Asia Pacific Container Transshipment Market Size, Share & Industry Analysis Report By Container Size (40-foot (FEU), 20-foot (TEU), and Other Container Size), By Data Source (Sea-based Transshipment, Land-based Transshipment, and Air-based Transshipment), By Service Type, By Container Type, By End User Industry, By Country and Growth Forecast, 2025 - 2032

Published Date : 25-Jun-2025 |

Pages: 244 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific Container Transshipment Market

The Asia Pacific Container Transshipment Market would witness market growth of 3.7% CAGR during the forecast period (2025-2032).

The Singapore market dominated the Asia Pacific Container Transshipment Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $2,906.1 million by 2032. The China market is registering a CAGR of 3.1% during (2025 - 2032). Additionally, The Malaysia market would showcase a CAGR of 4.6% during (2025 - 2032).

Trends in the market reflect the broader shifts in global trade and technology. One prominent trend is the increasing reliance on automation to streamline port operations. Automated cranes, guided vehicles, and digital terminal management systems are becoming standard in major transshipment hubs, boosting throughput and reducing human error. Furthermore, the adoption of digital technologies, such as blockchain and IoT, is transforming the market by enabling real-time tracking, transparent documentation, and predictive analytics.

Innovation is at the heart of this market’s evolution, driving efficiency and sustainability. Ports are increasingly adopting smart technologies, such as AI-powered logistics platforms, to optimize container handling and yard planning. Furthermore, the integration of robotics in terminal operations is reducing dwell times and enhancing safety by automating repetitive tasks. Moreover, the development of floating and modular container ports represents a groundbreaking innovation, offering scalable solutions for regions with geographic constraints or surging trade volumes.

China has established itself as the undisputed leader in the Asia Pacific market, driven by its massive manufacturing base, strategic government policies, and aggressive port development. The introduction of economic reforms in the late 20th century, combined with China's position as the "world's factory," catalyzed explosive growth in seaborne trade and necessitated advanced port infrastructure. Key government initiatives—such as the Belt and Road Initiative—have provided continuous funding and policy support for port expansion, hinterland connectivity, and integration with global shipping networks. As a result, Chinese ports like Shanghai, Ningbo-Zhoushan, Shenzhen, and Guangzhou consistently rank among the world’s top transshipment hubs, handling not only the nation's exports and imports but also serving as major transfer points for intercontinental shipping lines.

Japan’s container transshipment market reflects the nation’s strategic location at the crossroads of major East Asian shipping routes, as well as its advanced technological capabilities. Japanese ports such as Yokohama, Tokyo, and Kobe historically served as primary gateways for the nation’s export-driven economy and as important regional transshipment centers. The government, through the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), has long supported the modernization and integration of port facilities, focusing on digitalization, logistics efficiency, and environmental standards.

India’s market has seen transformative growth in the past two decades, fueled by economic liberalization, government reform, and the nation’s expanding role in global trade. Major transshipment ports like Jawaharlal Nehru Port (Nhava Sheva), Chennai, Mundra, and the fast-rising Vallarpadam International Container Transshipment Terminal in Kochi serve as gateways for both Indian cargo and international container movements between East and West. The government, via the Ministry of Ports, Shipping, and Waterways, has prioritized port modernization, private sector participation, and multimodal integration through initiatives such as the Sagarmala program. Therefore, China, Japan, and India exemplify the diverse strengths and strategic ambitions shaping the Asia Pacific market, positioning the region as a pivotal hub in the global maritime logistics network.

Free Valuable Insights: The Global Container Transshipment Market is Predict to reach USD 20.27 Billion by 2032, at a CAGR of 3.5%

