Asia Pacific Ceramide Market Size, Share & Trends Analysis Report By Application (Cosmetics, Food, and Others), By Process (Plant Extract, and Fermentation), By Type (Natural, and Synthetic), By Country and Growth Forecast, 2023 - 2030

Published Date : 29-Mar-2024 | Pages: 133 | Formats: PDF |

COVID-19 Impact on the Asia Pacific Ceramide Market

The Asia Pacific Ceramide Market would witness market growth of 6.0% CAGR during the forecast period (2023-2030). In the year 2021, the Asia Pacific market's volume surged to 150.35 tonnes, showcasing a growth of 2.9% (2019-2022).

In the market, the utilization of natural ingredients has gained significant attention due to their perceived safety, efficacy, and appeal to consumers seeking more sustainable and environmentally friendly options. Natural sources of ceramides, such as plant-based oils like sunflower, rice bran, and hemp seed oil, offer rich reservoirs of these lipid molecules that closely mimic those naturally found in the skin. Therefore, the China market make use of 32.53 tonnes of natural ceramide in 2022.

The China market dominated the Asia Pacific Ceramide Market, By Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $14,373.5 Thousands by 2030. The Japan market is registering a CAGR of 5.3% during (2023 - 2030). Additionally, The India market would showcase a CAGR of 6.7% during (2023 - 2030).

It can be incorporated into oral supplements or nutraceuticals for systemic benefits, supporting skin health from within. Oral supplements improve skin hydration, elasticity, and barrier function, complementing external skincare regimens. Its supplements contain bioavailable forms of ceramides that are orally ingested and absorbed into the bloodstream. These supplements aim to replenish its levels in the skin, enhancing barrier function and moisture retention from the inside out.

Furthermore, as disposable incomes rise, consumers are often willing to spend more on high-quality skincare products. As per the data from the Government of China, in 2023, the median of the nationwide per capita disposable income was 33,036 yuan, an increase of 5.3 percent. Likewise, as per the data published by the Office for National Statistics, the median disposable income of households in the United Kingdom increased by 2% annually to £31,400 in the fiscal year ending (FYE) 2021.

South Korea has a culture that places a strong emphasis on beauty and skincare. As a result, consumers in the country are highly knowledgeable about skincare ingredients and are willing to invest in high-quality products to achieve flawless skin. As per the data from the International Trade Administration, for 2021, the total value of cosmetics produced in South Korea was $14.5 billion, and cosmetics exports hit a record high, growing 21.3 percent from the previous year to $9.2 billion. South Korea’s trade surplus in the cosmetics sector grew by 28.6 percent to $7.8 billion. Thus, the rising cosmetics and pharmaceutical sectors in Asia Pacific will help in the expansion of the regional market.

Free Valuable Insights: The Global Ceramide Market is Predict to reach USD 146.0 Million by 2030, at a CAGR of 5.6%

Based on Application, the market is segmented into Cosmetics, Food, and Others. Based on Process, the market is segmented into Plant Extract, and Fermentation. Based on Type, the market is segmented into Natural, and Synthetic. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Ashland Inc.

- Toyobo Co., Ltd.

- Doosan Corporation

- Arkema S.A.

- Evonik Industries AG (RAG-Stiftung)

- Cayman Chemical Company, Inc.

- Kao Corporation

- Croda International PLC

- Vantage Specialty Chemicals (H.I.G. Capital, LLC)

- Incospam Co., Ltd.

Asia Pacific Ceramide Market Report Segmentation

By Application (Volume, Tonnes, USD Million, 2019-2030)

- Cosmetics

- Food

- Others

By Process

- Plant Extract

- Fermentation

By Type (Volume, Tonnes, USD Million, 2019-2030)

- Natural

- Synthetic

By Country (Volume, Tonnes, USD Million, 2019-2030)

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Ceramide Market, by Application

1.4.2 Asia Pacific Ceramide Market, by Process

1.4.3 Asia Pacific Ceramide Market, by Type

1.4.4 Asia Pacific Ceramide Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Opportunities

3.2.3 Market Restraints

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. Strategies Deployed in Ceramide Market

