, 2021 - 2032, USD Million

FIG 13 Asia Pacific Core Banking Software Market share by Component, 2024

FIG 14 Asia Pacific Core Banking Software Market share by Component, 2032

FIG 15 Asia Pacific Core Banking Software Market by Component, 2021 - 2032, USD Million

FIG 16 Asia Pacific Core Banking Software Market share by Country, 2024

FIG 17 Asia Pacific Core Banking Software Market share by Country, 2032

FIG 18 Asia Pacific Core Banking Software Market by Country, 2021 - 2032, USD Million

FIG 19 SWOT Analysis: Capgemini SE

FIG 20 Swot Analysis: Temenos AG

FIG 21 Recent strategies and developments: HCL Technologies Ltd.

FIG 22 SWOT Analysis: HCL Technologies Ltd.

FIG 23 SWOT Analysis: Oracle Corporation

FIG 24 SWOT Analysis: Infosys Limited

FIG 25 SWOT Analysis: SAP SE

FIG 26 SWOT Analysis: Tata Consultancy Services Ltd.