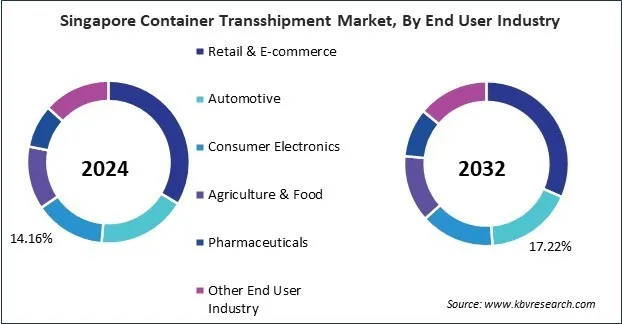

Based on Container Size, the market is segmented into 40-foot (FEU), 20-foot (TEU), and Other Container Size. Based on Data Source, the market is segmented into Sea-based Transshipment, Land-based Transshipment, and Air-based Transshipment. Based on Service Type, the market is segmented into Container Handling Services, Logistics & Forwarding Services, Warehousing & Storage, and Customs Clearance & Documentation. Based on Container Type, the market is segmented into Standard Containers, High Cube Containers, Refrigerated Containers, Open Top Containers, and Flat Rack Containers. Based on End User Industry, the market is segmented into Retail & E-commerce, Automotive, Consumer Electronics, Agriculture & Food, Pharmaceuticals, and Other End User Industry. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- MSC Mediterranean Shipping Company S.A.

- A.P. Moller - Maersk A/S

- CMA CGM Group

- Cosco Shipping Lines Co. Ltd.

- Hapag-Lloyd AG

- Evergreen Marine Corp. (Taiwan) Ltd. (Evergreen Group)

- Ocean Network Express Pte. Ltd.

- HMM Co., Ltd.

- YANG MING Group

- ZIM Integrated Shipping Services Ltd. (KENON HOLDINGS LTD.)

Asia Pacific Container Transshipment Market Report Segmentation

By Container Size

- 40-foot (FEU)

- 20-foot (TEU)

- Other Container Size

By Data Source

- Sea-based Transshipment

- Land-based Transshipment

- Air-based Transshipment

By Service Type

- Container Handling Services

- Logistics & Forwarding Services

- Warehousing & Storage

- Customs Clearance & Documentation

By Container Type

- Standard Containers

- High Cube Containers

- Refrigerated Containers

- Open Top Containers

- Flat Rack Containers

By End User Industry

- Retail & E-commerce

- Automotive

- Consumer Electronics

- Agriculture & Food

- Pharmaceuticals

- Other End User Industry

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Container Transshipment Market, by Container Size