Chapter 5. Asia Pacific Ceramide Market, By Application

5.1 Asia Pacific Cosmetics Market, By Country

5.2 Asia Pacific Food Market, By Country

5.3 Asia Pacific Others Market, By Country

Chapter 6. Asia Pacific Ceramide Market, By Process

6.1 Asia Pacific Plant Extract Market, By Country

6.2 Asia Pacific Fermentation Market, By Country

Chapter 7. Asia Pacific Ceramide Market, By Type

7.1 Asia Pacific Natural Market, By Country

7.2 Asia Pacific Synthetic Market, By Country

Chapter 8. Asia Pacific Ceramide Market, By Country

8.1 China Ceramide Market

8.1.1 China Ceramide Market, By Application

8.1.2 China Ceramide Market, By Process

8.1.3 China Ceramide Market, By Type

8.2 Japan Ceramide Market

8.2.1 Japan Ceramide Market, By Application

8.2.2 Japan Ceramide Market, By Process

8.2.3 Japan Ceramide Market, By Type

8.3 India Ceramide Market

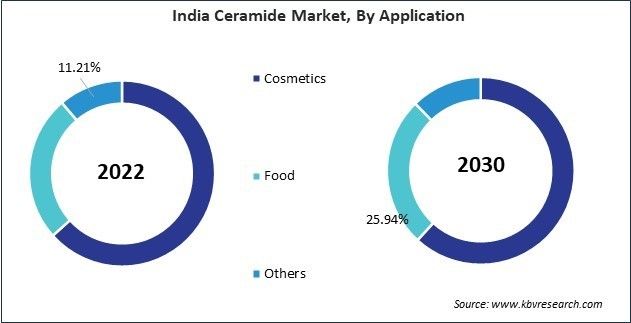

8.3.1 India Ceramide Market, By Application

8.3.2 India Ceramide Market, By Process

8.3.3 India Ceramide Market, By Type

8.4 South Korea Ceramide Market

8.4.1 South Korea Ceramide Market, By Application

8.4.2 South Korea Ceramide Market, By Process

8.4.3 South Korea Ceramide Market, By Type

8.5 Singapore Ceramide Market

8.5.1 Singapore Ceramide Market, By Application

8.5.2 Singapore Ceramide Market, By Process

8.5.3 Singapore Ceramide Market, By Type

8.6 Malaysia Ceramide Market

8.6.1 Malaysia Ceramide Market, By Application

8.6.2 Malaysia Ceramide Market, By Process

8.6.3 Malaysia Ceramide Market, By Type

8.7 Rest of Asia Pacific Ceramide Market

8.7.1 Rest of Asia Pacific Ceramide Market, By Application

8.7.2 Rest of Asia Pacific Ceramide Market, By Process

8.7.3 Rest of Asia Pacific Ceramide Market, By Type

Chapter 9. Company Profiles

9.1 Ashland Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 SWOT Analysis

9.2 Toyobo Co., Ltd.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 SWOT Analysis

9.3 Doosan Corporation

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 SWOT Analysis

9.4 Arkema S.A.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expenses

9.4.5 Recent strategies and developments:

9.4.5.1 Acquisition and Mergers:

9.4.6 SWOT Analysis

9.5 Evonik Industries AG (RAG-Stiftung)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 Recent strategies and developments:

9.5.5.1 Product Launches and Product Expansions:

9.5.5.2 Geographical Expansions:

9.5.6 SWOT Analysis

9.6 Cayman Chemical Company, Inc.

9.6.1 Company Overview

9.6.2 SWOT Analysis

9.7 Kao Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expenses

9.7.5 Recent strategies and developments:

9.7.5.1 Product Launches and Product Expansions:

9.7.6 SWOT Analysis

9.8 Croda International PLC

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Recent strategies and developments:

9.8.4.1 Acquisition and Mergers:

9.8.5 SWOT Analysis

9.9 Vantage Specialty Chemicals (H.I.G. Capital, LLC)

9.9.1 Company Overview

9.9.2 Recent strategies and developments:

9.9.2.1 Partnerships, Collaborations, and Agreements:

9.9.2.2 Geographical Expansions:

9.9.3 SWOT Analysis

9.10. Incospam Co., Ltd.

9.10.1 Company Overview

9.10.2 SWOT Analysis

TABLE 2 Asia Pacific Ceramide Market, 2023 - 2030, USD Thousands

TABLE 3 Asia Pacific Ceramide Market, 2019 - 2022, Tonnes

TABLE 4 Asia Pacific Ceramide Market, 2023 - 2030, Tonnes

TABLE 5 Asia Pacific Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 6 Asia Pacific Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 7 Asia Pacific Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 8 Asia Pacific Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 9 Asia Pacific Cosmetics Market, By Country, 2019 - 2022, USD Thousands