1.4.2 Asia Pacific Container Transshipment Market, by Data Source

1.4.3 Asia Pacific Container Transshipment Market, by Service Type

1.4.4 Asia Pacific Container Transshipment Market, by Container Type

1.4.5 Asia Pacific Container Transshipment Market, by End User Industry

1.4.6 Asia Pacific Container Transshipment Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis – Global

4.1 Market Share Analysis, 2024

4.2 Recent Strategies Deployed in Container Transshipment Market

4.3 Porter Five Forces Analysis

Chapter 5. Value Chain Analysis of Container Transshipment Market

5.1 Inbound Vessel and Cargo Management

5.2 Container Unloading and Handling

5.3 Yard Storage and Container Stacking

5.4 Transshipment Coordination and Scheduling

5.5 Loading Containers onto Feeder Vessels

5.6 Outbound Logistics and Hinterland Connectivity

5.7 Value-Added Services

5.8 Technology Integration and Data Management

5.9 Compliance, Security, and Environmental Management

5.10. Customer Relationship Management and Strategic Partnerships

Chapter 6. Key Costumer Criteria - Container Transshipment Market

6.1 Location & Connectivity

6.2 Operational Efficiency

6.3 Cost Competitiveness

6.4 Port Infrastructure & Capacity

6.5 Reliability & Service Quality

6.6 Customs & Regulatory Facilitation

6.7 Value-Added Services

6.8 Sustainability & Environmental Standards

6.9 IT & Digitalization

6.10. Security & Safety

Chapter 7. Asia Pacific Container Transshipment Market by Container Size

7.1 Asia Pacific 40-foot (FEU) Market by Country

7.2 Asia Pacific 20-foot (TEU) Market by Country

7.3 Asia Pacific Other Container Size Market by Country

Chapter 8. Asia Pacific Container Transshipment Market by Data Source

8.1 Asia Pacific Sea-based Transshipment Market by Country

8.2 Asia Pacific Land-based Transshipment Market by Country

8.3 Asia Pacific Air-based Transshipment Market by Country

Chapter 9. Asia Pacific Container Transshipment Market by Service Type

9.1 Asia Pacific Container Handling Services Market by Country

9.2 Asia Pacific Logistics & Forwarding Services Market by Country

9.3 Asia Pacific Warehousing & Storage Market by Country

9.4 Asia Pacific Customs Clearance & Documentation Market by Country

Chapter 10. Asia Pacific Container Transshipment Market by Container Type

10.1 Asia Pacific Standard Containers Market by Country

10.2 Asia Pacific High Cube Containers Market by Country

10.3 Asia Pacific Refrigerated Containers Market by Country

10.4 Asia Pacific Open Top Containers Market by Country

10.5 Asia Pacific Flat Rack Containers Market by Country

Chapter 11. Asia Pacific Container Transshipment Market by End User Industry

11.1 Asia Pacific Retail & E-commerce Market by Country

11.2 Asia Pacific Automotive Market by Country

11.3 Asia Pacific Consumer Electronics Market by Country

11.4 Asia Pacific Agriculture & Food Market by Country

11.5 Asia Pacific Pharmaceuticals Market by Country

11.6 Asia Pacific Other End User Industry Market by Country

Chapter 12. Asia Pacific Container Transshipment Market by Country

12.1 Singapore Container Transshipment Market

12.1.1 Singapore Container Transshipment Market by Container Size

12.1.2 Singapore Container Transshipment Market by Data Source

12.1.3 Singapore Container Transshipment Market by Service Type

12.1.4 Singapore Container Transshipment Market by Container Type

12.1.5 Singapore Container Transshipment Market by End User Industry

12.2 China Container Transshipment Market

12.2.1 China Container Transshipment Market by Container Size

12.2.2 China Container Transshipment Market by Data Source

12.2.3 China Container Transshipment Market by Service Type

12.2.4 China Container Transshipment Market by Container Type

12.2.5 China Container Transshipment Market by End User Industry

12.3 Malaysia Container Transshipment Market

12.3.1 Malaysia Container Transshipment Market by Container Size

12.3.2 Malaysia Container Transshipment Market by Data Source

12.3.3 Malaysia Container Transshipment Market by Service Type

12.3.4 Malaysia Container Transshipment Market by Container Type

12.3.5 Malaysia Container Transshipment Market by End User Industry

12.4 South Korea Container Transshipment Market

12.4.1 South Korea Container Transshipment Market by Container Size

12.4.2 South Korea Container Transshipment Market by Data Source

12.4.3 South Korea Container Transshipment Market by Service Type

12.4.4 South Korea Container Transshipment Market by Container Type

12.4.5 South Korea Container Transshipment Market by End User Industry

12.5 India Container Transshipment Market