TABLE 10 Asia Pacific Cosmetics Market, By Country, 2023 - 2030, USD Thousands

TABLE 11 Asia Pacific Cosmetics Market, By Country, 2019 - 2022, Tonnes

TABLE 12 Asia Pacific Cosmetics Market, By Country, 2023 - 2030, Tonnes

TABLE 13 Asia Pacific Food Market, By Country, 2019 - 2022, USD Thousands

TABLE 14 Asia Pacific Food Market, By Country, 2023 - 2030, USD Thousands

TABLE 15 Asia Pacific Food Market, By Country, 2019 - 2022, Tonnes

TABLE 16 Asia Pacific Food Market, By Country, 2023 - 2030, Tonnes

TABLE 17 Asia Pacific Others Market, By Country, 2019 - 2022, USD Thousands

TABLE 18 Asia Pacific Others Market, By Country, 2023 - 2030, USD Thousands

TABLE 19 Asia Pacific Others Market, By Country, 2019 - 2022, Tonnes

TABLE 20 Asia Pacific Others Market, By Country, 2023 - 2030, Tonnes

TABLE 21 Asia Pacific Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 22 Asia Pacific Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 23 Asia Pacific Plant Extract Market, By Country, 2019 - 2022, USD Thousands

TABLE 24 Asia Pacific Plant Extract Market, By Country, 2023 - 2030, USD Thousands

TABLE 25 Asia Pacific Fermentation Market, By Country, 2019 - 2022, USD Thousands

TABLE 26 Asia Pacific Fermentation Market, By Country, 2023 - 2030, USD Thousands

TABLE 27 Asia Pacific Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 28 Asia Pacific Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 29 Asia Pacific Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 30 Asia Pacific Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 31 Asia Pacific Natural Market, By Country, 2019 - 2022, USD Thousands

TABLE 32 Asia Pacific Natural Market, By Country, 2023 - 2030, USD Thousands

TABLE 33 Asia Pacific Natural Market, By Country, 2019 - 2022, Tonnes

TABLE 34 Asia Pacific Natural Market, By Country, 2023 - 2030, Tonnes

TABLE 35 Asia Pacific Synthetic Market, By Country, 2019 - 2022, USD Thousands

TABLE 36 Asia Pacific Synthetic Market, By Country, 2023 - 2030, USD Thousands

TABLE 37 Asia Pacific Synthetic Market, By Country, 2019 - 2022, Tonnes

TABLE 38 Asia Pacific Synthetic Market, By Country, 2023 - 2030, Tonnes

TABLE 39 Asia Pacific Ceramide Market, By Country, 2019 - 2022, USD Thousands

TABLE 40 Asia Pacific Ceramide Market, By Country, 2023 - 2030, USD Thousands

TABLE 41 Asia Pacific Ceramide Market, By Country, 2019 - 2022, Tonnes

TABLE 42 Asia Pacific Ceramide Market, By Country, 2023 - 2030, Tonnes

TABLE 43 China Ceramide Market, 2019 - 2022, USD Thousands

TABLE 44 China Ceramide Market, 2023 - 2030, USD Thousands

TABLE 45 China Ceramide Market, 2019 - 2022, Tonnes

TABLE 46 China Ceramide Market, 2023 - 2030, Tonnes

TABLE 47 China Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 48 China Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 49 China Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 50 China Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 51 China Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 52 China Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 53 China Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 54 China Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 55 China Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 56 China Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 57 Japan Ceramide Market, 2019 - 2022, USD Thousands

TABLE 58 Japan Ceramide Market, 2023 - 2030, USD Thousands

TABLE 59 Japan Ceramide Market, 2019 - 2022, Tonnes

TABLE 60 Japan Ceramide Market, 2023 - 2030, Tonnes

TABLE 61 Japan Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 62 Japan Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 63 Japan Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 64 Japan Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 65 Japan Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 66 Japan Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 67 Japan Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 68 Japan Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 69 Japan Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 70 Japan Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 71 India Ceramide Market, 2019 - 2022, USD Thousands

TABLE 72 India Ceramide Market, 2023 - 2030, USD Thousands

TABLE 73 India Ceramide Market, 2019 - 2022, Tonnes

TABLE 74 India Ceramide Market, 2023 - 2030, Tonnes

TABLE 75 India Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 76 India Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 77 India Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 78 India Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 79 India Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 80 India Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 81 India Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 82 India Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 83 India Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 84 India Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 85 South Korea Ceramide Market, 2019 - 2022, USD Thousands

TABLE 86 South Korea Ceramide Market, 2023 - 2030, USD Thousands

TABLE 87 South Korea Ceramide Market, 2019 - 2022, Tonnes

TABLE 88 South Korea Ceramide Market, 2023 - 2030, Tonnes

TABLE 89 South Korea Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 90 South Korea Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 91 South Korea Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 92 South Korea Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 93 South Korea Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 94 South Korea Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 95 South Korea Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 96 South Korea Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 97 South Korea Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 98 South Korea Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 99 Singapore Ceramide Market, 2019 - 2022, USD Thousands