12.5.1 India Container Transshipment Market by Container Size

12.5.2 India Container Transshipment Market by Data Source

12.5.3 India Container Transshipment Market by Service Type

12.5.4 India Container Transshipment Market by Container Type

12.5.5 India Container Transshipment Market by End User Industry

12.6 Japan Container Transshipment Market

12.6.1 Japan Container Transshipment Market by Container Size

12.6.2 Japan Container Transshipment Market by Data Source

12.6.3 Japan Container Transshipment Market by Service Type

12.6.4 Japan Container Transshipment Market by Container Type

12.6.5 Japan Container Transshipment Market by End User Industry

12.7 Rest of Asia Pacific Container Transshipment Market

12.7.1 Rest of Asia Pacific Container Transshipment Market by Container Size

12.7.2 Rest of Asia Pacific Container Transshipment Market by Data Source

12.7.3 Rest of Asia Pacific Container Transshipment Market by Service Type

12.7.4 Rest of Asia Pacific Container Transshipment Market by Container Type

12.7.5 Rest of Asia Pacific Container Transshipment Market by End User Industry

Chapter 13. Company Profiles

13.1 MSC Mediterranean Shipping Company S.A.

13.1.1 Company Overview

13.1.2 Recent strategies and developments:

13.1.2.1 Product Launches and Product Expansions:

13.2 A.P. Moller - Maersk A/S

13.2.1 Company Overview

13.2.2 Financial Analysis

13.2.3 Segmental and Regional Analysis

13.2.4 Recent strategies and developments:

13.2.4.1 Product Launches and Product Expansions:

13.3 CMA CGM Group

13.3.1 Company Overview

13.3.2 Recent strategies and developments:

13.3.2.1 Product Launches and Product Expansions:

13.4 Cosco Shipping Lines Co. Ltd.

13.4.1 Company Overview

13.4.2 Financial Analysis

13.4.3 Regional Analysis

13.4.4 Recent strategies and developments:

13.4.4.1 Product Launches and Product Expansions:

13.5 Hapag-Lloyd AG

13.5.1 Company Overview

13.5.2 Financial Analysis

13.5.3 Regional Analysis

13.6 Evergreen Marine Corp. (Taiwan) Ltd. (Evergreen Group)

13.6.1 Company Overview

13.6.2 Financial Analysis

13.7 Ocean Network Express Pte. Ltd.

13.7.1 Company Overview

13.7.2 Financial Analysis

13.7.3 Recent strategies and developments:

13.7.3.1 Product Launches and Product Expansions:

13.8 HMM Co., Ltd.

13.8.1 Company Overview

13.8.2 Financial Analysis

13.8.3 Recent strategies and developments:

13.8.3.1 Product Launches and Product Expansions:

13.9 YANG MING Group

13.9.1 Company Overview

13.9.2 Financial Analysis

13.9.3 Recent strategies and developments:

13.9.3.1 Product Launches and Product Expansions:

13.10. ZIM Integrated Shipping Services Ltd. (KENON HOLDINGS LTD.)

13.10.1 Company Overview

13.10.2 Financial Analysis

13.10.3 Recent strategies and developments:

13.10.3.1 Product Launches and Product Expansions:

TABLE 2 Asia Pacific Container Transshipment Market, 2025 - 2032, USD Million

TABLE 3 Key Costumer Criteria - Container Transshipment Market

TABLE 4 Asia Pacific Container Transshipment Market by Container Size, 2021 - 2024, USD Million

TABLE 5 Asia Pacific Container Transshipment Market by Container Size, 2025 - 2032, USD Million

TABLE 6 Asia Pacific 40-foot (FEU) Market by Country, 2021 - 2024, USD Million

TABLE 7 Asia Pacific 40-foot (FEU) Market by Country, 2025 - 2032, USD Million

TABLE 8 Asia Pacific 20-foot (TEU) Market by Country, 2021 - 2024, USD Million

TABLE 9 Asia Pacific 20-foot (TEU) Market by Country, 2025 - 2032, USD Million

TABLE 10 Asia Pacific Other Container Size Market by Country, 2021 - 2024, USD Million

TABLE 11 Asia Pacific Other Container Size Market by Country, 2025 - 2032, USD Million

TABLE 12 Use Case 1: 140-foot Equivalent Unit (FEU) Transshipment

TABLE 13 Use Case - 2 Facilitating Specialized and Heavy Cargo Movement via 20-foot Container Transshipment

TABLE 14 Use Case 3: Niche Market and Specialized Logistics for Non-Standard Container Transshipment

TABLE 15 Asia Pacific Container Transshipment Market by Data Source, 2021 - 2024, USD Million

TABLE 16 Asia Pacific Container Transshipment Market by Data Source, 2025 - 2032, USD Million

TABLE 17 Asia Pacific Sea-based Transshipment Market by Country, 2021 - 2024, USD Million

TABLE 18 Asia Pacific Sea-based Transshipment Market by Country, 2025 - 2032, USD Million

TABLE 19 Asia Pacific Land-based Transshipment Market by Country, 2021 - 2024, USD Million

TABLE 20 Asia Pacific Land-based Transshipment Market by Country, 2025 - 2032, USD Million

TABLE 21 Asia Pacific Air-based Transshipment Market by Country, 2021 - 2024, USD Million

TABLE 22 Asia Pacific Air-based Transshipment Market by Country, 2025 - 2032, USD Million

TABLE 23 Use Case - 4 Optimizing Global Ocean-to-Ocean Container Flow through Major Transshipment Hubs

TABLE 24 Use Case – 5 Seamless Multimodal Container Transfer for Inland Distribution and Cross-Border Trade

TABLE 25 Use Case - 6 Expedited Global Distribution of Time-Sensitive and High-Value Cargo

TABLE 26 Asia Pacific Container Transshipment Market by Service Type, 2021 - 2024, USD Million

TABLE 27 Asia Pacific Container Transshipment Market by Service Type, 2025 - 2032, USD Million

TABLE 28 Asia Pacific Container Handling Services Market by Country, 2021 - 2024, USD Million

TABLE 29 Asia Pacific Container Handling Services Market by Country, 2025 - 2032, USD Million

TABLE 30 Asia Pacific Logistics & Forwarding Services Market by Country, 2021 - 2024, USD Million

TABLE 31 Asia Pacific Logistics & Forwarding Services Market by Country, 2025 - 2032, USD Million

TABLE 32 Asia Pacific Warehousing & Storage Market by Country, 2021 - 2024, USD Million

TABLE 33 Asia Pacific Warehousing & Storage Market by Country, 2025 - 2032, USD Million

TABLE 34 Asia Pacific Customs Clearance & Documentation Market by Country, 2021 - 2024, USD Million

TABLE 35 Asia Pacific Customs Clearance & Documentation Market by Country, 2025 - 2032, USD Million

TABLE 36 Use Case – 7 Maximizing Throughput and Efficiency in Transshipment Hub Operations

TABLE 37 Use Case - 8 Orchestrating End-to-End Container Journeys through Transshipment Networks

TABLE 38 Use Case – 9 Providing Interim Storage and Value-Added Services at Transshipment Points

TABLE 39 Use Case - 10 Ensuring Regulatory Compliance and Seamless Flow of Transshipment Cargo

TABLE 40 Asia Pacific Container Transshipment Market by Container Type, 2021 - 2024, USD Million

TABLE 41 Asia Pacific Container Transshipment Market by Container Type, 2025 - 2032, USD Million

TABLE 42 Asia Pacific Standard Containers Market by Country, 2021 - 2024, USD Million

TABLE 43 Asia Pacific Standard Containers Market by Country, 2025 - 2032, USD Million

TABLE 44 Asia Pacific High Cube Containers Market by Country, 2021 - 2024, USD Million

TABLE 45 Asia Pacific High Cube Containers Market by Country, 2025 - 2032, USD Million

TABLE 46 Asia Pacific Refrigerated Containers Market by Country, 2021 - 2024, USD Million

TABLE 47 Asia Pacific Refrigerated Containers Market by Country, 2025 - 2032, USD Million

TABLE 48 Asia Pacific Open Top Containers Market by Country, 2021 - 2024, USD Million

TABLE 49 Asia Pacific Open Top Containers Market by Country, 2025 - 2032, USD Million

TABLE 50 Asia Pacific Flat Rack Containers Market by Country, 2021 - 2024, USD Million

TABLE 51 Asia Pacific Flat Rack Containers Market by Country, 2025 - 2032, USD Million

TABLE 52 Use Case: 11 Efficient Global Relocation of General Cargo through Standard Dry Container Transshipment

TABLE 53 Use Case: 12 Efficient Transshipment of Voluminous

TABLE 54 Use Case: 13 Temperature-Sensitive Cargo During Transshipment

TABLE 55 Use Case: 14 Facilitating Global Movement of Oversized and Tall Cargo Requiring Top Loading

TABLE 56 Use Case: 15 Enabling Global Logistics for Super Heavy and Oversized Project Cargo

TABLE 57 Asia Pacific Container Transshipment Market by End User Industry, 2021 - 2024, USD Million

TABLE 58 Asia Pacific Container Transshipment Market by End User Industry, 2025 - 2032, USD Million

TABLE 59 Asia Pacific Retail & E-commerce Market by Country, 2021 - 2024, USD Million

TABLE 60 Asia Pacific Retail & E-commerce Market by Country, 2025 - 2032, USD Million