TABLE 100 Singapore Ceramide Market, 2023 - 2030, USD Thousands

TABLE 101 Singapore Ceramide Market, 2019 - 2022, Tonnes

TABLE 102 Singapore Ceramide Market, 2023 - 2030, Tonnes

TABLE 103 Singapore Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 104 Singapore Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 105 Singapore Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 106 Singapore Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 107 Singapore Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 108 Singapore Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 109 Singapore Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 110 Singapore Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 111 Singapore Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 112 Singapore Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 113 Malaysia Ceramide Market, 2019 - 2022, USD Thousands

TABLE 114 Malaysia Ceramide Market, 2023 - 2030, USD Thousands

TABLE 115 Malaysia Ceramide Market, 2019 - 2022, Tonnes

TABLE 116 Malaysia Ceramide Market, 2023 - 2030, Tonnes

TABLE 117 Malaysia Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 118 Malaysia Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 119 Malaysia Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 120 Malaysia Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 121 Malaysia Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 122 Malaysia Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 123 Malaysia Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 124 Malaysia Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 125 Malaysia Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 126 Malaysia Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 127 Rest of Asia Pacific Ceramide Market, 2019 - 2022, USD Thousands

TABLE 128 Rest of Asia Pacific Ceramide Market, 2023 - 2030, USD Thousands

TABLE 129 Rest of Asia Pacific Ceramide Market, 2019 - 2022, Tonnes

TABLE 130 Rest of Asia Pacific Ceramide Market, 2023 - 2030, Tonnes

TABLE 131 Rest of Asia Pacific Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 132 Rest of Asia Pacific Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 133 Rest of Asia Pacific Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 134 Rest of Asia Pacific Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 135 Rest of Asia Pacific Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 136 Rest of Asia Pacific Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 137 Rest of Asia Pacific Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 138 Rest of Asia Pacific Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 139 Rest of Asia Pacific Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 140 Rest of Asia Pacific Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 141 Key Information – Ashland Inc.

TABLE 142 Key Information – TOYOBO CO., LTD.

TABLE 143 Key Information – Doosan Corporation

TABLE 144 Key information – Arkema S.A.

TABLE 145 Key Information – Evonik Industries AG

TABLE 146 Key Information – Cayman Chmeical Company, Inc.

TABLE 147 Key Information – Kao Corporation

TABLE 148 Key Information – Croda International PLC

TABLE 149 Key Information – Vantage Specialty Chemicals

TABLE 150 Key Information – Incospam Co., Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Ceramide Market, 2019 - 2030, USD Thousands

FIG 3 Key Factors Impacting Ceramide Market

FIG 4 Porter’s Five Forces Analysis - Ceramide Market

FIG 5 Asia Pacific Ceramide Market share, By Application, 2022

FIG 6 Asia Pacific Ceramide Market share, By Application, 2030

FIG 7 Asia Pacific Ceramide Market, By Application, 2019 - 2030, USD Thousands

FIG 8 Asia Pacific Ceramide Market share, By Process, 2022

FIG 9 Asia Pacific Ceramide Market share, By Process, 2030

FIG 10 Asia Pacific Ceramide Market, By Process, 2019 - 2030, USD Thousands

FIG 11 Asia Pacific Ceramide Market share, By Type, 2022

FIG 12 Asia Pacific Ceramide Market share, By Type, 2030

FIG 13 Asia Pacific Ceramide Market, By Type, 2019 - 2030, USD Thousands

FIG 14 Asia Pacific Ceramide Market share, By Country, 2022

FIG 15 Asia Pacific Ceramide Market share, By Country, 2030

FIG 16 Asia Pacific Ceramide Market, By Country, 2019 - 2030, USD Thousands

FIG 17 Swot Analysis: Ashland Inc.

FIG 18 SWOT Analysis: Toyobo Co., Ltd.

FIG 19 SWOT Analysis: Doosan Corporation

FIG 20 SWOT Analysis: Arkema S.A.

FIG 21 SWOT Analysis: Evonik Industries AG

FIG 22 Swot Analysis: Cayman Chemical Company, Inc.

FIG 23 SWOT Analysis: Kao Corporation

FIG 24 SWOT Analysis: Croda International PLC

FIG 25 SWOT Analysis: Vantage Specialty Chemicals

FIG 26 SWOT Analysis: Incospam Co., Ltd.