TABLE 61 Asia Pacific Automotive Market by Country, 2021 - 2024, USD Million

TABLE 62 Asia Pacific Automotive Market by Country, 2025 - 2032, USD Million

TABLE 63 Asia Pacific Consumer Electronics Market by Country, 2021 - 2024, USD Million

TABLE 64 Asia Pacific Consumer Electronics Market by Country, 2025 - 2032, USD Million

TABLE 65 Asia Pacific Agriculture & Food Market by Country, 2021 - 2024, USD Million

TABLE 66 Asia Pacific Agriculture & Food Market by Country, 2025 - 2032, USD Million

TABLE 67 Asia Pacific Pharmaceuticals Market by Country, 2021 - 2024, USD Million

TABLE 68 Asia Pacific Pharmaceuticals Market by Country, 2025 - 2032, USD Million

TABLE 69 Asia Pacific Other End User Industry Market by Country, 2021 - 2024, USD Million

TABLE 70 Asia Pacific Other End User Industry Market by Country, 2025 - 2032, USD Million

TABLE 71 Asia Pacific Container Transshipment Market by Country, 2021 - 2024, USD Million

TABLE 72 Asia Pacific Container Transshipment Market by Country, 2025 - 2032, USD Million

TABLE 73 Singapore Container Transshipment Market, 2021 - 2024, USD Million

TABLE 74 Singapore Container Transshipment Market, 2025 - 2032, USD Million

TABLE 75 Singapore Container Transshipment Market by Container Size, 2021 - 2024, USD Million

TABLE 76 Singapore Container Transshipment Market by Container Size, 2025 - 2032, USD Million

TABLE 77 Singapore Container Transshipment Market by Data Source, 2021 - 2024, USD Million

TABLE 78 Singapore Container Transshipment Market by Data Source, 2025 - 2032, USD Million

TABLE 79 Singapore Container Transshipment Market by Service Type, 2021 - 2024, USD Million

TABLE 80 Singapore Container Transshipment Market by Service Type, 2025 - 2032, USD Million

TABLE 81 Singapore Container Transshipment Market by Container Type, 2021 - 2024, USD Million

TABLE 82 Singapore Container Transshipment Market by Container Type, 2025 - 2032, USD Million

TABLE 83 Singapore Container Transshipment Market by End User Industry, 2021 - 2024, USD Million

TABLE 84 Singapore Container Transshipment Market by End User Industry, 2025 - 2032, USD Million

TABLE 85 China Container Transshipment Market, 2021 - 2024, USD Million

TABLE 86 China Container Transshipment Market, 2025 - 2032, USD Million

TABLE 87 China Container Transshipment Market by Container Size, 2021 - 2024, USD Million

TABLE 88 China Container Transshipment Market by Container Size, 2025 - 2032, USD Million

TABLE 89 China Container Transshipment Market by Data Source, 2021 - 2024, USD Million

TABLE 90 China Container Transshipment Market by Data Source, 2025 - 2032, USD Million

TABLE 91 China Container Transshipment Market by Service Type, 2021 - 2024, USD Million

TABLE 92 China Container Transshipment Market by Service Type, 2025 - 2032, USD Million

TABLE 93 China Container Transshipment Market by Container Type, 2021 - 2024, USD Million

TABLE 94 China Container Transshipment Market by Container Type, 2025 - 2032, USD Million

TABLE 95 China Container Transshipment Market by End User Industry, 2021 - 2024, USD Million

TABLE 96 China Container Transshipment Market by End User Industry, 2025 - 2032, USD Million

TABLE 97 Malaysia Container Transshipment Market, 2021 - 2024, USD Million

TABLE 98 Malaysia Container Transshipment Market, 2025 - 2032, USD Million

TABLE 99 Malaysia Container Transshipment Market by Container Size, 2021 - 2024, USD Million

TABLE 100 Malaysia Container Transshipment Market by Container Size, 2025 - 2032, USD Million

TABLE 101 Malaysia Container Transshipment Market by Data Source, 2021 - 2024, USD Million

TABLE 102 Malaysia Container Transshipment Market by Data Source, 2025 - 2032, USD Million

TABLE 103 Malaysia Container Transshipment Market by Service Type, 2021 - 2024, USD Million

TABLE 104 Malaysia Container Transshipment Market by Service Type, 2025 - 2032, USD Million

TABLE 105 Malaysia Container Transshipment Market by Container Type, 2021 - 2024, USD Million

TABLE 106 Malaysia Container Transshipment Market by Container Type, 2025 - 2032, USD Million

TABLE 107 Malaysia Container Transshipment Market by End User Industry, 2021 - 2024, USD Million

TABLE 108 Malaysia Container Transshipment Market by End User Industry, 2025 - 2032, USD Million

TABLE 109 South Korea Container Transshipment Market, 2021 - 2024, USD Million

TABLE 110 South Korea Container Transshipment Market, 2025 - 2032, USD Million

TABLE 111 South Korea Container Transshipment Market by Container Size, 2021 - 2024, USD Million

TABLE 112 South Korea Container Transshipment Market by Container Size, 2025 - 2032, USD Million

TABLE 113 South Korea Container Transshipment Market by Data Source, 2021 - 2024, USD Million

TABLE 114 South Korea Container Transshipment Market by Data Source, 2025 - 2032, USD Million

TABLE 115 South Korea Container Transshipment Market by Service Type, 2021 - 2024, USD Million

TABLE 116 South Korea Container Transshipment Market by Service Type, 2025 - 2032, USD Million

TABLE 117 South Korea Container Transshipment Market by Container Type, 2021 - 2024, USD Million

TABLE 118 South Korea Container Transshipment Market by Container Type, 2025 - 2032, USD Million

TABLE 119 South Korea Container Transshipment Market by End User Industry, 2021 - 2024, USD Million

TABLE 120 South Korea Container Transshipment Market by End User Industry, 2025 - 2032, USD Million

TABLE 121 India Container Transshipment Market, 2021 - 2024, USD Million

TABLE 122 India Container Transshipment Market, 2025 - 2032, USD Million

TABLE 123 India Container Transshipment Market by Container Size, 2021 - 2024, USD Million

TABLE 124 India Container Transshipment Market by Container Size, 2025 - 2032, USD Million

TABLE 125 India Container Transshipment Market by Data Source, 2021 - 2024, USD Million

TABLE 126 India Container Transshipment Market by Data Source, 2025 - 2032, USD Million

TABLE 127 India Container Transshipment Market by Service Type, 2021 - 2024, USD Million

TABLE 128 India Container Transshipment Market by Service Type, 2025 - 2032, USD Million

TABLE 129 India Container Transshipment Market by Container Type, 2021 - 2024, USD Million

TABLE 130 India Container Transshipment Market by Container Type, 2025 - 2032, USD Million

TABLE 131 India Container Transshipment Market by End User Industry, 2021 - 2024, USD Million

TABLE 132 India Container Transshipment Market by End User Industry, 2025 - 2032, USD Million

TABLE 133 Japan Container Transshipment Market, 2021 - 2024, USD Million

TABLE 134 Japan Container Transshipment Market, 2025 - 2032, USD Million

TABLE 135 Japan Container Transshipment Market by Container Size, 2021 - 2024, USD Million

TABLE 136 Japan Container Transshipment Market by Container Size, 2025 - 2032, USD Million

TABLE 137 Japan Container Transshipment Market by Data Source, 2021 - 2024, USD Million

TABLE 138 Japan Container Transshipment Market by Data Source, 2025 - 2032, USD Million

TABLE 139 Japan Container Transshipment Market by Service Type, 2021 - 2024, USD Million

TABLE 140 Japan Container Transshipment Market by Service Type, 2025 - 2032, USD Million

TABLE 141 Japan Container Transshipment Market by Container Type, 2021 - 2024, USD Million

TABLE 142 Japan Container Transshipment Market by Container Type, 2025 - 2032, USD Million

TABLE 143 Japan Container Transshipment Market by End User Industry, 2021 - 2024, USD Million

TABLE 144 Japan Container Transshipment Market by End User Industry, 2025 - 2032, USD Million

TABLE 145 Rest of Asia Pacific Container Transshipment Market, 2021 - 2024, USD Million

TABLE 146 Rest of Asia Pacific Container Transshipment Market, 2025 - 2032, USD Million

TABLE 147 Rest of Asia Pacific Container Transshipment Market by Container Size, 2021 - 2024, USD Million

TABLE 148 Rest of Asia Pacific Container Transshipment Market by Container Size, 2025 - 2032, USD Million

TABLE 149 Rest of Asia Pacific Container Transshipment Market by Data Source, 2021 - 2024, USD Million

TABLE 150 Rest of Asia Pacific Container Transshipment Market by Data Source, 2025 - 2032, USD Million

TABLE 151 Rest of Asia Pacific Container Transshipment Market by Service Type, 2021 - 2024, USD Million

TABLE 152 Rest of Asia Pacific Container Transshipment Market by Service Type, 2025 - 2032, USD Million

TABLE 153 Rest of Asia Pacific Container Transshipment Market by Container Type, 2021 - 2024, USD Million

TABLE 154 Rest of Asia Pacific Container Transshipment Market by Container Type, 2025 - 2032, USD Million

TABLE 155 Rest of Asia Pacific Container Transshipment Market by End User Industry, 2021 - 2024, USD Million

TABLE 156 Rest of Asia Pacific Container Transshipment Market by End User Industry, 2025 - 2032, USD Million

TABLE 157 Key Information – MSC Mediterranean Shipping Company S.A.

TABLE 158 Key Information – A.P. Moller - Maersk A/S

TABLE 159 Key Information – CMA CGM Group

TABLE 160 Key Information – Cosco Shipping Lines Co. Ltd.

TABLE 161 Key Information – Hapag-Lloyd AG

TABLE 162 Key Information – Evergreen Marine Corp. (Taiwan) Ltd.

TABLE 163 Key Information – Ocean Network Express Pte. Ltd.

TABLE 164 Key Information – HMM Co., Ltd.

TABLE 165 Key Information – YANG MING Group

TABLE 166 Key Information – ZIM Integrated Shipping Services Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Container Transshipment Market, 2021 - 2024, USD Million

FIG 3 Key Factors Impacting Container Transshipment Market

FIG 4 Market Share Analysis, 2024

FIG 5 Porter’s Five Forces Analysis – Container Transshipment Market

FIG 6 Value Chain Analysis of Container Transshipment Market

FIG 7 Key Costumer Criteria - Container Transshipment Market

FIG 8 Asia Pacific Container Transshipment Market by Container Size, 2024

FIG 9 Asia Pacific Container Transshipment Market by Container Size, 2032

FIG 10 Asia Pacific Container Transshipment Market by Container Size, 2021 - 2032, USD Million

FIG 11 Asia Pacific Container Transshipment Market by Data Source, 2024

FIG 12 Asia Pacific Container Transshipment Market by Data Source, 2032

FIG 13 Asia Pacific Container Transshipment Market by Data Source, 2021 - 2032, USD Million

FIG 14 Asia Pacific Container Transshipment Market by Service Type, 2024

FIG 15 Asia Pacific Container Transshipment Market by Service Type, 2032

FIG 16 Asia Pacific Container Transshipment Market by Service Type, 2021 - 2032, USD Million

FIG 17 Asia Pacific Container Transshipment Market by Container Type, 2024

FIG 18 Asia Pacific Container Transshipment Market by Container Type, 2032

FIG 19 Asia Pacific Container Transshipment Market by Container Type, 2021 - 2032, USD Million

FIG 20 Asia Pacific Container Transshipment Market by End User Industry, 2024

FIG 21 Asia Pacific Container Transshipment Market by End User Industry, 2032

FIG 22 Asia Pacific Container Transshipment Market by End User Industry, 2021 - 2032, USD Million

FIG 23 Asia Pacific Container Transshipment Market by Country, 2024

FIG 24 Asia Pacific Container Transshipment Market by Country, 2032

FIG 25 Asia Pacific Container Transshipment Market by Country, 2021 - 2032, USD Million